|

市场调查报告书

商品编码

1861051

全球氧化镁(MgO)市场按产品类型、产地、等级、应用、终端用户产业和地区划分-预测至2030年Magnesium Oxide (MgO) Market by Product Type (CCM, DBM, FM), Purity (High, Medium, Low), Source (Natural, Synthetic), Application (Animal Feed, Steel Making & Cement, Glass & Ceramics, Electronics, Pharmaceuticals, Fertilizers) - Global Forecast to 2030 |

||||||

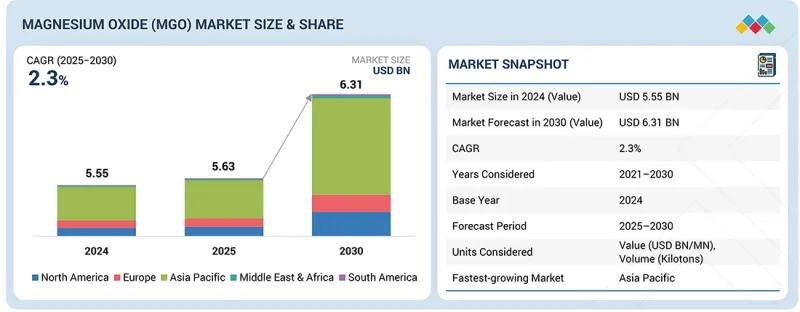

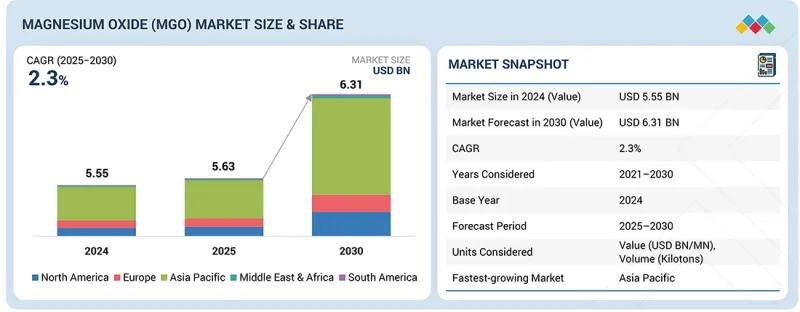

全球氧化镁(MgO)市场预计将从2025年的56.3亿美元成长到2030年的63.1亿美元,2025年至2030年的复合年增长率为2.3%。

受工业、建筑和环境因素的推动,全球市场正经历强劲成长。其中一个主要驱动因素是钢铁和耐火材料行业的快速扩张,氧化镁因其优异的热稳定性、低反应性和耐久性而被广泛应用于炉衬、钢包涂层和耐火砖等领域。

| 调查范围 | |

|---|---|

| 调查年度 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 考虑单位 | 金额(百万美元/十亿美元),数量(千吨) |

| 部分 | 按产品类型、产地、等级、应用、最终用途行业和地区划分 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

另一个关键驱动因素是基础设施和建设活动的激增,尤其是在亚太地区和新兴经济体。氧化镁基产品,包括水泥、板材和麵板,因其耐火性、环境友善性和结构强度而日益受到青睐,这些特性符合永续建筑实践。

在全球氧化镁(MgO)市场中,轻烧氧化镁细分市场预计在预测期内将实现显着的复合年增长率(CAGR)。该产品是透过在低于煅烧氧化镁的温度下煅烧菱镁矿而製得的,因此具有更高的反应活性和水溶性。轻烧氧化镁(CCM)独特的化学性质包括高反应活性、优异的酸中和能力以及适用于各种工业应用。化学和製药业是CCM的主要用户,用于调节pH值、污水处理、肥料和药物製剂。它也被用作农业土壤改良剂,以及用于环境领域的排烟脱硫和废水处理。其酸中和能力和pH稳定性使其成为所有这些製程的首选材料。

预计到2025年,合成氧化镁将占据全球氧化镁(MgO)市场第二大份额。合成氧化镁是透过化学沉淀各种镁化合物(例如氢氧化镁和氯化镁),然后煅烧製备而成,最终得到高纯度、可控等级的氧化镁。其成分均匀、纯度高且反应活性可控,使其成为天然来源氧化镁通常无法满足严格规格时的理想替代品。其高反应活性和稳定的品质使合成氧化镁非常适合应用于化学加工、製药和尖端电池技术等领域。它在环境管理方面也具有优势,例如污水处理和排烟脱硫,在这些领域中需要中和酸性化合物。此外,合成氧化镁在对性能要求严格的行业(例如电子、陶瓷和特殊涂料)中也越来越受欢迎。

本报告分析了全球氧化镁(MgO)市场,提供了有关产品类型、产地、等级、应用、终端用户行业、区域趋势和公司概况的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 介绍

- 市场动态

- 波特五力分析

- 价值链分析

- 生态系分析

- 专利分析

- 定价分析

- 案例研究分析

- 投资和资金筹措方案

- 贸易分析

- 主要相关人员和采购标准

- 2025-2026 年主要会议和活动

- 监管状态

- 技术分析

- 影响客户业务的趋势/干扰因素

- 世界宏观经济展望

- 人工智慧(AI)对氧化镁市场的影响

- 2025年美国关税对氧化镁市场的影响

第六章 氧化镁的形式

- 介绍

- 粉末

- 颗粒

- 薄片

第七章 氧化镁的纯度等级

- 介绍

- 高纯度

- 中等纯度

- 低纯度

第八章 氧化镁市场(依产品类型划分)

- 介绍

- 轻烧氧化镁

- 重烧氧化镁

- 熔融镁

第九章 氧化镁市场(依产地划分)

- 介绍

- 自然

- 合成

第十章 氧化镁市场(依等级划分)

- 介绍

- 食品级

- 医药级

- 工业级

- 防火等级

第十一章 氧化镁市场(依应用领域划分)

- 介绍

- 动物饲料

- 钢铁和水泥

- 玻璃和陶瓷

- 电子学

- 製药

- 肥料

- 其他的

第十二章 氧化镁市场(依终端用户产业划分)

- 介绍

- 食品/饮料

- 建造

- 农业

- 卫生保健

- 环境

- 其他的

第十三章 各地区氧化镁市场

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 南美洲

- 巴西

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

第十四章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2024年收入分析

- 2024年市占率分析

- 品牌/产品对比

- 估值和财务指标

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十五章 公司概况

- 主要参与企业

- HAICHENG MAGNESITE GROUP CO., LTD.

- MAGNEZIT GROUP

- RHI MAGNESITA

- MARTIN MARIETTA MAGNESIA SPECIALTIES

- GRECIAN MAGNESITE

- HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.

- UBE MATERIAL INDUSTRIES, LTD.

- KUMAS AS

- ICL

- TATEHO CHEMICAL INDUSTRIES CO., LTD.

- BAYMAG INC.

- NEDMAG BV

- INDUSTRIAS PENOLES

- PAUL RAUSCHERT GMBH & CO. KG.

- KONOSHIMA CHEMICAL CO., LTD.

- LEHMANN&VOSS&CO.

- LKAB MINERALS

- OMYA INTERNATIONAL AG

- HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.

- HOLY MAGNESIUM INDUSTRY(DASHIQIAO)CO., LTD.

- SINO MEIR INTERNATIONAL CO., LTD.

- HEBEI MEISHEN TECHNOLOGY CO., LTD.

- NANOSHEL LLC

- KYOWA CHEMICAL INDUSTRY CO., LTD.

- IBAR NORDESTE

- TIMAB MAGNESIUM

- YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.

- PRCO AMERICA

- QMAG PTY LIMITED

- HONGYE CHEMICAL

- LIAONING HONGYU REFRACTORY GROUP CO., LTD.

- YINGKOU MAGNESITE MINING CO., LTD.

- 其他公司

- STAR GRACE MINING CO., LTD.

- AMERICAN ELEMENTS

- LORAD CHEMICAL CORPORATION

- GARRISON MINERALS, LLC

- CHIMAG

- FENGCHEN GROUP CO., LTD.

- LATROBE MAGNESIUM

- DANDONG XINYANG MINERAL CO., LTD.

- YINGKOU SANHUA CHEMICAL CO., LTD.

第十六章:邻近及相关市场

第十七章附录

The global magnesium oxide (MgO) market is projected to reach USD 6.31 billion by 2030 from USD 5.63 billion in 2025, exhibiting a CAGR of 2.3% from 2025 to 2030. The global market is witnessing robust growth, driven by industrial, construction, and environmental factors. One of the primary drivers is the rapid expansion of the steel and refractory industries, where magnesium oxide is extensively used in furnace linings, ladle coatings, and refractory bricks due to its excellent thermal stability, low reactivity, and durability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Product Type, Source, Grade, Form, Purity, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

Another significant factor is the surge in infrastructure and construction activities, particularly in Asia Pacific and emerging economies. Magnesium oxide-based products, including cement, boards, and panels, are increasingly preferred for their fire resistance, eco-friendliness, and structural strength, aligning with sustainable construction practices.

"Caustic calcined magnesia segment is projected to exhibit a significant CAGR between 2025 and 2030"

In the global magnesium oxide (MgO) market, the caustic calcined magnesia segment is estimated to record a significant CAGR during the forecast period under product types. The product obtains high reactivity and water solubility by calcining magnesite at lower temperatures than dead-burned magnesia. The unique chemical properties of caustic calcined magnesia (CCM) include high reactivity, excellent neutralization capabilities, and suitability for various industrial applications. The chemical and pharmaceutical industries are among the key users of CCM for pH regulation, wastewater treatment, fertilizer, and medicinal formulations. It is also used in agriculture as a soil conditioner and environmental management for flue gas desulfurization and effluent treatment. Its acid-neutralizing capabilities and pH stabilization make it the preferred material in all these processes.

"Synthetic segment is likely to hold a commendable share of the magnesium oxide (MgO) market in 2025"

The synthetic magnesium oxide is anticipated to hold the second-largest share of the global magnesium oxide (MgO) market in 2025. Synthetic magnesium oxide is prepared by chemically precipitating various magnesium compounds, such as magnesium hydroxide or magnesium chloride, which is then calcined to obtain high-purity and controlled-grade magnesium oxide. Due to uniform composition, high purity, and tailor-made reactivity, it is the best alternative wherever natural sources do not generally meet the stringent specifications. Due to its high reactivity and consistency in quality, synthetic magnesium oxide finds application in chemical processing, pharmaceuticals, and state-of-the-art battery technologies. It is also beneficial in environmental management, such as treating wastewater and flue gas desulfurization, where acidic compounds must be neutralized. Synthetic magnesium oxide is also gaining prominence in industries such as electronics, ceramics, and specialty coatings, which require exact performance characteristics.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 45%, Tier 2 - 22%, and Tier 3 - 33%

- By Designation: C-level Executives - 50%, Directors - 10%, and Others - 40%

- By Region: North America - 17%, Europe - 33%, Asia Pacific - 17%, Middle East & Africa - 25%, and South America - 8%

Magnezit Group (Russia), RHI Magnesita (Austria), Martin Marietta Magnesia Specialties (US), Grecian Magnesite (Greece), and Haicheng Guangling Refractory Manufacturing Co. LTD (China) are some major players in the magnesium oxide (MgO) market. These players have adopted partnerships and expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the magnesium oxide (MgO) market based on product type, source, grade, form, purity, application, end-use industry, and region. It provides detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles magnesium oxide manufacturers, comprehensively analyzes their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions and partnerships.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the magnesium oxide (MgO) market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Increasing steel production and rising demand for advanced refractory applications, Extensive use in construction and building materials, Growing applications in advanced ceramics and electronic components), restraints (High production costs, Competition from alternatives), opportunities (Rising adoption in wastewater treatment, Emerging role of magnesium oxide in advanced battery technologies, Expanding applications in food & nutrition industry), and challenges (Quality consistency and technological limitations, Environmental and regulatory pressures) influencing the growth of the magnesium oxide (MgO) market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the magnesium oxide (MgO) market

- Market Development: Comprehensive information about lucrative markets-the report analyses the magnesium oxide (MgO) market across varied regions

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the industrial market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Magnezit Group (Russia), RHI Magnesita (Austria), Martin Marietta Magnesia Specialties (US), Grecian Magnesite (Greece), Haicheng Guangling Refractory Manufacturing Co. LTD (China), Ube Material Industries, Ltd. (Japan), KUMAS A.S. (Turkey), ICL (Israel), Tateho Chemical Industries Co., Ltd. (Japan), Baymag Inc. (Canada), Nedmag B.V. (Netherlands), Industrias Penoles (Mexico), Paul Rauschert GmbH & Co. KG. (Germany), Konoshima Chemical Co., Ltd. (Japan), Lehmann&Voss&Co. (Germany), LKAB Minerals (Sweden), Omya International AG (Switzerland), Haicheng Jiusheng Refractory Manufacturing Co., Ltd (China), HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD. (China), Sino Meir International Co. Ltd. (China), Hebei Meishen Technology Co., Ltd. (China), Nanoshel LLC (US), and Kyowa Chemical Industry Co., Ltd. (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MAGNESIUM OXIDE MARKET

- 4.2 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION AND COUNTRY

- 4.3 MAGNESIUM OXIDE MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing steel production and rising demand for advanced refractory applications

- 5.2.1.2 Extensive use in construction and building materials

- 5.2.1.3 Growing applications in advanced ceramics and electronic components

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production costs

- 5.2.2.2 Competition from alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption in wastewater treatment

- 5.2.3.2 Emerging role of magnesium oxide in advanced battery technologies

- 5.2.3.3 Expanding applications in food & nutrition industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Quality consistency and technological limitations

- 5.2.4.2 Environmental and regulatory pressures

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.1.1 Concentrated supply of magnesite reserves

- 5.3.1.2 Limited alternatives for key raw materials

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.2.1 Large volume purchases drive negotiation

- 5.3.2.2 Switching suppliers involves cost and certification

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.3.1 Cheaper minerals can replace magnesium oxide in certain uses

- 5.3.3.2 Few substitutes for high-purity applications

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.4.1 High capital and resource requirements

- 5.3.4.2 Access to raw materials and compliance barriers

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.5.1 Price pressure is limited in specialty grades

- 5.3.5.2 Differentiation through product quality and reliability

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PATENT ANALYSIS

- 5.6.1 METHODOLOGY

- 5.6.2 PATENT PUBLICATION TRENDS

- 5.6.3 INSIGHTS

- 5.6.4 JURISDICTION ANALYSIS

- 5.6.4.1 List of major patents

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY REGION

- 5.7.2 AVERAGE SELLING PRICE OF MAGNESIUM OXIDE, BY KEY PLAYERS

- 5.7.3 AVERAGE SELLING PRICE TREND, BY APPLICATION

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 SO3 REDUCTION USING HIGHLY-REACTIVE MAGNESIUM OXIDE

- 5.8.1.1 Objective

- 5.8.1.2 Challenge

- 5.8.1.3 Solution statement

- 5.8.1.4 Result

- 5.8.2 SYSTEMATIC KINETIC STUDY OF MAGNESIUM PRODUCTION FROM MAGNESIUM OXIDE USING CARBONIC REDUCTANTS

- 5.8.2.1 Objective

- 5.8.2.2 Challenge

- 5.8.2.3 Solution statement

- 5.8.2.4 Result

- 5.8.3 SYNTHESIS AND CHARACTERIZATION OF MAGNESIUM OXIDE NANOPARTICLES BY PRECIPITATION METHOD

- 5.8.3.1 Objective

- 5.8.3.2 Challenge

- 5.8.3.3 Solution statement

- 5.8.3.4 Result

- 5.8.4 HIGH-RECYCLING CONTAINING MAGNESIA-CARBON BRICKS IN HIGH-PERFORMANCE STEELMAKING APPLICATIONS

- 5.8.4.1 Objective

- 5.8.4.2 Challenge

- 5.8.4.3 Solution statement

- 5.8.4.4 Result

- 5.8.1 SO3 REDUCTION USING HIGHLY-REACTIVE MAGNESIUM OXIDE

- 5.9 INVESTMENT & FUNDING SCENARIO

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 INTRODUCTION

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATORY LANDSCAPE

- 5.13.4 NORTH AMERICA

- 5.13.4.1 Toxic Substances Control Act (TSCA)

- 5.13.4.2 Canadian Environmental Protection Act (CEPA)

- 5.13.5 EUROPE

- 5.13.5.1 REACH Regulation

- 5.13.5.2 Industrial Emissions Directive

- 5.13.6 ASIA PACIFIC

- 5.13.6.1 Measures for the Environmental Management of New Chemical Substances

- 5.13.6.2 Bureau of Indian Standards (BIS) Certification under the Bureau of Indian Standards Act, 2016

- 5.13.6.3 Chemical Substances Control Law

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Calcination of natural magnesite and dolomite

- 5.14.1.2 Seawater and brine precipitation route

- 5.14.2 ADJACENT TECHNOLOGIES

- 5.14.2.1 Sol-gel synthesis of magnesium oxide nanomaterials

- 5.14.2.2 Thermal decomposition and carbonization

- 5.14.3 COMPLEMENTARY TECHNOLOGIES

- 5.14.3.1 Surface modification and doping technologies

- 5.14.3.2 Carbon capture and utilization (CCU)

- 5.14.1 KEY TECHNOLOGIES

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 GLOBAL MACROECONOMIC OUTLOOK

- 5.16.1 GDP

- 5.17 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON MAGNESIUM OXIDE MARKET

- 5.17.1 MATERIALS DISCOVERY AND PROCESS OPTIMIZATION

- 5.17.2 SUPPLY CHAIN AND MARKET FORECASTING

- 5.17.3 SUSTAINABILITY AND ENVIRONMENTAL COMPLIANCE

- 5.17.4 PRODUCT INNOVATION AND APPLICATIONS

- 5.17.5 MARKET COMPETITIVENESS AND STRATEGY

- 5.18 IMPACT OF 2025 US TARIFF ON MAGNESIUM OXIDE MARKET

- 5.18.1 KEY TARIFF RATES

- 5.18.2 PRICE IMPACT ANALYSIS

- 5.18.3 IMPACT ON COUNTRIES/REGIONS

- 5.18.3.1 US

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.4 IMPACT ON END-USE INDUSTRIES

- 5.18.4.1 Construction

- 5.18.4.2 Agriculture

- 5.18.4.3 Healthcare

- 5.18.4.4 Food & beverage

- 5.18.4.5 Cosmetics

- 5.18.4.6 Other end-use industries

6 FORMS OF MAGNESIUM OXIDE

- 6.1 INTRODUCTION

- 6.2 POWDER

- 6.2.1 SUPPORTS HIGHER CROP YIELDS TO MEET GROWING GLOBAL FOOD DEMAND

- 6.3 GRANULES

- 6.3.1 HEAT RESISTANCE AND STRUCTURAL INTEGRITY UNDER HIGH TEMPERATURES TO DRIVE MARKET

- 6.4 FLAKES

- 6.4.1 GROWING PREFERENCE FOR ADVANCED MATERIALS WITH BALANCED PERFORMANCE AND LONG SERVICE LIFE TO DRIVE DEMAND

7 PURITY LEVELS OF MAGNESIUM OXIDE

- 7.1 INTRODUCTION

- 7.2 HIGH PURITY

- 7.2.1 RISING DEMAND IN ENVIRONMENTAL AND ENERGY APPLICATIONS TO DRIVE MARKET GROWTH

- 7.3 MEDIUM PURITY

- 7.3.1 ADOPTION AS NEUTRALIZING AGENT IN WASTEWATER TREATMENT AND FLUE GAS DESULFURIZATION TO DRIVE MARKET

- 7.4 LOW PURITY

- 7.4.1 NEED FOR AFFORDABLE MATERIALS FOR ROADS, BUILDINGS, AND STEELMAKING TO DRIVE DEMAND

8 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 CAUSTIC CALCINED MAGNESIA

- 8.2.1 RISING DEMAND FOR SUSTAINABLE AGRICULTURE AND HIGHER CROP YIELDS TO FUEL MARKET GROWTH

- 8.3 DEAD BURNED MAGNESIA

- 8.3.1 RISING STEEL PRODUCTION IN ASIA PACIFIC TO FUEL DEMAND

- 8.4 FUSED MAGNESIA

- 8.4.1 GROWTH IN ELECTRONICS AND RENEWABLE ENERGY SYSTEMS DRIVING DEMAND FOR FUSED MAGNESIA

9 MAGNESIUM OXIDE MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 NATURAL

- 9.2.1 GROWING FOOD DEMAND AND SHIFT TOWARD SUSTAINABLE FARMING PRACTICES TO DRIVE MARKET

- 9.3 SYNTHETIC

- 9.3.1 GROWING DEMAND IN PHARMACEUTICALS, ELECTRONICS, AND SPECIALTY CHEMICALS SECTORS TO DRIVE MARKET

10 MAGNESIUM OXIDE MARKET, BY GRADE

- 10.1 INTRODUCTION

- 10.2 FOOD GRADE

- 10.2.1 GROWING DEMAND FOR DIETARY SUPPLEMENTS TO DRIVE MARKET GROWTH

- 10.3 PHARMACEUTICAL GRADE

- 10.3.1 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS TO INCREASE CONSUMPTION

- 10.4 INDUSTRIAL GRADE

- 10.4.1 RISING DEMAND FOR AUTOMOTIVE TIRES, INDUSTRIAL RUBBER GOODS, AND PLASTICS TO DRIVE MARKET

- 10.5 REFRACTORY GRADE

- 10.5.1 EXCEPTIONAL THERMAL STABILITY AND CHEMICAL RESISTANCE DRIVING ADOPTION IN HIGH-TEMPERATURE INDUSTRIES

11 MAGNESIUM OXIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ANIMAL FEED

- 11.2.1 EXPANSION OF LIVESTOCK FARMING ACTIVITIES TO DRIVE MARKET

- 11.3 STEEL MAKING & CEMENT

- 11.3.1 RAPID EXPANSION OF GLOBAL CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- 11.4 GLASS & CERAMICS

- 11.4.1 DEMAND FOR SUSTAINABILITY AND ECO-FRIENDLY SOLUTIONS TO DRIVE MARKET

- 11.5 ELECTRONICS

- 11.5.1 SURGING DEMAND IN SEMICONDUCTORS & ADVANCED ELECTRONICS TO SUPPORT MARKET GROWTH

- 11.6 PHARMACEUTICALS

- 11.6.1 INCREASE IN AGING POPULATION TO SUPPORT MARKET GROWTH

- 11.7 FERTILIZERS

- 11.7.1 INCREASED FOCUS ON CROP QUALITY AND SPECIALTY CROPS SUPPORTING MARKET GROWTH

- 11.8 OTHER APPLICATIONS

12 MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 FOOD & BEVERAGE

- 12.2.1 RISE OF NUTRITIONAL DEFICIENCIES AND HEALTH AWARENESS TO DRIVE MARKET

- 12.3 CONSTRUCTION

- 12.3.1 INCREASED INFRASTRUCTURE SPENDING AND GOVERNMENT INVESTMENT TO FUEL DEMAND

- 12.4 AGRICULTURE

- 12.4.1 PRODUCTIVITY GAINS AND INNOVATION IN AGRICULTURAL INPUTS TO SUPPORT MARKET GROWTH

- 12.5 HEALTHCARE

- 12.5.1 INCREASE IN LIFESTYLE & ENVIRONMENTAL RISK FACTORS TO PROPEL MARKET

- 12.6 ENVIRONMENTAL

- 12.6.1 INCREASING NEED FOR WASTEWATER TREATMENT SOLUTION TO DRIVE GROWTH

- 12.7 OTHER END-USE INDUSTRIES

13 MAGNESIUM OXIDE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Expanding steel & refractory industry to drive demand

- 13.2.2 JAPAN

- 13.2.2.1 Growing demand for pharmaceuticals and dietary supplements to propel market

- 13.2.3 INDIA

- 13.2.3.1 Rising demand from agriculture & animal feed industry to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Rising need for ultra-high purity magnesium oxide in electronics manufacturing to drive market

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Construction sector boom to drive market growth

- 13.3.2 CANADA

- 13.3.2.1 Sustainability and emission-control measures to increase demand in environmental applications

- 13.3.3 MEXICO

- 13.3.3.1 Need for fire-safe building solutions in hurricane and earthquake-prone regions to support market growth

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 High demand for use as flame-retardant material to boost market

- 13.4.2 UK

- 13.4.2.1 Growing demand from refractory and metallurgical industries to drive market growth

- 13.4.3 FRANCE

- 13.4.3.1 Technological advancements in production methods to boost market growth

- 13.4.4 ITALY

- 13.4.4.1 Growing emphasis on food security and crop productivity to drive demand

- 13.4.5 SPAIN

- 13.4.5.1 Growth in construction and cement sectors to drive market

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Expansion of mining and energy sectors to fuel market growth

- 13.5.2 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

- 13.6.1.1 UAE

- 13.6.1.1.1 Rapid construction and infrastructure expansion to drive market growth

- 13.6.1.2 Rest of GCC Countries

- 13.6.1.1 UAE

- 13.6.2 SOUTH AFRICA

- 13.6.2.1 Demand in environmental and waste management applications to drive demand

- 13.6.3 REST OF MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Product type footprint

- 14.7.5.4 Source footprint

- 14.7.5.5 Grade footprint

- 14.7.5.6 Form footprint

- 14.7.5.7 Purity footprint

- 14.7.5.8 Application footprint

- 14.7.5.9 End-use industry footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 MAJOR PLAYERS

- 15.1.1 HAICHENG MAGNESITE GROUP CO., LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 MAGNEZIT GROUP

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 RHI MAGNESITA

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 MARTIN MARIETTA MAGNESIA SPECIALTIES

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 GRECIAN MAGNESITE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Expansions

- 15.1.5.3.2 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 MnM view

- 15.1.6.3.1 Right to win

- 15.1.6.3.2 Strategic choices

- 15.1.6.3.3 Weaknesses and competitive threats

- 15.1.7 UBE MATERIAL INDUSTRIES, LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 KUMAS A.S.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 ICL

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 TATEHO CHEMICAL INDUSTRIES CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 BAYMAG INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 NEDMAG B.V.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 INDUSTRIAS PENOLES

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 PAUL RAUSCHERT GMBH & CO. KG.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.15 KONOSHIMA CHEMICAL CO., LTD.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.16 LEHMANN&VOSS&CO.

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Expansions

- 15.1.17 LKAB MINERALS

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Solutions/Services offered

- 15.1.18 OMYA INTERNATIONAL AG

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Solutions/Services offered

- 15.1.19 HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Solutions/Services offered

- 15.1.20 HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD.

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Solutions/Services offered

- 15.1.21 SINO MEIR INTERNATIONAL CO., LTD.

- 15.1.21.1 Business overview

- 15.1.21.2 Products/Solutions/Services offered

- 15.1.22 HEBEI MEISHEN TECHNOLOGY CO., LTD.

- 15.1.22.1 Business overview

- 15.1.22.2 Products/Solutions/Services offered

- 15.1.23 NANOSHEL LLC

- 15.1.23.1 Business overview

- 15.1.23.2 Products/Solutions/Services offered

- 15.1.24 KYOWA CHEMICAL INDUSTRY CO., LTD.

- 15.1.24.1 Business overview

- 15.1.24.2 Products/Solutions/Services offered

- 15.1.25 IBAR NORDESTE

- 15.1.25.1 Business overview

- 15.1.25.2 Products/Solutions/Services offered

- 15.1.26 TIMAB MAGNESIUM

- 15.1.26.1 Business overview

- 15.1.26.2 Products/Solutions/Services offered

- 15.1.26.3 Recent developments

- 15.1.26.3.1 Deals

- 15.1.27 YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.

- 15.1.27.1 Business overview

- 15.1.27.2 Products/Solutions/Services offered

- 15.1.28 PRCO AMERICA

- 15.1.28.1 Business overview

- 15.1.28.2 Products/Solutions/Services offered

- 15.1.28.3 Recent developments

- 15.1.28.3.1 Deals

- 15.1.28.3.2 Expansions

- 15.1.29 QMAG PTY LIMITED

- 15.1.29.1 Business overview

- 15.1.29.2 Products/Solutions/Services offered

- 15.1.29.3 Recent developments

- 15.1.29.3.1 Deals

- 15.1.30 HONGYE CHEMICAL

- 15.1.30.1 Business overview

- 15.1.30.2 Products/Solutions/Services offered

- 15.1.31 LIAONING HONGYU REFRACTORY GROUP CO., LTD.

- 15.1.31.1 Business overview

- 15.1.31.2 Products/Solutions/Services offered

- 15.1.32 YINGKOU MAGNESITE MINING CO., LTD.

- 15.1.32.1 Business overview

- 15.1.32.2 Products/Solutions/Services offered

- 15.1.1 HAICHENG MAGNESITE GROUP CO., LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 STAR GRACE MINING CO., LTD.

- 15.2.2 AMERICAN ELEMENTS

- 15.2.3 LORAD CHEMICAL CORPORATION

- 15.2.4 GARRISON MINERALS, LLC

- 15.2.5 CHIMAG

- 15.2.6 FENGCHEN GROUP CO., LTD.

- 15.2.7 LATROBE MAGNESIUM

- 15.2.8 DANDONG XINYANG MINERAL CO., LTD.

- 15.2.9 YINGKOU SANHUA CHEMICAL CO., LTD.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATIONS

- 16.3 INTERCONNECTED MARKETS

- 16.3.1 REFRACTORIES MARKET

- 16.3.1.1 Market definition

- 16.3.1.2 Market overview

- 16.3.1 REFRACTORIES MARKET

- 16.4 REFRACTORIES MARKET, BY FORM

- 16.4.1 SHAPED REFRACTORIES

- 16.4.1.1 Increasing demand from boilers, nuclear reactors, and cement kilns to drive demand

- 16.4.2 UNSHAPED REFRACTORIES

- 16.4.2.1 Offers ease-of-use and better volume stability

- 16.4.1 SHAPED REFRACTORIES

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MAGNESIUM OXIDE MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 2 MAGNESIUM OXIDE MARKET: IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 MAGNESIUM OXIDE MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF MAGNESIUM OXIDE, BY REGION, 2021-2025 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE OF MAGNESIUM OXIDE, BY KEY PLAYERS, 2024 (USD/TON)

- TABLE 6 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2021-2025 (USD/TON)

- TABLE 7 IMPORT DATA FOR HS CODE 251990-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 251990-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 11 MAGNESIUM OXIDE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 16 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024 (%)

- TABLE 17 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024 (%)

- TABLE 18 FOREIGN DIRECT INVESTMENT, 2023 VS. 2024 (USD BILLION)

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR MAGNESIUM OXIDE MARKET

- TABLE 21 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 22 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 23 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 24 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KIL0TON)

- TABLE 25 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KIL0TON)

- TABLE 26 CAUSTIC CALCINED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 CAUSTIC CALCINED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 CAUSTIC CALCINED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KIL0TON)

- TABLE 29 CAUSTIC CALCINED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KIL0TON)

- TABLE 30 DEAD BURNED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 DEAD BURNED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 DEAD BURNED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 33 DEAD BURNED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 FUSED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 FUSED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FUSED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 37 FUSED MAGNESIA: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 39 MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 40 NATURAL: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 41 NATURAL: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 SYNTHETIC: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 43 SYNTHETIC: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 45 MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 46 FOOD GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 47 FOOD GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 48 PHARMACEUTICAL GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 49 PHARMACEUTICAL GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 50 INDUSTRIAL GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 51 INDUSTRIAL GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 REFRACTORY GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 53 REFRACTORY GRADE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 54 MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 55 MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 56 ANIMAL FEED: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 57 ANIMAL FEED: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 58 STEEL MAKING & CEMENT: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 59 STEEL MAKING & CEMENT: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 GLASS & CERAMICS: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 61 GLASS & CERAMICS: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 62 ELECTRONICS: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 63 ELECTRONICS: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 PHARMACEUTICALS: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 65 PHARMACEUTICALS: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 66 FERTILIZERS: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 67 FERTILIZERS: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 68 OTHER APPLICATIONS: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 69 OTHER APPLICATIONS: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 70 MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 71 MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 72 FOOD & BEVERAGE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 73 FOOD & BEVERAGE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 74 CONSTRUCTION: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 75 CONSTRUCTION: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 76 AGRICULTURE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 77 AGRICULTURE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 HEALTHCARE: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 79 HEALTHCARE: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 80 ENVIRONMENTAL: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 81 ENVIRONMENTAL: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 OTHER END-USE INDUSTRIES: MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 83 OTHER END-USE INDUSTRIES: MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 84 GLOBAL MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 GLOBAL MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 GLOBAL MAGNESIUM OXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 87 GLOBAL MAGNESIUM OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 88 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 91 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 92 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 95 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 96 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 97 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 98 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 99 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 100 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 101 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 102 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 103 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 104 CHINA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 105 CHINA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 106 CHINA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 107 CHINA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 108 CHINA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 109 CHINA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 110 JAPAN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 111 JAPAN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 112 JAPAN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 113 JAPAN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 114 JAPAN: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 115 JAPAN: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 116 INDIA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 117 INDIA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 118 INDIA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 119 INDIA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 120 INDIA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 121 INDIA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 122 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 123 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 124 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 125 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 126 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 127 SOUTH KOREA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 128 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 131 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 132 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 133 REST OF ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 134 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 137 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 138 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 141 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 142 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 143 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 144 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 145 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 146 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 147 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 148 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 149 NORTH AMERICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 150 US: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 151 US: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 152 US: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 153 US: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 154 US: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 155 US: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 156 CANADA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 157 CANADA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 158 CANADA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 159 CANADA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 160 CANADA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 161 CANADA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 162 MEXICO: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 163 MEXICO: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 164 MEXICO: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 165 MEXICO: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 166 MEXICO: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 167 MEXICO: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 168 EUROPE: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 EUROPE: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 171 EUROPE: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 172 EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 173 EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 174 EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 175 EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 176 EUROPE: MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 177 EUROPE: MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 178 EUROPE: MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 179 EUROPE: MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 180 EUROPE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 181 EUROPE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 182 EUROPE: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 183 EUROPE: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 184 GERMANY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 185 GERMANY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 186 GERMANY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 187 GERMANY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 188 GERMANY: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 189 GERMANY: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 190 UK: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 191 UK: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 192 UK: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 193 UK: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 194 UK: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 195 UK: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 196 FRANCE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 197 FRANCE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 198 FRANCE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 199 FRANCE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 200 FRANCE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 201 FRANCE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 202 ITALY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 203 ITALY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 204 ITALY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 205 ITALY: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 206 ITALY: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 207 ITALY: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 208 SPAIN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 209 SPAIN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 210 SPAIN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 211 SPAIN: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 212 SPAIN: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 213 SPAIN: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 214 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 215 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 216 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 217 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 218 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 219 REST OF EUROPE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 220 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 221 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 222 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 223 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 224 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 225 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 226 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 227 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 228 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 229 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 230 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 231 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 232 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 233 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 234 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 235 SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 236 BRAZIL: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 237 BRAZIL: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 238 BRAZIL: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 239 BRAZIL: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 240 BRAZIL: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 241 BRAZIL: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 242 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 243 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 244 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 245 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 246 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 247 REST OF SOUTH AMERICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 248 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 251 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 252 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 255 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2021-2024 (KILOTON)

- TABLE 257 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY SOURCE, 2025-2030 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 259 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 261 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 262 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 263 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 264 UAE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 265 UAE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 266 UAE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 267 UAE: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 268 UAE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 269 UAE: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 270 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 271 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 272 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 273 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 274 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 275 REST OF GCC COUNTRIES: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 276 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 277 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 278 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 279 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 280 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 281 SOUTH AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 282 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 283 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 284 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 285 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 286 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 287 REST OF MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 288 MAGNESIUM OXIDE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025)

- TABLE 289 MAGNESIUM OXIDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 290 MAGNESIUM OXIDE MARKET: REGION FOOTPRINT

- TABLE 291 MAGNESIUM OXIDE MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 292 MAGNESIUM OXIDE MARKET: SOURCE FOOTPRINT

- TABLE 293 MAGNESIUM OXIDE MARKET: GRADE FOOTPRINT

- TABLE 294 MAGNESIUM OXIDE MARKET: FORM FOOTPRINT

- TABLE 295 MAGNESIUM OXIDE MARKET: PURITY FOOTPRINT

- TABLE 296 MAGNESIUM OXIDE MARKET: APPLICATION FOOTPRINT

- TABLE 297 MAGNESIUM OXIDE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 298 MAGNESIUM OXIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 299 MAGNESIUM OXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (1/2)

- TABLE 300 MAGNESIUM OXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 301 MAGNESIUM OXIDE MARKET: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 302 MAGNESIUM OXIDE MARKET: OTHER DEVELOPMENTS, JANUARY 2020-SEPTEMBER 2025

- TABLE 303 HAICHENG MAGNESITE GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 304 HAICHENG MAGNESITE GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 305 MAGNEZIT GROUP: COMPANY OVERVIEW

- TABLE 306 MAGNEZIT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 MAGNEZIT GROUP: OTHER DEVELOPMENTS

- TABLE 308 RHI MAGNESITA: COMPANY OVERVIEW

- TABLE 309 RHI MAGNESITA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 RHI MAGNESITA: DEALS

- TABLE 311 MARTIN MARIETTA MAGNESIA SPECIALTIES: COMPANY OVERVIEW

- TABLE 312 MARTIN MARIETTA MAGNESIA SPECIALTIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 313 MARTIN MARIETTA MAGNESIA SPECIALTIES: DEALS

- TABLE 314 GRECIAN MAGNESITE: COMPANY OVERVIEW

- TABLE 315 GRECIAN MAGNESITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 GRECIAN MAGNESITE: EXPANSIONS

- TABLE 317 GRECIAN MAGNESITE: OTHER DEVELOPMENTS

- TABLE 318 HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.: COMPANY OVERVIEW

- TABLE 319 HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 UBE MATERIAL INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 321 UBE MATERIAL INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 KUMAS A.S.: COMPANY OVERVIEW

- TABLE 323 KUMAS A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 KUMAS A.S.: DEALS

- TABLE 325 ICL: COMPANY OVERVIEW

- TABLE 326 ICL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 TATEHO CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 328 TATEHO CHEMICAL INDUSTRIES CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 329 TATEHO CHEMICAL INDUSTRIES CO., LTD.: DEALS

- TABLE 330 BAYMAG INC.: COMPANY OVERVIEW

- TABLE 331 BAYMAG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 BAYMAG INC.: DEALS

- TABLE 333 NEDMAG B.V.: COMPANY OVERVIEW

- TABLE 334 NEDMAG B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 INDUSTRIAS PENOLES: COMPANY OVERVIEW

- TABLE 336 INDUSTRIAS PENOLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 PAUL RAUSCHERT GMBH & CO. KG.: COMPANY OVERVIEW

- TABLE 338 PAUL RAUSCHERT GMBH & CO. KG.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 PAUL RAUSCHERT GMBH & CO. KG.: DEALS

- TABLE 340 KONOSHIMA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 341 KONOSHIMA CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 LEHMANN&VOSS&CO.: COMPANY OVERVIEW

- TABLE 343 LEHMANN&VOSS&CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 LEHMANN&VOSS&CO.: EXPANSIONS

- TABLE 345 LEHMANN&VOSS&CO.: OTHER DEVELOPMENTS

- TABLE 346 LKAB MINERALS: COMPANY OVERVIEW

- TABLE 347 LKAB MINERALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 OMYA INTERNATIONAL AG: COMPANY OVERVIEW

- TABLE 349 OMYA INTERNATIONAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 351 HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD.: COMPANY OVERVIEW

- TABLE 353 HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 354 SINO MEIR INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 355 SINO MEIR INTERNATIONAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 356 HEBEI MEISHEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 357 HEBEI MEISHEN TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 358 NANOSHEL LLC: COMPANY OVERVIEW

- TABLE 359 NANOSHEL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 KYOWA CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 361 KYOWA CHEMICAL INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 362 IBAR NORDESTE: COMPANY OVERVIEW

- TABLE 363 IBAR NORDESTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 TIMAB MAGNESIUM: COMPANY OVERVIEW

- TABLE 365 TIMAB MAGNESIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 366 TIMAB MAGNESIUM: DEALS

- TABLE 367 YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 368 YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 PRCO AMERICA: COMPANY OVERVIEW

- TABLE 370 PRCO AMERICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 PRCO AMERICA: DEALS

- TABLE 372 PRCO AMERICA: EXPANSIONS

- TABLE 373 QMAG PTY LIMITED: COMPANY OVERVIEW

- TABLE 374 QMAG PTY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 QMAG PTY LIMITED: DEALS

- TABLE 376 HONGYE CHEMICAL: COMPANY OVERVIEW

- TABLE 377 HONGYE CHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 LIAONING HONGYU REFRACTORY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 379 LIAONING HONGYU REFRACTORY GROUP CO., LTD.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 380 YINGKOU MAGNESITE MINING CO., LTD.: COMPANY OVERVIEW

- TABLE 381 YINGKOU MAGNESITE MINING CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 382 STAR GRACE MINING CO., LTD.: COMPANY OVERVIEW

- TABLE 383 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 384 LORAD CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 385 GARRISON MINERALS, LLC: COMPANY OVERVIEW

- TABLE 386 CHIMAG: COMPANY OVERVIEW

- TABLE 387 FENGCHEN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 388 LATROBE MAGNESIUM: COMPANY OVERVIEW

- TABLE 389 DANDONG XINYANG MINERAL CO., LTD.: COMPANY OVERVIEW

- TABLE 390 YINGKOU SANHUA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 391 REFRACTORIES MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 392 REFRACTORIES MARKET, BY FORM, 2022-2029 (USD MILLION)

- TABLE 393 REFRACTORIES MARKET, BY FORM, 2018-2021 (KILOTON)

- TABLE 394 REFRACTORIES MARKET, BY FORM, 2022-2029 (KILOTON)

List of Figures

- FIGURE 1 MAGNESIUM OXIDE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MAGNESIUM OXIDE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE ANALYSIS

- FIGURE 7 MAGNESIUM OXIDE MARKET: DATA TRIANGULATION

- FIGURE 8 FACTOR ANALYSIS

- FIGURE 9 DEAD BURNED MAGNESIA TO ACCOUNT FOR LARGEST SHARE OF MAGNESIUM OXIDE MARKET IN 2024

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MAGNESIUM OXIDE MARKET IN 2024

- FIGURE 11 GROWING USE OF MAGNESIUM OXIDE IN STEEL MAKING AND CEMENT INDUSTRIES TO DRIVE MARKET

- FIGURE 12 STEEL MAKING & CEMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 CHINA TO REGISTER HIGHEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 14 MAGNESIUM OXIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 CRUDE STEEL DEMAND (2025-2030)

- FIGURE 16 GROWTH OF ADVANCED CERAMICS (2025-2029)

- FIGURE 17 GROWTH OF WASTEWATER TREATMENT SERVICES MARKET (2025-2030)

- FIGURE 18 GROWTH OF FOOD ADDITIVES MARKET (2025-2028)

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: MAGNESIUM OXIDE MARKET

- FIGURE 20 MAGNESIUM OXIDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 MAGNESIUM OXIDE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 NUMBER OF PATENTS REGISTERED, 2014-2024

- FIGURE 23 US ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF MAGNESIUM OXIDE, BY REGION, 2020-2025

- FIGURE 25 AVERAGE SELLING PRICE OF MAGNESIUM OXIDE, BY KEY PLAYERS

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2021-2025

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 251990-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 251990-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 DEAD BURNED MAGNESIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 NATURAL SOURCE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 34 REFRACTORY GRADE TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 STEEL MAKING & CEMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 CONSTRUCTION TO BE DOMINANT END USER OF MAGNESIUM OXIDE DURING FORECAST PERIOD

- FIGURE 37 GLOBAL MAGNESIUM OXIDE MARKET, BY REGION

- FIGURE 38 ASIA PACIFIC: MAGNESIUM OXIDE MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: MAGNESIUM OXIDE MARKET SNAPSHOT

- FIGURE 40 EUROPE: MAGNESIUM OXIDE MARKET SNAPSHOT

- FIGURE 41 SOUTH AMERICA: MAGNESIUM OXIDE MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: MAGNESIUM OXIDE MARKET SNAPSHOT

- FIGURE 43 MAGNESIUM OXIDE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024

- FIGURE 44 MAGNESIUM OXIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 45 MAGNESIUM OXIDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 MAGNESIUM OXIDE MARKET: EV/EBITDA

- FIGURE 47 MAGNESIUM OXIDE MARKET: EV/REVENUE

- FIGURE 48 MAGNESIUM OXIDE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 49 MAGNESIUM OXIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 MAGNESIUM OXIDE MARKET: COMPANY FOOTPRINT

- FIGURE 51 MAGNESIUM OXIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 RHI MAGNESITA: COMPANY SNAPSHOT

- FIGURE 53 MARTIN MARIETTA MAGNESIA SPECIALTIES: COMPANY SNAPSHOT

- FIGURE 54 ICL: COMPANY SNAPSHOT

- FIGURE 55 INDUSTRIAS PENOLES: COMPANY SNAPSHOT

- FIGURE 56 LKAB MINERALS: COMPANY SNAPSHOT