|

市场调查报告书

商品编码

1876443

全球临床分析市场按产品、资料来源、应用情境、最终用户和地区划分-预测至2030年Clinical Analytics Market by Offering, Source, Use Case, End User, Region - Global Forecast to 2030 |

||||||

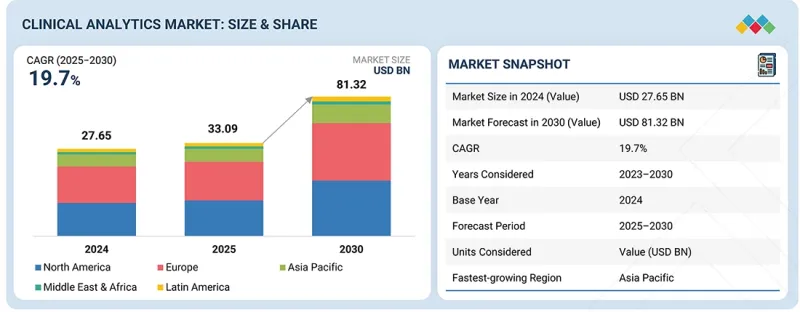

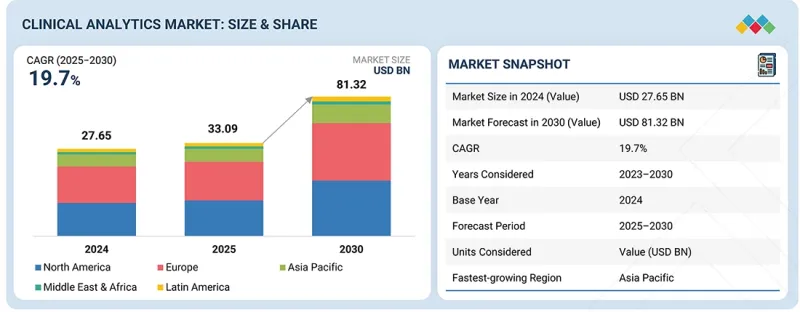

预计到 2025 年,临床分析市场规模将达到 330.9 亿美元,到 2030 年将达到 813.2 亿美元,预测期内复合年增长率将达到 19.7%。

市场成长的驱动力是临床数据的爆炸性成长,而临床数据的爆炸性成长又得益于电子健康记录 (EHR)、连网医疗设备和远端监控解决方案的广泛应用,从而产生了对先进分析能力的迫切需求。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2033 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 金额(十亿美元) |

| 部分 | 按产品/服务、资料来源、使用案例、最终使用者、区域 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

人工智慧 (AI)、机器学习 (ML) 和高效能运算的进步使得资料处理速度更快、精度更高,从而能够从复杂的资料集中提取可操作的洞见。随着对真实世界数据 (RWE) 的限制逐渐放宽,医疗机构越来越多地利用分析技术来支持临床试验、治疗方案製定和基于价值的医疗模式,因此,RWE 的应用正在加速发展。此外,向个人化和精准医疗的转变也推动了对患者特定分析的需求,以优化诊断、治疗选择和治疗效果。对即时临床决策日益增长的需求,进一步凸显了临床分析作为关键工具在提高病人安全、减少医疗差错和提升医疗服务整体效率方面的作用。

临床分析市场中电子健康记录 (EHR) 细分市场显着增长的关键驱动因素是电子健康记录作为结构化和非结构化患者数据的主要来源,在高级分析和决策支援中的应用日益广泛。 EHR 系统收集各种临床信息,包括患者人口统计资讯、病历、诊断结果、治疗方案和治疗效果,为即时洞察和预测建模提供了至关重要的基础。随着互通性和标准化资料交换的日益重视,以及美国《21 世纪治疗方法》等法规和全球数位健康倡议的支持,EHR 资料与临床分析平台的整合正在加速推进。随着医疗服务提供者和支付方越来越依赖数据驱动策略来提高医疗品质和营运效率,EHR 系统能够实现更准确的风险分层、更早的疾病检测和个人化治疗方案,从而推动了其市场的强劲成长。

在对全面、高品质数据日益增长的需求推动下,原始资料区段,这些数据对于提供精准的洞察和预测分析至关重要。来自电子病历、实验室系统、影像设备和病患监测工具等来源的原始临床数据是高级分析的基础,使医疗机构能够识别趋势、评估人群健康状况并做出明智的决策。此外,数据驱动型策略和措施的日益普及,以及对多样化医疗数据集的标准化和整合,也进一步推动了对原始数据的需求,因为原始数据是分析平台的重要输入。

由于医疗服务提供者为改善患者疗效和提升营运效率而日益广泛地采用电子健康记录 (EHR)、远端医疗和人工智慧 (AI) 分析解决方案等数位健康技术,亚太地区的临床分析市场正快速成长。该地区医疗保健支出不断攀升,政府主导的智慧医院和医疗数位化措施不断扩大,医疗资讯IT基础设施投资也持续成长,尤其是在中国、印度和日本等国家。此外,慢性病盛行率的上升、人口老化以及对价值医疗的日益重视,都推动了对数据驱动型洞察、预测分析和人群健康管理解决方案的需求,进一步促进了亚太地区市场的成长。

本报告对全球临床分析市场进行了分析,并按产品/服务、数据来源、用例、最终用户、区域趋势以及参与市场的公司概况对其进行了细分。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 介绍

- 市场动态

- 影响客户业务的趋势/颠覆性因素

- 产业趋势

- 定价分析

- 供应链分析

- 生态系分析

- 投资和资金筹措方案

- 技术分析

- 专利分析

- 2025-2026 年主要会议和活动

- 案例研究分析

- 监管状态

- 波特五力分析

- 主要相关人员和采购标准

- 终端用户分析

- 经营模式分析

- 人工智慧/生成式人工智慧对临床分析市场的影响

- 2025年美国关税对临床分析市场的影响

6. 临床分析市场(依产品/服务分类)

- 介绍

- 原始数据

- 软体

- 平台

第七章:临床分析市场(依资料来源划分)

- 介绍

- 临床试验数据

- 计费数据

- 电子健康记录

- 註册登记和真实世界证据

- 影像诊断

- 实验室和病理学

- 多组体学数据

- 其他的

第八章 临床分析市场(按应用案例划分)

- 介绍

- 卫生保健

- 生命科学

第九章 临床分析市场(依最终使用者划分)

- 介绍

- 医疗保健提供者

- 医疗保健支付方

- 生命科学

- 其他的

第十章 临床分析市场(按地区划分)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东和非洲宏观经济展望

- 海湾合作委员会国家

- 南非

- 其他的

第十一章 竞争格局

- 概述

- 主要参与企业采取的策略

- 2020-2024年收入分析

- 2024年市占率分析

- 市场排名分析

- 估值和财务指标

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- IQVIA

- OPTUM, INC.

- MERATIVE

- EPIC SYSTEMS CORPORATION

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- ORACLE

- MCKESSON CORPORATION

- VERADIGM LLC

- INOVALON

- WNS(HOLDINGS)LTD.

- SOPHIA GENETICS

- COTIVITI, INC.

- HEALTH CATALYST

- COGNIZANT

- F. HOFFMANN-LA ROCHE LTD

- KONINKLIJKE PHILIPS NV

- DASSAULT SYSTEMES(MEDIDATA)

- ATHENAHEALTH, INC.

- VEEVA SYSTEMS

- ICON PLC

- ECLINICALWORKS

- ACCENTURE

- CVS HEALTH

- SAS INSTITUTE INC.

- 其他公司

- APRIQOT

- OLER HEALTH

- PERCIPIO HEALTH

- FERRUM HEALTH

- AMPLIFY HEALTH

第十三章附录

The clinical analytics market was valued at USD 33.09 billion in 2025 and is estimated to reach USD 81.32 billion by 2030, registering a CAGR of 19.7% during the forecast period. Market growth is driven by the explosion of clinical data, fueled by the widespread adoption of EHRs, connected medical devices, and remote monitoring solutions, creating a pressing need for advanced analytics capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offering, Data Source, Use Case, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

Advances in AI, machine learning (ML), and high-performance computing are enabling faster and more accurate data processing, unlocking actionable insights from complex datasets. Growing regulatory openness to real-world evidence (RWE) is further accelerating adoption, as healthcare organizations increasingly leverage analytics to support clinical trials, treatment planning, and value-based care models. Additionally, the shift toward personalized and precision medicine is driving demand for patient-specific analytics to optimize diagnostics, treatment selection, and outcomes. The increasing need for real-time clinical decision-making is reinforcing the role of clinical analytics as a critical tool for improving patient safety, reducing errors, and enhancing the overall efficiency of care delivery.

Based on the data source, the EHR segment is expected to record significant growth in the clinical analytics market during the forecast period.

A key driver for the significant growth of the EHR segment in the clinical analytics market is the increasing adoption of electronic health records as the primary source of structured and unstructured patient data used for advanced analytics and decision support. EHR systems capture a wide range of clinical information including patient demographics, medical history, diagnostics, treatment plans, and outcomes-making them a critical foundation for real-time insights and predictive modeling. The rising emphasis on interoperability and standardized data exchange, supported by regulations such as the US 21st Century Cures Act and global digital health initiatives, further accelerates the integration of EHR data into clinical analytics platforms. As healthcare providers and payers increasingly rely on data-driven strategies to improve care quality and operational performance, EHR systems enable more accurate risk stratification, early disease detection, and personalized treatment planning, fueling their strong market growth.

Based on the offering, the raw data segment is expected to hold a significant share in the clinical analytics market for 2024.

Driven by the growing need for comprehensive, high-quality data to support accurate insights and predictive analytics, the raw data segment is expected to hold a significant share in the clinical analytics market for 2024. Raw clinical data from sources such as EHRs, laboratory systems, imaging devices, and patient monitoring tools form the foundation for advanced analytics, enabling healthcare organizations to identify trends, assess population health, and make informed decisions. The increasing adoption of data-driven strategies and initiatives to standardize and integrate diverse healthcare datasets further fuels the demand for raw data as a critical input for analytics platforms.

The Asia Pacific market accounted for the fastest growth in the clinical analytics market for the forecast period.

A key driver for the rapid growth of the Asia Pacific clinical analytics market is the increasing adoption of digital health technologies, including EHRs, telemedicine, and AI-powered analytics solutions, by healthcare providers seeking to improve patient outcomes and operational efficiency. The region is witnessing rising healthcare expenditure, growing government initiatives to promote smart hospitals and healthcare digitization, and expanding investments in health IT infrastructure, particularly in countries like China, India, and Japan. Additionally, the rising prevalence of chronic diseases, aging populations, and a growing focus on value-based care are driving demand for data-driven insights, predictive analytics, and population health management solutions, further accelerating market growth in the Asia Pacific region.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the clinical analytics market.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (41%), Tier 2 (31%), and Tier 3 (28%)

- By Designation - C Level (44%), Directors (31%), and Others (25%)

- By Region - North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), Middle East & Africa (3%)

Key Players in the Clinical Analytics Market

Prominent players in the clinical analytics market include Optum, Inc. (UnitedHealth Group) (US), Epic Systems Corporation (US), GE HealthCare (US), Siemens Healthineers (Germany), Oracle Health Sciences (US), McKesson Corporation (US), Veradigm LLC (US), IQVIA (US), Cotiviti Inc. (US), Health Catalyst (US), Cognizant (US), Koninklijke Philips N.V. (Netherlands), Dassault Systemes (France), Athenahealth, Inc. (US), Veeva Systems (US), ICON plc (Ireland), eClinicalWorks (US), Accenture (Ireland), CVS Health (US), Inovalon (US), WNS (Holdings) Ltd. (UK), Merative (US), SOPHiA GENETICS (Switzerland), F. Hoffmann-La Roche Ltd (Roche)(FLATIRON HEALTH) (US), SAS Institute, Inc. (US).

Market players are focusing on organic as well as inorganic growth strategies such as product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances to broaden their offerings, cater to the unmet needs of customers, increase profitability, and expand their presence in the global market.

The study includes an in-depth competitive analysis of these key players in the clinical analytics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

- The report studies the clinical analytics market based on offering, data source, use case, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the global clinical analytics market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the following five strategies.

This report provides insights into the following pointers:

- Analysis of key drivers (healthcare data from diverse sources fuels advanced analytics and deeper insights, Payers and providers use outcome metrics to enhance population health and care quality, value-based care & reimbursement pressure, explosion of clinic macro dynamic industry and compute, adoption of cloud & modern data platforms, regulatory openness to RWE, shift toward personalized and precision medicine, increasing need for real-time clinical decision-making), restraints (data privacy & regulatory constraints, data quality & standardization issues, high implementation cost & unclear ROI), opportunities (analytics for decentralized & hybrid clinical trials, edge & on-device analytics for remote monitoring), and challenges (model validation & clinical evidence, biased training data, vendor lock in & migration risk.) influencing the industry macro dynamics of clinical analytics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the clinical analytics market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes clinical analytics across varied regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the clinical analytics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the clinical analytics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 RESEARCH METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CLINICAL ANALYTICS MARKET OVERVIEW

- 4.2 CLINICAL ANALYTICS MARKET, BY USE CASE AND REGION

- 4.3 CLINICAL ANALYTICS MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 CLINICAL ANALYTICS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid growth of clinical data

- 5.2.1.2 Ongoing transition from fee-for-service models to value-based care

- 5.2.1.3 Rising advancements in AI/ML and computing capabilities

- 5.2.1.4 Increasing acceptance of real-world evidence

- 5.2.1.5 Growing recognition of social determinants of health

- 5.2.1.6 Rising volume of clinical trials

- 5.2.1.7 Expanding healthcare data

- 5.2.1.8 Increasing use of outcome metrics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and regulatory constraints

- 5.2.2.2 Data quality and standardization issues

- 5.2.2.3 High implementation cost and unclear return on investment

- 5.2.2.4 Interoperability gaps and prevalence of legacy IT systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of decentralized and hybrid clinical trial models

- 5.2.3.2 Increasing adoption of edge computing and on-device analytics

- 5.2.3.3 Increasing use of embedded workflow analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of biased or unrepresentative training data

- 5.2.4.2 Vendor lock-in and migration risk

- 5.2.4.3 Pricing and contracting complexities

- 5.2.4.4 Data governance and provenance issues

- 5.2.4.5 Model validation and clinical evidence challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 GENERATIVE AI FOR CLINICAL REASONING

- 5.4.2 REAL-WORLD EVIDENCE AND DECENTRALIZED TRIALS

- 5.4.3 VALUE-BASED CARE AND POPULATION HEALTH ANALYTICS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.5.3 QUALITATIVE PRICING MODELS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Predictive analytics and risk stratification

- 5.9.1.2 Health Information Exchange (HIE) platforms

- 5.9.1.3 Clinical Decision Support Systems (CDSS)

- 5.9.1.4 Machine Learning (ML) and Deep Learning (DL)

- 5.9.1.5 Natural Language Processing (NLP)

- 5.9.1.6 Data visualization & business intelligence tools

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Blockchain

- 5.9.2.2 Internet of Medical Things (IoMT)

- 5.9.2.3 Robotic Process Automation (RPA)

- 5.9.2.4 FHIR/HL7 Interoperability Standards

- 5.9.2.5 Digital twin technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Virtual clinical trial platforms

- 5.9.3.2 Digital Therapeutics (DTx)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS

- 5.10.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ENHANCED PATIENT FLOW AND REDUCED EMERGENCY DEPARTMENT CONGESTION USING REAL-TIME OPERATIONAL ANALYTICS

- 5.12.2 IMPROVED GENOMIC DATA INTERPRETATION THROUGH AI-POWERED GENOMIC ANALYTICS

- 5.12.3 ENHANCED PROVIDER PERFORMANCE USING ADVANCED CLINICAL ANALYTICS

- 5.12.4 OPTIMIZING CARE DELIVERY THROUGH PREDICTIVE MODEL INTEGRATION

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODEL ANALYSIS

- 5.17.1 LICENSE-BASED BUSINESS MODEL

- 5.17.2 SUBSCRIPTION-BASED BUSINESS MODEL

- 5.17.3 SOFTWARE-AS-A-SERVICE (SAAS) BUSINESS MODEL

- 5.17.4 PAY-PER-USE BUSINESS MODEL

- 5.17.5 FREEMIUM BUSINESS MODEL

- 5.17.6 INTEGRATED SERVICE AND SOFTWARE BUNDLE BUSINESS MODEL

- 5.17.7 OUTCOME-BASED OR VALUE-BASED BUSINESS MODEL

- 5.17.8 SOFTWARE AS A MEDICAL DEVICE (SAMD) BUSINESS MODEL

- 5.18 IMPACT OF AI/GEN AI ON CLINICAL ANALYTICS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN CLINICAL ANALYTICS ECOSYSTEM

- 5.18.3 KEY USE CASES

- 5.18.4 AI CASE STUDY

- 5.18.4.1 Case Study 1: AI-powered analytics platform for patient satisfaction

- 5.18.4.2 Case Study 2: Next-generation predictive modelling solution for operational efficiency

- 5.18.5 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.5.1 AI in patient engagement & support platforms

- 5.18.5.2 AI in healthcare operations & management tools

- 5.18.5.3 AI in personalized health & wellness coaching

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 User readiness

- 5.18.6.1.1 User A: Healthcare providers

- 5.18.6.1.2 User B: Healthcare payers

- 5.18.6.1.3 User C: Life science companies

- 5.18.6.2 Impact assessment

- 5.18.6.2.1 User A: Healthcare providers

- 5.18.6.2.1.1 Implementation

- 5.18.6.2.1.2 Impact

- 5.18.6.2.2 User B: Healthcare payers

- 5.18.6.2.2.1 Implementation

- 5.18.6.2.2.2 Impact

- 5.18.6.2.3 User C: Life sciences

- 5.18.6.2.3.1 Implementation

- 5.18.6.2.3.2 Impact

- 5.18.6.2.1 User A: Healthcare providers

- 5.18.6.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON CLINICAL ANALYTICS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 CLINICAL ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 RAW DATA

- 6.2.1 NEED FOR REAL-WORLD EVIDENCE, OUTCOMES, AND RESEARCH TO DRIVE MARKET

- 6.3 SOFTWARE

- 6.3.1 IMPROVED CLINICAL, OPERATIONAL, AND FINANCIAL INTELLIGENCE TO BOOST MARKET

- 6.4 PLATFORM

- 6.4.1 INCREASING DIGITIZATION OF HEALTHCARE SYSTEMS TO FUEL MARKET

7 CLINICAL ANALYTICS MARKET, BY DATA SOURCE

- 7.1 INTRODUCTION

- 7.2 CLINICAL TRIALS DATA

- 7.2.1 ABILITY TO PROVIDE ROBUST, STRUCTURED, AND HIGH-QUALITY INFORMATION TO CONTRIBUTE TO GROWTH

- 7.3 CLAIMS DATA

- 7.3.1 INCREASING USE OF CLAIMS DATA BY HEALTHCARE INSTITUTIONS AND PAYERS TO EXPEDITE GROWTH

- 7.4 ELECTRONIC HEALTH RECORDS

- 7.4.1 RISING FOCUS ON PATIENT OUTCOMES, RISK STRATIFICATION, AND EARLY DETECTION OF CLINICAL DETERIORATION TO AID GROWTH

- 7.5 REGISTRIES & RWE

- 7.5.1 GROWING EMPHASIS VALUE-BASED CARE, PERSONALIZED TREATMENT, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 7.6 IMAGING & DIAGNOSTICS

- 7.6.1 RISING DEMAND FOR PRECISION DIAGNOSTICS AND EVIDENCE-BASED TREATMENT PLANNING TO PROMOTE GROWTH

- 7.7 LAB & PATHOLOGY

- 7.7.1 INCREASING USE OF HIGH-THROUGHPUT TECHNOLOGIES TO SPUR GROWTH

- 7.8 MULTIOMICS DATA

- 7.8.1 RAPID ADVANCEMENT OF NEXT-GENERATION SEQUENCING, MASS SPECTROMETRY, AND SINGLE-CELL TECHNOLOGIES TO FAVOR GROWTH

- 7.9 OTHER DATA SOURCES

8 CLINICAL ANALYTICS MARKET, BY USE CASE

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE USE CASES

- 8.2.1 CLINICAL DECISION SUPPORT

- 8.2.1.1 Growing complexity of patient care and rising prevalence of chronic diseases to drive market

- 8.2.2 POPULATION HEALTH & RISK STRATIFICATION

- 8.2.2.1 Ability to drive proactive, preventive care to facilitate growth

- 8.2.3 QUALITY COMPLIANCE & REPORTING

- 8.2.3.1 Rising focus on enhancing integrity, transparency, and regulatory adherence to support growth

- 8.2.4 OPERATIONAL & CAPACITY ANALYTICS

- 8.2.4.1 Growing focus on optimized healthcare services to fuel market

- 8.2.5 REMOTE PATIENT MONITORING

- 8.2.5.1 Need for continuous data-driven patient care to spur growth

- 8.2.6 OTHER HEALTHCARE USE CASES

- 8.2.1 CLINICAL DECISION SUPPORT

- 8.3 LIFE SCIENCE USE CASES

- 8.3.1 R&D & CLINICAL DEVELOPMENT

- 8.3.1.1 Increasing adoption of predictive modeling and simulation tools to aid growth

- 8.3.2 SAFETY & PHARMACOVIGILANCE

- 8.3.2.1 Enhanced drug safety to contribute to growth

- 8.3.3 PRECISION & TRANSLATIONAL CLINICAL ANALYTICS

- 8.3.3.1 Ability to drive precision medicine through data-driven translational insights to favor growth

- 8.3.4 REGULATORY EVIDENCE ANALYTICS

- 8.3.4.1 Evolving regulatory landscape to bolster growth

- 8.3.5 HEOR & RWE ANALYTICS

- 8.3.5.1 Increasing strategic collaborations and technological innovations to boost market

- 8.3.6 OTHER LIFE SCIENCE USE CASES

- 8.3.1 R&D & CLINICAL DEVELOPMENT

9 CLINICAL ANALYTICS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HEALTHCARE PROVIDERS

- 9.2.1 HOSPITALS & CLINICS

- 9.2.1.1 Increasing adoption of clinical analytics in hospitals and clinics to support growth

- 9.2.2 AMBULATORY CARE SERVICES

- 9.2.2.1 Need to improve quality outcomes and reduce avoidable hospital admissions to foster growth

- 9.2.3 DIAGNOSTIC CENTERS

- 9.2.3.1 Rising shift toward precision medicine and value-based care models to stimulate growth

- 9.2.4 SPECIALTY PRACTICE PROVIDERS

- 9.2.4.1 Growing prevalence of chronic and complex diseases care to boost market

- 9.2.5 OTHER HEALTHCARE PROVIDERS

- 9.2.1 HOSPITALS & CLINICS

- 9.3 HEALTHCARE PAYERS

- 9.3.1 NEED TO IMPROVE RETURN ON INVESTMENT TO ENCOURAGE GROWTH

- 9.4 LIFE SCIENCES

- 9.4.1 PHARMACEUTICALS & BIOTECH COMPANIES

- 9.4.1.1 Increasing complexity of therapeutic development to augment growth

- 9.4.2 MEDTECH COMPANIES

- 9.4.2.1 Need to accelerate product development cycles and economic value to propel market

- 9.4.3 OTHER LIFE SCIENCE END USERS

- 9.4.1 PHARMACEUTICALS & BIOTECH COMPANIES

- 9.5 OTHER END USERS

10 CLINICAL ANALYTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Growing advancements in machine learning, predictive modeling, and natural language processing to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing prevalence of chronic diseases and accelerated digital transformation in healthcare to fuel market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Comprehensive digital health policy framework and significant federal investment in healthcare modernization to aid growth

- 10.3.3 FRANCE

- 10.3.3.1 Strong commitment to digital health transformation and robust institutional research ecosystem to foster growth

- 10.3.4 UK

- 10.3.4.1 Favorable investments and digital health strategy to contribute to growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing emphasis on digital health record systems and healthcare research to stimulate growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing public investment in data-driven healthcare and national mental health strategies to boost market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising focus on modernizing healthcare delivery and enhancing patient outcomes to expedite growth

- 10.4.3 JAPAN

- 10.4.3.1 Booming geriatric population and advanced technological ecosystem to amplify growth

- 10.4.4 INDIA

- 10.4.4.1 Rapid adoption of electronic health records to accelerate growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing prevalence of chronic and lifestyle-related conditions to aid growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Rising integration of AI-driven analytics in healthcare systems to encourage growth

- 10.5.3 MEXICO

- 10.5.3.1 Rising burden of non-communicable diseases to facilitate growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Saudi Arabia

- 10.6.2.1.1 Growing adoption of electronic health records and centralized digital platforms to fuel market

- 10.6.2.2 UAE

- 10.6.2.2.1 Favorable policy and regulatory environment to promote growth

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Saudi Arabia

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Robust public and private health systems to facilitate growth

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLINICAL ANALYTICS MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 MARKET RANKING ANALYSIS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Offering footprint

- 11.8.5.4 Data source footprint

- 11.8.5.5 Use case footprint

- 11.8.5.6 End-user footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 IQVIA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 OPTUM, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 MERATIVE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 EPIC SYSTEMS CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 GE HEALTHCARE

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SIEMENS HEALTHINEERS AG

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.7 ORACLE

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 MCKESSON CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 VERADIGM LLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 INOVALON

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.10.3.2 Deals

- 12.1.11 WNS (HOLDINGS) LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 SOPHIA GENETICS

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches and approvals

- 12.1.12.3.2 Deals

- 12.1.13 COTIVITI, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches and approvals

- 12.1.13.3.2 Deals

- 12.1.14 HEALTH CATALYST

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches and approvals

- 12.1.14.3.2 Deals

- 12.1.15 COGNIZANT

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches and approvals

- 12.1.15.3.2 Deals

- 12.1.16 F. HOFFMANN-LA ROCHE LTD

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches and approvals

- 12.1.16.3.2 Deals

- 12.1.17 KONINKLIJKE PHILIPS N.V.

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches and approvals

- 12.1.17.3.2 Deals

- 12.1.18 DASSAULT SYSTEMES (MEDIDATA)

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches and approvals

- 12.1.18.3.2 Deals

- 12.1.19 ATHENAHEALTH, INC.

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product launches and approvals

- 12.1.19.3.2 Deals

- 12.1.20 VEEVA SYSTEMS

- 12.1.20.1 Business overview

- 12.1.20.2 Products offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches and approvals

- 12.1.20.3.2 Deals

- 12.1.21 ICON PLC

- 12.1.21.1 Business overview

- 12.1.21.2 Products offered

- 12.1.21.3 Recent developments

- 12.1.21.3.1 Product launches and approvals

- 12.1.21.3.2 Deals

- 12.1.22 ECLINICALWORKS

- 12.1.22.1 Business overview

- 12.1.22.2 Products offered

- 12.1.22.3 Recent developments

- 12.1.22.3.1 Product launches and approvals

- 12.1.22.3.2 Deals

- 12.1.23 ACCENTURE

- 12.1.23.1 Business overview

- 12.1.23.2 Products offered

- 12.1.23.3 Recent developments

- 12.1.23.3.1 Deals

- 12.1.24 CVS HEALTH

- 12.1.24.1 Business overview

- 12.1.24.2 Products offered

- 12.1.24.3 Recent developments

- 12.1.24.3.1 Product launches and approvals

- 12.1.24.3.2 Deals

- 12.1.25 SAS INSTITUTE INC.

- 12.1.25.1 Business overview

- 12.1.25.2 Products offered

- 12.1.25.3 Recent developments

- 12.1.25.3.1 Product launches and approvals

- 12.1.25.3.2 Deals

- 12.1.1 IQVIA

- 12.2 OTHER PLAYERS

- 12.2.1 APRIQOT

- 12.2.2 OLER HEALTH

- 12.2.3 PERCIPIO HEALTH

- 12.2.4 FERRUM HEALTH

- 12.2.5 AMPLIFY HEALTH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CLINICAL ANALYTICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2022-2025

- TABLE 3 CLINICAL ANALYTICS MARKET: RISK ASSESSMENT

- TABLE 4 CLINICAL ANALYTICS MARKET: IMPACT ANALYSIS

- TABLE 5 INDICATIVE PRICE OF CLINICAL ANALYTICS SOLUTIONS, BY KEY PLAYER, 2024 (USD)

- TABLE 6 INDICATIVE PRICE OF CLINICAL ANALYTICS SOFTWARE (USD)

- TABLE 7 INDICATIVE PRICE OF CLINICAL ANALYTICS SOLUTIONS, BY REGION, 2024 (USD)

- TABLE 8 CLINICAL ANALYTICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 CLINICAL ANALYTICS MARKET: KEY TECHNOLOGIES

- TABLE 10 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR CLINICAL ANALYTICS SOLUTIONS

- TABLE 11 CLINICAL ANALYTICS MARKET: LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 12 CLINICAL ANALYTICS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 REGULATORY REQUIREMENTS IN NORTH AMERICA

- TABLE 14 REGULATORY REQUIREMENTS IN EUROPE

- TABLE 15 REGULATORY REQUIREMENTS IN ASIA PACIFIC

- TABLE 16 REGULATORY REQUIREMENTS IN LATIN AMERICA

- TABLE 17 REGULATORY REQUIREMENTS IN MIDDLE EAST & AFRICA

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REGULATORY STANDARDS IN CLINICAL ANALYTICS MARKET

- TABLE 22 CLINICAL ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 24 KEY BUYING CRITERIA, BY END USER

- TABLE 25 UNMET NEEDS IN CLINICAL ANALYTICS MARKET

- TABLE 26 END-USER EXPECTATIONS IN CLINICAL ANALYTICS MARKET

- TABLE 27 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 29 CLINICAL ANALYTICS PRODUCTS FOR RAW DATA OFFERED BY MAJOR PLAYERS

- TABLE 30 CLINICAL ANALYTICS MARKET FOR RAW DATA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 CLINICAL ANALYTICS SOFTWARE OFFERED BY MAJOR PLAYERS

- TABLE 32 CLINICAL ANALYTICS MARKET FOR SOFTWARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 CLINICAL ANALYTICS PLATFORMS OFFERED BY MAJOR PLAYERS

- TABLE 34 CLINICAL ANALYTICS MARKET FOR PLATFORM, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 36 CLINICAL ANALYTICS PRODUCTS FOR CLINICAL TRIALS DATA OFFERED BY MAJOR PLAYERS

- TABLE 37 CLINICAL ANALYTICS MARKET FOR CLINICAL TRIALS DATA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 CLINICAL ANALYTICS PRODUCTS FOR CLAIMS DATA OFFERED BY MAJOR PLAYERS

- TABLE 39 CLINICAL ANALYTICS MARKET FOR CLAIMS DATA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 CLINICAL ANALYTICS PRODUCTS FOR EHR OFFERED BY MAJOR PLAYERS

- TABLE 41 CLINICAL ANALYTICS MARKET FOR EHR, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 CLINICAL ANALYTICS PRODUCTS FOR REGISTRIES & RWE OFFERED BY MAJOR PLAYERS

- TABLE 43 CLINICAL ANALYTICS MARKET FOR REGISTRIES & RWE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 CLINICAL ANALYTICS PRODUCTS FOR IMAGING & DIAGNOSTICS OFFERED BY MAJOR PLAYERS

- TABLE 45 CLINICAL ANALYTICS MARKET FOR IMAGING & DIAGNOSTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 CLINICAL ANALYTICS PRODUCTS FOR LAB & PATHOLOGY OFFERED BY MAJOR PLAYERS

- TABLE 47 CLINICAL ANALYTICS MARKET FOR LAB & PATHOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 CLINICAL ANALYTICS PRODUCTS FOR MULTIOMICS DATA OFFERED BY MAJOR PLAYERS

- TABLE 49 CLINICAL ANALYTICS MARKET FOR MULTIOMICS DATA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 CLINICAL ANALYTICS PRODUCTS FOR OTHER DATA SOURCES OFFERED BY MAJOR PLAYERS

- TABLE 51 CLINICAL ANALYTICS MARKET FOR OTHER DATA SOURCES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 53 CLINICAL ANALYTICS PRODUCTS FOR HEALTHCARE USE CASES OFFERED BY MAJOR PLAYERS

- TABLE 54 CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 55 CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 CLINICAL ANALYTICS MARKET FOR CLINICAL DECISION SUPPORT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 CLINICAL ANALYTICS MARKET FOR POPULATION HEALTH & RISK STRATIFICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 CLINICAL ANALYTICS MARKET FOR QUALITY COMPLIANCE & REPORTING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 CLINICAL ANALYTICS MARKET FOR OPERATIONAL & CAPACITY ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 CLINICAL ANALYTICS MARKET FOR REMOTE PATIENT MONITORING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 CLINICAL ANALYTICS MARKET FOR OTHER USE CASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 CLINICAL ANALYTICS PRODUCTS FOR LIFE SCIENCE USE CASES BY MAJOR PLAYERS

- TABLE 63 CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 CLINICAL ANALYTICS MARKET FOR R&D & CLINICAL DEVELOPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 CLINICAL ANALYTICS MARKET FOR SAFETY & PHARMACOVIGILANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 CLINICAL ANALYTICS MARKET FOR PRECISION & TRANSLATIONAL CLINICAL ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 CLINICAL ANALYTICS MARKET FOR REGULATORY EVIDENCE ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 CLINICAL ANALYTICS MARKET FOR HEOR & RWE ANALYTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 CLINICAL ANALYTICS MARKET FOR OTHER LIFE SCIENCE USE CASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 72 CLINICAL ANALYTICS PRODUCTS FOR HEALTHCARE PROVIDERS OFFERED BY MAJOR PLAYERS

- TABLE 73 CLINICAL ANALYTICS MARKET FOR BY HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 CLINICAL ANALYTICS MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 CLINICAL ANALYTICS MARKET FOR AMBULATORY CARE SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 CLINICAL ANALYTICS MARKET FOR DIAGNOSTIC CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 CLINICAL ANALYTICS MARKET FOR SPECIALTY PRACTICE PROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 CLINICAL ANALYTICS MARKET FOR OTHER HEALTHCARE PROVIDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 CLINICAL ANALYTICS PRODUCTS FOR HEALTHCARE PAYERS OFFERED BY MAJOR PLAYERS

- TABLE 81 CLINICAL ANALYTICS MARKET FOR HEALTHCARE PAYERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 CLINICAL ANALYTICS PRODUCTS FOR LIFE SCIENCES OFFERED BY MAJOR PLAYERS

- TABLE 83 CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 CLINICAL ANALYTICS MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 CLINICAL ANALYTICS MARKET FOR MEDTECH COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 CLINICAL ANALYTICS MARKET FOR OTHER LIFE SCIENCE END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 CLINICAL ANALYTICS PRODUCTS FOR OTHER END USERS OFFERED BY MAJOR PLAYERS

- TABLE 89 CLINICAL ANALYTICS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 CLINICAL ANALYTICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 92 NORTH AMERICA: CLINICAL ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 US: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 102 US: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 103 US: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 104 US: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 US: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 US: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 US: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 US: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 111 CANADA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 112 CANADA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 CANADA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 CANADA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 115 CANADA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 CANADA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 118 EUROPE: CLINICAL ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 EUROPE: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 GERMANY: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 128 GERMANY: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 129 GERMANY: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 130 GERMANY: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 GERMANY: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 GERMANY: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 GERMANY: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 GERMANY: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 FRANCE: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 136 FRANCE: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 137 FRANCE: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 138 FRANCE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 FRANCE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 FRANCE: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 141 FRANCE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 FRANCE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 UK: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 144 UK: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 145 UK: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 146 UK: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 UK: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 UK: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 UK: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 UK: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 ITALY: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 152 ITALY: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 153 ITALY: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 154 ITALY: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 ITALY: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 ITALY: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 157 ITALY: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 ITALY: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 160 SPAIN: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 161 SPAIN: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 162 SPAIN: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 SPAIN: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 SPAIN: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 SPAIN: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 SPAIN: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF EUROPE: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF EUROPE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 176 ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 CHINA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 186 CHINA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 187 CHINA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 188 CHINA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 CHINA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 CHINA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 191 CHINA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 CHINA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 JAPAN: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 194 JAPAN: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 195 JAPAN: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 196 JAPAN: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 JAPAN: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 JAPAN: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 199 JAPAN: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 JAPAN: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 INDIA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 202 INDIA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 203 INDIA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 204 INDIA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 INDIA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 INDIA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 207 INDIA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 INDIA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 SOUTH KOREA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 210 SOUTH KOREA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 211 SOUTH KOREA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 212 SOUTH KOREA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 SOUTH KOREA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 SOUTH KOREA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 SOUTH KOREA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 SOUTH KOREA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 226 LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 227 LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 228 LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 BRAZIL: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 236 BRAZIL: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 237 BRAZIL: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 238 BRAZIL: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 BRAZIL: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 BRAZIL: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 241 BRAZIL: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 BRAZIL: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 MEXICO: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 244 MEXICO: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 245 MEXICO: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 246 MEXICO: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 MEXICO: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 MEXICO: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 249 MEXICO: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 MEXICO: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 252 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 253 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 254 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 257 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 REST OF LATIN AMERICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 260 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 270 GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 271 GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 272 GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 275 GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 SAUDI ARABIA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 278 SAUDI ARABIA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 279 SAUDI ARABIA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 280 SAUDI ARABIA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 SAUDI ARABIA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 SAUDI ARABIA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 283 SAUDI ARABIA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 SAUDI ARABIA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 UAE: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 286 UAE: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 287 UAE: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 288 UAE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 UAE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 UAE: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 UAE: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 UAE: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 294 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 295 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 296 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 299 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 REST OF GCC COUNTRIES: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 SOUTH AFRICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 302 SOUTH AFRICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 303 SOUTH AFRICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 304 SOUTH AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 SOUTH AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 SOUTH AFRICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 307 SOUTH AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 SOUTH AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2023-2030 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY USE CASE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCE USE CASES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: CLINICAL ANALYTICS MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST AND AFRICA: CLINICAL ANALYTICS MARKET FOR LIFE SCIENCES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLINICAL ANALYTICS MARKET, JANUARY 2022-OCTOBER 2025

- TABLE 318 CLINICAL ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 319 CLINICAL ANALYTICS MARKET: COMPANY FOOTPRINT

- TABLE 320 CLINICAL ANALYTICS MARKET: REGION FOOTPRINT

- TABLE 321 CLINICAL ANALYTICS MARKET: OFFERING FOOTPRINT

- TABLE 322 CLINICAL ANALYTICS MARKET: DATA SOURCE FOOTPRINT

- TABLE 323 CLINICAL ANALYTICS MARKET: USE CASE FOOTPRINT

- TABLE 324 CLINICAL ANALYTICS MARKET: END-USER FOOTPRINT

- TABLE 325 CLINICAL ANALYTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 326 CLINICAL ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 327 CLINICAL ANALYTICS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 328 CLINICAL ANALYTICS MARKET: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 329 CLINICAL ANALYTICS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 330 IQVIA: COMPANY OVERVIEW

- TABLE 331 IQVIA: PRODUCTS OFFERED

- TABLE 332 IQVIA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 333 IQVIA: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 334 OPTUM, INC.: COMPANY OVERVIEW

- TABLE 335 OPTUM, INC.: PRODUCTS OFFERED

- TABLE 336 OPTUM, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 337 OPTUM, INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 338 MERATIVE: COMPANY OVERVIEW

- TABLE 339 MERATIVE: PRODUCTS OFFERED

- TABLE 340 MERATIVE: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 341 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 342 EPIC SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 343 EPIC SYSTEMS CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 344 EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 345 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 346 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 347 GE HEALTHCARE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 348 GE HEALTHCARE: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 349 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 350 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 351 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 352 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 353 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 354 SIEMENS HEALTHINEERS AG: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 355 ORACLE: COMPANY OVERVIEW

- TABLE 356 ORACLE: PRODUCTS OFFERED

- TABLE 357 ORACLE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 358 ORACLE: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 359 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 360 MCKESSON CORPORATION: PRODUCTS OFFERED

- TABLE 361 MCKESSON CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 362 MCKESSON CORPORATION: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 363 MCKESSON CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 364 VERADIGM LLC: COMPANY OVERVIEW

- TABLE 365 VERADIGM LLC: PRODUCTS OFFERED

- TABLE 366 VERADIGM LLC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 367 VERADIGM LLC: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 368 VERADIGM LLC: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 369 INOVALON: COMPANY OVERVIEW

- TABLE 370 INOVALON: PRODUCTS OFFERED

- TABLE 371 INOVALON: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 372 INOVALON: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 373 WNS (HOLDINGS) LTD.: COMPANY OVERVIEW

- TABLE 374 WNS (HOLDINGS) LTD.: PRODUCTS OFFERED

- TABLE 375 WNS (HOLDINGS) LTD.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 376 WNS (HOLDINGS) LTD.: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 377 SOPHIA GENETICS: COMPANY OVERVIEW

- TABLE 378 SOPHIA GENETICS: PRODUCTS OFFERED

- TABLE 379 SOPHIA GENETICS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 380 SOPHIA GENETICS: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 381 COTIVITI, INC.: COMPANY OVERVIEW

- TABLE 382 COTIVITI, INC.: PRODUCTS OFFERED

- TABLE 383 COTIVITI, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 384 COTIVITI, INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 385 HEALTH CATALYST: COMPANY OVERVIEW

- TABLE 386 HEALTH CATALYST: PRODUCTS OFFERED

- TABLE 387 HEALTH CATALYST: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 388 HEALTH CATALYST: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 389 COGNIZANT: COMPANY OVERVIEW

- TABLE 390 COGNIZANT: PRODUCTS OFFERED

- TABLE 391 COGNIZANT: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 392 COGNIZANT: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 393 F. HOFFMANN-LA ROCHE LTD: COMPANY OVERVIEW

- TABLE 394 F. HOFFMANN-LA ROCHE LTD: PRODUCTS OFFERED

- TABLE 395 F. HOFFMANN-LA ROCHE LTD: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 396 F. HOFFMANN-LA ROCHE LTD: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 397 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 398 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 399 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 400 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 401 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 402 DASSAULT SYSTEMES: PRODUCTS OFFERED

- TABLE 403 DASSAULT SYSTEMES: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 404 DASSAULT SYSTEMES: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 405 ATHENAHEALTH, INC.: COMPANY OVERVIEW

- TABLE 406 ATHENAHEALTH, INC.: PRODUCTS OFFERED

- TABLE 407 ATHENAHEALTH, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 408 ATHENAHEALTH, INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 409 VEEVA SYSTEMS: COMPANY OVERVIEW

- TABLE 410 VEEVA SYSTEMS: PRODUCTS OFFERED

- TABLE 411 VEEVA SYSTEMS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 412 VEEVA SYSTEMS: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 413 ICON PLC: COMPANY OVERVIEW

- TABLE 414 ICON PLC: PRODUCTS OFFERED

- TABLE 415 ICON PLC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 416 ICON PLC: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 417 ECLINICALWORKS: COMPANY OVERVIEW

- TABLE 418 ECLINICALWORKS: PRODUCTS OFFERED

- TABLE 419 ECLINICALWORKS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 420 ECLINICALWORKS: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 421 ACCENTURE: COMPANY OVERVIEW

- TABLE 422 ACCENTURE: PRODUCTS OFFERED

- TABLE 423 ACCENTURE: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 424 CVS HEALTH: COMPANY OVERVIEW

- TABLE 425 CVS HEALTH: PRODUCTS OFFERED

- TABLE 426 CVS HEALTH: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 427 CVS HEALTH: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 428 SAS INSTITUTE INC.: COMPANY OVERVIEW

- TABLE 429 SAS INSTITUTE INC.: PRODUCTS OFFERED

- TABLE 430 SAS INSTITUTE INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 431 SAS INSTITUTE INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 432 APRIQOT: COMPANY OVERVIEW

- TABLE 433 OLER HEALTH: COMPANY OVERVIEW

- TABLE 434 PERCIPIO HEALTH: COMPANY OVERVIEW

- TABLE 435 FERRUM HEALTH: COMPANY OVERVIEW

- TABLE 436 AMPLIFY HEALTH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CLINICAL ANALYTICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 CLINICAL ANALYTICS MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 CLINICAL ANALYTICS MARKET, BY DATA SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 CLINICAL ANALYTICS MARKET, BY USE CASE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 CLINICAL ANALYTICS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 CLINICAL ANALYTICS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 15 EXPANDING HEALTHCARE INFRASTRUCTURE AND GROWING ADOPTION OF AI TO DRIVE MARKET

- FIGURE 16 HEALTHCARE USE CASES AND US LED NORTH AMERICAN MARKET IN 2024

- FIGURE 17 INDIA TO HAVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 CLINICAL ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 CLINICAL ANALYTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 CLINICAL ANALYTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 CLINICAL ANALYTICS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 24 JURISDICTION AND TOP APPLICANT ANALYSIS CLINICAL ANALYTICS SOLUTIONS

- FIGURE 25 CLINICAL ANALYTICS MARKET: PATENT ANALYSIS, JANUARY 2015-SEPTEMBER 2025

- FIGURE 26 CLINICAL ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 28 KEY BUYING CRITERIA, BY END USER

- FIGURE 29 MARKET POTENTIAL OF CLINICAL ANALYTICS ACROSS INDUSTRIES

- FIGURE 30 PRICE IMPACT ANALYSIS

- FIGURE 31 NORTH AMERICA: CLINICAL ANALYTICS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: CLINICAL ANALYTICS MARKET SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN CLINICAL ANALYTICS MARKET, 2020-2024

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS IN CLINICAL ANALYTICS MARKET, 2024

- FIGURE 35 CLINICAL ANALYTICS MARKET: KEY PLAYERS, 2024

- FIGURE 36 EV/EBITDA OF KEY VENDORS

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 38 CLINICAL ANALYTICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 CLINICAL ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 CLINICAL ANALYTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 IQVIA: COMPANY SNAPSHOT (2024)

- FIGURE 42 OPTUM, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 44 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 45 ORACLE: COMPANY SNAPSHOT (2024)

- FIGURE 46 MCKESSON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 VERADIGM LLC: COMPANY SNAPSHOT (2022)

- FIGURE 48 WNS (HOLDINGS) LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 49 SOPHIA GENETICS: COMPANY SNAPSHOT (2024)

- FIGURE 50 HEALTH CATALYST: COMPANY SNAPSHOT (2024)

- FIGURE 51 COGNIZANT: COMPANY SNAPSHOT (2024)

- FIGURE 52 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT (2024)

- FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 54 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 55 VEEVA SYSTEMS: COMPANY SNAPSHOT (2024)

- FIGURE 56 ICON PLC: COMPANY SNAPSHOT (2024)

- FIGURE 57 ACCENTURE: COMPANY SNAPSHOT (2024)

- FIGURE 58 CVS HEALTH: COMPANY SNAPSHOT (2024)