|

市场调查报告书

商品编码

1883066

全球密度计市场按类型、操作类型、精确度、测量方法、工作原理、组件、应用、最终用户产业和地区划分-预测至2032年Density Meter Market by Type, Measurement Method and Region - Global Forecast to 2032 |

||||||

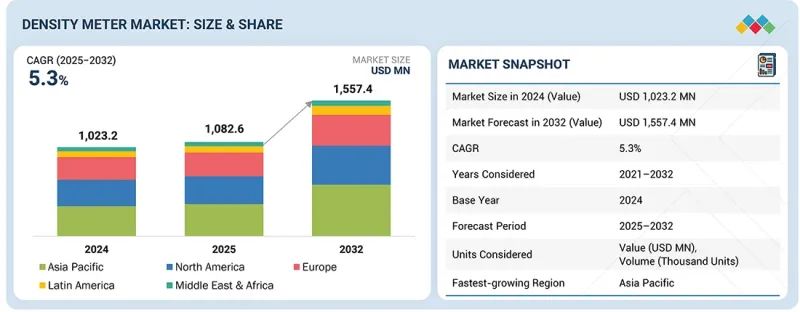

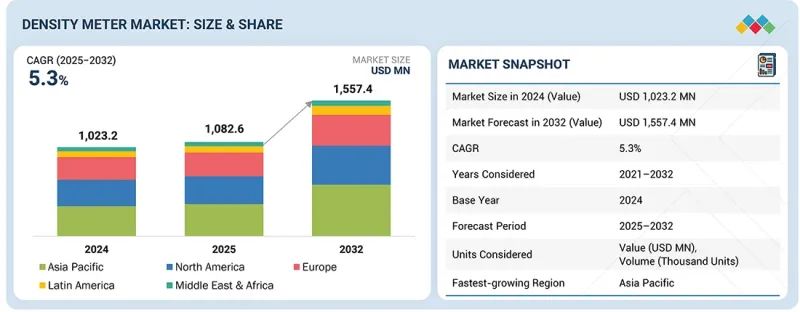

全球密度计市场规模预计将从 2025 年的 10.826 亿美元成长到 2032 年的 15.574 亿美元,复合年增长率为 5.3%。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 目标单元 | 金额(百万美元) |

| 部分 | 按类型、操作类型、精确度、测量方法、工作原理、组成部分、应用、最终用户产业、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

预计在预测期内,全球密度计市场将稳定成长,这主要得益于众多工业用户、监管机构和商业流程营运商对密度计日益增长的需求。大规模製造和加工企业正越来越多地部署密度测量系统,以提高材料一致性、增强製程稳定性,并在连续运行过程中保持严格的品管。监管机构也越来越多地使用密度测量工具来辅助合规性检查、执行安全标准,并检验敏感应用中的流体特性。环境监测机构正在部署密度计来评估液体特性、支持污染防治工作,并提高永续性计画的报告准确性。同时,多个行业的商业营运商正在应用密度测量进行产品检验、资源最佳化和提高营运效率。这些使用者群体表明,密度计在全球工业环境中推动准确、高效和数据驱动的决策方面的重要性日益凸显。

由于超音波密度计提供了一种非接触式、免维护的测量方法,能够满足现代工业的需求,预计在预测期内将实现最高的复合年增长率。与传统感测器设计相比,超音波密度计无需与流体直接接触即可测量密度,从而减少磨损、降低污染风险并延长使用寿命。此外,其在腐蚀性、磨蚀性和高温介质中的可靠性能使其应用范围广泛。随着各行业对更清洁、更安全、更数位化技术的日益普及,预计对超音波密度计的需求将快速增长,从而支撑全球市场的强劲成长前景。

预计到2024年,化学和石化行业将占据最大的市场份额,因为该行业需要对流体性质进行连续、高精度的监测,以保持产品均匀性、安全处理挥发性物质并满足严格的国际品质标准。密度测量对于化学和石化生产的核心应用至关重要,例如浓度控制、混合、反应监测和所有权转移。这些行业运作着大规模一体化设施和高度自动化的系统,因此先进的密度计是製程仪器的重要组成部分。复杂的製程需求、严格的监管要求以及对运作效率的持续追求,共同推动了该行业对密度计的广泛应用,使其成为市场上的主要终端用户。

预计亚太地区在预测期内将实现最高的复合年增长率,这主要得益于技术进步的加速和出口导向产业的扩张。中国的快速工业化、日本对智慧製造的投资以及韩国和东南亚化工和食品加工产业的成长,都在推动对密度计的需求。该地区也正在大力采用整合式数位监控系统和自动化技术,以提高营运效率并满足国际合规标准。随着企业不断向数据驱动的流程优化转型,预计对紧凑型智慧密度测量系统的需求成长速度将超过其他地区。

本报告对全球密度计市场进行了分析,并按类型、操作类型、精度、测量方法、工作原理、组件、应用、最终用户行业、区域趋势和公司概况进行了细分。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 介绍

- 市场动态

- 相互关联的市场与跨产业机会

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 介绍

- 波特五力分析

- 宏观经济展望

- 供应链分析

- 生态系分析

- 定价分析

- 贸易分析

- 2025-2026 年主要会议和活动

- 影响客户业务的趋势/干扰因素

- 2021-2025年投资与资金筹措情景

- 案例研究分析

- 2025年美国关税对密度计市场的影响

第六章:技术进步、人工智慧的影响、专利与创新

- 关键新兴技术

- 互补技术

- 技术蓝图

- 专利分析

- 人工智慧/生成式人工智慧对密度计市场的影响

第七章永续性和监管环境

第八章:顾客状况与购买行为

- 决策流程

- 主要相关人员和采购标准

- 招募障碍和内部挑战

- 来自各个终端使用者产业的未满足需求

第九章 密度测量原理

- 如何测量密度

- 密度测量背后的物理原理

第十章:振动管密度计的运行原理

- 振动机制

- 频率测量

- 温度补偿

- 讯号处理和输出

第十一章 与其他测量仪器的比较

- 密度计和屈光

- 密度计和比重计

- 密度计和比重瓶

第十二章 密度计市场(按类型划分)

- 介绍

- 科里奥利密度计

- 比重计

- 比重瓶

- 振动管

- 辐射

- 超音波

- 微波

- 光学

- 其他的

第十三章 密度计市场(依安装类型划分)

- 介绍

- 过程

- 实验室

第十四章 密度计市场(依精确度划分)

- 介绍

- 高端/高精度设备

- 中型製程设备

- 低成本/设备

第十五章 密度计市场(依测量方法)

- 介绍

- 在线连续密度计

- 实验室/桌上型密度计

- 可携式/手持密度计

- 面板/OEM嵌入式密度计

- 模组化/多感测器平台

第十六章 密度计市场(依工作原理划分)

- 介绍

- 数位的

- 模拟

- 杂交种

第十七章 密度计市场(依组件划分)

- 介绍

- 感应器和换能器

- 显示控制单元

- 样品处理系统

- 校准标准和设备

第十八章 密度计市场(依应用领域划分)

- 介绍

- 製程控制与监控

- 品管与保证

- 研究与开发

- 环境监测

- 纯度测试与检验

- 浓度测量

- 混合最佳化

- 发酵监测

- 其他的

第十九章 密度计市场(依最终用途产业划分)

- 介绍

- 化学品和石油化工

- 製药

- 食品/饮料

- 石油和天然气

- 金属和采矿

- 水和污水处理

- 纸浆和造纸

- 其他的

第20章 密度计市场(依地区划分)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 泰国

- 越南

- 马来西亚

- 印尼

- 新加坡

- 其他的

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 荷兰

- 北欧的

- 其他的

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他的

- 中东和非洲

- GCC

- 南非

- 其他的

第21章 竞争情势

- 介绍

- 主要参与企业、策略/优势,2021-2025 年

- 2020-2024年收入分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第22章 公司简介

- 主要参与企业

- EMERSON ELECTRIC CO.

- METTLER-TOLEDO INTERNATIONAL INC.

- ANTON PAAR GMBH

- ENDRESS+HAUSER GROUP SERVICES AG

- YOKOGAWA ELECTRIC CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- VEGA

- BERTHOLD TECHNOLOGIES GMBH & CO.KG

- TOSHIBA CORPORATION

- VALMET

- 其他公司

- AMETEK, INC.

- AVENISENSE

- RUDOLPH RESEARCH ANALYTICAL

- SCHMIDT+HAENSCH

- A. KRUSS OPTRONIC GMBH

- BOPP & REUTHER MESSTECHNIK GMBH

- SENSOTECH

- INTEGRATED SENSING SYSTEMS, INC.

- RHEONICS

- BRITISH ROTOTHERM GROUP

- FLUID.IO SENSOR+CONTROL GMBH & CO. KG

- MICROTRAC RETSCH GMBH

- KOEHLER INSTRUMENT COMPANY, INC.

- KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- DOSCHER MICROWAVE SYSTEMS GMBH

第23章调查方法

第24章附录

The global density meter market is anticipated to grow from USD 1,082.6 million in 2025 to USD 1,557.4 million by 2032, growing at a CAGR of 5.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Implementation Type, Accuracy, Measurement Method, Component and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Extensive use of density measurement across industries to support market growth."

The global density meter market is expected to experience steady expansion during the forecast period, driven by increasing adoption among a wide range of industrial users, regulatory bodies, and commercial process operators. Large manufacturing and processing facilities are integrating density measurement systems to improve material consistency, enhance process stability, and maintain tighter quality control across continuous operations. Regulatory authorities are increasingly using density measurement tools to support compliance checks, enforce safety standards, and validate fluid properties in sensitive applications. Environmental and monitoring organizations are deploying density meters to assess liquid characteristics, support pollution control activities, and improve reporting accuracy for sustainability programs. At the same time, commercial operators across multiple sectors are applying density measurement for product verification, resource optimization, and operational efficiency. Together, these user groups demonstrate the increasing relevance of density meters in facilitating accurate, efficient, and data-driven decision-making across global industrial environments.

"Ultrasonic type segment to record higher CAGR during the forecast period."

Ultrasonic density meters are expected to record the highest CAGR during the forecast period because they offer a non-intrusive and maintenance-friendly measurement method that aligns well with modern industrial needs. Their ability to measure density without direct contact with the fluid reduces wear, minimizes contamination risk, and ensures longer operational life compared to conventional sensor designs. These systems also perform reliably with corrosive, abrasive, or high-temperature media, making them suitable for a wider range of applications. As industries continue to adopt cleaner, safer, and digitally compatible technologies, the demand for ultrasonic density meters is projected to rise rapidly, supporting their strong growth outlook across global markets.

"Chemical and petrochemical industries accounted for the largest market share in 2024."

Chemical and petrochemical industries are expected to hold the largest market share in 2024, as their operations require continuous, highly accurate monitoring of fluid properties to maintain product consistency, ensure the safe handling of volatile materials, and meet stringent international quality standards. Density measurement is essential for applications such as concentration control, blending, reaction monitoring, and custody transfer, all of which are central to chemical and petrochemical production. These industries also operate large, integrated facilities with extensive automation systems, making advanced density meters a critical part of their process instrumentation. The combination of complex processing needs, high regulatory requirements, and constant demand for operational efficiency drives the strong adoption of density meters in this segment, positioning it as the leading end user in the market.

"Asia Pacific to record the highest CAGR during the forecast period."

The Asia Pacific is expected to register the highest CAGR during the forecast period, driven by accelerating technological advancements and the expansion of export-oriented industries. Rapid industrialization in China, investment in smart manufacturing in Japan, and the growth of the chemical and food processing sectors in South Korea and Southeast Asia are driving demand for density meters. The region is also witnessing notable adoption of integrated digital monitoring systems and automation to improve operational efficiency and meet global compliance standards. As companies continue to shift toward data-driven process optimization, demand for compact, intelligent density measurement systems is projected to grow faster than in other regions.

Breakdown of Primaries

A variety of executives from key organizations operating in the density meter market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level Executives - 30%, Directors - 40%, and Others - 30%

- By Region: North America - 40%, Europe - 32%, Asia Pacific - 23%, and RoW - 5%

Note: Other designations include sales, marketing, and product managers.

Tier 1 companies include market players with revenues exceeding USD 500 million; Tier 2 companies earn revenues between USD 100 million and USD 500 million; and Tier 3 companies earn revenues of up to USD 100 million.

The density meter market is dominated by globally established players, including Anton Paar GmbH (Austria), Mettler-Toledo International Inc. (US), Emerson Electric Co. (US), Endress+Hauser Group Services AG (Switzerland), and Yokogawa Electric Corporation (Japan). The study includes an in-depth competitive analysis of these key players in the density meter market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the density meter market and forecasts its size by type, implementation type, accuracy, measurement method, operating principle, component, application, end user, and region. It also discusses the market's drivers, restraints, opportunities, and challenges, and gives a detailed view of the market across four main regions: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. The report includes a supply chain analysis and the key players and their competitive analysis in the density meter ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (growing demand for process optimization, increasing quality control requirements, and rising R&D in pharmaceutical industries), restraints (high cost of advanced digital density meters and sensitivity to environmental conditions leading to measurement errors), opportunities (development of smart density meters and expansion in emerging economies), and challenges (limited skilled workforce for operation and calibration and complexity in data management) influencing the growth of the density meter market.

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product/solution/service launches in the density meter market.

- Market Development: Comprehensive information about lucrative markets. The report analyzes the density meter market across various regions.

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the density meter market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Anton Paar GmbH (Austria), Mettler-Toledo International Inc. (US), Emerson Electric Co. (US), Endress+Hauser Group Services AG (Switzerland), and Yokogawa Electric Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN DENSITY METER MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: REGIONAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DENSITY METER MARKET

- 3.2 DENSITY METER MARKET, BY TYPE

- 3.3 DENSITY METER MARKET, BY IMPLEMENTATION TYPE

- 3.4 DENSITY METER MARKET, BY ACCURACY

- 3.5 DENSITY METER MARKET, BY MEASUREMENT METHOD

- 3.6 DENSITY METER MARKET, BY OPERATING PRINCIPLE

- 3.7 DENSITY METER MARKET, BY COMPONENT

- 3.8 DENSITY METER MARKET, BY APPLICATION

- 3.9 DENSITY METER MARKET, BY END-USE INDUSTRY

- 3.10 DENSITY METER MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Shift toward automation and smart manufacturing

- 4.2.1.2 Increasing quality control requirements

- 4.2.1.3 Growing R&D in pharmaceutical industry

- 4.2.2 RESTRAINTS

- 4.2.2.1 High purchase and implementation cost of advanced digital density meters

- 4.2.2.2 High sensitivity to environmental conditions

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Development of smart density meters

- 4.2.3.2 Rapid industrialization in developing countries

- 4.2.4 CHALLENGES

- 4.2.4.1 Lack of skilled human resources

- 4.2.4.2 Complexities associated with data management

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF VIBRATING TUBE DENSITY METERS, BY KEY PLAYER, 2020-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY END-USE INDUSTRY, 2020-2024

- 5.6.3 AVERAGE SELLING PRICE TREND, BY MEASUREMENT METHOD, 2020-2024

- 5.6.4 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY REGION, 2020-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9027)

- 5.7.2 EXPORT SCENARIO (HS CODE 9027)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FRENCH HYDRO-ELECTRIC POWER PLANT COLLABORATES WITH RHOSONICS ANALYTICAL TO PREVENT SEDIMENT ACCUMULATION AND TURBINE WEAR

- 5.11.2 SOUTH AFRICAN FERROCHROME SMELTER PARTNERS WITH RHOSONICS TO REMOVE MANUAL SAMPLING AND IMPROVE PROCESS CONTROL

- 5.11.3 ANTON PAAR'S DENSITY MEASUREMENT SOLUTION ENHANCES QUALITY CONTROL AT AVISTA OIL

- 5.12 IMPACT OF 2025 US TARIFF ON DENSITY METER MARKET

- 5.12.1 INTRODUCTION

- 5.12.1.1 Key tariff rates

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT OF COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON END-USE INDUSTRIES

- 5.12.1 INTRODUCTION

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 VIBRATING ELEMENT

- 6.1.2 CORIOLIS FLOW MEASUREMENT

- 6.1.3 ULTRASONIC DENSITY MEASUREMENT

- 6.1.4 NUCLEAR/RADIATION ABSORPTION TECHNIQUE

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SCADA

- 6.2.2 SMART TRANSMITTERS AND DIGITAL INTERFACES

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON DENSITY METER MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN DENSITY METER MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN DENSITY METER MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT AI IN DENSITY METER MARKET

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 ASTM D4052

- 7.1.2.2 ASTM D5002

- 7.1.2.3 ISO 12185

- 7.1.2.4 ISO 15212 1

- 7.1.2.5 JIS K2249-1

- 7.1.2.6 USP <841>

- 7.1.2.7 ASTM D1480

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PRINCIPLES OF DENSITY MEASUREMENT

- 9.1 METHODS OF MEASURING DENSITY

- 9.1.1 DIRECT MEASUREMENT METHODS

- 9.1.2 INDIRECT OR INSTRUMENT-BASED METHODS

- 9.1.3 ADVANCED CONTINUOUS AND NON-CONTACT METHODS

- 9.2 PHYSICAL PRINCIPLES BEHIND DENSITY MEASUREMENT

10 OPERATING PRINCIPLES OF VIBRATING TUBE DENSITY METER

- 10.1 OSCILLATION MECHANISM

- 10.2 FREQUENCY MEASUREMENT

- 10.3 TEMPERATURE COMPENSATION

- 10.4 SIGNAL PROCESSING AND OUTPUT

11 COMPARISON WITH OTHER MEASUREMENT INSTRUMENTS

- 11.1 DENSITY METER VS. REFRACTOMETER

- 11.2 DENSITY METER VS. HYDROMETER

- 11.3 DENSITY METER VS. PYCNOMETER

12 DENSITY METER MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 CORIOLIS DENSITY METERS

- 12.2.1 REAL-TIME MEASUREMENT CAPABILITY FOR CONTINUOUS OPERATIONS TO FUEL MARKET GROWTH

- 12.2.2 CHEMICAL DOSING AND BLENDING

- 12.2.3 OIL & GAS CUSTODY TRANSFER

- 12.2.4 FOOD & BEVERAGES FILLING LINES

- 12.2.5 PHARMACEUTICAL INGREDIENT MEASUREMENT

- 12.3 HYDROMETERS

- 12.3.1 NEED TO DETERMINE LIQUID DENSITY USING GRAVITY-BASED MEASUREMENT FOR FOUNDATIONAL ACCURACY TO FOSTER MARKET GROWTH

- 12.3.2 ALCOHOL CONTENT MEASUREMENT IN BREWING AND DISTILLING

- 12.3.3 BATTERY ELECTROLYTE TESTING IN AUTOMOTIVE AND INDUSTRIAL BATTERIES

- 12.3.4 SALINITY MEASUREMENT IN AQUARIUMS AND SEAWATER ANALYSIS

- 12.3.5 PETROLEUM PRODUCT DENSITY TESTING IN OIL REFINERIES

- 12.4 PYCNOMETERS

- 12.4.1 VOLUMETRIC PRECISION USING CALIBRATED GLASS OR METAL VESSELS TO OFFER GROWTH OPPORTUNITIES

- 12.4.2 POWDER AND SOLID MATERIAL DENSITY IN PHARMACEUTICALS

- 12.4.3 SOIL PARTICLE DENSITY ANALYSIS IN GEOTECHNICAL ENGINEERING

- 12.4.4 QUALITY CONTROL IN CERAMICS AND GLASS INDUSTRIES

- 12.4.5 PAINT AND PIGMENT FORMULATION IN COATINGS MANUFACTURING

- 12.5 VIBRATING TUBES

- 12.5.1 SUITABILITY FOR DYNAMIC AND STATIC MEASUREMENT ENVIRONMENTS TO FOSTER MARKET GROWTH

- 12.5.2 FUEL QUALITY AND BLENDING CONTROL IN PETROCHEMICALS

- 12.5.3 GAS AND LIQUID DENSITY MEASUREMENT IN CHEMICAL PLANTS

- 12.5.4 LUBRICANT MONITORING IN AUTOMOTIVE AND INDUSTRIAL APPLICATIONS

- 12.5.5 BEVERAGE CONCENTRATION MEASUREMENT IN FOOD PROCESSING

- 12.5.6 DIGITAL (OSCILLATING U TUBES)

- 12.5.6.1 Pharmaceutical formulation testing

- 12.5.6.2 Quality control in food & beverage production

- 12.5.6.3 Chemical concentration analysis in lab and field environments

- 12.5.6.4 E-liquids and cosmetic fluid density measurement

- 12.6 NUCLEAR

- 12.6.1 COMPLIANCE WITH INDUSTRIAL SAFETY STANDARDS FOR APPROVED DEPLOYMENT IN REGULATED ENVIRONMENTS TO FUEL MARKET GROWTH

- 12.6.2 SOIL COMPACTION TESTING IN CONSTRUCTION AND ROAD BUILDING

- 12.6.3 MINING SLURRY MONITORING FOR PROCESS OPTIMIZATION

- 12.6.4 BULK MATERIAL FLOW MEASUREMENT IN MINERAL PROCESSING

- 12.6.5 PIPELINE MONITORING IN OIL AND GAS OPERATIONS

- 12.7 ULTRASONIC

- 12.7.1 SUITABILITY FOR APPLICATIONS REQUIRING UNINTERRUPTED PROCESS FLUID HANDLING TO SUPPORT MARKET GROWTH

- 12.7.2 CORROSIVE OR HAZARDOUS FLUID MONITORING IN CHEMICAL PROCESSING

- 12.7.3 IN-LINE DENSITY MEASUREMENT IN FOOD PRODUCTION

- 12.7.4 REAL-TIME MONITORING OF SLURRIES AND EMULSIONS

- 12.7.5 HIGH-TEMPERATURE APPLICATIONS LIKE MOLTEN METAL OR GLASS

- 12.8 MICROWAVE

- 12.8.1 REAL-TIME AND FULLY AUTOMATED MEASUREMENT CAPABILITY TO BOOST DEMAND

- 12.8.2 SLURRY MONITORING IN MINING AND MINERALS

- 12.8.3 PULP AND PAPER INDUSTRY

- 12.9 OPTICAL

- 12.9.1 RAPID NON-CONTACT MEASUREMENT FOR CONTINUOUS MONITORING TO FOSTER MARKET GROWTH

- 12.9.2 SUSPENDED SOLID ANALYZER/SLUDGE DENSITY METER

- 12.9.3 REFRACTOMETER

- 12.9.4 OPTICAL CONSISTENCY TRANSMITTER

- 12.10 OTHER TYPES

13 DENSITY METER MARKET, BY IMPLEMENTATION TYPE

- 13.1 INTRODUCTION

- 13.2 PROCESS

- 13.2.1 ABILITY TO OFFER PRECISE CONTROL OVER CHEMICAL REACTIONS TO FUEL MARKET GROWTH

- 13.2.2 LIQUID

- 13.2.2.1 Tanks

- 13.2.2.2 Pipelines

- 13.2.3 GAS

- 13.3 LAB

- 13.3.1 NEED TO ENSURE ACCURACY AND PRECISION IN SMALL-SCALE MEASUREMENTS TO FUEL MARKET GROWTH

- 13.3.2 LIQUID

- 13.3.3 GAS

14 DENSITY METER MARKET, BY ACCURACY

- 14.1 INTRODUCTION

- 14.2 PREMIUM/HIGH-PRECISION INSTRUMENTS

- 14.2.1 INCREASING NEED FOR STRINGENT QUALITY CONTROL IN AUTOMATED PRODUCTION LINES TO FOSTER MARKET GROWTH

- 14.3 MID-RANGE PROCESS INSTRUMENTS

- 14.3.1 SUITABILITY FOR VARIOUS INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 14.4 LOW-COST/VALUE INSTRUMENTS

- 14.4.1 INCREASING APPLICATION IN ROUTINE QUALITY CHECKS AND SMALL-SCALE PROCESSING OPERATIONS TO SUPPORT MARKET GROWTH

15 DENSITY METER MARKET, BY MEASUREMENT METHOD

- 15.1 INTRODUCTION

- 15.2 INLINE/ONLINE DENSITY METERS

- 15.2.1 CONTINUOUS MONITORING OF LIQUID STREAMS FOR PRODUCT QUALITY TO BOOST DEMAND

- 15.3 LABORATORY/BENCHTOP DENSITY METERS

- 15.3.1 DIGITAL INTERFACES WITH DATA LOGGING AND LIMS EXPORT TO SUPPORT MARKET

- 15.4 PORTABLE/HANDHELD DENSITY METERS

- 15.4.1 MOBILITY AND EASE OF USE FOR REMOTE LOCATIONS TO FUEL MARKET GROWTH

- 15.5 PANEL/OEM EMBEDDED DENSITY METERS

- 15.5.1 ACCURATE MEASUREMENT IN HIGH-PRESSURE AND HIGH-TEMPERATURE ENVIRONMENTS TO DRIVE MARKET

- 15.6 MODULAR/MULTI-SENSOR PLATFORMS

- 15.6.1 REDUCED MATERIAL WASTE THROUGH CONSOLIDATED MULTI-PARAMETER MEASUREMENT TO SUPPORT MARKET GROWTH

16 DENSITY METER MARKET, BY OPERATING PRINCIPLE

- 16.1 INTRODUCTION

- 16.2 DIGITAL

- 16.2.1 HIGH PRECISION AND RELIABILITY FOR CRITICAL PROCESS MONITORING TO BOOST DEMAND

- 16.3 ANALOG

- 16.3.1 DURABILITY AND LOW MAINTENANCE FOR RELIABLE FIELD PERFORMANCE TO SUPPORT MARKET GROWTH

- 16.4 HYBRID

- 16.4.1 INTEGRATION OF OSCILLATION-BASED SENSING WITH ELECTRONIC PROCESSING TO OFFER GROWTH OPPORTUNITIES

17 DENSITY METER MARKET, BY COMPONENT

- 17.1 INTRODUCTION

- 17.2 SENSORS AND TRANSDUCERS

- 17.2.1 DURABILITY AND RESISTANCE TO CORROSION TO BOOST DEMAND

- 17.3 DISPLAY AND CONTROL UNITS

- 17.3.1 DIGITAL SCREENS AND TOUCH INTERFACES FOR CLEARER OPERATIONAL USABILITY TO FUEL MARKET GROWTH

- 17.4 SAMPLE HANDLING SYSTEMS

- 17.4.1 ENHANCED RELIABILITY AND REPEATABILITY FOR LONG-TERM MEASUREMENT PERFORMANCE TO FOSTER MARKET GROWTH

- 17.5 CALIBRATION STANDARDS AND DEVICES

- 17.5.1 COMPLIANCE WITH INTERNATIONAL QUALITY AND SAFETY GUIDELINES FOR ASSURED OPERATION TO SUPPORT MARKET GROWTH

18 DENSITY METER MARKET, BY APPLICATION

- 18.1 INTRODUCTION

- 18.2 PROCESS CONTROL AND MONITORING

- 18.2.1 NEED TO ENSURE REGULATORY COMPLIANCE ACROSS COMPLEX PRODUCTION ENVIRONMENTS TO DRIVE MARKET

- 18.3 QUALITY CONTROL AND ASSURANCE

- 18.3.1 ABILITY TO DELIVER REPEATABLE AND HIGH-ACCURACY MEASUREMENTS TO FUEL MARKET GROWTH

- 18.4 RESEARCH AND DEVELOPMENT

- 18.4.1 INCREASING APPLICATIONS FOR EXPERIMENTAL MODELING AND PROTOTYPE TESTING TO SUPPORT MARKET GROWTH

- 18.5 ENVIRONMENTAL MONITORING

- 18.5.1 NEED TO DELIVER CONSISTENT AND REAL-TIME DATA TO FOSTER MARKET GROWTH

- 18.6 PURITY TESTING AND VERIFICATION

- 18.6.1 RISING CONCERNS OVER ADULTERATION IN HIGH-VALUE PRODUCTS TO DRIVE MARKET

- 18.7 CONCENTRATION MEASUREMENT

- 18.7.1 MINIMIZED RESOURCE WASTE DURING MANUFACTURING AND FORMULATION STAGES TO BOOST DEMAND

- 18.8 BLEND OPTIMIZATION

- 18.8.1 GROWING DEMAND FOR CONSISTENT PRODUCT QUALITY ACROSS GLOBAL SUPPLY CHAINS TO FUEL MARKET GROWTH

- 18.9 FERMENTATION MONITORING

- 18.9.1 GROWING APPLICATIONS IN BREWING, BIOTECHNOLOGY, AND PHARMACEUTICALS TO FOSTER MARKET GROWTH

- 18.10 OTHER APPLICATIONS

19 DENSITY METER MARKET, BY END-USE INDUSTRY

- 19.1 INTRODUCTION

- 19.2 CHEMICALS & PETROCHEMICALS

- 19.2.1 IMPROVED COMPOSITION MONITORING TO BOOST DEMAND

- 19.2.2 PROCESS CHEMICAL MANUFACTURING

- 19.2.3 SPECIALTY CHEMICALS

- 19.2.4 POLYMER AND PLASTICS MANUFACTURING

- 19.2.5 QUALITY ASSURANCE

- 19.2.6 CORROSIVE CHEMICAL MONITORING

- 19.2.7 BULK STORAGE AND TRANSFER

- 19.3 PHARMACEUTICALS

- 19.3.1 HIGH-QUALITY OUTPUT ASSURANCE TO FUEL MARKET GROWTH

- 19.3.2 DRUG MANUFACTURING PROCESS APPLICATIONS

- 19.3.3 BIOPHARMACEUTICAL APPLICATIONS

- 19.3.4 RESEARCH AND DEVELOPMENT

- 19.3.5 REGULATORY COMPLIANCE

- 19.4 FOOD & BEVERAGES

- 19.4.1 PRODUCT UNIFORMITY DRIVEN BY ACCURATE DENSITY READINGS TO FOSTER MARKET GROWTH

- 19.4.2 BREWERY AND DISTILLERY APPLICATIONS

- 19.4.3 SOFT DRINKS AND CARBONATED BEVERAGES

- 19.4.4 DAIRY PROCESSING

- 19.4.5 SYRUPS AND SWEETENERS

- 19.4.6 PROCESSED FOODS AND SAUCES

- 19.4.7 EDIBLE OILS AND FATS

- 19.5 OIL & GAS

- 19.5.1 NEED TO STRENGTHEN SAFETY ASSURANCE ACROSS OIL & GAS OPERATIONS TO STRENGTHEN MARKET

- 19.5.2 DRILLING OPERATIONS

- 19.5.3 PIPELINE MONITORING

- 19.5.4 REFINING AND BLENDING

- 19.5.5 RESERVOIR ANALYSIS

- 19.6 METALS & MINING

- 19.6.1 ABILITY TO OFFER ACCURATE READINGS IN ABRASIVE OR HIGH-TEMPERATURE CONDITIONS TO FOSTER MARKET GROWTH

- 19.6.2 ORE PROCESSING

- 19.6.3 MINERAL CONCENTRATION

- 19.6.4 SMELTING OPERATIONS

- 19.6.5 TAILINGS MANAGEMENT

- 19.7 WATER & WASTEWATER TREATMENT

- 19.7.1 ABILITY TO PERFORM REAL-TIME MEASUREMENTS IN CHALLENGING ENVIRONMENTS TO BOOST DEMAND

- 19.7.2 SLUDGE TREATMENT

- 19.7.3 EFFLUENT MONITORING

- 19.7.4 CHEMICAL DOSING

- 19.7.5 DESALINATION SYSTEMS

- 19.8 PULP & PAPER

- 19.8.1 REDUCED MATERIAL WASTE THROUGH ACCURATE DENSITY MONITORING TO BENEFIT MARKET

- 19.8.2 PULPING PROCESS CONTROL

- 19.8.3 CHEMICAL RECOVERY SYSTEMS

- 19.9 OTHER END-USE INDUSTRIES

20 DENSITY METER MARKET, BY REGION

- 20.1 INTRODUCTION

- 20.2 ASIA PACIFIC

- 20.2.1 CHINA

- 20.2.1.1 Robust local supply and smart automation to fuel market growth

- 20.2.2 JAPAN

- 20.2.2.1 Integration with high-precision industrial processes and advanced automation systems to support market growth

- 20.2.3 INDIA

- 20.2.3.1 Rapid expansion of process-driven sectors to strengthen market

- 20.2.4 SOUTH KOREA

- 20.2.4.1 Advanced manufacturing and technology-driven industries to offer growth opportunities

- 20.2.5 AUSTRALIA

- 20.2.5.1 Growing deployment of digital interfaces and automatic temperature compensation to drive market

- 20.2.6 THAILAND

- 20.2.6.1 Tailored deployment of inline, benchtop, and modular systems to boost demand

- 20.2.7 VIETNAM

- 20.2.7.1 Growing adoption of automation and digital monitoring among chemical plants to foster market growth

- 20.2.8 MALAYSIA

- 20.2.8.1 Growing application in quality verification and control to drive market

- 20.2.9 INDONESIA

- 20.2.9.1 Rising demand from oil & gas sector to fuel market growth

- 20.2.10 SINGAPORE

- 20.2.10.1 Emphasis on environmental stewardship, carbon management, and biodiversity conservation to fuel demand

- 20.2.11 REST OF ASIA PACIFIC

- 20.2.1 CHINA

- 20.3 NORTH AMERICA

- 20.3.1 US

- 20.3.1.1 Integration of density measurement into industrial automation systems to fuel market growth

- 20.3.2 CANADA

- 20.3.2.1 Widespread presence of multiple end-user industries to offer growth opportunities

- 20.3.1 US

- 20.4 EUROPE

- 20.4.1 GERMANY

- 20.4.1.1 Strong preference for oscillating-tube and Coriolis density meters across industrial and laboratory settings to drive market

- 20.4.2 FRANCE

- 20.4.2.1 Increasing demand for sensors and transducers to fuel market growth

- 20.4.3 UK

- 20.4.3.1 Growing demand for precision measurement and quality assurance across various applications to offer growth opportunities

- 20.4.4 ITALY

- 20.4.4.1 Rising demand for flexible and user-friendly instrumentation to drive market

- 20.4.5 SPAIN

- 20.4.5.1 Increasing emphasis on operational precision and regulatory compliance across industrial and laboratory setting to offer growth opportunities

- 20.4.6 NETHERLANDS

- 20.4.6.1 Reliance on accurate measurement for process control and quality assurance to foster market growth

- 20.4.7 NORDICS

- 20.4.7.1 Growing demand for efficient and sustainable processes to drive market

- 20.4.8 REST OF EUROPE

- 20.4.1 GERMANY

- 20.5 LATIN AMERICA

- 20.5.1 BRAZIL

- 20.5.1.1 Reliance of oil & gas on precise density measurement for quality verification to offer growth opportunities

- 20.5.2 ARGENTINA

- 20.5.2.1 Increasing application in food & beverage sector to foster market growth

- 20.5.3 MEXICO

- 20.5.3.1 Growing use of digital and automated instruments for real-time readings to fuel market growth

- 20.5.4 REST OF LATIN AMERICA

- 20.5.1 BRAZIL

- 20.6 MIDDLE EAST & AFRICA

- 20.6.1 GCC

- 20.6.1.1 Saudi Arabia

- 20.6.1.1.1 Need to monitor crude oil quality, refining processes, and pipeline transport to drive market

- 20.6.1.2 UAE

- 20.6.1.2.1 Focus on advanced process control and precision measurement across various applications to support market growth

- 20.6.1.3 Rest of GCC

- 20.6.1.1 Saudi Arabia

- 20.6.2 SOUTH AFRICA

- 20.6.2.1 Increasing demand for robust and easy-to-integrate instruments to fuel market growth

- 20.6.3 REST OF MIDDLE EAST & AFRICA

- 20.6.1 GCC

21 COMPETITIVE LANDSCAPE

- 21.1 INTRODUCTION

- 21.2 KEY PLAYERS, STRATEGIES/RIGHT TO WIN, 2021-2025

- 21.3 REVENUE ANALYSIS, 2020-2024

- 21.4 MARKET SHARE ANALYSIS, 2024

- 21.5 COMPANY VALUATION AND FINANCIAL METRICS

- 21.6 BRAND/PRODUCT COMPARISON

- 21.6.1 ANTON PAAR GMBH

- 21.6.2 EMERSON ELECTRIC CO.

- 21.6.3 METTLER-TOLEDO INTERNATIONAL INC.

- 21.6.4 YOKOGAWA ELECTRIC CORPORATION

- 21.6.5 TOSHIBA CORPORATION

- 21.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 21.7.1 STARS

- 21.7.2 EMERGING LEADERS

- 21.7.3 PERVASIVE PLAYERS

- 21.7.4 PARTICIPANTS

- 21.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 21.7.5.1 Company footprint

- 21.7.5.2 Region footprint

- 21.7.5.3 Type footprint

- 21.7.5.4 Implementation type footprint

- 21.7.5.5 Measurement method footprint

- 21.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 21.8.1 PROGRESSIVE COMPANIES

- 21.8.2 RESPONSIVE COMPANIES

- 21.8.3 DYNAMIC COMPANIES

- 21.8.4 STARTING BLOCKS

- 21.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 21.8.5.1 Detailed list of key startups/SMEs

- 21.9 COMPETITIVE SCENARIO

- 21.9.1 PRODUCT LAUNCHES

- 21.9.2 DEALS

22 COMPANY PROFILES

- 22.1 KEY PLAYERS

- 22.1.1 EMERSON ELECTRIC CO.

- 22.1.1.1 Business overview

- 22.1.1.2 Products/Solutions/Services offered

- 22.1.1.3 Recent developments

- 22.1.1.3.1 Product launches

- 22.1.1.4 MnM view

- 22.1.1.4.1 Key strengths/Right to win

- 22.1.1.4.2 Strategic choices

- 22.1.1.4.3 Weaknesses/Competitive threats

- 22.1.2 METTLER-TOLEDO INTERNATIONAL INC.

- 22.1.2.1 Business overview

- 22.1.2.2 Products/Solutions/Services offered

- 22.1.2.3 MnM view

- 22.1.2.3.1 Key strengths/Right to win

- 22.1.2.3.2 Strategic choices

- 22.1.2.3.3 Weaknesses/Competitive threats

- 22.1.3 ANTON PAAR GMBH

- 22.1.3.1 Business overview

- 22.1.3.2 Products/Solutions/Services offered

- 22.1.3.3 Recent developments

- 22.1.3.3.1 Product launches

- 22.1.3.4 MnM view

- 22.1.3.4.1 Key strengths/Right to win

- 22.1.3.4.2 Strategic choices

- 22.1.3.4.3 Weaknesses/Competitive threats

- 22.1.4 ENDRESS+HAUSER GROUP SERVICES AG

- 22.1.4.1 Business overview

- 22.1.4.2 Products/Solutions/Services offered

- 22.1.4.3 Recent developments

- 22.1.4.3.1 Product launches

- 22.1.4.4 MnM view

- 22.1.4.4.1 Key strengths/Right to win

- 22.1.4.4.2 Strategic choices

- 22.1.4.4.3 Weaknesses/Competitive threats

- 22.1.5 YOKOGAWA ELECTRIC CORPORATION

- 22.1.5.1 Business overview

- 22.1.5.2 Products/Solutions/Services offered

- 22.1.5.3 Recent developments

- 22.1.5.3.1 Deals

- 22.1.5.4 MnM view

- 22.1.5.4.1 Key strengths/Right to win

- 22.1.5.4.2 Strategic choices

- 22.1.5.4.3 Weaknesses/Competitive threats

- 22.1.6 THERMO FISHER SCIENTIFIC INC.

- 22.1.6.1 Business overview

- 22.1.6.2 Products/Solutions/Services offered

- 22.1.7 VEGA

- 22.1.7.1 Business overview

- 22.1.7.2 Products/Solutions/Services offered

- 22.1.8 BERTHOLD TECHNOLOGIES GMBH & CO.KG

- 22.1.8.1 Business overview

- 22.1.8.2 Products/Solutions/Services offered

- 22.1.9 TOSHIBA CORPORATION

- 22.1.9.1 Business overview

- 22.1.9.2 Products/Solutions/Services offered

- 22.1.10 VALMET

- 22.1.10.1 Business overview

- 22.1.10.2 Products/Solutions/Services offered

- 22.1.1 EMERSON ELECTRIC CO.

- 22.2 OTHER PLAYERS

- 22.2.1 AMETEK, INC.

- 22.2.2 AVENISENSE

- 22.2.3 RUDOLPH RESEARCH ANALYTICAL

- 22.2.4 SCHMIDT + HAENSCH

- 22.2.5 A. KRUSS OPTRONIC GMBH

- 22.2.6 BOPP & REUTHER MESSTECHNIK GMBH

- 22.2.7 SENSOTECH

- 22.2.8 INTEGRATED SENSING SYSTEMS, INC.

- 22.2.9 RHEONICS

- 22.2.10 BRITISH ROTOTHERM GROUP

- 22.2.11 FLUID.IO SENSOR + CONTROL GMBH & CO. KG

- 22.2.12 MICROTRAC RETSCH GMBH

- 22.2.13 KOEHLER INSTRUMENT COMPANY, INC.

- 22.2.14 KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- 22.2.15 DOSCHER MICROWAVE SYSTEMS GMBH

23 RESEARCH METHODOLOGY

- 23.1 RESEARCH DATA

- 23.1.1 SECONDARY DATA

- 23.1.1.1 Key data from secondary sources

- 23.1.1.2 List of key secondary sources

- 23.1.2 PRIMARY DATA

- 23.1.2.1 Key data from primary sources

- 23.1.2.2 List of key primary interview participants

- 23.1.2.3 Breakdown of primaries

- 23.1.2.4 Key industry insights

- 23.1.3 SECONDARY AND PRIMARY RESEARCH

- 23.1.1 SECONDARY DATA

- 23.2 MARKET SIZE ESTIMATION

- 23.2.1 BOTTOM-UP APPROACH

- 23.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 23.2.2 TOP-DOWN APPROACH

- 23.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 23.2.1 BOTTOM-UP APPROACH

- 23.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 23.4 RESEARCH ASSUMPTIONS

- 23.5 RISK ASSESSMENT

- 23.6 RESEARCH LIMITATIONS

24 APPENDIX

- 24.1 DISCUSSION GUIDE

- 24.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 24.3 CUSTOMIZATION OPTIONS

- 24.4 RELATED REPORTS

- 24.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DENSITY METER MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 STRATEGIC MOVES

- TABLE 3 DENSITY METER MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 5 ROLE OF PLAYERS IN DENSITY METER ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND OF VIBRATING TUBE DENSITY METERS, BY KEY PLAYER, 2020-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY END-USE INDUSTRY, 2020-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY MEASUREMENT METHOD, 2020-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY REGION, 2020-2024 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 DENSITY METER MARKET: KEY CONFERENCES AND EVENTS, 2026

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 EVOLUTION OF DENSITY METER TECHNOLOGIES

- TABLE 15 LIST OF APPLIED/GRANTED PATENTS, 2023-2025

- TABLE 16 TOP USE CASES AND MARKET POTENTIAL

- TABLE 17 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 18 DENSITY METER MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 19 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 26 UNMET NEEDS IN DENSITY METER MARKET, BY END-USE INDUSTRIES

- TABLE 27 DENSITY METER VS. REFRACTOMETER

- TABLE 28 DENSITY METER VS. HYDROMETER

- TABLE 29 DENSITY METER VS. PYCNOMETER

- TABLE 30 DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 32 DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 33 DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 34 DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 35 DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 36 DENSITY METER MARKET, BY MEASUREMENT METHOD, 2021-2024 (USD MILLION)

- TABLE 37 DENSITY METER MARKET, BY MEASUREMENT METHOD, 2025-2032 (USD MILLION)

- TABLE 38 DENSITY METER MARKET, BY MEASUREMENT METHOD, 2021-2024 (THOUSAND UNITS)

- TABLE 39 DENSITY METER MARKET, BY MEASUREMENT METHOD, 2025-2032 (THOUSAND UNITS)

- TABLE 40 KEY SUPPLIERS OF INLINE DENSITY METERS

- TABLE 41 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 43 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 44 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 45 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 46 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 47 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 48 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 49 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 51 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 53 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 57 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 59 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 61 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 63 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 65 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 INLINE/ONLINE DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 67 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 69 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 70 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 71 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 72 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 73 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 74 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 75 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 76 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 77 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 79 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 83 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 85 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 87 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 89 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 91 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 LABORATORY/BENCHTOP DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 93 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 95 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 96 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 97 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 98 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 99 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 100 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 101 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 103 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 104 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 105 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 109 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 111 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 113 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 115 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 117 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 PORTABLE/HANDHELD DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 119 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 121 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 122 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 123 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 124 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 125 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 126 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 127 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 129 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 131 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 133 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 135 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 137 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 139 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 141 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 143 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 PANEL /OEM EMBEDDED DENSITY METERS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 145 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 147 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY IMPLEMENTATION TYPE, 2025-2032 (USD MILLION)

- TABLE 149 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY ACCURACY, 2021-2024 (USD MILLION)

- TABLE 150 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY ACCURACY, 2025-2032 (USD MILLION)

- TABLE 151 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 152 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 153 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 155 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 157 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 159 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 161 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 163 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 165 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR LATIN AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 167 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 169 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 MODULAR/MULTI-SENSOR PLATFORMS: DENSITY METER MARKET FOR GCC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 171 DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2021-2024 (USD MILLION)

- TABLE 172 DENSITY METER MARKET, BY OPERATING PRINCIPLE, 2025-2032 (USD MILLION)

- TABLE 173 DENSITY METER MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 174 DENSITY METER MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 175 DENSITY METER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 176 DENSITY METER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 177 DENSITY METER MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 DENSITY METER MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 179 DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 181 ASIA PACIFIC: DENSITY METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DENSITY METER MARKET, BY COUNTRY, -USD MILLION)

- TABLE 183 DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2021-2024 ((USD MILLION)

- TABLE 184 DENSITY METER MARKET FOR NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 185 EUROPE: DENSITY METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: DENSITY METER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 187 LATIN AMERICA: DENSITY METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 LATIN AMERICA: DENSITY METER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: DENSITY METER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: DENSITY METER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 191 GCC: DENSITY METER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 192 GCC: DENSITY METER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 193 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DENSITY METER MARKET, 2021-2025

- TABLE 194 DENSITY METER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 195 DENSITY METER MARKET: REGION FOOTPRINT

- TABLE 196 DENSITY METER MARKET: TYPE FOOTPRINT

- TABLE 197 DENSITY METER MARKET: IMPLEMENTATION TYPE FOOTPRINT

- TABLE 198 DENSITY METER MARKET: MEASUREMENT METHOD FOOTPRINT

- TABLE 199 DENSITY METER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 200 DENSITY METER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 201 DENSITY METER MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2025

- TABLE 202 DENSITY METER MARKET: DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 203 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 204 EMERSON ELECTRIC CO.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 205 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 206 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 207 METTLER-TOLEDO INTERNATIONAL INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ANTON PAAR GMBH: BUSINESS OVERVIEW

- TABLE 209 ANTON PAAR GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ANTON PAAR GMBH: PRODUCT LAUNCHES

- TABLE 211 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 212 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

- TABLE 214 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 215 YOKOGAWA ELECTRIC CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 216 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 217 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 218 THERMO FISHER SCIENTIFIC INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 219 VEGA: COMPANY OVERVIEW

- TABLE 220 VEGA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 221 BERTHOLD TECHNOLOGIES GMBH & CO.KG: COMPANY OVERVIEW

- TABLE 222 BERTHOLD TECHNOLOGIES GMBH & CO.KG: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 223 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 224 TOSHIBA CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 225 VALMET: COMPANY OVERVIEW

- TABLE 226 VALMET: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 227 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 228 DENSITY METER MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 DENSITY METER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 DENSITY METER MARKET, BY TYPE, 2025-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DENSITY METER MARKET 2021-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF DENSITY METER MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN DENSITY METER MARKET, 2024

- FIGURE 8 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 GROWING ADOPTION OF DIGITAL MONITORING AND AUTOMATED MEASUREMENT SYSTEMS TO DRIVE MARKET

- FIGURE 10 CORIOLIS DENSITY METERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 11 PROCESS SEGMENT TO HOLD LARGER MARKET SHARE IN 2032

- FIGURE 12 PREMIUM / HIGH-PRECISION INSTRUMENTS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 13 INLINE/ONLINE DENSITY METERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 14 DIGITAL SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 15 SENSORS AND TRANSDUCERS SEGMENT TO SECURE LARGEST MARKET SHARE IN 2032

- FIGURE 16 PROCESS CONTROL AND MONITORING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 17 CHEMICALS & PETROCHEMICALS SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 18 INDIA TO RECORD HIGHEST CAGR IN GLOBAL DENSITY METER MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DENSITY METER MARKET

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS IN DENSITY METER MARKET

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS IN DENSITY METER MARKET

- FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES IN DENSITY METER MARKET

- FIGURE 23 IMPACT ANALYSIS OF CHALLENGES IN DENSITY METER MARKET

- FIGURE 24 DENSITY METER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 DENSITY METER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 DENSITY METER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF VIBRATING TUBE DENSITY METERS, BY KEY PLAYER, 2020-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY END-USE INDUSTRY, 2020-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY MEASUREMENT METHOD, 2020-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY REGION, 2020-2024

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 9027-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 35 DENSITY METER MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 36 DENSITY METER MARKET: FACTORS INFLUENCING DECISION-MAKING

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 38 KEY BUYING CRITERIA FOR THE TOP THREE END-USE INDUSTRIES

- FIGURE 39 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 40 DENSITY METER MARKET, BY TYPE

- FIGURE 41 DENSITY METER MARKET, BY IMPLEMENTATION TYPE

- FIGURE 42 DENSITY METER MARKET, BY ACCURACY

- FIGURE 43 DENSITY METER MARKET, BY MEASUREMENT METHOD

- FIGURE 44 DENSITY METER MARKET, BY OPERATING PRINCIPLE

- FIGURE 45 DENSITY METER MARKET, BY COMPONENT

- FIGURE 46 DENSITY METER MARKET, BY APPLICATION

- FIGURE 47 DENSITY METER MARKET, BY END-USE INDUSTRY

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC: DENSITY METER MARKET SNAPSHOT

- FIGURE 50 NORTH AMERICA: DENSITY METER MARKET SNAPSHOT

- FIGURE 51 EUROPE: DENSITY METER MARKET SNAPSHOT

- FIGURE 52 LATIN AMERICA: DENSITY METER MARKET SNAPSHOT

- FIGURE 53 MIDDLE EAST & AFRICA: DENSITY METER MARKET SNAPSHOT

- FIGURE 54 DENSITY METER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 55 MARKET SHARE ANALYSIS, 2024

- FIGURE 56 COMPANY VALUATION, 2024

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 DENSITY METER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 60 DENSITY METER MARKET: COMPANY FOOTPRINT

- FIGURE 61 DENSITY METER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 62 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 63 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 66 VALMET: COMPANY SNAPSHOT

- FIGURE 67 DENSITY METER MARKET: RESEARCH DESIGN

- FIGURE 68 DENSITY METER MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE)

- FIGURE 69 DENSITY METER MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY SIDE)

- FIGURE 70 DENSITY METER MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3 (DEMAND SIDE)

- FIGURE 71 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 72 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 73 DATA TRIANGULATION: DENSITY METER MARKET

- FIGURE 74 DENSITY METER MARKET: RESEARCH LIMITATIONS