|

市场调查报告书

商品编码

1880373

全球生物识别系统市场(至2030年):依认证方法(指纹、虹膜、脸部、语音、静脉、掌纹、签名、多因素认证、步态、击键)、产品类别(感测器、摄影机、读取器、扫描器、软体、服务)、类型(接触式、非接触式)和移动性划分Biometric System Market by Authentication (Fingerprint, Iris, Face, Voice, Vein, Palm, Signature, Multi-factor, Gait, Keystrokes), Offering (Sensor, Camera, Reader, Scanner, Software, Service), Contact, Contactless, Mobility - Global Forecast to 2030 |

||||||

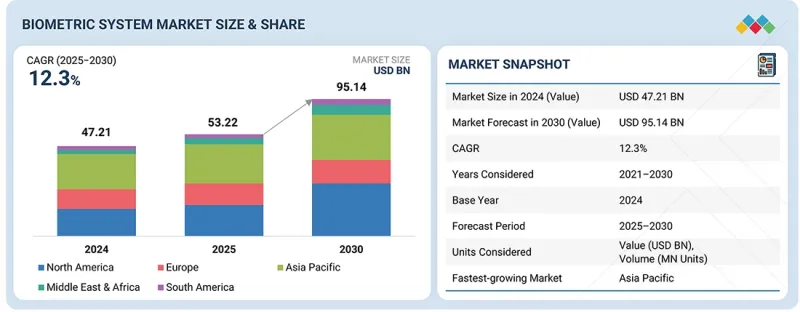

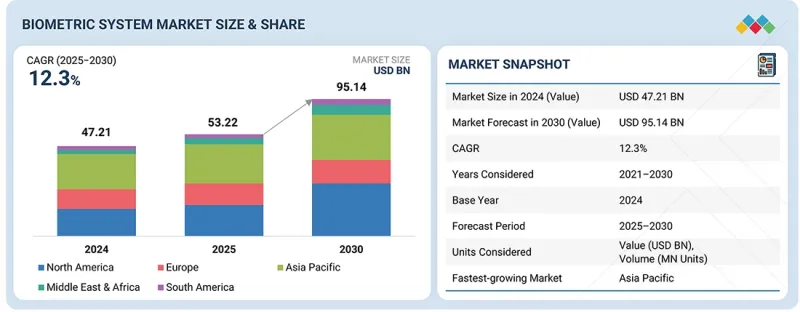

预计生物识别系统市场将从 2025 年的 532.2 亿美元成长到 2030 年的 951.4 亿美元,2025 年至 2030 年的复合年增长率为 12.3%。

随着先进的生物识别功能整合到智慧型手机、笔记型电脑、平板电脑、穿戴式装置和智慧家居设备中,消费性电子产品对生物识别技术的需求正在迅速增长。指纹感应器、脸部认证、虹膜扫描和语音辨识已成为许多装置的标配,在提供安全且方便的使用者存取方式的同时,也提升了整体使用者体验。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部门 | 按服务类别、类型、行业和地区划分 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

随着行动支付、数位钱包和网路银行的蓬勃发展,消费者对安全性和便利性的日益重视,也加速了对可靠生物识别的需求。此外,智慧型手錶和健身追踪器等穿戴式装置越来越多地利用生物识别感测器来监测健康参数、追踪活动并提供安全的装置存取。智慧家庭产品,例如安防系统、门锁和智慧家庭助手,也在整合生物识别解决方案以防止未授权存取。数位化程度的不断提高、物联网设备的日益普及以及消费者对个人化和安全体验的需求,共同推动了该领域的显着成长。技术进步、微型化感测器和人工智慧驱动的分析技术实现了更精准、更无缝的认证,使消费性电子产品成为生物识别系统市场中一个高成长的机会。

“预计到2025年和2030年,软体产业将占据市场的主要份额。”

预计在2025年和2030年,软体领域将占据市场的重要份额,这主要得益于对高阶身分管理、认证和分析解决方案日益增长的需求。生物识别软体能够跨多种模式(包括指纹、脸部、虹膜和语音辨识)进行精确的资料撷取、处理和检验。云端基础和人工智慧的软体解决方案能够实现即时分析、诈欺检测以及与企业安全系统的集成,使其成为政府、银行、医疗保健和企业应用等大规模部署的关键。此外,软体平台还有助于与行动装置、物联网网路和存取控制系统无缝整合,从而提高扩充性和营运效率。对安全数位交易、电子政府措施和监管合规性的重视进一步推动了高级生物识别软体解决方案的普及。人工智慧、机器学习和模式识别技术的不断进步正在提高系统的准确性和可靠性,进一步提升了软体在整个市场中的重要性。因此,预计在预测期内,提供强大、灵活且扩充性的生物识别软体的供应商将占据相当大的市场收入份额。

“预计2025年至2030年间,行动部署领域将实现显着的复合年增长率。”

这一成长主要得益于智慧型手机、平板电脑和穿戴式装置的广泛普及,这些装置整合了生物识别功能。行动生物识别,包括指纹感应器、脸部辨识和虹膜扫描,为设备存取、行动支付、数位银行和身分验证提供安全、便捷、快速的认证。行动钱包、网路银行和非接触式支付解决方案的日益普及进一步推动了市场需求,因为用户在追求更高安全性的同时,也希望保持便利性。行动生物识别还支援多应用功能,使企业和服务供应商能够为行动应用、企业网路和医疗保健平台实现安全存取。行动感测器技术、人工智慧驱动的识别技术和云端整合技术的进步正在提升准确性、可靠性和用户体验。此外,新兴市场智慧型手机普及率的不断提高,以及政府和企业推行基于行动装置的数位身分计划,也进一步推动了市场成长。随着行动装置在日常交易、通讯和保全行动中扮演越来越重要的角色,行动领域预计将成为生物识别系统市场中成长最快的细分市场。

按地区划分,到 2024 年,亚太地区将占据最大份额。

预计亚太地区将在2024年占据最大的市场份额,这主要得益于技术的快速普及、政府的支持以及在安全和身分管理方面的高额投资。中国、印度、日本和韩国等国家正在实施大规模的数位身分计画、电子政府倡议和智慧城市计划,从而推动生物识别系统的广泛应用。庞大的人口基数、不断提高的智慧型手机普及率以及不断扩大的企业和公共部门基础设施进一步刺激了市场需求。生物识别技术的主要应用领域包括边防安全、执法机关、银行、医疗保健和交通运输,这些领域能够确保准确的身份验证、存取控制和诈欺防范。本地技术供应商和Start-Ups正在推动人工智慧驱动、非接触式和云端整合生物识别解决方案的创新,从而重塑竞争格局。此外,意识提升也是推动该技术普及的重要因素。技术进步、公私合营以及持续的研发有望维持该地区的市场主导地位,为供应商提供巨大的成长机会,并巩固该地区作为全球生物识别系统应用关键中心的地位。

本报告调查了全球生物识别系统市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家/地区进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

第五章 产业趋势

- 波特五力分析

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 2025-2026 年重要会议与活动

- 影响客户业务的趋势/干扰因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税的影响

- 主要技术

- 互补技术

- 技术蓝图

- 专利分析

- 生成式人工智慧/人工智慧对生物识别系统市场的影响

第七章 监理环境

- 地方法规和合规性

第八章:顾客状况与购买行为

- 决策流程

- 相关利益者和采购标准

- 采用障碍和内部挑战

- 市场盈利

第九章生物识别系统市场(依应用领域划分)

- 存取控制和身份验证

- 考勤管理

- 身份验证

- 监控与安防

- 支付和交易处理

- 其他(诈欺检测)

第十章生物识别系统市场(依生物辨识特征划分)

- 生物学/生理学

- DNA/血液

- 形态学

- 帐单

- 脸

- 鸢尾花

- 视网膜

- 嗓音

- 行为

- 步态

- 签名

- 键盘输入模式

第十一章 依网路连线分類的生物识别系统市场

- 离线/独立

- LAN

- 具备 Wi-Fi 功能

- 蜂窝网路(4G/5G)

- BLUETOOTH/NFC

第十二章生物识别系统市场(依认证类型划分)

- 单因素身份验证

- 指纹辨识

- 虹膜辨识

- 手掌识别

- 脸部辨识

- 静脉辨识

- 签名辨识

- 语音辨识

- 其他的

- 多因素身份验证

- 2 个元素

- 3个要素

- 4个要素

- 5个要素

第十三章 移动性生物识别系统市场

- 固定类型

- 携带式的

第十四章生物识别系统市场依服务区隔市场划分

- 硬体

- 指纹感应器

- 阅读器/扫描仪

- 相机

- 其他的

- 软体

- 生物识别管理软体

- 服务

第十五章生物识别系统市场(按类型划分)

- 联繫类型

- 非接触式

- 杂交种

第十六章生物识别系统市场依部署细分市场划分

- 本地部署

- 云端基础的

第十七章生物识别系统市场(依产业划分)

- 政府

- 国民身分证

- 执法机关

- 边境管制与安全

- 军事/国防

- 国防基地、军火库和限制区域的出入控制

- 军人和承包商身份验证

- 武器存取授权

- 利用脸部认证进行监视和监控

- 安全通讯认证

- 卫生保健

- 识别以防止患者身分误认

- 员工进出限制区域/药局的权限控制

- 电子健康记录(EHR/EMR) 存取认证

- 处方药配送检验

- 医疗人员考勤管理

- BFSI

- 用于行动银行应用程式的生物识别

- ATM提款和存取款的指纹/虹膜辨识

- 开户时需进行 KYC 身份验证

- 利用行为生物特征进行诈欺检测

- POS机和线上支付的生物识别支付

- 加密货币

- CE产品

- 智慧型手机

- 笔记型电脑和平板电脑

- 游戏主机与VR头戴装置

- 穿戴式装置

- 具备语音/脸部辨识的智慧家庭设备

- 旅行和移民

- 自动边境管制门

- 带有嵌入式生物识别资讯的电子护照

- 航空旅客报到及登机授权

- 常旅客计画验证

- 移民和签证程序

- 车

- 驾驶员身份验证(指纹/脸部辨识)用于车辆访问/启动

- 基于生物识别的个人化车内设定(座椅、资讯娱乐系统)

- 采用生物识别启动认证的防盗车辆安全系统

- 车队管理:驾驶员监控与检验

- 酒精检测结合驾驶生物识别,提升安全性

- 安全

- 家庭安全

- 商业安全

- 其他的

- 产业

- 公用事业

- 运动的

- 娱乐

第十八章生物识别系统市场(按地区划分)

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他的

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 其他地区

- 宏观经济展望

- 中东

- 非洲

- 南美洲

第十九章 竞争情势

- 概述

- 主要参与企业的策略/优势

- 收入分析

- 市占率分析

- 品牌/产品对比

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小企业

- 估值和财务指标

- 竞争场景

第二十章 公司简介

- 主要企业

- THALES

- IDEMIA

- NEC CORPORATION

- ASSA ABLOY

- FUJITSU

- PRECISE BIOMETRICS

- SECUNET SECURITY NETWORKS AG

- AWARE INC.

- COGNITEC SYSTEMS GMBH

- ANVIZ GLOBAL INC.

- 其他主要企业

- DAON, INC.

- DERMALOG IDENTIFICATION SYSTEMS GMBH

- NEUROTECHNOLOGY

- INNOVATRICS

- VERIDOS GMBH

- ZETES

- JUMIO

- IPROOV

- FACETEC, INC.

- MITEK SYSTEMS, INC.

- BEIJING KUANGSHI TECHNOLOGY CO., LTD. (MEGVII)

- SENSETIME

- FACEBANX

- BIO-KEY INTERNATIONAL

- SECURIPORT

- M2SYS TECHNOLOGY

- SUPREMA INC.

- FULCRUM BIOMETRICS

- ONESPAN

- QUALCOMM TECHNOLOGIES, INC.

- INTEGRATED BIOMETRICS

- LEIDOS

- PAPILLON

- NUANCE COMMUNICATIONS, INC.

第21章调查方法

第22章附录

The biometric system market is projected to be valued at USD 53.22 billion in 2025 and USD 95.14 billion by 2030, registering a CAGR of 12.3% from 2025 to 2030. The demand for biometric technology in consumer electronics is rapidly increasing as smartphones, laptops, tablets, wearables, and smart home devices integrate advanced biometric authentication features. Fingerprint sensors, facial recognition, iris scanning, and voice recognition are standard in many devices, offering secure and convenient user access while enhancing overall user experience.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Type, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of mobile payments, digital wallets, and online banking has accelerated the need for reliable biometric authentication, as consumers prioritize security and convenience. Additionally, wearable devices, such as smartwatches and fitness trackers, increasingly leverage biometric sensors to monitor health parameters, track activities, and provide secure device access. Smart home products, including security systems, door locks, and home assistants, also integrate biometric solutions to prevent unauthorized access. The combination of rising digitalization, growing adoption of IoT devices, and consumer demand for personalized, secure experiences drives significant growth. Technology advancements, miniaturization of sensors, and AI-powered analytics further enable precise and seamless authentication, positioning consumer electronics as a high-growth opportunity within the biometric system market.

"Software segment is likely to contribute a major share of the biometric system market in 2025 and 2030."

The software segment is expected to account for a significant share of the biometric system market in 2025 and 2030, driven by the growing demand for advanced identity management, authentication, and analytics solutions. Biometric software enables accurate data capture, processing, and verification across multiple modalities, including fingerprint, facial, iris, and voice recognition. Cloud-based and AI-enabled software solutions allow real-time analytics, fraud detection, and integration with enterprise security systems, making them essential for large-scale deployments in government, banking, healthcare, and enterprise applications. Additionally, software platforms facilitate seamless integration with mobile devices, IoT networks, and access control systems, enhancing scalability and operational efficiency. The increasing emphasis on secure digital transactions, e-governance initiatives, and regulatory compliance further drives the adoption of sophisticated biometric software solutions. Continuous advancements in AI, machine learning, and pattern recognition enhance system accuracy and reliability, further reinforcing the importance of software in the overall market. Consequently, vendors focusing on robust, flexible, and scalable biometric software are expected to capture a substantial portion of market revenue during the forecast period.

"Mobile deployment mode segment is expected to record a significant CAGR from 2025 to 2030."

The mobile segment is projected to register the highest CAGR in the biometric system market during the forecast period due to the widespread adoption of smartphones, tablets, and wearable devices integrated with biometric authentication features. Mobile biometrics, including fingerprint sensors, facial recognition, and iris scanning, offer secure, convenient, and fast authentication for device access, mobile payments, digital banking, and identity verification. The growing use of mobile wallets, online banking, and contactless payment solutions has further accelerated the demand, as users seek enhanced security without compromising convenience. Mobile biometrics also support multi-application functionality, enabling enterprises and service providers to deploy secure access for mobile apps, corporate networks, and healthcare platforms. Technological advancements in mobile sensors, AI-driven recognition, and cloud integration are improving accuracy, reliability, and user experience. Additionally, the rising penetration of smartphones in emerging markets and government and enterprise initiatives to adopt mobile-based digital identity programs further propel growth. As mobile devices become central to daily transactions, communications, and security operations, the mobile segment is poised to experience the fastest expansion in the biometric system market.

"Asia Pacific accounted for the largest share of the biometric system market in 2024."

Asia Pacific held the largest share of the biometric system market in 2024, fueled by rapid technological adoption, supportive government initiatives, and high investment in security and identity management. Countries such as China, India, Japan, and South Korea are implementing large-scale digital identity programs, e-governance initiatives, and smart city projects, driving widespread deployment of biometric systems. The substantial population, rising smartphone penetration, and expanding enterprise and public sector infrastructure further accelerate demand. Key applications include border security, law enforcement, banking, healthcare, and transportation, where biometrics ensure accurate identification, access control, and fraud prevention. The presence of local technology providers and startups fosters innovation in AI-powered, contactless, and cloud-integrated biometric solutions, creating a competitive market landscape. Additionally, increasing consumer awareness about data security, privacy, and seamless authentication contributes to adoption. With technological advancements, public-private collaborations, and continuous R&D, the regional market dominance is expected to continue, offering significant growth opportunities for vendors and positioning the region as a leading hub for global biometric system deployment.

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Managers - 30%, and Others - 30%

- By Region: North America - 35%, Europe - 35%, Asia Pacific- 20%, and RoW - 10%

Prominent players profiled in this report include Renishaw plc (UK), Keysight Technologies (US), ZEISS Group (Germany), Zygo Corporation (US), and Bruker (US).

Report Coverage

The report defines, describes, and forecasts the biometric system market based on authentication type (single-factor authentication, multi-factor authentication), offering (hardware, software), type (contact-based, contactless, hybrid), mobility (fixed, portable), deployment mode (on-premises, cloud-based), and region (North America, Europe, Asia Pacific, RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall biometric system market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Surging demand for biometric technology-enabled consumer electronics, Elevating use of biometrics in government projects to enhance security and efficiency, Escalating deployment of biometrics in security and surveillance applications due to increasing terrorism, Rising focus of automakers on enhancing vehicle safety, Pressing need to protect smart infrastructure from cyber threat), restraints (High costs associated with biometric systems, Stringent regulations related to biometric data collection, storage, and processing), opportunities (Development of AI- and ML-based biometric solutions, Collaborative strategies among participants in supply chain, Increasing number of subscribers for BaaS, Transition of businesses toward IoT and cloud technologies), and challenges (Data security concerns and shortage of technical knowledge, Detecting authorized and unauthorized users, System integration-related challenges) in the biometric system market

- Product developments/innovations: Detailed insights into upcoming technologies, research & development activities, and new product launches in the biometric system market

- Market developments: Comprehensive information about lucrative markets; the report analyses the biometric system market across various regions

- Market diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the biometric system market

- Competitive assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Thales (France), IDEMIA (France), ASSA ABLOY (Sweden), NEC Corporation (Japan), Fujitsu (Japan), Precise Biometrics (Sweden), secunet Security Networks AG (Germany), Anviz Global Inc. (US), and Aware Inc. (US), in the biometric system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.3.6 LIMITATIONS

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOMETRIC SYSTEM MARKET

- 3.2 BIOMETRIC SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY AND AUTHENTICATION TYPE

- 3.3 BIOMETRIC SYSTEM MARKET IN ASIA PACIFIC, BY VERTICAL

- 3.4 BIOMETRIC SYSTEM MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surging demand for biometric technology-enabled consumer electronics

- 4.2.1.2 Use in government projects to enhance security and efficiency

- 4.2.1.3 Deployment of biometrics in security and surveillance applications due to increasing terrorism

- 4.2.1.4 Rising focus of automakers on enhancing vehicle safety

- 4.2.1.5 Pressing need to protect smart infrastructure from cyberthreats

- 4.2.2 RESTRAINTS

- 4.2.2.1 High costs associated with biometric systems

- 4.2.2.2 Stringent regulations related to biometric data collection, storage, and processing

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Development of AI- and ML-based biometric solutions

- 4.2.3.2 Collaborative strategies among participants in supply chain

- 4.2.3.3 Increasing number of subscribers for BaaS

- 4.2.3.4 Transition of businesses toward IoT and cloud technologies

- 4.2.4 CHALLENGES

- 4.2.4.1 Data security concerns and shortage of technical knowledge

- 4.2.4.2 Detecting authorized and unauthorized users

- 4.2.4.3 System integration-related challenges

- 4.2.1 DRIVERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.1.2 BARGAINING POWER OF SUPPLIERS

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 THREAT OF NEW ENTRANTS

- 5.1.5 THREAT OF SUBSTITUTES

- 5.2 VALUE CHAIN ANALYSIS

- 5.3 ECOSYSTEM ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY FINGERPRINT SENSOR TECHNOLOGY

- 5.4.2 AVERAGE SELLING PRICE TREND OF IRIS SCANNERS, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND OF FINGERPRINT SENSOR TECHNOLOGIES, BY REGION

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA (HS CODE 847190)

- 5.5.2 EXPORT DATA (HS CODE 847190)

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 EUROPEAN UNION DEPLOYS SBMS TO ENHANCE BORDER SECURITY

- 5.9.2 UAE FACILITATES MULTI-BIOMETRIC ENTRY/EXIT PROGRAMS FOR SMOOTH BORDER CROSSINGS

- 5.9.3 THALES AND GEMALTO IMPLEMENT ADVANCED BIOMETRIC SOLUTIONS TO ENHANCE ELECTORAL INTEGRITY

- 5.9.4 NEC IMPLEMENTS FACIAL RECOGNITION SYSTEM AT HEADQUARTERS TO SECURE ENTRY

- 5.10 IMPACT OF 2025 US TARIFF - BIOMETRIC SYSTEM MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 KEY IMPACTS ON VARIOUS COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 END-USE INDUSTRY IMPACT

6 STRATEGIC DISRUPTIONS THROUGH TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 CLOUD-BASED BIOMETRIC SYSTEM

- 6.1.2 FINGER-VEIN RECOGNITION

- 6.1.3 3D FACE RECOGNITION

- 6.1.4 FINGERPRINT RECOGNITION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 LIVENESS DETECTION

- 6.2.2 MULTIMODAL BIOMETRICS

- 6.2.3 INTERNET OF THINGS

- 6.2.4 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF GEN/AI ON BIOMETRIC SYSTEM MARKET

- 6.5.1 INTRODUCTION

- 6.5.2 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2.1 Facial recognition

- 6.5.2.2 Iris recognition

- 6.5.2.3 Palm recognition

- 6.5.2.4 Vein recognition

- 6.5.2.5 Signature recognition

- 6.5.3 BEST PRACTICES

- 6.5.3.1 Case study

- 6.5.4 INTERCONNECT ADJACENT ECOSYSTEM

- 6.5.5 ADOPTION OF AI BY CLIENTS/READINESS TO ADOPT AI

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1.1 Other regional regulations

- 7.1.2 INDUSTRY STANDARDS

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 CUSTOMER LANDSCAPE & BUYING BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 MARKET PROFITABILITY

- 8.4.1 REVENUE POTENTIAL

- 8.4.2 COST DYNAMICS

- 8.4.3 MARGIN OPPORTUNITIES, BY APPLICATION

9 BIOMETRIC SYSTEMS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ACCESS CONTROL & AUTHENTICATION

- 9.2.1 SECURING CRITICAL ENTRY POINTS WITH BIOMETRIC AUTHORIZATION

- 9.3 TIME & ATTENDANCE TRACKING

- 9.3.1 STREAMLINING WORKFORCE ADMINISTRATION THROUGH AUTOMATED BIOMETRIC TRACKING

- 9.4 IDENTITY VERIFICATION

- 9.4.1 DRIVING TRUST AND COMPLIANCE IN FINTECH, TELECOM, AND PUBLIC SERVICES

- 9.5 SURVEILLANCE & SECURITY

- 9.5.1 AUTOMATING PASSENGER IDENTITY MANAGEMENT AT BORDERS AND AIRPORTS

- 9.5.2 ENHANCING NATIONAL SECURITY THROUGH BIOMETRIC BORDER MANAGEMENT

- 9.6 PAYMENT & TRANSACTION PROCESSING

- 9.6.1 EMPOWERING CONTACTLESS TRANSACTIONS THROUGH BIOMETRIC WALLETS AND POS SYSTEMS

- 9.7 OTHERS (FRAUD DETECTION)

10 BIOMETRIC TRAITS OF BIOMETRIC SYSTEMS MARKET

- 10.1 INTRODUCTION

- 10.2 BIOLOGICAL/PHYSIOLOGICAL

- 10.2.1 DNA/BLOOD

- 10.2.1.1 Forensic and high security applications

- 10.2.1.2 Processing time and challenges

- 10.2.1 DNA/BLOOD

- 10.3 MORPHOLOGICAL

- 10.3.1 HAND GEOMETRY

- 10.3.1.1 Legacy system transition analysis

- 10.3.1.2 Niche applications

- 10.3.1.3 Palm vein

- 10.3.1.4 Fingerprint

- 10.3.2 FACE

- 10.3.2.1 2D

- 10.3.2.2 3D

- 10.3.2.3 AI-enhanced

- 10.3.3 IRIS

- 10.3.3.1 Near infrared vs. visible light system

- 10.3.3.2 Accuracy and security advantages

- 10.3.3.3 Adoption barriers

- 10.3.4 RETINA

- 10.3.5 VOICE

- 10.3.1 HAND GEOMETRY

- 10.4 BEHAVIORAL

- 10.4.1 GAIT

- 10.4.1.1 Surveillance and security

- 10.4.1.2 Technological limitations

- 10.4.1.3 Healthcare and elderly care

- 10.4.2 SIGNATURES

- 10.4.2.1 Static vs. dynamic

- 10.4.2.2 Digital transformation impact

- 10.4.3 KEYBOARD STROKES

- 10.4.3.1 Enterprise security integration

- 10.4.3.2 Continuous authentication

- 10.4.1 GAIT

11 BIOMETRIC SYSTEMS MARKET, BY NETWORK CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 OFFLINE/STANDALONE

- 11.3 LAN

- 11.4 WI-FI ENABLED

- 11.5 CELLULAR(4G/5G)

- 11.6 BLUETOOTH/NFC

12 BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE

- 12.1 INTRODUCTION

- 12.2 SINGLE-FACTOR

- 12.2.1 FINGERPRINT RECOGNITION

- 12.2.1.1 AFIS

- 12.2.1.1.1 High reliance on biometrics for criminal identification and forensic investigations to boost demand

- 12.2.1.2 Non-AFIS

- 12.2.1.2.1 Surging deployment in educational institutions to support market growth

- 12.2.1.1 AFIS

- 12.2.2 IRIS RECOGNITION

- 12.2.2.1 Rising demand from government sector to fuel segmental growth

- 12.2.3 PALM PRINT RECOGNITION

- 12.2.3.1 Growing concerns over security across various sectors to accelerate market growth

- 12.2.4 FACE RECOGNITION

- 12.2.4.1 Increasing use of surveillance and security applications to spur demand

- 12.2.5 VEIN RECOGNITION

- 12.2.5.1 Rising demand for high security in banking and immigration to foster growth

- 12.2.6 SIGNATURE RECOGNITION

- 12.2.6.1 Requirement for convenience in banking & finance to support market growth

- 12.2.7 VOICE RECOGNITION

- 12.2.7.1 Low operational cost, better accuracy, and simplified design to boost demand

- 12.2.8 OTHER SINGLE-FACTOR AUTHENTICATION TYPES

- 12.2.1 FINGERPRINT RECOGNITION

- 12.3 MULTI-FACTOR

- 12.3.1 TWO-FACTOR

- 12.3.1.1 Biometric smart cards

- 12.3.1.1.1 Rising demand for managing access to buildings, secure areas, and IT systems to drive market

- 12.3.1.2 Biometric PIN

- 12.3.1.2.1 Increasing adoption in educational institutions to fuel market

- 12.3.1.3 Two-factor biometric technology

- 12.3.1.3.1 Growing preference for multifaceted authentication to boost demand

- 12.3.1.1 Biometric smart cards

- 12.3.2 THREE-FACTOR

- 12.3.2.1 Biometric smart card with PIN

- 12.3.2.1.1 Surging focus on mitigating cyber threats to foster segmental growth

- 12.3.2.2 Smart card with two-factor biometric technology

- 12.3.2.2.1 Escalating demand for sensitive data handling in healthcare and finance to propel market

- 12.3.2.3 PIN with two-factor biometric technology

- 12.3.2.3.1 Increasing instances of data breaches and identity theft to accelerate demand

- 12.3.2.4 Three-factor biometric technology

- 12.3.2.4.1 Surging deployment in government organizations and forensic labs to drive market

- 12.3.2.1 Biometric smart card with PIN

- 12.3.3 FOUR-FACTOR

- 12.3.3.1 Pressing need to protect sensitive systems from unauthorized access and cyberattacks to boost demand

- 12.3.4 FIVE-FACTOR

- 12.3.4.1 Need for high levels of security in susceptible and regulated sectors to fuel segmental growth

- 12.3.1 TWO-FACTOR

13 BIOMETRIC SYSTEM MARKET, BY MOBILITY

- 13.1 INTRODUCTION

- 13.2 FIXED

- 13.2.1 INCREASING SECURITY CONCERNS TO DRIVE ADOPTION OF FIXED BIOMETRIC SOLUTIONS

- 13.2.1.1 Access control installations

- 13.2.1.2 Border control and immigration systems

- 13.2.1.3 ATMs and kiosks

- 13.2.1.4 Security system blocks

- 13.2.1.5 Others

- 13.2.1 INCREASING SECURITY CONCERNS TO DRIVE ADOPTION OF FIXED BIOMETRIC SOLUTIONS

- 13.3 PORTABLE 159 13.3.1 SURGING DEMAND FROM LAW ENFORCEMENT AGENCIES TO SUPPORT MARKET GROWTH

- 13.3.1.1 Smartphones

- 13.3.1.2 Portable biometrics fitness trackers

- 13.3.1.3 Field authentication

- 13.3.1.4 Wearables

- 13.3.1.4.1 Smart watches

- 13.3.1.4.2 Fitness trackers

- 13.3.1.4.3 Health monitoring

14 BIOMETRIC SYSTEM MARKET, BY OFFERING

- 14.1 INTRODUCTION

- 14.2 HARDWARE

- 14.2.1 FINGERPRINT SENSORS

- 14.2.1.1 Sensor technology

- 14.2.1.1.1 Capacitive

- 14.2.1.1.1.1 Widespread adoption in smartphones, laptops, and other consumer electronics to drive market

- 14.2.1.1.2 Optical

- 14.2.1.1.2.1 Increasing adoption by smartphone manufacturers to boost demand

- 14.2.1.1.3 Thermal

- 14.2.1.1.3.1 Growing use of smart cards for payments and authentication to fuel segmental growth

- 14.2.1.1.4 Ultrasonic

- 14.2.1.1.4.1 Continuous advancements in sensing technology contribute to market growth

- 14.2.1.1.1 Capacitive

- 14.2.1.1 Sensor technology

- 14.2.2 READERS & SCANNERS

- 14.2.3 CAMERAS

- 14.2.3.1 Infrared

- 14.2.3.2 Multispectral

- 14.2.4 OTHER BIOMETRIC HARDWARE

- 14.2.4.1 Microphones

- 14.2.4.2 Speakers

- 14.2.4.3 Connectivity ICs and AI chips

- 14.2.4.4 Iris recognition sensors

- 14.2.4.5 Processing hardware

- 14.2.4.5.1 Edge computing hardware

- 14.2.4.5.2 Cloud processing infrastructure

- 14.2.1 FINGERPRINT SENSORS

- 14.3 SOFTWARE

- 14.3.1 BIOMETRIC MANAGEMENT SOFTWARE

- 14.3.1.1 Machine learning and AI integration

- 14.3.1.2 Identity management software

- 14.3.1.3 Access control software

- 14.3.1.4 Database management software

- 14.3.1.5 Integration middleware and APIs

- 14.3.1.6 Cloud-based management software/platform

- 14.3.1.7 Others (SDKs, biometric algorithms)

- 14.3.2 SERVICES

- 14.3.2.1 Professional

- 14.3.2.1.1 Consulting & advisory

- 14.3.2.1.2 System integration

- 14.3.2.1.3 Installation

- 14.3.2.2 Managed

- 14.3.2.2.1 Cloud biometrics

- 14.3.2.2.2 Biometrics as a service

- 14.3.2.2.3 Maintenance & upgrades

- 14.3.2.2.4 Monitoring & analytics

- 14.3.2.3 Support services

- 14.3.2.1 Professional

- 14.3.1 BIOMETRIC MANAGEMENT SOFTWARE

15 BIOMETRIC SYSTEM MARKET, BY TYPE

- 15.1 INTRODUCTION

- 15.2 CONTACT-BASED

- 15.2.1 HIGH RELIABILITY AND ACCURACY TO CONTRIBUTE TO MARKET GROWTH

- 15.2.1.1 Traditional fingerprint scanners

- 15.2.1.2 Palm print recognition devices

- 15.2.1 HIGH RELIABILITY AND ACCURACY TO CONTRIBUTE TO MARKET GROWTH

- 15.3 CONTACTLESS

- 15.3.1 ADOPTION OF TOUCHLESS TECHNOLOGIES DUE TO HYGIENE CONCERNS TO ACCELERATE DEMAND

- 15.3.1.1 Facial recognition camera systems

- 15.3.1.2 Iris recognition

- 15.3.1.3 Voice recognition

- 15.3.1 ADOPTION OF TOUCHLESS TECHNOLOGIES DUE TO HYGIENE CONCERNS TO ACCELERATE DEMAND

- 15.4 HYBRID

- 15.4.1 FLEXIBILITY AND USER CONVENIENCE TO FOSTER MARKET GROWTH

- 15.4.1.1 Technology integration complexity

- 15.4.1.2 Multi-environment deployment

- 15.4.1 FLEXIBILITY AND USER CONVENIENCE TO FOSTER MARKET GROWTH

16 BIOMETRIC SYSTEM MARKET, BY DEPLOYMENT MODE

- 16.1 INTRODUCTION

- 16.2 ON-PREMISES

- 16.2.1 INCREASING CONCERNS ABOUT DATA SECURITY AND PRIVACY TO FUEL MARKET GROWTH

- 16.3 CLOUD-BASED

- 16.3.1 RISING DEMAND FOR SCALABLE AND COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET

17 BIOMETRIC SYSTEM MARKET, BY VERTICAL

- 17.1 INTRODUCTION

- 17.2 GOVERNMENT

- 17.2.1 INCREASING ADOPTION TO SECURE CRUCIAL DATA TO CONTRIBUTE TO MARKET GROWTH

- 17.2.2 NATIONAL ID

- 17.2.2.1 National ID programs

- 17.2.2.2 Voter registration and authentication in elections

- 17.2.3 LAW ENFORCEMENT

- 17.2.3.1 Criminal identification and forensic investigation

- 17.2.3.2 Evidence management

- 17.2.3.3 Social welfare scheme authentication

- 17.2.4 BORDER CONTROL AND SECURITY

- 17.2.4.1 e-passport & e-visa verification

- 17.3 MILITARY & DEFENSE

- 17.3.1 PRESSING NEED TO COMPLY WITH RIGOROUS SECURITY PROTOCOLS TO BOOST DEMAND

- 17.3.2 ACCESS CONTROL TO DEFENSE BASES, ARSENALS, AND RESTRICTED AREAS

- 17.3.3 IDENTITY VERIFICATION OF MILITARY PERSONNEL AND CONTRACTORS

- 17.3.4 WEAPON ACCESS AUTHORIZATION

- 17.3.5 SURVEILLANCE & MONITORING USING FACIAL RECOGNITION

- 17.3.6 SECURE COMMUNICATIONS AUTHENTICATION

- 17.4 HEALTHCARE

- 17.4.1 NEED FOR RELIABILITY AND ACCURACY IN MEDICAL SETTINGS TO SUPPORT MARKET GROWTH

- 17.4.2 PATIENT IDENTITY VERIFICATION TO AVOID MIX-UPS

- 17.4.3 ACCESS CONTROL FOR MEDICAL STAFF IN RESTRICTED LABS/PHARMACIES

- 17.4.4 AUTHENTICATION FOR ELECTRONIC HEALTH RECORDS (EHR/EMR)

- 17.4.5 PRESCRIPTION DISPENSING VALIDATION

- 17.4.6 TIME & ATTENDANCE TRACKING OF HEALTHCARE STAFF

- 17.5 BFSI

- 17.5.1 INCREASING NEED FOR ROBUST FRAUD PREVENTION SOLUTIONS TO ACCELERATE MARKET GROWTH

- 17.5.2 BIOMETRIC AUTHENTICATION FOR MOBILE BANKING APPS

- 17.5.3 ATM ACCESS AND WITHDRAWAL AUTHORIZATION USING FINGERPRINT/IRIS

- 17.5.4 KYC VERIFICATION DURING ACCOUNT OPENING

- 17.5.5 FRAUD DETECTION VIA BEHAVIORAL BIOMETRICS

- 17.5.6 BIOMETRIC-ENABLED PAYMENTS AT POS OR ONLINE CHECKOUT

- 17.5.7 CRYPTOCURRENCY

- 17.6 CONSUMER ELECTRONICS

- 17.6.1 RISING DEMAND FOR SMARTPHONES WITH IMPROVED SECURITY FEATURES TO SUPPORT MARKET GROWTH

- 17.6.2 SMARTPHONES

- 17.6.3 LAPTOPS & TABLETS

- 17.6.4 GAMING CONSOLES AND VR HEADSETS

- 17.6.5 WEARABLES

- 17.6.6 SMART HOME DEVICES WITH VOICE/FACIAL RECOGNITION

- 17.7 TRAVEL & IMMIGRATION

- 17.7.1 GOVERNMENT-LED INITIATIVES TO PREVENT UNAUTHORIZED ACCESS TO SPUR DEMAND

- 17.7.2 AUTOMATED BORDER CONTROL GATES

- 17.7.3 E-PASSPORTS EMBEDDED WITH BIOMETRIC IDENTIFIERS

- 17.7.4 AIRLINE PASSENGER CHECK-IN AND BOARDING AUTHENTICATION

- 17.7.5 FREQUENT TRAVELER PROGRAM VERIFICATION

- 17.7.6 IMMIGRATION CONTROL AND VISA PROCESSING

- 17.8 AUTOMOTIVE

- 17.8.1 INCREASING EMPHASIS ON ENHANCING VEHICLE SECURITY TO BOOST DEMAND

- 17.8.2 DRIVER IDENTIFICATION FOR VEHICLE ACCESS/START (FINGERPRINT/FACE)

- 17.8.3 PERSONALIZED IN-VEHICLE SETTINGS (SEAT, INFOTAINMENT) BASED ON BIOMETRICS

- 17.8.4 ANTI-THEFT VEHICLE SECURITY USING BIOMETRIC START AUTHORIZATION

- 17.8.5 FLEET MANAGEMENT - MONITORING AND VERIFYING DRIVERS

- 17.8.6 ALCOHOL DETECTION COMBINED WITH DRIVER BIOMETRICS FOR SAFETY

- 17.9 SECURITY

- 17.9.1 HOME SECURITY

- 17.9.1.1 Rising adoption of IoT and wireless technologies in residential settings to drive market

- 17.9.1.2 Smart door locks with fingerprint/face recognition

- 17.9.1.3 Biometrics-enabled home alarm systems

- 17.9.1.4 Surveillance systems with facial recognition for intruder detection

- 17.9.1.5 Voice recognition for smart home assistants controlling security

- 17.9.2 COMMERCIAL SECURITY

- 17.9.2.1 Growing need to replace manual attendance tracking to drive market

- 17.9.2.2 Workplace access control

- 17.9.2.3 Biometrics-enabled visitor management systems

- 17.9.2.4 Multi-factor security for data centers

- 17.9.2.5 Surveillance & anomaly detection in corporate campuses

- 17.9.2.6 Secure storage/vault access

- 17.9.1 HOME SECURITY

- 17.10 OTHER VERTICALS

- 17.10.1 INDUSTRIAL

- 17.10.1.1 Access control to hazardous areas

- 17.10.1.2 Worker attendance and productivity monitoring

- 17.10.1.3 Safety compliance (ensures machines access only for trained workers)

- 17.10.2 UTILITIES

- 17.10.2.1 Biometric authentication for control room operators

- 17.10.2.2 Prevention of unauthorized access to power plants, oil & gas facilities

- 17.10.3 SPORTS

- 17.10.3.1 Stadium access control for ticket holders

- 17.10.3.2 VIP and player identification at events

- 17.10.3.3 Anti-hooliganism surveillance using face recognition

- 17.10.4 ENTERTAINMENT

- 17.10.4.1 Online gaming platforms

- 17.10.4.2 Theme parks (fingerprint passes)

- 17.10.4.3 AR/VR entertainment systems

- 17.10.1 INDUSTRIAL

18 BIOMETRIC SYSTEM MARKET, BY REGION

- 18.1 INTRODUCTION

- 18.2 ASIA PACIFIC

- 18.2.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 18.2.2 CHINA

- 18.2.2.1 Increasing deployment of surveillance cameras to support market growth

- 18.2.3 JAPAN

- 18.2.3.1 Commitment to integrating biometric systems across various applications to propel market

- 18.2.4 SOUTH KOREA

- 18.2.4.1 Development of smart devices based on advanced biometric technologies to boost demand

- 18.2.5 INDIA

- 18.2.5.1 Growing need for more secure, efficient, and convenient transaction methods to spike demand

- 18.2.6 AUSTRALIA

- 18.2.6.1 Increasing use of voice recognition to streamline interactions with public to drive market

- 18.2.7 REST OF ASIA PACIFIC

- 18.3 NORTH AMERICA

- 18.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 18.3.2 US

- 18.3.2.1 Increasing focus on modernizing technologies for border surveillance to fuel market growth

- 18.3.3 CANADA

- 18.3.3.1 Rising focus on upgrading immigration biometric identification to accelerate demand

- 18.3.4 MEXICO

- 18.3.4.1 Implementation of city-wide facial recognition system for public safety to spur demand

- 18.4 EUROPE

- 18.4.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 18.4.2 GERMANY

- 18.4.2.1 Integration of biometrics into automotive sector to fuel market growth

- 18.4.3 UK

- 18.4.3.1 Deployment of contactless biometric scanners in high-traffic areas to foster market growth

- 18.4.4 FRANCE

- 18.4.4.1 Implementation of biometrics across finance, healthcare, and transportation sectors to drive market

- 18.4.5 ITALY

- 18.4.5.1 Adoption of advanced biometric technologies in travel & immigration sector to support market growth

- 18.4.6 SPAIN

- 18.4.6.1 Need for security enhancement due to robust tourism sector to stimulate market growth

- 18.4.7 REST OF EUROPE

- 18.5 ROW

- 18.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 18.5.2 MIDDLE EAST

- 18.5.2.1 Advancements and investments in security infrastructure to foster growth

- 18.5.2.2 Bahrain

- 18.5.2.3 Kuwait

- 18.5.2.4 Oman

- 18.5.2.5 Qatar

- 18.5.2.6 Saudi Arabia

- 18.5.2.7 UAE

- 18.5.2.8 Rest of Middle East

- 18.5.3 AFRICA

- 18.5.3.1 Implementation of biometric systems for identity verification and security to boost market

- 18.5.3.2 South Africa

- 18.5.3.3 Other African countries

- 18.5.4 SOUTH AMERICA

- 18.5.4.1 National ID programs, border security, financial services, and public sector digital initiatives - key drivers

19 COMPETITIVE LANDSCAPE

- 19.1 OVERVIEW

- 19.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 19.2.1 COMPETITIVE STRATEGIES INITIATIVES

- 19.2.2 OPERATIONAL STRATEGIC INITIATIVES

- 19.3 REVENUE ANALYSIS, 2020-2024

- 19.4 MARKET SHARE ANALYSIS, 2024

- 19.5 BRAND/PRODUCT COMPARISON

- 19.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 19.6.1 STARS

- 19.6.2 EMERGING LEADERS

- 19.6.3 PERVASIVE PLAYERS

- 19.6.4 PARTICIPANTS

- 19.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 19.6.5.1 Company footprint

- 19.6.5.2 Region footprint

- 19.6.5.3 Authentication footprint

- 19.6.5.4 Mobility footprint

- 19.6.5.5 Offering footprint

- 19.6.5.6 Vertical footprint

- 19.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 19.7.1 PROGRESSIVE COMPANIES

- 19.7.2 RESPONSIVE COMPANIES

- 19.7.3 DYNAMIC COMPANIES

- 19.7.4 STARTING BLOCKS

- 19.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 19.7.5.1 Detailed list of startups/SMEs

- 19.7.5.2 Competitive benchmarking of key startups/SMEs

- 19.8 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 19.9 COMPETITIVE SCENARIO

- 19.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 19.9.2 DEALS

- 19.9.3 EXPANSIONS

- 19.9.4 OTHER DEVELOPMENTS

20 COMPANY PROFILES

- 20.1 KEY PLAYERS

- 20.1.1 THALES

- 20.1.1.1 Business overview

- 20.1.1.2 Products/Solutions/Services offered

- 20.1.1.3 Recent developments

- 20.1.1.3.1 Product launches/developments

- 20.1.1.3.2 Deals

- 20.1.1.3.3 Expansions

- 20.1.1.3.4 Other developments

- 20.1.1.4 MnM view

- 20.1.1.4.1 Key strengths

- 20.1.1.4.2 Strategic choices

- 20.1.1.4.3 Weaknesses and competitive threats

- 20.1.2 IDEMIA

- 20.1.2.1 Business overview

- 20.1.2.2 Products/Solutions/Services offered

- 20.1.2.3 Recent developments

- 20.1.2.3.1 Product launches/developments

- 20.1.2.3.2 Deals

- 20.1.2.3.3 Other developments

- 20.1.2.4 MnM view

- 20.1.2.4.1 Key strengths

- 20.1.2.4.2 Strategic choices

- 20.1.2.4.3 Weaknesses and competitive threats

- 20.1.3 NEC CORPORATION

- 20.1.3.1 Business overview

- 20.1.3.2 Products/Solutions/Services offered

- 20.1.3.3 Recent developments

- 20.1.3.3.1 Product launches/developments

- 20.1.3.3.2 Deals

- 20.1.3.3.3 Other developments

- 20.1.3.4 MnM view

- 20.1.3.4.1 Key strengths

- 20.1.3.4.2 Strategic choices

- 20.1.3.4.3 Weaknesses and competitive threats

- 20.1.4 ASSA ABLOY

- 20.1.4.1 Business overview

- 20.1.4.2 Products/Solutions/Services offered

- 20.1.4.3 Recent developments

- 20.1.4.3.1 Deals

- 20.1.4.4 MnM view

- 20.1.4.4.1 Key strengths

- 20.1.4.4.2 Strategic choices

- 20.1.4.4.3 Weaknesses and competitive threats

- 20.1.5 FUJITSU

- 20.1.5.1 Business overview

- 20.1.5.2 Products/Solutions/Services offered

- 20.1.5.3 Recent developments

- 20.1.5.3.1 Product launches/developments

- 20.1.5.3.2 Deals

- 20.1.5.4 MnM view

- 20.1.5.4.1 Key strengths

- 20.1.5.4.2 Strategic choices

- 20.1.5.4.3 Weaknesses and competitive threats

- 20.1.6 PRECISE BIOMETRICS

- 20.1.6.1 Business overview

- 20.1.6.2 Products/Solutions/Services offered

- 20.1.6.3 Recent developments

- 20.1.6.3.1 Product launches/developments

- 20.1.6.3.2 Deals

- 20.1.7 SECUNET SECURITY NETWORKS AG

- 20.1.7.1 Business overview

- 20.1.7.2 Products/Solutions/Services offered

- 20.1.7.3 Recent developments

- 20.1.7.3.1 Deals

- 20.1.8 AWARE INC.

- 20.1.8.1 Business overview

- 20.1.8.2 Products/Solutions/Services offered

- 20.1.8.3 Recent developments

- 20.1.8.3.1 Product launches/developments

- 20.1.8.3.2 Deals

- 20.1.9 COGNITEC SYSTEMS GMBH

- 20.1.9.1 Business overview

- 20.1.9.2 Products/Solutions/Services offered

- 20.1.9.3 Recent developments

- 20.1.9.3.1 Product launches/developments

- 20.1.9.3.2 Deals

- 20.1.10 ANVIZ GLOBAL INC.

- 20.1.10.1 Business overview

- 20.1.10.2 Products/Solutions/Services offered

- 20.1.10.3 Recent developments

- 20.1.10.3.1 Product launches/developments

- 20.1.1 THALES

- 20.2 OTHER KEY PLAYERS

- 20.2.1 DAON, INC.

- 20.2.2 DERMALOG IDENTIFICATION SYSTEMS GMBH

- 20.2.3 NEUROTECHNOLOGY

- 20.2.4 INNOVATRICS

- 20.2.5 VERIDOS GMBH

- 20.2.6 ZETES

- 20.2.7 JUMIO

- 20.2.8 IPROOV

- 20.2.9 FACETEC, INC.

- 20.2.10 MITEK SYSTEMS, INC.

- 20.2.11 BEIJING KUANGSHI TECHNOLOGY CO., LTD. (MEGVII)

- 20.2.12 SENSETIME

- 20.2.13 FACEBANX

- 20.2.14 BIO-KEY INTERNATIONAL

- 20.2.15 SECURIPORT

- 20.2.16 M2SYS TECHNOLOGY

- 20.2.17 SUPREMA INC.

- 20.2.18 FULCRUM BIOMETRICS

- 20.2.19 ONESPAN

- 20.2.20 QUALCOMM TECHNOLOGIES, INC.

- 20.2.21 INTEGRATED BIOMETRICS

- 20.2.22 LEIDOS

- 20.2.23 PAPILLON

- 20.2.24 NUANCE COMMUNICATIONS, INC.

21 RESEARCH METHODOLOGY

- 21.1 RESEARCH APPROACH

- 21.1.1 SECONDARY AND PRIMARY RESEARCH

- 21.1.2 SECONDARY DATA

- 21.1.2.1 List of major secondary sources

- 21.1.2.2 Key data from secondary sources

- 21.1.3 PRIMARY DATA

- 21.1.3.1 Intended interview participants

- 21.1.3.2 List of key primary interview participants

- 21.1.3.3 Breakdown of primaries

- 21.1.3.4 Key data from primary sources

- 21.1.3.5 Key industry insights

- 21.2 MARKET SIZE ESTIMATION METHODOLOGY

- 21.2.1 BOTTOM-UP APPROACH

- 21.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 21.2.2 TOP-DOWN APPROACH

- 21.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 21.2.1 BOTTOM-UP APPROACH

- 21.3 DATA TRIANGULATION

- 21.4 RESEARCH ASSUMPTIONS

- 21.5 RESEARCH LIMITATIONS

- 21.6 RISK ASSESSMENT

22 APPENDIX

- 22.1 DISCUSSION GUIDE

- 22.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 22.3 CUSTOMIZATION OPTIONS

- 22.4 RELATED REPORTS

- 22.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USE CASES OF MODERN-DAY CONSUMER ELECTRONICS: FINGERPRINT AND FACE AUTHENTICATION

- TABLE 2 TOP 10 COUNTRIES WITH HIGHEST NUMBER OF FATALITIES, 2024

- TABLE 3 RECENT UPDATES AND USE CASES BY SUPPLIERS AND END USERS OF BIOMETRIC SYSTEMS

- TABLE 4 DEVELOPMENTS SHOWCASING BIOMETRIC DEPLOYMENT

- TABLE 5 SYSTEM PROVIDERS: PARTNERSHIPS

- TABLE 6 SAAS DEVELOPMENTS BY PARTICIPANTS IN BIOMETRIC SYSTEM ECOSYSTEM

- TABLE 7 BIOMETRIC SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE TREND OF FINGERPRINT SENSOR TECHNOLOGY, BY KEY PLAYER (USD), 2024

- TABLE 10 INDICATIVE PRICING TREND OF IRIS SCANNERS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 11 IMPORT DATA FOR HS CODE 847190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 847190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 BIOMETRIC SYSTEM MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 15 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 APPLIED/GRANTED PATENTS RELATED TO BIOMETRIC SYSTEMS, 2020-2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 ADOPTION BARRIERS & INTERNAL CHALLENGES

- TABLE 24 BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 25 BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 26 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 27 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 28 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 29 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 30 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 33 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 34 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 37 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT RECOGNITION, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 38 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR IRIS RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 39 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR IRIS RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 40 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR IRIS RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR IRIS RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PALM RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 43 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PALM RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 44 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PALM RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PALM RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 FACIAL RECOGNITION TECHNOLOGY: RECENT DEVELOPMENTS

- TABLE 47 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FACE RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 48 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FACE RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 49 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FACE RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR FACE RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VEIN RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 52 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VEIN RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 53 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VEIN RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VEIN RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SIGNATURE RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 56 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SIGNATURE RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 57 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SIGNATURE RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SIGNATURE RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VOICE RECOGNITION, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 60 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VOICE RECOGNITION, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 61 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VOICE RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR VOICE RECOGNITION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR OTHER AUTHENTICATION TYPES, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 64 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR OTHER AUTHENTICATION TYPES, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 65 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR OTHER AUTHENTICATION TYPES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 SINGLE-FACTOR: BIOMETRIC SYSTEM MARKET FOR OTHER AUTHENTICATION TYPES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 68 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 69 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 70 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 71 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR TWO-FACTOR AUTHENTICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR TWO-FACTOR AUTHENTICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC SMART CARDS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC SMART CARDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC PIN, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC PIN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 TWO-FACTOR: BIOMETRIC SYSTEM MARKET FOR TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR THREE-FACTOR AUTHENTICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR THREE-FACTOR AUTHENTICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC SMART CARD WITH PIN, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR BIOMETRIC SMART CARD WITH PIN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR THREE-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 THREE-FACTOR: BIOMETRIC SYSTEM MARKET FOR THREE-FACTOR BIOMETRIC TECHNOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR FOUR-FACTOR AUTHENTICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR FOUR-FACTOR AUTHENTICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR FIVE-FACTOR AUTHENTICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 MULTI-FACTOR: BIOMETRIC SYSTEM MARKET FOR FIVE-FACTOR AUTHENTICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 BIOMETRIC SYSTEM MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 96 BIOMETRIC SYSTEM MARKET, BY MOBILITY, 2025-2030 (USD MILLION)

- TABLE 97 BIOMETRIC SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 98 BIOMETRIC SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 BIOMETRIC HARDWARE LAUNCHES, 2020-2025

- TABLE 100 HARDWARE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 101 HARDWARE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 102 HARDWARE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 HARDWARE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 HARDWARE: BIOMETRIC SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 HARDWARE: BIOMETRIC SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 HARDWARE: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT SENSORS, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 107 HARDWARE: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT SENSORS, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 108 HARDWARE: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT SENSORS, BY TECHNOLOGY, 2021-2024 (MILLION UNITS)

- TABLE 109 HARDWARE: BIOMETRIC SYSTEM MARKET FOR FINGERPRINT SENSORS, BY TECHNOLOGY, 2025-2030 (MILLION UNITS)

- TABLE 110 BIOMETRIC SOFTWARE LAUNCHES, 2020-2023

- TABLE 111 SOFTWARE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 112 SOFTWARE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 SOFTWARE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 114 SOFTWARE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 BIOMETRIC SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 116 BIOMETRIC SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 117 BIOMETRIC SYSTEM MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 118 BIOMETRIC SYSTEM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 119 BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 120 BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 121 GOVERNMENT: BIOMETRIC SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 GOVERNMENT: BIOMETRIC SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 GOVERNMENT: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 GOVERNMENT: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 MILITARY & DEFENSE: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 MILITARY & DEFENSE: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 HEALTHCARE: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 HEALTHCARE: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 BFSI: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 BFSI: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 CONSUMER ELECTRONICS: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 CONSUMER ELECTRONICS: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 TRAVEL & IMMIGRATION: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 TRAVEL & IMMIGRATION: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 AUTOMOTIVE: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 AUTOMOTIVE: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 SECURITY: BIOMETRIC SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 SECURITY: BIOMETRIC SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 SECURITY: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 SECURITY: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 141 OTHER VERTICALS: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 OTHER VERTICALS: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 144 BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: BIOMETRIC SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 168 EUROPE: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 169 ROW: BIOMETRIC SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 ROW: BIOMETRIC SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 ROW: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 172 ROW: BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 173 ROW: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 174 ROW: BIOMETRIC SYSTEM MARKET FOR SINGLE-FACTOR AUTHENTICATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 ROW: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 176 ROW: BIOMETRIC SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 177 BIOMETRIC SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 178 BIOMETRIC SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 BIOMETRIC SYSTEM MARKET: REGION FOOTPRINT

- TABLE 180 BIOMETRIC SYSTEM MARKET: AUTHENTICATION FOOTPRINT

- TABLE 181 BIOMETRIC SYSTEM MARKET: MOBILITY FOOTPRINT

- TABLE 182 BIOMETRIC SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 183 BIOMETRIC SYSTEM MARKET: VERTICAL FOOTPRINT

- TABLE 184 BIOMETRIC SYSTEM MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 185 BIOMETRIC SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 BIOMETRIC SYSTEM MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-OCTOBER 2025

- TABLE 187 BIOMETRIC SYSTEM MARKET: DEALS, JANUARY 2020-OCTOBER 2025

- TABLE 188 BIOMETRIC SYSTEM MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2025

- TABLE 189 BIOMETRIC SYSTEM MARKET: OTHER DEVELOPMENTS, JANUARY 2020-OCTOBER 2025

- TABLE 190 THALES: COMPANY OVERVIEW

- TABLE 191 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 THALES: PRODUCT LAUNCHES /DEVELOPMENTS

- TABLE 193 THALES: DEALS

- TABLE 194 THALES: EXPANSIONS

- TABLE 195 THALES: OTHER DEVELOPMENTS

- TABLE 196 IDEMIA: COMPANY OVERVIEW

- TABLE 197 IDEMIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 IDEMIA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 199 IDEMIA: DEALS

- TABLE 200 IDEMIA: OTHER DEVELOPMENTS

- TABLE 201 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 202 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 NEC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 204 NEC CORPORATION: DEALS

- TABLE 205 NEC CORPORATION: OTHER DEVELOPMENTS

- TABLE 206 ASSA ABLOY: COMPANY OVERVIEW

- TABLE 207 ASSA ABLOY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ASSA ABLOY: DEALS

- TABLE 209 FUJITSU: COMPANY OVERVIEW

- TABLE 210 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 FUJITSU: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 212 FUJITSU: DEALS

- TABLE 213 PRECISE BIOMETRICS: COMPANY OVERVIEW

- TABLE 214 PRECISE BIOMETRICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 PRECISE BIOMETRICS AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 216 PRECISE BIOMETRICS AB: DEALS

- TABLE 217 SECUNET SECURITY NETWORKS AG: COMPANY OVERVIEW

- TABLE 218 SECUNET SECURITY NETWORKS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 SECUNET SECURITY NETWORKS AG: DEALS

- TABLE 220 AWARE INC.: COMPANY OVERVIEW

- TABLE 221 AWARE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 AWARE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 223 AWARE INC.: DEALS

- TABLE 224 COGNITEC SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 225 COGNITEC SYSTEMS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 COGNITEC SYSTEMS GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 227 COGNITEC SYSTEMS GMBH: DEALS

- TABLE 228 ANVIZ GLOBAL INC.: COMPANY OVERVIEW

- TABLE 229 ANVIZ GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ANVIZ GLOBAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

List of Figures

- FIGURE 1 BIOMETRIC SYSTEM MARKET SEGMENTATION

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL BIOMETRIC SYSTEM MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BIOMETRIC SYSTEM MARKET (2021-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF BIOMETRIC SYSTEM MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN BIOMETRIC SYSTEM MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN BIOMETRIC SYSTEM MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 8 RISING SECURITY CONCERNS AND BORDER MANAGEMENT NEEDS TO OFFER LUCRATIVE OPPORTUNITIES

- FIGURE 9 SINGLE-FACTOR AUTHENTICATION AND US TO HOLD LARGEST SHARE IN 2025

- FIGURE 10 GOVERNMENT VERTICAL TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC

- FIGURE 11 INDIA TO EXHIBIT HIGHEST CAGR IN BIOMETRIC SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 12 BIOMETRIC SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 BIOMETRIC SYSTEM MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 14 SMARTPHONE ADOPTION RATE, BY REGION, 2022 VS. 2030 (%)

- FIGURE 15 BIOMETRIC SYSTEM MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 16 BIOMETRIC SYSTEM MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 17 BIOMETRIC SYSTEM MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 BIOMETRIC SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 BIOMETRIC SYSTEM ECOSYSTEM ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE OF FINGERPRINT SENSOR TECHNOLOGY OFFERED BY KEY PLAYERS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF IRIS SCANNERS OFFERED BY KEY PLAYERS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF IRIS SCANNERS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 24 AVERAGE SELLING PRICE TREND, BY FINGERPRINT SENSOR TECHNOLOGY, 2020-2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CAPACITIVE FINGERPRINT SENSORS, BY REGION, 2020-2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF OPTICAL FINGERPRINT SENSORS, BY REGION, 2020-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF THERMAL FINGERPRINT SENSORS, BY REGION, 2020-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF ULTRASONIC FINGERPRINT SENSORS, BY REGION, 2020-2024

- FIGURE 29 IMPORT DATA FOR HS CODE 847190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA FOR HS CODE 847190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 BIOMETRIC SYSTEMS: NUMBER OF PATENTS APPLIED FOR AND GRANTED, 2014-2024

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 36 BIOMETRIC SYSTEM MARKET, BY AUTHENTICATION TYPE

- FIGURE 37 MULTI-FACTOR SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 BIOMETRIC SYSTEM MARKET, BY MOBILITY

- FIGURE 39 PORTABLE SEGMENT TO REGISTER HIGHER CAGR IN BIOMETRIC SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 40 BIOMETRIC SYSTEM MARKET, BY OFFERING

- FIGURE 41 SOFTWARE SEGMENT TO DOMINATE BIOMETRIC SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 42 BIOMETRIC SYSTEM MARKET, BY TYPE

- FIGURE 43 CONTACTLESS SEGMENT TO EXHIBIT HIGHEST CAGR IN BIOMETRIC SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 44 BIOMETRIC SYSTEM MARKET, BY DEPLOYMENT MODE

- FIGURE 45 CLOUD-BASED SEGMENT TO REGISTER HIGHER CAGR IN BIOMETRIC SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 46 BIOMETRIC SYSTEM MARKET, BY VERTICAL

- FIGURE 47 GOVERNMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025 AND 2030

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC: BIOMETRIC SYSTEM MARKET SNAPSHOT

- FIGURE 50 NORTH AMERICA: BIOMETRIC SYSTEM MARKET SNAPSHOT

- FIGURE 51 EUROPE: BIOMETRIC SYSTEM MARKET SNAPSHOT

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 53 BIOMETRIC SYSTEM MARKET SHARE ANALYSIS, 2024

- FIGURE 54 BIOMETRIC SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 55 BIOMETRIC SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 BIOMETRIC SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 57 BIOMETRIC SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 COMPANY VALUATION, 2025

- FIGURE 59 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 60 THALES: COMPANY SNAPSHOT

- FIGURE 61 IDEMIA: COMPANY SNAPSHOT

- FIGURE 62 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 ASSA ABLOY: COMPANY SNAPSHOT

- FIGURE 64 FUJITSU: COMPANY SNAPSHOT

- FIGURE 65 PRECISE BIOMETRICS: COMPANY SNAPSHOT

- FIGURE 66 SECUNET SECURITY NETWORKS AG: COMPANY SNAPSHOT

- FIGURE 67 AWARE INC.: COMPANY SNAPSHOT

- FIGURE 68 BIOMETRIC SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 69 BIOMETRIC SYSTEM MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 70 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 71 BIOMETRIC SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 72 BIOMETRIC SYSTEM MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 73 DATA TRIANGULATION

- FIGURE 74 BIOMETRIC SYSTEM MARKET: RESEARCH ASSUMPTIONS

- FIGURE 75 BIOMETRIC SYSTEM MARKET: RESEARCH LIMITATIONS