|

市场调查报告书

商品编码

1829990

全球氟聚合物管材市场(按外形规格、材料、应用和地区划分)- 预测至 2030 年Fluoropolymer Tubing Market by Material (PTFE, FEP, PFA, ETFE, PVDF, and Others), Form Factor (Heat Shrink, Single Lumen, Co-extruded, Multi Lumen, Tapered or Bump Tubing, Braided Tubing), Application, and Region - Global Forecast to 2030 |

||||||

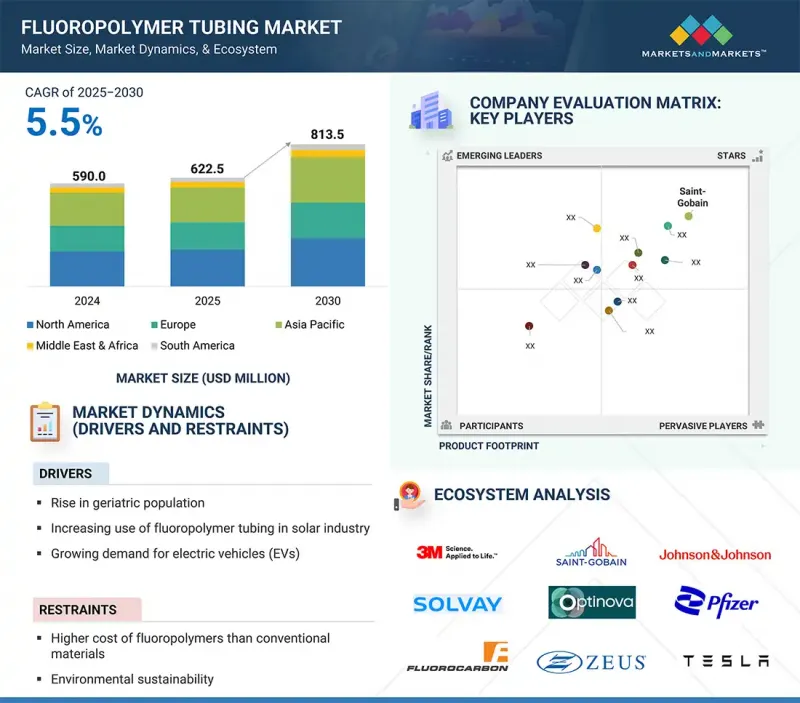

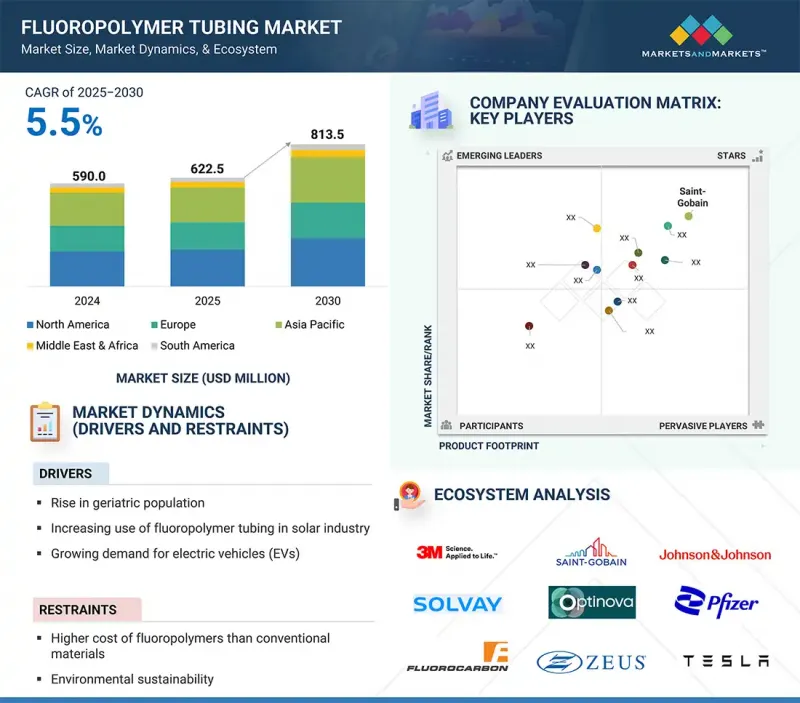

氟聚合物管市场预计将从 2025 年的 6.225 亿美元成长到 2030 年的 8.135 亿美元,2025 年至 2030 年的复合年增长率为 5.5%。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)、数量(千吨) |

| 部分 | 按外形规格、材质、应用和地区 |

| 目标区域 | 欧洲、北美、亚太地区、中东和非洲、南美 |

以金额为准,PFA 材料占据氟聚合物管材市场的第三大份额,这反映了其作为各行各业多功能、高性能材料的强势地位。 PFA 管材具有独特的性能平衡:PTFE 具有出色的耐化学性和热稳定性,同时兼具柔韧性和熔融加工性,易于製造精确而复杂的形状。其高纯度和抗应力开裂性使其特别适合半导体和电子应用,在这些应用中,无污染流体处理在晶圆加工和无尘室操作中至关重要。除了电子产品之外,PFA 管材也广泛用于製药、生物技术和医疗设备应用,因为它具有生物相容性、耐灭菌性以及即使暴露于刺激性化学物质和反覆灭菌循环中也能保持完整性的能力。在化学加工行业中,它是恶劣条件下安全运输高腐蚀性液体和气体的首选材料。此外,它的透明度在需要视觉化流量监控的应用中也具有优势。儘管 PFA 往往比其他氟聚合物更昂贵,但其在专业、高价值应用中的性能优势和可靠性使其在氟聚合物管材市场中占据第三大以金额为准。

预计在预测期内,汽车应用领域将占据氟聚合物管材市场以金额为准的第三大份额,这得益于对能够承受恶劣操作条件的高性能材料的日益依赖。氟聚合物管材凭藉其优异的耐热性、耐化学性和耐腐蚀性,广泛应用于燃油处理、煞车管路、变速箱、涡轮增压器组件和排放控制系统等汽车系统。电动和混合动力汽车的日益普及推动了对先进管材解决方案的需求,尤其是在温度控管系统、电池冷却和线路保护等领域,这些领域的安全性、耐用性和效率至关重要。主要汽车市场排放法规的日益严格促使製造商使用氟聚合物管材来提高流体处理和废气再循环系统的性能和可靠性。此外,氟聚合物的轻量化特性进一步支持了汽车产业对燃油效率和减少环境影响的关注。随着汽车製造商越来越多地整合先进技术,并优先考虑延长使用寿命和减少维护,氟聚合物管材正成为必不可少的部件,汽车行业对整个市场做出了巨大贡献。

预计在预测期内,亚太地区将占据氟聚合物管道市场的第二大份额,这得益于其快速扩张的工业基础和多样化的终端应用领域。该地区已建立起强大的製造业生态系统,尤其是在中国、日本、韩国和印度等国家,并且对高性能材料的需求持续成长。集中在亚太地区的半导体和电子产业是氟聚合物管道的主要消费者,因为晶片製造和无尘室操作需要超纯、无污染的解决方案。受医疗支出成长和医疗基础设施进步的推动,该地区的製药和医疗设备业越来越多地将氟聚合物管道应用于药物输送、诊断和微创手术等应用。亚太地区化学加工、汽车和航太产业的强劲表现进一步推动了对氟聚合物管道的需求,因为这些产业需要具有优异耐化学性、耐用性和在恶劣操作条件下性能的材料。该地区的快速工业化、对先进技术的不断增加的投资以及政府支持製造业和医疗保健业扩张的优惠政策,进一步巩固了该地区的市场地位。这些因素共同推动亚太地区在预测期内占据全球氟聚合物管材市场的第二大份额。

本报告研究了全球氟聚合物管市场,提供了外形规格、材料、应用和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

- 人工智慧/生成式人工智慧的影响

- 价值链分析

- 生态系分析

- 案例研究分析

- 监管状况

- 技术分析

- 影响客户业务的趋势/中断

- 贸易分析

- 2025-2026年主要会议和活动

- 定价分析

- 投资金筹措场景

- 专利分析

- 2025年美国关税对氟聚合物管材市场的影响

第六章 氟聚合物管市场(依外形规格)

- 介绍

- 热缩

- 单腔

- 共挤

- 多重腔

- 锥形或凸起管

- 编织管

第七章 氟聚合物管市场(依材料)

- 介绍

- PTFE

- FEP

- PFA

- ETFE

- PVDF

- 其他的

第 8 章 氟聚合物管市场(依应用)

- 介绍

- 医疗保健

- 半导体

- 活力

- 石油和天然气

- 车

- 航太

- 体液管理

- 一般工业

- 其他的

第九章 氟聚合物管材市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势,2023-2025

- 2022-2024年收益分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十一章:公司简介

- 主要参与企业

- SAINT-GOBAIN

- ZEUS COMPANY LLC

- OPTINOVA

- PARKER HANNIFIN CORP

- TE CONNECTIVITY

- ADTECH POLYMER ENGINEERING LTD.

- AMETEK, INC.

- SWAGELOK COMPANY

- TEF-CAP INDUSTRIES INC.

- TELEFLEX INCORPORATED

- 3M

- 其他公司

- FLUOROTHERM

- PEXCO

- JUNKOSHA INC.

- NES

- NICHIAS CORPORATION

- POLYFLON TECHNOLOGY LIMITED

- QUALTEK ELECTRONICS CORP.

- ALLIEDSUPRE CORP

- ELRINGKLINGER AG

- ENTEGRIS

- FLUORTUBING

- HABIA

- NEWAGE INDUSTRIES

- XTRAFLEX

第十二章 附录

Fluoropolymer tubing market is projected to reach USD 813.5 million by 2030 from USD 622.5 million in 2025, registering a CAGR of 5.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Segments | Form Factor, Material, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

''By material, the PFA segment accounted for the third-largest share of the fluoropolymer tubing market, in terms of value.''

In terms of value, the PFA material segment accounted for the third-largest share of the fluoropolymer tubing market, reflecting its strong position as a versatile and high-performance option across several industries. PFA tubing offers a unique balance of properties, combining the exceptional chemical resistance and thermal stability of PTFE with greater flexibility and melt-processability, which makes it easier to manufacture into precise and complex shapes. Its high purity and resistance to stress cracking make it particularly suitable for semiconductor and electronics applications, where contamination-free fluid handling is critical in wafer processing and cleanroom operations. Beyond electronics, PFA tubing is also widely used in pharmaceuticals, biotechnology, and medical devices due to its biocompatibility, sterilization resistance, and ability to maintain integrity when exposed to aggressive drugs or repeated sterilization cycles. In the chemical processing industry, it is preferred for safely transporting highly corrosive fluids and gases under extreme conditions. Its transparency further provides an advantage in applications requiring visual flow monitoring. Although PFA tends to be costlier compared to other fluoropolymers, its performance advantages and reliability in specialized, high-value applications secure its position as the third-largest material segment in the fluoropolymer tubing market by value.

"By application, the automotive segment is estimated to account for the third-largest market share in terms of value during the forecast period."

The automotive application segment is projected to account for the third-largest share of the fluoropolymer tubing market in terms of value during the forecast period, supported by the sector's growing reliance on high-performance materials that can withstand demanding operating conditions. Fluoropolymer tubing is widely used in automotive systems for fuel handling, brake lines, transmission, turbocharger components, and emission control systems due to its excellent resistance to heat, chemicals, and corrosion. With the increasing adoption of electric and hybrid vehicles, the demand for advanced tubing solutions is also rising, particularly for thermal management systems, battery cooling, and wiring protection, where safety, durability, and efficiency are critical. Stricter emission standards and regulations across major automotive markets are driving manufacturers to adopt fluoropolymer tubing for improved performance and reliability in fluid handling and exhaust gas recirculation systems. Its lightweight nature further supports the automotive industry's focus on fuel efficiency and reduced environmental impact. As automakers continue to integrate advanced technologies and prioritize longer service life with minimal maintenance, fluoropolymer tubing is becoming an essential component, reinforcing the automotive segment's strong contribution to the overall market.

"Asia Pacific is projected to hold the second-largest market share during the forecast period."

The Asia Pacific region is projected to hold the second-largest share of the fluoropolymer tubing market during the forecast period, driven by its rapidly expanding industrial base and diverse end-use sectors. The region is home to a strong manufacturing ecosystem, particularly in countries such as China, Japan, South Korea, and India, where demand for high-performance materials continues to rise. The semiconductor and electronics industry, which is heavily concentrated in the Asia Pacific, is a major consumer of fluoropolymer tubing due to the need for ultra-pure and contamination-free solutions in chip fabrication and cleanroom operations. The region's growing pharmaceutical and medical device industries are increasingly adopting fluoropolymer tubing for applications in drug delivery, diagnostics, and minimally invasive procedures, supported by rising healthcare spending and advancements in medical infrastructure. Asia Pacific's robust chemical processing, automotive, and aerospace sectors are driving further demand for fluoropolymer tubing, as these industries require materials with superior chemical resistance, durability, and performance in extreme operating conditions. The region's rapid industrialization, increasing investments in advanced technologies, and favorable government policies supporting manufacturing and healthcare expansion further reinforce its market position. Together, these factors contribute to Asia Pacific securing the second-largest share in the global fluoropolymer tubing market during the forecast period.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, Middle East & Africa- 15%, and Latin America- 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Saint-Gobain (France), Zeus Company LLC (US), Optinova (Finland), Parker Hannifin (US), TE Connectivity (Ireland), Adtech Polymer Engineering Ltd. (UK), AMETEK Inc. (US), Swagelok Company (US), Tef-Cap Industries (US), and Teleflex Incorporated (US).

Research Coverage

This research report categorizes the fluoropolymer tubing market by Material (PTFE, FEP, PFA, ETFE, PVDF and Others), Form Factor (Heat Shrink, Single Lumen, Co-extruded, Multi Lumen, Tapered or Bump Tubing, Braided Tubing), Application (Medical, Semiconductor, Energy, Oil & Gas, Automotive, Aerospace, Fluid Management, General Industrial), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the fluoropolymer tubing market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. Product launches, mergers & acquisitions, and recent developments in the fluoropolymer tubing market are all covered. This report includes a competitive analysis of upcoming startups in the fluoropolymer tubing market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fluoropolymer tubing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rise in geriatric population, increasing use of fluoropolymer tubing in the solar industry, growing demand for electric vehicles (EVs)), restraints (higher cost of fluoropolymers than conventional materials, environmental sustainability), opportunities (increasing healthcare investments in emerging economies, emerging market for melt extrusion), and challenges (stringent and time-consuming regulatory policies, difficulty in processing high-performance fluoropolymers, intense competition from low-cost suppliers in China).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the fluoropolymer tubing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the fluoropolymer tubing market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the fluoropolymer tubing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Saint-Gobain (France), Zeus Company LLC (US), Optinova (Finland), Parker Hannifin (US), TE Connectivity (Ireland), Adtech Polymer Engineering Ltd. (UK), AMETEK Inc. (US), Swagelok Company (US), Tef-Cap Industries (US), and Teleflex Incorporated (US), among others, in the fluoropolymer tubing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLUOROPOLYMER TUBING MARKET

- 4.2 FLUOROPOLYMER TUBING MARKET, BY MATERIAL

- 4.3 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR

- 4.4 FLUOROPOLYMER TUBING MARKET, BY APPLICATION

- 4.5 FLUOROPOLYMER TUBING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in geriatric population

- 5.2.1.2 Increasing use of fluoropolymer tubing in solar energy sector

- 5.2.1.3 Surging electric vehicle sales

- 5.2.1.4 Industrialization in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher production cost of fluoropolymers compared to conventional materials

- 5.2.2.2 Environmental sustainability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing healthcare investments in emerging economies

- 5.2.3.2 Emerging market for melt extrusion

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent and time-consuming regulatory policies

- 5.2.4.2 Difficulty in processing high-performance fluoropolymers

- 5.2.4.3 Intense competition from China-based low-cost suppliers

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 IMPACT OF AI/GEN AI

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL SUPPLIERS

- 5.7.2 MANUFACTURERS

- 5.7.3 DISTRIBUTORS

- 5.7.4 END USERS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 OPTIMIZING CENTRIFUGAL FAN PERFORMANCE WITH DURABLE HALAR ECTFE COATING

- 5.9.2 ENHANCING MEDICAL APPLICATIONS WITH PTFE VALVE SOLUTIONS

- 5.9.3 EXTENDING PTFE COMPONENT LIFECYCLE IN FOOD PROCESSING EQUIPMENT

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Expanded polytetrafluoroethylene (ePTFE)

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Radiopaque and custom fillers

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO

- 5.13.2 IMPORT SCENARIO

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY REGION (2022-2024)

- 5.15.2 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY APPLICATION, 2022-2024

- 5.15.3 AVERAGE SELLING PRICES OF KEY PLAYERS FOR FLUOROPOLYMER TUBING, BY APPLICATION, 2024

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 APPROACH

- 5.17.2 DOCUMENT TYPES

- 5.17.3 PUBLICATION TRENDS

- 5.17.4 INSIGHTS

- 5.17.5 LEGAL STATUS OF PATENTS

- 5.17.6 JURISDICTION ANALYSIS

- 5.17.7 TOP COMPANIES/APPLICANTS

- 5.17.8 TOP 10 PATENT OWNERS (US) 2014-2024

- 5.18 IMPACT OF 2025 US TARIFF ON FLUOROPOLYMER TUBING MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR

- 6.1 INTRODUCTION

- 6.2 HEAT SHRINK

- 6.2.1 SECURING PERFORMANCE WITH HEAT-SHRINK FLUOROPOLYMER TUBING

- 6.3 SINGLE LUMEN

- 6.3.1 ADVANCING PATIENT CARE THROUGH SPECIALIZED FLUOROPOLYMER TUBING

- 6.4 CO-EXTRUDED

- 6.4.1 ADVANCING PATIENT CARE THROUGH SPECIALIZED FLUOROPOLYMER TUBING

- 6.5 MULTI-LUMEN

- 6.5.1 REDEFINING TUBING DESIGN THROUGH ADVANCED MATERIAL INTEGRATION

- 6.6 TAPERED OR BUMP TUBING

- 6.6.1 EXPANDING APPLICATIONS THROUGH PRECISION ENGINEERING

- 6.7 BRAIDED TUBING

- 6.7.1 DRIVING ADOPTION IN CRITICAL INDUSTRIAL AND MEDICAL SYSTEMS

7 FLUOROPOLYMER TUBING MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 PTFE

- 7.2.1 EXHIBITS EXCELLENT CHEMICAL AND THERMAL RESISTANCE

- 7.3 FEP

- 7.3.1 CAN BE MELTED AND RE-EXTRUDED

- 7.4 PFA

- 7.4.1 HAS COMBINED PROPERTIES OF PTFE AND FEP

- 7.5 ETFE

- 7.5.1 PROVIDES BALANCE BETWEEN PHYSICAL PROPERTIES AND COST-EFFECTIVENESS

- 7.6 PVDF

- 7.6.1 RESISTANT TO ACIDS, BASES, AND MANY ORGANIC SOLVENTS

- 7.7 OTHERS

8 FLUOROPOLYMER TUBING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 MEDICAL

- 8.2.1 DEMAND FOR BIOCOMPATIBLE AND NON-REACTIVE MATERIALS IN MEDICAL DEVICE MANUFACTURING TO DRIVE MARKET

- 8.3 SEMICONDUCTOR

- 8.3.1 ABILITY TO ENDURE AND PERFORM UNDER EXTREME CONDITIONS TO DRIVE DEMAND IN SEMICONDUCTOR INDUSTRY

- 8.4 ENERGY

- 8.4.1 DEMAND FOR CHEMICAL RESISTANCE, THERMAL STABILITY, AND ELECTRICAL INSULATION IN ENERGY SECTOR TO DRIVE MARKET

- 8.5 OIL & GAS

- 8.5.1 DEMAND FOR DURABLE AND CHEMICAL-RESISTANT MATERIALS IN OIL & GAS SECTOR TO DRIVE MARKET

- 8.6 AUTOMOTIVE

- 8.6.1 NEED FOR LOW-FRICTION SURFACES IN AUTOMOTIVE TO DRIVE MARKET

- 8.7 AEROSPACE

- 8.7.1 DEMAND FOR MATERIAL RELIABILITY UNDER EXTREME CONDITIONS TO DRIVE MARKET

- 8.8 FLUID MANAGEMENT

- 8.8.1 PTFE, FEP, AND PFA ARE WIDELY USED IN FLUID MANAGEMENT

- 8.9 GENERAL INDUSTRIAL

- 8.9.1 NEED TO INSULATE WIRES & CABLES FOR HIGH-PRESSURE APPLICATIONS TO DRIVE MARKET

- 8.9.2 WIRE COATING

- 8.9.3 OPTICAL FIBER

- 8.9.4 MONOFILAMENT

- 8.10 OTHERS

9 FLUOROPOLYMER TUBING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Growth in EV and renewable energy adoption to drive market

- 9.2.2 CANADA

- 9.2.2.1 Industrial diversification to boost tubing applications

- 9.2.3 MEXICO

- 9.2.3.1 Energy transition policies to stimulate tubing demand in renewable projects

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Investments in medical R&D to fuel market

- 9.3.2 FRANCE

- 9.3.2.1 Defense and aerospace leadership to enhance fluoropolymer tubing demand

- 9.3.3 UK

- 9.3.3.1 Increasing aging population and chronic diseases to boost fluoropolymer tubing consumption

- 9.3.4 ITALY

- 9.3.4.1 Integrated industrial growth to create new opportunities for fluoropolymer tubing

- 9.3.5 SPAIN

- 9.3.5.1 Increase in automotive manufacturing and medical technology demand to fuel market

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Rising electronics production to support growth of industrial tubing applications

- 9.4.2 JAPAN

- 9.4.2.1 Medical sector modernization to spur demand for high-performance tubing

- 9.4.3 INDIA

- 9.4.3.1 Rise in EV and battery manufacturing to create market growth opportunities

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Vibrant semiconductor and energy sectors to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Petrochemical expansion to elevate tubing requirements

- 9.5.1.2 Rest of GCC countries

- 9.5.1.3 South Africa

- 9.5.1.3.1 Investment in healthcare infrastructure to support market growth

- 9.5.1.1 Saudi Arabia

- 9.5.2 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Automotive modernization to support tubing application expansion in EVs

- 9.6.2 ARGENTINA

- 9.6.2.1 Industrial expansion to fuel adoption of fluoropolymer tubing

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Form factor footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 Material footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SAINT-GOBAIN

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ZEUS COMPANY LLC

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 OPTINOVA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 PARKER HANNIFIN CORP

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 TE CONNECTIVITY

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 ADTECH POLYMER ENGINEERING LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.4 MnM view

- 11.1.7 AMETEK, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.8 SWAGELOK COMPANY

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 TEF-CAP INDUSTRIES INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 TELEFLEX INCORPORATED

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.11 3M

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.1 SAINT-GOBAIN

- 11.2 OTHER PLAYERS

- 11.2.1 FLUOROTHERM

- 11.2.2 PEXCO

- 11.2.3 JUNKOSHA INC.

- 11.2.4 NES

- 11.2.5 NICHIAS CORPORATION

- 11.2.6 POLYFLON TECHNOLOGY LIMITED

- 11.2.7 QUALTEK ELECTRONICS CORP.

- 11.2.8 ALLIEDSUPRE CORP

- 11.2.9 ELRINGKLINGER AG

- 11.2.10 ENTEGRIS

- 11.2.11 FLUORTUBING

- 11.2.12 HABIA

- 11.2.13 NEWAGE INDUSTRIES

- 11.2.14 XTRAFLEX

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON FLUOROPOLYMER TUBING MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 6 FLUOROPOLYMER TUBING MARKET: VALUE CHAIN STAKEHOLDERS

- TABLE 7 FLUOROPOLYMER TUBING MARKET: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 FLUOROPOLYMER TUBING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY REGION (2022-2030) (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY APPLICATION (2022-2030) (USD/KG)

- TABLE 11 TOTAL PATENT COUNT, 2014-2024

- TABLE 12 TOP 10 PATENT OWNERS 2014-2014

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR, 2022-2024 (USD MILLION)

- TABLE 15 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 16 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR, 2022-2024 (KILOTONS)

- TABLE 17 FLUOROPOLYMER TUBING MARKET, BY FORM FACTOR, 2025-2030 (KILOTONS)

- TABLE 18 FLUOROPOLYMER TUBING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 19 FLUOROPOLYMER TUBING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 20 FLUOROPOLYMER TUBING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 21 FLUOROPOLYMER TUBING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 22 FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 23 FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 25 FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 26 MEDICAL APPLICATION ASSESSMENT

- TABLE 27 SEMICONDUCTOR APPLICATION ASSESSMENT

- TABLE 28 ENERGY APPLICATION ASSESSMENT

- TABLE 29 OIL AND GAS APPLICATION ASSESSMENT

- TABLE 30 AUTOMOTIVE APPLICATION ASSESSMENT

- TABLE 31 AEROSPACE APPLICATION ASSESSMENT

- TABLE 32 FLUID MANAGEMENT APPLICATION ASSESSMENT

- TABLE 33 WIRE COATING APPLICATION ASSESSMENT

- TABLE 34 OPTICAL FIBER APPLICATION ASSESSMENT

- TABLE 35 MONOFILAMENT APPLICATION ASSESSMENT

- TABLE 36 GENERAL MANUFACTURING APPLICATION ASSESSMENT

- TABLE 37 FLUOROPOLYMER TUBING MARKET, BY REGION, 2022-2024 (KILOTONS)

- TABLE 38 FLUOROPOLYMER TUBING MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 39 FLUOROPOLYMER TUBING MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 40 FLUOROPOLYMER TUBING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 42 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 43 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 46 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 47 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 US: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 50 US: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 51 US: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 52 US: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 CANADA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 54 CANADA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 55 CANADA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 56 CANADA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 MEXICO: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 58 MEXICO: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 59 MEXICO: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 60 MEXICO: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 EUROPE: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 62 EUROPE: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 63 EUROPE: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 64 EUROPE: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 66 EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 67 EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 GERMANY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 70 GERMANY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 71 GERMANY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 72 GERMANY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 FRANCE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 74 FRANCE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 75 FRANCE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 FRANCE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 UK: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 78 UK: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 79 UK: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 80 UK: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 ITALY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 82 ITALY: FLUOROPOLYMER TUBING 5MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 83 ITALY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 ITALY: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 SPAIN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 86 SPAIN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 87 SPAIN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 88 SPAIN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 REST OF EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 90 REST OF EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 91 REST OF EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 92 REST OF EUROPE: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 94 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 95 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 98 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 99 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 CHINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 102 CHINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 103 CHINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 104 CHINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 JAPAN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 106 JAPAN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 107 JAPAN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 108 JAPAN: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 INDIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 110 INDIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2025-2030 (KILOTONS)

- TABLE 111 INDIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 112 INDIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 SOUTH KOREA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2022-2024 (KILOTONS)

- TABLE 114 SOUTH KOREA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 115 SOUTH KOREA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 116 SOUTH KOREA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 118 REST OF ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2025-2030 (KILOTONS)

- TABLE 119 REST OF ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 122 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 123 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 126 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 127 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 SAUDI ARABIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 130 SAUDI ARABIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 131 SAUDI ARABIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 132 SAUDI ARABIA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 REST OF GCC COUNTRIES: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2022-2024 (KILOTONS)

- TABLE 134 REST OF GCC COUNTRIES: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 135 REST OF GCC COUNTRIES: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 REST OF GCC COUNTRIES: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 SOUTH AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2022-2024 (KILOTONS)

- TABLE 138 SOUTH AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 139 SOUTH AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 140 SOUTH AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 146 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 147 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 150 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 151 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 BRAZIL: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 154 BRAZIL: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 155 BRAZIL: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 156 BRAZIL: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2025-2030 (USD MILLION)

- TABLE 157 ARGENTINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION 2022-2024 (KILOTONS)

- TABLE 158 ARGENTINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 159 ARGENTINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 160 ARGENTINA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 162 REST OF SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 163 REST OF SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: FLUOROPOLYMER TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 STRATEGIES ADOPTED BY KEY FLUOROPOLYMER TUBING MANUFACTURERS, JANUARY 2023-JUNE 2025

- TABLE 166 FLUOROPOLYMER TUBING MARKET: DEGREE OF COMPETITION

- TABLE 167 FLUOROPOLYMER TUBING MARKET: REGION FOOTPRINT

- TABLE 168 FLUOROPOLYMER TUBING MARKET: FORM FACTOR FOOTPRINT

- TABLE 169 FLUOROPOLYMER TUBING MARKET: APPLICATION FOOTPRINT

- TABLE 170 FLUOROPOLYMER TUBING MARKET: MATERIAL FOOTPRINT

- TABLE 171 FLUOROPOLYMER TUBING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 172 FLUOROPOLYMER TUBING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 173 FLUOROPOLYMER TUBING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 174 FLUOROPOLYMER TUBING MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2025

- TABLE 175 FLUOROPOLYMER TUBING MARKET: EXPANSIONS, JANUARY 2023-JUNE 2025

- TABLE 176 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 177 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SAINT-GOBAIN: PRODUCT LAUNCHES

- TABLE 179 ZEUS COMPANY LLC: COMPANY OVERVIEW

- TABLE 180 ZEUS COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 OPTINOVA: COMPANY OVERVIEW

- TABLE 182 OPTINOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 OPTINOVA: EXPANSIONS

- TABLE 184 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 185 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 187 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ADTECH POLYMER ENGINEERING LTD.: COMPANY OVERVIEW

- TABLE 189 ADTECH POLYMER ENGINEERING LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 ADTECH POLYMER ENGINEERING LTD.: PRODUCT LAUNCHES

- TABLE 191 AMETEK, INC.: COMPANY OVERVIEW

- TABLE 192 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 SWAGELOK COMPANY: COMPANY OVERVIEW

- TABLE 194 SWAGELOK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TEF-CAP INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 196 TEF-CAP INDUSTRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 198 TELEFLEX INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 3M: COMPANY OVERVIEW

- TABLE 200 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 FLUOROTHERM: COMPANY OVERVIEW

- TABLE 202 PEXCO: COMPANY OVERVIEW

- TABLE 203 JUNKOSHA INC.: COMPANY OVERVIEW

- TABLE 204 NES: COMPANY OVERVIEW

- TABLE 205 NICHIAS CORPORATION: COMPANY OVERVIEW

- TABLE 206 POLYFLON TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 207 QUALTEK ELECTRONICS CORP.: COMPANY OVERVIEW

- TABLE 208 ALLIEDSUPRE CORP: COMPANY OVERVIEW

- TABLE 209 ELRINGKLINGER AG: COMPANY OVERVIEW

- TABLE 210 ENTEGRIS: COMPANY OVERVIEW

- TABLE 211 FLUORTUBING: COMPANY OVERVIEW

- TABLE 212 HABIA: COMPANY OVERVIEW

- TABLE 213 NEWAGE INDUSTRIES: COMPANY OVERVIEW

- TABLE 214 XTRAFLEX: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FLUOROPOLYMER TUBING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FLUOROPOLYMER TUBING MARKET: RESEARCH DESIGN

- FIGURE 3 FLUOROPOLYMER TUBING MARKET: BOTTOM-UP APPROACH

- FIGURE 4 FLUOROPOLYMER TUBING MARKET: TOP-DOWN APPROACH

- FIGURE 5 FLUOROPOLYMER TUBING MARKET: MARKET SIZE ESTIMATION-TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 FLUOROPOLYMER TUBING MARKET: DATA TRIANGULATION

- FIGURE 8 PTFE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 SINGLE LUMEN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 MEDICAL SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 11 NORTH AMERICA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR FLUOROPOLYMER TUBING ACROSS EMERGING ECONOMIES TO DRIVE MARKET

- FIGURE 13 PVDF SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 SINGLE LUMEN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MEDICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 FLUOROPOLYMER TUBING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 FLUOROPOLYMER TUBING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 21 OVERVIEW OF FLUOROPOLYMER TUBING VALUE CHAIN

- FIGURE 22 FLUOROPOLYMER TUBING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 FLUOROPOLYMER TUBING MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 EXPORT DATA FOR HS CODE 390461-COMPLIANT PRODUCTS, BY COUNTRY (USD THOUSAND)

- FIGURE 25 IMPORT DATA HS CODE 390461-COMPLIANT PRODUCTS, BY COUNTRY (USD THOUSAND)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY REGION (2022-2024)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF FLUOROPOLYMER TUBING, BY APPLICATION (2022-2024)

- FIGURE 28 AVERAGE SELLING PRICES OF KEY PLAYERS FOR FLUOROPOLYMER TUBING, BY APPLICATION, 2024

- FIGURE 29 FLUOROPOLYMER TUBING MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 TOTAL NUMBER OF PATENTS, 2014-2024

- FIGURE 31 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 32 PATENT ANALYSIS, BY LEGAL STATUS (2014-2024)

- FIGURE 33 TOP JURISDICTION, BY DOCUMENT (2014-2024)

- FIGURE 34 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2014-2024

- FIGURE 35 SINGLE LUMEN SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 36 PTFE SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 37 MEDICAL SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 38 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: FLUOROPOLYMER TUBING MARKET SNAPSHOT

- FIGURE 40 EUROPE: FLUOROPOLYMER TUBING MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: FLUOROPOLYMER TUBING MARKET SNAPSHOT

- FIGURE 42 FLUOROPOLYMER TUBING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 43 FLUOROPOLYMER TUBING MARKET: SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 44 VALUATION OF KEY COMPANIES IN FLUOROPOLYMER TUBING MARKET, 2024

- FIGURE 45 FINANCIAL METRICS OF KEY COMPANIES IN FLUOROPOLYMER TUBING MARKET, 2024

- FIGURE 46 FLUOROPOLYMER TUBING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 FLUOROPOLYMER TUBING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 FLUOROPOLYMER TUBING MARKET: COMPANY FOOTPRINT

- FIGURE 49 FLUOROPOLYMER TUBING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 51 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 52 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 53 AMETEK, INC.: COMPANY SNAPSHOT

- FIGURE 54 TELEFLEX INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 3M: COMPANY SNAPSHOT