|

市场调查报告书

商品编码

1823734

全球罐头涂料市场类型、应用和地区预测(至 2030 年)Can Coatings Market by Type (Epoxy, Acrylic, Polyester, Other Types), Application (Food Cans, Beverage Cans, Aerosol Cans, Other Applications), and Region - Global Forecast to 2030 |

||||||

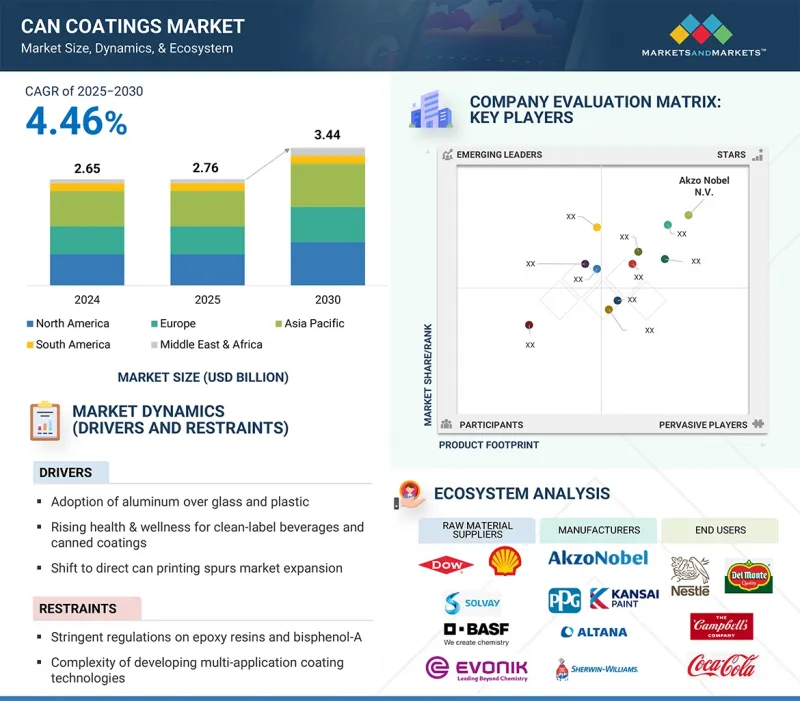

预计全球罐头涂料市场规模到 2025 年将达到 27.6 亿美元,到 2030 年将达到 34.4 亿美元,2025 年至 2030 年的复合年增长率为 4.46%。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万美元每千吨 |

| 部分 | 类型、用途、区域 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

涂层技术和材料的进步推动罐头涂层市场的发展

涂料创新带来多种功能优势,包括更快的固化速度、更大的柔韧性以及更少的环境影响。溶剂型涂料系统正被水性、紫外光固化和粉末涂料系统所取代,这些系统必须满足永续性和能源效率标准。奈米技术正在提供更佳的阻隔保护、更薄的涂层和更长的耐久性。这些进步正在帮助製造商缩短生产时间、降低成本并提高营运效率。针对食品和饮料应用的客製化涂料正日益普及。凭藉有助于提升性能和永续性的技术,先进涂料正在建立行业标准,并在不断变化的市场对更高品质和更有效率的需求中提供竞争优势。

以以金额为准,丙烯酸涂料是全球罐头涂料市场的第三大细分市场。

丙烯酸罐头涂料正变得越来越重要,因为它们的透明度使金属基材或下面的印刷图案清晰可见。这种透明度不仅提升了罐头的美感,也使品牌能够更灵活地展示高端饰面的优势,并创造独特的陈列架形象。与不透明涂料相比,丙烯酸配方使消费者能够看到金属光泽和装饰性覆盖层,使其成为高端饮料和特色食品的理想解决方案。由于消费者通常根据视觉吸引力做出购买决定,丙烯酸涂料能够积极地支持和提升货架上独特的品牌形象和差异化,从而推动了竞争激烈的包装市场对此类涂料的需求不断增长。

2024 年,食品罐头领域在以金额为准占据第二大市场。

2024年,食品罐头涂料应用将占据罐头涂料市场的第二大份额。食品罐头需要能够在罐头金属和食品之间形成极强屏障的涂料,以保护食品免受外部污染物、污染水平和营养品质劣化。此类罐头涂料有助于确保罐内食品即使在经过一定储存期和条件后仍能保持安全、美味和美观。随着全球供应链覆盖全球各个角落,以及全球对包装食品的需求不断增长,涂料透过持续保护食品,持续解决污染问题。

预计南美将成为罐头涂料市场以金额为准成长最快的地区。

预计南美洲将在2025年至2030年期间达到最高的复合年增长率。在政府和私人投资者的支持下,区域罐头製造设施的扩张正在推动罐头涂料市场的发展。巴西和哥伦比亚等国家正在新建设施并升级现有设施,以满足国内消费和出口需求。投资本地製造设施,改善供应链,减少对进口的依赖,并采用最新的涂料技术,正在推动每个国家的成长。投资建设生产能力意味着本地製造能够根据地区差异和当地气候条件定製配方。增强本地生产能力可以加快反应速度,降低成本,并降低与市场波动相关的风险,从而进一步巩固南美洲在全球罐头涂料市场中的地位。

本报告对全球罐头涂料市场进行了分析,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 罐头涂料市场充满机会

- 罐头涂料市场(按地区)

- 亚太罐头涂料市场(按应用和国家划分)

- 罐头涂料市场、应用与地区

- 罐头涂料市场:主要国家

第五章 市场概况

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 主要相关利益者和采购标准

- 宏观经济展望

第六章 产业趋势

- 供应链分析

- 原物料供应商

- 製造商

- 分销网络

- 最终用途产业

- 定价分析

- 主要企业每种应用的平均销售价格(2024 年)

- 罐头涂料各地区平均售价趋势(2022-2030)

- 影响客户业务的趋势/中断

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 案例研究分析

- 贸易分析

- 进口情形(HS 编码 320820)

- 出口情形(HS 编码 320820)

- 监管格局

- 监管机构、政府机构和其他组织

- 法规结构

- 大型会议和活动(2025-2026)

- 投资金筹措场景

- 专利分析

- 方法

- 文件类型

- 主申请人

- 司法管辖权分析

- 2025年美国关税的影响—概述

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

- 人工智慧/生成式人工智慧对罐头涂料市场的影响

7. 罐头涂料市场类型

第八章罐头涂料市场(按应用)

- 介绍

- 饮料罐

- 食品罐

- 气雾罐

- 其他用途

9. 罐头涂料市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 泰国

- 澳洲

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 中东和非洲

- 南美洲

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市占率分析

- 收益分析

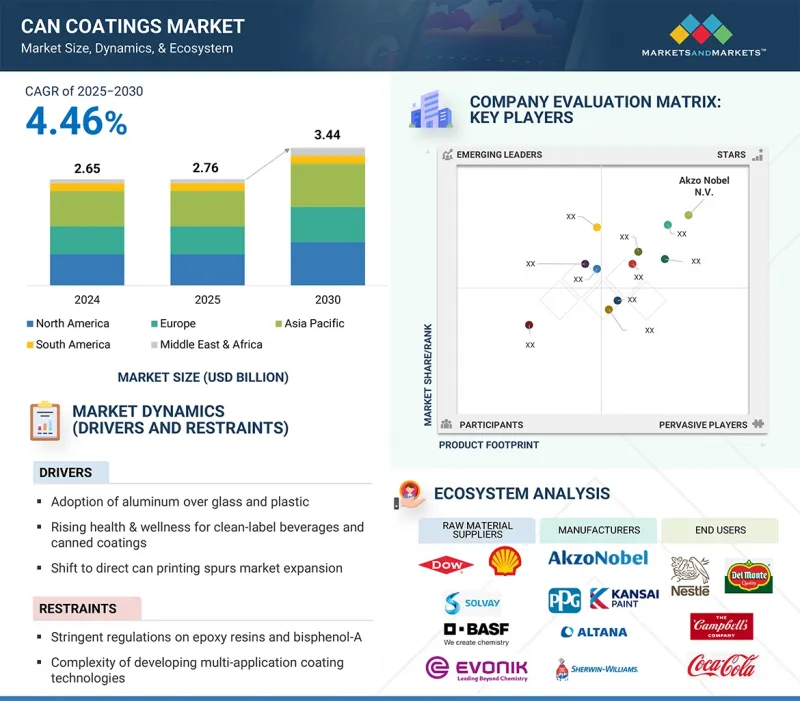

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 品牌/产品比较分析

- 公司估值及财务指标

- 竞争场景

第 11 章:公司简介

- 主要企业

- THE SHERWIN-WILLIAMS COMPANY

- PPG INDUSTRIES, INC.

- AKZO NOBEL NV

- ALTANA AG

- KANSAI PAINT CO., LTD.

- TOYO INK GROUP

- SUZHOU 3N PACKAGING COATINGS CO., LTD.

- BERGER PAINTS INDIA LIMITED

- TIGER COATINGS

- SALCHI METALCOAT SRL

- Start-Ups/中小型企业

- SAKATA INX

- VPL COATINGS GMBH & CO KG

- LANKWITZER LACKFABRIK GMBH

- SPECTRUM INDUSTRIES LLC

- DIOSTYL COATING

- IPC GMBH & CO. KG

- FOSHAN SHENGRUN METAL PACKAGING MATERIALS CO., LTD.

- KUPSA COATINGS PVT. LTD.

- PEARL COATING

- FINE CHEMICAL INDUSTRIES

- MIDAD PRINTING INK

- TARA PAINTS PVT. LTD.

- ROCKLINK SCIENCE & TECHNOLOGY(FOSHAN)CO. LTD

- FOSHAN FAXUS NEW MATERIALS CO., LTD.

- GUANGZHOU HUMAN NEW MATERIAL SCIENCE AND TECHNOLOGY CO., LTD.

第十二章:相邻市场与相关市场

- 介绍

- 限制

- 工业涂料市场

- 市场定义

- 市场概况

- 工业涂料市场(按地区)

- 亚太地区

- 北美洲

- 欧洲

- 中东和非洲

- 南美洲

第十三章 附录

Can coatings market is estimated to be valued at USD 2.76 billion in 2025 and reach USD 3.44 billion by 2030, at a CAGR of 4.46% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Advancements in coating technologies and materials to drive can coating market

Innovation in coatings are creating multi-functional benefits, such as faster curing, higher flexibility, and reduced environmental impact. Solvent-based coating systems are being replaced with water-based systems, UV-curable systems, and powder coating systems and are required to meet sustainability and energy efficiency standards. Nanotechnology is allowing for superior barrier protection and thinner application with longer durability. These advancements assist in limiting production time, reducing costs, and providing manufacturers operational efficiency. Customizable coatings that are specific to foods or beverages are being more widely recognized. With technology contributing to better performance and sustainability, advanced coatings are setting standards and offering better competitive advantages in an ever-changing market demand for higher quality and efficiency.

The acrylic segment was the third-largest segment, in terms of value, of the global can coatings market

Acrylic can coatings have become increasingly important because they are transparent, which allows the visibility of the metal substrate or any printed designs beneath the coating. Such transparency not only enhances the esthetic appeal of the can but also allows brands to be more flexible in showing benefits of premium finishes and creating a unique shelf presence. Compared to opaque coatings, acrylic formulations allow the consumer to see the metallic luster or decorative overlays, which makes them a perfect solution for luxury beverage and specialty food products. As consumers typically make purchasing decisions based on visual appeal, acrylic coating positively supports and encourages distinctive brand identity and differentiation on the shelf, which is a large part of the reason for the increase in the demand for these coatings in competitive packaging markets.

The food cans segment accounted for the second-largest share of the can coatings market, in terms of value, in 2024

The food cans application held the second-largest share of the can coatings market in 2024. Food cans require coatings that can provide very strong barriers between the can metal, and whatever the food contents are, for the protection of the food contents from external contaminates or levels of contamination, and degradation of nutritional quality. These can coatings help to ensure that the food within the can is still safe, flavor-rich, and visually appealing even after certain storage periods or conditions. With global supply chains that are reaching all corners of the world, and global demand for packaged foods increasing, coatings continue to bridge contamination issues by protecting the food for a specified period of time.

South America is expected to be the fastest-growing region in the can coatings market, in terms of value

South America is projected to witness the highest CAGR between 2025 and 2030. The expansion of regional can manufacturing facilities, built with the support of governments and private investors, is fueling the can coatings market. New facilities and upgrades to existing facilities are underway in countries like Brazil and Colombia with domestic consumption and exports in mind. Investments in local manufacturing facilities, which improve supply chains, decrease reliance on imports, and adopt the latest coating technologies, are bolstering growth in all countries. Investments to build capacities mean localized manufacturing can create custom formulations tailored not only to regional interpretation but to regional climatic conditions. Enhanced local capability allows for faster responsiveness, lower costs, and less risk associated with changing markets, furthering South America's position in global can coatings.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The key players profiled in the report include The Sherwin-Williams Company (US), PPG Industries, Inc. (US), Akzo Nobel N.V. (Netherlands), Kansai Paint Co., Ltd. (Japan), ALTANA AG (Germany), Toyo Ink Group (Japan), Suzhou 3N Packaging Coatings (China), Berger Paints (India), Tiger Coatings (Austria), and Salchi Metalcoat S.r.l. (Italy).

Research Coverage

This report segments the market for can coatings based on type, application, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for can coatings.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the can coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on can coatings offered by top players in the global market.

- Analysis of key drivers: (Adoption of aluminum over glass and plastic, rising health & wellness for clean-label beverages and canned coatings, shift to direct can printing spurs market expansion, and growth in flexible packaging formats fuels can coatings market), restraints (Stringent regulations on epoxy resins and bisphenol-A and complexity of developing multi-application coating technologies), opportunities (Growth in emerging economies and eco-friendly raw materials and BPA-NI-based coatings), and challenges (Slow technological adoption in emerging markets) influencing the growth of the can coatings market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the can coatings market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for can coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global can coatings market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the can coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 CAN COATINGS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 CAN COATINGS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3.5 YEARS CONSIDERED

- 1.3.6 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Data from key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CAN COATINGS MARKET

- 4.2 CAN COATINGS MARKET, BY REGION

- 4.3 ASIA PACIFIC CAN COATINGS MARKET, BY APPLICATION AND COUNTRY

- 4.4 CAN COATINGS MARKET, APPLICATION VS. REGION

- 4.5 CAN COATINGS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of aluminum over glass and plastic

- 5.2.1.2 Rising health & wellness for clean-label beverages and canned coatings

- 5.2.1.3 Shift to direct can printing driving expansion

- 5.2.1.4 Growth in flexible packaging formats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations on epoxy resins and bisphenol-A

- 5.2.2.2 Complexity of developing multi-application coating technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in emerging economies

- 5.2.3.2 Eco-friendly raw materials and BPA-NI-based coatings

- 5.2.4 CHALLENGES

- 5.2.4.1 Slow technological adoption in emerging markets

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORKS

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF APPLICATIONS, BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF CAN COATINGS, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 ELECTROCOATING TECHNOLOGY

- 6.5.1.2 SPRAY COATING TECHNOLOGY

- 6.5.2 COMPLIMENTARY TECHNOLOGIES

- 6.5.2.1 ROLL COATING TECHNOLOGY

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CASE STUDY ON BPA-NI COATING ADOPTION IN FOOD CANS

- 6.6.2 CASE STUDY OF AKZONOBEL N.V. ON CAN COATINGS IN BEVERAGE AND AEROSOL CANS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 320820)

- 6.7.2 EXPORT SCENARIO (HS CODE 320820)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 International Organization for Standardization (ISO)

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON CAN COATINGS MARKET

7 CAN COATINGS MARKET, BY TYPE

- 7.1 INTRODUCTION

8 CAN COATINGS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 BEVERAGE CANS

- 8.2.1 GROWING PREFERENCE FOR CONVENIENT AND SUSTAINABLE PACKAGING TO DRIVE DEMAND

- 8.3 FOOD CANS

- 8.3.1 NEED FOR EXTENDED SHELF LIFE AND PROTECTION AGAINST MICROBIAL CONTAMINATION TO DRIVE DEMAND

- 8.4 AEROSOL CANS

- 8.4.1 EXPANDING PERSONAL CARE AND HOUSEHOLD PRODUCTS MARKET TO DRIVE DEMAND

- 8.5 OTHER APPLICATIONS

9 CAN COATINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Growing demand for canned food & beverage to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Strong packaging demand to drive market

- 9.2.3 INDIA

- 9.2.3.1 Packaging innovation and FMCG boom to fuel demand

- 9.2.4 THAILAND

- 9.2.4.1 Government and investment support to boost demand

- 9.2.5 AUSTRALIA

- 9.2.5.1 Increasing exports of premium food and beverage products

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Strong industrial infrastructure to fuel growth

- 9.3.2 CANADA

- 9.3.2.1 Focus on advanced research & development to drive demand

- 9.3.3 MEXICO

- 9.3.3.1 Expanding manufacturing sector to support market growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Strong industrial base to fuel demand

- 9.4.2 FRANCE

- 9.4.2.1 Stringent food safety regulations and strong packaged food demand to drive market

- 9.4.3 UK

- 9.4.3.1 Stringent regulatory framework to propel market

- 9.4.4 SPAIN

- 9.4.4.1 Rising food exports and sustainable packaging to drive market

- 9.4.5 ITALY

- 9.4.5.1 Robust food industry and sustainability push driving can coatings growth in Italy

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Growing demand for beverage cans to drive market

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 THE SHERWIN-WILLIAMS COMPANY

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM View

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 PPG INDUSTRIES, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM View

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 AKZO NOBEL N.V.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM View

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ALTANA AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM View

- 11.1.4.4.1 Right to Win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 KANSAI PAINT CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM View

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 TOYO INK GROUP

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 SUZHOU 3N PACKAGING COATINGS CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 BERGER PAINTS INDIA LIMITED

- 11.1.8.1 Business Overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 TIGER COATINGS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 SALCHI METALCOAT S.R.L.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 THE SHERWIN-WILLIAMS COMPANY

- 11.2 START-UP/SMES

- 11.2.1 SAKATA INX

- 11.2.2 VPL COATINGS GMBH & CO KG

- 11.2.3 LANKWITZER LACKFABRIK GMBH

- 11.2.4 SPECTRUM INDUSTRIES LLC

- 11.2.5 DIOSTYL COATING

- 11.2.6 IPC GMBH & CO. KG

- 11.2.7 FOSHAN SHENGRUN METAL PACKAGING MATERIALS CO., LTD.

- 11.2.8 KUPSA COATINGS PVT. LTD.

- 11.2.9 PEARL COATING

- 11.2.10 FINE CHEMICAL INDUSTRIES

- 11.2.11 MIDAD PRINTING INK

- 11.2.12 TARA PAINTS PVT. LTD.

- 11.2.13 ROCKLINK SCIENCE & TECHNOLOGY (FOSHAN) CO. LTD

- 11.2.14 FOSHAN FAXUS NEW MATERIALS CO., LTD.

- 11.2.15 GUANGZHOU HUMAN NEW MATERIAL SCIENCE AND TECHNOLOGY CO., LTD.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATION

- 12.3 INDUSTRIAL COATINGS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 INDUSTRIAL COATINGS MARKET, BY REGION

- 12.4.1 ASIA PACIFIC

- 12.4.2 NORTH AMERICA

- 12.4.3 EUROPE

- 12.4.4 MIDDLE EAST & AFRICA

- 12.4.5 SOUTH AMERICA

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CAN COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 4 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 5 AVERAGE SELLING PRICE OF APPLICATIONS, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE TREND OF CAN COATINGS, BY REGION, 2023-2030 (USD/KG)

- TABLE 7 CAN COATINGS MARKET: ECOSYSTEM

- TABLE 8 IMPORT OF CAN COATINGS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 9 EXPORT OF CAN COATINGS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 10 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 CAN COATINGS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 CAN COATINGS MARKET: FUNDING/INVESTMENT SCENARIO, 2024-2025

- TABLE 18 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 19 LIST OF MAJOR PATENTS RELATED TO CAN COATINGS, 2014-2024

- TABLE 20 PATENTS BY PPG INDUSTRIES, INC.

- TABLE 21 TABLE 1: US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 CAN COATINGS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 23 CAN COATINGS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 24 CAN COATINGS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 25 CAN COATINGS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 26 CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 27 CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 29 CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 30 BEVERAGE CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 BEVERAGE CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 BEVERAGE CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 33 BEVERAGE CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 FOOD CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 FOOD CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FOOD CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 37 FOOD CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 AEROSOL CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 AEROSOL CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 AEROSOL CANS: CAN COATINGS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 41 AEROSOL CANS: CAN COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 OTHER APPLICATIONS: CAN COATINGS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: CAN COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 OTHER APPLICATIONS: CAN COATINGS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 45 OTHER APPLICATIONS: CAN COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 CAN COATINGS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 CAN COATINGS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 CAN COATINGS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 49 CAN COATINGS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 50 ASIA PACIFIC: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 53 ASIA PACIFIC: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 54 ASIA PACIFIC: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 55 ASIA PACIFIC: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 57 ASIA PACIFIC: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 58 CHINA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 59 CHINA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 CHINA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 61 CHINA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 62 JAPAN: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 63 JAPAN: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 JAPAN: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 65 JAPAN: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 66 INDIA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 67 INDIA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 INDIA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 69 INDIA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 70 THAILAND: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 71 THAILAND: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 THAILAND: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 73 THAILAND: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 74 AUSTRALIA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 75 AUSTRALIA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 AUSTRALIA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 77 AUSTRALIA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 78 NORTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 81 NORTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 82 NORTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 85 NORTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 86 US: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 87 US: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 US: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 89 US: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 90 CANADA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 91 CANADA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 CANADA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 93 CANADA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 94 MEXICO: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 95 MEXICO: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 MEXICO: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 97 MEXICO: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 98 EUROPE: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 99 EUROPE: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 101 EUROPE: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 102 EUROPE: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 103 EUROPE: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 105 EUROPE: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 106 GERMANY: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 107 GERMANY: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 GERMANY: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 109 GERMANY: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 110 FRANCE: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 111 FRANCE: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 FRANCE: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 113 FRANCE: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 114 UK: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 115 UK: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 UK: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 117 UK: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 118 SPAIN: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 119 SPAIN: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 SPAIN: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 121 SPAIN: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 122 ITALY: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 123 ITALY: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 ITALY: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 125 ITALY: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 130 SOUTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 131 SOUTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 SOUTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 133 SOUTH AMERICA: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 134 SOUTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 135 SOUTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 137 SOUTH AMERICA: CAN COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 138 BRAZIL: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 139 BRAZIL: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 BRAZIL: CAN COATINGS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 141 BRAZIL: CAN COATINGS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 142 STRATEGIES ADOPTED BY KEY CAN COATING MANUFACTURERS, JANUARY 2020-MAY 2025

- TABLE 143 CAN COATINGS MARKET: DEGREE OF COMPETITION

- TABLE 144 CAN COATINGS MARKET: REGION FOOTPRINT

- TABLE 145 CAN COATINGS MARKET: TYPE FOOTPRINT

- TABLE 146 CAN COATINGS MARKET: APPLICATION FOOTPRINT

- TABLE 147 CAN COATINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 148 CAN COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 149 CAN COATINGS MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 150 CAN COATINGS MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 151 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 152 THE SHERWIN-WILLIAMS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 THE SHERWIN-WILLIAMS COMPANY: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 154 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 155 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 PPG INDUSTRIES, INC.: DEALS, JANUARY 2020-MAY 2025

- TABLE 157 PPG INDUSTRIES, INC.: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 158 AKZO NOBEL N.V.: COMPANY OVERVIEW

- TABLE 159 AKZO NOBEL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 AKZO NOBEL N.V.: DEALS, JANUARY 2020-MAY 2025

- TABLE 161 AKZO NOBEL N.V.: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 162 ALTANA AG: COMPANY OVERVIEW

- TABLE 163 ALTANA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 ALTANA AG: DEALS, JANUARY 2020-MAY 2025

- TABLE 165 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- TABLE 166 KANSAI PAINT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 KANSAI PAINT CO., LTD.: DEALS, JANUARY 2020-MAY 2025

- TABLE 168 TOYO INK GROUP: COMPANY OVERVIEW

- TABLE 169 TOYO INK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 TOYO INK GROUP: DEALS, JANUARY 2020-MAY 2025

- TABLE 171 SUZHOU 3N PACKAGING COATINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 172 SUZHOU 3N PACKAGING COATINGS CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 173 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 174 BERGER PAINTS INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 TIGER COATINGS: COMPANY OVERVIEW

- TABLE 176 TIGER COATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 TIGER COATINGS: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 178 SALCHI METALCOAT S.R.L.: COMPANY OVERVIEW

- TABLE 179 SALCHI METALCOAT S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SAKATA INX: COMPANY OVERVIEW

- TABLE 181 VPL COATINGS GMBH & CO KG: COMPANY OVERVIEW

- TABLE 182 LANKWITZER LACKFABRIK GMBH: COMPANY OVERVIEW

- TABLE 183 SPECTRUM INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 184 DIOSTYL COATING: COMPANY OVERVIEW

- TABLE 185 IPC GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 186 FOSHAN SHENGRUN METAL PACKAGING MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 187 KUPSA COATINGS PVT. LTD.: COMPANY OVERVIEW

- TABLE 188 PEARL COATING: COMPANY OVERVIEW

- TABLE 189 FINE CHEMICAL INDUSTRIES: COMPANY OVERVIEW

- TABLE 190 MIDAD PRINTING INK: COMPANY OVERVIEW

- TABLE 191 TARA PAINTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 192 ROCKLINK SCIENCE & TECHNOLOGY (FOSHAN) CO. LTD: COMPANY OVERVIEW

- TABLE 193 FOSHAN FAXUS NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 194 GUANGZHOU HUMAN NEW MATERIAL SCIENCE AND TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 195 ADJACENT MARKET

- TABLE 196 ASIA PACIFIC: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 197 ASIA PACIFIC: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 199 ASIA PACIFIC: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 200 NORTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 201 NORTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 NORTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 203 NORTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 204 EUROPE: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 205 EUROPE: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 206 EUROPE: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 207 EUROPE: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 212 SOUTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 213 SOUTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 215 SOUTH AMERICA: INDUSTRIAL COATINGS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

List of Figures

- FIGURE 1 CAN COATINGS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CAN COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP-DOWN

- FIGURE 6 CAN COATINGS MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 9 EPOXY SEGMENT LED CAN COATINGS MARKET IN 2024

- FIGURE 10 BEVERAGE CANS SEGMENT TO REGISTER HIGHEST CAGR IN CAN COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN CAN COATINGS MARKET IN 2024

- FIGURE 12 GROWING FOOD CANS SEGMENT TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 SOUTH AMERICA TO REGISTER HIGHEST CAGR IN CAN COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 14 FOOD CANS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC CAN COATINGS MARKET IN 2024

- FIGURE 15 BEVERAGE CANS SEGMENT LED CAN COATINGS MARKET IN 2024

- FIGURE 16 THAILAND TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 17 CAN COATINGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 CAN COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 21 CAN COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF CAN COATINGS OFFERED BY KEY PLAYERS FOR TOP THREE APPLICATIONS, 2024

- FIGURE 23 AVERAGE SELLING PRICE TREND OF CAN COATINGS, BY REGION, 2023-2030 (USD/KG)

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 CAN COATINGS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 IMPORT OF CAN COATINGS, BY KEY COUNTRIES (2019-2024)

- FIGURE 27 EXPORT OF CAN COATINGS, BY KEY COUNTRIES (2019-2024)

- FIGURE 28 PATENTS REGISTERED FOR CAN COATINGS, 2014-2024

- FIGURE 29 MAJOR PATENTS RELATED TO CAN COATINGS, 2014-2024

- FIGURE 30 LEGAL STATUS OF PATENTS FILED RELATED TO CAN COATINGS MARKET, 2014-2024

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA, 2014-2024

- FIGURE 32 IMPACT OF AI/GEN AI ON CAN COATINGS MARKET

- FIGURE 33 EPOXY TO LEAD CAN COATINGS MARKET BETWEEN 2025 AND 2030

- FIGURE 34 BEVERAGE CANS TO BE LARGEST APPLICATION OF CAN COATINGS DURING FORECAST PERIOD

- FIGURE 35 SOUTH AMERICA TO REGISTER HIGHEST CAGR IN CAN COATINGS MARKET BETWEEN 2025 AND 2030

- FIGURE 36 ASIA PACIFIC: CAN COATINGS MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: CAN COATINGS MARKET SNAPSHOT

- FIGURE 38 EUROPE: CAN COATINGS MARKET SNAPSHOT

- FIGURE 39 THE SHERWIN-WILLIAMS LED CAN COATINGS MARKET IN 2024

- FIGURE 40 CAN COATINGS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024

- FIGURE 41 CAN COATINGS MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 42 CAN COATINGS MARKET: COMPANY FOOTPRINT

- FIGURE 43 CAN COATINGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 CAN COATINGS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 46 CAN COATINGS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 47 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 48 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 49 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 50 ALTANA AG: COMPANY SNAPSHOT

- FIGURE 51 KANSAI PINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 TOYO INK GROUP: COMPANY SNAPSHOT

- FIGURE 53 BERGER PAINTS INDIA LIMITED: COMPANY SNAPSHOT