|

市场调查报告书

商品编码

1822295

全球离心机市场按应用、容量、最终用途行业、转子类型、速度、类型和地区划分 - 预测至 2030 年Centrifuge Market by Type (Laboratory, Industrial), Rotor Type (Fixed-Angle, Swinging Bucket), Application (Fluid Clarification, Dewatering), End-use Industry (Pharmaceutical, Food & Beverage), Speed, Capacity, & Region - Global Forecast to 2030 |

||||||

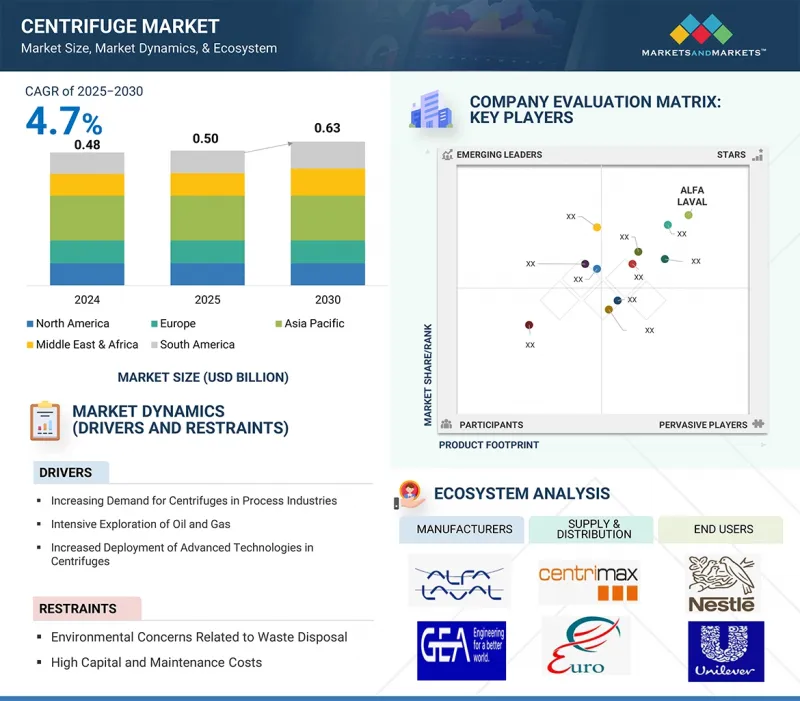

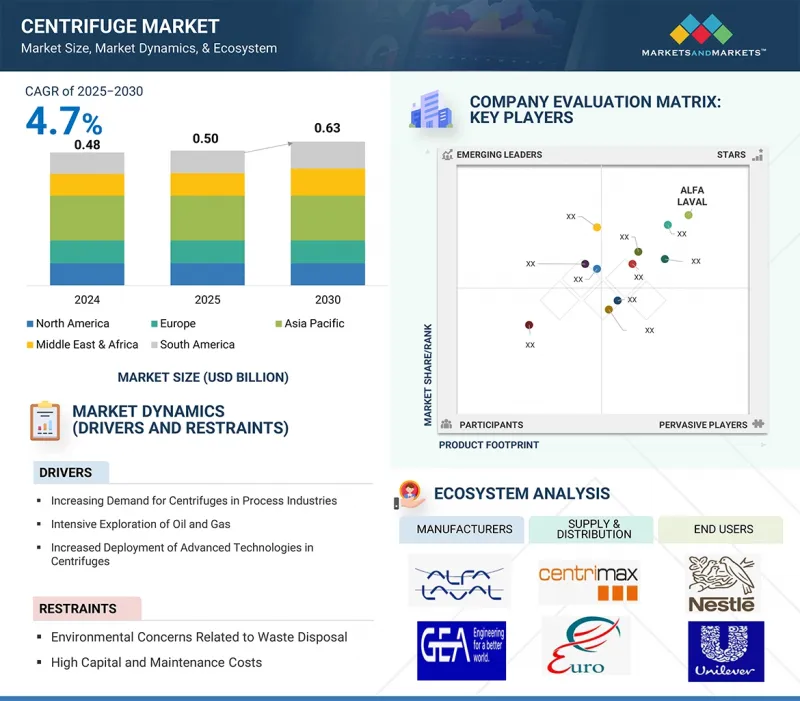

离心机市场预计将从 2025 年的 5 亿美元成长到 2030 年的 6.3 亿美元,复合年增长率为 4.7%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单位 | 金额(百万美元/十亿美元)和数量(单位) |

| 部分 | 按应用、容量、最终用途行业、转子类型、速度、类型、地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、南美 |

由于製药、生物技术、食品和饮料、化学、采矿、污水处理等行业的需求不断增长,离心机市场正在稳步成长。全球人口的成长、快速的都市化和严格的环境法规正在推动各行各业采用先进的分离技术来提高效率、品质和合规性。

在製药和生物技术领域,药物製造和诊断中对精确分离的需求正在扩大离心机的使用范围;而在食品加工领域,对高品质、无污染产品的需求正在推动需求成长。离心机在采矿业中用于矿物回收,在污水处理厂中用于污泥脱水和资源回收。自动化、节能设计和增强的製程控制等技术进步进一步推动了离心机的应用。由于工业扩张、城市基础设施建设和医疗保健投资的增加,亚太地区引领市场发展;而由于技术创新和法规遵从,北美和欧洲的需求保持稳定。儘管面临设备成本和维护需求上升等挑战,全球离心机市场预计将在工业现代化和资源效率追求的支持下持续扩张。可再生能源、生物技术研究和精密製造领域的新兴应用将进一步增强这一成长动能。

工业离心机因其在製药、食品饮料、化学製造、石油天然气和污水处理等大型加工行业的广泛应用而呈现强劲增长势头。这些离心机专为连续高通量运作而设计,能够高效分离固体,并在工业规模上实现颗粒澄清。工业自动化程度的提高、品质标准的日益严格以及生产设施对高效废弃物管理的需求推动了工业离心机需求的成长。在製药业,工业离心机对于活性药物成分 (API) 的生产至关重要;而在食品业,它们则用于牛奶澄清、果汁提取和食用油精炼等工艺。污水处理厂也严重依赖工业离心机进行污泥脱水和污水管理。节能马达、增强的安全系统和物联网监控等设计改进正在推动其应用。新兴国家製造地的扩张以及清洁工业流程法规的不断加强,进一步推动了市场成长。

小容量离心机(定义为处理能力低于 10 立方公尺/小时的离心机)因其适用于专业精密应用,在离心机市场中成长最快。这类离心机广泛应用于研究实验室、临床诊断、中试生产和利基工业流程,这些领域对高精度、可控的样品处理和紧凑的设计至关重要。它们占地相对较小,便携性,易于整合到现有设施中,使其成为空间和预算受限的实验室和小规模生产单位的理想选择。此外,对客製化、专用离心机的需求日益增长,尤其是在製药、生物技术、食品加工和环境测试领域,这进一步加速了它们的普及。全球个人化医疗的兴起、对研发活动的日益重视以及新兴国家小规模製造业的扩张也是关键的成长动力。此外,小容量离心机通常需要较低的资本投入和维护成本,因此对注重成本的最终用户具有吸引力。改进的转子设计、数位控制和能源效率等技术进步正在扩大其容量并使其适合更复杂的分离任务。

中速离心机的转速为 5,000 至 20,000 RPM,由于其多功能性和广泛的应用范围,在离心机市场中成长最快。这些离心机在分离效率和样品完整性之间取得了最佳平衡,使其适用于工业和实验室环境。在生物技术和製药领域,中速离心机用于细胞收穫、蛋白质纯化和疫苗製造,在这些领域中,精确分离而不损坏精细的生物材料至关重要。在工业过程中,中速离心机在污水处理、食品和饮料澄清以及化学加工中发挥关键作用,可实现有效分离,同时最大限度地减少零件磨损。它们能够处理各种各样的物料输送,从生物样本到工业泥浆,这正在推动各个行业的需求。此外,中速离心机通常比超高速型号消耗更少的能源,从而节省成本并实现营运永续性。转子平衡增强、自动控制和改进的安全机制等技术创新进一步提高了效率和易用性。生物製药生产的扩张、研发投入的增加以及对扩充性且高效的分离解决方案的需求也推动了该行业的成长。

定角转子离心机凭藉其高效能、多功能以及在工业和实验室中的广泛应用,在离心机市场中成长最快。定角转子以相对于旋转轴的固定角度(通常为 25-40 度)固定样品,使颗粒能够沿着管壁快速沉积。这种设计在实现高分离效率的同时,最大限度地缩短了运行时间,使其成为细胞沉淀、亚细胞成分分离、核酸纯化以及工业工作流程中大体积处理等应用的理想选择。在生物製药生产中,定角转子是高产量细胞培养收穫和蛋白质分离的首选。与水平转子相比,其坚固的设计可支援更高的转速和离心力,使其适用于各种黏度和密度的样品。食品加工、化学品製造和污水处理等行业因其耐用性和成本效益而越来越多地采用此类离心机。转子材料(例如耐腐蚀合金和轻质复合材料)的进步提高了性能并延长了使用寿命。此外,与具有自动控制和增强安全机制的现代离心机系统的兼容性也推动了需求。

流体澄清领域在离心机市场中成长最快,这得益于其在需要高纯度流体的各行各业中发挥的关键作用。流体澄清涉及有效去除液体中的悬浮固体、杂质和其他颗粒物,以确保下游製程中一致的品质和性能。该应用在食品和饮料行业尤为重要,用于果汁、葡萄酒和啤酒的澄清;在製药行业,用于活性成分和注射液的纯化;在生物技术行业,用于从有价值的生物分子中分离细胞碎片。此外,化学和石化产业也依赖流体澄清来维持製程效率和产品完整性。对法规遵循、产品安全和品质标准的日益重视正在推动其应用。此外,离心机技术的进步,例如高速、自动化和就地清洗 (CIP) 系统,正在提高澄清效率,同时减少停机时间。水处理倡议的不断扩展,尤其是在都市区和工业环境中,进一步推动了对流体净化离心机的需求。新兴经济体的工业产量不断增加,环境法规也越来越严格,对这项成长做出了重大贡献。

随着工业界越来越重视效率、永续性和精确度,使用离心机进行流体净化变得至关重要,确保其作为市场价值成长最快的应用领域的地位。

人口成长、老化以及慢性病和感染疾病的流行推动了全球对药品、疫苗和生技药品的需求成长,因此製药业是离心机市场成长最快的终端应用领域。离心机在製药生产中发挥关键作用,特别是在原料药生技药品成分、血液成分、细胞培养和生物製剂的分离、纯化和澄清过程中。生物製药和个人化医疗的快速成长进一步加速了离心机的采用,特别是高速离心机和超速离心机。此外,COVID-19 大流行凸显了疫苗生产和研究对先进离心机技术的需求。严格的监管要求和製药业向连续生产的转变也推动了对高性能自动离心机的投资,以确保精度、无菌和合规性。

亚太地区是离心机市场成长最快的地区,这得益于快速的工业化进程、不断扩大的产能以及对基础设施和加工工业的大量投资。中国、印度、日本和韩国等国家在製药、生物技术、食品饮料、化学加工和污水处理等领域正经历强劲成长,而这些领域都严重依赖离心机技术。人口成长和可支配收入的提高推动了医疗保健需求的不断增长,这推动了对製药和生物加工离心机的需求。政府在清洁水、废弃物管理和环境合规方面的措施正在加速其在市政和工业污水处理中的应用。此外,亚太地区正在成为製造和研发中心,跨国公司纷纷建立生产设施,以提高本地运转率并降低成本。竞争激烈的劳动力市场、优惠的贸易政策以及不断增长的出口也促进了市场扩张。该地区强劲的经济成长、城市发展和产业多元化使其成为全球离心机产业的主要成长引擎。

本报告研究了全球离心机市场,并提供了按应用、容量、最终用途行业、转子类型、速度、类型和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 生成式人工智慧对离心机市场的影响

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/中断

- 供应链分析

- 2025年美国关税对离心机市场的影响

- 投资金筹措场景

- 定价分析

- 生态系分析

- 技术分析

- 专利分析

- 过去 10 年的出版趋势

- 法律地位

- 贸易分析

- 2025-2026年主要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

- 案例研究分析

第七章离心机市场(依应用)

- 介绍

- 固体管理

- 泥浆清理

- 脱水

- 液体澄清

- 其他的

第八章离心机市场(按容量)

- 介绍

- 小容量离心机(小于10m3/H)

- 中容量离心机(10-50 m3/H)

- 大容量离心机(50m3/H以上)

9. 离心机市场(依最终用途产业)

- 介绍

- 製药

- 食品/饮料

- 石油和天然气

- 化学品

- 水和污水处理

- 其他的

第 10 章离心机市场(按转子类型)

- 介绍

- 定角转子离心机

- 吊桶式离心机

- 立式和卧式离心机

- 其他的

第 11 章离心机市场(按速度)

- 介绍

- 低速(低于 5,000 RPM)

- 中速(5,000 至 20,000 RPM)

- 高速(超过 20,000 RPM)

第十二章离心机市场(按类型)

- 介绍

- 实验室离心机

- 工业离心机

- 卧螺离心机

- 高速分离机

- 其他的

第 13 章:离心机市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 阿根廷

- 巴西

- 其他的

第十四章竞争格局

- 介绍

- 主要参与企业的策略/优势,2021 年 1 月至 2025 年 8 月

- 2024年市占率分析

- 2020-2024年收益分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十五章:公司简介

- 主要参与企业

- ALFA LAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- ANDRITZ

- FLSMIDTH A/S

- KUBOTA CORPORATION

- FLOTTWEG SE

- SPX FLOW, INC.

- MITSUBISHI KAKOKI KAISHA, LTD.

- FERRUM AG

- SIEBTECHNIK GMBH

- 其他公司

- SIGMA LABORZENTRIFUGEN GMBH

- BECKMAN COULTER, INC.

- EPPENDORF SE

- THERMO FISHER SCIENTIFIC INC.

- ANDREAS HETTICH GMBH

- PIERALISI MAIP SPA

- THOMAS BROADBENT & SONS LTD.

- ROUSSELET ROBATEL

- HEINKEL PROCESS TECHNOLOGY GMBH

- COLE-PARMER INSTRUMENT COMPANY, LLC

- HAUS CENTRIFUGE TECHNOLOGIES

- GTECH

- WESTERN STATES

- B&P LITTLEFORD

- ELGIN SEPARATION SOLUTIONS

第十六章 附录

The centrifuge market is projected to grow from USD 0.50 billion in 2025 to USD 0.63 billion by 2030, at a CAGR of 4.7%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Units) |

| Segments | Type, Speed, Rotor Type, Capacity, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and South America |

The centrifuge market is experiencing steady growth driven by rising demand across industries such as pharmaceuticals, biotechnology, food and beverage, chemicals, mining, and wastewater treatment. Increasing global population, rapid urbanization, and stricter environmental regulations are prompting industries to adopt advanced separation technologies for improved efficiency, quality, and compliance.

In pharmaceuticals and biotechnology, the need for precise separation in drug manufacturing and diagnostics is expanding centrifuge usage, while in food processing, the demand is fueled by the need for high-quality, contaminant-free products. The mining sector uses centrifuges for mineral recovery, and wastewater treatment plants rely on them for sludge dewatering and resource recovery. Technological advancements, including automation, energy-efficient designs, and enhanced process control, are further boosting adoption. Asia Pacific leads market growth due to industrial expansion, urban infrastructure development, and rising healthcare investments, while North America and Europe see steady demand driven by innovation and regulatory compliance. Despite challenges such as high equipment costs and maintenance requirements, the global centrifuge market is poised for sustained expansion, supported by industrial modernization and the push for resource efficiency. This growth is further reinforced by emerging applications in renewable energy, biotechnology research, and precision manufacturing.

" Industrial centrifuge is projected to register the fastest growth in the centrifuge market in terms of value during the forecast period."

Industrial centrifuges are witnessing strong growth due to their widespread adoption in large-scale processing industries, including pharmaceuticals, food & beverage, chemical manufacturing, oil & gas, and wastewater treatment. These machines are designed for continuous, high-throughput operations, enabling efficient separation of solids from liquids, liquids from liquids, and particle clarification at an industrial scale. Their rising demand is driven by increasing industrial automation, stricter quality standards, and the need for efficient waste management in production facilities. In the pharmaceutical sector, industrial centrifuges are critical for producing active pharmaceutical ingredients (APIs), while in the food industry, they are used for processes such as milk clarification, juice extraction, and edible oil purification. Wastewater treatment plants also rely heavily on industrial centrifuges for sludge dewatering and effluent management. Advancements in design, such as energy-efficient motors, enhanced safety systems, and IoT-enabled monitoring, are boosting their adoption. The expansion of manufacturing bases in emerging economies, combined with regulatory pushes for cleaner industrial processes, further fuels market growth. As industries increasingly focus on operational efficiency and sustainable practices, industrial centrifuges are becoming indispensable, leading to their position as the fastest-growing type segment in the global centrifuge market.

"Small capacity (< 10 m3/hour) segment to register the fastest growth in the centrifuge market in terms of value during the forecast period."

The small capacity centrifuge segment, defined as units with a throughput of less than 10 m3/hour, is experiencing the fastest growth in the centrifuge market due to its suitability for specialized, precision-driven applications. These centrifuges are widely used in research laboratories, clinical diagnostics, pilot-scale production, and niche industrial processes where high accuracy, controlled sample handling, and compact design are critical. Their relatively low operational footprint, portability, and ease of integration into existing facilities make them ideal for laboratories and small-scale production units with space and budget constraints. Moreover, the rising demand for customized, application-specific centrifugation, especially in pharmaceuticals, biotechnology, food processing, and environmental testing, has further accelerated adoption. The global surge in personalized medicine, increased focus on R&D activities, and expansion of small-scale manufacturing in emerging economies are also key growth drivers. Additionally, small capacity centrifuges often require lower capital investment and offer reduced maintenance costs, appealing to cost-sensitive end users. Technological advancements, such as improved rotor designs, digital controls, and energy efficiency, have expanded their capabilities, making them suitable for more complex separation tasks. As industries increasingly value flexibility, precision, and operational efficiency, small capacity centrifuges are set to maintain their strong growth trajectory during the forecast period.

"Medium speed (5,000-20,000 RPM) segment to register the highest growth in the centrifuge market, in terms of value, during the forecast period."

The medium-speed centrifuge segment, operating between 5,000 and 20,000 RPM, is witnessing the fastest growth in the centrifuge market due to its versatility and broad application range. These centrifuges strike an optimal balance between separation efficiency and sample integrity, making them suitable for both industrial and laboratory settings. In biotechnology and pharmaceuticals, medium-speed centrifuges are used for cell harvesting, protein purification, and vaccine production, where precise separation without damaging sensitive biological materials is essential. In industrial processes, they play a critical role in wastewater treatment, food and beverage clarification, and chemical processing, where moderate speeds ensure effective separation with reduced wear on components. Their adaptability to handle a wide variety of materials, from biological samples to industrial slurries, has expanded their demand across diverse sectors. Furthermore, medium-speed centrifuges typically consume less energy than ultra-high-speed models, offering cost savings and operational sustainability. Technological innovations, such as enhanced rotor balancing, automated controls, and improved safety mechanisms, have further increased their efficiency and user-friendliness. The growth is also driven by expanding biopharmaceutical manufacturing, increased investment in research, and the need for scalable yet efficient separation solutions. As industries seek cost-effective, versatile centrifugation options, the medium-speed category is positioned for sustained high growth.

"Fixed-angle rotor centrifuge segment to register the highest growth in the centrifuge market in terms of value during the forecast period."

The fixed-angle rotor centrifuge segment is experiencing the fastest growth in the rotor type category of the centrifuge market due to its efficiency, versatility, and widespread industrial and laboratory adoption. Fixed-angle rotors hold samples at a constant angle (typically 25°-40°) relative to the axis of rotation, enabling rapid sedimentation of particles along the tube wall. This design minimizes run time while delivering high separation efficiency, making it ideal for applications such as pelleting cells, separating subcellular components, purifying nucleic acids, and processing large volumes in industrial workflows. In biopharmaceutical manufacturing, fixed-angle rotors are favored for high-yield cell culture harvesting and protein isolation. Their robust design supports higher speeds and greater centrifugal forces compared to swinging-bucket rotors, making them suitable for a wide range of viscosities and densities. Industrial sectors, including food processing, chemical manufacturing, and wastewater treatment, are increasingly adopting these centrifuges for their durability and cost-effectiveness. Advances in rotor materials, such as corrosion-resistant alloys and lightweight composites, have enhanced performance and extended service life. Additionally, their compatibility with modern centrifuge systems featuring automated controls and enhanced safety mechanisms is driving demand. As industries prioritize speed, efficiency, and reliability, fixed-angle rotor centrifuges are becoming a preferred choice, fueling their rapid market growth.

"Fluid clarification segment to register the highest growth in the centrifuge market during the forecast period."

The fluid clarification segment is witnessing the fastest growth in the centrifuge market due to its critical role across industries requiring high-purity liquids. Fluid clarification involves the efficient removal of suspended solids, impurities, and other particulates from liquids, ensuring consistent quality and performance in downstream processes. This application is particularly vital in the food & beverage industry for juice, wine, and beer clarification; in pharmaceuticals for purifying active ingredients and injectable solutions; and in biotechnology for separating cell debris from valuable biomolecules. The chemical and petrochemical industries also rely on fluid clarification to maintain process efficiency and product integrity. The growing emphasis on regulatory compliance, product safety, and quality standards is driving adoption. Additionally, advances in centrifuge technology, such as high-speed, automated, and clean-in-place (CIP) systems, have enhanced clarification efficiency while reducing operational downtime. Expanding water treatment initiatives, especially in urban and industrial settings, are further boosting demand for centrifuges in fluid purification. Emerging economies, with their rising industrial output and stricter environmental regulations, are contributing significantly to this growth. As industries increasingly prioritize efficiency, sustainability, and precision, fluid clarification using centrifuges is becoming indispensable, securing its position as the fastest-growing application segment in terms of market value.

"Pharmaceutical industry to witness the fastest growth in the centrifuge market in terms of value during the forecast period."

The pharmaceutical industry is the fastest-growing end-use segment for the centrifuge market due to increasing global demand for medicines, vaccines, and biologics, driven by rising population, aging demographics, and the prevalence of chronic and infectious diseases. Centrifuges play a critical role in drug manufacturing, particularly in separation, purification, and clarification processes for active pharmaceutical ingredients (APIs), blood components, cell cultures, and biologics. The rapid growth of biopharmaceuticals and personalized medicine has further accelerated centrifuge adoption, especially high-speed and ultracentrifuges. Additionally, the COVID-19 pandemic highlighted the need for advanced centrifugation technologies for vaccine production and research. Stringent regulatory requirements and the shift toward continuous manufacturing in pharma have also driven investments in high-performance, automated centrifuges that ensure precision, sterility, and compliance. Emerging markets, such as India and China, are boosting pharmaceutical production capacity, creating significant opportunities for centrifuge manufacturers to cater to both large-scale and specialty drug manufacturing needs.

"Asia Pacific is projected to be the fastest-growing region in the centrifuge market, in terms of value, during the forecast period."

Asia Pacific is the fastest-growing region in the centrifuge market due to rapid industrialization, expanding manufacturing capacity, and significant investments in infrastructure and process industries. Countries like China, India, Japan, and South Korea are witnessing strong growth in pharmaceuticals, biotechnology, food and beverage, chemical processing, and wastewater treatment, all of which rely heavily on centrifuge technology. Rising healthcare needs, fueled by large populations and increasing disposable incomes, are boosting demand for pharmaceutical and bioprocessing centrifuges. Government initiatives for clean water, waste management, and environmental compliance are accelerating adoption in municipal and industrial wastewater treatment. Additionally, the Asia Pacific is becoming a hub for manufacturing and R&D, attracting global players to set up production facilities, thereby improving local availability and reducing costs. Competitive labor markets, favorable trade policies, and growing exports also contribute to market expansion. The region's robust economic growth, urban development, and industrial diversification establish it as the leading growth engine for the global centrifuge industry.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the centrifuge market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, Middle East & Africa - 5%, and South America - 5%

The centrifuge market comprises major players such as ALFA LAVAL (Sweden), GEA Group Aktiengesellschaft (Germany), ANDRITZ (Austria), FLSmidth A/S (Denmark), KUBOTA Corporation (Japan), Flottweg SE (Germany), SPX FLOW, Inc. (US), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Ferrum AG (Switzerland), and SIEBTECHNIK GmbH (Germany). The study includes an in-depth competitive analysis of these key players in the centrifuge market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the centrifuge market by type, speed, rotor type, capacity, application, end-use industry, and region, and estimates the overall market value across various regions. It has also conducted a detailed analysis of key industry players to provide insights into their business overviews, products and services, key strategies, and expansions associated with the centrifuge market.

Key Benefits of Buying This Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the centrifuge market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers (increasing demand for centrifuges in process industries, intensive exploration of oil and gas, and increased deployment of advanced technologies in centrifuges), restraints (environmental concerns related to waste disposal and high capital and maintenance costs), opportunities (growth in pharmaceutical and biotechnology sectors), and challenges (increasing competition from alternative technologies).

- Market Penetration: Comprehensive information on the centrifuge offered by top players in the centrifuge market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, investments, collaborations, and partnerships in the market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the centrifuge market across regions.

- Market Capacity: Wherever possible, the production capacities of companies producing centrifuges are provided, along with upcoming capacities for the centrifuge market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the centrifuge market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for interviews with experts

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CENTRIFUGE MARKET

- 4.2 CENTRIFUGE MARKET, BY TYPE

- 4.3 CENTRIFUGE MARKET, BY SPEED

- 4.4 CENTRIFUGE MARKET, BY APPLICATION

- 4.5 CENTRIFUGE MARKET, BY CAPACITY

- 4.6 CENTRIFUGE MARKET, BY ROTOR TYPE

- 4.7 CENTRIFUGE MARKET, BY END-USE INDUSTRY

- 4.8 CENTRIFUGE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Critical role in enhancing efficiency, productivity, and quality across sectors

- 5.2.1.2 Intensive oil & gas exploration

- 5.2.1.3 Increased deployment of advanced technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental concerns related to waste disposal

- 5.2.2.2 High capital and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of pharmaceutical and biotechnology sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing competition from alternative technologies

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON CENTRIFUGE MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 PREDICTIVE MAINTENANCE AND OPERATIONAL EFFICIENCY

- 5.3.3 ACCELERATED DESIGN AND PROTOTYPING OF CENTRIFUGES

- 5.3.4 PROCESS OPTIMIZATION IN END-USE INDUSTRIES

- 5.3.5 ENHANCED CUSTOMER SUPPORT AND TRAINING

- 5.3.6 MARKET INTELLIGENCE AND DEMAND FORECASTING

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CENTRIFUGE MANUFACTURERS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END USERS

- 6.4 IMPACT OF 2025 US TARIFFS ON CENTRIFUGE MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON COUNTRY/REGION

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON END-USE INDUSTRIES

- 6.5 INVESTMENT AND FUNDING SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP THREE TYPES, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 GRANTED PATENTS, 2015-2024

- 6.10 PUBLICATION TRENDS FOR LAST TEN YEARS

- 6.10.1 INSIGHTS

- 6.11 LEGAL STATUS

- 6.11.1 LEGAL STATUS SEARCH WAS CONDUCTED TO DETERMINE IF PATENTS ARE ACTIVE, INACTIVE, OR ABANDONED

- 6.11.2 JURISDICTION ANALYSIS

- 6.11.3 TOP APPLICANTS

- 6.11.4 KEY PATENTS FOR CENTRIFUGES

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT SCENARIO (HS CODE 842119)

- 6.12.2 EXPORT SCENARIO (HS CODE 842119)

- 6.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.14 TARIFF AND REGULATORY LANDSCAPE

- 6.14.1 TARIFF AND REGULATIONS RELATED TO CENTRIFUGES

- 6.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14.3 REGULATIONS RELATED TO CENTRIFUGE MARKET

- 6.15 PORTER'S FIVE FORCES ANALYSIS

- 6.15.1 THREAT OF NEW ENTRANTS

- 6.15.2 THREAT OF SUBSTITUTES

- 6.15.3 BARGAINING POWER OF SUPPLIERS

- 6.15.4 BARGAINING POWER OF BUYERS

- 6.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

- 6.17 MACROECONOMIC INDICATORS

- 6.17.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

- 6.18 CASE STUDY ANALYSIS

- 6.18.1 EPPENDORF'S SUSTAINABLE CENTRIFUGE INNOVATION

- 6.18.2 BECKMAN COULTER'S DEVELOPMENT OF AI-ENABLED CENTRIFUGES

- 6.18.3 ALFA LAVAL'S WATER TREATMENT CENTRIFUGE DEPLOYMENT

7 CENTRIFUGE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SOLID CONTROL

- 7.2.1 RISING DEMAND FOR EFFICIENT DRILLING FLUID MANAGEMENT AND ENVIRONMENTAL COMPLIANCE TO DRIVE MARKET

- 7.3 MUD CLEANING

- 7.3.1 INCREASING DEMAND FOR EFFICIENT DRILLING FLUID PURIFICATION AND COST-EFFECTIVE MUD RECYCLING TO BOOST MARKET

- 7.4 DEWATERING

- 7.4.1 EFFICIENT WASTE MANAGEMENT AND WATER RECOVERY IN WASTEWATER, MINING, AND CHEMICAL INDUSTRIES TO FUEL MARKET

- 7.5 FLUID CLARIFICATION

- 7.5.1 REQUIREMENT OF HIGH-PURITY AND STRINGENT QUALITY STANDARDS IN PHARMACEUTICALS, FOOD, AND BIOTECHNOLOGY TO PROPEL MARKET

- 7.6 OTHER APPLICATIONS

- 7.6.1 CELL HARVESTING

- 7.6.2 MATERIAL TESTING

8 CENTRIFUGE MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- 8.2 SMALL CAPACITY CENTRIFUGES (<10 M3/H)

- 8.2.1 RISING ADOPTION IN CLINICAL DIAGNOSTICS, RESEARCH, PHARMACEUTICAL AND BIOTECH APPLICATIONS TO DRIVE DEMAND

- 8.3 MEDIUM CAPACITY CENTRIFUGES (10-50 M3/H)

- 8.3.1 INCREASING DEMAND IN PHARMACEUTICALS, FOOD PROCESSING, AND WASTEWATER TREATMENT TO BOOST MARKET

- 8.4 LARGE CAPACITY CENTRIFUGES (>50 M3/H)

- 8.4.1 GROWING USE IN LARGE-SCALE INDUSTRIES TO PROPEL MARKET

9 CENTRIFUGE MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL

- 9.2.1 ADVANCED DRUG PURIFICATION AND STERILE MANUFACTURING PROCESSES TO DRIVE MARKET

- 9.3 FOOD & BEVERAGES

- 9.3.1 RISING DEMAND FOR HIGH-QUALITY, CONTAMINATION-FREE PRODUCTS TO BOOST MARKET

- 9.4 OIL & GAS

- 9.4.1 EFFICIENT SEPARATION OF CRUDE OIL COMPONENTS AND REMOVAL OF DRILLING MUD CONTAMINANTS TO PROPEL DEMAND

- 9.5 CHEMICALS

- 9.5.1 INCREASING PRODUCTION OF HIGH-PURITY SPECIALTY CHEMICALS TO FOSTER MARKET GROWTH

- 9.6 WATER & WASTEWATER TREATMENT

- 9.6.1 INTENSIFYING ENVIRONMENTAL REGULATIONS AND URBAN WASTEWATER CHALLENGES TO DRIVE DEMAND

- 9.7 OTHER END-USE INDUSTRIES

- 9.7.1 MINING AND MINERAL PROCESSING

- 9.7.2 ENERGY & POWER

- 9.7.3 TEXTILE

10 CENTRIFUGE MARKET, BY ROTOR TYPE

- 10.1 INTRODUCTION

- 10.2 FIXED-ANGLE ROTOR CENTRIFUGES

- 10.2.1 GROWING DEMAND FOR HIGH-SPEED AND EFFICIENT SEPARATION IN FINE PARTICLE RECOVERY AND MICROFILTRATION PRE-TREATMENT TO DRIVE MARKET

- 10.3 SWINGING BUCKET CENTRIFUGES

- 10.3.1 INCREASING USE IN CLINICAL DIAGNOSTICS, BLOOD PROCESSING, AND CELL CULTURE TO FUEL MARKET GROWTH

- 10.4 VERTICAL & HORIZONTAL CENTRIFUGES

- 10.4.1 EXPANDING APPLICATIONS IN LARGE-SCALE INDUSTRIAL SEPARATION AND FOOD PROCESSING TO BOOST DEMAND

- 10.5 OTHER ROTOR TYPES

- 10.5.1 ZONAL ROTORS

- 10.5.2 CONTINUOUS-FLOW ROTORS

- 10.5.3 AIR-DRIVEN ROTORS

11 CENTRIFUGE MARKET, BY SPEED

- 11.1 INTRODUCTION

- 11.2 LOW SPEED (BELOW 5,000 RPM)

- 11.2.1 WIDESPREAD ADOPTION IN CLINICAL DIAGNOSTICS AND ACADEMIC LABORATORIES TO BOOST MARKET

- 11.3 MEDIUM SPEED ( 5,000 RPM - 20,000 RPM)

- 11.3.1 INCREASING DEMAND IN PHARMACEUTICAL RESEARCH AND BIOPROCESSING TO DRIVE MARKET

- 11.4 HIGH SPEED ( ABOVE 20,000 RPM)

- 11.4.1 RISING APPLICATIONS IN GENOMICS, PROTEOMICS, AND ADVANCED MOLECULAR BIOLOGY TO PROPEL GROWTH

12 CENTRIFUGE MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 LABORATORY CENTRIFUGES

- 12.2.1 MICRO CENTRIFUGE

- 12.2.1.1 Increasing demand for rapid small-volume sample processing to drive growth

- 12.2.2 REFRIGERATED CENTRIFUGE

- 12.2.2.1 Rising need for temperature-sensitive sample preservation in proteomic and genomic research to propel market

- 12.2.3 ULTRACENTRIFUGE

- 12.2.3.1 Growing applications in separating nanoparticles, viruses, and macromolecules to fuel market

- 12.2.1 MICRO CENTRIFUGE

- 12.3 INDUSTRIAL CENTRIFUGES

- 12.3.1 SEDIMENTATION CENTRIFUGE

- 12.3.1.1 Expanding industrial use for high-volume sludge dewatering and mineral processing to support market growth

- 12.3.2 FILTRATION CENTRIFUGE

- 12.3.2.1 Rising demand for efficient solid-liquid separation in chemical and pharmaceutical manufacturing to propel market

- 12.3.1 SEDIMENTATION CENTRIFUGE

- 12.4 DECANTER CENTRIFUGES

- 12.4.1 INCREASING WASTEWATER TREATMENT AND FOOD PROCESSING APPLICATIONS TO DRIVE MARKET

- 12.5 HIGH SPEED SEPARATORS

- 12.5.1 DEMAND IN DAIRY, BEVERAGE, AND BIOFUEL INDUSTRIES TO PROPEL MARKET GROWTH

- 12.6 OTHER TYPES

- 12.6.1 PUSHER CENTRIFUGES

- 12.6.2 SCRAPER CENTRIFUGES

- 12.6.3 CONTINUOUS-FLOW CENTRIFUGES

13 CENTRIFUGE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Rapid industrialization and pharmaceutical innovation to drive market

- 13.2.2 JAPAN

- 13.2.2.1 Technological advancements in carbon-neutral energy-efficient centrifuge designs to fuel market

- 13.2.3 INDIA

- 13.2.3.1 Rising government investments in water treatment infrastructure to boost demand

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Increased R&D funding for biotechnology and environmental projects to propel adoption

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Escalating pharmaceutical production and government R&D funding to propel market growth

- 13.3.2 CANADA

- 13.3.2.1 Expanding oil & gas activities and clean energy initiatives to drive adoption

- 13.3.3 MEXICO

- 13.3.3.1 Growing food & beverage exports and investments in mining to fuel market expansion

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Escalating pharmaceutical R&D investments to propel market expansion

- 13.4.2 ITALY

- 13.4.2.1 Rising exports of foods and beverages to boost market

- 13.4.3 FRANCE

- 13.4.3.1 Stringent EU water treatment regulations to drive adoption

- 13.4.4 UK

- 13.4.4.1 Innovative automation technologies to fuel market

- 13.4.5 SPAIN

- 13.4.5.1 Increased focus on sustainable chemical production to enhance demand

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 UAE

- 13.5.1.1.1 Increasing water treatment initiatives under Vision 2021 to propel market growth

- 13.5.1.2 Saudi Arabia

- 13.5.1.2.1 Ambitious industrial diversification under Vision 2030 to drive adoption

- 13.5.1.3 Rest of GCC Countries

- 13.5.1.1 UAE

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Rising demand for water management solutions to boost market

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 ARGENTINA

- 13.6.1.1 Rising water treatment needs to drive market

- 13.6.2 BRAZIL

- 13.6.2.1 Robust growth in agricultural exports to propel market

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 ARGENTINA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-AUGUST 2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.3.1 MARKET SHARE OF KEY PLAYERS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Type footprint

- 14.6.5.4 Application footprint

- 14.6.5.5 End-use industry footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs, 2024

- 14.7.5.2 Competitive benchmarking of key startups/SMEs, 2024

- 14.7.6 VALUATION AND FINANCIAL METRICS OF KEY CENTRIFUGE VENDORS

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

- 14.8.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ALFA LAVAL

- 15.1.1.1 Products/Solutions/Services offered

- 15.1.1.2 Recent developments

- 15.1.1.2.1 Product launches

- 15.1.1.2.2 Deals

- 15.1.1.3 MnM view

- 15.1.1.3.1 Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 GEA GROUP AKTIENGESELLSCHAFT

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 ANDRITZ

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 FLSMIDTH A/S

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 KUBOTA CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 FLOTTWEG SE

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Expansions

- 15.1.6.4 MnM view

- 15.1.6.4.1 Right to win

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses and competitive threats

- 15.1.7 SPX FLOW, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Expansions

- 15.1.7.4 MnM view

- 15.1.7.4.1 Right to win

- 15.1.7.4.2 Strategic choices

- 15.1.7.4.3 Weaknesses and competitive threats

- 15.1.8 MITSUBISHI KAKOKI KAISHA, LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.8.3.1 Right to win

- 15.1.8.3.2 Strategic choices

- 15.1.8.3.3 Weaknesses and competitive threats

- 15.1.9 FERRUM AG

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 MnM view

- 15.1.9.3.1 Right to win

- 15.1.9.3.2 Strategic choices

- 15.1.9.3.3 Weaknesses and competitive threats

- 15.1.10 SIEBTECHNIK GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 MnM view

- 15.1.10.3.1 Right to win

- 15.1.10.3.2 Strategic choices

- 15.1.10.3.3 Weaknesses and competitive threats

- 15.1.1 ALFA LAVAL

- 15.2 OTHER PLAYERS

- 15.2.1 SIGMA LABORZENTRIFUGEN GMBH

- 15.2.2 BECKMAN COULTER, INC.

- 15.2.3 EPPENDORF SE

- 15.2.4 THERMO FISHER SCIENTIFIC INC.

- 15.2.5 ANDREAS HETTICH GMBH

- 15.2.6 PIERALISI MAIP SPA

- 15.2.7 THOMAS BROADBENT & SONS LTD.

- 15.2.8 ROUSSELET ROBATEL

- 15.2.9 HEINKEL PROCESS TECHNOLOGY GMBH

- 15.2.10 COLE-PARMER INSTRUMENT COMPANY, LLC

- 15.2.11 HAUS CENTRIFUGE TECHNOLOGIES

- 15.2.12 GTECH

- 15.2.13 WESTERN STATES

- 15.2.14 B&P LITTLEFORD

- 15.2.15 ELGIN SEPARATION SOLUTIONS

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TOP THREE TYPES (USD/UNIT)

- TABLE 3 CENTRIFUGE MARKET: ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 4 CENTRIFUGE MARKET: KEY TECHNOLOGIES

- TABLE 5 CENTRIFUGE MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 6 CENTRIFUGE MARKET: ADJACENT TECHNOLOGIES

- TABLE 7 TOTAL NUMBER OF PATENTS

- TABLE 8 MAJOR PATENT OWNERS FOR CENTRIFUGES

- TABLE 9 CENTRIFUGE MARKET: MAJOR PATENTS

- TABLE 10 CENTRIFUGE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TARIFFS RELATED TO CENTRIFUGES, BY COUNTRY, 2025

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 CENTRIFUGE MARKET: REGULATIONS/STANDARDS

- TABLE 18 IMPACT OF PORTERS FIVE FORCES ON CENTRIFUGE MARKET

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 21 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 22 CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 23 CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 25 CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 26 CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 27 CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 28 CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 29 CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 30 CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 31 CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 32 CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 CENTRIFUGE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 CENTRIFUGE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 CENTRIFUGE MARKET, BY REGION, 2021-2024 (UNIT)

- TABLE 37 CENTRIFUGE MARKET, BY REGION, 2025-2030 (UNIT)

- TABLE 38 ASIA PACIFIC: CENTRIFUGE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 ASIA PACIFIC: CENTRIFUGE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 ASIA PACIFIC: CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 ASIA PACIFIC: CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 43 ASIA PACIFIC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 52 CHINA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 53 CHINA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 54 JAPAN: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 55 JAPAN: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 56 INDIA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 57 INDIA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 SOUTH KOREA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 59 SOUTH KOREA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: CENTRIFUGE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: CENTRIFUGE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 76 US: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 77 US: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 CANADA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 79 CANADA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 MEXICO: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 81 MEXICO: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: CENTRIFUGE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: CENTRIFUGE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 96 GERMANY: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 97 GERMANY: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 101 FRANCE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 102 UK: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 103 UK: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 104 SPAIN: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 105 SPAIN: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 107 REST OF EUROPE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 122 UAE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 123 UAE: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 SAUDI ARABIA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 125 SAUDI ARABIA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 126 REST OF GCC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 127 REST OF GCC: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 SOUTH AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 129 SOUTH AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 SOUTH AMERICA: CENTRIFUGE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 SOUTH AMERICA: CENTRIFUGE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 SOUTH AMERICA: CENTRIFUGE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 SOUTH AMERICA: CENTRIFUGE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AMERICA: CENTRIFUGE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH AMERICA: CENTRIFUGE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH AMERICA: CENTRIFUGE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 141 SOUTH AMERICA: CENTRIFUGE MARKET, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 142 SOUTH AMERICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 143 SOUTH AMERICA: CENTRIFUGE MARKET, BY ROTOR TYPE, 2025-2030 (USD MILLION)

- TABLE 144 SOUTH AMERICA: CENTRIFUGE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 145 SOUTH AMERICA: CENTRIFUGE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 146 ARGENTINA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 147 ARGENTINA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 BRAZIL: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 149 BRAZIL: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 151 REST OF SOUTH AMERICA: CENTRIFUGE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 OVERVIEW OF STRATEGIES ADOPTED BY KEY CENTRIFUGE MANUFACTURERS, JANUARY 2021-AUGUST 2025

- TABLE 153 CENTRIFUGE MARKET: DEGREE OF COMPETITION

- TABLE 154 CENTRIFUGE MARKET: REGION FOOTPRINT

- TABLE 155 CENTRIFUGE MARKET: TYPE FOOTPRINT

- TABLE 156 CENTRIFUGE MARKET: APPLICATION FOOTPRINT

- TABLE 157 CENTRIFUGE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 158 CENTRIFUGE MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 159 CENTRIFUGE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES, 2024

- TABLE 160 CENTRIFUGE MARKET: PRODUCT LAUNCHES, JANUARY 2021- AUGUST 2025

- TABLE 161 CENTRIFUGE MARKET: DEALS, JANUARY 2021- AUGUST 2025

- TABLE 162 CENTRIFUGE MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 163 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 164 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 ALFA LAVAL: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 166 ALFA LAVAL: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 167 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 168 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 170 GEA GROUP AKTIENGESELLSCHAFT: DEALS, JANUARY 2021-JULY 2025

- TABLE 171 GEA GROUP AKTIENGESELLSCHAFT: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 172 ANDRITZ: COMPANY OVERVIEW

- TABLE 173 ANDRITZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 ANDRITZ: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 175 FLSMIDTH A/S: COMPANY OVERVIEW

- TABLE 176 FLSMIDTH A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 FLSMIDTH A/S: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 178 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 179 KUBOTA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 180 FLOTTWEG SE: COMPANY OVERVIEW

- TABLE 181 FLOTTWEG SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 FLOTTWEG SE: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 183 FLOTTWEG SE: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 184 SPX FLOW, INC.: COMPANY OVERVIEW

- TABLE 185 SPX FLOW, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 SPX FLOW, INC.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 187 SPX FLOW, INC.: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 188 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY OVERVIEW

- TABLE 189 MITSUBISHI KAKOKI KAISHA, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 FERRUM AG: COMPANY OVERVIEW

- TABLE 191 FERRUM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SIEBTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 193 SIEBTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SIGMA LABORZENTRIFUGEN GMBH: COMPANY OVERVIEW

- TABLE 195 BECKMAN COULTER, INC.: COMPANY OVERVIEW

- TABLE 196 EPPENDORF SE: COMPANY OVERVIEW

- TABLE 197 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 198 ANDREAS HETTICH GMBH: COMPANY OVERVIEW

- TABLE 199 PIERALISI MAIP SPA: COMPANY OVERVIEW

- TABLE 200 THOMAS BROADBENT & SONS LTD.: COMPANY OVERVIEW

- TABLE 201 ROUSSELET ROBATEL: COMPANY OVERVIEW

- TABLE 202 HEINKEL PROCESS TECHNOLOGY GMBH: COMPANY OVERVIEW

- TABLE 203 COLE-PARMER INSTRUMENT COMPANY, LLC: COMPANY OVERVIEW

- TABLE 204 HAUS CENTRIFUGE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 205 GTECH: COMPANY OVERVIEW

- TABLE 206 WESTERN STATES: COMPANY OVERVIEW

- TABLE 207 B&P LITTLEFORD : COMPANY OVERVIEW

- TABLE 208 ELGIN SEPARATION SOLUTIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CENTRIFUGE MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 CENTRIFUGE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 CENTRIFUGE MARKET: DATA TRIANGULATION

- FIGURE 9 MEDIUM SPEED (5,000 RPM-20,000 RPM) SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 10 FLUID CLARIFICATION SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 11 INDUSTRIAL CENTRIFUGES SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 12 FIXED-ANGLE ROTOR CENTRIFUGES SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 13 SMALL CAPACITY SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 14 PHARMACEUTICAL SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 15 ASIA PACIFIC DOMINATED CENTRIFUGE MARKET IN 2024

- FIGURE 16 RISING DEMAND FROM PHARMACEUTICAL, FOOD & BEVERAGES, AND CHEMICAL SECTORS TO DRIVE MARKET

- FIGURE 17 INDUSTRIAL CENTRIFUGES TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- FIGURE 18 MEDIUM SPEED ( 5,000 RPM-20,000 RPM) TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 FLUID CLARIFICATION TO BE FASTEST-GROWING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 20 SMALL CAPACITY (<10 M3/HOUR) TO BE FASTEST-GROWING CAPACITY SEGMENT DURING FORECAST PERIOD

- FIGURE 21 FIXED-ANGLE ROTOR CENTRIFUGES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 22 PHARMACEUTICAL TO BE FASTEST-GROWING END-USE INDUSTRY SEGMENT DURING FORECAST PERIOD

- FIGURE 23 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES IN CENTRIFUGE MARKET

- FIGURE 25 USE OF GENERATIVE AI IN CENTRIFUGE MARKET

- FIGURE 26 REVENUE SHIFT IN CENTRIFUGE MARKET

- FIGURE 27 CENTRIFUGE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 CENTRIFUGE MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 CENTRIFUGE MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND FOR TOP THREE TYPES, BY KEY PLAYERS, 2024

- FIGURE 31 CENTRIFUGE MARKET ECOSYSTEM

- FIGURE 32 PATENTS GRANTED IN LAST TEN YEARS

- FIGURE 33 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 34 REGIONAL ANALYSIS OF CENTRIFUGE-RELATED PATENTS GRANTED, 2024

- FIGURE 35 TOP 10 PATENT APPLICANTS IN LAST TEN YEARS

- FIGURE 36 IMPORT DATA RELATED TO HS CODE 842119-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 37 EXPORT DATA RELATED TO HS CODE 842119-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS: CENTRIFUGE MARKET

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 40 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- FIGURE 41 FLUID CLARIFICATION SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 42 SMALL CAPACITY SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 43 PHARMACEUTICALS SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 44 FIXED-ANGLE ROTOR CENTRIFUGES SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 45 MEDIUM SPEED SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 46 INDUSTRIAL CENTRIFUGE SEGMENT TO LEAD CENTRIFUGE MARKET DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC: CENTRIFUGE MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: CENTRIFUGE MARKET SNAPSHOT

- FIGURE 50 EUROPE: CENTRIFUGE MARKET SNAPSHOT

- FIGURE 51 CENTRIFUGE MARKET: SHARE OF KEY PLAYERS, 2024

- FIGURE 52 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 53 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SEGMENT

- FIGURE 54 CENTRIFUGE MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 55 CENTRIFUGE MARKET: COMPANY FOOTPRINT

- FIGURE 56 CENTRIFUGE MARKET: COMPANY EVALUATION MATRIX STARTUPS/SMES, 2024

- FIGURE 57 EV/EBITDA OF KEY VENDORS

- FIGURE 58 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 59 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 60 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 61 ANDRITZ: COMPANY SNAPSHOT

- FIGURE 62 FLSMIDTH A/S: COMPANY SNAPSHOT

- FIGURE 63 KUBOTA CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY SNAPSHOT