|

市场调查报告书

商品编码

1830048

全球放射性配体治疗 (RLT) 市场(按产品、目标、适应症、最终用户和地区划分)- 预测至 2035 年Radioligand Therapy (RLT) Market by Product (Lutetium-177 Vipivotide Tetraxetan, (Lu-177)- PNT2002, Radium-223 dichloride), Target (PSMA, SSTR, Bone Metastases), Indication (Prostate Cancer, Neuroendocrine Tumors (NETS), SCLC) - Global Forecast to 2035 |

||||||

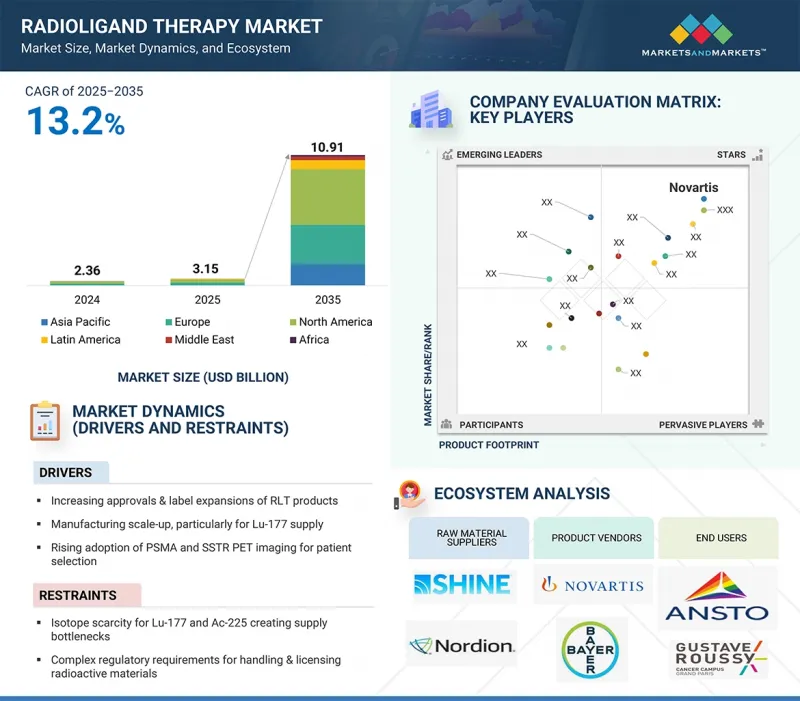

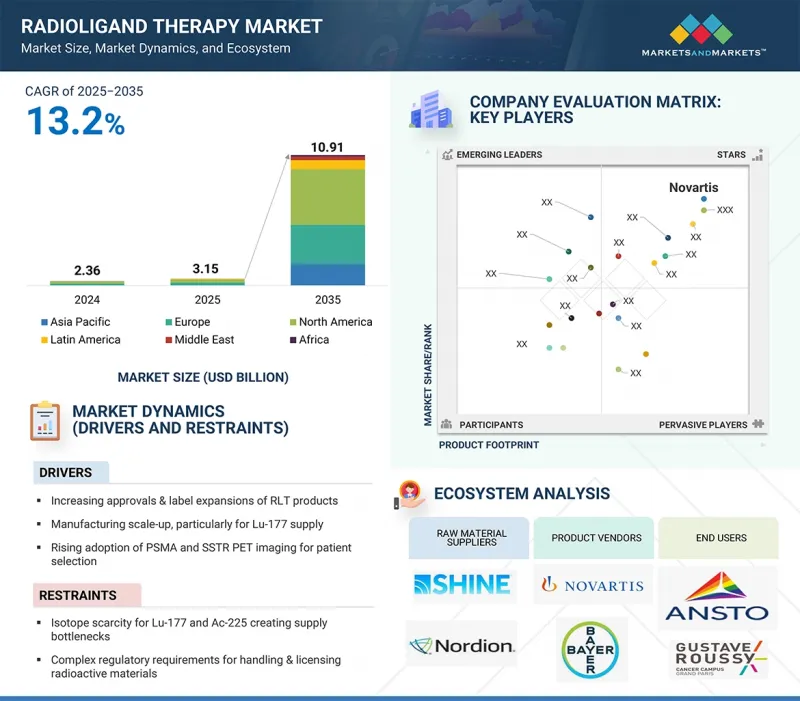

全球放射性配体治疗市场预计将从 2025 年的 31.5 亿美元成长到 2035 年的 109.1 亿美元,预测期内复合年增长率为 13.2%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2035 |

| 基准年 | 2024 |

| 预测期 | 2025-2035 |

| 对价单位 | 金额(十亿美元) |

| 按细分市场 | 按产品、目标、适应症、最终用户和地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

放射性配体治疗市场的成长主要得益于 RLT 产品的核准和标籤扩展的增加、製造规模的扩大(特别是 Lu-177 供应)、PSMA 和 SSTR PET 成像在患者选择中的应用增加,以及支持更多患者获得治疗的报销范围的扩大。

以标靶划分,市场分为前列腺特异性膜抗原 (PSMA)、生长抑制素受体 (SSTR) 和其他标靶。前列腺特异性膜抗原 (PSMA) 占据了 2024 年最大的市场。该细分市场的巨大份额归因于其在前列腺癌细胞中的高表达,而在正常组织中的含量极低。这使得 PSMA 成为精准肿瘤学的理想生物标记物,有助于精准的患者选择和有效的治疗。 PSMA 标靶疗法(例如 Pulvict(镏-177 比匹博肽四环素))的成功,尤其是在转移性去势抗性前列腺癌 (mCRPC) 中的成功,进一步巩固了其在肿瘤治疗领域的主导地位。

根据产品,市场细分为镥-177 Vipivotide Tetraxetan、镥-177 Dotatate、镭-223 二氯化物、[LU-177]-PNT2002、225AC-PSMA-617、FPI-2265/225A-0ITLT Rosopatamab Tetraxetan)、Alphamedix (212PB-DOTAMTATE)、67CU-SAR-BISPSMA 等。镏-177 Bipibotide Tetraxetan 细分市场在 2024 年占据了最大的市场份额。由诺华开发和商业化的镏-177 bipibotide tetraxetan (Pluvict) 靶向前列腺特异性膜抗原 (PSMA),这是一种在前列腺中高度表达的蛋白质该疗法可有效杀伤前列腺癌细胞,是治疗转移性去势抗性前列腺癌 (mCRPC) 患者的精准医疗方案。自从获得 FDA 和 EMA核准以来,该治疗方法因其能够延长生存期并改善治疗方案有限的患者的生活品质而广泛应用。镏-177 的使用可实现靶向 β 射线照射,在最大程度抑制肿瘤的同时保护周围健康组织。

市场按地区细分为北美、欧洲、亚太、拉丁美洲和中东及非洲。预计亚太地区在预测期内的复合年增长率最高。市场成长的主要驱动力包括癌症发病率上升、医疗基础设施改善以及对精准肿瘤学解决方案的认识不断提高。在扩大诊断能力和预后诊断的投资支持下,中国、日本、韩国、印度和澳洲等国家正在扩大核子医学的应用。政府和私人机构正在积极投资同位素生产设施,以解决商业化和管道 RLT 产品所需的关键同位素(如镏-177 和锕-225)的长期供应短缺问题。该地区的监管机构也积极核准放射性药物,为加速临床开发和患者获得创造有利环境。

本报告研究了全球放射性配体治疗 (RLT) 市场,按产品、目标、适应症、最终用户和地区对其进行细分,并介绍了参与市场的公司。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 影响客户业务的趋势/中断

- 定价分析

- 价值链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 2025年至2027年的主要会议和活动

- 监管状况

- 波特五力分析

- 关键相关人员和购买流程

- 总体经济指标

- 管道分析

- 未满足的需求和差距

- 人工智慧/产生人工智慧对放射配体治疗市场的影响

- 2025年美国关税的影响

6. 放射配体治疗市场(依产品)

- 介绍

- 镏-177 Bipibotide 四氧环丁烷

- 镏177

- 氯化镭-223

- LU-177 PNT2002

- 225AC-PSMA-617

- FPI-2265

- I-131-1095

- TLX591

- Alpha Medics (212PB-DOTAMTATE)

- 67CU-SAR-BISPSMA

- 其他的

7. 放射配体治疗市场(依目标)

- 介绍

- 摄护腺特异性膜抗原

- 生长抑制素受体

- 其他的

8. 放射配体治疗市场(按适应症)

- 介绍

- 摄护腺癌

- 神经内分泌肿瘤

- 其他的

9. 放射性配体治疗市场(依最终使用者)

- 介绍

- 三级医学学术/综合癌症中心

- 专业核子医学中心

- 其他的

第 10 章放射配体治疗市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东

- 中东宏观经济展望

- 海湾合作委员会国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他海湾合作委员会国家

- 其他中东国家

- 非洲

- 加强临床试验生态系统和监管改革以促进成长

- 非洲宏观经济展望

第十一章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 主要参与企业采取的策略概述

- 2028-2030年收益分析

- 2030年市占率分析

- 估值和财务指标

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- NOVARTIS AG

- BAYER AG

- CURIUM US LLC

- ELI LILLY AND COMPANY

- ASTRAZENECA

- PROGENICS PHARMACEUTICALS INC.(LANTHEUS)

- ARICEUM THERAPEUTICS

- TELIX PHARMACEUTICALS

- ITM ISOTOPE TECHNOLOGIES

- CONVERGENT THERAPEUTICS, INC.

- ORANO SA

- ACTINIUM PHARMACEUTICALS, INC.

- PERSPECTIVE THERAPEUTICS, INC.

- CLARITY PHARMACEUTICALS

- RADIOPHARM THERANOSTICS LTD.

- 其他公司

- ALPHA 9 ONCOLOGY

- RATIO THERAPEUTICS

- NORIA THERAPEUTICS

- PRECIRIX

- SOFIE

- ECKERT & ZIEGLER RADIOPHARMA

- NORTHSTAR MEDICAL RADIOISOTOPES, LLC

- IRE-IRE ELIT

- BWXT MEDICAL LTD.

- NTP RADIOISOTOPES

第十三章 附录

The global radioligand therapy market is projected to reach USD 10.91 billion by 2035 from an estimated USD 3.15 billion in 2025, at a CAGR of 13.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD billion) |

| Segments | By Product, Target, Indication, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

The growth of the radioligand therapy market is majorly driven by increasing approvals and label expansions of RLT products, manufacturing scale-up, particularly for Lu-177 supply, rising adoption of PSMA and SSTR PET imaging for patient selection, and expanding reimbursement coverage supporting broader patient access.

By target, the prostate-specific membrane antigen segment accounted for the largest market share in 2024.

Based on target, the market is categorized into Prostate-Specific Membrane Antigen (PSMA), Somatostatin Receptor (SSTR), and other targets. The Prostate-Specific Membrane Antigen (PSMA) segment accounted for the largest share of the market in 2024. The large share of this segment is attributed to its high expression in prostate cancer cells and its minimal presence in normal tissues. This makes PSMA an ideal biomarker for precision oncology, enabling accurate patient selection and effective therapy delivery. The success of PSMA-targeted treatments, such as Pluvicto (lutetium-177 vipivotide tetraxetan), has reinforced its dominance, particularly in metastatic castration-resistant prostate cancer (mCRPC).

By product, the Lutetium-177 vipivotide tetraxetan segment accounted for the largest share of the market in 2024.

By product, the market is segmented into Lutetium-177 Vipivotide Tetraxetan, Lutetium-177 Dotatate, Radium-223 Dichloride, [LU-177]-PNT2002, 225AC-PSMA-617, FPI-2265/ 225 AC PSMA - I&T, I-131-1095, TLX591 (177LU Rosopatamab Tetraxetan), Alphamedix (212PB-DOTAMTATE), 67CU-SAR-BISPSMA, and other products. In 2024, the lutetium-177 vipivotide tetraxetan segment accounted for the largest share of the market. Developed and commercialized by Novartis, Lutetium-177 vipivotide tetraxetan (Pluvicto) targets Prostate-Specific Membrane Antigen (PSMA), a protein highly expressed in prostate cancer cells, making it a precision therapy for patients with metastatic castration-resistant prostate cancer (mCRPC). Since its FDA and EMA approvals, the therapy has become widely adopted due to its ability to extend survival and improve quality of life in patients with limited treatment options. Its use of lutetium-177 enables targeted beta radiation delivery, sparing surrounding healthy tissues while maximizing tumor control.

By region, the Asia Pacific market is projected to grow at the highest CAGR during the forecast period.

The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The key factors contributing to market growth include the rising cancer incidence, improvements in healthcare infrastructure, and increasing awareness of precision oncology solutions. Countries such as China, Japan, South Korea, India, and Australia are witnessing the growing adoption of nuclear medicine, which is supported by expanding diagnostic capabilities and investments in theragnostic. Governments & private institutions are actively investing in isotope production facilities, addressing long-standing supply challenges for key isotopes like lutetium-177 and actinium-225, essential for commercialized and pipeline RLT products. Regulatory authorities in the region also show greater receptivity to radiopharmaceutical approvals, creating a favourable environment for clinical development and faster patient access.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side- 30%

- By Designation: Managers- 45%, CXO and Directors- 30%, and Executives- 25%

- By Region: North America- 30%, Europe- 30%, Asia Pacific- 30%, Latin America- 5%, and the Middle East & Africa- 5%

Key Companies

The key players in the radioligand therapy market include Novartis AG (Switzerland), Bayer AG (Germany), Curium US LLC (US), Eli Lilly and Company (US), AstraZeneca plc (UK), Progenics Pharmaceuticals, Inc. (US), Ariceum Therapeutics GmbH (Germany), Telix Pharmaceuticals Limited (Australia), ITM Isotope Technologies Munich SE (Germany), Convergent Therapeutics, Inc. (US), Orano Med SAS (France), Actinium Pharmaceuticals, Inc. (US), Perspective Therapeutics, Inc. (US), Clarity Pharmaceuticals Ltd. (Australia), and Radiopharm Theranostics Ltd. (Australia), among others.

Research Coverage

This research report categorizes the radioligand therapy market, by product [Lutetium-177 vipivotide tetraxetan, LUTETIUM-177 DOTATATE, Radium-223 dichloride, (LU-177)-PNT2002, 225AC-PSMA-617, FPI-2265/ 225 AC PSMA - I&T, I-131-1095, TLX591 (177LU ROSOPATAMAB TETRAXETAN), ALPHAMEDIX (212PB-DOTAMTATE), 67CU-SAR-BISPSMA, and other products), target (PSMA, SSTR, and other targets), indication (prostate cancer, neuroendocrine tumors, and other indications), and end user (tertiary care academic/comprehensive cancer centers, specialized nuclear medicine centers, and other end user), and region (North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the radioligand therapy market. A thorough analysis of the key industry players has provided insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements: new approvals/launches, collaborations, acquisitions, and recent developments associated with the radioligand therapy market.

Reasons to buy this report

The report will help market leaders and new entrants by providing the closest approximations of the revenue numbers for the radioligand therapy market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their businesses better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing approvals and label expansions of RLT products, manufacturing scale-up, particularly for Lu-177 supply, the rising adoption of PSMA and SSTR PET imaging for patient selection. Expanding reimbursement coverage supporting broader patient access), restraints (Isotope scarcity for Lu-177 and Ac-225 creating supply bottlenecks, complex regulatory requirements for handling & licensing radioactive materials, logistical hurdles & half-life constraints limiting distribution), opportunities [advancements of alpha therapies (Ac-225, Pb-212) with strong clinical potential, expansion into earlier-line and adjuvant use, broadening eligible populations, combination regimens with immuno-oncology, PARP inhibitors, and other targeted agents), and challenges (reactor outages and geopolitical risks impacting isotope production & supply chains and the growing competition from alternative modalities such as ADCs and bispecific antibodies)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the radioligand therapy market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the radioligand therapy market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/approvals, acquisitions, partnerships, agreements, collaborations, other recent developments, investment & funding activities, brand/product comparative analysis, and vendor valuation & financial metrics of the radioligand therapy market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (Bottom-up approach)

- 2.2.1.2 Revenue share analysis

- 2.2.1.3 MnM repository analysis

- 2.2.1.4 Primary interviews

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 STRATEGIC IMPERATIVES FOR KEY STAKEHOLDERS

- 3.1.1 BIOTECH STARTUPS AND INNOVATIVE COMPANIES

- 3.1.2 ESTABLISHED MARKET LEADERS

- 3.1.3 CDMOS AND CROS

4 PREMIUM INSIGHTS

- 4.1 RADIOLIGAND THERAPY MARKET OVERVIEW

- 4.2 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY PRODUCT AND COUNTRY, 2025

- 4.3 RADIOLIGAND THERAPY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 RADIOLIGAND THERAPY MARKET: EMERGING VS. DEVELOPED MARKETS

- 4.5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.6 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFT

- 4.7 VC/PRIVATE EQUITY INVESTMENT TRENDS AND STARTUP LANDSCAPE

- 4.8 REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing approvals and label expansion of RLT products

- 5.2.1.2 Manufacturing scale-up of Lu-177

- 5.2.1.3 Rising adoption of prostate-specific membrane antigen and somatostatin receptor PET imaging

- 5.2.1.4 Expanding reimbursement coverage

- 5.2.2 RESTRAINTS

- 5.2.2.1 Isotope supply scarcity

- 5.2.2.2 Stringent regulatory requirements

- 5.2.2.3 Logistical hurdles and half-life constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in alpha therapies

- 5.2.3.2 Expansion of radioligand therapy into earlier-line and adjuvant settings

- 5.2.3.3 Combination regimens integrating radioligand therapy

- 5.2.4 CHALLENGES

- 5.2.4.1 Reactor outages and geopolitical risks

- 5.2.4.2 Growing competition from alternative modalities

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER, 2024

- 5.4.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Beta-emitting therapeutic radionuclides

- 5.8.1.2 Alpha-emitting therapeutic radionuclides

- 5.8.1.3 Targeting ligands

- 5.8.1.4 Monoclonal antibody-directed radiotherapeutics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 SPECT/CT and PET/CT

- 5.8.2.2 Alternative isotopes

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Antibody drug conjugates

- 5.8.3.2 Bispecific antibodies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY ANALYSIS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 BARGAINING POWER OF SUPPLIERS

- 5.11.2 BARGAINING POWER OF BUYERS

- 5.11.3 THREAT OF NEW ENTRANTS

- 5.11.4 THREAT OF SUBSTITUTES

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 MACROECONOMICS INDICATORS

- 5.13.1 HEALTHCARE EXPENDITURE TRENDS

- 5.13.2 GLOBAL CANCER BURDEN

- 5.14 PIPELINE ANALYSIS

- 5.15 UNMET NEEDS AND WHITE SPACES

- 5.16 IMPACT OF AI/GEN AI ON RADIOLIGAND THERAPY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN RADIOLIGAND THERAPY APPLICATIONS

- 5.16.3 AI USE CASES

- 5.17 IMPACT OF 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.4 Rest of the World

- 5.17.5 IMPACT ON MANUFACTURING INDUSTRY

6 RADIOLIGAND THERAPY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 LUTETIUM 177 VIPIVOTIDE TETRAXETAN

- 6.2.1 BROADER REGULATORY ACCEPTANCE AND EXPANDING PAYER COVERAGE TO AID GROWTH

- 6.3 LUTETIUM-177 DOTATATE

- 6.3.1 INCREASING RECOGNITION OF LUTETIUM-177 DOTATATE IN TREATING GASTROENTEROPANCREATIC NEUROENDOCRINE TUMORS TO BOOST MARKET

- 6.4 RADIUM-223 DICHLORIDE

- 6.4.1 INCREASING ADOPTION OF RADIUM-223 DICHLORIDE IN EMERGING MARKETS TO STIMULATE GROWTH

- 6.5 LU-177 PNT2002

- 6.5.1 STRONG PHASE III CLINICAL VALIDATION AND STRATEGIC COMMERCIALIZATION PARTNERSHIPS TO SPUR GROWH

- 6.6 225AC-PSMA-617

- 6.6.1 POTENT THERAPEUTIC PROFILE AND EXPANDING CLINICAL VALIDATION TO BOLSTER GROWTH

- 6.7 FPI-2265

- 6.7.1 EARLY RESPONSE DATA AND SAFETY REASSURANCE TO AMPLIFY GROWTH

- 6.8 I-131-1095

- 6.8.1 FAVORABLE DOSIMETRY AND SAFETY PROFILES TO SUSTAIN GROWTH

- 6.9 TLX591

- 6.9.1 SIMPLIFIED DOSING REGIMEN AND FAVORABLE TOLERABILITY TO DRIVE MARKET

- 6.10 ALPHAMEDIX ( 212PB-DOTAMTATE)

- 6.10.1 ROBUST EARLY-PHASE EFFICACY AND STRONG COMMERCIALIZATION TO SUPPORT GROWTH

- 6.11 67CU-SAR-BISPSMA

- 6.11.1 ENHANCED LESION UPTAKE & RETENTION AND FAVORABLE TOLERABILITY PROFILE TO FOSTER GROWTH

- 6.12 OTHER PRODUCTS

7 RADIOLIGAND THERAPY MARKET, BY TARGET

- 7.1 INTRODUCTION

- 7.2 PROSTATE-SPECIFIC MEMBRANE ANTIGEN

- 7.2.1 STRONG BIOLOGICAL RATIONALE, ROBUST CLINICAL OUTCOMES, AND RAPID SCALING OF GLOBAL SUPPLY CHAINS TO PROMOTE GROWTH

- 7.3 SOMATOSTATIN RECEPTOR

- 7.3.1 PROVEN EFFICACY IN TREATING NEUROENDOCRINE TUMORS TO EXPEDITE GROWTH

- 7.4 OTHER TARGETS

8 RADIOLIGAND THERAPY MARKET, BY INDICATION

- 8.1 INTRODUCTION

- 8.2 PROSTATE CANCER

- 8.2.1 EXPANDING TREATMENT POPULATIONS AND CLINICAL VALIDATION TO ENCOURAGE GROWTH

- 8.3 NEUROENDOCRINE TUMORS

- 8.3.1 REGULATORY ADVANCEMENTS AND STRATEGIC INDUSTRY MOVES TO FACILITATE GROWTH

- 8.4 OTHER INDICATIONS

9 RADIOLIGAND THERAPY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS

- 9.2.1 ADVANCED TREATMENT DELIVERY AND CLINICAL TRIAL CAPABILITIES TO CONTRIBUTE TO GROWTH

- 9.3 SPECIALIZED NUCLEAR MEDICINE CENTERS

- 9.3.1 HIGHLY TRAINED PERSONNEL AND TARGETED FACILITIES TO ACCELERATE GROWTH

- 9.4 OTHER END USERS

10 RADIOLIGAND THERAPY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Robust ecosystem of biotech innovation and strong academic-industry collaboration to spur growth.

- 10.2.3 CANADA

- 10.2.3.1 Growing clinical trial momentum to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Strong clinical advancements and active industry partnerships to foster growth.

- 10.3.3 UK

- 10.3.3.1 Growing efforts for decentralized access and innovations to boost market

- 10.3.4 FRANCE

- 10.3.4.1 Strong nuclear medicine manufacturing and isotope supply foundation to bolster growth

- 10.3.5 ITALY

- 10.3.5.1 Rising preclinical exploration and early discovery stages to stimulate growth

- 10.3.6 SPAIN

- 10.3.6.1 Established nuclear-medicine departments and authorized radiopharmacy frameworks to aid growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Favorable regulatory reforms and expanding hospital-based nuclear medicine capabilities to amplify growth

- 10.4.3 JAPAN

- 10.4.3.1 Academic excellence, manufacturing expansion, and supportive regulation to contribute to growth

- 10.4.4 INDIA

- 10.4.4.1 Lower trial costs and skilled medical professionals to accelerate growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Growing emphasis on nuclear medicine innovation to propel market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Need to maintain high standards of quality, compliance, and innovation to facilitate growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Favorable educational initiatives and expanding biopharma infrastructure to promote growth

- 10.5.3 MEXICO

- 10.5.3.1 Growing cyclotron capacity to fuel market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 10.6.2 GCC COUNTRIES

- 10.6.3 SAUDI ARABIA

- 10.6.3.1 Growing initiatives for healthcare and life sciences sectors to drive market

- 10.6.4 UAE

- 10.6.4.1 Emerging biotechnology sector to intensify growth

- 10.6.5 REST OF GCC COUNTRIES

- 10.6.6 REST OF MIDDLE EAST

- 10.7 AFRICA

- 10.7.1 ENHANCED CLINICAL TRIAL ECOSYSTEM AND REGULATORY REFORMS TO AID GROWTH

- 10.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 REVENUE ANALYSIS, 2028-2030

- 11.5 MARKET SHARE ANALYSIS, 2030

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Region footprint

- 11.8.5.2 Target footprint

- 11.8.5.3 Indication footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NOVARTIS AG

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Products in pipeline

- 12.1.1.4 Recent developments

- 12.1.1.4.1 Product launches and approvals

- 12.1.1.4.2 Deals

- 12.1.1.4.3 Expansions

- 12.1.1.5 MnM view

- 12.1.1.5.1 Key strengths

- 12.1.1.5.2 Strategic choices

- 12.1.1.5.3 Weaknesses and competitive threats

- 12.1.2 BAYER AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.2.1 Deals

- 12.1.2.2.2 Other developments

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 CURIUM US LLC

- 12.1.3.1 Business overview

- 12.1.3.2 Products in pipeline

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ELI LILLY AND COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products in pipeline

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 ASTRAZENECA

- 12.1.5.1 Business overview

- 12.1.5.2 Products in pipeline

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 PROGENICS PHARMACEUTICALS INC. (LANTHEUS)

- 12.1.6.1 Business overview

- 12.1.6.2 Products in pipeline

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ARICEUM THERAPEUTICS

- 12.1.7.1 Products in pipeline

- 12.1.7.2 Recent developments

- 12.1.7.2.1 Deals

- 12.1.8 TELIX PHARMACEUTICALS

- 12.1.8.1 Business overview

- 12.1.8.2 Products in pipeline

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.8.3.3 Other developments

- 12.1.9 ITM ISOTOPE TECHNOLOGIES

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.10 CONVERGENT THERAPEUTICS, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products in pipeline

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.10.3.2 Deals

- 12.1.11 ORANO SA

- 12.1.11.1 Business overview

- 12.1.11.2 Products in pipeline

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.12 ACTINIUM PHARMACEUTICALS, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products in pipeline

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches and approvals

- 12.1.12.3.2 Deals

- 12.1.13 PERSPECTIVE THERAPEUTICS, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products in pipeline

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 CLARITY PHARMACEUTICALS

- 12.1.14.1 Business overview

- 12.1.14.2 Products in pipeline

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Other developments

- 12.1.15 RADIOPHARM THERANOSTICS LTD.

- 12.1.15.1 Business overview

- 12.1.15.2 Products in pipeline

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.1 NOVARTIS AG

- 12.2 OTHER PLAYERS

- 12.2.1 ALPHA 9 ONCOLOGY

- 12.2.2 RATIO THERAPEUTICS

- 12.2.3 NORIA THERAPEUTICS

- 12.2.4 PRECIRIX

- 12.2.5 SOFIE

- 12.2.6 ECKERT & ZIEGLER RADIOPHARMA

- 12.2.7 NORTHSTAR MEDICAL RADIOISOTOPES, LLC

- 12.2.8 IRE- IRE ELIT

- 12.2.9 BWXT MEDICAL LTD.

- 12.2.10 NTP RADIOISOTOPES

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RADIOLIGAND THERAPY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 3 RADIOLIGAND THERAPY MARKET: RISK ANALYSIS

- TABLE 4 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, FOR RADIOPHARMACEUTICAL MOLECULES BY REGION, 2023-2030 (USD BILLION)

- TABLE 5 RADIOLIGAND THERAPY MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 INDICATIVE PRICING ANALYSIS OF RADIOLIGAND THERAPY PRODUCTS, BY KEY PLAYER, 2024

- TABLE 7 INDICATIVE PRICING ANALYSIS OF RADIOLIGAND THERAPY PRODUCTS, BY REGION, 2024

- TABLE 8 RADIOLIGAND THERAPY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 RADIOLIGAND THERAPY MARKET: KEY CONFERENCES AND EVENTS, 2025-2027

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 RADIOLIGAND THERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RADIOLIGAND THERAPY PRODUCTS (%)

- TABLE 16 KEY BUYING CRITERIA FOR RADIOLIGAND THERAPY, BY END USER

- TABLE 17 HEALTH EXPENDITURE AND FINANCING, 2015-2024 (IN PERCENTAGE OF GDP)

- TABLE 18 US: CANCER INCIDENCE, BY STATE, 2024

- TABLE 19 RADIOLIGAND THERAPY PRODUCTS IN CLINICAL PIPELINE, 2025-2032

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 22 RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 23 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 24 EUROPE: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 25 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 26 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 27 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 28 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 VIPIVOTIDE TETRAXETAN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 29 RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 30 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 31 EUROPE: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 32 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 33 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 34 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 35 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR LUTETIUM-177 DOTATATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 36 RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 37 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 38 EUROPE: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 39 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 40 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 41 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 42 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR RADIUM-223 DICHLORIDE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 43 RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY REGION, 2023-2035 (USD MILLION)

- TABLE 44 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 45 EUROPE: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 46 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 47 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 48 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY REGION, 2023-2035 (USD MILLION)

- TABLE 49 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR LU-177 PNT2002, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 50 RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY REGION, 2023-2035 (USD MILLION)

- TABLE 51 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 52 EUROPE: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 53 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 54 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617,0 BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 55 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY REGION, 2023-2035 (USD MILLION)

- TABLE 56 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR 225AC-PSMA-617, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 57 RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY REGION, 2023-2035 (USD MILLION)

- TABLE 58 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 59 EUROPE: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 60 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 61 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 62 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY REGION, 2023-2035 (USD MILLION)

- TABLE 63 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR FPI-2265, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 64 RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY REGION, 2023-2035 (USD MILLION)

- TABLE 65 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 66 EUROPE: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 67 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 68 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 69 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY REGION, 2023-2035 (USD MILLION)

- TABLE 70 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR I-131-1095, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 71 RADIOLIGAND THERAPY MARKET FOR TLX591, BY REGION, 2023-2035 (USD MILLION)

- TABLE 72 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR TLX591, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 73 EUROPE: RADIOLIGAND THERAPY MARKET FOR TLX591, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 74 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR TLX591, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 75 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR TLX591, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 76 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR TLX591, BY REGION, 2023-2035 (USD MILLION)

- TABLE 77 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR TLX591, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 78 RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 79 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 80 EUROPE: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 81 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 82 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 83 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY REGION, 2023-2035 (USD MILLION)

- TABLE 84 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR 212PB-DOTAMTATE, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 85 RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY REGION, 2023-2035 (USD MILLION)

- TABLE 86 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 87 EUROPE: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 88 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 89 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 90 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY REGION, 2023-2035 (USD MILLION)

- TABLE 91 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR 67CU-SAR-BISPSMA, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 92 RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 93 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 94 EUROPE: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 95 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 96 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 97 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 98 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 99 RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 100 RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 101 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 102 EUROPE: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 103 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 104 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 105 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY REGION, 2023-2035 (USD MILLION)

- TABLE 106 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR PROSTATE-SPECIFIC MEMBRANE ANTIGEN, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 107 RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY REGION, 2023-2035 (USD MILLION)

- TABLE 108 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 109 EUROPE: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 110 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 111 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 112 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY REGION, 2023-2035 (USD MILLION)

- TABLE 113 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR SOMATOSTATIN RECEPTOR, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 114 RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 115 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 116 EUROPE: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 117 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 118 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 119 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 120 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR OTHER TARGETS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 121 RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 122 RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY REGION, 2023-2035 (USD MILLION)

- TABLE 123 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 124 EUROPE: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 125 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 126 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 127 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY REGION, 2023-2035 (USD MILLION)

- TABLE 128 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 129 RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 130 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 131 EUROPE: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 133 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 134 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 135 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR NEUROENDOCRINE TUMORS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 136 RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 137 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 138 EUROPE: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 139 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 140 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 141 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 142 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 143 RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 144 RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 145 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 146 EUROPE: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 147 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 148 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 149 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 150 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR TERTIARY CARE ACADEMIC/COMPREHENSIVE CANCER CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 151 RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 152 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 153 EUROPE: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 154 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 155 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 156 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 157 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR SPECIALIZED NUCLEAR MEDICINE CENTERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 158 RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 159 NORTH AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 160 EUROPE: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 161 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 162 LATIN AMERICA: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 163 MIDDLE EAST: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY REGION, 2023-2035 (USD MILLION)

- TABLE 164 GCC COUNTRIES: RADIOLIGAND THERAPY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 165 RADIOLIGAND THERAPY MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 166 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 167 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 168 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 169 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 170 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 171 NORTH AMERICA: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 172 US: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 173 US: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 174 US: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 175 US: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 176 CANADA: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 177 CANADA: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 178 CANADA: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 179 CANADA: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 180 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 181 EUROPE: RADIOLIGAND THERAPY MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 182 EUROPE: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 183 EUROPE: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 184 EUROPE: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 185 EUROPE: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 186 GERMANY: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 187 GERMANY: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 188 GERMANY: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 189 GERMANY: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 190 UK: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 191 UK: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 192 UK: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 193 UK: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 194 FRANCE: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 195 FRANCE: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 196 FRANCE: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 197 FRANCE: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 198 ITALY: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 199 ITALY: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 200 ITALY: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 201 ITALY: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 202 SPAIN: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 203 SPAIN: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 204 SPAIN: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 205 SPAIN: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

- TABLE 206 REST OF EUROPE: RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2023-2035 (USD MILLION)

- TABLE 207 REST OF EUROPE: RADIOLIGAND THERAPY MARKET, BY TARGET, 2023-2035 (USD MILLION)

- TABLE 208 REST OF EUROPE: RADIOLIGAND THERAPY MARKET, BY INDICATION, 2023-2035 (USD MILLION)

- TABLE 209 REST OF EUROPE: RADIOLIGAND THERAPY MARKET, BY END USER, 2023-2035 (USD MILLION)

List of Figures

- FIGURE 1 RADIOLIGAND THERAPY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RADIOLIGAND THERAPY MARKET: YEARS CONSIDERED

- FIGURE 3 RADIOLIGAND THERAPY MARKET: RESEARCH DESIGN

- FIGURE 4 RADIOLIGAND THERAPY MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 RADIOLIGAND THERAPY MARKET: BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RADIOLIGAND THERAPY MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 7 COMPANY REVENUE ANALYSIS-BASED ESTIMATION: BOTTOM-UP APPROACH, 2030

- FIGURE 8 REVENUE SHARE ANALYSIS OF NOVARTIS, 2024

- FIGURE 9 RADIOLIGAND THERAPY MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 10 RADIOLIGAND THERAPY MARKET: TOP-DOWN APPROACH

- FIGURE 11 RADIOLIGAND THERAPY MARKET: CAGR PROJECTIONS

- FIGURE 12 RADIOLIGAND THERAPY MARKET: DATA TRIANGULATION

- FIGURE 13 RADIOLIGAND THERAPY MARKET: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

- FIGURE 14 RADIOLIGAND THERAPY MARKET, BY PRODUCT, 2025 VS. 2035 (USD MILLION)

- FIGURE 15 RADIOLIGAND THERAPY MARKET, BY TARGET, 2025 VS. 2035 (USD MILLION)

- FIGURE 16 RADIOLIGAND THERAPY MARKET, BY INDICATION, 2025 VS. 2035 (USD MILLION)

- FIGURE 17 RADIOLIGAND THERAPY MARKET, BY END USER, 2025 VS. 2035 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF RADIOLIGAND THERAPY MARKET

- FIGURE 19 INCREASING APPROVALS AND LABEL EXPANSION OF RLT PRODUCTS TO DRIVE MARKET

- FIGURE 20 LUTETIUM-177 VIPIVOTIDE TETRAXETAN SEGMENT AND US TO LEAD NORTH AMERICAN MARKET IN 2024

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 DEVELOPED MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 RADIOLIGAND THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 NEW REVENUE POCKETS FOR PLAYERS IN RADIOLIGAND THERAPY MARKET

- FIGURE 25 INDICATIVE PRICING ANALYSIS OF RADIOLIGAND THERAPY PRODUCTS, BY KEY PLAYER, 2024

- FIGURE 26 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- FIGURE 27 RADIOLIGAND THERAPY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 RADIOLIGAND THERAPY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 RADIOLIGAND THERAPY MARKET: INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 30 RADIOLIGAND THERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF RADIOLIGAND THERAPY PRODUCTS

- FIGURE 32 KEY BUYING CRITERIA FOR RADIOLIGAND THERAPY PRODUCTS, BY END USER

- FIGURE 33 RADIOLIGAND THERAPY MARKET: AI USE CASES

- FIGURE 34 NORTH AMERICA: RADIOLIGAND THERAPY MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: RADIOLIGAND THERAPY MARKET SNAPSHOT

- FIGURE 36 RADIOLIGAND THERAPY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2028-2030 (USD MILLION)

- FIGURE 37 RADIOLIGAND THERAPY MARKET SHARE ANALYSIS OF KEY PLAYERS, 2030

- FIGURE 38 EV/EBITDA OF KEY VENDORS

- FIGURE 39 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 40 RADIOLIGAND THERAPY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 RADIOLIGAND THERAPY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 RADIOLIGAND THERAPY MARKET: COMPANY FOOTPRINT

- FIGURE 43 RADIOLIGAND THERAPY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 NOVARTIS AG: COMPANY SNAPSHOT (2024)

- FIGURE 45 BAYER AG: COMPANY SNAPSHOT (2024)

- FIGURE 46 ELI LILLY AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 47 ASTRAZENECA: COMPANY SNAPSHOT (2024)

- FIGURE 48 PROGENICS PHARMACEUTICAL INC. (LANTHEUS): COMPANY SNAPSHOT (2024)

- FIGURE 49 TELIX PHARMACEUTICALS: COMPANY SNAPSHOT (2024)

- FIGURE 50 ORANO SA: COMPANY SNAPSHOT (2024)

- FIGURE 51 ACTINIUM PHARMACEUTICALS, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 52 CLARITY PHARMACEUTICALS: COMPANY SNAPSHOT (2024)