|

市场调查报告书

商品编码

1872635

全球层状双氢氧化物市场按类型、等级、应用、最终用途、形态、分销管道、产品类型和地区划分-预测至2030年Layered Double Hydroxide Market by Type (Mg-Al, Zn-Al, Ca-Al), Application (Catalysts & Precursors, Additives, Absorbent, Water Treatment), End-Use (Chemicals, Electronics, Construction, Agriculture), Grade, Form, and Region - Global Forecast to 2030 |

||||||

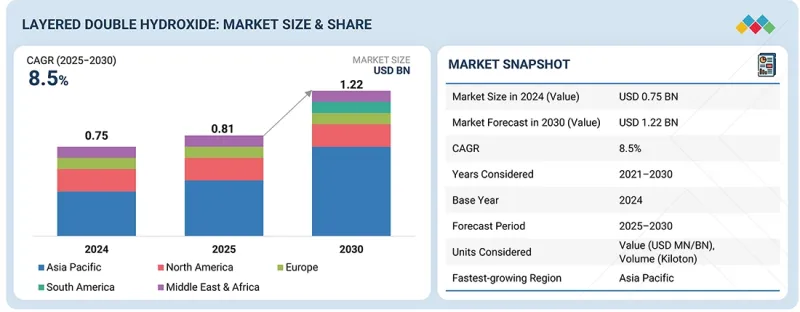

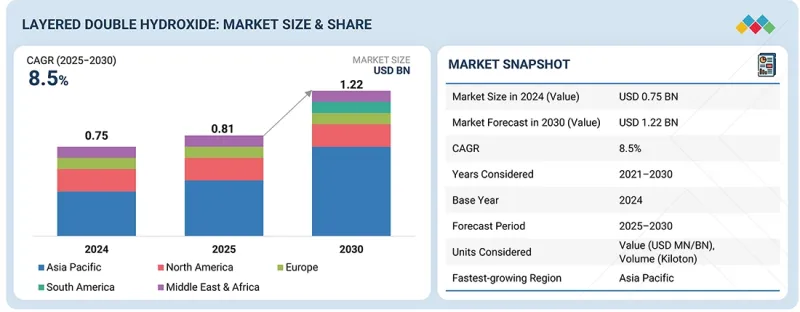

全球层状双氢氧化物市场规模预计将从 2025 年的 8.1 亿美元成长到 2030 年的 12.2 亿美元,预测期内复合年增长率为 8.5%。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 金额(百万美元),数量(千吨) |

| 部分 | 按类型、等级、应用、最终用途、形式、分销管道、产品类型和地区 |

| 目标区域 | 北美洲、亚太地区、欧洲、中东和非洲、南美洲 |

由于层状双氢氧化物(LDHs)在建筑、製药、聚合物、水处理等多个领域有着广泛的应用,其市场正经历强劲的成长。对阻燃剂、催化剂和吸附剂的需求日益增长。此外,环境法规的实施以及全球对永续材料的转型也推动了LDHs的应用。

预计在预测期内,电子产业将占据堆迭二元氢氧化物市场第二大份额(按以金额为准),这主要归功于其在先进储能应用中的卓越性能。由于其高度可调的组成、独特的层状结构和优异的电化学性能,堆迭二元氢氧化物正被用作下一代超级电容和电池的高性能电极材料,从而提高能量密度和循环稳定性,这对于小型化电子设备至关重要。

在预测期内,催化剂和前驱体领域预计将继续占据层状双氢氧化物市场第二大份额(以金额为准)。这主要归功于其作为催化剂和触媒撑体的高效应用,这得益于其可调控的组成、高比表面积和优异的阴离子交换性能。其层状结构能够实现活性金属的可控引入,从而在氧化、氢化和聚合反应中展现出卓越的性能。层状双氢氧化物作为混合金属氧化物的绿色前驱体也日益受到认可,有助于实现永续和节能的化学过程。随着对干净科技、可再生能源解决方案和工业催化剂的需求不断增长,层状双氢氧化物正成为催化剂和前驱体领域不可或缺的材料。

预计在预测期内,行动装置领域将占据层状双氢氧化物市场第二大份额(以价值计)。这主要归功于层状双氢氧化物在合成橡胶和天然橡胶化合物中作为稳定剂、阻燃剂和增强填料的重要作用。它们能够中和酸性残留物、提高热稳定性并增强机械性能,因此在汽车零件、工业橡胶製品和鞋类等应用领域具有显着优势。橡胶级层状双氢氧化物是市场扩张的关键促进者,尤其是在那些优先考虑永续性和性能的行业。

在预测期内,北美预计将占据层状双氢氧化物市场以金额为准第二大的份额,这主要得益于基础设施建设的改善、工业现代化以及对永续材料日益增长的需求。美国的需求成长主要受电动汽车电池製造的快速扩张、水处理方面日益严格的环境法规以及建筑业阻燃添加剂使用量的增加所推动。加拿大市场则受惠于电力产业的巨额投资以及对高效污水处理日益增长的需求。同时,墨西哥则受益于农业现代化、对永续肥料的需求以及建设活动的增加。这些因素共同推动北美成为该市场的重要成长中心。

本报告考察了全球层状双氢氧化物市场,并按类型、等级、应用、最终用途、形态、分销管道、产品类型、区域趋势和公司概况对市场进行了全面分析。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

第六章 产业趋势

- 世界宏观经济展望

- 价值链分析

- 生态系分析

- 波特五力分析

- 主要相关人员和采购标准

- 定价分析

- 监管状态

- 2025-2026 年主要会议和活动

- 专利分析

- 技术分析

- 贸易数据

- 影响客户业务的趋势/干扰因素

- 投资和资金筹措方案

- 人工智慧对层状双氢氧化物市场的影响

- 川普关税对层状双氢氧化物市场的影响

7. 层状双氢氧化物市场(依类型)

- 介绍

- MG-AL层状双氢氧化物

- ZN-AL 层状双氢氧化物

- CA-AL 层状双氢氧化物

- 其他的

8. 层状双氢氧化物市场(依等级划分)

- 介绍

- 塑胶级

- 橡胶级

- 医药级

- 其他/特殊等级

9. 层状双氢氧化物市场(依应用领域划分)

- 介绍

- 添加剂

- 催化剂和前驱

- 吸收性

- 水处理

- 其他的

10. 层状双氢氧化物市场依最终用途划分

- 介绍

- 化学品

- 电子学

- 建造

- 农业

- 其他的

第十一章:层状双氢氧化物市场(依形态)

- 介绍

- 粉末状

- 颗粒状

- 液体

第十二章 层状双氢氧化物市场(依分销通路划分)

- 介绍

- 直销

- 线上零售

- 经销商和批发商

- 专业化学品商店

13. 层状双氢氧化物市场(依产品类型划分)

- 具有阴离子插层的层状双氢氧化物

第十四章 多层氢氧化物市场(依地区划分)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 荷兰

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 其他的

第十五章 竞争格局

- 介绍

- 市占率分析

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 主要Start-Ups/中小企业的竞争性基准化分析

- 估值和财务指标

第十六章:公司简介

- 主要参与企业

- KYOWA CHEMICAL INDUSTRY CO., LTD.

- CLARIANT

- DOOBON

- SHANDONG REPOLYFINE ADDITIVES CO., LTD.

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- SASOL

- SAEKYUNG CHEMICAL CO., LIMITED

- BASF

- AVANSCHEM

- TODA KOGYO CORP.

- CONSCIENTIA INDUSTRIAL CO., LTD.

- DAYANG CHEM(HANGZHOU)CO., LTD.

- FENGCHEN GROUP CO., LTD.

- JIANGXI HONGYUAN CHEMICAL INDUSTRY CO., LTD.

- AKDENIZ CHEMSON

- TAURUS CHEMICALS

- SHANDONG WORLDSUN BIOLOGICAL TECHNOLOGY CO., LTD.

- PAR DRUGS AND CHEMICAL LIMITED

- BELIKE CHEMICAL COMPANY LTD.

- SINWON INDUSTRIAL CO., LTD.

- 其他公司

- BILVA CHEMICALS

- NANOCHEMAZONE

- MEHA PHARMA

- HANGZHOU LINGRUI CHEMICAL CO., LTD.

- SMALLMATEK-SMALL MATERIALS AND TECHNOLOGIES, LDA.

- CHEMVERA SPECIALITY CHEMICALS PVT. LTD.

第十七章:邻近及相关市场

第十八章附录

The global layered double hydroxide market is projected to grow from USD 0.81 billion in 2025 to USD 1.22 billion by 2030, at a CAGR of 8.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Product Type, Grade, Type, Form, Distribution Channel, End-use, and Application |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The market is experiencing strong growth due to its widespread use in various sectors, including construction, pharmaceuticals, polymers, water treatment, and other sectors. There is a growing need for flame retardants, catalysts, and adsorbents. Furthermore, environmental regulations and the global shift toward sustainable materials are driving the adoption of LDH.

"Electronics segment, by end-use, is estimated to account for the second largest share during the forecast period in terms of value."

The electronics segment is projected to hold the second-largest share in the layered double hydroxide market by value during the forecast period, primarily driven by their exceptional performance in advanced energy storage applications. Due to their highly tunable composition, unique layered structure, and excellent electrochemical properties, layered double hydroxides are being adopted as high-performance electrode materials in next-generation supercapacitors and batteries, offering improved energy density and cycling stability, which are crucial for compact electronic devices.

"By application, the catalysts & precursors segment accounted for the second largest share during the forecast period in terms of value."

The catalysts & precursors segment is anticipated to hold the second-largest share in terms of value in the layered double hydroxide market during the forecast period, due to their tunable composition, high surface area, and exceptional anion-exchange properties, which make them highly effective as both catalysts and catalyst supports. Their layered structure enables the controlled incorporation of active metals, resulting in superior performance in oxidation, hydrogenation, and polymerization reactions. LDHs are also increasingly valued as green precursors for mixed metal oxides, supporting sustainable and energy-efficient chemical processes. With rising demand for clean technologies, renewable energy solutions, and industrial catalysts, LDHs are becoming an indispensable material in the catalysts and precursors segment.

"By grade, the rubber segment accounted for the second largest share during the forecast period in terms of value."

The portable device segment is anticipated to hold the second-largest share in terms of value in the layered double hydroxide market during the forecast period, as it serves as a stabilizer, flame retardant, and reinforcing filler in synthetic and natural rubber formulations. Their ability to neutralize acidic residues, improve thermal stability, and enhance mechanical properties makes them highly effective in applications such as automotive components, industrial rubber goods, and footwear. The rubber-grade LDHs are a key contributor to market expansion, particularly in sectors that emphasize sustainability and performance.

"The North America region is estimated to account for the second largest share during the forecast period in terms of value."

The North America region is estimated to account for the second-largest share in terms of value in the layered double hydroxide market during the forecast period, driven by advancements in infrastructure, industrial modernization, and the increasing push for sustainable materials. In the US, demand is accelerating due to the rapid expansion of electric vehicle (EV) battery manufacturing, stringent environmental regulations for water treatment, and the rising use of flame-retardant additives in construction. Canada's market is supported by large-scale investments in the power sector and the growing need for efficient wastewater treatment. At the same time, Mexico benefits from agricultural modernization, sustainable fertilizer demand, and construction activities. Collectively, these factors are positioning North America as a key growth hub for the market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Kyowa Chemical Industry Co., Ltd. (Japan), CLARIANT (Switzerland), DOOBON (South Korea), Shandong Repolyfine Additives Co., Ltd. (China), Sakai Chemical Industry Co., Ltd. (Japan), Sasol (South Africa), and Saekyung Chemical Co., Ltd. (China) are some of the major players operating in the layered double hydroxide market.

Research Coverage:

The report defines segments and projects in the layered double hydroxide market based on product type, grade, type, form, distribution channel, application, end-use, and region. It provides detailed information on the significant factors influencing the market's growth, including drivers, restraints, opportunities, and challenges. It strategically profiles layered double hydroxide manufacturers, providing a comprehensive analysis of their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the layered double hydroxide market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market's competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of critical drivers (growth in water and wastewater treatment applications, growing demand for efficient and sustainable catalysts, and growth in carbon capture and environmental remediation efforts), restraints (high production and processing costs, and competition from cheaper and established alternatives), opportunities (advancements of nanostructured LDH materials, and growth in advanced drug delivery solutions), and challenges (safety and regulatory constraints) influencing the development of the layered double hydroxide market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the layered double hydroxide market

- Market Development: Comprehensive information about lucrative markets - the report analyses the layered double hydroxide market across varied regions

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Kyowa Chemical Industry Co., Ltd. (Japan), CLARIANT (Switzerland), DOOBON (South Korea), Shandong Repolyfine Additives Co., Ltd. (China), Sakai Chemical Industry Co., Ltd. (Japan), Sasol (South Africa), and Saekyung Chemical Co., Limited (China) in the layered double hydroxide market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 SUPPLY-SIDE ANALYSIS

- 2.3.3.1 Calculations for supply-side analysis

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAYERED DOUBLE HYDROXIDE MARKET

- 4.2 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION

- 4.3 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE

- 4.4 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION

- 4.5 LAYERED DOUBLE HYDROXIDE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growth in water and wastewater treatment applications

- 5.1.1.2 Growing demand for efficient and sustainable catalysts

- 5.1.1.3 Growth in carbon capture and environmental remediation efforts

- 5.1.2 RESTRAINTS

- 5.1.2.1 High production and processing costs

- 5.1.2.2 Competition from cheaper and established alternatives

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Advancement of nanostructured LDH materials

- 5.1.3.2 Growth in advanced drug delivery solutions

- 5.1.4 CHALLENGES

- 5.1.4.1 Safety and regulatory constraints

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF LAYERED DOUBLE HYDROXIDES, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE OF LAYERED DOUBLE HYDROXIDES, BY KEY PLAYERS, 2024

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Coprecipitation Method

- 6.10.2 ADJACENT TECHNOLOGIES

- 6.10.2.1 Hydrothermal Approach

- 6.10.3 COMPLEMENTARY TECHNOLOGIES

- 6.10.3.1 So-gel Technique

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE DATA

- 6.11.1 IMPORT SCENARIO (HS CODE 283429)

- 6.11.2 EXPORT SCENARIO (HS CODE 283429)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF GENERATIVE AI ON LAYERED DOUBLE HYDROXIDE MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 ENHANCING MATERIAL DISCOVERY AND DESIGN

- 6.14.3 OPTIMIZING SYNTHESIS PROCESSES

- 6.14.4 TAILORING APPLICATIONS FOR END-USE SECTORS

- 6.14.5 BROADER MARKET IMPLICATIONS

- 6.15 TRUMP TARIFF IMPACT ON LAYERED DOUBLE HYDROXIDE MARKET

- 6.15.1 KEY TARIFF RATES IMPACTING MARKET

- 6.15.2 PRICE IMPACT ANALYSIS

- 6.15.3 KEY IMPACT ON VARIOUS REGIONS

- 6.15.3.1 US

- 6.15.3.2 Europe

- 6.15.3.3 Asia Pacific

- 6.15.4 IMPACT ON END-USE INDUSTRIES OF LAYERED DOUBLE HYDROXIDE MARKET

- 6.15.4.1 Chemicals

- 6.15.4.2 Electronics

- 6.15.4.3 Construction

- 6.15.4.4 Agriculture

- 6.15.4.5 Others (Pharma, Environment)

7 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MG-AL LAYERED DOUBLE HYDROXIDE

- 7.3 ZN-AL LAYERED DOUBLE HYDROXIDE

- 7.4 CA-AL LAYERED DOUBLE HYDROXIDE

- 7.5 OTHER TYPES

8 LAYERED DOUBLE HYDROXIDE MARKET, BY GRADE

- 8.1 INTRODUCTION

- 8.2 PLASTIC GRADE

- 8.2.1 SUSTAINABLE STABILIZER AND FLAME RETARDANT FOR POLYMERS TO DRIVE MARKET

- 8.3 RUBBER GRADE

- 8.3.1 ENHANCING DURABILITY AND STABILITY IN RUBBER APPLICATIONS TO DRIVE MARKET

- 8.4 PHARMACEUTICAL GRADE

- 8.4.1 ADVANCING DRUG DELIVERY AND MEDICAL FORMULATIONS TO DRIVE MARKET

- 8.5 OTHER/SPECIALTY GRADES

9 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ADDITIVES

- 9.2.1 ENHANCING PERFORMANCE AND SAFETY IN POLYMERS AND COATINGS TO DRIVE MARKET

- 9.3 CATALYSTS & PRECURSORS

- 9.3.1 DRIVING EFFICIENCY AND SUSTAINABILITY IN INDUSTRIAL REACTIONS TO BOOST MARKET

- 9.4 ABSORBENT

- 9.4.1 EFFICIENT REMOVAL OF POLLUTANTS AND CONTAMINANTS TO DRIVE MARKET

- 9.5 WATER TREATMENT

- 9.5.1 PURIFYING AND PROTECTING VITAL WATER RESOURCES TO DRIVE DEMAND

- 9.6 OTHER APPLICATIONS

10 LAYERED DOUBLE HYDROXIDE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 CHEMICALS

- 10.2.1 CATALYTIC AND STABILIZING ROLE OF LAYERED DOUBLE HYDROXIDE IN CHEMICAL INDUSTRY TO DRIVE MARKET

- 10.3 ELECTRONICS

- 10.3.1 ENHANCING STABILITY AND PERFORMANCE IN ELECTRONIC APPLICATIONS TO DRIVE MARKET

- 10.4 CONSTRUCTION

- 10.4.1 IMPROVING DURABILITY AND SAFETY IN BUILDING MATERIALS TO INCREASE DEMAND

- 10.5 AGRICULTURE

- 10.5.1 CONTROLLED-RELEASE AND SOIL-ENHANCING APPLICATIONS TO DRIVE MARKET

- 10.6 OTHER END USES

11 LAYERED DOUBLE HYDROXIDE MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 POWDERED FORM

- 11.3 GRANULAR FORM

- 11.4 LIQUID FORM

12 LAYERED DOUBLE HYDROXIDE MARKET, BY DISTRIBUTION CHANNEL

- 12.1 INTRODUCTION

- 12.2 DIRECT SALES

- 12.3 ONLINE RETAIL

- 12.4 DISTRIBUTORS AND WHOLESALERS

- 12.5 SPECIALTY CHEMICAL STORES

13 LAYERED DOUBLE HYDROXIDE MARKET, BY PRODUCT TYPE

- 13.1 LAYERED DOUBLE HYDROXIDE WITH ANIONIC INTERCALATION

14 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Country's emphasis on green, low-carbon construction, and urban renewal projects to drive demand

- 14.2.2 JAPAN

- 14.2.2.1 Expansion of chemicals industry to drive demand

- 14.2.3 INDIA

- 14.2.3.1 Expansion of agriculture sector to drive demand

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Rise in chemical production and exports to drive demand

- 14.2.5 AUSTRALIA

- 14.2.5.1 Expansion of agricultural production and strong export activity to boost demand

- 14.2.6 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 NORTH AMERICA

- 14.3.1 US

- 14.3.1.1 Surge in EV battery boom and water infrastructure to fuel market

- 14.3.2 CANADA

- 14.3.2.1 Rise in water treatment and construction to drive market

- 14.3.3 MEXICO

- 14.3.3.1 Growth in agriculture and construction to drive market

- 14.3.1 US

- 14.4 EUROPE

- 14.4.1 GERMANY

- 14.4.1.1 Rise in pharmaceutical and other sectors to fuel market growth

- 14.4.2 FRANCE

- 14.4.2.1 Surge in agriculture and wastewater treatment sectors to drive market

- 14.4.3 UK

- 14.4.3.1 Growth in electronics and water treatment industries to drive market

- 14.4.4 SPAIN

- 14.4.4.1 Growth in infrastructure and wastewater treatment to drive market

- 14.4.5 NETHERLANDS

- 14.4.5.1 Growth in chemicals, semiconductors, and agriculture sectors to drive market

- 14.4.6 REST OF EUROPE

- 14.4.1 GERMANY

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Large-scale infrastructure projects and sustainability-focused construction to increase demand

- 14.5.1.2 UAE

- 14.5.1.2.1 Expanding construction and infrastructure investments under national development agenda to drive demand

- 14.5.1.3 Rest of GCC countries

- 14.5.1.1 Saudi Arabia

- 14.5.2 SOUTH AFRICA

- 14.5.2.1 Rise in demand from agriculture, forestry, and fishing sectors to drive market

- 14.5.3 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Expanding applications in industrial and agricultural sectors to drive market

- 14.6.2 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 MARKET SHARE ANALYSIS

- 15.3 BRAND/PRODUCT COMPARISON

- 15.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.4.1 STARS

- 15.4.2 EMERGING LEADERS

- 15.4.3 PERVASIVE PLAYERS

- 15.4.4 PARTICIPANTS

- 15.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.4.5.1 Company footprint

- 15.4.5.2 Region footprint

- 15.4.5.3 Grade footprint

- 15.4.5.4 Type footprint

- 15.4.5.5 Form footprint

- 15.4.5.6 End use footprint

- 15.4.5.7 Application footprint

- 15.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.5.1 PROGRESSIVE COMPANIES

- 15.5.2 RESPONSIVE COMPANIES

- 15.5.3 DYNAMIC COMPANIES

- 15.5.4 STARTING BLOCKS

- 15.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.5.5.1 Detailed list of key startups/SMEs

- 15.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 15.7 COMPANY VALUATION AND FINANCIAL METRICS

16 COMPANY PROFILES

- 16.1 KEY COMPANIES

- 16.1.1 KYOWA CHEMICAL INDUSTRY CO., LTD.

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 MnM View

- 16.1.1.3.1 Right to Win

- 16.1.1.3.2 Strategic choices

- 16.1.1.3.3 Weaknesses and competitive threats

- 16.1.2 CLARIANT

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 MnM View

- 16.1.2.3.1 Right to win

- 16.1.2.3.2 Strategic choices

- 16.1.2.3.3 Weaknesses and competitive threats

- 16.1.3 DOOBON

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 MnM View

- 16.1.3.3.1 Right to Win

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 SHANDONG REPOLYFINE ADDITIVES CO., LTD.

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 MnM View

- 16.1.4.3.1 Right to Win

- 16.1.4.3.2 Strategic choices

- 16.1.4.3.3 Weaknesses and competitive threats

- 16.1.5 SAKAI CHEMICAL INDUSTRY CO., LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 MnM View

- 16.1.5.3.1 Right to Win

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 SASOL

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 MnM View

- 16.1.6.3.1 Right to Win

- 16.1.6.3.2 Strategic choices

- 16.1.6.3.3 Weaknesses and competitive threats

- 16.1.7 SAEKYUNG CHEMICAL CO., LIMITED

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 MnM View

- 16.1.7.3.1 Right to Win

- 16.1.7.3.2 Strategic choices

- 16.1.7.3.3 Weaknesses and competitive threats

- 16.1.8 BASF

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 AVANSCHEM

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.10 TODA KOGYO CORP.

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.11 CONSCIENTIA INDUSTRIAL CO., LTD.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.12 DAYANG CHEM (HANGZHOU) CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.13 FENGCHEN GROUP CO., LTD.

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.14 JIANGXI HONGYUAN CHEMICAL INDUSTRY CO., LTD.

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.15 AKDENIZ CHEMSON

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.16 TAURUS CHEMICALS

- 16.1.16.1 Business overview

- 16.1.16.2 Products offered

- 16.1.17 SHANDONG WORLDSUN BIOLOGICAL TECHNOLOGY CO., LTD.

- 16.1.17.1 Business overview

- 16.1.17.2 Products offered

- 16.1.18 PAR DRUGS AND CHEMICAL LIMITED

- 16.1.18.1 Business Overview

- 16.1.18.2 Products offered

- 16.1.19 BELIKE CHEMICAL COMPANY LTD.

- 16.1.19.1 Business overview

- 16.1.19.2 Products offered

- 16.1.20 SINWON INDUSTRIAL CO., LTD.

- 16.1.20.1 Business overview

- 16.1.20.2 Products offered

- 16.1.1 KYOWA CHEMICAL INDUSTRY CO., LTD.

- 16.2 OTHER PLAYERS

- 16.2.1 BILVA CHEMICALS

- 16.2.2 NANOCHEMAZONE

- 16.2.3 MEHA PHARMA

- 16.2.4 HANGZHOU LINGRUI CHEMICAL CO., LTD.

- 16.2.5 SMALLMATEK - SMALL MATERIALS AND TECHNOLOGIES, LDA.

- 16.2.6 CHEMVERA SPECIALITY CHEMICALS PVT. LTD.

17 ADJACENT AND RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 INTERCONNECTED MARKETS

- 17.4 SODIUM HYDROXIDE MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 MARKET OVERVIEW

- 17.4.3 SODIUM HYDROXIDE MARKET, BY GRADE

- 17.5 SOLID

- 17.5.1 WIDE ADOPTION IN TEXTILE PROCESSING TO DRIVE MARKET

- 17.6 50% W/W SOLUTION

- 17.6.1 HIGH DEMAND FROM NUMEROUS END-USE INDUSTRIES TO FUEL MARKET GROWTH

- 17.7 OTHER GRADES

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LAYERED DOUBLE HYDROXIDE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION)

- TABLE 6 ROLES OF COMPANIES IN LAYERED DOUBLE HYDROXIDE ECOSYSTEM

- TABLE 7 LAYERED DOUBLE HYDROXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 9 KEY BUYING CRITERIA, BY END USE

- TABLE 10 AVERAGE SELLING PRICE TREND OF LAYERED DOUBLE HYDROXIDES, BY REGION, 2022-2024 (USD/KILOTON)

- TABLE 11 AVERAGE SELLING PRICE OF LAYERED DOUBLE HYDROXIDES, BY KEY PLAYERS, 2024 (USD/KILOTON)

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LAYERED DOUBLE HYDROXIDE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 LAYERED DOUBLE HYDROXIDE MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 17 IMPORT DATA FOR HS CODE 283429, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 283429, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 19 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 22 LAYERED DOUBLE HYDROXIDE MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 23 LAYERED DOUBLE HYDROXIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 24 LAYERED DOUBLE HYDROXIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 25 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 28 LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 29 ADDITIVES: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 ADDITIVES: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 CATALYSTS & PRECURSORS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 CATALYSTS & PRECURSORS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ABSORBENTS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 ABSORBENTS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 WATER TREATMENT: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 WATER TREATMENT: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 OTHER APPLICATIONS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 40 LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 41 CHEMICALS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 CHEMICALS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 ELECTRONICS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 ELECTRONICS: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 CONSTRUCTION: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 CONSTRUCTION: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 AGRICULTURE: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 AGRICULTURE: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER END USES: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OTHER END USES: LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 54 LAYERED DOUBLE HYDROXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 58 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 59 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 63 CHINA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 64 CHINA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 65 JAPAN: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 66 JAPAN: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 67 INDIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 68 INDIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 69 SOUTH KOREA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 70 SOUTH KOREA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 71 AUSTRALIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 72 AUSTRALIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 78 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 79 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 83 US: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 84 US: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 85 CANADA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 86 CANADA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 87 MEXICO: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 88 MEXICO: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 92 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 93 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 97 GERMANY: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 98 GERMANY: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 99 FRANCE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 100 FRANCE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 101 UK: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 102 UK: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 103 SPAIN: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 104 SPAIN: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 105 NETHERLANDS: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 106 NETHERLANDS: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 108 REST OF EUROPE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 115 SAUDI ARABIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 116 SAUDI ARABIA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 117 UAE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 118 UAE: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 119 REST OF GCC COUNTRIES: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 120 REST OF GCC COUNTRIES: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 121 SOUTH AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 122 SOUTH AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 125 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 128 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 129 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 132 SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 133 BRAZIL: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 134 BRAZIL: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 135 REST OF SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 137 LAYERED DOUBLE HYDROXIDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 138 LAYERED DOUBLE HYDROXIDE MARKET: REGION FOOTPRINT (20 COMPANIES)

- TABLE 139 LAYERED DOUBLE HYDROXIDE MARKET: GRADE TYPE FOOTPRINT (20 COMPANIES)

- TABLE 140 LAYERED DOUBLE HYDROXIDE MARKET: TYPE FOOTPRINT (20 COMPANIES)

- TABLE 141 LAYERED DOUBLE HYDROXIDE MARKET: FORM FOOTPRINT (20 COMPANIES)

- TABLE 142 LAYERED DOUBLE HYDROXIDE MARKET: END-USE FOOTPRINT (20 COMPANIES)

- TABLE 143 LAYERED DOUBLE HYDROXIDE MARKET: APPLICATION FOOTPRINT (20 COMPANIES)

- TABLE 144 LAYERED DOUBLE HYDROXIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 145 LAYERED DOUBLE HYDROXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 146 LAYERED DOUBLE HYDROXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 147 KYOWA CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 148 KYOWA CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 149 CLARIANT: COMPANY OVERVIEW

- TABLE 150 CLARIANT: PRODUCTS OFFERED

- TABLE 151 DOOBON: COMPANY OVERVIEW

- TABLE 152 DOOBON: PRODUCTS OFFERED

- TABLE 153 SHANDONG REPOLYFINE ADDITIVES CO., LTD.: COMPANY OVERVIEW

- TABLE 154 SHANDONG REPOLYFINE ADDITIVES CO., LTD.: PRODUCTS OFFERED

- TABLE 155 SAKAI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 156 SAKAI CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 157 SASOL: COMPANY OVERVIEW

- TABLE 158 SASOL: PRODUCTS OFFERED

- TABLE 159 SAEKYUNG CHEMICAL CO., LIMITED: COMPANY OVERVIEW

- TABLE 160 SAEKYUNG CHEMICAL CO., LIMITED: PRODUCTS OFFERED

- TABLE 161 BASF CORPORATION: COMPANY OVERVIEW

- TABLE 162 BASF CORPORATION: PRODUCTS OFFERED

- TABLE 163 AVANSCHEM: COMPANY OVERVIEW

- TABLE 164 AVANSCHEM: PRODUCTS OFFERED

- TABLE 165 TODA KOGYO CORP.: COMPANY OVERVIEW

- TABLE 166 TODA KOGYO CORP.: PRODUCTS OFFERED

- TABLE 167 CONSCIENTIA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 168 CONSCIENTIA INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 169 DAYANG CHEM (HANGZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 170 DAYANG CHEM (HANGZHOU) CO., LTD.: PRODUCTS OFFERED

- TABLE 171 FENGCHEN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 172 FENGCHEN GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 173 JIANGXI HONGYUAN CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 174 JIANGXI HONGYUAN CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 175 AKDENIZ CHEMSON: COMPANY OVERVIEW

- TABLE 176 AKDENIZ CHEMSON: PRODUCTS OFFERED

- TABLE 177 TAURUS CHEMICALS: COMPANY OVERVIEW

- TABLE 178 TAURUS CHEMICALS: PRODUCTS OFFERED

- TABLE 179 SHANDONG WORLDSUN BIOLOGICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 180 SHANDONG WORLDSUN BIOLOGICAL TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 181 PAR DRUGS AND CHEMICAL LIMITED: COMPANY OVERVIEW

- TABLE 182 PAR DRUGS AND CHEMICAL LIMITED: PRODUCTS OFFERED

- TABLE 183 BELIKE CHEMICAL COMPANY LTD.: COMPANY OVERVIEW

- TABLE 184 BELIKE CHEMICAL COMPANY LTD.: PRODUCTS OFFERED

- TABLE 185 SINWON INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 186 SINWON INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 187 SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 188 SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (USD MILLION)

- TABLE 189 SODIUM HYDROXIDE MARKET, BY GRADE, 2018-2021 (KILOTON)

- TABLE 190 SODIUM HYDROXIDE MARKET, BY GRADE, 2022-2029 (KILOTON)

List of Figures

- FIGURE 1 LAYERED DOUBLE HYDROXIDE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LAYERED DOUBLE HYDROXIDE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR LAYERED DOUBLE HYDROXIDES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF LAYERED DOUBLE HYDROXIDES

- FIGURE 7 LAYERED DOUBLE HYDROXIDE MARKET: DATA TRIANGULATION

- FIGURE 8 PLASTIC GRADE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 9 WATER TREATMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 MG-AL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 CHEMICALS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 GROWTH IN ADVANCED DRUG DELIVERY SOLUTIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 MG-AL SEGMENT TO WITNESS HIGH GROWTH FROM 2025 TO 2030

- FIGURE 16 WATER TREATMENT SEGMENT TO WITNESS FASTEST GROWTH FROM 2025 TO 2030

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 LAYERED DOUBLE HYDROXIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 SUBSTANTIAL PROGRESS WAS ACHIEVED FROM 2015 TO 2022 IN WASTEWATER TREATMENT

- FIGURE 20 LAYERED DOUBLE HYDROXIDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 LAYERED DOUBLE HYDROXIDE MARKET: ECOSYSTEM MAPPING

- FIGURE 22 LAYERED DOUBLE HYDROXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 24 KEY BUYING CRITERIA, BY END USE

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LAYERED DOUBLE HYDROXIDES, BY REGION, 2022-2024 (USD/KILOTON)

- FIGURE 26 AVERAGE SELLING PRICE OF LAYERED DOUBLE HYDROXIDE, BY KEY PLAYERS, 2024

- FIGURE 27 LIST OF MAJOR PATENTS RELATED TO LAYERED DOUBLE HYDROXIDE, 2014-2024

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 283429, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 283429, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 31 LAYERED DOUBLE HYDROXIDE MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 32 MG-AL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 PHARMACEUTICAL GRADE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 34 ADDITIVES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 35 ELECTRONICS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO LEAD LAYERED DOUBLE HYDROXIDE MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC: LAYERED DOUBLE HYDROXIDE MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: LAYERED DOUBLE HYDROXIDE MARKET SNAPSHOT

- FIGURE 39 EUROPE: LAYERED DOUBLE HYDROXIDE MARKET SNAPSHOT

- FIGURE 40 LAYERED DOUBLE HYDROXIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 41 LAYERED DOUBLE HYDROXIDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 LAYERED DOUBLE HYDROXIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 LAYERED DOUBLE HYDROXIDE MARKET: COMPANY FOOTPRINT

- FIGURE 44 LAYERED DOUBLE HYDROXIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 LAYERED DOUBLE HYDROXIDE MARKET: EV/EBITDA

- FIGURE 46 LAYERED DOUBLE HYDROXIDE MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 47 LAYERED DOUBLE HYDROXIDE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 48 CLARIANT: COMPANY SNAPSHOT

- FIGURE 49 SAKAI CHEMICAL INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 SASOL: COMPANY SNAPSHOT

- FIGURE 51 BASF CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 TODA KOGYO CORP.: COMPANY SNAPSHOT

- FIGURE 53 PAR DRUGS AND CHEMICAL LIMITED: COMPANY SNAPSHOT