|

市场调查报告书

商品编码

1845348

全球 GFRP 复合材料市场(按树脂类型、製造流程、最终用途产业和地区划分)- 预测至 2030 年GFRP Composites Market by Resin Type, Manufacturing Process (Compression & Injection Molding, Filament Winding, Layup, Pultrusion, Resin Transfer Molding, Other Manufacturing Processes), End-use Industry, Region - Global Forecast to 2030 |

||||||

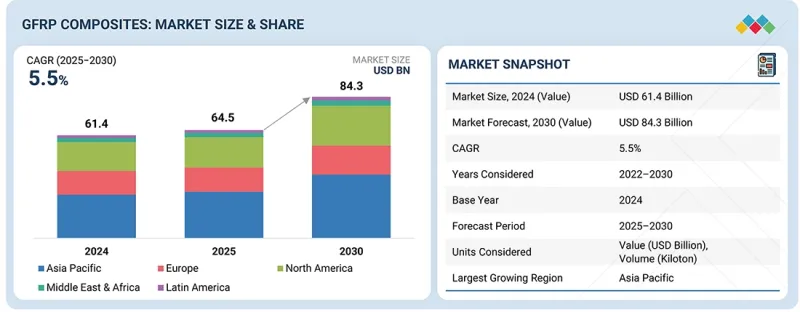

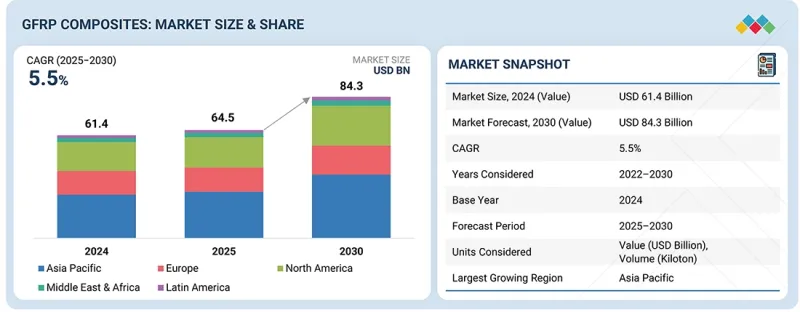

预计 2025 年 GFRP 复合材料市场规模将达到 645 亿美元,预计 2025 年至 2030 年期间的复合年增长率为 5.5%,到 2030 年将达到 843 亿美元。

近年来,热塑性塑胶作为纤维增强复合材料基材的使用显着增加。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元)和数量(千吨) |

| 部分 | 按树脂类型、製造工艺、最终用途行业和地区 |

| 目标区域 | 欧洲、北美、亚太地区、中东和非洲、南美 |

热塑性树脂已与玻璃纤维连续纱一起用于製造结构复合材料材料产品。热塑性树脂作为基质材料的主要优势在于,与热固性树脂不同,成型的玻璃复合材料增强塑胶 (GFRP) 复合材料可以再形成和改质。此外,成型的玻璃纤维增强塑胶 (GFRP)复合材料易于回收。因此,在过去十年中,它们的使用量显着增加。然而,由于热塑性树脂是固体,因此难以以增强纤维浸渍。因此,热塑性树脂的价格明显高于热固性树脂。

风力发电机叶片是风力发电系统的关键元件。用于风力发电机叶片的玻璃钢复合材料广泛应用于大型风力发电机的研发。叶片製造商的研发重点主要在于降低风力发电成本。这推动了复合材料的使用,因为它们比其他纤维成本更低,同时又不损害其高性能。玻璃钢复合材料还具有高抗拉强度,有助于製造更大的叶片并提高能量输出。玻璃钢复合复合材料的耐腐蚀性能使风力发电机能够在最恶劣的环境下运作。

预计亚太地区将在预测期内实现玻璃钢复合材料市场的最高成长率。中国、印度和东南亚等国家正经历快速的工业成长和城市扩张。人口成长和经济扩张推动了玻璃钢复合材料在各种应用中的使用量不断增加。永续建筑实践的推广、新基础设施建设计划(例如中国的「新基建」计划和印度的「智慧城市」计划)以及支持国内製造业的政策正在推动该地区的需求和产能增长。

风力发电、航太与国防、汽车以及建筑与基础设施领域的成长推动了用于涡轮叶片和其他零件的玻璃钢复合复合材料的需求。製造流程的改进提高了产品品质并降低了成本,进一步扩大了市场。除了建筑和汽车之外,电气电子、船舶、管道和储罐等行业也促进了该地区玻璃钢复合材料市场的成长。

本报告研究了全球 GFRP 复合材料市场,按树脂类型、製造流程、最终用途行业和地理趋势进行细分,并提供了参与该市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 价值链分析

- 生态系分析

- 定价分析

- 2021-2024年贸易分析

- 技术分析

- 人工智慧/生成式人工智慧对 GFRP 复合材料市场的影响

- 宏观经济展望

- 专利分析

- 监管状况

- 2025-2026年主要会议和活动

- 案例研究分析

- 影响客户业务的趋势/中断

- 投资金筹措场景

- 2025年美国关税的影响 - GFRP复合材料市场

第六章 GFRP复合材料市场(依树脂类型)

- 介绍

- 聚酯纤维

- 乙烯基酯

- 环氧树脂

- 聚氨酯

- 热塑性塑料

- 其他的

7. GFRP复合材料市场(依製造流程)

- 介绍

- 压缩和射出成型工艺

- 缠绕成型

- 积层法

- 拉挤成型

- 树脂转注成形(RTM)

- 其他的

8. GFRP复合材料市场(依最终用途产业)

- 介绍

- 运输

- 建筑和基础设施

- 电机与电子工程

- 管道和储罐

- 船

- 航太和国防

- 风力发电

- 其他的

第九章 GFRP复合材料市场(按地区)

- 介绍

- 欧洲

- 亚太地区

- 北美洲

- 拉丁美洲

- 中东和非洲

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 2020-2024年收益分析

- 2024年市占率分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 竞争场景

第十一章 公司简介

- 主要参与企业

- GURIT SERVICES AG

- STRONGWELL CORPORATION

- EXEL COMPOSITES

- MITSUBISHI CHEMICAL GROUP CORPORATION

- AGY

- ASAHI KASEI CORPORATION

- POLSER COMPOSITE MATERIALS CORPORATION

- LM WIND POWER

- TENCOM

- BASF

- SGL CARBON

- AVIENT CORPORATION

- LEHMANN&VOSS&CO.(LEHVOSS GROUP)

- LANXESS

- 其他公司

- ADVANCED COMPOSITES INC.

- RELIANCE INDUSTRIES LIMITED(RELIANCE COMPOSITES SOLUTIONS)

- MRG COMPOSITES REBAR

- JPS COMPOSITE MATERIALS

- ASAHI YUKIZAI CORPORATION

- MATEENBAR COMPOSITE REINFORCEMENTS, LLC

- CELANESE CORPORATION

- DANTERR

- TOPOLO NEW MATERIALS

- CQDJ COMPOSITES

- BEETLE PLASTICS

第十二章 附录

The GFRP composites market is estimated at USD 64.5 billion in 2025 and is projected to reach USD 84.3 billion by 2030, at a CAGR of 5.5% from 2025 to 2030. The application of thermoplastic resin as a matrix material in fiber-reinforced composites has increased significantly over the last few years.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and volume (kiloton) |

| Segments | Resin Type, Manufacturing Process, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Thermoplastic resin has been used with continuous glass fiber to create structural composite products. The main advantage of thermoplastic resin as a matrix material is that the GFRP composite formed can be reshaped and reformed, unlike a thermoset resin. The GFRP composite formed is also easily recyclable. Hence, its use has increased significantly over the last decade. However, thermoplastic resin is solid, which makes it difficult to impregnate with reinforcing fibers. Hence, thermoplastic resins are quite expensive in comparison to thermoset resins.

"In terms of value, the wind energy industry is projected to register the highest CAGR among all the end-use industries."

Wind turbine blades are the key components in the wind power generation system. GFRP composites in wind turbine blades are widely used in the development of large-scale wind turbines. The R&D focus of blade manufacturers has been mainly on reducing the cost of wind energy. This is driving the use of GFRP composites, as they are less costly than other fibers without compromising their high-performance properties. GFRP composites also provide high tensile strength, helping manufacturers achieve larger blades and higher energy output. GFRP composites allow wind turbines to work in the harshest environments due to their corrosion-resistant properties.

"The Asia Pacific region is projected to register the highest growth rate in the GFRP composites market during the forecast period."

Asia Pacific is projected to be the fastest-growing region in the GFRP composites market during the forecast period. Countries such as China, India, and Southeast Asia are experiencing swift industrial growth and urban expansion. Rising population and expanding economies contribute to increased use of GFRP composites in various applications. Initiatives promoting sustainable building practices, new infrastructure plans (e.g., China's "New Infrastructure Plan" and India's "Smart Cities Mission"), and policies supporting domestic manufacturing boost demand and production capacity in the region.

Growth in wind energy, aerospace & defense, automobile, and construction & infrastructure sectors fuels demand for GFRP composites used in turbine blades and other components. Improvements in manufacturing processes enhance product quality and reduce costs, further enabling market expansion. Beyond construction and automotive, sectors like electrical & electronics, marine, and pipes & tanks also contribute to the GFRP composites market growth in the region.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Gurit Services AG (Switzerland), Strongwell Corporation (US), Exel Composites (Finland), Mitsubishi Chemical Group of Companies (Japan), AGY (US), Asahi Kasei Corporation (Japan), POLSER Composite Materials Corporation (Turkey), LM Wind Power (Denmark), Tencom Limited (US), BASF (Germany), SGL Carbon (Germany), Avient Corporation (US), Lehmann&Voss&Co. (Germany), and LANXESS (Germany).

Research coverage

This research report categorizes the GFRP composites market, by resin type (polyester, vinyl ester, epoxy, polyurethane, thermoplastics, and other resins), by manufacturing process [compression & injection molding, filament winding, layup, pultrusion, resin transfer molding (RTM), other manufacturing processes], end-use industry (transportation, construction & infrastructure, electrical & electronics, pipes & tanks, marine, aerospace & defense, wind energy, and other end-use industries), and region. The scope of the report includes detailed information about the major factors influencing the growth of the GFRP composites market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the GFRP composites market. This report includes a competitive analysis of upcoming startups in the GFRP composites market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall GFRP composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following points:

- Analysis of key drivers (increasing number of wind energy installations, increasing adoption of GFRP composites in the transportation industry, increasing use of GFRP composite pipes in sewage & water management and oil & gas industry), restraints (issues related to recycling, high processing and manufacturing costs, high processing and manufacturing costs), opportunities (high demand for GFRP composite pipes in the emerging economies, increasing demand for GFRP composites in the construction & infrastructure industry in Middle East & Africa), and challenges (developing low-cost technologies, standardization and regulation) influencing the growth of the GFRP composites market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the GFRP composites market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the GFRP composites market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the GFRP composites market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like are Gurit Services AG (Switzerland), Strongwell Corporation (US), Exel Composites (Finland), Mitsubishi Chemical Group of Companies (Japan), AGY (US), Asahi Kasei Corporation (Japan), POLSER Composite Materials Corporation (Turkey), LM Wind Power (Denmark), Tencom Limited (US), BASF (Germany), SGL Carbon (Germany), Avient Corporation (US), Lehmann&Voss&Co. (Germany), and LANXESS (Germany) in the GFRP composites market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN GFRP COMPOSITES MARKET

- 4.2 GFRP COMPOSITES MARKET, BY RESIN TYPE AND REGION

- 4.3 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 4.4 GFRP COMPOSITES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of wind energy installations

- 5.2.1.2 Rising adoption of GFRP composites in transportation industry

- 5.2.1.3 Growing demand for GFRP composite pipes in sewage & water management and oil & gas industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues related to recycling

- 5.2.2.2 High processing and manufacturing costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for GFRP composites from construction & infrastructure industry in Middle East & Africa

- 5.2.3.2 High demand for GFRP composite pipes in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Developing low-cost technologies

- 5.2.4.2 Standardization and regulation

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION (2023-2024)

- 5.8 TRADE ANALYSIS, 2021-2024

- 5.8.1 IMPORT SCENARIO (HS CODE 7019)

- 5.8.2 EXPORT SCENARIO (HS CODE 7019)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES (GFRP COMPOSITES MANUFACTURING)

- 5.9.1.1 GRP Molding

- 5.9.1.2 GRP Pultrusion

- 5.9.1.3 GRP Hand/Spray Layup Molding

- 5.9.2 COMPLEMENTARY TECHNOLOGIES (GFRP COMPOSITE MANUFACTURING)

- 5.9.2.1 GRP Resin Transfer Molding

- 5.9.2.2 GRP Compression Molding

- 5.9.2.3 GRP Long Fiber Injection Molding

- 5.9.1 KEY TECHNOLOGIES (GFRP COMPOSITES MANUFACTURING)

- 5.10 IMPACT OF AI/GEN AI ON GFRP COMPOSITES MARKET

- 5.10.1 TOP USE CASES AND MARKET POTENTIAL

- 5.10.2 CASE STUDIES OF AI IMPLEMENTATION IN GFRP COMPOSITES MARKET

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 INTRODUCTION

- 5.11.2 GDP TRENDS AND FORECAST

- 5.11.3 TRENDS IN GLOBAL AEROSPACE INDUSTRY

- 5.11.4 TRENDS IN WIND ENERGY INDUSTRY

- 5.11.5 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.11.6 TRENDS IN CONSTRUCTION INDUSTRY

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 PATENT TYPES

- 5.12.3 INSIGHTS

- 5.12.4 LEGAL STATUS

- 5.12.5 JURISDICTION ANALYSIS

- 5.12.6 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 GURIT SERVICES AG ACQUIRED MAJORITY SHARE IN FIBERLINE COMPOSITES A/S

- 5.15.2 OWENS CORNING AND PULTRON COMPOSITES SIGNED AN AGREEMENT TO MANUFACTURE GFRP REBAR

- 5.15.3 EXEL COMPOSITES, OWENS CORNING, AND URBAN CANOPEE JOINED FORCES TO MAKE A COMPOSITE SOLUTION WHOLLY MADE FROM CIRCULAR AND BIOBASED INPUTS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFFS- GFRP COMPOSITES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END USERS

6 GFRP COMPOSITES MARKET, BY RESIN TYPE

- 6.1 INTRODUCTION

- 6.2 POLYESTER

- 6.2.1 MASS APPLICATIONS IN CONSTRUCTION PANELS, PIPES, TANKS, AUTOMOTIVE PARTS, AND CONSUMER GOODS TO DRIVE MARKET

- 6.3 VINYL ESTER

- 6.3.1 ENHANCED CORROSION RESISTANCE PROPERTIES TO BOOST DEMAND

- 6.4 EPOXY

- 6.4.1 HIGH PERFORMANCE AT ELEVATED TEMPERATURES TO DRIVE GROWTH IN ADVERSE APPLICATIONS

- 6.5 POLYURETHANE

- 6.5.1 FAST CURE TIME AND FLEXIBILITY TO PROPEL MARKET

- 6.6 THERMOPLASTIC

- 6.6.1 RECYCLABILITY TO BOOST DEMAND

- 6.7 OTHER RESIN TYPES

- 6.7.1 PHENOLIC

- 6.7.2 BENZOXAZINE

- 6.7.3 CYANATE ESTER

- 6.7.4 BISMALIMIDE (BMI)

7 GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 7.1 INTRODUCTION

- 7.2 COMPRESSION & INJECTION MOLDING PROCESS

- 7.2.1 LOW MAINTENANCE AND INVESTMENT TO SUPPORT ADOPTION

- 7.3 FILAMENT WINDING

- 7.3.1 HIGH FIBER VOLUME FRACTION TO FOSTER GROWTH

- 7.4 LAYUP

- 7.4.1 INEXPENSIVE TOOLING AND SIMPLE MACHINERY TO DRIVE DEMAND

- 7.5 PULTRUSION

- 7.5.1 CONTINUOUS AND AUTOMATION PROPERTIES TO FUEL GROWTH

- 7.6 RESIN TRANSFER MOLDING (RTM)

- 7.6.1 PRODUCTION OF COMPLEX, DURABLE PARTS AT COMPETITIVE COSTS TO FUEL MARKET

- 7.7 OTHER MANUFACTURING PROCESSES

- 7.7.1 3D PRINTING

- 7.7.2 COLD PRESS MOLDING

- 7.7.3 VACUUM BAGGING

8 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 TRANSPORTATION

- 8.2.1 HIGH STRENGTH-TO-WEIGHT RATIO TO DRIVE DEMAND

- 8.2.2 RAIL

- 8.2.3 AUTOMOTIVE

- 8.3 CONSTRUCTION & INFRASTRUCTURE

- 8.3.1 SUSTAINABILITY AND REGULATORY SUPPORT TO PROPEL MARKET GROWTH

- 8.3.2 DECKING AND RAILING

- 8.3.3 REBARS

- 8.3.4 OTHER CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRIES

- 8.4 ELECTRICAL & ELECTRONICS

- 8.4.1 EXCELLENT ELECTRICAL CONDUCTIVITY AND THERMAL RESISTANCE PROPERTIES TO BOOST GROWTH

- 8.5 PIPES & TANKS

- 8.5.1 LONG SERVICE LIFE AND DURABILITY TO DRIVE ADOPTION

- 8.5.2 OIL & GAS

- 8.5.3 WATER & WASTEWATER TREATMENT PLANTS

- 8.5.4 PULP & PAPER

- 8.6 OTHER PIPE & TANK END-USE INDUSTRIES

- 8.7 MARINE

- 8.7.1 EXCEPTIONAL CORROSION RESISTANCE TO FUEL GROWTH

- 8.8 AEROSPACE & DEFENSE

- 8.8.1 DESIGN AND MANUFACTURING FLEXIBILITY TO BOOST MARKET

- 8.8.2 INTERIOR

- 8.8.3 EXTERIOR

- 8.9 WIND ENERGY

- 8.9.1 HIGH STRENGTH-TO-WEIGHT RATIO TO PROPEL DEMAND

- 8.10 OTHER END-USE INDUSTRIES

- 8.10.1 HEALTHCARE

- 8.10.2 CONSUMER GOODS

- 8.10.3 SPORTING GOODS

9 GFRP COMPOSITES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.1.1 GFRP COMPOSITES MARKET, BY REGION

- 9.2 EUROPE

- 9.2.1 EUROPE: GFRP COMPOSITES MARKET, BY RESIN TYPE

- 9.2.2 EUROPE: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 9.2.3 EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.2.4 EUROPE: GFRP COMPOSITES MARKET, BY COUNTRY

- 9.2.4.1 Germany

- 9.2.4.1.1 Growth of automotive and aerospace sectors to drive demand

- 9.2.4.2 France

- 9.2.4.2.1 Presence of aerospace manufacturers to boost market

- 9.2.4.3 Italy

- 9.2.4.3.1 Shift toward sustainability to propel demand

- 9.2.4.4 UK

- 9.2.4.4.1 Increase in demand for lightweight and high-performance materials for automobiles to fuel market

- 9.2.4.5 Spain

- 9.2.4.5.1 Demand from wind energy sector to propel market

- 9.2.4.6 Russia

- 9.2.4.6.1 Innovation in fiber-reinforced technologies to boost growth

- 9.2.4.7 Rest of Europe

- 9.2.4.1 Germany

- 9.3 ASIA PACIFIC

- 9.3.1 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY RESIN

- 9.3.2 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 9.3.3 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.3.4 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY COUNTRY

- 9.3.4.1 China

- 9.3.4.1.1 Presence of major fiberglass and GFRP composites manufacturing companies to fuel market

- 9.3.4.2 Japan

- 9.3.4.2.1 Demand for lightweight composites from automotive industry to drive market

- 9.3.4.3 India

- 9.3.4.3.1 Growing construction industry to fuel demand

- 9.3.4.4 South Korea

- 9.3.4.4.1 Presence of key electronics companies to drive demand

- 9.3.4.5 Australia

- 9.3.4.5.1 Expansion of renewable energy infrastructure to propel demand

- 9.3.4.6 Rest of Asia Pacific

- 9.3.4.1 China

- 9.4 NORTH AMERICA

- 9.4.1 NORTH AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE

- 9.4.2 NORTH AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 9.4.3 NORTH AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.4.4 NORTH AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY

- 9.4.4.1 US

- 9.4.4.1.1 Increasing reliance on lightweight, corrosion-resistant, and durable materials for key end-use industries to drive market

- 9.4.4.2 Canada

- 9.4.4.2.1 Growing aerospace industry to support market growth

- 9.4.4.1 US

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE

- 9.5.2 LATIN AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 9.5.3 LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.5.4 LATIN AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY

- 9.5.4.1 Brazil

- 9.5.4.1.1 Growth of automotive industry to fuel demand

- 9.5.4.2 Mexico

- 9.5.4.2.1 Increase in demand from automotive industry to drive growth

- 9.5.4.3 Rest of Latin America

- 9.5.4.1 Brazil

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY RESIN TYPE

- 9.6.2 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 9.6.3 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.6.4 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY COUNTRY

- 9.6.5 GCC COUNTRIES

- 9.6.5.1 UAE

- 9.6.5.1.1 Stringent energy efficiency regulations to boost market

- 9.6.5.2 Saudi Arabia

- 9.6.5.2.1 Increased investments in infrastructural development to drive market

- 9.6.5.1 UAE

- 9.6.6 REST OF GCC COUNTRIES

- 9.6.7 SOUTH AFRICA

- 9.6.7.1 Increased spending on infrastructure projects to boost growth

- 9.6.8 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 KEY STRATEGIES ADOPTED BY PLAYERS IN GFRP COMPOSITES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 SPRINT (GURIT SERVICES AG)

- 10.5.2 EXTREN (STRONGWELL COMPOSITES)

- 10.5.3 GMT (MITSUBISHI CHEMICAL GROUP CORPORATION)

- 10.5.4 LENCEN (ASAHI KASEI CORPORATION)

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Resin type footprint

- 10.6.5.4 Manufacturing process footprint

- 10.6.5.5 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 GURIT SERVICES AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 STRONGWELL CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 EXEL COMPOSITES

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 AGY

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.6 ASAHI KASEI CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 POLSER COMPOSITE MATERIALS CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 LM WIND POWER

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 TENCOM

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 BASF

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.11 SGL CARBON

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 AVIENT CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 LEHMANN&VOSS&CO. (LEHVOSS GROUP)

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.14 LANXESS

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.1 GURIT SERVICES AG

- 11.2 OTHER PLAYERS

- 11.2.1 ADVANCED COMPOSITES INC.

- 11.2.2 RELIANCE INDUSTRIES LIMITED (RELIANCE COMPOSITES SOLUTIONS)

- 11.2.3 MRG COMPOSITES REBAR

- 11.2.4 JPS COMPOSITE MATERIALS

- 11.2.5 ASAHI YUKIZAI CORPORATION

- 11.2.6 MATEENBAR COMPOSITE REINFORCEMENTS, LLC

- 11.2.7 CELANESE CORPORATION

- 11.2.8 DANTERR

- 11.2.9 TOPOLO NEW MATERIALS

- 11.2.10 CQDJ COMPOSITES

- 11.2.11 BEETLE PLASTICS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 GLOBAL WIND ENERGY INSTALLATIONS, 2019-2024

- TABLE 2 GFRP COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 GFRP COMPOSITES MARKET: ROLE IN ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF GFRP COMPOSITES IN TOP APPLICATIONS, BY KEY PLAYER, 2024 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF GFRP COMPOSITES, BY REGION, 2023-2024 (USD/KG)

- TABLE 8 IMPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 AI TECHNOLOGIES REVOLUTIONIZING GFRP COMPOSITES MARKET

- TABLE 12 GDP PERCENTAGE (%) CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 13 GFRP COMPOSITES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 14 LIST OF PATENTS BY SUBARU CORPORATION

- TABLE 15 LIST OF PATENTS BY THE BOEING COMPANY

- TABLE 16 LIST OF PATENTS BY TAYLOR MADE GOLF COMPANY INC.

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 GFRP COMPOSITES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR GFRP COMPOSITES, 2024 VS. 2025

- TABLE 24 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO IMPACT OF US TARIFF

- TABLE 25 GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 26 GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 27 GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 28 GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 29 POLYESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 POLYESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 31 POLYESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 POLYESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 33 VINYL ESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 34 VINYL ESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 35 VINYL ESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 VINYL ESTER RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 37 EPOXY RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 38 EPOXY RESIN: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 39 EPOXY RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 EPOXY RESIN: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 41 POLYURETHANE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 42 POLYURETHANE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 43 POLYURETHANE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 POLYURETHANE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 45 THERMOPLASTIC: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 46 THERMOPLASTIC: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 47 THERMOPLASTIC: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 THERMOPLASTIC: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 49 OTHER RESIN TYPES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 50 OTHER RESIN TYPES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 51 OTHER RESIN TYPES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 OTHER RESIN TYPES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 53 COMPARATIVE STUDY OF MAJOR COMPOSITE MANUFACTURING PROCESSES

- TABLE 54 GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 55 GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 56 GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 57 GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 58 COMPRESSION & INJECTION MOLDING PROCESS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 59 COMPRESSION & INJECTION MOLDING PROCESS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 60 COMPRESSION & INJECTION MOLDING: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 COMPRESSION & INJECTION MOLDING: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 62 FILAMENT WINDING: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 63 FILAMENT WINDING: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 64 FILAMENT WINDING: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 FILAMENT WINDING: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 66 LAYUP: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 67 LAYUP: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 68 LAYUP: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 LAYUP: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 70 PULTRUSION: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 71 PULTRUSION: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 72 PULTRUSION: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 PULTRUSION: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 74 RESIN TRANSFER MOLDING (RTM): GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 75 RESIN TRANSFER MOLDING (RTM): GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 76 RESIN TRANSFER MOLDING (RTM): GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 RESIN TRANSFER MOLDING (RTM): GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 OTHER MANUFACTURING PROCESSES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 79 OTHER MANUFACTURING PROCESSES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 80 OTHER MANUFACTURING PROCESSES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER MANUFACTURING PROCESSES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 83 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 84 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 86 TRANSPORTATION: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 87 TRANSPORTATION: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 88 TRANSPORTATION: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 TRANSPORTATION: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 90 CONSTRUCTION & INFRASTRUCTURE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 91 CONSTRUCTION & INFRASTRUCTURE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 92 CONSTRUCTION & INFRASTRUCTURE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 CONSTRUCTION & INFRASTRUCTURE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 94 ELECTRICAL & ELECTRONICS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 95 ELECTRICAL & ELECTRONICS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 96 ELECTRICAL & ELECTRONICS: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 ELECTRICAL & ELECTRONICS: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 98 PIPES & TANKS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 99 PIPES & TANKS: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 100 PIPES & TANKS: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 PIPES & TANKS: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 102 MARINE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 103 MARINE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 104 MARINE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 MARINE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 106 AEROSPACE & DEFENSE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 107 AEROSPACE & DEFENSE: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 108 AEROSPACE & DEFENSE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 AEROSPACE & DEFENSE: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 110 WIND ENERGY: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 111 WIND ENERGY: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 112 WIND ENERGY: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 WIND ENERGY: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 114 OTHER END-USE INDUSTRIES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 115 OTHER END-USE INDUSTRIES: GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 116 OTHER END-USE INDUSTRIES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 OTHER END-USE INDUSTRIES: GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 118 GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 119 GFRP COMPOSITES MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 120 GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 GFRP COMPOSITES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 122 EUROPE: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 123 EUROPE: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 124 EUROPE: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 126 EUROPE: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 127 EUROPE: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 128 EUROPE: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 130 EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 131 EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 132 EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 EUROPE: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 135 EUROPE: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 136 EUROPE: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 138 GERMANY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 139 GERMANY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 140 GERMANY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 GERMANY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 142 FRANCE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 143 FRANCE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 144 FRANCE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 FRANCE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 146 ITALY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 147 ITALY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 148 ITALY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 ITALY: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 150 UK: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 151 UK: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 152 UK: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 UK: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 SPAIN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 155 SPAIN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 156 SPAIN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 SPAIN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 158 RUSSIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 159 RUSSIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 160 RUSSIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 RUSSIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 REST OF EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 163 REST OF EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 164 REST OF EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 166 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 168 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 170 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 172 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 174 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 176 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 178 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 180 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 182 CHINA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 183 CHINA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 184 CHINA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 CHINA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 186 JAPAN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 187 JAPAN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 188 JAPAN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 JAPAN: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 190 INDIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 191 INDIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 192 INDIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 INDIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 SOUTH KOREA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 195 SOUTH KOREA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 196 SOUTH KOREA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH KOREA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 198 AUSTRALIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 199 AUSTRALIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 200 AUSTRALIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 201 AUSTRALIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 202 REST OF ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 204 REST OF ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 206 NORTH AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 207 NORTH AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 208 NORTH AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 209 NORTH AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 210 NORTH AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 211 NORTH AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 212 NORTH AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 214 NORTH AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 215 NORTH AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 216 NORTH AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 NORTH AMERICA: GFRP COMPOSITES COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 218 NORTH AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 219 NORTH AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 220 NORTH AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 NORTH AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 222 US: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 223 US: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 224 US: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 225 US: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 226 CANADA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 227 CANADA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 228 CANADA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 229 CANADA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 230 LATIN AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 231 LATIN AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 232 LATIN AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 234 LATIN AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 235 LATIN AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 236 LATIN AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 238 LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 239 LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 240 LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 242 LATIN AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 243 LATIN AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 244 LATIN AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 246 BRAZIL: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 247 BRAZIL: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 248 BRAZIL: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 249 BRAZIL: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 250 MEXICO: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 251 MEXICO: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 252 MEXICO: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 253 MEXICO: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 254 REST OF LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 255 REST OF LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 256 REST OF LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 257 REST OF LATIN AMERICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2022-2024 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 262 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KILOTON)

- TABLE 266 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 270 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 274 UAE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 275 UAE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 276 UAE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 277 UAE: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 278 SAUDI ARABIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 279 SAUDI ARABIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 280 SAUDI ARABIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 281 SAUDI ARABIA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 282 REST OF GCC COUNTRIES: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 283 REST OF GCC COUNTRIES: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 284 REST OF GCC COUNTRIES: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 285 REST OF GCC COUNTRIES: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 286 SOUTH AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 287 SOUTH AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 288 SOUTH AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 289 SOUTH AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 291 REST OF MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: GFRP COMPOSITES MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 294 GFRP COMPOSITES MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2020-AUGUST 2025

- TABLE 295 GFRP COMPOSITES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 296 GFRP COMPOSITES MARKET: REGION FOOTPRINT

- TABLE 297 GFRP COMPOSITES MARKET: RESIN TYPE FOOTPRINT

- TABLE 298 GFRP COMPOSITES MARKET: MANUFACTURING PROCESS FOOTPRINT

- TABLE 299 GFRP COMPOSITES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 300 GFRP COMPOSITES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 301 GFRP COMPOSITES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 302 GFRP COMPOSITES MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 303 GFRP COMPOSITES MARKET: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 304 GURIT SERVICES AG: COMPANY OVERVIEW

- TABLE 305 GURIT SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 GURIT SERVICES AG: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 307 STRONGWELL CORPORATION: COMPANY OVERVIEW

- TABLE 308 STRONGWELL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 STRONGWELL CORPORATION: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 310 EXEL COMPOSITES: COMPANY OVERVIEW

- TABLE 311 EXEL COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 EXEL COMPOSITES: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 313 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 314 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 315 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 316 AGY: COMPANY OVERVIEW

- TABLE 317 AGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 AGY: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 319 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 320 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 POLSER COMPOSITE MATERIALS CORPORATION: COMPANY OVERVIEW

- TABLE 322 POLSER COMPOSITE MATERIALS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 323 POLSER COMPOSITE MATERIALS CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 324 LM WIND POWER: COMPANY OVERVIEW

- TABLE 325 LM WIND POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 LM WIND POWER: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 327 TENCOM : COMPANY OVERVIEW

- TABLE 328 TENCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 BASF: COMPANY OVERVIEW

- TABLE 330 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 SGL CARBON: COMPANY OVERVIEW

- TABLE 332 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 334 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 LEHMANN&VOSS&CO. (LEHVOSS GROUP): COMPANY OVERVIEW

- TABLE 336 LEHMANN&VOSS&CO. (LEHVOSS GROUP): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 337 LANXESS: COMPANY OVERVIEW

- TABLE 338 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 ADVANCED COMPOSITES INC.: COMPANY OVERVIEW

- TABLE 340 RELIANCE INDUSTRIES LIMITED (RELIANCE COMPOSITES SOLUTIONS): COMPANY OVERVIEW

- TABLE 341 MRG COMPOSITES REBAR: COMPANY OVERVIEW

- TABLE 342 JPS COMPOSITE MATERIALS: COMPANY OVERVIEW

- TABLE 343 ASAHI YUKIZAI CORPORATION: COMPANY OVERVIEW

- TABLE 344 MATEENBAR COMPOSITE REINFORCEMENTS, LLC: COMPANY OVERVIEW

- TABLE 345 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 346 DANTERR: COMPANY OVERVIEW

- TABLE 347 TOPOLO NEW MATERIALS: COMPANY OVERVIEW

- TABLE 348 CQDJ COMPOSITES: COMPANY OVERVIEW

- TABLE 349 BEETLE PLASTICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 GFRP COMPOSITES: MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 GFRP COMPOSITES MARKET: RESEARCH DESIGN

- FIGURE 3 GFRP COMPOSITES MARKET: BOTTOM-UP APPROACH

- FIGURE 4 GFRP COMPOSITES MARKET: TOP-DOWN APPROACH

- FIGURE 5 GFRP COMPOSITES MARKET: DATA TRIANGULATION

- FIGURE 6 POLYESTER TO BE LEADING RESIN TYPE OF GFRP COMPOSITES BETWEEN 2025 AND 2030

- FIGURE 7 COMPRESSION & INJECTION MOLDING TO BE LEADING MANUFACTURING PROCESS DURING FORECAST PERIOD

- FIGURE 8 TRANSPORTATION TO BE LEADING END-USE INDUSTRY OF GFRP COMPOSITES BETWEEN 2025 AND 2030

- FIGURE 9 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE AND GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 10 GFRP COMPOSITES MARKET TO WITNESS HIGH GROWTH IN ASIA PACIFIC BETWEEN 2025 AND 2030

- FIGURE 11 POLYESTER AND ASIA PACIFIC MARKETS HELD LARGEST MARKET SHARE IN 2024

- FIGURE 12 TRANSPORTATION SEGMENT TO DOMINATE OVERALL GFRP COMPOSITES MARKET, BY VOLUME

- FIGURE 13 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GFRP COMPOSITES MARKET

- FIGURE 15 GFRP COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 17 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 18 GFRP COMPOSITES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 GFRP COMPOSITES MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 20 GFRP COMPOSITES MARKET: ECOSYSTEM

- FIGURE 21 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/KG)

- FIGURE 22 IMPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA RELATED TO HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 24 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 25 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 26 GFRP COMPOSITES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 27 US REGISTERED HIGHEST PATENT PERCENTAGE

- FIGURE 28 SUBARU CORPORATION REGISTERED HIGHEST PERCENTAGE OF PATENTS

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 GFRP COMPOSITES MARKET: DEALS AND FUNDING SOARED IN 2021

- FIGURE 31 POLYESTER TO BE LEADING RESIN TYPE OF GFRP COMPOSITES DURING FORECAST PERIOD

- FIGURE 32 COMPRESSION & INJECTION MOLDING TO BE LEADING MANUFACTURING PROCESS OF GFRP COMPOSITES DURING FORECAST PERIOD

- FIGURE 33 TRANSPORTATION TO BE LEADING END-USE INDUSTRY OF GFRP COMPOSITES DURING FORECAST PERIOD

- FIGURE 34 CHINA TO REGISTER HIGHEST CAGR IN GFRP COMPOSITES MARKET DURING FORECAST PERIOD

- FIGURE 35 EUROPE: GFRP COMPOSITES MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: GFRP COMPOSITES MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: GFRP COMPOSITES MARKET SNAPSHOT

- FIGURE 38 GFRP COMPOSITES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 39 GFRP COMPOSITES MARKET SHARE ANALYSIS, 2024

- FIGURE 40 GFRP COMPOSITES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 GFRP COMPOSITES MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 42 GFRP COMPOSITES MARKET: COMPANY FOOTPRINT

- FIGURE 43 GFRP COMPOSITES MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 44 GFRP COMPOSITES MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 GFRP COMPOSITES MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 47 GURIT SERVICES AG: COMPANY SNAPSHOT

- FIGURE 48 EXEL COMPOSITES: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 BASF: COMPANY SNAPSHOT

- FIGURE 52 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 53 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 LANXESS: COMPANY SNAPSHOT