|

市场调查报告书

商品编码

1856023

全球原儿茶酸市场依等级、形态、应用、生产流程、终端用户产业及地区划分-预测至2030年Protocatechuic Acid Market By Grade, By Production, By Form, By Application, By End-use Industry And By Regional Global Forecast To 2030 |

||||||

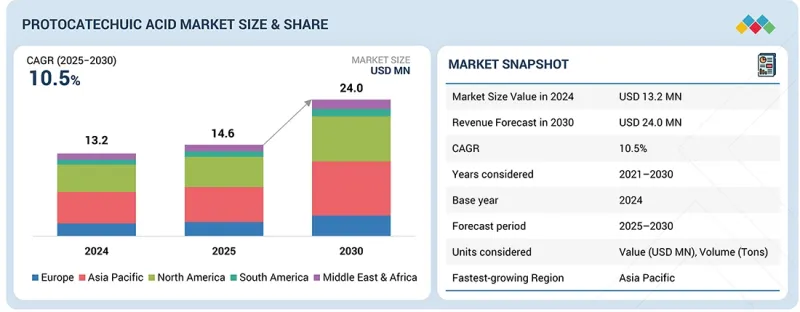

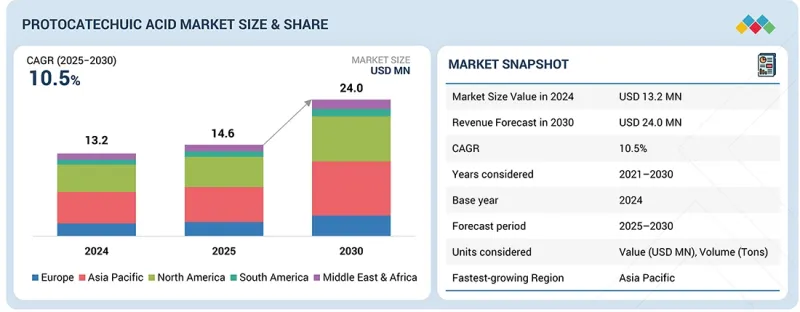

预计原儿茶酸市场规模将从 2025 年的 1,460 万美元成长到 2030 年的 2,400 万美元,在预测期内复合年增长率将达到 10.5%。

| 调查范围 | |

|---|---|

| 调查年度 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 考虑单位 | 金额(百万美元),数量(吨) |

| 部分 | 按等级、形状、应用、产量、最终用途行业和地区划分 |

| 目标区域 | 北美洲、欧洲、中东/非洲、南美洲 |

受健康趋势、技术进步和工业需求成长等因素的共同推动,全球原儿茶酸市场正经历快速成长。其中一个关键驱动因素是癌症、糖尿病、心血管疾病和神经退化性疾病等慢性疾病的日益普遍。原儿茶酸已被证实具有抗氧化、抗发炎、抗癌和抗菌特性,因此其作为治疗成分和药物中间体在製药业的研发和应用日益广泛。同时,全球对天然和植物来源产品的偏好也推动了对营养保健品和化妆品的需求,而原儿茶酸则被应用于营养保健品、抗衰老配方和护肤品中。

由于原儿茶酸在先进製药、生物技术和分析研究领域具有关键应用价值,其超纯级产品占据了该行业最大的市场份额。这些领域对化合物的纯度要求极高,通常超过99.9%,以确保实验、药物和诊断测试的准确性和安全性。例如,神经保护药物的研发利用了原儿茶酸的抗氧化特性,因此需要超纯级产品以避免干扰敏感的检测方法。此外,医药和营养补充剂领域对源自天然植物来源的生物活性化合物的日益重视也推动了对高纯度原儿茶酸的需求。这些因素共同促进了原儿茶酸市场超纯级产品的快速成长。

与天然萃取相比,化学合成法具有品质稳定、纯度高、易于规模化生产等优点,是原儿茶酸产业成长最快的生产流程。该方法能够满足製药、保健品和化妆品行业日益增长的需求,这些行业对浓度和可靠性要求极高。此外,化学合成法减少了对季节性植物原料的依赖,降低了生产成本,并实现了大规模工业生产,使其成为高效满足不断增长的市场需求的首选方法。

由于兼具实用性、功能性和经济性优势,原儿茶酸粉末/晶体形式已成为业界成长最快的细分市场。与液体和颗粒形式不同,晶体形式具有更优异的化学稳定性和更长的保质期,使其成为医药、营养保健品和化妆品等应用领域中产品功效必须长期保持的关键。其高浓度和均一性使其能够实现精确给药,并确保片剂、胶囊和营养保健品等製剂的稳定性能。此外,与液体形式相比,粉末/晶体形式更易于运输、储存和处理,从而降低了物流挑战并最大限度地减少了劣化风险。在研究和分析领域,由于其能够提供精确的测量结果和可重复的结果,尤其是在与抗氧化和神经保护相关的敏感实验中,这种形式更受青睐。此外,工业生产的日益普及以及对高纯度植物来源生物活性化合物需求的不断增长,也进一步加速了粉末和晶体形式的应用。这些优势使得原儿茶酸市场的粉末/晶体部分成为最具吸引力且成长最快的市场。

亚太地区是原儿茶酸市场成长最快的地区,这主要得益于人口、经济、技术和监管等多方面因素的共同作用,这些因素为市场扩张创造了肥沃的土壤。该地区拥有全球最庞大的人口之一,印度、中国和东南亚国协等正在经历快速的都市化,显着扩大了健康和保健产品的消费群体。这种人口结构的变化,加上中产阶级的崛起和可支配收入的增加,正在推动人们生活方式向健康意识的显着转变,并刺激了对原儿茶酸等天然生物活性成分的需求,这些成分广泛应用于药品、营养保健品和化妆品领域。该地区的消费者越来越青睐具有经证实的抗氧化、抗发炎和抗菌功效的产品,这使得原儿茶酸成为机能性食品、营养保健品和护肤配方中的重要成分。

本报告考察了全球原儿茶酸市场,并按等级、形式、应用、生产流程、最终用途行业、区域趋势和公司概况提供了市场资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 介绍

- 市场动态

- 生成式人工智慧效应

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/干扰因素

- 供应链分析

- 定价分析

- 投资状况和资金筹措方案

- 生态系分析

- 技术分析

- 2025年美国关税对原儿茶酸市场的影响

- 专利分析

- 贸易分析

- 2025-2026 年主要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

- 案例研究分析

第七章 原儿茶酸市场(依等级划分)

- 介绍

- 超高纯度

- 工业级

- 低级

第八章 原儿茶酸市场(依形式)

- 介绍

- 粉末/晶体

- 颗粒

- 液体

- 其他的

9. 原儿茶酸市场(依生产流程划分)

- 介绍

- 化学合成

- 天然萃取/生物基

第十章 原儿茶酸市场(依应用领域划分)

- 介绍

- 防腐剂和抗氧化剂

- 化学中间体

- 聚合物

- 染料

- 饲料添加剂和营养补充剂

- 防锈抑制剂

- 其他的

第十一章 原儿茶酸市场(依终端用途产业划分)

- 介绍

- 製药

- 食品/饮料

- 化妆品/个人护理

- 农业

- 其他的

第十二章 原儿茶酸(依地区划分)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十三章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市占率分析

- 收入分析

- 品牌/产品比较分析

- 公司估值矩阵(主要参与企业),2024 年

- Start-Ups/中小企业企业估值矩阵(2024)

- 竞争场景

第十四章:公司简介

- 主要参与企业

- VERTEXYN(NANJING)BIOWORKS

- GREEN CHEMICALS CO., LTD.

- NANJING NUTRIHERB BIOTECH CO., LTD.

- SHAANXI LONIERHERB BIO-TECHNOLOGY CO., LTD.

- SIMSON PHARMA LIMITED

- CENTRAL DRUG HOUSE

- CAYMAN CHEMICAL COMPANY

- TAIZHOU ZHONGDA CHEMICAL CO., LTD.

- HANGZHOU VIABLIFE BIOTECH CO., LTD.

- CHEMFACES

- 其他公司

- ANANT PHARMACEUTICALS PVT. LTD.

- JINAN FINER CHEMICAL CO.

- OTTO CHEMIE PVT. LTD.

- SIGMA-ALDRICH

- BIOSYNTH

- AXIOM CHEMICALS PVT. LTD.

- PHARMAFFILIATES PRIVATE LIMITED

- BLDPHARM

- SELLECK CHEMICALS

- LKT LABORATORIES

第十五章附录

The protocatechuic acid market size is projected to grow from USD 14.6 million in 2025 to USD 24.0 million by 2030, registering a CAGR of 10.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Tons) |

| Segments | Grade, production process, Application, End-use Industry, and Region. |

| Regions covered | North America, Europe, Middle East & Africa, and South America. |

The global protocatechuic acid market is experiencing rapid growth due to a combination of health trends, technological advancements, and increasing industrial demand. One of the primary drivers is the rising prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and neurodegenerative conditions. Since PCA has been proven to have antioxidant, anti-inflammatory, anticancer, and antimicrobial properties, it is increasingly being studied and adopted in the pharmaceutical industry as a therapeutic ingredient and drug intermediate. Alongside this, the global push toward natural and plant-based products is fueling demand in nutraceuticals and cosmetics, where PCA is used in dietary supplements, anti-aging formulations, and skin-protective products.

"Ultra-high purity grade is projected to be the largest segment in the grade segment of the protocatechuic acid market in terms of value."

The ultra-high purity grade of protocatechuic acid is the largest segment in the industry due to its critical applications in advanced pharmaceuticals, biotechnology, and analytical research. These sectors demand compounds with exceptional purity levels-often exceeding 99.9%-to ensure the accuracy and safety of experiments, drug formulations, and diagnostic tests. For instance, in the development of neuroprotective agents, protocatechuic acid's antioxidant properties are harnessed, necessitating ultra-pure forms to avoid interference in sensitive assays. Additionally, the increasing emphasis on natural, plant-derived bioactive compounds in medicine and nutraceuticals further propels the demand for high-purity protocatechuic acid, as it is considered safer and more effective than synthetic alternatives. These factors collectively contribute to the rapid growth of the ultra-high purity grade segment in the protocatechuic acid market.

"Chemical synthesis is anticipated to be the fastest-growing segment in production process segment of the protocatechuic acid market in terms of value."

Chemical synthesis is the fastest-growing production process in the protocatechuic acid industry because it offers consistent quality, high purity, and scalability compared to extraction from natural sources. This method allows manufacturers to meet the increasing demand from the pharmaceuticals, nutraceuticals, and cosmetic industries, where precise concentration and reliability are critical. Additionally, chemical synthesis reduces dependency on seasonal plant sources, lowers production costs, and enables large-scale industrial production, making it a preferred method for meeting the market's growing requirements efficiently.

"Powder/ Crystalline is the fastest growing segment of the protocatechuic acid market in terms of value."

The powder/ crystalline form of protocatechuic acid has emerged as the fastest-growing segment in the industry due to a combination of practical, functional, and economic advantages. Unlike liquid or granular forms, the crystalline form offers superior chemical stability and a longer shelf life, which is critical for pharmaceutical, nutraceutical, and cosmetic applications where product efficacy must be maintained over time. Its highly concentrated and uniform nature allows for precise dosing, ensuring consistent performance in formulations such as tablets, capsules, and dietary supplements. Moreover, the powder/crystalline form is easier to transport, store, and handle, reducing logistical challenges and minimizing degradation risks compared to liquids. In research and analytical contexts, this form is particularly preferred because it facilitates accurate measurement and reproducible results in sensitive experiments, especially those related to antioxidant or neuroprotective studies. Furthermore, the increasing trend toward industrial-scale production and the growing demand for high-purity, plant-derived bioactive compounds further amplify the adoption of the powder and crystalline forms. Collectively, these factors make the powder/crystalline segment the most attractive and rapidly expanding option in the protocatechuic acid market.

"Asia Pacific is the fastest growing region in the protocatechuic acid market in terms of value."

Asia-Pacific stands out as the fastest-growing region in the protocatechuic acid market due to a confluence of demographic, economic, technological, and regulatory factors that create a fertile ground for market expansion. The region boasts one of the largest populations globally, with countries like India, China, and the ASEAN nations experiencing rapid urbanization, which has significantly expanded the consumer base for health and wellness products. This demographic shift is accompanied by a burgeoning middle class, whose rising disposable incomes are driving a pronounced shift toward health-conscious lifestyles, increasing the demand for natural bioactives such as PCA in pharmaceuticals, nutraceuticals, and cosmetics. The region's consumers are increasingly favoring products with proven antioxidant, anti-inflammatory, and antimicrobial properties, positioning PCA as a valuable ingredient in functional foods, dietary supplements, and skincare formulations.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the protocatechuic acid market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, South America - 5%.

The protocatechuic acid market comprises Vertexyn Bioworks Co., Ltd. (China), Green Chemicals Co., Ltd. (GCC) (Japan), Nanjing NutriHerb BioTech Co.,Ltd (China), Shaanxi LonierHerb Bio-Technology Co., Ltd. (China), SimSon Pharma Limited (China), Central Drug House (India), Cayman Chemical (US), Taizhou Zhongda Chemical Co., Ltd. (China), Hangzhou Viablife Biotech Co., Ltd. (China), ChemFaces (China). The study includes an in-depth competitive analysis of these key players in the protocatechuic acid market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for protocatechuic acid on the basis of form, production process, grade, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the protocatechuic acid market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the protocatechuic acid market; high-growth region; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Rising consumer preferences towards Natural Antioxidants & Clean Label Products), restraints (Constrained competition from the substituted products in the industry), opportunities (From Plastic Waste to Bioactive Wealth: PET-to-PCA Upcycling for a Sustainable Future), and challenges (Limited Industrial-Scale Applications of PCA due to high costs, low yields, and regulatory barriers for PCA).

- Market Penetration: Comprehensive information on the protocatechuic acid market is offered by top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, partnerships, agreements, joint ventures, collaboration, announcements, awards, and expansion in the market.

- Market Development: Comprehensive information about lucrative emerging markets, the report analyzes the markets for protocatechuic acid across regions.

- Market Capacity: Production capacities of companies producing protocatechuic acid are provided wherever available, with upcoming capacities for the protocatechuic acid market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the protocatechuic acid market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants in primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 GROWTH FORECAST

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROTOCATECHUIC ACID MARKET

- 4.2 PROTOCATECHUIC ACID MARKET, BY GRADE

- 4.3 PROTOCATECHUIC ACID MARKET, BY FORM

- 4.4 PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS

- 4.5 PROTOCATECHUIC ACID MARKET, BY APPLICATION

- 4.6 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY

- 4.7 PROTOCATECHUIC ACID MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising consumer preferences toward natural antioxidants & clean-label products

- 5.2.1.2 Growing demand in expanding cosmetics & personal care industry

- 5.2.1.3 PCA used as bioactives for sustainable agriculture and crop protection adoption

- 5.2.1.4 Regulatory frameworks supporting application in nutraceuticals industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Competition posed by established phenolics

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 PET-to-PCA upcycling for sustainable future

- 5.2.3.2 Green extraction technologies unlocking sustainable opportunities for protocatechuic acid innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited industrial-scale applications due to high costs, low yields, and regulatory barriers

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GENERATIVE AI ON PROTOCATECHUIC ACID MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL & FEEDSTOCK SOURCING

- 6.3.2 CONVERSION & PRODUCTION

- 6.3.3 PURIFICATION, MODIFICATION, AND MANUFACTURING

- 6.3.4 DISTRIBUTION & END-USE INDUSTRIES

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY REGION, 2021-2024

- 6.4.2 AVERAGE SELLING PRICE, BY GRADE, 2021-2024

- 6.4.3 AVERAGE SELLING PRICE, BY GRADE, 2021-2024

- 6.4.4 AVERAGE SELLING PRICE, BY KEY PLAYERS AND GRADE, 2021-2024

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 IMPACT OF 2025 US TARIFFS ON PROTOCATECHUIC ACID MARKET

- 6.8.1 INTRODUCTION

- 6.8.2 KEY TARIFF RATES

- 6.8.3 PRICE IMPACT ANALYSIS

- 6.8.4 IMPACT ON COUNTRY/REGION

- 6.8.4.1 US

- 6.8.4.2 Europe

- 6.8.4.3 Asia Pacific

- 6.8.5 IMPACT ON END-USE INDUSTRIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 291829)

- 6.10.2 EXPORT SCENARIO (HS CODE 291829)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFFS RELATED TO PROTOCATECHUIC ACID MARKET

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO PROTOCATECHUIC ACID MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 ENGINEERING BACILLUS LICHENIFORMIS FOR SUSTAINABLE PRODUCTION OF PROTOCATECHUIC ACID FROM GLUCOSE

- 6.16.2 DEVELOPMENT OF ASPERGILLUS NIGER CELL FACTORY FOR PRODUCING PROTOCATECHUIC ACID FROM PLANT-DERIVED AROMATICS

- 6.16.3 PROTOCATECHUIC ACID AS NATURAL FEED ADDITIVE ENHANCING POULTRY HEALTH AND PERFORMANCE

7 PROTOCATECHUIC ACID MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 ULTRA-HIGH PURITY GRADE

- 7.2.1 ENSURES PRECISION, SAFETY, AND REGULATORY COMPLIANCE IN CRITICAL APPLICATIONS

- 7.3 INDUSTRIAL GRADE

- 7.3.1 REDUCES MICROBIAL GROWTH IN FOOD PRODUCTS

- 7.4 LOWER GRADE

- 7.4.1 ACTS AS NATURAL PRESERVATIVE IN ANIMAL FEED

8 PROTOCATECHUIC ACID MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 POWDER/ CRYSTALLINE

- 8.2.1 PROVIDES LONG SHELF LIFE AND STABILITY UNDER STORAGE CONDITIONS

- 8.3 GRANULES

- 8.3.1 EASY TO MEASURE AND OFFER CONTROLLED DISSOLUTION RATES COMPARED TO POWDER

- 8.4 LIQUID

- 8.4.1 GROWING USE IN COSMETICS AND AGRICULTURE INDUSTRIES TO DRIVE DEMAND

- 8.5 OTHER FORMS

9 PROTOCATECHUIC ACID MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CHEMICAL SYNTHESIS

- 9.2.1 DOMINANCE DRIVEN BY WELL-DEVELOPED SUPPLY CHAIN

- 9.3 NATURAL EXTRACTION/ BIO-BASED

- 9.3.1 CUTS GREENHOUSE GAS EMISSIONS BY UP TO 40%

10 PROTOCATECHUIC ACID MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PRESERVATIVES & ANTIOXIDANTS

- 10.2.1 PROTOCATECHUIC ACID REPLACING SYNTHETIC ANTIOXIDANTS

- 10.2.2 FOOD PRESERVATIVES

- 10.2.3 COSMETIC PRESERVATIVES

- 10.2.4 INDUSTRIAL ANTIOXIDANTS

- 10.3 CHEMICAL INTERMEDIATES

- 10.3.1 PROTOCATECHUIC ACID FACILITATES PRODUCTION OF BIOACTIVE COMPOUNDS

- 10.3.2 PHARMACEUTICAL INTERMEDIATES

- 10.3.3 AGROCHEMICAL INTERMEDIATES

- 10.3.4 SPECIALTY CHEMICAL INTERMEDIATES

- 10.4 POLYMERS

- 10.4.1 MULTI-FUNCTIONAL BIO-BASED COMPOUND MAKES PROTOCATECHUIC ACID DIFFERENT FROM CONVENTIONAL PETROCHEMICAL ADDITIVES

- 10.4.2 POLYMER ADDITIVES

- 10.4.3 RESIN MODIFIERS

- 10.4.4 PLASTIC STABILIZERS

- 10.5 DYES

- 10.5.1 PROTOCATECHUIC ACID ENHANCES LIGHTFASTNESS AND IMPROVES ANTHRAQUINONE DYE PERFORMANCE BY UP TO TWO GRADES

- 10.5.2 TEXTILE DYES

- 10.5.3 LEATHER DYES

- 10.5.4 INK COLORANTS

- 10.6 FEED ADDITIVES & NUTRACEUTICALS

- 10.6.1 PROTOCATECHUIC ACID EMERGING AS CLEAN-LABELED NUTRACEUTICAL INGREDIENT

- 10.6.2 ANIMAL FEED ADDITIVES

- 10.6.3 NUTRITIONAL SUPPLEMENTS

- 10.6.4 FUNCTIONAL HEALTH INGREDIENTS

- 10.7 RUST INHIBITORS

- 10.7.1 PROTOCATECHUIC ACID EMERGING AS KEY NATURAL COMPONENT IN MODERN CORROSION PREVENTION TECHNOLOGIES

- 10.7.2 METAL COATINGS

- 10.7.3 INDUSTRIAL LUBRICANT ADDITIVES

- 10.7.4 CORROSION PROTECTION SOLUTIONS

- 10.8 OTHER APPLICATIONS

- 10.8.1 ADHESIVES

11 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICALS

- 11.2.1 ANTI-INFLAMMATORY AND MULTIFACETED PROPERTY OF PROTOCATECHUIC ACID TO DRIVE DEMAND

- 11.3 FOOD & BEVERAGES

- 11.3.1 GROWING DEMAND FOR NATURAL PRESERVATIVES TO INFLUENCE GROWTH

- 11.4 COSMETICS/ PERSONAL CARE

- 11.4.1 GLOBAL GREEN BEAUTY MOVEMENT TO EXPAND DEMAND

- 11.5 AGRICULTURE

- 11.5.1 GROWING EMPHASIS ON SUSTAINABLE FARMING PRACTICES TO DRIVE MARKET

- 11.6 OTHER END-USE INDUSTRIES

- 11.6.1 TEXTILES

12 PROTOCATECHUIC ACID, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Government promoting integration of herbal and plant-derived ingredients into mainstream healthcare to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Focus on functional foods and strict regulatory oversight to drive market

- 12.2.3 INDIA

- 12.2.3.1 Government-backed initiatives promoting natural healthcare to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Growth of K-Health exports and biotechnology support to drive market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Stringent regulatory frameworks to drive market

- 12.3.2 CANADA

- 12.3.2.1 Growing consumer preference for clean-label and natural ingredients to drive market

- 12.3.3 MEXICO

- 12.3.3.1 Increasing use of protocatechuic acid in dietary supplements to drive market

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Shift to eco-friendly, bio-based production to drive demand

- 12.4.2 ITALY

- 12.4.2.1 Sustainability commitment by domestic manufacturers to drive market

- 12.4.3 FRANCE

- 12.4.3.1 Growing demand for natural extracts in pharmaceuticals industry to drive market

- 12.4.4 UK

- 12.4.4.1 Ongoing research on antimicrobial and neuroprotective applications of protocatechuic acid to drive market

- 12.4.5 SPAIN

- 12.4.5.1 Favorable climate and adherence to stringent regulations to drive market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Saudi Green Initiative to drive growth

- 12.5.1.2 UAE

- 12.5.1.2.1 Strong incentives and policies supporting sustainability initiatives to drive market

- 12.5.1.3 Rest of GCC countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Focus on indigenous herbal medicines to drive market

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Focus on sustainable agroforestry to drive market

- 12.6.2 ARGENTINA

- 12.6.2.1 Growing focus on natural health products to drive demand

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.3.1 MARKET RANKING ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT

- 13.7 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING

- 13.7.5.1 List of key startups/SMEs

- 13.7.6 PROTOCATECHUIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.7.6.1 Competitive benchmarking of key startups/SMEs

- 13.7.7 VALUATION AND FINANCIAL METRICS OF KEY PROTOCATECHUIC ACID VENDORS

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 VERTEXYN (NANJING) BIOWORKS

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 GREEN CHEMICALS CO., LTD.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 NANJING NUTRIHERB BIOTECH CO., LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 SHAANXI LONIERHERB BIO-TECHNOLOGY CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 SIMSON PHARMA LIMITED

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 CENTRAL DRUG HOUSE

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 CAYMAN CHEMICAL COMPANY

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 TAIZHOU ZHONGDA CHEMICAL CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 HANGZHOU VIABLIFE BIOTECH CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 CHEMFACES

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 VERTEXYN (NANJING) BIOWORKS

- 14.2 OTHER PLAYERS

- 14.2.1 ANANT PHARMACEUTICALS PVT. LTD.

- 14.2.2 JINAN FINER CHEMICAL CO.

- 14.2.3 OTTO CHEMIE PVT. LTD.

- 14.2.4 SIGMA-ALDRICH

- 14.2.5 BIOSYNTH

- 14.2.6 AXIOM CHEMICALS PVT. LTD.

- 14.2.7 PHARMAFFILIATES PRIVATE LIMITED

- 14.2.8 BLDPHARM

- 14.2.9 SELLECK CHEMICALS

- 14.2.10 LKT LABORATORIES

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF PROTOCATECHUIC ACID, BY REGION, 2021-2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE, BY GRADE, 2021-2024 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE, BY KEY PLAYERS AND GRADE, 2021-2024 (USD/KG)

- TABLE 4 PROTOCATECHUIC ACID MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN PROTOCATECHUIC ACID MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN PROTOCATECHUIC ACID MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN PROTOCATECHUIC ACID MARKET

- TABLE 8 PROTOCATECHUIC ACID MARKET: TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 9 PROTOCATECHUIC ACID MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 PROTOCATECHUIC ACID MARKET: LIST OF MAJOR PATENTS, 2021-2024

- TABLE 11 PROTOCATECHUIC ACID MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TARIFFS RELATED TO PROTOCATECHUIC ACID MARKET

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REGULATIONS FOR PLAYERS IN PROTOCATECHUIC ACID MARKET

- TABLE 19 PROTOCATECHUIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 24 PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 25 PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 26 PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 27 PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 28 PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 29 PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 30 PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 31 PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 32 PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 33 PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 34 PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 35 PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 36 PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 37 PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 38 PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 39 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 40 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 41 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 42 PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 43 PROTOCATECHUIC ACID MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 44 PROTOCATECHUIC ACID MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 45 PROTOCATECHUIC ACID MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 46 PROTOCATECHUIC ACID MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 47 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 48 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 49 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (TONS)

- TABLE 50 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 51 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 52 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 53 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 54 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 55 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 56 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 57 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 58 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 59 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 60 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 61 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 62 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 63 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 64 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 65 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 66 ASIA PACIFIC PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 67 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 68 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 69 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 70 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 71 CHINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 72 CHINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 73 CHINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 74 CHINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 75 JAPAN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 76 JAPAN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 77 JAPAN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 78 JAPAN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 79 INDIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 80 INDIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 81 INDIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 82 INDIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 83 SOUTH KOREA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 84 SOUTH KOREA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 85 SOUTH KOREA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 86 SOUTH KOREA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 87 REST OF ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 88 REST OF ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 89 REST OF ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 90 REST OF ASIA PACIFIC: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 91 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 92 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 93 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (TONS)

- TABLE 94 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 95 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 97 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 98 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 99 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 100 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 101 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 102 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 103 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 104 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 105 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 106 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 107 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 108 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 109 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 110 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 111 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 112 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 113 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 114 NORTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 115 US: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 116 US: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 117 US: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 118 US: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 119 CANADA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 120 CANADA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 121 CANADA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 122 CANADA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 123 MEXICO: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 124 MEXICO: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 125 MEXICO: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 126 MEXICO: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 127 EUROPE: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 128 EUROPE: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 129 EUROPE: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (TONS)

- TABLE 130 EUROPE: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 131 EUROPE: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 132 EUROPE: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 133 EUROPE: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 134 EUROPE: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 135 EUROPE: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 136 EUROPE: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 137 EUROPE: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 138 EUROPE: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 139 EUROPE: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 140 EUROPE: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 141 EUROPE: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 142 EUROPE: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 143 EUROPE: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 144 EUROPE: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 145 EUROPE: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 146 EUROPE: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 147 EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 148 EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 149 EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 150 EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 151 GERMANY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 152 GERMANY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 153 GERMANY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 154 GERMANY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 155 ITALY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 156 ITALY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 157 ITALY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 158 ITALY: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 159 FRANCE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 160 FRANCE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 161 FRANCE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 162 FRANCE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 163 UK: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 164 UK: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 165 UK: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 166 UK: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 167 SPAIN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 168 SPAIN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 169 SPAIN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 170 SPAIN: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 171 REST OF EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 172 REST OF EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 173 REST OF EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 174 REST OF EUROPE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 175 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 176 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 177 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (TONS)

- TABLE 178 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 179 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 180 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 182 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 183 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 184 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 186 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 187 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 190 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 191 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 192 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 193 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 194 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 195 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 196 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 197 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 198 MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 199 SAUDI ARABIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 200 SAUDI ARABIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 201 SAUDI ARABIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 202 SAUDI ARABIA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 203 UAE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 204 UAE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 205 UAE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 206 UAE: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 207 REST OF GCC COUNTRIES: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 208 REST OF GCC COUNTRIES: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 209 REST OF GCC COUNTRIES: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 210 REST OF GCC COUNTRIES: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 211 SOUTH AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 212 SOUTH AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 213 SOUTH AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 214 SOUTH AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 219 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 220 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 221 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2021-2024 (TONS)

- TABLE 222 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 223 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (USD THOUSAND)

- TABLE 224 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (USD THOUSAND)

- TABLE 225 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2021-2024 (TONS)

- TABLE 226 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY GRADE, 2025-2030 (TONS)

- TABLE 227 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (USD THOUSAND)

- TABLE 228 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (USD THOUSAND)

- TABLE 229 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2021-2024 (TONS)

- TABLE 230 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY PRODUCTION PROCESS, 2025-2030 (TONS)

- TABLE 231 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (USD THOUSAND)

- TABLE 232 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (USD THOUSAND)

- TABLE 233 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2021-2024 (TONS)

- TABLE 234 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 235 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (USD THOUSAND)

- TABLE 236 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 237 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2021-2024 (TONS)

- TABLE 238 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 239 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 240 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 241 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 242 SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 243 BRAZIL: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 244 BRAZIL: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 245 BRAZIL: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 246 BRAZIL: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 247 ARGENTINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 248 ARGENTINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 249 ARGENTINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 250 ARGENTINA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 251 REST OF SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 252 REST OF SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 253 REST OF SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (TONS)

- TABLE 254 REST OF SOUTH AMERICA: PROTOCATECHUIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (TONS)

- TABLE 255 OVERVIEW OF STRATEGIES ADOPTED BY KEY PROTOCATECHUIC ACID MANUFACTURERS

- TABLE 256 PROTOCATECHUIC ACID MARKET: DEGREE OF COMPETITION

- TABLE 257 PROTOCATECHUIC ACID MARKET: REGION FOOTPRINT

- TABLE 258 PROTOCATECHUIC ACID MARKET: FORM FOOTPRINT

- TABLE 259 PROTOCATECHUIC ACID MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 260 PROTOCATECHUIC ACID MARKET: APPLICATION FOOTPRINT

- TABLE 261 PROTOCATECHUIC ACID MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 262 PROTOCATECHUIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 263 PROTOCATECHUIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 264 PROTOCATECHUIC ACID MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 265 VERTEXYN (NANJING) BIOWORKS: COMPANY OVERVIEW

- TABLE 266 VERTEXYN (NANJING) BIOWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 GREEN CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 268 GREEN CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 NANJING NUTRIHERB BIOTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 270 NANJING NUTRIHERB BIOTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 SHAANXI LONIERHERB BIO-TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 272 SHAANXI LONIERHERB BIO-TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 SIMSON PHARMA LIMITED: COMPANY OVERVIEW

- TABLE 274 SIMSON PHARMA LIMITED: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 275 CENTRAL DRUG HOUSE: COMPANY OVERVIEW

- TABLE 276 CENTRAL DRUG HOUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CAYMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 278 CAYMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 TAIZHOU ZHONGDA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 280 TAIZHOU ZHONGDA CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 TAIZHOU ZHONGDA CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 282 HANGZHOU VIABLIFE BIOTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 283 HANGZHOU VIABLIFE BIOTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 CHEMFACES: COMPANY OVERVIEW

- TABLE 285 CHEMFACES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 ANANT PHARMACEUTICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 287 JINAN FINER CHEMICAL CO.: COMPANY OVERVIEW

- TABLE 288 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 289 SIGMA-ALDRICH: COMPANY OVERVIEW

- TABLE 290 BIOSYNTH: COMPANY OVERVIEW

- TABLE 291 AXIOM CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 292 PHARMAFFILIATES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 293 BLDPHARM: COMPANY OVERVIEW

- TABLE 294 SELLECK CHEMICALS: COMPANY OVERVIEW

- TABLE 295 LKT LABORATORIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PROTOCATECHUIC ACID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PROTOCATECHUIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 PROTOCATECHUIC ACID MARKET: DATA TRIANGULATION

- FIGURE 9 ULTRA-HIGH PURITY GRADE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 CHEMICAL SYNTHESIS SEGMENT TO BE LARGER PRODUCTION PROCESS DURING FORECAST PERIOD

- FIGURE 11 POWDER/ CRYSTALLINE TO BE LARGEST FORM SEGMENT DURING FORECAST PERIOD

- FIGURE 12 CHEMICAL INTERMEDIATES TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 13 PHARMACEUTICALS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 RISING DEMAND FOR NATURAL ANTIOXIDANTS AND BIOACTIVE COMPOUNDS ACROSS PHARMACEUTICALS, NUTRACEUTICALS, COSMETICS, AND FUNCTIONAL FOODS TO DRIVE MARKET

- FIGURE 16 ULTRA-HIGH PURITY GRADE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 POWDER/CRYSTALLINE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 CHEMICAL SYNTHESIS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 CHEMICAL INTERMEDIATES APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 PHARMACEUTICALS END-USE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 CHINA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 PROTOCATECHUIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 USE OF GENERATIVE AI IN PROTOCATECHUIC ACID MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 SUPPLY CHAIN ANALYSIS OF PROTOCATECHUIC ACID MARKET

- FIGURE 26 AVERAGE SELLING PRICE OF PROTOCATECHUIC ACID, BY REGION, 2021-2024 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PROTOCATECHUIC ACID, BY GRADE, 2024 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE, KEY PLAYERS AND GRADE, 2021-2024

- FIGURE 29 PROTOCATECHUIC ACID MARKET: INVESTMENT AND FUNDING SCENARIO, 2023-2024 (USD MILLION)

- FIGURE 30 PROTOCATECHUIC ACID MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 NUMBER OF PATENTS GRANTED (2015-2024)

- FIGURE 32 PROTOCATECHUIC ACID MARKET: LEGAL STATUS OF PATENTS

- FIGURE 33 PATENT ANALYSIS FOR PROTOCATECHUIC ACID, BY JURISDICTION, 2015-2024

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 35 IMPORT OF HS CODE 291829 -COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 36 EXPORT OF HS CODE 291829 -COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 37 PROTOCATECHUIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 39 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 40 ULTRA-HIGH PURITY GRADE SEGMENT TO LEAD PROTOCATECHUIC ACID MARKET IN 2025

- FIGURE 41 POWDER/ CRYSTALLINE SEGMENT TO LEAD PROTOCATECHUIC ACID MARKET IN 2025

- FIGURE 42 CHEMICAL SYNTHESIS SEGMENT TO LEAD PROTOCATECHUIC ACID MARKET IN 2025

- FIGURE 43 CHEMICAL INTERMEDIATES SEGMENT TO LEAD PROTOCATECHUIC ACID MARKET IN 2025

- FIGURE 44 PHARMACEUTICALS SEGMENT TO LEAD PROTOCATECHUIC ACID MARKET IN 2025

- FIGURE 45 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC: PROTOCATECHUIC ACID MARKET SNAPSHOT

- FIGURE 47 NORTH AMERICA: PROTOCATECHUIC ACID MARKET SNAPSHOT

- FIGURE 48 EUROPE: PROTOCATECHUIC ACID MARKET SNAPSHOT

- FIGURE 49 PROTOCATECHUIC ACID MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 50 RANKING OF TOP 5 PLAYERS IN PROTOCATECHUIC ACID MARKET, 2024

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025

- FIGURE 52 BRAND/PRODUCT COMPARATIVE ANALYSIS OF PROTOCATECHUIC ACID MARKET

- FIGURE 53 PROTOCATECHUIC ACID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 PROTOCATECHUIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 55 PROTOCATECHUIC ACID MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 56 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 57 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2025