|

市场调查报告书

商品编码

1856027

全球综合防空反导市场(依系统、组件、范围、最终用户和地区划分)-预测至2030年Integrated Air and Missile Defense Market by System (Missile Defense, Anti-Aircraft, C-UAS, C-RAM, Counter-Hypersonics), by Component (Weapon Systems, Radars & Sensors, C2), by Range (SHORAD, MRAD, LRAD) by End-User and Region - Global Forecast to 2030 |

||||||

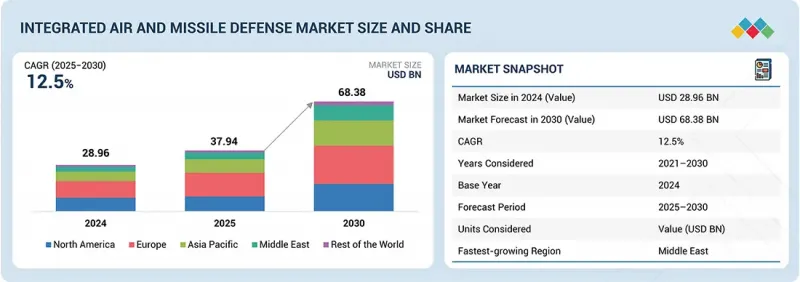

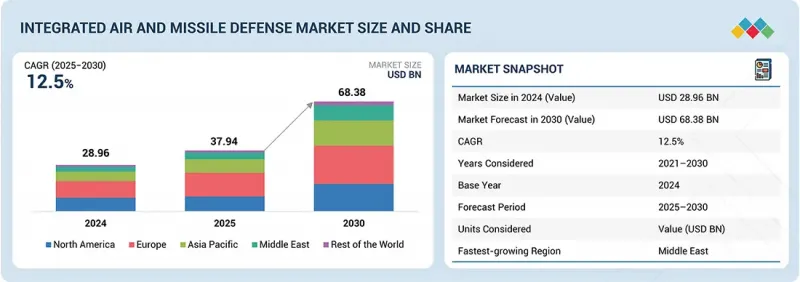

预计到 2025 年,综合防空和飞弹防御市场规模将达到 379.4 亿美元,到 2030 年将达到 683.8 亿美元,年复合成长率为 12.5%。

| 调查范围 | |

|---|---|

| 调查年度 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 考虑单位 | 金额(十亿美元) |

| 按细分市场 | 按系统、组件、范围、最终使用者和区域划分 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

成长的驱动力源自于对由雷达、拦截飞弹和指挥控制系统组成的强大系统的需求,以应对不断涌现的威胁。不断演进的军事现代化计画以及在敌对地形上安全、高速传输数据和电力的需求被认为是推动扩张的主要因素。 C4ISR(指挥、控制、通讯、电脑、情报、监视和侦察)网路采购、电子战系统以及分层防御战略中的无人系统也在加速高容量、小型化解决方案的发展。全球国防费用的成长,以及对自主和人工智慧赋能的作战管理系统的投入,都推动了对强大、小型化解决方案的需求,以在多域综合反导(IAMD)任务中保持高效能。

由于飞弹防御系统在应对弹道飞弹、巡航飞弹和高超音速飞弹威胁方面发挥着至关重要的作用,预计将占据综合防空反导市场最大的份额。各国正优先购买反导飞弹、建构多层防御体係以及对旧有系统进行现代化改造。不断增长的国防预算和日益严峻的跨国威胁,确保了飞弹防御系统仍然是国家安全战略的支柱,并使其在全球市场占据主导地位。

由于保护空域免受先进飞弹和无人机威胁的需求日益增长,空军领域正成为综合防空反导市场中成长最快的领域。现代空军优先发展机载预警系统、远距拦截飞弹和下一代雷达网络,以提升作战准备。战斗机一体化飞弹防御解决方案采购量的增加以及多层防空架构的扩展,正推动着该领域在全球范围内的快速成长。

亚太地区预计将成为全球第二大综合防空反导市场,其成长主要受国防预算增加、领土争端和军事现代化快速推进的推动。印度、中国、日本和韩国等国正大力投资兴建多层飞弹防御系统,以应对弹道飞弹和巡弋飞弹日益增长的威胁。区域合作和独立研发项目进一步巩固了该地区强劲的成长势头。

本报告分析了全球综合防空和飞弹防御市场,提供了按系统、组件、范围、最终用户和地区分類的趋势信息,以及参与该市场的公司的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

- 因应多域威胁的策略差距

- 基础设施在确保综合防空反导系统有效性中的作用

- 分层式一体化防空飞弹架构以实现作战优势

- 引进变革性技术

第五章 市场概览

- 介绍

- 市场动态

- 定价分析

- 材料清单

- 营运数据

- 投资和资金筹措方案

- 总拥有成本

- 主要相关人员和采购标准

- 技术分析

- 技术蓝图

- 专利分析

- 科技趋势

- 人工智慧的影响

第六章 产业趋势

- 生态系分析

- 价值链分析

- 监管状态

- 2025年美国关税

- 贸易分析

- 案例研究分析

- 大型会议和活动

- 宏观经济展望

- 大趋势的影响

7. 综合防空反导市场(依系统划分)

- 介绍

- 飞弹防御系统

- 防空系统

- 反无人机系统

- 反火箭弹和迫击炮系统

- 反高超音速防御系统

- 整合多威胁系统

8. 综合防空反导市场(依组件划分)

- 介绍

- 武器系统

- 火控系统

- 雷达和感测器

- 启动器

- 指挥与控制

- 系统整合

9. 综合防空反导市场(以射程划分)

- 介绍

- 短程(SHORAD)

- 中程(MRAD)

- 远距(LRAD)

10. 综合防空反导市场(依最终用户划分)

- 介绍

- 军队

- 海军

- 空军

第十一章 区域综合防空反导市场

- 介绍

- 北美洲

- PESTLE分析

- 美国

- 加拿大

- 欧洲

- PESTLE分析

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 其他的

- 亚太地区

- PESTLE分析

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 新加坡

- 其他的

- 中东

- PESTLE分析

- GCC

- 以色列

- 土耳其

- 其他的

- 其他地区

- PESTLE分析

- 拉丁美洲

- 非洲

第十二章 竞争格局

- 介绍

- 主要参与企业的策略/优势,2020-2024 年

- 2021-2024年收入分析

- 2024年市占率分析

- 品牌/产品对比

- 估值和财务指标

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:新兴企业/中小企业,2024 年

- 竞争场景

第十三章:公司简介

- 主要参与企业

- RTX

- LOCKHEED MARTIN CORPORATION

- MBDA

- NORTHROP GRUMMAN

- IAI

- THALES

- RHEINMETALL AG

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- KONGSBERG

- HANWHA GROUP

- ASELSAN AS

- DIEHL STIFTUNG & CO. KG

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- LIG NEX1

- HENSOLDT AG

- 其他公司

- ALMAZ-ANTEY

- CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION

- BHARAT DYNAMICS LIMITED

- BHARAT ELECTRONICS LIMITED

- SAAB AB

- ELBIT SYSTEMS LTD.

- LEONARDO DRS

- EDGE GROUP PJSC

- INDRA SISTEMAS, SA

- ROKETSAN

第十四章附录

The integrated air & missile defense market is estimated in terms of market size to be USD 37.94 billion in 2025 and USD 68.38 billion by 2030, at a CAGR of 12.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By System, Component, Range, End-user, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The need for rugged systems consisting of radars, interceptors, and command-and-control systems for addressing emerging threats is bolstering growth. Advancing military modernization programs and the need for secure, high-speed data and power transmission via hostile territory top the list of the expansion-driving factors. C4ISR net procurements, electronic warfare systems, and unmanned systems within multi-layer defense strategies also accelerate the pace for high-capacity, small solutions. Advancing defense spending globally, along with autonomous and AI-capable battle management system spending, is reinforcing the need for rugged and miniaturized solutions for maintaining high performance across multi-domain IAMD missions.

"The missile defense systems segment is projected to account for the largest market share in the integrated air and missile defense market during the forecast period."

The missile defense systems segment is estimated to account for the greatest share of the integrated air & missile defense market because of its critical role in countering ballistic, cruise, and hypersonic missile threats. Nations are prioritizing large-scale procurement of missile interceptors, multi-layered defense architectures, and modernization of legacy systems. Growing defense budgets, combined with heightened cross-border threats, ensure missile defense systems remain the backbone of national security strategies, driving their dominant market share globally.

"The air force segment is set to be the fastest segment in the integrated air & missile defense market during the forecast period."

The air force segment is becoming the fastest-growing segment in the integrated air & missile defense market because of the increasing need to safeguard airspace against advanced missile and UAV threats. Modern air forces are prioritizing airborne early warning systems, long-range interceptors, and next-generation radar networks to enhance operational readiness. Rising procurement of fighter-integrated missile defense solutions and expansion of multi-layered aerial defense architectures are fueling the rapid growth of this segment worldwide.

"The Asia Pacific is projected to be the second-fastest-growing market in the integrated air & missile defense market."

Asia Pacific is estimated to be the second-fastest-growing market in the integrated air & missile defense market, driven by rising defense budgets, territorial disputes, and the rapid modernization of armed forces. Countries such as India, China, Japan, and South Korea are heavily investing in multi-layered missile defense systems to counter growing threats from ballistic and cruise missiles. Regional collaborations and indigenous development programs further reinforce the region's strong growth trajectory.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%; Tier 2 - 45%; and Tier 3 - 20%

- By Designation: C Level - 35%; Directors - 25%; and Others - 40%

- By Region: North America - 40%; Europe - 25%; Asia Pacific - 15%; Middle East - 10%; Rest of the World - 10%

RTX (US), Lockheed Martin Corporation (US), MBDA (France), Northrop Grumman (US), and IAI (Israel) are some of the leading players operating in the integrated air & missile defense market.

Research Coverage

The study covers the integrated air and missile defense market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on system, component, deployment, range, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall integrated air and missile defense market and its subsegments. The report covers the entire ecosystem of the integrated air and missile defense market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key growth drivers, including the rising threat from asymmetric warfare and missile proliferation, the increasing requirement for maritime and airspace security, and heightened defense spending on layered air and missile defense architectures; expanding modernization programs across the armed forces are also reinforcing investments in advanced IAMD capabilities

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets-the report analyzes the integrated air and missile defense market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the integrated air & missile defense market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like market RTX (US), Lockheed Martin Corporation (US), MBDA (France), Northrop Grumman (US), and IAI (Israel), among others, in the integrated air and missile defense market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 3.3 HIGH-GROWTH SEGMENT AND EMERGING FRONTIERS

- 3.4 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 STRATEGIC GAPS IN COUNTERING MULTI-DOMAIN THREATS

- 4.1.1 AIRBORNE THREATS

- 4.1.2 MISSILE THREATS

- 4.1.3 INDIRECT FIRE THREATS

- 4.2 ROLE OF INFRASTRUCTURE IN ENSURING INTEGRATED AIR AND MISSILE DEFENSE EFFECTIVENESS

- 4.2.1 MOBILE INFRASTRUCTURE

- 4.2.2 FIXED INFRASTRUCTURE

- 4.2.3 TRAINING CENTERS

- 4.2.4 TESTING RANGES

- 4.2.5 MAINTENANCE AND LOGISTICS

- 4.2.6 COMMUNICATION NETWORKS

- 4.3 LAYERED INTEGRATED AIR AND MISSILE DEFENSE ARCHITECTURE FOR OPERATIONAL SUPERIORITY

- 4.3.1 SENSOR LAYER

- 4.3.2 C2 LAYER

- 4.3.3 SHOOTER LAYER

- 4.4 ADOPTION OF TRANSFORMATIVE TECHNOLOGIES

- 4.4.1 KINETIC-KILL EFFECTORS

- 4.4.2 DIRECTED ENERGY WEAPONS

- 4.4.3 ELECTRONIC WARFARE AND CYBER DEFENSE

- 4.4.4 ARTIFICIAL INTELLIGENCE AND DATA FUSION

- 4.4.5 SPACE AND CYBER INTEGRATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for standardized IAMD architectures across allied and coalition forces

- 5.2.1.2 Emergence of hypersonic glide vehicles, sleath missiles, and re-entry vehicles

- 5.2.1.3 Rapid adoption of multi-tiered architectures combining short, medium, and long-range defense systems

- 5.2.1.4 Heightened geopolitical conflicts

- 5.2.2 RESTRAINTS

- 5.2.2.1 Restrictions on transferring sensitive BMC4I technologies

- 5.2.2.2 Resistance to replacing standalone systems with fully integrated networks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of terrestrial, airborne, and space-based assets into a unified architecture

- 5.2.3.2 Untapped potential for shared IAMD frameworks across neighboring states

- 5.2.3.3 Recurring revenues from upgrades, digital twin deployments, and modular battle management enhancements

- 5.2.3.4 Recapitalization programs for national-level integrated defense networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical barriers in harmonizing data from dissimilar radar bands and sensors

- 5.2.4.2 Vulnerability of centralized C2 nodes to cyber intrusion or electronic attack

- 5.2.4.3 Preference for visible kinetic platforms over investments in command, control, and integration infrastructure

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS

- 5.3.1.1 Short-range IAMD programs

- 5.3.1.2 Medium-range IAMD programs

- 5.3.1.3 Long-range IAMD programs

- 5.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.3.1 AVERAGE SELLING PRICE OF INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS

- 5.4 BILL OF MATERIALS

- 5.4.1 INTERCEPTORS

- 5.4.2 LAUNCHERS

- 5.4.3 SENSORS

- 5.4.4 C2/BATTLE MANAGEMENT

- 5.4.5 INFRASTRUCTURE AND SITE SUPPORT

- 5.4.6 SERVICES AND LIFECYCLE SUPPORT

- 5.5 OPERATIONAL DATA

- 5.5.1 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2021-2024

- 5.5.2 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2025-2030

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TOTAL COST OF OWNERSHIP

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Real-time use of AI/ML to process radar, EO/IR, satellite, and SIGINT data into fire-control quality tracks

- 5.9.1.2 New seekers, propulsion, and kill-vehicle technologies designed to track and neutralize maneuvering hypersonic threats

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Jamming, spoofing, and deception systems that contest adversary missile seekers and radars

- 5.9.2.2 High-altitude drones extending reach and persistence of IAMD systens

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 High-energy lasers and high-power microwaves for low-cost interception of UAVs, rockets, and cruise missiles

- 5.9.3.2 Infrared and EO satellites providing global coverage for missile launches

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TECHNOLOGY ROADMAP

- 5.11 PATENT ANALYSIS

- 5.12 TECHNOLOGY TRENDS

- 5.12.1 RESILIENT COMMUNICATION AND MULTI-DOMAIN DATA LINKS

- 5.12.2 MULTI-MISSION INTERCEPTORS

- 5.12.3 HYPERSONIC DEFENSE TESTBEDS AND SIMULATION PLATFORMS

- 5.12.4 ENERGY STORAGE AND POWER MANAGEMENT FOR DIRECTED ENERGY SYSTEMS

- 5.13 IMPACT OF AI

- 5.13.1 SYSTEM-LEVEL IMPACT

- 5.13.1.1 Real-time multi-sensor fusion

- 5.13.1.2 Automated threat prioritization and engagement management

- 5.13.1.3 Accelerated decision loops

- 5.13.1.4 Adaptive battle management

- 5.13.2 SUBSYSTEM-LEVEL IMPACT

- 5.13.2.1 AI in radars and sensors

- 5.13.2.2 AI in C2 nodes

- 5.13.2.3 AI in interceptors and kill vehicles

- 5.13.1 SYSTEM-LEVEL IMPACT

6 INDUSTRY TRENDS

- 6.1 ECOSYSTEM ANALYSIS

- 6.1.1 PROMINENT COMPANIES

- 6.1.2 PRIVATE AND SMALL ENTERPRISES

- 6.1.3 END USERS

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND DEVELOPMENT

- 6.2.2 RAW MATERIAL

- 6.2.3 SUBSYSTEM/PRODUCT MANUFACTURING

- 6.2.4 ASSEMBLY AND INTEGRATION

- 6.2.5 POST-SALES SERVICE

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3.2 KEY REGULATIONS

- 6.3.2.1 North America

- 6.3.2.2 Europe

- 6.3.2.3 Asia Pacific

- 6.3.2.4 Middle East

- 6.3.2.5 Rest of the World

- 6.4 2025 US TARIFF

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON COUNTRY/REGION

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON END-USE INDUSTRIES

- 6.4.5.1 Military

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 9306)

- 6.5.2 EXPORT SCENARIO (HS CODE 9306)

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 DEPLOYMENT OF PATRIOT PAC-3 IN UKRAINE

- 6.6.2 ADOPTION OF NASAMS FOR NATO'S EASTERN FLANK

- 6.6.3 INTEGRATION OF S-400 AMID INDO-PAK TENSIONS

- 6.7 KEY CONFERENCES AND EVENTS

- 6.8 MACROECONOMIC OUTLOOK

- 6.8.1 NORTH AMERICA

- 6.8.2 EUROPE

- 6.8.3 ASIA PACIFIC

- 6.8.4 MIDDLE EAST

- 6.8.5 REST OF THE WORLD

- 6.9 IMPACT OF MEGATRENDS

- 6.9.1 AI-PREDICTIVE MAINTENANCE AND DIGITAL TWINS

- 6.9.2 QUANTUM-ENHANCED SENSING

- 6.9.3 CYBER-HARDENING AND ZERO-TRUST SECURITY ARCHITECTURES

7 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 MISSILE DEFENSE SYSTEMS

- 7.2.1 EXPANDING BALLISTIC AND CRUISE MISSILE THREATS TO DRIVE MARKET

- 7.2.2 USE CASE: PATRIOT PAC-3 MSE BY RTX AND LOCKHEED MARTIN CORPORATION

- 7.3 ANTI-AIRCRAFT SYSTEMS

- 7.3.1 INTEGRATION OF AI-ASSISTED TARGET RECOGNITION TO COUNTER AERIAL THREATS TO DRIVE MARKET

- 7.3.2 USE CASE: IRIS-T SLM BY DIEHL DEFENCE

- 7.4 COUNTER-UNMANNED AERIAL SYSTEMS

- 7.4.1 GROWING PROLIFERATION OF DRONES AND LOITERING MUNITIONS TO DRIVE MARKET

- 7.4.2 USE CASE: DRONEGUN MKIII BY DRONESHIELD

- 7.5 COUNTER-ROCKET ARTILLERY AND MORTAR SYSTEMS

- 7.5.1 INCREASING INDIRECT FIRE THREATS TO DRIVE MARKET

- 7.5.2 USE CASE: IRON DOME BY RAFAEL ADVANCED DEFENSE SYSTEMS

- 7.6 COUNTER-HYPERSONIC DEFENSE SYSTEMS

- 7.6.1 ONGOING DEVELOPMENT OF HYPERSONIC WEAPONS TO DRIVE MARKET

- 7.6.2 USE CASE: GLIDE PHASE INTERCEPTOR BY RTX AND NORTHROP GRUMMAN

- 7.7 INTEGRATED MULTI-THREAT SYSTEMS

- 7.7.1 RISING HYBRID AND MULTI-DOMAIN THREATS TO DRIVE MARKET

- 7.7.2 USE CASE: BARAK-MX SYSTEM BY ISRAEL AEROSPACE INDUSTRIES

8 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 WEAPON SYSTEMS

- 8.2.1 DIVERSITY OF MISSILE, DRONE, AND ARTILLERY THREATS TO DRIVE MARKET

- 8.2.2 INTERCEPTORS

- 8.2.3 DIRECTED ENERGY WEAPONS

- 8.2.4 CLOSE-IN WEAPON SYSTEMS & GUNS

- 8.2.5 MAN-PORTABLE AIR DEFENSE SYSTEMS

- 8.3 FIRE CONTROL SYSTEMS

- 8.3.1 NEED FOR RAPID MULTI-TARGET ENGAGEMENTS TO DRIVE MARKET

- 8.3.2 ENGAGEMENT OPERATION CENTERS

- 8.3.3 TARGET ACQUISITION & TRACKING SYSTEMS

- 8.4 RADARS & SENSORS

- 8.4.1 INCREASED STEALTH AND HYPERSONIC CHALLENGES TO DRIVE MARKET

- 8.4.2 EARLY WARNING RADARS

- 8.4.3 FIRE CONTROL RADARS

- 8.4.4 EO/IR & SPACE SENSORS

- 8.4.5 ELINT

- 8.5 LAUNCHERS

- 8.5.1 ELEVATED DEMAND FOR SURVIVABILITY AND MODULARITY TO DRIVE MARKET

- 8.5.2 MOBILE LAUNCHERS

- 8.5.3 VERTICAL LAUNCHING SYSTEMS

- 8.6 COMMAND & CONTROL

- 8.6.1 EXTENSIVE USE IN HYBRID AND COALITION WARFARE TO DRIVE MARKET

- 8.6.2 CENTRALIZED COMMAND & CONTROL

- 8.6.3 INTEGRATED BATTLE MANAGEMENT SYSTEMS

- 8.7 SYSTEM INTEGRATION

- 8.7.1 GROWING MULTINATIONAL OPERATIONS AND SATURATION THREATS TO DRIVE MARKET

- 8.7.2 COALITION INTEROPERABILITY SOFTWARE

- 8.7.3 DATA FUSION SYSTEMS

9 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE

- 9.1 INTRODUCTION

- 9.2 SHORT RANGE (SHORAD)

- 9.2.1 RISE OF DRONES AND LOW-FLYING AIRCRAFT TO DRIVE MARKET

- 9.2.2 USE CASE: PANTSIR-S1 BY KBP INSTRUMENT DESIGN BUREAU

- 9.3 MEDIUM RANGE (MRAD)

- 9.3.1 REGIONAL SECURITY TENSIONS TO DRIVE MARKET

- 9.3.2 USE CASE: NASAMS BY KONGSBERG

- 9.4 LONG RANGE (LRAD)

- 9.4.1 EXPANSION OF LONG-RANGE STRIKE CAPABILITIES TO DRIVE MARKET

- 9.4.2 THEATER MISSILE DEFENSE (TMD)

- 9.4.3 GROUND-BASED MIDCOURSE DEFENSE (GMD)

- 9.4.4 USE CASE: THAAD BY LOCKHEED MARTIN CORPORATION

10 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 ARMY

- 10.2.1 EMPHASIS ON GROUND-BASED MISSILE DEFENSE AND MODERNIZATION TO DRIVE MARKET

- 10.2.2 KEY PROGRAMS PROCURED BY ARMY

- 10.2.2.1 Patriot PAC-3 MSE

- 10.2.2.2 THAAD

- 10.2.2.3 GMD-GBI

- 10.2.2.4 NGI for GMD

- 10.2.2.5 KM-SAM Cheongung-II

- 10.2.2.6 DE M-SHORAD

- 10.2.2.7 IFPC-HPM

- 10.2.2.8 LD-2000

- 10.2.2.9 MANTIS

- 10.2.2.10 Skynex

- 10.2.2.11 Korkut

- 10.2.2.12 FIM-92 Stinger

- 10.2.2.13 Piorun

- 10.2.2.14 Mistral 3

- 10.2.2.15 Starstreak

- 10.2.2.16 QW-series

- 10.2.2.17 KP-SAM Shingung

- 10.2.2.18 Sungur

- 10.2.2.19 Igla-S and advancing DRDO VSHORAD

- 10.3 NAVY

- 10.3.1 NAVAL FOCUS ON INTEGRATED FLEET PROTECTION AND MODULAR MISSILE DEFENSE TO DRIVE MARKET

- 10.3.2 KEY PROGRAMS PROCURED BY NAVY

- 10.3.2.1 SM-3

- 10.3.2.2 Sea Viper

- 10.3.2.3 CAMM/CAMM-ER

- 10.3.2.4 Barak-8

- 10.3.2.5 SM-6

- 10.3.2.6 HELIOS

- 10.3.2.7 ODIN

- 10.3.2.8 Phalanx CIWS

- 10.3.2.9 Goalkeeper CIWS

- 10.3.2.10 Type 730 CIWS

- 10.3.2.11 Type 1130 CIWS

- 10.3.2.12 Millennium Gun

- 10.4 AIR FORCE

- 10.4.1 NEED FOR REAL-TIME SITUATIONAL AWARENESS AND NETWORKED COMMAND INTEGRATION TO DRIVE MARKET

- 10.4.2 KEY PROGRAMS PROCURED BY AIR FORCE

- 10.4.2.1 Arrow-3

- 10.4.2.2 David's Sling

- 10.4.2.3 Iron Dome

- 10.4.2.4 S-400

- 10.4.2.5 AIM-120 AMRAAM

- 10.4.2.6 DN-3

- 10.4.2.7 HQ-20

- 10.4.2.8 Iron Beam

11 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Comprehensive modernization programs and sustained procurement to drive market

- 11.2.3 CANADA

- 11.2.3.1 Need to counter evolving threats to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Domestic defense modernization strategy to drive market

- 11.3.3 GERMANY

- 11.3.3.1 ESSI leadership and expanded IRIS-T SLM procurement to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Defense upgrade programs and strong maritime capabilities to drive market

- 11.3.5 ITALY

- 11.3.5.1 Commitment to multinational defense to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Patriot modernization and Aegis-equipped frigate expansion to drive market

- 11.3.7 POLAND

- 11.3.7.1 Expanding IAMD capabilities through WISLA and NAREW to drive market

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Focus on military modernization as part of PLA reforms to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Rising threats from North Korea's ballistic missile program and China's missile arsenal to drive market

- 11.4.4 INDIA

- 11.4.4.1 Development of indigenous ballistic missile defense systems to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Regional security challenges to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Strong push toward layered air defense and advanced radar integration to drive market

- 11.4.7 SINGAPORE

- 11.4.7.1 Aster 30 upgrade and allied partnerships to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 THAAD, PAC-3, and EDGE programs to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Repeated threats from ballistic and cruise missiles to drive market

- 11.5.2.1 UAE

- 11.5.3 ISRAEL

- 11.5.3.1 Iron Dome, David's Sling, and Arrow expansion to drive market

- 11.5.4 TURKEY

- 11.5.4.1 Indigenous development and NATO cooperation to drive market

- 11.5.5 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 LATIN AMERICA

- 11.6.2.1 Selective procurement of NASAMS, Spyder, and Indigenous Radar Programs to drive market

- 11.6.3 AFRICA

- 11.6.3.1 Advanced system procurements in Algeria and Morocco to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 System footprint

- 12.7.5.4 Component footprint

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 List of start-ups/SMEs

- 12.8.5.2 Competitive benchmarking of start-ups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 RTX

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 LOCKHEED MARTIN CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MBDA

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 NORTHROP GRUMMAN

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Others

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 IAI

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 THALES

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Others

- 13.1.7 RHEINMETALL AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Others

- 13.1.8 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Others

- 13.1.9 KONGSBERG

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Others

- 13.1.10 HANWHA GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 ASELSAN A.S.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 DIEHL STIFTUNG & CO. KG

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 LIG NEX1

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Others

- 13.1.15 HENSOLDT AG

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Others

- 13.1.1 RTX

- 13.2 OTHER PLAYERS

- 13.2.1 ALMAZ-ANTEY

- 13.2.2 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION

- 13.2.3 BHARAT DYNAMICS LIMITED

- 13.2.4 BHARAT ELECTRONICS LIMITED

- 13.2.5 SAAB AB

- 13.2.6 ELBIT SYSTEMS LTD.

- 13.2.7 LEONARDO DRS

- 13.2.8 EDGE GROUP PJSC

- 13.2.9 INDRA SISTEMAS, S.A.

- 13.2.10 ROKETSAN

14 APPENDIX

- 14.1 LONG LIST OF COMPANIES

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 TRANSFORMATIVE TECHNOLOGIES DRIVING ADOPTION

- TABLE 3 AVERAGE SELLING PRICE OF SHORT-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

- TABLE 4 AVERAGE SELLING PRICE OF MEDIUM-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

- TABLE 5 AVERAGE SELLING PRICE OF LONG-RANGE INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

- TABLE 6 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2024 (USD MILLION)

- TABLE 7 BILL OF MATERIALS FOR INTEGRATED AIR AND MISSILE DEFENSE PROGRAMS, 2024

- TABLE 8 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2021-2024 (UNITS)

- TABLE 9 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2025-2030 (UNITS)

- TABLE 10 TOTAL COST OF OWNERSHIP OF INTEGRATED AIR AND MISSILE DEFENSE PROGRAMS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 12 KEY BUYING CRITERIA, BY COMPONENT

- TABLE 13 EVOLUTION OF INTEGRATED AIR AND MISSILE DEFENSE TECHNOLOGIES

- TABLE 14 PATENT ANALYSIS

- TABLE 15 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 23 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 24 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 26 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 27 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 28 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 29 WEAPON SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 WEAPON SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 FIRE CONTROL SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 FIRE CONTROL SYSTEMS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 RADARS & SENSORS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 RADARS & SENSORS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 LAUNCHERS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 LAUNCHERS: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 COMMAND & CONTROL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 COMMAND & CONTROL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 SYSTEM INTEGRATION: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 SYSTEM INTEGRATION: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 42 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 43 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 44 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 45 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 58 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 59 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 60 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 61 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 62 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 63 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 64 US: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 65 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 66 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 67 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 68 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 69 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 70 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 71 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 72 CANADA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 84 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 85 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 86 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 87 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 88 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 89 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 90 UK: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 91 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 92 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 93 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 94 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 95 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 96 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 97 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 98 GERMANY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 102 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 103 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 104 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 105 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 FRANCE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 108 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 109 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 110 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 111 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 112 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 113 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 114 ITALY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 115 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 116 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 117 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 118 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 119 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 120 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 121 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 SPAIN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 124 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 125 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 126 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 127 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 128 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 129 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 130 POLAND: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 134 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 REST OF EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 150 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 151 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 152 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 154 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 155 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 CHINA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 158 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 159 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 160 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 161 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 162 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 163 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 JAPAN: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 166 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 167 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 168 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 169 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 170 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 171 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 172 INDIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 178 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH KOREA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 181 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 182 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 183 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 184 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 185 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 186 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 187 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 188 AUSTRALIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 189 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 190 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 191 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 192 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 193 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 194 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 195 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 196 SINGAPORE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 206 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 216 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 217 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 218 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 219 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 220 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 221 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 222 UAE: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 223 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 224 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 225 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 226 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 227 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 228 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 229 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 230 SAUDI ARABIA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 231 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 232 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 233 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 234 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 235 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 236 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 237 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 238 ISRAEL: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 239 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 240 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 241 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 242 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 243 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 244 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 245 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 246 TURKEY: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 247 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 248 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 255 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 256 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 257 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 258 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 259 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 260 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 261 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 262 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 263 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 264 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 266 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 268 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 270 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 272 LATIN AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 273 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 274 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 275 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 276 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 277 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 278 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 279 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 280 AFRICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 281 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 282 INTEGRATED AIR AND MISSILE DEFENSE MARKET: DEGREE OF COMPETITION

- TABLE 283 REGION FOOTPRINT

- TABLE 284 SYSTEM FOOTPRINT

- TABLE 285 COMPONENT FOOTPRINT

- TABLE 286 LIST OF START-UPS/SMES

- TABLE 287 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 288 INTEGRATED AIR AND MISSILE DEFENSE MARKET: DEALS, 2021-2025

- TABLE 289 INTEGRATED AIR AND MISSILE DEFENSE MARKET: OTHERS, 2021-2025

- TABLE 290 RTX: COMPANY OVERVIEW

- TABLE 291 RTX: PRODUCTS OFFERED

- TABLE 292 RTX: OTHERS

- TABLE 293 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 294 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 295 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 296 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 297 MBDA: COMPANY OVERVIEW

- TABLE 298 MBDA: PRODUCTS OFFERED

- TABLE 299 MBDA: DEALS

- TABLE 300 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 301 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 302 NORTHROP GRUMMAN: OTHERS

- TABLE 303 IAI: COMPANY OVERVIEW

- TABLE 304 IAI: PRODUCTS OFFERED

- TABLE 305 IAI: DEALS

- TABLE 306 IAI: OTHERS

- TABLE 307 THALES: COMPANY OVERVIEW

- TABLE 308 THALES: PRODUCTS OFFERED

- TABLE 309 THALES: OTHERS

- TABLE 310 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 311 RHEINMETALL AG: PRODUCTS OFFERED

- TABLE 312 RHEINMETALL AG: OTHERS

- TABLE 313 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 314 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 315 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

- TABLE 316 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: OTHERS

- TABLE 317 KONGSBERG: COMPANY OVERVIEW

- TABLE 318 KONGSBERG: PRODUCTS OFFERED

- TABLE 319 KONGSBERG: DEALS

- TABLE 320 KONGSBERG: OTHERS

- TABLE 321 HANWHA GROUP: COMPANY OVERVIEW

- TABLE 322 HANWHA GROUP: PRODUCTS OFFERED

- TABLE 323 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 324 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 325 ASELSAN A.S.: DEALS

- TABLE 326 DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

- TABLE 327 DIEHL STIFTUNG & CO. KG: PRODUCTS OFFERED

- TABLE 328 DIEHL STIFTUNG & CO. KG: DEALS

- TABLE 329 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 330 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 331 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 332 LIG NEX1: COMPANY OVERVIEW

- TABLE 333 LIG NEX1: PRODUCTS OFFERED

- TABLE 334 LIG NEX1: OTHERS

- TABLE 335 HENSOLDT AG: COMPANY OVERVIEW

- TABLE 336 HENSOLDT AG: PRODUCTS OFFERED

- TABLE 337 HENSOLDT AG: DEALS

- TABLE 338 HENSOLDT AG: OTHERS

List of Figures

- FIGURE 1 INTEGRATED AIR AND MISSILE DEFENSE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 9 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- FIGURE 10 MIDDLE EAST TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 11 INTEGRATED AIR AND MISSILE DEFENSE MARKET DYNAMICS

- FIGURE 12 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2024 (USD MILLION)

- FIGURE 13 INVESTMENT AND FUNDING SCENARIO, 2019-2024

- FIGURE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 15 KEY BUYING CRITERIA, BY COMPONENT

- FIGURE 16 TECHNOLOGY ROADMAP FOR INTEGRATED AIR AND MISSILE DEFENSE

- FIGURE 17 PATENT ANALYSIS

- FIGURE 18 TECHNOLOGY TRENDS

- FIGURE 19 IMPACT OF AI ON SYSTEM LEVEL

- FIGURE 20 IMPACT OF AI ON SUBSYSTEM LEVEL

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 25 IMPACT OF MEGATRENDS

- FIGURE 26 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- FIGURE 27 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- FIGURE 28 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE, 2025-2030 (USD MILLION)

- FIGURE 29 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER, 2025-2030 (USD MILLION)

- FIGURE 30 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION, 2025-2030

- FIGURE 31 NORTH AMERICA: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

- FIGURE 32 EUROPE: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

- FIGURE 34 MIDDLE EAST: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

- FIGURE 35 REST OF THE WORLD: INTEGRATED AIR AND MISSILE DEFENSE MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF TOP LISTED PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 37 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 38 BRAND/PRODUCT COMPARISON

- FIGURE 39 COMPANY VALUATION (USD BILLION)

- FIGURE 40 FINANCIAL METRICS (EV/EBIDTA)

- FIGURE 41 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 COMPANY FOOTPRINT

- FIGURE 43 COMPANY EVALUATION MATRIX (START-UP/SMES), 2024

- FIGURE 44 RTX: COMPANY SNAPSHOT

- FIGURE 45 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 47 IAI: COMPANY SNAPSHOT

- FIGURE 48 THALES: COMPANY SNAPSHOT

- FIGURE 49 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 50 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 51 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 52 HANWHA GROUP: COMPANY SNAPSHOT

- FIGURE 53 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 54 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 55 LIG NEX1: COMPANY SNAPSHOT

- FIGURE 56 HENSOLDT AG: COMPANY SNAPSHOT