|

市场调查报告书

商品编码

1876463

全球血管影像市场(至2030年)依产品类型、应用和最终用户划分Vascular Imaging Market by Product Type, Application, End User - Global Forecast to 2030 |

||||||

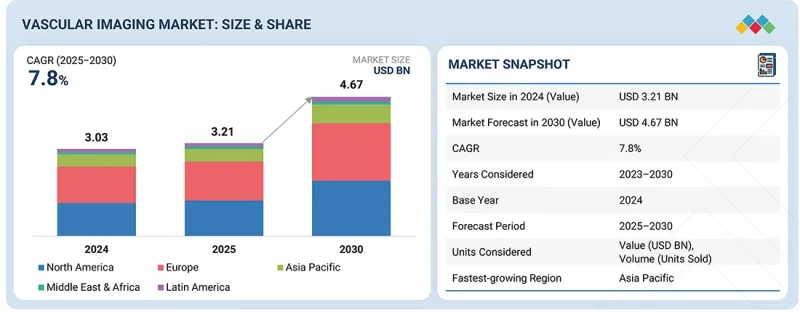

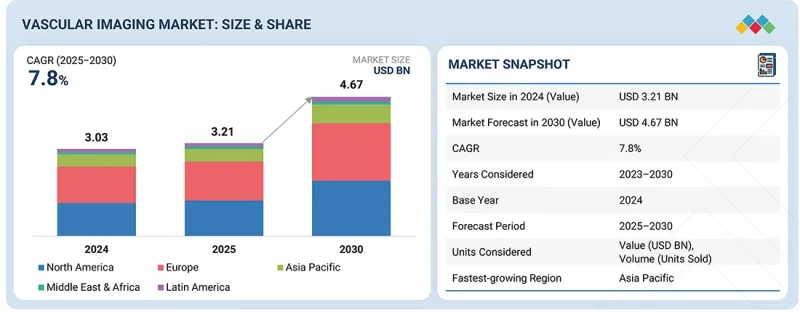

全球血管影像市场预计将从 2025 年的 31.9 亿美元成长到 2030 年的 45.4 亿美元,预测期内复合年增长率为 7.3%。

心血管疾病的增加、对早期准确诊断的需求以及老年人口的增长(老年人患血管疾病的风险更高)正在推动血管成像市场的成长。 3D影像、人工智慧诊断和非侵入性技术等技术创新正在提高诊断的准确性和效率,从而促进其更广泛的应用。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 金额(美元) |

| 部分 | 产品类型、应用程式、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

此外,医疗保健投资的增加、基础设施的改善以及对预防性医疗保健的日益重视,尤其是在新兴经济体中,都极大地促进了市场扩张。

按产品类型划分,预计系统和主机细分市场在预测期内将实现最高的复合年增长率。

这是因为它们是核心平台,支援血管内超音波(IVUS)、光同调断层扫瞄(OCT) 和近红外线光谱 (NIRS) 等先进成像技术。这些系统提供高解析度、即时视觉化影像,对于精准诊断和引导介入治疗至关重要,从而推动了医院、门诊手术中心和专科诊所的需求。人工智慧整合、增强型成像软体和混合成像功能等持续的技术创新,正在推动其临床效用和普及。此外,相容导管和配件的持续收入也进一步促进了市场成长,使得系统和主机成为製造商的关键投资目标。

“按应用领域来看,血管炎细分市场将在2024年实现最高的复合年增长率。”

这主要归因于血管炎盛行率的不断上升以及准确诊断和监测血管内发炎的重要性日益凸显。 PET、MRI 和 CT血管造影术等影像技术的进步显着提高了早期血管炎的检测和评估能力,从而能够进行及时有效的标靶治疗。此外,临床医师对血管影像在血管炎管理中的重要性认识不断提高,以及对先进影像技术投入的持续成长,也推动了市场的发展。血管炎的慢性特征及其可能导致的严重併发症,进一步凸显了对先进血管成像解决方案的需求,从而促进了该领域的蓬勃发展。

“预计亚太地区在预测期内将实现最高增长率。”

亚太地区血管影像市场预计将实现最高的复合年增长率,主要驱动因素包括人口老化、心血管疾病发病率上升、久坐不动的生活方式以及糖尿病和高血压盛行率的增加。医疗基础设施的大规模投资、政府推广早期诊断的项目以及先进成像技术的快速普及,都进一步推动了市场需求。此外,医疗费用支出的成长、对价格合理的诊断成像解决方案的需求,以及中国和印度等主要经济体对人工智慧工具的整合,也强劲地推动了该地区的市场成长。

本报告调查了全球血管成像市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家/地区进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

- 血管影像市场概览

- 北美:血管成像市场(按国家和最终用户划分)

- 血管影像市场地理概况

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求

- 相互关联的市场与跨产业机会

- 一级/二级/三级公司的策略性倡议

第六章 产业趋势

- 波特五力分析

- 总体经济指标

- 供应链分析

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 重大会议和活动

- 影响我们客户业务的趋势

- 投资和资金筹措方案

- 案例研究分析

- 美国关税的影响

第七章:科技、专利、数位化和人工智慧应用带来的策略颠覆

- 关键新兴技术

- MRI

- CT

- 超音波影像

- 互补技术

- 专利分析

- 人工智慧对血管成像市场的影响

- 成功案例和实际应用

第八章:监理环境

- 法规与合规

- 业界标准

- 客户状况与购买行为

- 主要相关利益者和采购评估标准

- 招募障碍和内部挑战

- 来自各类终端用户客户的未满足需求

9. 按产品类型分類的血管影像市场

- 系统和主机

- 超音波

- MRI

- X射线

- 核子造影系统

- CT扫描仪

- 光学同调断层扫描

- 其他的

- 配件和耗材

- 软体和服务

- 应变成像

- 高空间和时间分辨率

- 自动血管形态评估

- 简化的工作流程

- 其他的

第十章 血管影像市场依应用领域划分

- 动脉粥状硬化

- 动脉瘤

- 血管炎

- 深层静脉栓塞症

- 动静脉畸形和瘻管

- 其他的

第十一章 血管影像市场(依最终用户划分)

- 医院

- 诊断影像中心

- 门诊手术中心

- 其他的

第十二章 血管影像市场(按地区划分)

- 北美洲

- 北美:宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲:宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 亚太地区:宏观经济展望

- 日本

- 中国

- 印度

- 韩国

- 澳洲

- 其他的

- 拉丁美洲

- 拉丁美洲:宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东与非洲:宏观经济展望

- 海湾合作委员会国家

- 其他的

第十三章 竞争格局

- 主要企业/主要企业的策略

- 收入分析

- 市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司估值矩阵:血管影像市场

- 公司估值矩阵:Start-Ups/中小企业

- 竞争场景

第十四章:公司简介

- 主要企业

- SIEMENS HEALTHINEERS AG

- GE HEALTHCARE

- FUJIFILM CORPORATION

- PHILIPS HEALTHCARE

- SHIMADZU CORPORATION

- UNITED IMAGING HEALTHCARE CO., LTD

- SAMSUNG HEALTHCARE

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- CANON MEDICAL SYSTEMS CORPORATION

- KONICA MINOLTA, INC.

- NEUSOFT CORPORATION

- TERUMO CORPORATION

- HOLOGIC, INC.

- BRACCO IMAGING SPA

- BAYER AG

- GUERBET

- NIPRO EUROPE GROUP COMPANIES

- 其他公司

- ACCUVEIN, INC.

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- SONOSCAPE MEDICAL CORP.

- PIUR IMAGING

- ARINETA LTD

- HEALCERION CO., LTD.

- ECHONOUS INC.

- BEIJING WEMED MEDICAL EQUIPMENT

- CLARIUS

- ESAOTE SPA

第十五章附录

The global vascular imaging market is projected to reach USD 4.54 billion by 2030 from USD 3.19 billion in 2025, growing at a CAGR of 7.3% during the forecast period. The growth in the vascular imaging market is fueled by the increasing burden of cardiovascular diseases, the need for early and precise diagnosis, and the expanding elderly population vulnerable to vascular conditions. Advances in technology, including 3D imaging, AI-powered diagnostics, and non-invasive techniques, are enhancing accuracy and efficiency, driving wider adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Furthermore, rising healthcare investments, improved infrastructure, and greater emphasis on preventive care, especially across emerging economies, are contributing significantly to the market's expansion.

By product type, the systems & consoles segment is expected to register the highest CAGR during the forecast period.

By product type, the systems & consoles segment is expected to account for the highest CAGR in the vascular imaging market because they serve as the core platforms enabling advanced imaging modalities such as intravascular ultrasound (IVUS), optical coherence tomography (OCT), and near-infrared spectroscopy (NIRS). These systems provide high-resolution, real-time visualization critical for accurate diagnosis and guided interventions, driving demand in hospitals, ambulatory surgery centers, and specialty clinics. Continuous technological innovations-such as integration with AI, enhanced imaging software, and hybrid imaging capabilities-boost their clinical utility and adoption. Additionally, recurring revenue from compatible catheters and accessories further propels market growth, making systems and consoles a key investment focus for manufacturers.

By application, the vasculitis segment accounted for the highest CAGR of the market in 2024.

In the vascular imaging market, the vasculitis segment dominated the market due to its increasing prevalence and the critical need for accurate diagnosis and monitoring of inflammation in blood vessels. Advances in imaging technologies such as PET, MRI, and CT angiography have significantly improved the ability to detect and assess vasculitis at early stages, enabling timely and targeted treatment. Additionally, growing awareness among clinicians about the importance of vascular imaging in managing vasculitis, coupled with rising investment in advanced imaging modalities, is accelerating market growth. The chronic nature of vasculitis and its potential to cause severe complications further underscores the demand for sophisticated vascular imaging solutions, fueling robust expansion in this segment.

Asia Pacific is expected to register the highest growth rate in the market during the forecast period.

The Asia-Pacific region is expected to register the highest CAGR in the vascular imaging market, driven by the growing burden of cardiovascular diseases linked to an aging population, sedentary lifestyles, and the increasing prevalence of diabetes and hypertension. Significant investments in healthcare infrastructure, government programs promoting early diagnosis, and the rapid adoption of advanced imaging technologies are further fueling demand. Additionally, rising healthcare spending, the need for affordable imaging solutions, and the integration of AI-based tools across major economies such as China and India are propelling the region's strong market growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

The prominent players in this market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), Shenzhen Mindray Bio-Medical Electronics (China), FUJIFILM Corporation (Japan), Hologic Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Shimadzu Corporation (Japan), United Imaging Healthcare (China), Konica Minolta (Japan), Neusoft Corporation (China), Bracco Imaging SPA (Italy), Bayer AG (Germany), Guerbet (France), Nipro Europe Group Companies (Belgium).

Research Coverage

The vascular imaging market is segmented by product type, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the Vascular imaging market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the vascular imaging market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report provides insights into both key and smaller players in the market, which can help create a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following points:

- Key drivers (rising prevalence of cardiovascular diseases, minimally invasive and personalized interventions, technological advancements in vascular imaging technology, increasing investments, funds, and grants by public-private organizations), restraints (radiation exposure and contrast-related risks, unfavorable reimbursement scenario, high costs and resource requirements), opportunities (expanding economies offer high growth potential, increasing establishment of hospitals and diagnostic imaging centers, increasing adoption of teleradiology), and challenges (hospital budget cuts, increasing adoption of refurbished diagnostic imaging systems, dearth of trained professionals, image quality limitations because of patient and physiological motion) fueling the market growth of vascular imaging market.

- Product Development/Innovation: Emerging technologies in space, R&D, recent product launches & approvals in the vascular imaging market.

- Market Growth: In-depth insights into remunerative markets report analyze the vascular imaging market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the vascular imaging market

- Competitive Assessment: Detailed assessment of market share, service offerings, leading strategies of key players such as Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), and FUJIFILM Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.3 MARKET FORECASTING

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VASCULAR IMAGING MARKET OVERVIEW

- 4.2 NORTH AMERICA: VASCULAR IMAGING MARKET, BY COUNTRY AND END USER, 2025

- 4.3 GEOGRAPHIC SNAPSHOT OF VASCULAR IMAGING MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising prevalence of cardiovascular diseases

- 5.2.1.2 Growing inclination toward minimally invasive and personalized interventions

- 5.2.1.3 Technological advancements in vascular imaging systems

- 5.2.1.4 Increasing investments, funds, and grants by public-private organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and resource requirements

- 5.2.2.2 Radiation exposure and contrast-related risks

- 5.2.2.3 Unfavorable reimbursement scenario

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging economies

- 5.2.3.2 Increasing establishment of hospitals and diagnostic imaging centers

- 5.2.3.3 Rising adoption of teleradiology

- 5.2.4 CHALLENGES

- 5.2.4.1 Need to maintain high-quality, artifact-free images

- 5.2.4.2 Hospital budget cuts

- 5.2.4.3 Increasing adoption of refurbished vascular imaging systems

- 5.2.4.4 Dearth of trained professionals

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMIC INDICATORS

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL ENVIRONMENTAL INDUSTRY

- 6.2.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 6.3.3 END USERS

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH & DEVELOPMENT

- 6.4.2 RAW MATERIAL PROCUREMENT

- 6.4.3 MANUFACTURING & ASSEMBLY

- 6.4.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALE SERVICES

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.7 TRADE ANALYSIS

- 6.7.1 TRADE DATA FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212)

- 6.7.1.1 Import data

- 6.7.1.2 Export data

- 6.7.2 TRADE ANALYSIS FOR ULTRASOUND SYSTEMS (HS CODE 901812)

- 6.7.2.1 Import data

- 6.7.2.2 Export data

- 6.7.3 TRADE ANALYSIS FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813)

- 6.7.3.1 Import data

- 6.7.3.2 Export data

- 6.7.4 TRADE ANALYSIS FOR X-RAY SYSTEMS (HS CODE 902214)

- 6.7.4.1 Import data

- 6.7.4.2 Export data

- 6.7.1 TRADE DATA FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 MAGNETIC RESONANCE IMAGING (MRI)

- 7.1.2 COMPUTED TOMOGRAPHY (CT)

- 7.1.3 ULTRASOUND IMAGING

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 PICTURE ARCHIVING AND COMMUNICATION SYSTEMS (PACS)

- 7.2.2 ARTIFICIAL INTELLIGENCE (AI) FOR IMAGE ANALYSIS

- 7.3 PATENT ANALYSIS

- 7.4 IMPACT OF AI ON VASCULAR IMAGING MARKET

- 7.4.1 INTRODUCTION

- 7.4.2 TOP USE CASES AND MARKET POTENTIAL

- 7.4.3 BEST PRACTICES IN VASCULAR IMAGING MARKET

- 7.4.4 CASE STUDY ON AI IMPLEMENTATION IN VASCULAR IMAGING MARKET

- 7.4.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN THE VASCULAR IMAGING MARKET

- 7.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

8 REGULATORY LANDSCAPE

- 8.1 REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.1.1 North America

- 8.1.1.1.1 US

- 8.1.1.1.2 Canada

- 8.1.1.2 Europe

- 8.1.1.3 Asia Pacific

- 8.1.1.3.1 Japan

- 8.1.1.3.2 China

- 8.1.1.3.3 India

- 8.1.1.1 North America

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.2 INDUSTRY STANDARDS

- 8.3 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.3.1 DECISION-MAKING PROCESS

- 8.4 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.4.2 BUYING CRITERIA

- 8.5 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.6 UNMET NEEDS FROM VARIOUS END-USE CUSTOMERS

9 VASCULAR IMAGING MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 SYSTEMS & CONSOLES

- 9.2.1 ULTRASOUND

- 9.2.1.1 Duplex ultrasound

- 9.2.1.1.1 Ongoing shift toward non-invasive and radiation-free imaging techniques to drive market

- 9.2.1.2 Doppler ultrasound

- 9.2.1.2.1 Increasing prevalence of lifestyle-related conditions to propel market

- 9.2.1.1 Duplex ultrasound

- 9.2.2 MRI

- 9.2.2.1 Growing adoption of non-invasive diagnostic techniques to fuel market

- 9.2.3 X-RAY

- 9.2.3.1 High spatial resolution and real-time imaging ability to boost market

- 9.2.4 NUCLEAR IMAGING SYSTEMS

- 9.2.4.1 Increasing advancements in hybrid imaging systems to facilitate growth

- 9.2.5 CT SCANNERS

- 9.2.5.1 Wide applicability of CT in diagnosing vascular abnormalities to favor growth

- 9.2.6 OPTICAL COHERENCE TOMOGRAPHY

- 9.2.6.1 Ability to provide micron-level resolution to support growth

- 9.2.7 OTHER SYSTEMS & CONSOLES

- 9.2.1 ULTRASOUND

- 9.3 ACCESSORIES & CONSUMABLES

- 9.3.1 NEED FOR CONSISTENT IMAGE QUALITY AND PATIENT SAFETY TO FOSTER GROWTH

- 9.4 SOFTWARE & SERVICES

- 9.4.1 STRAIN IMAGING

- 9.4.1.1 Rising focus on early detection of vascular diseases to aid growth

- 9.4.2 HIGH SPATIAL AND TEMPORAL RESOLUTION

- 9.4.2.1 Increasing product development to facilitate growth

- 9.4.3 AUTOMATED VESSEL MORPHOLOGY ASSESSMENT

- 9.4.3.1 Need for precise and reproducible analysis to expedite growth

- 9.4.4 STREAMLINED PROCEDURAL WORKFLOW

- 9.4.4.1 Rising patient volume to contribute to growth

- 9.4.5 OTHER SOFTWARE & SERVICES

- 9.4.1 STRAIN IMAGING

10 VASCULAR IMAGING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 ATHEROSCLEROSIS

- 10.2.1 GROWING GLOBAL BURDEN OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

- 10.3 ANEURYSM

- 10.3.1 EXPANDING ACCESS TO DIAGNOSTIC FACILITIES TO BOOST MARKET

- 10.4 VASCULITIS

- 10.4.1 GROWING INCIDENCE OF AUTOIMMUNE AND INFLAMMATORY DISORDERS TO PROPEL MARKET

- 10.5 DEEP VEIN THROMBOSIS

- 10.5.1 INCREASING FOCUS ON PREVENTIVE HEALTHCARE AND TECHNOLOGICAL INNOVATIONS TO PROMOTE GROWTH

- 10.6 ARTERIOVENOUS MALFORMATIONS & FISTULAS

- 10.6.1 RISING USE OF MINIMALLY INVASIVE ENDOVASCULAR THERAPIES TO EXPEDITE GROWTH

- 10.7 OTHER APPLICATIONS

11 VASCULAR IMAGING MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITALS

- 11.2.1 STRONG REIMBURSEMENT FRAMEWORKS AND GOVERNMENT SUPPORT FOR MODERNIZING HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

- 11.3 DIAGNOSTIC IMAGING CENTERS

- 11.3.1 INCREASING FOCUS ON OUTPATIENT CARE AND PREVENTIVE DIAGNOSTICS TO ENCOURAGE GROWTH

- 11.4 AMBULATORY SURGERY CENTERS

- 11.4.1 GROWING EMPHASIS ON VALUE-BASED CARE TO PROPEL MARKET

- 11.5 OTHER END USERS

12 VASCULAR IMAGING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 High prevalence of chronic vascular diseases to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rapidly aging population to support growth

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 High number of MRI and CT units to fuel market

- 12.3.3 UK

- 12.3.3.1 Increasing investments in imaging infrastructure to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Increasing focus on early detection of vascular disorders and strong technological adoption to boost market

- 12.3.5 ITALY

- 12.3.5.1 Demographic shift toward aging population and increasing focus on non-invasive diagnostic solutions to aid growth

- 12.3.6 SPAIN

- 12.3.6.1 Growing access to advanced cancer vascular to propel market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 JAPAN

- 12.4.2.1 Presence of universal healthcare coverage to fuel market

- 12.4.3 CHINA

- 12.4.3.1 Favorable government initiatives and demographic shift to aid growth

- 12.4.4 INDIA

- 12.4.4.1 Increasing number of vascular procedures and public & private investments to promote growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Growing awareness about diseases and rising applications of ultrasound to boost market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing healthcare spending to propel market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Favorable demographic conditions and coverage policies to propel market

- 12.5.3 MEXICO

- 12.5.3.1 Growing adoption of advanced diagnostic imaging systems to drive market

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Increasing prevalence of cardiovascular diseases, diabetes, and hypertension to support growth

- 12.6.3 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN VASCULAR IMAGING MARKET

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: VASCULAR IMAGING MARKET, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Product footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES, UPGRADES, AND APPROVALS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SIEMENS HEALTHINEERS AG

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GE HEALTHCARE

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches, upgrades, and approvals

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 FUJIFILM CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches, upgrades, and approvals

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats.

- 14.1.4 PHILIPS HEALTHCARE

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches, upgrades, and approvals

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 SHIMADZU CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.6 UNITED IMAGING HEALTHCARE CO., LTD

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches, upgrades, and approvals

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 SAMSUNG HEALTHCARE

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches, upgrades, and approvals

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Other developments

- 14.1.8 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches, upgrades, and approvals

- 14.1.8.3.2 Deals

- 14.1.9 CANON MEDICAL SYSTEMS CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches, upgrades, and approvals

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 KONICA MINOLTA, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 NEUSOFT CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches, upgrades, and approvals

- 14.1.12 TERUMO CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 HOLOGIC, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Expansions

- 14.1.14 BRACCO IMAGING S.P.A.

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.14.3.2 Expansions

- 14.1.15 BAYER AG

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Expansions

- 14.1.16 GUERBET

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.17 NIPRO EUROPE GROUP COMPANIES

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.1 SIEMENS HEALTHINEERS AG

- 14.2 OTHER PLAYERS

- 14.2.1 ACCUVEIN, INC.

- 14.2.2 CHISON MEDICAL TECHNOLOGIES CO., LTD.

- 14.2.3 SONOSCAPE MEDICAL CORP.

- 14.2.4 PIUR IMAGING

- 14.2.5 ARINETA LTD

- 14.2.6 HEALCERION CO., LTD.

- 14.2.7 ECHONOUS INC.

- 14.2.8 BEIJING WEMED MEDICAL EQUIPMENT

- 14.2.9 CLARIUS

- 14.2.10 ESAOTE SPA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 VASCULAR IMAGING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 VASCULAR IMAGING MARKET: RISK ANALYSIS

- TABLE 3 TECHNOLOGICAL ADVANCEMENTS IN VASCULAR IMAGING SYSTEMS

- TABLE 4 VASCULAR IMAGING MARKET: UNMET NEEDS

- TABLE 5 STRATEGIC MOVES BY KEY COMPANIES IN VASCULAR IMAGING MARKET

- TABLE 6 VASCULAR IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 REGIONAL PRICING ANALYSIS OF KEY VASCULAR IMAGING MODALITIES, 2024 (USD)

- TABLE 8 REGIONAL PRICING ANALYSIS OF KEY DIAGNOSTIC IMAGING MODALITIES, 2024 (USD)

- TABLE 9 IMPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS, 2020-2024 (HS CODE 902212)

- TABLE 10 EXPORT DATA FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 IMPORT DATA FOR ULTRASOUND SYSTEMS (HS CODE 901812), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR ULTRASOUND SYSTEMS (HS CODE 901812), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 IMPORT DATA FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR X-RAY SYSTEMS (HS CODE 902214), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR X-RAY SYSTEMS (HS CODE 902214), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 VASCULAR IMAGING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 CASE STUDY: MAINTAINING STRONG FOCUS ON TECHNOLOGICAL INNOVATION AND ADDRESSING REGULATORY COMPLIANCE

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 CASE STUDY: AI-ASSISTED INTRAVASCULAR IMAGING FOR PRECISION ANGIOPLASTY

- TABLE 21 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 22 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 23 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 24 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 25 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 26 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 27 INDUSTRY STANDARDS FOR VASCULAR IMAGING MARKET

- TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 29 KEY BUYING CRITERIA, BY END USER

- TABLE 30 VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 31 VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 VASCULAR IMAGING MARKET FOR ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 VASCULAR IMAGING MARKET FOR DUPLEX ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 VASCULAR IMAGING MARKET FOR DOPPLER ULTRASOUND, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 VASCULAR IMAGING MARKET FOR MRI, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 VASCULAR IMAGING MARKET FOR X-RAY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 VASCULAR IMAGING MARKET FOR NUCLEAR IMAGING SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 VASCULAR IMAGING MARKET FOR CT SCANNERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 VASCULAR IMAGING MARKET FOR OPTICAL COHERENCE TOMOGRAPHY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 VASCULAR IMAGING MARKET FOR ACCESSORIES & CONSUMABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 VASCULAR IMAGING MARKET FOR STRAIN IMAGING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 VASCULAR IMAGING MARKET FOR HIGH SPATIAL AND TEMPORAL RESOLUTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 VASCULAR IMAGING MARKET FOR AUTOMATED VESSEL MORPHOLOGY ASSESSMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 VASCULAR IMAGING MARKET FOR STREAMLINED PROCEDURAL WORKFLOW, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 VASCULAR IMAGING MARKET FOR OTHER SOFTWARE & SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 VASCULAR IMAGING MARKET FOR ATHEROSCLEROSIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 VASCULAR IMAGING MARKET FOR ANEURYSM, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 VASCULAR IMAGING MARKET FOR VASCULITIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 VASCULAR IMAGING MARKET FOR DEEP VEIN THROMBOSIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 VASCULAR IMAGING MARKET FOR ARTERIOVENOUS MALFORMATIONS & FISTULAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 VASCULAR IMAGING MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 VASCULAR IMAGING MARKET, BY END USER, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 55 VASCULAR IMAGING MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 VASCULAR IMAGING MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 VASCULAR IMAGING MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 VASCULAR IMAGING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 VASCULAR IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NUMBER OF IMAGING TESTS IN UK, 2022-2025

- TABLE 61 NUMBER OF MRI UNITS PER COUNTRY, 2022-2024

- TABLE 62 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 63 NORTH AMERICA: VASCULAR IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: VASCULAR IMAGING MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: VASCULAR IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 US: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 71 US: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 US: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 77 EUROPE: VASCULAR IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: VASCULAR IMAGING MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: VASCULAR IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 84 GERMANY: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 85 GERMANY: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 GERMANY: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 UK: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 88 UK: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 UK: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 FRANCE: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 91 FRANCE: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 ITALY: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 94 ITALY: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 ITALY: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 SPAIN: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 97 SPAIN: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 SPAIN: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 103 ASIA PACIFIC: VASCULAR IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: VASCULAR IMAGING MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: VASCULAR IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 JAPAN: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 111 JAPAN: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 JAPAN: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 CHINA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 114 CHINA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 CHINA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 INDIA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 117 INDIA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 INDIA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SOUTH KOREA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 SOUTH KOREA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 AUSTRALIA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 AUSTRALIA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 129 LATIN AMERICA: VASCULAR IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 131 LATIN AMERICA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: ULTRASOUND MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 LATIN AMERICA: VASCULAR IMAGING MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 LATIN AMERICA: VASCULAR IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 BRAZIL: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 137 BRAZIL: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 BRAZIL: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 MEXICO: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 140 MEXICO: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 MEXICO: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 REST OF LATIN AMERICA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 143 REST OF LATIN AMERICA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 146 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 153 GCC COUNTRIES: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 154 GCC COUNTRIES: VASCULAR IMAGING MARKET FOR SYSTEMS & CONSOLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 GCC COUNTRIES: VASCULAR IMAGING MARKET FOR ULTRASOUND, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: VASCULAR IMAGING MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: SYSTEMS AND CONSOLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN VASCULAR IMAGING MARKET, JANUARY 2022-OCTOBER 2025

- TABLE 160 VASCULAR IMAGING MARKET: DEGREE OF COMPETITION

- TABLE 161 VASCULAR IMAGING MARKET: REGION FOOTPRINT

- TABLE 162 VASCULAR IMAGING MARKET: PRODUCT TYPE FOOTPRINT (1/2)

- TABLE 163 VASCULAR IMAGING MARKET: PRODUCT TYPE FOOTPRINT (2/2)

- TABLE 164 VASCULAR IMAGING MARKET: APPLICATION FOOTPRINT

- TABLE 165 VASCULAR IMAGING MARKET: END-USER FOOTPRINT

- TABLE 166 VASCULAR IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 167 VASCULAR IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 168 VASCULAR IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY PRODUCT TYPE

- TABLE 169 VASCULAR IMAGING MARKET: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 170 VASCULAR IMAGING MARKET: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 171 VASCULAR IMAGING MARKET: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 172 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 173 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 174 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 175 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 176 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 177 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 178 GE HEALTHCARE: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 179 GE HEALTHCARE: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 180 GE HEALTHCARE: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 181 FUJIFILM CORPORATION: COMPANY OVERVIEW

- TABLE 182 FUJIFILM CORPORATION: PRODUCTS OFFERED

- TABLE 183 FUJIFILM CORPORATION: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 184 FUJIFILM CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 185 FUJIFILM CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 186 PHILIPS HEALTHCARE: COMPANY OVERVIEW

- TABLE 187 PHILIPS HEALTHCARE: PRODUCTS OFFERED

- TABLE 188 PHILIPS HEALTHCARE: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 189 PHILIPS HEALTHCARE: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 190 PHILIPS HEALTHCARE: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 191 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 192 SHIMADZU CORPORATION: PRODUCTS OFFERED

- TABLE 193 SHIMADZU CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 194 UNITED IMAGING HEALTHCARE CO., LTD: COMPANY OVERVIEW

- TABLE 195 UNITED IMAGING HEALTHCARE CO., LTD: PRODUCTS OFFERED

- TABLE 196 UNITED IMAGING HEALTHCARE CO., LTD: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 197 UNITED IMAGING HEALTHCARE CO., LTD: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 198 UNITED IMAGING HEALTHCARE CO., LTD: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 199 SAMSUNG HEALTHCARE: COMPANY OVERVIEW

- TABLE 200 SAMSUNG HEALTHCARE: PRODUCTS OFFERED

- TABLE 201 SAMSUNG HEALTHCARE: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 202 SAMSUNG HEALTHCARE: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 203 SAMSUNG HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 204 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 205 SHEZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 206 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 207 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 208 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 209 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 210 CANON MEDICAL SYSTEMS CORPORATION: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 211 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 212 CANON MEDICAL SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 213 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 214 KONICA MINOLTA, INC.: PRODUCTS OFFERED

- TABLE 215 NEUSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 216 NEUSOFT CORPORATION: PRODUCTS OFFERED

- TABLE 217 NEUSOFT CORPORATION: PRODUCT LAUNCHES, UPGRADES, AND APPROVALS, JANUARY 2022-AUGUST 2024

- TABLE 218 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 219 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 220 HOLOGIC, INC.: COMPANY OVERVIEW

- TABLE 221 HOLOGIC, INC.: PRODUCTS OFFERED

- TABLE 222 HOLOGIC, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 223 HOLOGIC, INC.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 224 BRACCO IMAGING S.P.A.: COMPANY OVERVIEW

- TABLE 225 BRACCO IMAGING S.P.A.: PRODUCTS OFFERED

- TABLE 226 BRACCO IMAGING S.P.A.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 227 BRACCO IMAGING S.P.A.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 228 BAYER AG: COMPANY OVERVIEW

- TABLE 229 BAYER AG: PRODUCTS OFFERED

- TABLE 230 BAYER AG: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 231 BAYER AG: EXPANSION, JANUARY 2022-AUGUST 2025

- TABLE 232 GUERBET: COMPANY OVERVIEW

- TABLE 233 GUERBET: PRODUCTS OFFERED

- TABLE 234 NIPRO EUROPE GROUP COMPANIES: COMPANY OVERVIEW

- TABLE 235 NIPRO EUROPE GROUP COMPANIES: PRODUCTS OFFERED

- TABLE 236 ACCUVEIN, INC.: COMPANY OVERVIEW

- TABLE 237 CHISON MEDICAL TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 238 SONOSCAPE MEDICAL CORP.: COMPANY OVERVIEW

- TABLE 239 PIUR IMAGING: COMPANY OVERVIEW

- TABLE 240 ARINETA LTD: COMPANY OVERVIEW

- TABLE 241 HEALCERION CO., LTD.: COMPANY OVERVIEW

- TABLE 242 ECHONOUS INC.: COMPANY OVERVIEW

- TABLE 243 BEIJING WEMED MEDICAL EQUIPMENT: COMPANY OVERVIEW

- TABLE 244 CLARIUS: COMPANY OVERVIEW

- TABLE 245 ESAOTE SPA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 VASCULAR IMAGING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 KEY SECONDARY SOURCES

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 8 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 9 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 GLOBAL MARKET GROWTH PROJECTIONS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 VASCULAR IMAGING MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 VASCULAR IMAGING MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 VASCULAR IMAGING MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 GROWING PREVALENCE OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

- FIGURE 17 HOSPITALS SEGMENT AND US LED NORTH AMERICAN MARKET IN 2025

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 VASCULAR IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VASCULAR IMAGING MARKET: PORTER'S FIVE FORCES

- FIGURE 21 VASCULAR IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 VASCULAR IMAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 IMPORT SCENARIO FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212), 2020-2024 (USD THOUSAND)

- FIGURE 25 EXPORT SCENARIO FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212), 2020-2024 (USD THOUSAND)

- FIGURE 26 IMPORT SCENARIO FOR ULTRASOUND SYSTEMS (HS CODE 901812), 2020-2024 (USD THOUSAND)

- FIGURE 27 EXPORT SCENARIO FOR ULTRASOUND SYSTEMS (HS CODE 901812), 2020-2024 (USD THOUSAND)

- FIGURE 28 IMPORT SCENARIO FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813), 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT SCENARIO FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813), 2020-2024 (USD THOUSAND)

- FIGURE 30 IMPORT SCENARIO FOR X-RAY SYSTEMS (HS CODE 902214), 2020-2024 (USD THOUSAND)

- FIGURE 31 EXPORT SCENARIO FOR X-RAY SYSTEMS (HS CODE 902214), 2020-2024 (USD THOUSAND)

- FIGURE 32 VASCULAR IMAGING MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 34 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 35 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 36 TOP 10 PATENT APPLICANTS FOR CT SCANNERS, JANUARY 2015-NOVEMBER 2025

- FIGURE 37 TOP 10 PATENT APPLICANTS FOR MRI SYSTEMS, JANUARY 2015-NOVEMBER 2025

- FIGURE 38 TOP 10 PATENT APPLICANTS FOR ULTRASOUND IMAGING SYSTEMS, JANUARY 2015- NOVEMBER 2025

- FIGURE 39 TOP 10 PATENT APPLICANTS FOR X-RAY IMAGING SYSTEMS, JANUARY 2015- NOVEMBER 2025

- FIGURE 40 TOP 10 PATENT APPLICANTS FOR NUCLEAR IMAGING SYSTEMS, JANUARY 2015-DECEMBER 2025

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR END USERS

- FIGURE 42 KEY BUYING CRITERIA, BY END USER

- FIGURE 43 NORTH AMERICA: VASCULAR IMAGING MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: VASCULAR IMAGING MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN VASCULAR IMAGING MARKET, 2021-2024 (USD BILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS IN VASCULAR IMAGING MARKET, 2024

- FIGURE 47 RANKING OF KEY PLAYERS IN VASCULAR IMAGING MARKET, 2024

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 VASCULAR IMAGING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 51 VASCULAR IMAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 VASCULAR IMAGING MARKET: COMPANY FOOTPRINT

- FIGURE 53 VASCULAR IMAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 55 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 56 FUJIFILM CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 57 PHILIPS HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 58 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 59 UNITED IMAGING HEALTHCARE CO., LTD: COMPANY SNAPSHOT (2024)

- FIGURE 60 SAMSUNG HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 61 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 62 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 63 KONICA MINOLTA, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 64 NEUSOFT CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 65 TERUMO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 66 HOLOGIC, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 67 BAYER AG: COMPANY SNAPSHOT (2024)

- FIGURE 68 GUERBET: COMPANY SNAPSHOT (2022)