|

市场调查报告书

商品编码

1880368

全球生物技术人工智慧市场(至2035年)按功能和最终用户划分AI in Biotechnology Market by Function and End User - Global Forecast to 2035 |

||||||

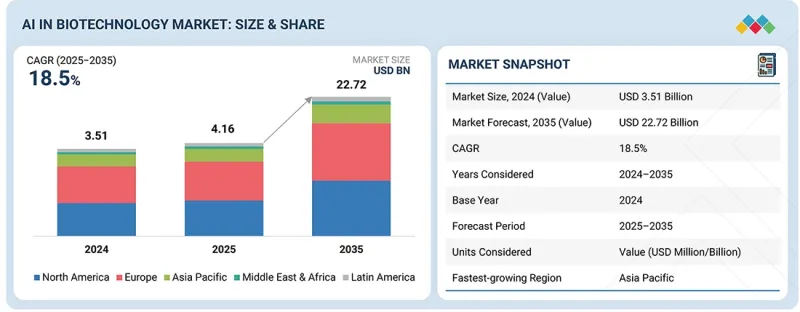

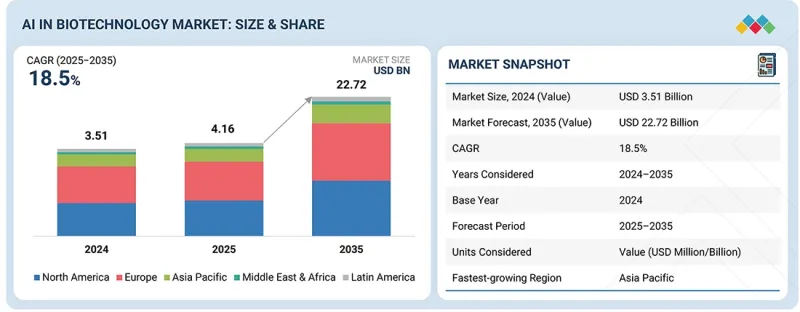

全球生物技术人工智慧市场规模预计将从 2025 年的 41.569 亿美元成长到 2035 年的 227.165 亿美元,预测期内复合年增长率为 18.5%。

由于人工智慧在药物安全性和有效性预测分析中的应用日益广泛,人工智慧驱动的自动化在实验室流程中的应用日益增多,以及对成本效益和更快研发流程的需求不断增长,该市场正在稳步发展。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2035 |

| 基准年 | 2024 |

| 预测期 | 2025-2035 |

| 单元 | 金额(美元) |

| 部分 | 供应类别、功能、实施类别、最终使用者、区域 |

| 目标区域 | 北美洲、欧洲、亚太地区、中东和非洲、拉丁美洲 |

此外,大规模生物数据集的日益普及、云端运算基础设施的进步以及政府鼓励生命科学领域采用人工智慧的支持措施,都进一步推动了市场成长。人工智慧与新兴生物技术的融合,正在加速创新、改善决策并提供更个人化的医疗保健解决方案。

按功能划分,预计研发部门在预测期内将占最大份额。

按功能划分,研发领域占据最大份额,预计未来几年将继续保持领先地位。这一领先地位主要得益于人工智慧在加速药物发现、优化分子设计以及预测化合物疗效和安全性方面的日益广泛应用。人工智慧工具使研究人员能够更有效率地分析大规模基因组、蛋白质组和临床数据集,从而缩短实验时间并降低成本。此外,机器学习演算法与高通量筛检和自动化实验平台的结合,正在提高研发流程的准确性和扩充性。随着生技公司加速将新型疗法推向市场,人工智慧在研发领域的应用将继续成为重要的成长要素。

按最终用户划分,预计医药产业在预测期内将占据最大份额。

这一增长主要得益于人工智慧在加速药物发现、优化临床试验设计以及预测药物疗效和安全性方面的广泛应用。製药公司正利用人工智慧分析大规模生物临床数据集、识别新的药物标靶并简化研发流程,从而降低时间和成本。此外,人工智慧驱动的预测建模和虚拟筛检工具也有助于支援数据驱动的决策,提高成功率,并更有效率地将新治疗方法推向市场。对个人化医疗日益增长的需求以及快速创新的压力也进一步推动了人工智慧在製药业的应用。

预计亚太地区在预测期内将实现最高的成长率。

这项快速扩张得益于技术进步和对卓越研究的高度重视。区域内各国正透过完善基础设施、加强产学合作、跨国合作来强化其创新生态系统。对精准医疗、数据驱动型医疗和永续生物製造的日益关注也为市场发展创造了新的机会。此外,凭藉着完善的法规结构和不断加强的公私合营,亚太地区正将自身打造成为下一代生物技术发展的全球中心。

本报告调查了全球生物技术领域的人工智慧市场,并提供了市场概览、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求和閒置频段

- 与相关市场和不同产业相关的跨领域机会

- 一级/二级/三级公司的策略性倡议

第六章 产业趋势

- 人工智慧在生物技术领域的演变

- 波特五力分析

- 总体经济指标

- 价值链分析

- 生态系分析

- 定价分析

- 大型会议和活动

- 影响客户业务的趋势与干扰因素

- 投资和资金筹措方案

- 案例研究分析

- 美国关税对市场的影响

第七章:科技、专利、数位化和人工智慧应用带来的策略颠覆

- 关键新兴技术

- 自然语言处理(NLP)

- 预测分析

- 互补技术

- 云端运算

- 巨量资料分析

- 技术/产品蓝图

- 专利分析

- 生物技术领域人工智慧专利揭露趋势

- 专利申请区域及主要申请人分析

- 未来应用

- 人工智慧驱动的精准发现与多体学整合

- 生成生物学和分子、蛋白质和基因係统的自动化设计

- 人工智慧/生成式人工智慧对生物技术市场的影响

- 主要应用案例和市场潜力

- 与邻近生态系统的合作以及对参与企业的影响

- 生物技术领域客户对生成式人工智慧的准备情况

- 人工智慧/生成式人工智慧实施案例:案例研究

第八章:监理环境

- 地方法规和合规性

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 监管机构、政府机构和其他组织

- 业界标准

第九章:顾客状况与购买行为

- 决策流程

- 相关利益者的影响和采购标准

- 采用障碍和内部挑战

- 来自各个终端使用者产业的未满足需求

- 最终用户期望

第十章 生物技术领域人工智慧市场依服务区隔市场划分

- 端对端解决方案

- 利基解决方案

- 科技

- 服务

- 咨询服务

- 实施服务和持续的IT支持

- 培训和教育服务

- 售后服务及维护服务

第十一章 生物技术领域的AI市场依功能划分

- 研究与开发

- 药物发现

- 临床开发

- 监理合规

- 製造和供应链

- 供应链规划

- 库存管理

- 物流最佳化

- 需求预测

- 预测性维护

- 其他的

- 发布和商业化

- 发射调整

- 病人参与

- 市场营运

- 预测定价

- 上市后监测和病患支持

- 用药依从性

- 不利事件报告

- 病患监测

- 合规性监控

- 患者援助计划

- 公司职能

- 风险管理

- 合规性监控

- 销售部门最佳化

- 其他的

第十二章:按应用领域分類的生物技术领域人工智慧市场

- 云端基础的解决方案

- 公共云端

- 私有云端

- 多重云端

- 混合云端

- 本地部署解决方案

13. 生物技术领域的人工智慧市场(依最终用户划分)

- 製药公司

- 生技公司

- 研究机构和实验室

- 医疗保健提供者

- CRO

14. 各地区生物技术领域的人工智慧市场

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 宏观经济展望

- 日本

- 中国

- 印度

- 韩国

- 澳洲

- 其他的

- 拉丁美洲

- 宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东和非洲宏观经济展望

- 海湾合作委员会国家

- 其他的

第十五章 竞争格局

- 主要企业/主要企业的策略

- 收入分析

- 市占率分析

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小企业

- 估值和财务指标

- 品牌/产品对比

- 竞争场景

第十六章:公司简介

- 主要企业

- NVIDIA CORPORATION

- ILLUMINA, INC.

- RECURSION

- SCHRODINGER, INC.

- BENEVOLENTAI

- DATA4CURE, INC.

- QIAGEN

- INSILICO MEDICINE

- DNANEXUS, INC.

- TEMPUS

- SOPHIA GENETICS

- PREDICTIVE ONCOLOGY

- DEEP GENOMICS

- NUMEDII, INC.

- XTALPI INC.

- IKTOS

- BPGBIO, INC.

- EUROFINS DISCOVERY

- 其他公司

- VERISIM LIFE

- LIFEBIT BIOTECH INC.

- VALO HEALTH

- VERGE GENOMICS

- LOGICA

- AMERICAN CHEMICAL SOCIETY

- AGANITHA AI INC.

第十七章附录

The global AI in biotechnology market is projected to reach USD 22,716.5 million by 2035 from USD 4,156.9 million in 2025, at a high CAGR of 18.5% during the forecast period. The market is progressing steadily, driven by the growing adoption of AI for predictive analytics in drug safety and efficacy, the increasing use of AI-powered automation in laboratory processes, and the rising demand for cost-efficient and accelerated research pipelines.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD million) |

| Segments | Offering, Function, Deployment Mode, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Moreover, the expanding availability of large-scale biological datasets, advancements in cloud computing infrastructure, and supportive government initiatives promoting AI in life sciences further propel market growth. The convergence of AI with emerging biotechnologies is enabling faster innovation, improved decision-making, and more personalized healthcare solutions.

"The research & development segment of the AI in biotechnology market is the largest segment during the forecast period."

Based on function, the research & development (R&D) segment accounted for the largest share of the AI in biotechnology market and is projected to maintain its lead in the coming years. This dominance is driven by the increasing use of AI to accelerate drug discovery, optimize molecular design, and predict compound efficacy and safety. AI-powered tools enable researchers to analyze large-scale genomic, proteomic, and clinical datasets more efficiently, reducing experimental timelines and costs. Additionally, the integration of machine learning algorithms with high-throughput screening and automated laboratory platforms is enhancing the precision and scalability of R&D processes. As biotech companies strive to bring novel therapeutics to market faster, the adoption of AI in R&D continues to be a key growth driver.

"Based on the end user, the pharmaceutical companies segment accounted for the largest share of AI in biotechnology market during the forecast period."

The pharmaceutical companies segment accounted for the largest share of the AI in biotechnology market during the forecast period. This growth is driven by the increasing adoption of AI for accelerating drug discovery, optimizing clinical trial design, and predicting drug efficacy and safety profiles. Pharmaceutical firms are leveraging AI to analyze large-scale biological and clinical datasets, identify novel drug targets, and streamline R&D workflows, reducing time and cost. Additionally, AI-enabled predictive modeling and virtual screening tools help companies make data-driven decisions, enhance success rates, and bring new therapies to market more efficiently. The rising demand for personalized medicine and the pressure to innovate rapidly further reinforce the adoption of AI within the pharmaceutical sector.

"Asia Pacific is projected to witness the highest growth rate during the forecast period."

The Asia Pacific region is projected to witness the highest growth rate in the AI in biotechnology market during the forecast period. This rapid expansion is driven by a strong focus on technological advancement and research excellence. Countries across the region are strengthening their innovation ecosystems through enhanced infrastructure, academic-industry partnerships, and cross-border collaborations. The growing emphasis on precision medicine, data-driven healthcare, and sustainable biomanufacturing is also creating new opportunities for market development. Moreover, supportive regulatory frameworks and increasing public-private initiatives position Asia Pacific as a global hub for next-generation biotechnological progress.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the AI in biotechnology marketplace. The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 34%, Tier 2: 46%, and Tier 3: 20%

- By Designation - C-Level: 35%, Director Level: 25%, and Others: 40%

- By Region - North America: 30%, Europe: 45%, Asia Pacific: 20%, Latin America: 3%, Middle East & Africa: 2%

Key Players in the AI in Biotechnology Market

The key players operating in the AI in biotechnology market include NVIDIA (US), Illumina, Inc. (US), Recursion (US), Schrodinger, Inc. (US), BenevolentAI (UK), Data4Cure, Inc. (US), Qiagen (Germany), Insilico Medicine (US), DNAnexus, Inc. (US), Tempus (US), SOPHiA GENETIC (Switzerland), Predictive Oncology (US), Deep Genomics (Canada), NuMedii, Inc. (US), XtalPi Inc. (China), Iktos (France), BPGbio, Inc. (US), Eurofins Discovery (US), VeriSIM Life (US), Lifebit (UK), Verge Genomics (US), Logica (US), American Chemical Society (US), and Aganitha AI Inc. (India).

Research Coverage

The report analyzes the AI in biotechnology market and aims to estimate the market size and future growth potential of various market segments, based on offering, function, deployment mode, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will benefit established firms as well as new entrants and smaller firms in gauging the market pulse, which in turn will help them capture a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights into the following:

- Analysis of key drivers (growing cross-industry collaborations and partnerships, growing need to reduce time and cost of drug discovery and development, rising adoption of AI in precision medicine, improving computing power and declining hardware cost), restraints (high implementation costs of AI limit adoption in biotechnology, especially for SMEs and emerging economies, data privacy risks and compliance challenges for AI in biotechnology), opportunities (integrating AI and big data in precision medicine for biotechnology advancement, surge in biotechnology investments enhances opportunities for AI to accelerate drug discovery innovations, innovation across healthcare, agriculture, and environmental science for global growth) challenges (data quality and interpretability issues that hinder AI integration and trustworthiness, AI deployment in biotechnology hindered by talent shortages and evolving regulatory challenges) influencing the growth of the AI in biotechnology market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in biotechnology market

- Market Development: Comprehensive information on the lucrative emerging markets, offering, function, deployment mode, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the AI in biotechnology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the AI in biotechnology market, like NVIDIA (US), Illumina, Inc. (US), Recursion (US), Schrodinger Inc. (US), and BenevolentAI (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 AI IN BIOTECHNOLOGY MARKET OVERVIEW

- 4.2 AI IN BIOTECHNOLOGY MARKET, BY REGION

- 4.3 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING AND COUNTRY

- 4.4 AI IN BIOTECHNOLOGY MARKET: GEOGRAPHIC SNAPSHOT

- 4.5 AI IN BIOTECHNOLOGY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing cross-industry collaborations and partnerships

- 5.2.1.2 Increasing need to reduce time and cost of drug discovery & development

- 5.2.1.3 Rising adoption of AI in precision medicine

- 5.2.1.4 Increasing investments in semiconductor chipsets

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs

- 5.2.2.2 Data privacy risks and compliance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of advanced analytics and predictive modeling

- 5.2.3.2 Surge in biotechnology investments

- 5.2.3.3 Innovations across healthcare, agriculture, and environmental science

- 5.2.4 CHALLENGES

- 5.2.4.1 Data quality and interpretability issues

- 5.2.4.2 Shortage of qualified experts and evolving regulatory challenges

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 EVOLUTION OF AI IN BIOTECHNOLOGY

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 BARGAINING POWER OF SUPPLIERS

- 6.2.2 BARGAINING POWER OF BUYERS

- 6.2.3 THREAT OF SUBSTITUTES

- 6.2.4 THREAT OF NEW ENTRANTS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 MACROECONOMICS INDICATORS

- 6.3.1 INTRODUCTION

- 6.3.2 GDP TRENDS AND FORECAST

- 6.3.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING ANALYSIS FOR AI IN BIOTECHNOLOGY, BY OFFERING, BY KEY PLAYERS (2024)

- 6.6.2 INDICATIVE PRICING OF AI IN BIOTECHNOLOGY, BY REGION

- 6.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 CASE STUDY 1: RAPID TRAINING OF PROTEIN MODELS USING NVIDIA DGX CLOUD

- 6.10.2 CASE STUDY 2: IMPROVED END-TO-END NGS WORKFLOW FOR EFFICIENT GENETIC VARIANT DETECTION

- 6.10.3 CASE STUDY 3: ACCELERATED DRUG DISCOVERY WITH GENERATIVE AI AND STREAMLINED WORKFLOWS

- 6.11 IMPACT OF 2025 US TARIFF ON AI IN BIOTECHNOLOGY MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRIES/REGIONS

- 6.11.4.1 North America

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USE INDUSTRIES

- 6.11.5.1 Pharmaceutical companies

- 6.11.5.2 Biotechnology companies

- 6.11.5.3 Research institutes and labs

- 6.11.5.4 Healthcare providers

- 6.11.5.5 Contract Research Organizations (CROs)

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 NATURAL LANGUAGE PROCESSING (NLP)

- 7.1.2 PREDICTIVE ANALYTICS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 CLOUD COMPUTING

- 7.2.2 BIG DATA ANALYTICS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.4 PATENT ANALYSIS

- 7.4.1 PATENT PUBLICATION TRENDS FOR AI IN BIOTECHNOLOGY

- 7.4.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 7.5 FUTURE APPLICATIONS

- 7.5.1 AI-ENABLED PRECISION DISCOVERY AND MULTI-OMICS INTEGRATION

- 7.5.2 GENERATIVE BIOLOGY AND AUTOMATED DESIGN OF MOLECULES, PROTEINS, AND GENETIC SYSTEMS

- 7.6 IMPACT OF AI/GEN AI ON AI IN BIOTECHNOLOGY MARKET

- 7.6.1 INTRODUCTION

- 7.6.2 TOP USE CASES AND MARKET POTENTIAL

- 7.6.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.6.3.1 Drug discovery and development market

- 7.6.3.2 Genomics and bioinformatics market

- 7.6.3.3 Medical imaging & diagnostics market

- 7.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AI IN BIOTECHNOLOGY MARKET

- 7.6.4.1 User readiness

- 7.6.4.1.1 Pharmaceutical companies

- 7.6.4.1.2 Biotechnology companies

- 7.6.4.2 Impact assessment

- 7.6.4.2.1 User A: Pharmaceutical companies

- 7.6.4.2.1.1 Implementation

- 7.6.4.2.1.2 Impact

- 7.6.4.2.2 User B: Biotechnology companies

- 7.6.4.2.2.1 Implementation

- 7.6.4.2.2.2 Impact

- 7.6.4.2.1 User A: Pharmaceutical companies

- 7.6.4.1 User readiness

- 7.6.5 CASE STUDY ON AI/GENERATIVE AI IMPLEMENTATION

- 7.6.5.1 Case Study 1: Enhanced operations and revenue using AI-driven real-world data analytics

- 7.6.5.2 Case study 2: Advance AI-powered target discovery with proprietary AI platform

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 NORTH AMERICA

- 8.1.2 EUROPE

- 8.1.3 ASIA PACIFIC

- 8.1.4 LATIN AMERICA

- 8.1.5 MIDDLE EAST & AFRICA

- 8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.3 INDUSTRY STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 INFLUENCE OF STAKEHOLDERS AND BUYING CRITERIA

- 9.2.1 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 END-USER EXPECTATIONS

10 AI IN BIOTECHNOLOGY MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 END-TO-END SOLUTIONS

- 10.2.1 GROWING USE OF ADVANCED ALGORITHMS FOR BETTER PRECISION AND EFFICIENCY TO BOOST MARKET GROWTH

- 10.3 NICHE SOLUTIONS

- 10.3.1 ABILITY OF NICHE SOLUTIONS TO ADDRESS SPECIFIC CHALLENGES WITHIN DRUG DISCOVERY TO SUPPORT ADOPTION

- 10.4 TECHNOLOGIES

- 10.4.1 ADOPTION OF ADVANCED TECHNOLOGIES FOR DRUG DISCOVERY, PERSONALIZED MEDICINE, AND DATA ANALYTICS TO FUEL GROWTH

- 10.5 SERVICES

- 10.5.1 CONSULTING SERVICES

- 10.5.1.1 Increasing efficiency of research processes and cost savings to boost adoption

- 10.5.2 IMPLEMENTATION SERVICES & ONGOING IT SUPPORT

- 10.5.2.1 Increasing precision and efficiency in IT support services to boost demand

- 10.5.3 TRAINING & EDUCATION SERVICES

- 10.5.3.1 Need for skilled talent for better training & education services to drive market

- 10.5.4 POST-SALES & MAINTENANCE SERVICES

- 10.5.4.1 Complexity of AI systems and need for improvement in AI algorithms to boost market

- 10.5.1 CONSULTING SERVICES

11 AI IN BIOTECHNOLOGY MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 RESEARCH & DEVELOPMENT

- 11.2.1 DRUG DISCOVERY

- 11.2.1.1 Molecular design & optimization

- 11.2.1.1.1 Increased efficiency in drug discovery with molecular design & optimization to drive market

- 11.2.1.2 Biomarker discovery

- 11.2.1.2.1 Ability to analyze large data sets with AI-enabled biomarker discovery to boost demand

- 11.2.1.3 Structure-activity relationship (SAR) modeling

- 11.2.1.3.1 Improved data analysis, predictive modeling, and compound optimization for drug candidates with SAR to fuel growth

- 11.2.1.1 Molecular design & optimization

- 11.2.2 CLINICAL DEVELOPMENT

- 11.2.2.1 Trial design

- 11.2.2.1.1 Ability of AI to improve trial design through simulations and patient stratification to favor market

- 11.2.2.2 Site selection

- 11.2.2.2.1 Optimized process of selecting clinical trial sites to fuel growth

- 11.2.2.3 Recruitment

- 11.2.2.3.1 Enhanced process of selecting and enrolling participants for clinical trials to drive demand

- 11.2.2.4 Clinical data assessment

- 11.2.2.4.1 Ability of clinical data assessment for efficient and accurate of data interpretation to propel market

- 11.2.2.5 Predictive toxicity & risk monitoring

- 11.2.2.5.1 Ability of data integration and predictive modeling to create comprehensive risk profiles for drug candidates

- 11.2.2.6 Monitoring & drug adherence

- 11.2.2.6.1 Enhanced patient compliance with monitoring and drug adherence to drive market

- 11.2.2.7 Real-world evidence (RWE) analysis

- 11.2.2.7.1 Enhanced safety monitoring and economic evaluation with RWE analysis to propel growth

- 11.2.2.1 Trial design

- 11.2.1 DRUG DISCOVERY

- 11.3 REGULATORY COMPLIANCE

- 11.3.1 ABILITY OF AI TO ENSURE REGULATORY COMPLIANCE IN CLINICAL TRIALS TO SUPPORT GROWTH

- 11.4 MANUFACTURING & SUPPLY CHAIN

- 11.4.1 SUPPLY CHAIN PLANNING

- 11.4.1.1 Increasing demand for real-time data analytics to accelerate market growth

- 11.4.2 INVENTORY MANAGEMENT

- 11.4.2.1 Automating stock tracking and replenishment with advanced analytics to fuel market growth

- 11.4.3 LOGISTICS OPTIMIZATION

- 11.4.3.1 Ability of AI for increased collaboration and transparency in biotechnology logistics to aid growth

- 11.4.4 DEMAND FORECASTING

- 11.4.4.1 Ability to integrate data for a reliable demand forecast to fuel market growth

- 11.4.5 PREDICTIVE MAINTENANCE

- 11.4.5.1 Boosting equipment reliability with AI-powered predictive maintenance to drive demand

- 11.4.6 OTHER MANUFACTURING & SUPPLY CHAIN FUNCTIONS

- 11.4.1 SUPPLY CHAIN PLANNING

- 11.5 LAUNCH & COMMERCIAL

- 11.5.1 LAUNCH COORDINATION

- 11.5.1.1 Increasing product launch success rates through predictive analytics to boost adoption

- 11.5.2 PATIENT ENGAGEMENT

- 11.5.2.1 Real-time patient feedback for better health outcomes to support growth

- 11.5.3 MARKETING OPERATIONS

- 11.5.3.1 Enhanced marketing performance with AI to boost market growth

- 11.5.4 PREDICTIVE PRICING

- 11.5.4.1 Ability of AI to enhance pricing accuracy to drive adoption

- 11.5.1 LAUNCH COORDINATION

- 11.6 POST-MARKETING SURVEILLANCE & PATIENT SUPPORT

- 11.6.1 MEDICATION ADHERENCE

- 11.6.1.1 Growing demand for personalized treatment plans to drive market

- 11.6.2 ADVERSE EVENT REPORTING

- 11.6.2.1 Faster post-market surveillance and enhanced drug safety to drive demand

- 11.6.3 PATIENT MONITORING

- 11.6.3.1 Rise of remote healthcare solutions to boost market demand

- 11.6.4 COMPLIANCE MONITORING

- 11.6.4.1 Increasing complexity of regulatory requirements to drive adoption

- 11.6.5 PATIENT SUPPORT PROGRAMS

- 11.6.5.1 Growing interest in patient-centered care to support market growth

- 11.6.1 MEDICATION ADHERENCE

- 11.7 CORPORATE

- 11.7.1 RISK MANAGEMENT

- 11.7.1.1 Rising expenditure for drug development to support growth

- 11.7.2 COMPLIANCE MONITORING

- 11.7.2.1 Strict guidelines for complex regulatory landscapes to aid market growth

- 11.7.3 SALES FORCE OPTIMIZATION

- 11.7.3.1 Need for data-driven decision-making to boost adoption of sales force optimization

- 11.7.4 OTHER CORPORATE FUNCTIONS

- 11.7.1 RISK MANAGEMENT

12 AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE

- 12.1 INTRODUCTION

- 12.2 CLOUD-BASED SOLUTIONS

- 12.2.1 PUBLIC CLOUD

- 12.2.1.1 Need to reduce dependency on expensive on-premises infrastructure to boost demand

- 12.2.2 PRIVATE CLOUD

- 12.2.2.1 Need for enhanced security and data protection to propel market growth

- 12.2.3 MULTI-CLOUD

- 12.2.3.1 Enhanced flexibility and cost optimization to support market growth

- 12.2.4 HYBRID CLOUD

- 12.2.4.1 Cost efficiency and flexibility of hybrid cloud models to fuel market growth

- 12.2.1 PUBLIC CLOUD

- 12.3 ON-PREMISES SOLUTIONS

- 12.3.1 BETTER DATA SECURITY, PRIVACY, AND COMPLIANCE WITH REGULATIONS TO FAVOR GROWTH

13 AI IN BIOTECHNOLOGY MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 PHARMACEUTICAL COMPANIES

- 13.2.1 INNOVATION AND EFFICIENCY WITH AI INTEGRATION IN DRUG DISCOVERY & DEVELOPMENT TO BOOST ADOPTION

- 13.3 BIOTECHNOLOGY COMPANIES

- 13.3.1 ABILITY OF AI-DRIVEN INNOVATIONS FOR BETTER PERSONALIZED MEDICINE AND DRUG DISCOVERY TO SUPPORT MARKET GROWTH

- 13.4 RESEARCH INSTITUTES & LABS

- 13.4.1 STRATEGIC INVESTMENTS AND COLLABORATIONS TO PROPEL AI ADVANCEMENTS IN RESEARCH INSTITUTES AND LABS

- 13.5 HEALTHCARE PROVIDERS

- 13.5.1 IMPROVED PATIENT OUTCOMES TO SUPPORT ADOPTION

- 13.6 CONTRACT RESEARCH ORGANIZATIONS

- 13.6.1 ABILITY OF AI TECHNOLOGIES TO ACCELERATE CLINICAL TRIALS AND IMPROVE PATIENT RECRUITMENT TO FUEL GROWTH

14 AI IN BIOTECHNOLOGY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to dominate North American AI in biotechnology market during study period

- 14.2.3 CANADA

- 14.2.3.1 Availability of advanced facilities and shorter approval times for drug candidates to drive market

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Increased funding in startups to drive uptake of AI in biotechnology

- 14.3.3 UK

- 14.3.3.1 Increasing investments and government fund allocations to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Government initiatives in France to support market growth

- 14.3.5 ITALY

- 14.3.5.1 Growing investments to create opportunities for market growth

- 14.3.6 SPAIN

- 14.3.6.1 Increasing need for personalized medicine and data-driven healthcare to increase adoption rate in market

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 JAPAN

- 14.4.2.1 Accelerating AI-driven drug discovery and biotechnology innovation to drive Japanese market

- 14.4.3 CHINA

- 14.4.3.1 Rising foreign investments in biotechnology and biopharmaceuticals to propel market growth

- 14.4.4 INDIA

- 14.4.4.1 Increasing number of startups and growing support from government to propel market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Significant advances in AI integration for R&D to fuel growth

- 14.4.6 AUSTRALIA

- 14.4.6.1 Accelerating AI adoption in Australia's biotech sector to augment market growth

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Funding of biotech companies to drive Brazilian market growth

- 14.5.3 MEXICO

- 14.5.3.1 Investment inflows and strengthening AI-related education to spur market growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.6.2 GCC COUNTRIES

- 14.6.2.1 Increase in healthcare investments to support market growth

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN AI IN BIOTECHNOLOGY MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 RANKING OF KEY MARKET PLAYERS

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Component footprint

- 15.5.5.4 Function footprint

- 15.5.5.5 End-user footprint

- 15.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SME players

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES & UPGRADES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 NVIDIA CORPORATION

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 ILLUMINA, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 RECURSION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.3.4 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 SCHRODINGER, INC.

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product upgrades

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 BENEVOLENTAI

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 DATA4CURE, INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.7 QIAGEN

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches and enhancements

- 16.1.7.3.2 Deals

- 16.1.8 INSILICO MEDICINE

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches, approvals, and enhancements

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Other developments

- 16.1.9 DNANEXUS, INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Other developments

- 16.1.10 TEMPUS

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product approvals

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Other developments

- 16.1.11 SOPHIA GENETICS

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Other developments

- 16.1.12 PREDICTIVE ONCOLOGY

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Expansions

- 16.1.13 DEEP GENOMICS

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.14 NUMEDII, INC.

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.15 XTALPI INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Deals

- 16.1.16 IKTOS

- 16.1.16.1 Business overview

- 16.1.16.2 Products offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Product launches

- 16.1.16.3.2 Deals

- 16.1.16.3.3 Other developments

- 16.1.17 BPGBIO, INC.

- 16.1.17.1 Business overview

- 16.1.17.2 Products offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Product launches

- 16.1.17.3.2 Deals

- 16.1.17.3.3 Other developments

- 16.1.18 EUROFINS DISCOVERY

- 16.1.18.1 Business overview

- 16.1.18.2 Products offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches

- 16.1.18.3.2 Deals

- 16.1.18.3.3 Expansions

- 16.1.1 NVIDIA CORPORATION

- 16.2 OTHER PLAYERS

- 16.2.1 VERISIM LIFE

- 16.2.2 LIFEBIT BIOTECH INC.

- 16.2.3 VALO HEALTH

- 16.2.4 VERGE GENOMICS

- 16.2.5 LOGICA

- 16.2.6 AMERICAN CHEMICAL SOCIETY

- 16.2.7 AGANITHA AI INC.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AI IN BIOTECHNOLOGY MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 3 AI IN BIOTECHNOLOGY MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 AI IN BIOTECHNOLOGY MARKET: RISK ASSESSMENT

- TABLE 5 AI IN BIOTECHNOLOGY MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 INDICATIVE LIST OF COLLABORATIONS AND PARTNERSHIPS IN AI IN BIOTECHNOLOGY MARKET, 2022-2025

- TABLE 7 TABLE AI IN BIOTECHNOLOGY MARKET: UNMET NEEDS

- TABLE 8 AI IN BIOTECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 FIGURE 5 AI IN BIOTECHNOLOGY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 TABLE INDICATIVE PRICING ANALYSIS FOR AI IN BIOTECHNOLOGY OFFERINGS, BY KEY PLAYER, 2024 (USD)

- TABLE 11 TABLE INDICATIVE PRICING ANALYSIS FOR AI IN BIOTECHNOLOGY, BY REGION (2024)

- TABLE 12 AI IN BIOTECHNOLOGY MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES, 2015-2025

- TABLE 15 TABLE AI IN BIOTECHNOLOGY MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2022-2025

- TABLE 16 REGULATORY SCENARIO OF NORTH AMERICA

- TABLE 17 REGULATORY SCENARIO OF EUROPE

- TABLE 18 REGULATORY SCENARIO OF ASIA PACIFIC

- TABLE 19 REGULATORY SCENARIO OF LATIN AMERICA

- TABLE 20 REGULATORY SCENARIO OF MIDDLE EAST & AFRICA

- TABLE 21 TABLE NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 TABLE EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 TABLE ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 TABLE REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END USERS (%)

- TABLE 26 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 27 UNMET NEEDS IN AI IN BIOTECHNOLOGY MARKET

- TABLE 28 TABLE END-USER EXPECTATIONS IN AI IN BIOTECHNOLOGY MARKET

- TABLE 29 AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 30 AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 31 AI IN BIOTECHNOLOGY MARKET FOR END-TO-END SOLUTIONS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 32 AI IN BIOTECHNOLOGY MARKET FOR END-TO-END SOLUTIONS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 33 AI IN BIOTECHNOLOGY MARKET FOR NICHE SOLUTIONS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 34 AI IN BIOTECHNOLOGY MARKET FOR NICHE SOLUTIONS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 35 AI IN BIOTECHNOLOGY MARKET FOR TECHNOLOGIES, BY REGION, 2023-2029 (USD MILLION)

- TABLE 36 AI IN BIOTECHNOLOGY MARKET FOR TECHNOLOGIES, BY REGION, 2030-2035 (USD MILLION)

- TABLE 37 AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY REGION, 2023-2029 (USD MILLION)

- TABLE 38 AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY REGION, 2030-2035 (USD MILLION)

- TABLE 39 CONSULTING SERVICES MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 40 CONSULTING SERVICES MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 41 IMPLEMENTATION SERVICES & ONGOING IT SUPPORT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 42 IMPLEMENTATION SERVICES & ONGOING IT SUPPORT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 43 TRAINING AND EDUCATION SERVICES MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 44 TRAINING AND EDUCATION SERVICES MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 45 POST-SALES AND MAINTENANCE SERVICES MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 46 AI IN BIOTECHNOLOGY MARKET FOR POST-SALES AND MAINTENANCE SERVICES, BY REGION, 2030-2035 (USD MILLION)

- TABLE 47 AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 48 AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 49 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 50 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 51 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY REGION, 2023-2029 (USD MILLION)

- TABLE 52 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY REGION, 2030-2035 (USD MILLION)

- TABLE 53 EXAMPLES OF AI TOOLS USED IN DRUG DISCOVERY

- TABLE 54 DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 55 DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 56 DRUG DISCOVERY MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 57 DRUG DISCOVERY MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 58 MOLECULAR DESIGN & OPTIMIZATION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 59 MOLECULAR DESIGN & OPTIMIZATION MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 60 BIOMARKER DISCOVERY MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 61 BIOMARKER DISCOVERY MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 62 STRUCTURE-ACTIVITY RELATIONSHIP (SAR) MODELING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 63 STRUCTURE-ACTIVITY RELATIONSHIP (SAR) MODELING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 64 CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 65 CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 66 CLINICAL DEVELOPMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 67 CLINICAL DEVELOPMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 68 TRIAL DESIGN MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 69 TRIAL DESIGN MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 70 SITE SELECTION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 71 SITE SELECTION MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 72 RECRUITMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 73 RECRUITMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 74 CLINICAL DATA ASSESSMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 75 CLINICAL DATA ASSESSMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 76 PREDICTIVE TOXICITY & RISK MONITORING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 77 PREDICTIVE TOXICITY & RISK MONITORING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 78 MONITORING & DRUG ADHERENCE MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 79 MONITORING & DRUG ADHERENCE MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 80 REAL-WORLD EVIDENCE (RWE) ANALYSIS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 81 REAL-WORLD EVIDENCE (RWE) ANALYSIS MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 82 AI IN BIOTECHNOLOGY MARKET FOR REGULATORY COMPLIANCE, BY REGION, 2023-2029 (USD MILLION)

- TABLE 83 AI IN BIOTECHNOLOGY MARKET FOR REGULATORY COMPLIANCE, BY REGION, 2030-2035 (USD MILLION)

- TABLE 84 AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 85 AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 86 AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY REGION, 2023-2029 (USD MILLION)

- TABLE 87 AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY REGION, 2030-2035 (USD MILLION)

- TABLE 88 SUPPLY CHAIN PLANNING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 89 SUPPLY CHAIN PLANNING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 90 INVENTORY MANAGEMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 91 INVENTORY MANAGEMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 92 LOGISTICS OPTIMIZATION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 93 LOGISTICS OPTIMIZATION MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 94 DEMAND FORECASTING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 95 DEMAND FORECASTING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 96 PREDICTIVE MAINTENANCE MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 97 PREDICTIVE MAINTENANCE MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 98 OTHER MANUFACTURING & SUPPLY CHAIN FUNCTIONS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 99 OTHER MANUFACTURING & SUPPLY CHAIN FUNCTIONS MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 100 AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 101 AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 102 AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY REGION, 2023-2029 (USD MILLION)

- TABLE 103 AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY REGION, 2030-2035 (USD MILLION)

- TABLE 104 LAUNCH COORDINATION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 105 LAUNCH COORDINATION MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 106 PATIENT ENGAGEMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 107 PATIENT ENGAGEMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 108 MARKETING OPERATIONS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 109 MARKETING OPERATIONS MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 110 PREDICTIVE PRICING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 111 PREDICTIVE PRICING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 112 AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 113 AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 114 AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY REGION, 2023-2029 (USD MILLION)

- TABLE 115 AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY REGION, 2030-2035 (USD MILLION)

- TABLE 116 MEDICATION ADHERENCE MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 117 MEDICATION ADHERENCE MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 118 ADVERSE EVENT REPORTING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 119 ADVERSE EVENT REPORTING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 120 PATIENT MONITORING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 121 PATIENT MONITORING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 122 COMPLIANCE MONITORING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 123 COMPLIANCE MONITORING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 124 PATIENT SUPPORT PROGRAMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 125 PATIENT SUPPORT PROGRAMS MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 126 AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 127 AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 128 AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY REGION, 2023-2029 (USD MILLION)

- TABLE 129 AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY REGION, 2030-2035 (USD MILLION)

- TABLE 130 RISK MANAGEMENT MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 131 RISK MANAGEMENT MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 132 COMPLIANCE MONITORING MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 133 COMPLIANCE MONITORING MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 134 SALES FORCE OPTIMIZATION MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 135 SALES FORCE OPTIMIZATION MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 136 OTHER CORPORATE FUNCTIONS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 137 OTHER CORPORATE FUNCTIONS MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 138 AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 139 AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 140 AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 141 AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 142 AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 143 AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 144 PUBLIC CLOUD MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 145 PUBLIC CLOUD MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 146 PRIVATE CLOUD MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 147 PRIVATE CLOUD MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 148 MULTI CLOUD MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 149 MULTI CLOUD MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 150 HYBRID CLOUD MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 151 HYBRID CLOUD MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 152 AI IN BIOTECHNOLOGY MARKET FOR ON-PREMISES SOLUTIONS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 153 AI IN BIOTECHNOLOGY MARKET FOR ON-PREMISES SOLUTIONS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 154 AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 155 AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 156 AI IN BIOTECHNOLOGY MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2023-2029 (USD MILLION)

- TABLE 157 AI IN BIOTECHNOLOGY MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2030-2035 (USD MILLION)

- TABLE 158 AI IN BIOTECHNOLOGY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2029 (USD MILLION)

- TABLE 159 AI IN BIOTECHNOLOGY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2030-2035 (USD MILLION)

- TABLE 160 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH INSTITUTES & LABS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 161 AI IN BIOTECHNOLOGY MARKET FOR RESEARCH INSTITUTES & LABS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 162 AI IN BIOTECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 163 AI IN BIOTECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 164 AI IN BIOTECHNOLOGY MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 165 AI IN BIOTECHNOLOGY MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2030-2035 (USD MILLION)

- TABLE 166 AI IN BIOTECHNOLOGY MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 167 AI IN BIOTECHNOLOGY MARKET, BY REGION, 2030-2035 (USD MILLION)

- TABLE 168 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2030-2035 (USD MILLION)

- TABLE 170 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 171 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 172 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 173 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 174 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 175 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 176 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 177 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 178 NORTH AMERICA: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 179 NORTH AMERICA: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 180 NORTH AMERICA: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 181 NORTH AMERICA: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 182 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 183 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 184 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 185 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 186 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 187 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 188 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 189 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 190 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 191 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 192 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 193 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 194 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 195 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 196 US: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 197 US: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 198 US: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 199 US: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 200 US: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 201 US: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 202 US: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 203 US: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 204 US: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 205 US: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 206 US: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 207 US: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 208 US: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 209 US: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 210 US: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 211 US: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 212 US: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 213 US: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 214 US: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 215 US: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 216 US: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 217 US: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 218 US: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 219 US: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 220 US: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 221 US: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 222 CANADA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 223 CANADA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 224 CANADA: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 225 CANADA: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 226 CANADA: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 227 CANADA: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 228 CANADA: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 229 CANADA: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 230 CANADA: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 231 CANADA: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 232 CANADA: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 233 CANADA: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 234 CANADA: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 235 CANADA: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 236 CANADA: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 237 CANADA: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 238 CANADA: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 239 CANADA: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 240 CANADA: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 241 CANADA: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 242 CANADA: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 243 CANADA: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 244 CANADA: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 245 CANADA: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 246 CANADA: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 247 CANADA: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 248 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 249 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2030-2035 (USD MILLION)

- TABLE 250 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 251 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 252 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 253 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 254 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 255 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 256 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 257 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 258 EUROPE: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 259 EUROPE: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 260 EUROPE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 261 EUROPE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 262 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 263 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 264 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 265 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 266 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 267 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 268 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 269 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 270 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 271 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 272 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 273 EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 274 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 275 EUROPE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 276 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 277 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 278 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 279 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 280 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 281 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 282 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 283 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 284 GERMANY: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 285 GERMANY: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 286 GERMANY: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 287 GERMANY: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 288 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 289 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 290 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 291 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 292 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 293 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 294 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 295 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 296 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 297 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 298 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 299 GERMANY: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 300 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 301 GERMANY: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 302 UK: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 303 UK: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 304 UK: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 305 UK: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 306 UK: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 307 UK: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 308 UK: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 309 UK: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 310 UK: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 311 UK: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 312 UK: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 313 UK: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 314 UK: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 315 UK: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 316 UK: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 317 UK: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 318 UK: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 319 UK: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 320 UK: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 321 UK: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 322 UK: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 323 UK: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 324 UK: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 325 UK: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 326 UK: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 327 UK: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 328 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 329 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 330 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 331 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 332 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 333 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 334 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 335 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 336 FRANCE: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 337 FRANCE: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 338 FRANCE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 339 FRANCE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 340 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 341 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 342 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 343 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 344 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 345 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 346 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 347 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 348 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 349 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 350 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 351 FRANCE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 352 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 353 FRANCE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 354 ITALY: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 355 ITALY: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 356 ITALY: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 357 ITALY: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 358 ITALY: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 359 ITALY: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 360 ITALY: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 361 ITALY: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 362 ITALY: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 363 ITALY: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 364 ITALY: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 365 ITALY: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 366 ITALY: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 367 ITALY: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 368 ITALY: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 369 ITALY: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 370 ITALY: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 371 ITALY: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 372 ITALY: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 373 ITALY: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 374 ITALY: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 375 ITALY: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 376 ITALY: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 377 ITALY: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 378 ITALY: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 379 ITALY: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 380 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 381 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 382 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 383 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 384 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 385 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 386 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 387 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 388 SPAIN: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 389 SPAIN: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 390 SPAIN: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 391 SPAIN: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 392 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 393 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 394 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 395 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 396 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 397 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 398 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 399 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 400 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 401 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 402 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 403 SPAIN: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 404 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 405 SPAIN: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 406 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 407 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 408 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 409 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 410 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 411 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 412 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 413 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 414 REST OF EUROPE: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 415 REST OF EUROPE: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 416 REST OF EUROPE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 417 REST OF EUROPE: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 418 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 419 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 420 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 421 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 422 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 423 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 424 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 425 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 426 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 427 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 428 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 429 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 430 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 431 REST OF EUROPE: AI IN BIOTECHNOLOGY MARKET, BY END USER, 2030-2035 (USD MILLION)

- TABLE 432 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 433 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY COUNTRY, 2030-2035 (USD MILLION)

- TABLE 434 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2023-2029 (USD MILLION)

- TABLE 435 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY OFFERING, 2030-2035 (USD MILLION)

- TABLE 436 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 437 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 438 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2023-2029 (USD MILLION)

- TABLE 439 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY FUNCTION, 2030-2035 (USD MILLION)

- TABLE 440 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 441 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR RESEARCH & DEVELOPMENT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 442 ASIA PACIFIC: DRUG DISCOVERY MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 443 ASIA PACIFIC: DRUG DISCOVERY MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 444 ASIA PACIFIC: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 445 ASIA PACIFIC: CLINICAL DEVELOPMENT MARKET, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 446 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 447 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR MANUFACTURING & SUPPLY CHAIN, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 448 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 449 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR LAUNCH & COMMERCIAL, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 450 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 451 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR POST-MARKETING SURVEILLANCE & PATIENT SUPPORT, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 452 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 453 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR CORPORATE, BY TYPE, 2030-2035 (USD MILLION)

- TABLE 454 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2023-2029 (USD MILLION)

- TABLE 455 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2030-2035 (USD MILLION)

- TABLE 456 ASIA PACIFIC: AI IN BIOTECHNOLOGY MARKET FOR CLOUD-BASED SOLUTIONS, BY TYPE, 2023-2029 (USD MILLION)