|

市场调查报告书

商品编码

1881231

全球农业生物技术市场(至2030年):依物种(植物、动物、微生物)、类型、技术及应用划分Agriculture Biotechnology Market by Type of Organism (Plant, Animal, and Microbes), by Type, by Technology, and by Application - Global Forecast to 2030 |

||||||

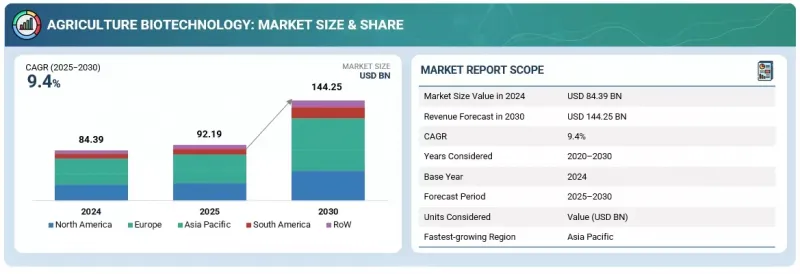

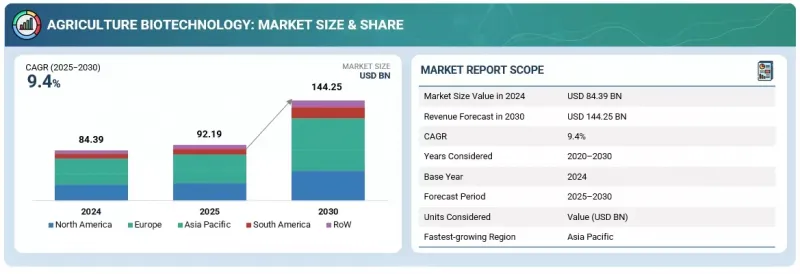

预计农业生物技术市场将从 2025 年的 921.9 亿美元成长到 2030 年的 1,442.5 亿美元,复合年增长率为 9.4%。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 价值(美元)和数量(吨) |

| 部分 | 物种、技术、类型、用途、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美及其他地区 |

农业生物技术市场的成长主要受全球粮食需求成长、耕地减少以及对永续农业解决方案的需求所驱动。生物技术提供先进方法,可在提高作物产量、改善土壤健康和提升畜牧业生产力的同时,减少对环境的影响。基因改造作物、微生物接种剂和生物肥料的日益普及,有助于更好地管理资源并减少对化学物质的依赖。

此外,气候变迁带来的压力正在加速推广耐旱抗虫作物品种,增强农业的韧性。各国政府和国际组织正透过支持性法规、研究经费和永续性措施来促进生物技术创新。同时,基因组编辑、分子诊断和微生物工程的快速发展正在扩大农业生物技术在植物、动物和微生物系统中的应用。这些因素共同推动全球农业转型为高科技、环境友善、产量农业。

预计在预测期内,植物生物技术将主导市场。

这一主导地位归功于基因改造作物的广泛应用、种子性状开发的进步以及生物肥料和生物农药的日益普及。全球粮食需求不断增长,加上在自然资源有限的情况下确保更高作物产量的迫切需求,正在推动植物生物技术解决方案的普及。农民越来越多地选择具有耐除草剂、抗虫害和抗逆性等性状的基因改造品种,从而提高产量和利润。此外,CRISPR和分子育种技术的创新提高了作物改良的精准度,并促进了新品种的快速商业化。政府支持永续农业的政策,以及公私合作的研发投资,进一步巩固了该产业的地位。在对气候适应型和营养型作物日益增长的需求驱动下,植物生物技术将在整个预测期内继续成为现代农业创新的主要驱动力。

“预计在预测期内,基因工程和基因组编辑领域将主导市场。”

由于基因工程和基因组编辑对作物和牲畜改良的变革性影响,预计该领域将在预测期内推动市场成长。 CRISPR-Cas9、TALEN 和RNA干扰(RNAi) 等技术使科学家能够培育出精准、产量的品种,这些品种不仅产量更高,而且抗逆性更强,营养价值也更高。例如,Calyxt 公司开发的基因编辑大豆能够生产更健康的高油酸大豆油,是美国首批商业化的 CRISPR 技术作物之一。同样,Corteva Agriscience 公司也利用先进的基因编辑技术培育出了耐旱玉米,显着提高了其在缺水地区的适应能力。

在畜牧业生产领域,Genus PLC公司培育出了抗猪繁殖与呼吸症候群(PRRS)的猪,这项突破性进展将改善动物福利并减少经济损失。巴西、美国和阿根廷政府也放宽了对基因编辑作物的监管,加速了其商业化进程。在强大的研发投入、全球伙伴关係以及不断完善的生物安全框架的支持下,基因工程和基因组编辑技术预计将在2030年之前继续成为农业生物技术领域有效性、永续性和创新方面的关键驱动力。

“预计亚太地区在预测期内将呈现最高增长。”

预计在预测期内,亚太地区将实现最高成长,这主要得益于不断增长的粮食需求、日益增强的农业现代化以及政府为推广永续农业实践而采取的倡议。中国、印度、日本和菲律宾等国正在增加对生物技术研发的投资,以提高作物产量、改善牲畜健康和提升土壤肥力。基因改造作物、微生物肥料和生物基害虫防治产品的日益普及正在改变该地区的农业模式。

本报告调查了全球农业生物技术市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、市场规模趋势和预测、按各个细分市场、地区/主要国家进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 生成式人工智慧对农业生物技术的影响

第六章 产业趋势

- 波特五力分析

- 总体经济指标

- 供应链分析

- 价值链分析

- 生态系分析

- 参考价格分析

- 贸易分析

- 大型会议和活动

- 影响我们客户业务的趋势

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税的影响:农业生物技术市场

第七章:顾客状况与购买行为

- 决策流程

- 相关利益者和采购标准

- 采用障碍和内部挑战

- 来自各个终端使用者产业的未满足需求

- 市场盈利

第八章:科技、专利、数位化和人工智慧应用带来的策略颠覆

- 关键新兴技术

- 互补技术

- 技术/产品蓝图

- 专利分析

- 未来应用

- 人工智慧/生成式人工智慧对农业生物技术市场的影响

- 成功案例和实际应用

第九章永续性和监管环境

- 地方法规和合规性

- 对永续性的承诺

- 永续性影响和监管政策倡议

- 认证、标籤和环境标准

10. 按物种分類的农业生物技术市场

- 植物

- 动物

- 微生物

第十一章 农业生物技术市场(按类型划分)

- 植物生物技术市场按类型划分

- 基因改造

- 基因改造动物

- 微生物生物肥料

第十二章 按应用分類的农业生物技术市场

- 按应用分類的植物生物技术市场

- 作物保护

- 获利能力提升

- 营养品质提高

- 耐气候变迁的作物

- 动物生物技术市场按应用领域划分

- 抗病性

- 成长和生产力提升

- 动物福利解决方案

- 兽医治疗

- 微生物生物技术市场按应用领域划分

- 土壤健康管理

- 病虫害防治

- 永续的营养循环

- 生物修復和废弃物利用

13. 按技术分類的农业生物技术市场

- 按技术分類的植物生物技术市场

- 组织培养

- 体细胞杂交

- 分子诊断

- 基因工程

- 按技术分類的动物生物技术市场

- 胚胎拯救与移植

- 基因工程/CRISPR

- 分子诊断

- 疫苗生物技术

- 按技术分類的微生物生物技术市场

- 发酵技术

- 总体基因体学和微生物基因组学

- 分子标记辅助选择

- 合成生物学

14. 各地区农业生物技术市场

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 西班牙

- 英国

- 其他的

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

- 其他地区

- 中东

- 非洲

第十五章 竞争格局

- 概述

- 主要企业的策略

- 收入分析

- 市占率分析

- 品牌/产品对比

- 估值和财务指标

- 植物生物技术公司估值矩阵:主要企业

- 动物生物技术公司估值矩阵:主要企业

- 微生物生物技术公司估值矩阵:主要企业

- 竞争场景

第十六章:公司简介

- 植物生物技术公司

- BASF SE

- BAYER AG

- CORTEVA AGRISCIENCE

- SYNGENTA

- KWS SAAT SE & CO. KGAA

- UPL

- FMC CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- NUFARM

- PRO FARM GROUP

- 动物生物技术公司

- ZOETIS SERVICES LLC

- ELANCO OR ITS AFFILIATES

- MERCK & CO., INC.

- CEVA

- VIRBAC

- HESTER BIOSCIENCES LIMITED

- GENUS PLC

- VAXXINOVA

- AB VISTA

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 微生物生物技术公司

- VALENT USA LLC

- NOVONESIS GROUP

- INDIGO AG, INC.

- PIVOT BIO

- BIOATLANTIS LTD.

- CERTIS USA LLC

- ZYMOLENT BIOSCIENCES PVT. LTD.

- AGRICEN

- VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD.

- GROUNDWORK BIOAG

第十七章:邻近及相关市场

第十八章附录

The agriculture biotechnology market is estimated at USD 92.19 billion in 2025 and is projected to reach USD 144.25 billion by 2030, at a CAGR of 9.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Organism Type, Technology, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

The growth of the agriculture biotechnology market is mainly driven by increasing global food demand, diminishing arable land, and the need for sustainable farming solutions. Biotechnology provides advanced methods to increase crop yields, improve soil health, and boost livestock productivity while reducing environmental impact. The rising use of genetically modified (GM) crops, microbial inoculants, and biofertilizers supports better resource management and less reliance on chemicals.

Moreover, climate change pressures have sped up the adoption of drought-tolerant and pest-resistant crop varieties, ensuring greater resilience in farming. Governments and international groups are encouraging biotech innovations through supportive regulations, research funding, and sustainability efforts. Additionally, quick progress in genome editing, molecular diagnostics, and microbial engineering is broadening the use of agricultural biotechnology in plant, animal, and microbial systems. Collectively, these factors are driving a shift toward high-tech, eco-friendly, and high-yield agriculture worldwide.

"Plant biotechnology is projected to dominate the market during the forecast period."

The plant biotechnology segment is expected to dominate the global agriculture biotechnology market during the forecast period. This leadership is due to widespread adoption of genetically modified (GM) crops, advancements in seed trait development, and increased use of biofertilizers and biopesticides. Rising global food demand, combined with the need for higher crop yields with limited natural resources, is fueling the adoption of plant biotechnology solutions. Farmers are increasingly opting for GM varieties that offer herbicide tolerance, pest resistance, and improved stress tolerance to achieve better yields and profits. Additionally, innovations in CRISPR and molecular breeding technologies are enhancing precision in crop improvement, enabling faster commercialization of new varieties. Supportive government policies promoting sustainable agriculture, along with public-private R&D investments, are further reinforcing this segment's position. The growing need for climate-resilient and nutrient-rich crops will continue to make plant biotechnology a key driver of innovation in modern agriculture throughout the forecast period.

"The genetic engineering and genome editing subsegment is projected to dominate the agriculture biotechnology market during the forecast period."

The genetic engineering and genome editing segment is expected to lead the agriculture biotechnology market during the forecast period due to its transformative effect on crop and livestock improvement. Technologies like CRISPR-Cas9, TALEN, and RNA interference (RNAi) are allowing scientists to create precise, high-yield varieties with better yield, stress tolerance, and nutritional content. An example is Calyxt's gene-edited soybean, which produces healthier high-oleic oil and was among the first CRISPR-based crops to be commercialized in the US. Likewise, Corteva Agriscience has developed drought-tolerant maize using advanced gene-editing methods, greatly enhancing resilience in water-scarce areas.

In livestock, Genus PLC has developed pigs resistant to Porcine Reproductive and Respiratory Syndrome (PRRS), a breakthrough that enhances animal welfare and cuts economic losses. Governments in Brazil, the US, and Argentina have also relaxed regulations on gene-edited crops, supporting faster commercialization. Supported by strong R&D investments, global partnerships, and evolving biosafety frameworks, genetic engineering and genome editing are set to remain the leading technologies that drive efficiency, sustainability, and innovation in agricultural biotechnology through 2030.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

The Asia Pacific region is expected to see the fastest growth in the agriculture biotechnology market during the forecast period, fueled by increasing food demands, expanding agricultural modernization, and government-supported initiatives that promote sustainable farming practices. Countries like China, India, Japan, and the Philippines are increasingly investing in biotechnology R&D to improve crop yields, livestock health, and soil fertility. The rising adoption of genetically modified (GM) crops, microbial biofertilizers, and bio-based pest control products is transforming the region's agricultural landscape.

India's approval of GM mustard (Dhara Mustard Hybrid-11) in 2023 and China's increasing commercialization of gene-edited soybean and maize varieties highlight the region's progressive regulatory approach. Additionally, strong support from regional organizations and public-private partnerships is driving innovation in genome editing, fermentation technologies, and microbial applications. With rapid population growth, limited arable land, and growing focus on food security, the Asia Pacific region is expected to remain the most dynamic and opportunity-rich area in the agriculture biotechnology market through 2030.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations in the agriculture biotechnology market.

- By Company Type: Tier 1-25%, Tier 2-45%, and Tier 3-30%

- By Designation: CXOs-20%, Managers-50%, Executives-30%

- By Region: North America-25%, Europe-20%, Asia Pacific-30%, South America-15%, and Rest of the World-10%

Prominent companies in the market include Bayer Crop Science, Corteva Agriscience, BASF SE, Syngenta AG, Zoetis Inc., Elanco Animal Health, and Novonesis (Novozymes and Chr. Hansen)

Research Coverage

This research report categorizes the agriculture biotechnology market by organism type (plants, animals, microbes), type (genetic modification, crop protection, soil enhancement, stress tolerance, transgenic animals, vaccines, feed additives, diagnostics, biofertilizers, biocontrol agents, microbial enzymes & biostimulants, microbial genomics & fermentation), technology (genetic engineering, molecular diagnostics, tissue culture, CRISPR, fermentation, metagenomics, synthetic biology, and molecular marker-assisted selection), application (crop protection, yield enhancement, disease resistance, animal health management, soil health improvement, and sustainable nutrient cycling), end user (farmers and producer groups, agribusinesses, seed and input companies, research institutions, and government agencies), and region (North America, Europe, Asia Pacific, South America, the Middle East, and Africa).

The report's scope includes detailed information about major factors such as drivers, restraints, challenges, and opportunities that influence the growth of agricultural biotechnology. A comprehensive analysis of key industry players offers insights into their businesses, services, key strategies, contracts, partnerships, agreements, product launches, mergers and acquisitions, and recent developments in the agriculture biotechnology market. This report also features a competitive analysis of emerging startups within the agriculture biotechnology ecosystem. Additionally, the study covers industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscapes, among other topics.

Reasons to Buy This Report

The report will provide market leaders and new entrants with approximate revenue figures for the overall agriculture biotechnology sector and its subsegments. It will also help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market pulse and offers information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points.

- Analysis of key drivers (growing demand for sustainable and high-yield biotechnology-based agriculture), restraints (high regulatory hurdles and lengthy approval processes for GMOs), opportunities (increasing adoption of microbial and bio-based agricultural inputs globally), and challenges (public skepticism and ethical concerns over genetic modification technologies) influencing the growth of the agriculture biotechnology market

- Product Development/Innovation: Detailed insights into ongoing R&D initiatives in genome editing, CRISPR applications, microbial biofertilizers, and biocontrol agents are included, along with emerging product launches across plant, animal, and microbial biotechnology segments.

- Market Development: The report offers comprehensive information about expanding market opportunities across developed and emerging regions, emphasizing growing investment in biotechnology-enabled agriculture.

- Market Diversification: Includes detailed analysis of new product innovations, regional adoption patterns, government-funded biotechnology initiatives, and expansion of key players into new applications such as climate-resilient crops and animal health solutions.

- Competitive Assessment: In-depth assessment of market share, company strategies, product portfolios, and innovation footprints of leading players such as Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Syngenta AG (Switzerland), Novonesis (Denmark), Ginkgo Bioworks (US), Zoetis Inc. (US), and ADM Animal Nutrition (US), among others in the agriculture biotechnology ecosystem.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.2.1 AGRICULTURE BIOTECHNOLOGY COMPANIES

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 AGRICULTURE BIOTECHNOLOGY MARKET OVERVIEW

- 4.2 AGRICULTURE BIOTECHNOLOGY MARKET: GROWTH RATES OF MAJOR REGIONAL SUBMARKETS

- 4.3 EUROPE: AGRICULTURE BIOTECHNOLOGY MARKET FOR PLANT BIOTECHNOLOGY, BY TYPE AND COUNTRY

- 4.4 AGRICULTURE BIOTECHNOLOGY MARKET, BY ORGANISM TYPE AND REGION

- 4.5 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 4.6 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 4.7 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing Need for Sustainable Food Production

- 5.2.1.2 Government Support and Regulatory Approvals

- 5.2.1.3 Rising Focus on Reducing Chemical Inputs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Public Perception and Ethical Concerns

- 5.2.2.2 Infrastructure and Cold Chain Limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion in Emerging Economies

- 5.2.3.2 Focus on Carbon-negative and Regenerative Agriculture

- 5.2.3.3 Growth in Microbial and Bio-based Inputs

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory Uncertainty and Trade Barriers

- 5.2.4.2 Dominance of Few Multinational Players

- 5.2.4.3 Climate and Disease Variability

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GEN AI ON AGRICULTURE BIOTECHNOLOGY

- 5.3.1 INTRODUCTION

- 5.3.2 USE OF GEN AI IN AGRICULTURE BIOTECHNOLOGY

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Using Gen AI to Enhance Crop Disease Diagnostics via Synthetic Imagery

- 5.3.3.2 PhytoSynth: Generative AI for Crop Disease Data Generation

- 5.3.4 IMPACT ON AGRICULTURE BIOTECHNOLOGY MARKET

- 5.3.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.2.2 BARGAINING POWER OF SUPPLIERS

- 6.2.3 BARGAINING POWER OF BUYERS

- 6.2.4 THREAT OF SUBSTITUTES

- 6.2.5 THREAT OF NEW ENTRANTS

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GLOBAL POPULATION GROWTH & FOOD DEMAND

- 6.3.2 STABLE GLOBAL GDP GROWTH AND MACRO PROJECTIONS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- 6.7 INDICATIVE PRICING ANALYSIS

- 6.7.1 INDICATIVE PRICING ANALYSIS, BY KEY COMPANY AND ORGANISM

- 6.7.2 INDICATIVE PRICING BY REGION

- 6.8 TRADE ANALYSIS

- 6.8.1 TRADE ANALYSIS OF HS CODE 843280: PREPARED CULTURE MEDIA FOR DEVELOPMENT OR MAINTENANCE OF MICROORGANISMS, INCLUDING VIRUSES AND THE LIKE, OR OF PLANT, HUMAN, OR ANIMAL CELLS

- 6.8.1.1 Export Trends of Agriculture Biotechnology under HS Code 382100 (2020-2024)

- 6.8.1.2 Import Trends of Agriculture Biotechnology under HS Code 382100 (2020-2024)

- 6.8.1 TRADE ANALYSIS OF HS CODE 843280: PREPARED CULTURE MEDIA FOR DEVELOPMENT OR MAINTENANCE OF MICROORGANISMS, INCLUDING VIRUSES AND THE LIKE, OR OF PLANT, HUMAN, OR ANIMAL CELLS

- 6.9 KEY CONFERENCES & EVENTS

- 6.10 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 6.11 INVESTMENT AND FUNDING SCENARIO

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 PIVOT BIO'S GENE-EDITED NITROGEN-FIXING MICROBES (2025)

- 6.12.2 NOVONESIS MICROBIAL SEED INOCULANT (JUMPSTART(R)) (2024)

- 6.12.3 RECOMBINETICS - GENE-EDITED LIVESTOCK FOR DISEASE RESISTANCE AND WELFARE ENHANCEMENT (2024)

- 6.13 IMPACT OF 2025 US TARIFF - AGRICULTURE BIOTECHNOLOGY MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 United States

- 6.13.4.2 European Union

- 6.13.4.3 China

- 6.13.5 IMPACT ON END-USE INDUSTRIES

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 INTRODUCTION

- 7.2 DECISION-MAKING PROCESS

- 7.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.3.2 BUYING CRITERIA

- 7.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.6 MARKET PROFITABILITY

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 8.1 INTRODUCTION

- 8.2 KEY EMERGING TECHNOLOGIES

- 8.3 COMPLEMENTARY TECHNOLOGIES

- 8.4 TECHNOLOGY/PRODUCT ROADMAP

- 8.5 PATENT ANALYSIS

- 8.5.1 LIST OF MAJOR PATENTS

- 8.6 FUTURE APPLICATIONS

- 8.7 IMPACT OF AI/GEN AI ON AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.1 TOP USE CASES AND MARKET POTENTIAL

- 8.7.1.1 AI Use Cases in Agriculture Biotechnology Market

- 8.7.1.1.1 AI-driven Genomic Selection and Trait Discovery

- 8.7.1.1.2 Precision Bio-input Design and Microbial Optimization

- 8.7.1.1.3 Market Potential Impact of AI in Agricultural Biotechnology

- 8.7.1.1.4 Acceleration of R&D and Commercialization Pipelines

- 8.7.1.1.5 Enabling Data-driven Sustainable Agriculture and Global Scalability

- 8.7.1.1 AI Use Cases in Agriculture Biotechnology Market

- 8.7.2 BEST PRACTICES IN AGRICULTURE BIOTECHNOLOGY PROCESSING

- 8.7.3 CASE STUDIES OF AI IMPLEMENTATION IN AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.3.1 Using Gen AI to Enhance Crop Disease Diagnostics via Synthetic Imagery

- 8.7.3.2 PhytoSynth: Generative AI for Crop Disease Data Generation

- 8.7.4 INTERCONNECTED & ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 8.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.1 TOP USE CASES AND MARKET POTENTIAL

- 8.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

9 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 REGIONAL REGULATIONS AND COMPLIANCE

- 9.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 9.2.2 INDUSTRY STANDARDS

- 9.3 SUSTAINABILITY INITIATIVES

- 9.3.1 CARBON IMPACT AND ECO-APPLICATIONS OF AGRICULTURE BIOTECHNOLOGY

- 9.4 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 9.5 CERTIFICATIONS, LABELING, ECO-STANDARDS

10 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE OF ORGANISM

- 10.1 INTRODUCTION

- 10.2 PLANTS

- 10.2.1 GROWING GLOBAL FOOD DEMAND, CLIMATE CHANGE RESILIENCE, AND SUSTAINABILITY GOALS ACCELERATING ADOPTION OF PLANT BIOTECHNOLOGY

- 10.3 ANIMALS

- 10.3.1 RISING PROTEIN DEMAND, DISEASE PREVENTION NEEDS, AND SUSTAINABLE LIVESTOCK PRODUCTION DRIVING ANIMAL BIOTECHNOLOGY ADVANCEMENTS

- 10.4 MICROBIALS

- 10.4.1 RISING DEMAND FOR SUSTAINABLE SOIL HEALTH, BIOFERTILIZERS, AND ECO-FRIENDLY PEST CONTROL DRIVES MICROBIAL BIOTECHNOLOGY GROWTH

11 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 PLANT BIOTECHNOLOGY MARKET, BY TYPE

- 11.2.1 GROWING FOCUS ON ENHANCING CROP YIELD, STRESS RESISTANCE, AND SUSTAINABILITY

- 11.2.2 GENETIC MODIFICATION

- 11.2.2.1 Crop protection (Biopesticides, Herbicide-tolerant Traits)

- 11.2.2.1.1 Rising pest resistance, yield loss, and sustainability goals drive innovation in biotechnology-based crop protection

- 11.2.2.2 Soil enhancement (Biofertilizers, Microbial Solutions)

- 11.2.2.2.1 Declining soil fertility and sustainable farming practices are driving demand for biotechnology-based soil enhancement solutions

- 11.2.2.3 Stress tolerance (Drought/Heat-resistant Crops)

- 11.2.2.3.1 Climate change, erratic weather, and yield instability are driving demand for stress-tolerant biotechnology crops

- 11.2.2.4 Animal biotechnology market, by type

- 11.2.2.4.1 Focus on improving livestock productivity, health, and genetic performance

- 11.2.2.1 Crop protection (Biopesticides, Herbicide-tolerant Traits)

- 11.2.3 TRANSGENIC ANIMALS

- 11.2.3.1 Animal vaccine development

- 11.2.3.1.1 Increasing livestock diseases and zoonotic threats drive demand for advanced biotechnology-based animal vaccine solutions

- 11.2.3.2 Feed additives & nutrient optimization

- 11.2.3.2.1 Rising demand for efficient, sustainable livestock production drives adoption of biotechnology-based feed additives globally

- 11.2.3.3 Animal health diagnostics

- 11.2.3.3.1 Growing disease incidence and need for early detection drive innovation in biotechnology-based animal diagnostics

- 11.2.3.4 Microbial biotechnology market, by type

- 11.2.3.4.1 Expanding use of microbes in agriculture enhances yield and sustainability

- 11.2.3.1 Animal vaccine development

- 11.2.4 MICROBIAL BIOFERTILIZERS

- 11.2.4.1 Biocontrol agents (Fungi, Bacteria)

- 11.2.4.1.1 Stringent pesticide regulations and growing demand for residue-free, sustainable crop protection accelerate biocontrol adoption globally

- 11.2.4.2 Microbial enzymes & biostimulants

- 11.2.4.2.1 Rising demand for eco-friendly, stress-resilient crop enhancement solutions drives microbial enzyme and biostimulant adoption globally

- 11.2.4.3 Microbial genomics & fermentation

- 11.2.4.3.1 Advancements in microbial genomics and precision fermentation enable high-efficiency, scalable bio-based agricultural innovations globally

- 11.2.4.1 Biocontrol agents (Fungi, Bacteria)

12 AGRICULTURE BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.2.1 CROP PROTECTION

- 12.2.1.1 Increasing pest resistance and need for sustainable pest control drive innovation in biotech crop protection

- 12.2.2 YIELD ENHANCEMENT

- 12.2.2.1 Rising food demand and limited arable land accelerate adoption of high-yield biotechnology-based crop systems

- 12.2.3 NUTRITIONAL QUALITY IMPROVEMENT

- 12.2.3.1 Rising focus on combating micronutrient deficiency fuels demand for biotechnology-based nutritional crop improvement

- 12.2.4 CLIMATE-RESILIENT CROPS

- 12.2.4.1 Intensifying climate variability and food security concerns drive investment in biotechnology-based resilient crop development

- 12.2.1 CROP PROTECTION

- 12.3 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.3.1 DISEASE RESISTANCE

- 12.3.1.1 Rising livestock disease outbreaks and antibiotic resistance drive adoption of genetic and molecular resistance solutions

- 12.3.2 GROWTH & PRODUCTIVITY ENHANCEMENT

- 12.3.2.1 Increasing protein demand and emission-reduction mandates promote biotechnology adoption for livestock growth and productivity enhancement

- 12.3.3 ANIMAL WELFARE SOLUTIONS

- 12.3.3.1 Rising ethical concerns and regulatory focus on humane production drive demand for biotechnology-enabled animal welfare systems

- 12.3.4 VETERINARY THERAPEUTICS

- 12.3.4.1 Growing prevalence of zoonotic diseases and advancements in biologics fuel growth of veterinary biotechnology therapeutics

- 12.3.1 DISEASE RESISTANCE

- 12.4 MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.4.1 SOIL HEALTH MANAGEMENT

- 12.4.1.1 Increasing focus on regenerative agriculture and soil restoration drives adoption of microbial soil health management technologies

- 12.4.2 PEST & DISEASE CONTROL

- 12.4.2.1 Rising pesticide restrictions and demand for organic produce drive adoption of microbial pest control solutions

- 12.4.3 SUSTAINABLE NUTRIENT CYCLING

- 12.4.3.1 Growing nutrient inefficiency and fertilizer price volatility accelerate adoption of microbial nutrient cycling technologies

- 12.4.4 BIOREMEDIATION & WASTE UTILIZATION

- 12.4.4.1 Rising agricultural waste generation and environmental pollution drive adoption of microbial bioremediation technologies

- 12.4.1 SOIL HEALTH MANAGEMENT

13 AGRICULTURE BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.2.1 TISSUE CULTURE

- 13.2.1.1 Growing need for disease-free, high-quality planting materials and export-grade crops accelerates tissue culture adoption globally

- 13.2.2 SOMATIC HYBRIDIZATION

- 13.2.2.1 Advancements in cell fusion and interspecies hybridization foster innovation in developing resilient and high-yield crop hybrids

- 13.2.3 MOLECULAR DIAGNOSTICS

- 13.2.3.1 Increasing global biosecurity regulations and focus on disease-free seed trade enhance molecular diagnostic adoption in agriculture

- 13.2.4 GENETIC ENGINEERING

- 13.2.4.1 Genetic engineering represents most transformative technology in modern plant biotechnology

- 13.2.1 TISSUE CULTURE

- 13.3 ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.3.1 EMBRYO RESCUE & TRANSFER

- 13.3.1.1 Growing demand for genetic improvement, reproductive efficiency, and conservation drives widespread adoption of embryo transfer technologies

- 13.3.2 GENETIC ENGINEERING & CRISPR

- 13.3.2.1 Expanding use of CRISPR-Cas9 in livestock breeding drives precision genetic improvement and sustainability in animal farming

- 13.3.3 MOLECULAR DIAGNOSTICS

- 13.3.3.1 Rising livestock disease incidence and demand for rapid, accurate pathogen detection bolster molecular diagnostic adoption globally

- 13.3.4 VACCINE BIOTECHNOLOGIES

- 13.3.4.1 Rising zoonotic disease threats and focus on antibiotic-free livestock production accelerate biotech vaccine innovations globally

- 13.3.1 EMBRYO RESCUE & TRANSFER

- 13.4 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.4.1 FERMENTATION TECHNOLOGY

- 13.4.1.1 Increasing use of sustainable biofertilizers and precision fermentation drives growth in microbial input production technologies

- 13.4.2 METAGENOMICS & MICROBIAL GENOMICS

- 13.4.2.1 Expanding soil microbiome research and AI-based genomic analysis accelerate innovation in precision microbial biotechnology

- 13.4.3 MOLECULAR MARKER-ASSISTED SELECTION

- 13.4.3.1 Rising need for efficient microbial strain identification promotes adoption of molecular marker-assisted selection technologies

- 13.4.4 SYNTHETIC BIOLOGY

- 13.4.4.1 Expanding investments in engineered microbes and metabolic design accelerate adoption of synthetic biology in agriculture and biotechnology

- 13.4.1 FERMENTATION TECHNOLOGY

14 AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Expanding bioengineering investments, AI-integrated field trials, and streamlined GMO regulations drive US biotechnology market leadership

- 14.2.2 CANADA

- 14.2.2.1 Supportive biosafety regulations and strong genomic research collaborations boost biotechnology advancement and sustainability in Canada

- 14.2.3 MEXICO

- 14.2.3.1 Expanding gene-editing research and sustainable agriculture policies accelerate biotechnology adoption and innovation in Mexico

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Strong federal R&D support and industrial-scale bio-innovation reinforce Germany's leadership in sustainable agricultural biotechnology

- 14.3.2 ITALY

- 14.3.2.1 Expanding bioinput research programs and regional sustainability initiatives accelerate biotechnology adoption in Italy's agri-sector

- 14.3.3 FRANCE

- 14.3.3.1 Strong government R&D investment and progressive biosafety policies enhance France's leadership in sustainable agricultural biotechnology

- 14.3.4 SPAIN

- 14.3.4.1 Expanding gene-editing research and strong government funding boost Spain's sustainable agricultural biotechnology development

- 14.3.5 UK

- 14.3.5.1 Regulatory reforms and strong R&D investments strengthen UK's leadership in precision agricultural biotechnology innovation

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Expanding GMO approvals and strong state-led R&D investments reinforce China's leadership in agricultural biotechnology innovation

- 14.4.2 INDIA

- 14.4.2.1 Government-led biotech missions and microbial innovation drive India's agricultural transformation toward sustainable productivity growth

- 14.4.3 JAPAN

- 14.4.3.1 Strong government funding and innovation-driven industry partnerships accelerate Japan's agricultural biotechnology advancement

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Progressive gene-editing reforms and climate-resilient R&D accelerate biotechnology growth in Australia and New Zealand

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Expanding GMO approvals and microbial innovation solidify Brazil's leadership in agricultural biotechnology development

- 14.5.2 ARGENTINA

- 14.5.2.1 Global leadership in GM wheat and microbial bioinputs strengthens Argentina's agricultural biotechnology innovation capacity

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Government-backed innovation and food security strategies drive biotechnology adoption across Middle East's arid regions

- 14.6.2 AFRICA

- 14.6.2.1 Expanding GM approvals and microbial innovation strengthen Africa's resilience in sustainable agricultural biotechnology adoption

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS' STRATEGIES, 2022-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 BAYER AG (GERMANY)

- 15.5.2 SYNGENTA AG (SWITZERLAND)

- 15.5.3 CORTEVA (US)

- 15.5.4 ZOETIS INC. (US)

- 15.5.5 NOVONESIS GROUP (DENMARK)

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6.1 COMPANY VALUATION

- 15.6.2 EV/EBITDA

- 15.7 PLANT BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Application footprint

- 15.8 ANIMAL BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.8.1 STARS

- 15.8.2 EMERGING LEADERS

- 15.8.3 PERVASIVE PLAYERS

- 15.8.4 PARTICIPANTS

- 15.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.8.5.1 Company footprint

- 15.8.5.2 Region footprint

- 15.8.5.3 Type footprint

- 15.8.5.4 Application footprint

- 15.9 MICROBIAL BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.9.1 STARS

- 15.9.2 EMERGING LEADERS

- 15.9.3 PERVASIVE PLAYERS

- 15.9.4 PARTICIPANTS

- 15.9.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.9.5.1 Company footprint

- 15.9.5.2 Region footprint

- 15.9.5.3 Type footprint

- 15.9.5.4 Application footprint

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 PLANT BIOTECHNOLOGY COMPANIES

- 16.1.1 BASF SE

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 BAYER AG

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 CORTEVA AGRISCIENCE

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 SYNGENTA

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 KWS SAAT SE & CO. KGAA

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 UPL

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 FMC CORPORATION

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Expansions

- 16.1.7.3.4 Other developments

- 16.1.7.4 MnM view

- 16.1.8 SUMITOMO CHEMICAL CO., LTD.

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Expansions

- 16.1.8.4 MnM view

- 16.1.9 NUFARM

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.9.4 MnM view

- 16.1.10 PRO FARM GROUP

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.4 MnM view

- 16.1.1 BASF SE

- 16.2 ANIMAL BIOTECHNOLOGY COMPANIES

- 16.2.1 ZOETIS SERVICES LLC

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 Recent developments

- 16.2.1.3.1 Other developments

- 16.2.1.3.2 Expansions

- 16.2.1.4 MnM view

- 16.2.1.4.1 Key strengths

- 16.2.1.4.2 Strategic choices

- 16.2.1.4.3 Weaknesses and competitive threats

- 16.2.2 ELANCO OR ITS AFFILIATES

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 Recent developments

- 16.2.2.3.1 Product launches

- 16.2.2.4 MnM view

- 16.2.2.4.1 Key strengths

- 16.2.2.4.2 Strategic choices

- 16.2.2.4.3 Weaknesses and competitive threats

- 16.2.3 MERCK & CO., INC.

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 Recent developments

- 16.2.3.3.1 Expansions

- 16.2.3.4 MnM view

- 16.2.3.4.1 Key strengths

- 16.2.3.4.2 Strategic choices

- 16.2.3.4.3 Weaknesses and competitive threats

- 16.2.4 CEVA

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 Recent developments

- 16.2.4.3.1 Expansions

- 16.2.4.4 MnM view

- 16.2.5 VIRBAC

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 Recent developments

- 16.2.5.3.1 Product launches

- 16.2.5.4 MnM view

- 16.2.5.4.1 Key strengths

- 16.2.5.4.2 Strategic choices

- 16.2.5.4.3 Weaknesses and competitive threats

- 16.2.6 HESTER BIOSCIENCES LIMITED

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 MnM view

- 16.2.7 GENUS PLC

- 16.2.7.1 Business overview

- 16.2.7.2 Products/Solutions/Services offered

- 16.2.7.3 MnM view

- 16.2.8 VAXXINOVA

- 16.2.8.1 Business overview

- 16.2.8.2 Products/Solutions/Services offered

- 16.2.8.3 MnM view

- 16.2.9 AB VISTA

- 16.2.9.1 Business overview

- 16.2.9.2 Products/Solutions/Services offered

- 16.2.9.3 MnM view

- 16.2.10 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 16.2.10.1 Business overview

- 16.2.10.2 Products/Solutions/Services offered

- 16.2.10.3 Recent developments

- 16.2.10.3.1 Product launches

- 16.2.10.4 MnM view

- 16.2.10.4.1 Key strengths

- 16.2.10.4.2 Strategic choices

- 16.2.10.4.3 Weaknesses and competitive threats

- 16.2.1 ZOETIS SERVICES LLC

- 16.3 MICROBE BIOTECHNOLOGY COMPANIES

- 16.3.1 VALENT U.S.A. LLC

- 16.3.1.1 Business overview

- 16.3.1.2 Products/Solutions/Services offered

- 16.3.1.3 Recent developments

- 16.3.1.3.1 Deals

- 16.3.1.3.2 Expansions

- 16.3.1.4 MnM view

- 16.3.1.4.1 Key strengths

- 16.3.1.4.2 Strategic choices

- 16.3.1.4.3 Weaknesses and competitive threats

- 16.3.2 NOVONESIS GROUP

- 16.3.2.1 Business overview

- 16.3.2.2 Products/Solutions/Services offered

- 16.3.2.3 Recent developments

- 16.3.2.3.1 Product launches

- 16.3.2.3.2 Deals

- 16.3.2.3.3 Expansions

- 16.3.2.4 MnM view

- 16.3.2.4.1 Key strengths

- 16.3.2.4.2 Strategic choices

- 16.3.2.4.3 Weaknesses and competitive threats

- 16.3.3 INDIGO AG, INC.

- 16.3.3.1 Business overview

- 16.3.3.2 Products/Solutions/Services offered

- 16.3.3.3 Recent developments

- 16.3.3.3.1 Product launches

- 16.3.3.3.2 Deals

- 16.3.3.3.3 Expansions

- 16.3.3.4 MnM view

- 16.3.3.4.1 Key strengths

- 16.3.3.4.2 Strategic choices

- 16.3.3.4.3 Weaknesses and competitive threats

- 16.3.4 PIVOT BIO

- 16.3.4.1 Business overview

- 16.3.4.2 Products/Solutions/Services offered

- 16.3.4.3 Recent developments

- 16.3.4.3.1 Other developments

- 16.3.4.3.2 Expansions

- 16.3.4.4 MnM view

- 16.3.4.4.1 Key strengths

- 16.3.4.4.2 Strategic choices

- 16.3.4.4.3 Weaknesses and competitive threats

- 16.3.5 BIOATLANTIS LTD.

- 16.3.5.1 Business overview

- 16.3.5.2 Products/Solutions/Services offered

- 16.3.5.3 Recent developments

- 16.3.5.3.1 Product launches

- 16.3.5.3.2 Deals

- 16.3.5.4 MnM view

- 16.3.5.4.1 Key strengths

- 16.3.5.4.2 Strategic choices

- 16.3.5.4.3 Weaknesses and competitive threats

- 16.3.6 CERTIS USA L.L.C.

- 16.3.6.1 Business overview

- 16.3.6.2 Products/Solutions/Services offered

- 16.3.6.3 Recent developments

- 16.3.6.3.1 Product launches

- 16.3.6.3.2 Deals

- 16.3.6.4 MnM view

- 16.3.7 ZYMOLENT BIOSCIENCES PVT. LTD.

- 16.3.7.1 Business overview

- 16.3.7.2 Products/Solutions/Services offered

- 16.3.7.3 Recent developments

- 16.3.7.3.1 Other developments

- 16.3.7.4 MnM view

- 16.3.8 AGRICEN

- 16.3.8.1 Business overview

- 16.3.8.2 Products/Solutions/Services offered

- 16.3.8.3 Recent developments

- 16.3.8.3.1 Deals

- 16.3.8.4 MnM view

- 16.3.9 VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD.

- 16.3.9.1 Business overview

- 16.3.9.2 Products/Solutions/Services offered

- 16.3.9.3 Recent developments

- 16.3.9.4 MnM view

- 16.3.10 GROUNDWORK BIOAG

- 16.3.10.1 Business overview

- 16.3.10.2 Products/Solutions/Services offered

- 16.3.10.3 Recent developments

- 16.3.10.3.1 Product launches

- 16.3.10.3.2 Deals

- 16.3.10.4 MnM view

- 16.3.1 VALENT U.S.A. LLC

17 ADJACENT AND RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 PLANT BIOTECHNOLOGY MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 AGRICULTURAL MICROBIALS MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 AGRICULTURAL MICROBIALS MARKET, BY APPLICATION

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 AGRICULTURE BIOTECHNOLOGY MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 AGRICULTURE BIOTECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INDICATIVE PRICING ANALYSIS BY KEY COMPANIES FOR PLANT BIOTECHNOLOGY

- TABLE 5 INDICATIVE PRICING ANALYSIS BY KEY COMPANIES FOR MICROBIAL BIOTECHNOLOGY

- TABLE 6 INDICATIVE PRICING ANALYSIS BY KEY COMPANIES FOR ANIMAL BIOTECHNOLOGY

- TABLE 7 PLANT BIOTECHNOLOGY - INDICATIVE REGIONAL PRICING, 2024

- TABLE 8 MICROBIAL BIOTECHNOLOGY - INDICATIVE REGIONAL PRICING, 2024

- TABLE 9 ANIMAL BIOTECHNOLOGY - INDICATIVE REGIONAL PRICING, 2024

- TABLE 10 TOP 10 EXPORTERS OF HS CODE 382100, 2020-2024 (USD THOUSAND)

- TABLE 11 TOP 10 IMPORTERS OF HS CODE 382100, 2020-2024 (USD THOUSAND)

- TABLE 12 TOP 10 EXPORTERS OF HS CODE 382100, 2020-2024 (TONS)

- TABLE 13 TOP 10 IMPORTERS OF HS CODE 382100, 2020-2024 (TONS)

- TABLE 14 AGRICULTURE BIOTECHNOLOGY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 17 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AGRICULTURE BIOTECHNOLOGY TYPE

- TABLE 19 KEY BUYING CRITERIA FOR AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE

- TABLE 20 LIST OF MAJOR PATENTS FOR AGRICULTURE BIOTECHNOLOGY MARKET, 2021-2024

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE OF ORGANISM, 2020-2024 (USD MILLION)

- TABLE 27 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE OF ORGANISM, 2025-2030 (USD MILLION)

- TABLE 28 PLANTS: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 PLANTS: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ANIMALS: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 ANIMALS: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 MICROBIAL: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 MICROBIAL: AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 35 PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 CROP PROTECTION & SOIL ENHANCEMENT: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 37 CROP PROTECTION & SOIL ENHANCEMENT: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 38 CROP PROTECTION & SOIL ENHANCEMENT: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 39 CROP PROTECTION & SOIL ENHANCEMENT: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 40 BIOPESTICIDES: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 41 BIOPESTICIDES: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 42 BIOFERTILIZERS: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 43 BIOFERTILIZERS: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 44 PLANT GROWTH REGULATORS: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 45 PLANT GROWTH REGULATORS: PLANT BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 46 ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 47 ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 49 MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 50 MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 51 MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 52 MICROBIAL BIOFERTILIZERS & MICROBIAL BIOSTIMULANTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 53 MICROBIAL BIOFERTILIZERS & MICROBIAL BIOSTIMULANTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 54 MICROBIAL BIOCONTROL AGENTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 55 MICROBIAL BIOCONTROL AGENTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 56 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 57 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 59 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 61 MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 63 PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 64 ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 65 ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 66 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 67 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 68 AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 PLANT BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 PLANT BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 ANIMAL BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 ANIMAL BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 MICROBIAL BIOTECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 MICROBIAL BIOTECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 83 NORTH AMERICAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 84 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 101 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 102 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 US: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 107 US: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 US: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 109 US: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 US: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 111 US: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 US: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 113 US: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 US: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 115 US: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 US: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 117 US: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 CANADA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 119 CANADA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 CANADA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 121 CANADA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 CANADA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 123 CANADA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 125 CANADA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 127 CANADA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 129 CANADA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 MEXICO: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 131 MEXICO: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 132 MEXICO: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 133 MEXICO: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 MEXICO: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 135 MEXICO: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 MEXICO: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 137 MEXICO: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 MEXICO: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 139 MEXICO: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 MEXICO: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 141 MEXICO: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 EUROPEAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 149 EUROPEAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 150 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 151 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 153 EUROPE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 157 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 159 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 161 EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 163 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 165 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 167 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 168 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 169 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 171 EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 GERMANY: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 173 GERMANY: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 GERMANY: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 175 GERMANY: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 GERMANY: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 177 GERMANY: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 GERMANY: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 179 GERMANY: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 GERMANY: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 181 GERMANY: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 182 GERMANY: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 183 GERMANY: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 184 ITALY: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 185 ITALY: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 186 ITALY: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 187 ITALY: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 188 ITALY: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 189 ITALY: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 ITALY: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 191 ITALY: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 192 ITALY: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 193 ITALY: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 ITALY: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 195 ITALY: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 196 FRANCE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 197 FRANCE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 FRANCE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 199 FRANCE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 200 FRANCE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 201 FRANCE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 202 FRANCE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 203 FRANCE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 204 FRANCE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 205 FRANCE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 FRANCE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 207 FRANCE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 208 SPAIN: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 209 SPAIN: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 210 SPAIN: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 211 SPAIN: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 212 SPAIN: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 213 SPAIN: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 SPAIN: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 215 SPAIN: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 216 SPAIN: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 217 SPAIN: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 218 SPAIN: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 219 SPAIN: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 220 UK: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 221 UK: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 222 UK: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 223 UK: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 224 UK: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 225 UK: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 226 UK: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 227 UK: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 228 UK: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 229 UK: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 230 UK: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 231 UK: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 232 REST OF EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 233 REST OF EUROPE: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 REST OF EUROPE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 235 REST OF EUROPE: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 236 REST OF EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 237 REST OF EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 238 REST OF EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 239 REST OF EUROPE: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 240 REST OF EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 241 REST OF EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 242 REST OF EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 243 REST OF EUROPE: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 244 ASIA PACIFIC: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 245 ASIA PACIFIC: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 246 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 247 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 248 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 249 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 ASIA PACIFIC CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 251 ASIA PACIFIC CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 252 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 253 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 254 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 255 ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 256 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 257 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 258 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 259 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 260 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 261 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 262 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 263 ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 264 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 265 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 266 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 267 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 268 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 269 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 270 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 271 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 272 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 273 ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 274 CHINA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 275 CHINA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 276 CHINA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 277 CHINA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 278 CHINA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 279 CHINA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 280 CHINA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 281 CHINA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 282 CHINA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 283 CHINA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 284 CHINA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 285 CHINA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 286 INDIA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 287 INDIA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 288 INDIA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 289 INDIA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 290 INDIA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 291 INDIA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 292 INDIA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 293 INDIA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 294 INDIA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 295 INDIA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 296 INDIA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 297 INDIA: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 298 JAPAN: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 299 JAPAN: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 300 JAPAN: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 301 JAPAN: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 302 JAPAN: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 303 JAPAN: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 304 JAPAN: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 305 JAPAN: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 306 JAPAN: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 307 JAPAN: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 308 JAPAN: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 309 JAPAN: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 310 AUSTRALIA & NEW ZEALAND: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 311 AUSTRALIA & NEW ZEALAND: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 312 AUSTRALIA & NEW ZEALAND: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 313 AUSTRALIA & NEW ZEALAND: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 314 AUSTRALIA & NEW ZEALAND: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 315 AUSTRALIA & NEW ZEALAND: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 316 AUSTRALIA & NEW ZEALAND: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 317 AUSTRALIA & NEW ZEALAND: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 318 AUSTRALIA & NEW ZEALAND: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 319 AUSTRALIA & NEW ZEALAND: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 320 AUSTRALIA & NEW ZEALAND: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 321 AUSTRALIA & NEW ZEALAND: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 322 REST OF ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 323 REST OF ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 324 REST OF ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 325 REST OF ASIA PACIFIC: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 326 REST OF ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 327 REST OF ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 328 REST OF ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 329 REST OF ASIA PACIFIC: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 330 REST OF ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 331 REST OF ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 332 REST OF ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 333 REST OF ASIA PACIFIC: MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 334 SOUTH AMERICA: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 335 SOUTH AMERICA: AGRICULTURE BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 336 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 337 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 338 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 339 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 340 SOUTH AMERICAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 341 SOUTH AMERICAN CROP PROTECTION & SOIL ENHANCEMENT PRODUCTS: PLANT BIOTECHNOLOGY MARKET, BY PRODUCT, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 342 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 343 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 344 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 345 SOUTH AMERICA: PLANT BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 346 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 347 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 348 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 349 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 350 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 351 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 352 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 353 SOUTH AMERICA: ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 354 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 355 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 356 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 357 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 358 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 359 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 360 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 361 SOUTH AMERICA: MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)