|

市场调查报告书

商品编码

1883938

全球橡胶履带市场按应用、机械类型、胎面花纹、履带类型、销售管道、橡胶履带垫片和地区划分-预测至2032年Rubber Track Market By Application, Equipment Type, Thread Pattern, Track Type, Sales Channel, Rubber Track Pad and Region - Global Forecast to 2032 |

||||||

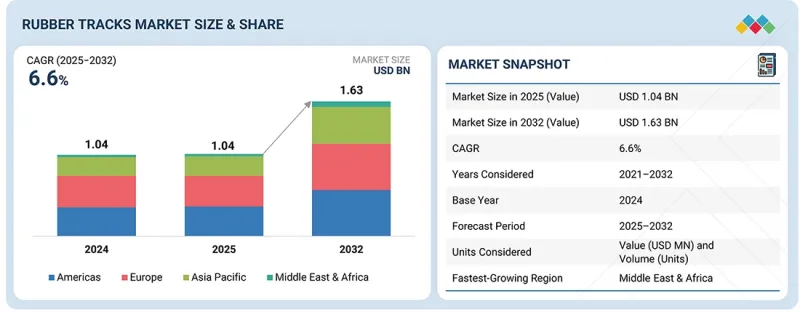

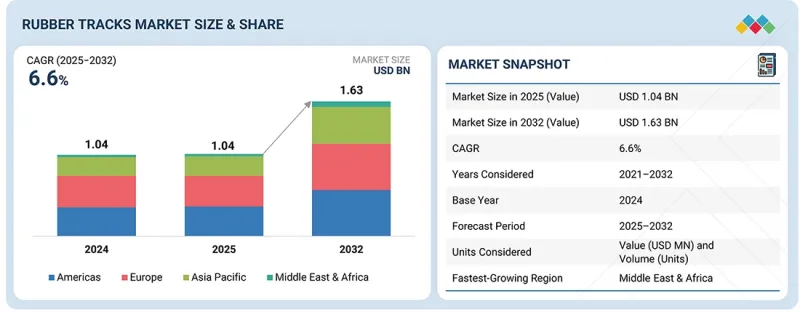

全球橡胶履带原厂配套市场预计将从 2025 年的 10.4 亿美元成长到 2032 年的 16.3 亿美元,复合年增长率为 6.6%。

橡胶履带市场的整体成长是由农业和建筑业中小型、高功率的机械设备的日益普及所推动的,在这些领域,提高牵引力、降低地面压力和提高机动性至关重要。

| 调查范围 | |

|---|---|

| 调查期 | 2023-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单元 | 10亿美元 |

| 部分 | 用途、机器类型、胎面花纹、履带类型、销售管道 |

| 目标区域 | 美洲、欧洲、亚太地区、中东和非洲 |

此外,橡胶配方、增强型芯材技术和地形优化胎面设计的进步,提高了耐用性和性能,从而推动了对原厂配套和替换应用的需求。同时,德国和法国活跃的农业活动,以及住宅和基础设施建设扩张带来的小型机械需求成长,也为橡胶履带在该地区的应用创造了高价值机会。

“根据胎面花纹划分,C型花纹轮胎预计在预测期内将占据最大的市场份额。”

预计在预测期内,C型履带将占据最大的市场份额。此细分市场的成长主要归功于其卓越的动态和越坡能力,使其广泛应用于鬆软地面、斜坡以及需要高浮力的地形作业。与块状履带设计类似,C型履带也是希望符合OEM标准的使用者的理想选择。 C型履带主要用于农业拖拉机和收割机,特别是水稻拖拉机、果园/葡萄园拖拉机和丘陵联合收割机。 C形凸耳几何形状使前缘能够深入鬆软地面。同时,弧形后缘增强了浮力并减少了打滑。小型履带装载机也采用这种履带,尤其是在地形复杂的建筑工地和林业作业中使用的装载机。在不平坦的地面上保持均匀的抓地力对于土地准备和物料输送至关重要。美洲地区葡萄园、果园和特色作物农场高度集中,因此C型履带的普及率很高。此外,像Bobcat和John Deere这样的原始设备製造商(OEM)在该地区强大的市场地位,也推动了C型履带在小型装载机和专为丘陵地形优化的窄型拖拉机上的应用。

根据销售管道,预计在预测期内,OE细分市场将保持其规模,而售后市场细分市场将保持其规模。

儘管单价较高,原厂配套 (OEM) 市场仍是橡胶履带市场的主要驱动力。这一成长与全球对新机械的强劲需求直接相关,尤其是在城市基础设施和住宅计划,包括小型挖土机、小型履带/多地形装载机和其他小型机械。虽然售后市场保持稳定,但 OEM 产量占据最大份额,因此 OEM 是市场扩张的主要驱动力。 OEM 厂商也倾向于选择经过严格测试的优质橡胶履带系统,以确保最佳的整合性、性能和保固可靠性。这为终端用户提供了可靠的适配性和长期的价值。这种对品质和机器级相容性的重视,正在巩固 OEM 通路作为橡胶履带市场成长型细分市场的地位。

“预计在预测期内,美洲将占据最大的市场份额。”

由于小型履带装载机、多地形装载机和农用拖拉机等小型机械的销量不断增长,预计美洲将成为最大的市场。美洲的主要原始设备製造商(OEM),例如卡特彼勒、约翰迪尔、久保田、JCB 和山猫,正在开发配备履带的小型机械和农用拖拉机,这催生了对原厂配套(OE)产品和售后市场产品的需求。

本报告调查并分析了全球橡胶履带市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 橡胶履带市场对企业而言极具吸引力的机会

- 按销售管道分類的橡胶履带市场

- 橡胶履带市场:依应用领域划分

- 橡胶履带市场:依胎面花纹划分

- 橡胶履带市场:依履带类型划分

- 按地区分類的橡胶履带市场

第五章 市场概览

- 介绍

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求和閒置频段

- 尺寸和设备的标准化

- 智慧配送,现场移动安装

- 可回收和永续材料

- 相互关联的市场与跨产业机会

- 建筑、工业/公用机械

- 农业、国防/林业

- 雪、旅游和远程多用途车辆

第六章 产业趋势

- 总体经济指标

- 介绍

- GDP趋势与预测

- 全球非公路用车产业趋势(内燃机+电动车)

- 生态系分析

- 原物料供应商

- 橡胶履带製造商

- OEM机器製造商

- 经销商/售后市场

- 最终用户

- 监管和永续性机构

- 供应链分析

- 海关编码

- 出口方案

- 导入场景

- 重大会议和活动(2025-2026)

- 美国2025年关税

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端用户产业的影响

- 案例研究分析

- 定价分析

- 橡胶履带平均售价趋势:依应用领域划分

- 各地区平均销售价格趋势

- 投资和资金筹措方案

- 决策流程

- 主要相关利益者和采购标准

- 招募障碍和内部挑战

第七章 科技与专利带来的策略颠覆

- 技术分析

- 介绍

- 主要新技术

- 互补技术

- 邻近技术

- 专利分析

第八章:永续性与监管环境

- 监管环境

- 对永续性的承诺

- 橡胶回收计划

- 橡胶履带的循环经济之路

第九章 按应用分類的橡胶履带市场

- 介绍

- 建筑和采矿

- 农业/收割机

- 主要发现

第十章 依机械类型分類的橡胶履带市场

- 介绍

- 农用拖拉机

- 结合

- 小型履带/多地形装载机

- 小型挖土机

- 其他机器类型

- 主要发现

第十一章 橡胶履带市场销售管道

- 介绍

- OE

- 售后市场

- 主要发现

第十二章 依胎面花纹分類的橡胶履带市场

- 介绍

- 方块图案

- C型图案

- 直桿

- 多条

- 之字形

- 其他的

- 主要发现

第十三章 依履带类型分類的橡胶履带市场

- 介绍

- 重迭/不连续的线股

- 连续钢丝

- 主要发现

第十四章:橡胶履带垫片的市场规模、预测与趋势

- 介绍

- 意义

- 橡胶履带垫片型

- 履带垫片选择指南

- 橡胶履带垫片市场规模及预测

- 橡胶履带垫片市场:主要企业

- BRIDGESTON CORPORATION

- EVERPADS CO., LTD

- RIO RUBBER TRACK

- ASTRAK

- TRACK PADS AUSTRALIA

- KMK RUBBER MANUFACTURING SDN BHD.

- GLOBAL TRACK WAREHOUSE

- SUPERIOR TIRE & RUBBER CORP.

- 橡胶履带垫片市场的关键技术趋势

- 业界考察

第十五章 橡胶履带市场区域概览

- 介绍

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 印尼

- 美洲

- 美国

- 加拿大

- 墨西哥

- 巴西

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十六章 竞争格局

- 概述

- 市占率分析(2024 年)

- 施工机械橡胶履带市场

- 农业橡胶履带市场

- 前三家公司的收入分析

- 企业评估矩阵:主要企业(2024)

- 比较品牌

- 公司评估

- 财务指标

- 经销商/经销商清单:按地区

- 亚太地区

- 欧洲

- 中东和非洲

- 美洲

- 策略伙伴关係和OEM联盟

- 竞争场景

第十七章:公司简介

- 主要企业

- BRIDGESTONE CORPORATION

- MCLAREN INDUSTRIES INC.

- GLOBAL TRACK WAREHOUSE

- CAMSO

- YOKOHAMA TWS

- GRIZZLY RUBBER TRACKS

- ASTRAK

- SOUCY

- MATTRACKS INC.

- JIAXING TAITE RUBBER CO., LTD.

- VMT INTERNATIONAL

- RUBBER TRACK SOLUTIONS INC.

- RIO RUBBER TRACK

- 其他主要企业

- TVH PARTS HOLDING NV

- BALKRISHNA INDUSTRIES LIMITED(BKT)

- XRTS RUBBER TRACKS & TIRES

- RUBTRACK TRACKED VEHICLE SYSTEMS CO., LTD.

- ACE VENTURA TYRES & TRACKS LLP

- DRB INDUSTRIAL CO., LTD.

- TRIDENT LIMITED

- HINOWA

- PROTIRE

- EVERPADS CO., LTD

- COHIDREX, SL

- ITR 比荷卢经济联盟

- GATOR TRACK

第十八章:MARKETSANDMARKETS 的建议

- 欧洲成为橡胶履带的主要市场

- 农业机械成为橡胶履带製造商关注的重点

- C 型花纹和块状花纹橡胶履带是橡胶履带供应商的重要胎面花纹类型。

- 结论

第十九章附录

The rubber tracks OE market is projected to grow from USD 1.04 billion in 2025 to USD 1.63 billion by 2032 at a CAGR of 6.6%. The overall growth of the rubber tracks market is being propelled by the rising adoption of compact and high-horsepower machinery in agriculture and construction, where improved traction, lower ground pressure, and enhanced mobility are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Application, Equipment Type, Tread Pattern, Track Type, and Sales Channel (OE and Aftermarket) |

| Regions covered | Americas, Europe, Asia Pacific, and Middle East & Africa |

Additionally, advancements in rubber compounds, reinforced core technologies, and terrain-optimized tread designs are boosting durability and performance, accelerating their demand in OEM and for replacement. Moreover, vigorous agricultural activity in Germany and France, and growing compact equipment demand driven by significant residential and infrastructure developments, are creating high-value opportunities for the adoption of rubber tracks in the region.

"By tread pattern, the C-pattern segment is projected to be the largest market during the forecast period."

The C-Pattern segment is projected to be the largest market during the forecast period. The growth of the segment is mainly driven by its superior traction dynamics and slope-handling capabilities, due to which it has been widely used across equipment operating on soft soils, gradients, and terrain requiring high flotation. Similar to block-pattern designs, c-pattern tracks are an excellent option for users who want to stay aligned with OEM standards. The highest adoption of C-Pattern is mainly in agricultural tractors and harvesters, particularly in rice paddy tractors, orchard/vineyard tractors, and hillside combine harvesters, where the C-shaped lug geometry allows the leading edge to dig into soft ground. At the same time, the curved trailing face enhances flotation and reduces slippage. These patterns are also adopted in compact track loaders used especially in terrain-challenged construction zones and forestry operations, where consistent grip on uneven slopes is critical for grading, site prep, and material handling. There is a high adoption of C-Pattern rubber type in the Americas due to the high concentration of vineyards, orchards, and specialty crop farms in the region. Additionally, the strong presence of OEMs, such as Bobcat and John Deere, in the region supports the adoption of C-Pattern tracks in compact loaders and narrow tractors optimized for hilly terrains.

"By sales channel, the OE segment is projected to be a larger segment than the aftermarket during the forecast period."

The Original Equipment (OE) segment continues to lead the rubber tracks market, even at a higher unit price, because its growth is directly linked to the strong global demand for new machinery, particularly mini-excavators, compact track/multi-terrain loaders, and other compact equipment categories increasingly used in urban infrastructure and residential projects. While the aftermarket remains steady, OEM production drives the highest volume, making OE the primary contributor to market expansion. OEMs also favor premium, rigorously tested rubber track systems that ensure optimal integration, performance, and warranty reliability, offering end users a guaranteed fit and long-term value. This focus on quality and machine-level compatibility reinforces the OE channel's position as a growing segment in the rubber tracks market.

"The Americas is projected to be the largest market during the forecast period."

The Americas is projected to account for the largest market, driven by the increasing sales of compact machinery like compact track loaders, multi-terrain loaders, and farm tractors. Major OEMs such as Caterpillar, John Deere, Kubota, JCB, and Bobcat from the Americas are developing compact equipment and farm tractors with tracks, which is creating both OE and aftermarket demand.

In the US and Canada, the use of compact track loaders, mini-excavators, and tracked carriers is significantly higher in construction and civil works projects. These machines benefit from rubber tracks due to their low ground disturbance, strong traction on mixed terrain, and smooth operation in urban or sensitive job sites. As a result, contractors prefer rubber-tracked equipment for roadwork, utilities, landscaping, and infrastructure projects where stability and surface protection are essential.

OEMs such as John Deere, CNH Industrial, and CLAAS have developed several rubber track variants of their 300-350+ HP high-horsepower tractors and combine harvesters. These configurations are preferred for large-acreage farming because they deliver superior flotation, reduced soil compaction, and higher traction under heavy loads. Additionally, in the Americas, C-Pattern and block-pattern rubber tracks are most widely used across compact construction and agricultural equipment. Major suppliers in the region include Camso (CEAT), Bridgestone, Continental, and Mattracks, all of which support the rising demand for OEM and aftermarket demand.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key companies operating in this market.

Here is the breakdown of the interviews conducted:

- By Company Type: OEMs - 20%, Rubber Track Manufacturers - 80%

- By Designation: C-Level - 30%, Director-Level - 50%, and Others - 20%

- By Region: Asia Pacific - 30%, The Americas - 20%, Europe - 40%, RoW - 10%

Note: Others include Sales Managers, Operational Heads, Supply Chain Heads/Managers.

The key players in the rubber tracks market are Bridgestone Corporation (Japan), Camso Inc. (Canada), McLaren Industries Inc. (US), Global Track Warehouse (Australia), and Grizzly Rubber Tracks (US). These companies adopt various strategies to maintain their position in the global rubber tracks market. Some of these strategies are mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the rubber tracks market and its segments. The report also discusses ups and downs in rubber tracks, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. It would further help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Market Dynamics: Analysis of key drivers (Performance advantages driving shift from tires to rubber tracks; growth of vineyard, orchard, and specialty crop cultivation), restraints (High cost and compatibility), opportunities (Electrification of agricultural and construction equipment, rental market push), and challenges (Weight and efficiency penalties on specific drive systems, lack of viable end-of-life solution) influencing the growth of the rubber tracks market

- Product Developments/Innovation: Detailed insights into upcoming technologies and product & service launches in the rubber tracks market

- Market Development: Comprehensive market information (the report analyses the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the rubber tracks market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Bridgestone Corporation (Japan), Camso Inc. (Canada), McLaren Industries Inc. (US), Global Track Warehouse (Australia), and Grizzly Rubber Tracks (US) in the rubber tracks market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for estimating base numbers

- 2.1.1.2 Key secondary sources for estimating market size

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Key primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 DISRUPTIVE TRENDS SHAPING MARKET

- 3.3 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.4 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RUBBER TRACKS MARKET

- 4.2 RUBBER TRACKS MARKET, BY SALES CHANNEL

- 4.3 RUBBER TRACKS MARKET, BY APPLICATION

- 4.4 RUBBER TRACKS MARKET, BY TREAD PATTERN

- 4.5 RUBBER TRACKS MARKET, BY TRACK TYPE

- 4.6 RUBBER TRACKS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Performance advantages driving shift from tires to rubber tracks

- 5.2.1.2 Growth of vineyard, orchard, and specialty crop cultivation

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and compatibility issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Electrification of agriculture and construction equipment

- 5.2.3.2 Rental market push

- 5.2.4 CHALLENGES

- 5.2.4.1 Recycling issues

- 5.2.4.2 Weight and efficiency penalties on specific drive systems

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 STANDARDIZATION OF SIZES AND FITMENT

- 5.3.2 SMART DISTRIBUTION AND ON-SITE MOBILE FITTING

- 5.3.3 RECYCLABILITY AND SUSTAINABLE MATERIALS

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 CONSTRUCTION AND INDUSTRIAL/UTILITY EQUIPMENT

- 5.4.2 AGRICULTURE AND DEFENSE/FORESTRY

- 5.4.3 SNOW, TOURISM, AND REMOTE UTILITY VEHICLES

6 INDUSTRY TRENDS

- 6.1 MACROECONOMIC INDICATORS

- 6.1.1 INTRODUCTION

- 6.1.2 GDP TRENDS AND FORECAST

- 6.1.3 TRENDS IN GLOBAL OFF-HIGHWAY INDUSTRY (ICE+EV)

- 6.1.3.1 Sales growth trend of construction equipment, 2025 vs. 2030

- 6.1.3.2 Farm tractor growth trend, by HP, 2025 vs. 2032

- 6.2 ECOSYSTEM ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 RUBBER TRACK MANUFACTURERS

- 6.2.3 OEM EQUIPMENT BUILDERS

- 6.2.4 DISTRIBUTORS/AFTERMARKET

- 6.2.5 END USERS

- 6.2.6 REGULATORY & SUSTAINABILITY BODIES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 HS CODE

- 6.4.1 EXPORT SCENARIO

- 6.4.1.1 Germany

- 6.4.1.2 China

- 6.4.1.3 US

- 6.4.1.4 Poland

- 6.4.1.5 Italy

- 6.4.2 IMPORT SCENARIO

- 6.4.2.1 US

- 6.4.2.2 Germany

- 6.4.2.3 Mexico

- 6.4.2.4 China

- 6.4.2.5 France

- 6.4.1 EXPORT SCENARIO

- 6.5 KEY CONFERENCES & EVENTS, 2025-2026

- 6.6 US 2025 TARIFF

- 6.6.1 INTRODUCTION

- 6.6.2 KEY TARIFF RATES

- 6.6.3 PRICE IMPACT ANALYSIS

- 6.6.4 IMPACT ON COUNTRY/REGION

- 6.6.4.1 US

- 6.6.4.2 Europe

- 6.6.4.3 Asia Pacific

- 6.6.5 IMPACT ON END-USE INDUSTRY

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 GATOR TRACK SUPPLIED HYBRID RUBBER TRACK SYSTEMS WITH REINFORCED STEEL CORDS AND HEAT-RESISTANT COMPOUNDS

- 6.7.2 NISSITRAC INTRODUCED AGRICULTURE-SPECIFIC RUBBER TRACKS USING SOFT TREAD COMPOUNDS FOR IMPROVED TRACTION ON UNEVEN, MUDDY TERRAIN

- 6.7.3 RTS IMPLEMENTED SHIPHAWK ADVANCED SHIPPING PLATFORM TO AUTOMATE LTL SHIPPING

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF RUBBER TRACKS, BY APPLICATION

- 6.8.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.9 INVESTMENT & FUNDING SCENARIO

- 6.10 DECISION-MAKING PROCESS

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 ADOPTION BARRIERS & INTERNAL CHALLENGES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY AND PATENTS

- 7.1 TECHNOLOGY ANALYSIS

- 7.1.1 INTRODUCTION

- 7.1.2 KEY EMERGING TECHNOLOGIES

- 7.1.2.1 IoT and telemetry in track wear monitoring

- 7.1.2.2 Sustainability trend: Recycling, use of recycled materials, and circular economy impact

- 7.1.2.3 Autonomous equipment and track requirements

- 7.1.2.4 Performance comparison: Durability, noise, and soil protection

- 7.1.2.5 Innovation trends: Recyclable materials, hybrid designs, and anti-vibration solutions

- 7.1.3 COMPLEMENTARY TECHNOLOGIES

- 7.1.3.1 Advanced polymer science and nanomaterials

- 7.1.3.2 Additive manufacturing (3D printing) for tooling and prototyping

- 7.1.4 ADJACENT TECHNOLOGIES

- 7.1.4.1 Electrification of compact and off-highway equipment

- 7.2 PATENT ANALYSIS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGULATORY LANDSCAPE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 INITIATIVES FOR RUBBER RECYCLING

- 8.2.2 CIRCULAR ECONOMY PATHWAYS FOR RUBBER TRACKS

- 8.2.2.1 Key takeaways

9 RUBBER TRACKS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CONSTRUCTION & MINING

- 9.2.1 INCREASE IN CONSTRUCTION AND MINING ACTIVITIES TO DRIVE MARKET

- 9.3 AGRICULTURE & HARVESTERS

- 9.3.1 PRECISION FARMING AND TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

- 9.4 PRIMARY INSIGHTS

10 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE

- 10.1 INTRODUCTION

- 10.2 AGRICULTURE TRACTORS

- 10.2.1 RISING DEMAND FOR HIGH-TRACTION, LOW-COMPACTION SOLUTIONS TO DRIVE MARKET

- 10.3 COMBINE HARVESTERS

- 10.3.1 RISING ADOPTION OF HIGH-CAPACITY TRACKED COMBINE HARVESTERS TO SUPPORT GROWTH

- 10.3.1.1 Typical combine harvester configurations in North America

- 10.3.1.2 Major track suppliers and their partnerships or supply relationships with combine harvester OEMS in North America

- 10.3.1 RISING ADOPTION OF HIGH-CAPACITY TRACKED COMBINE HARVESTERS TO SUPPORT GROWTH

- 10.4 COMPACT TRACK/MULTI-TERRAIN LOADERS

- 10.4.1 INCREASING DEMAND FOR HIGH-DURABILITY, LOW-VIBRATION EQUIPMENT TO BOOST GROWTH

- 10.5 MINI-EXCAVATORS

- 10.5.1 INCREASING DEMAND FOR COMPACT AND SURFACE-FRIENDLY EXCAVATION SOLUTIONS TO DRIVE MARKET

- 10.6 OTHER EQUIPMENT TYPES

- 10.7 PRIMARY INSIGHTS

11 RUBBER TRACKS MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OE

- 11.2.1 NEED FOR HIGH-QUALITY FIT AND DURABILITY TO DRIVE MARKET

- 11.3 AFTERMARKET

- 11.3.1 COST-COMPETITIVENESS AND FREQUENT REPLACEMENT CYCLES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 RUBBER TRACKS MARKET, BY TREAD PATTERN

- 12.1 INTRODUCTION

- 12.2 BLOCK-PATTERN

- 12.2.1 OEM STANDARDIZATION OF BLOCK-PATTERN TRACKS TO DRIVE MARKET

- 12.3 C-PATTERN

- 12.3.1 INCREASING USE OF EXCAVATORS AND LOADERS IN FORESTRY, PLANTATION, AND SLOPE-INTENSIVE TERRAIN TO DRIVE MARKET

- 12.4 STRAIGHT-BAR

- 12.4.1 RISING DEMAND FOR HIGH-TRACTION FORWARD-PUSH CAPABILITY IN GRADING AND FORESTRY APPLICATIONS TO DRIVE MARKET

- 12.5 MULTI-BAR

- 12.5.1 BETTER DISTRIBUTION OF GROUND LOAD ACROSS MULTIPLE CONTACT LINES TO SUPPORT MARKET GROWTH

- 12.6 ZIG-ZAG

- 12.6.1 RISING DEMAND FOR TRACKS THAT PROVIDE BALANCED FORWARD TRACTION TO SUPPORT GROWTH

- 12.7 OTHERS

- 12.8 PRIMARY INSIGHTS

13 RUBBER TRACKS MARKET, BY TRACK TYPE

- 13.1 INTRODUCTION

- 13.2 OVERLAPPING/NON-CONTINUOUS WIRE STRAND

- 13.2.1 COST-EFFECTIVENESS OF DESIGN TO DRIVE DEMAND

- 13.3 CONTINUOUS WIRE STRAND

- 13.3.1 ENHANCED DURABILITY AND UNIFORM LOAD DISTRIBUTION TO DRIVE GROWTH

- 13.4 PRIMARY INSIGHTS

14 RUBBER TRACK PADS MARKET SIZE, FORECAST, AND TRENDS

- 14.1 INTRODUCTION

- 14.1.1 DEFINITION

- 14.1.2 TYPES OF RUBBER TRACK PADS

- 14.1.2.1 Bolt-on track pads

- 14.1.2.2 Chain-on track pads

- 14.1.2.3 Clip-on track pads

- 14.1.3 TRACK PAD SELECTION GUIDE

- 14.2 MARKET SIZING AND FORECAST FOR RUBBER TRACK PADS

- 14.3 RUBBER TRACK PADS MARKET: KEY PLAYERS

- 14.3.1 BRIDGESTON CORPORATION

- 14.3.2 EVERPADS CO., LTD

- 14.3.3 RIO RUBBER TRACK

- 14.3.4 ASTRAK

- 14.3.5 TRACK PADS AUSTRALIA

- 14.3.6 KMK RUBBER MANUFACTURING SDN BHD.

- 14.3.7 GLOBAL TRACK WAREHOUSE

- 14.3.8 SUPERIOR TIRE & RUBBER CORP.

- 14.4 KEY TECHNOLOGY TRENDS IN RUBBER TRACK PADS MARKET

- 14.4.1 ADVANCED RUBBER COMPOUND FORMULATIONS

- 14.5 INDUSTRY INSIGHTS

15 RUBBER TRACKS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 EUROPE

- 15.2.1 GERMANY

- 15.2.1.1 Dominance of high-horsepower tracked machinery to support market growth

- 15.2.2 FRANCE

- 15.2.2.1 Advanced agricultural mechanization to drive market

- 15.2.3 UK

- 15.2.3.1 High demand for mini-excavators to drive market

- 15.2.4 ITALY

- 15.2.4.1 Specialized terrain requirements to support market

- 15.2.5 SPAIN

- 15.2.5.1 Deployment of tracked machinery in urban construction and high-value agriculture sectors to support growth

- 15.2.6 RUSSIA

- 15.2.6.1 Large-scale deployment of construction machinery to drive market

- 15.2.7 REST OF EUROPE

- 15.2.1 GERMANY

- 15.3 ASIA PACIFIC

- 15.3.1 CHINA

- 15.3.1.1 Heavy investments in infrastructural development to drive market

- 15.3.2 JAPAN

- 15.3.2.1 Technological innovation and expanding domestic production capacity to drive market

- 15.3.3 INDIA

- 15.3.3.1 Rising mechanization and adoption of compact equipment to drive market

- 15.3.4 INDONESIA

- 15.3.4.1 Adoption of rubber tracks in equipment used in agriculture and infrastructure to support market

- 15.3.1 CHINA

- 15.4 AMERICAS

- 15.4.1 US

- 15.4.1.1 High replacement demand from large rental fleets to drive market

- 15.4.2 CANADA

- 15.4.2.1 Increased investments in residential and non-residential construction activities to drive market

- 15.4.3 MEXICO

- 15.4.3.1 Increased investments in private and public sectors to support growth

- 15.4.4 BRAZIL

- 15.4.4.1 Increasing demand for farm tractors to drive market

- 15.4.1 US

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 SOUTH AFRICA

- 15.5.1.1 Infrastructure development programs to achieve UN sustainable development goals to drive market

- 15.5.2 SAUDI ARABIA

- 15.5.2.1 Increasing number of construction projects to support market

- 15.5.3 UAE

- 15.5.3.1 Rapid growth in construction industry to drive market

- 15.5.1 SOUTH AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 MARKET SHARE ANALYSIS, 2024

- 16.2.1 CONSTRUCTION EQUIPMENT RUBBER TRACKS MARKET

- 16.2.2 AGRICULTURE RUBBER TRACKS MARKET

- 16.3 REVENUE ANALYSIS OF TOP THREE PLAYERS

- 16.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.4.1 STARS

- 16.4.2 EMERGING LEADERS

- 16.4.3 PERVASIVE PLAYERS

- 16.4.4 PARTICIPANTS

- 16.4.5 COMPANY FOOTPRINT

- 16.5 BRAND COMPARISON

- 16.6 COMPANY VALUATION

- 16.7 FINANCIAL METRICS

- 16.8 LIST OF DEALERS/DISTRIBUTORS, BY REGION

- 16.8.1 ASIA PACIFIC

- 16.8.2 EUROPE

- 16.8.3 MIDDLE EAST & AFRICA

- 16.8.4 AMERICAS

- 16.9 STRATEGIC PARTNERSHIPS & OEM TIE-UPS

- 16.9.1 STRATEGIC PARTNERSHIPS & OEM TIE-UPS

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.10.2 DEALS

- 16.10.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 BRIDGESTONE CORPORATION

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 MnM view

- 17.1.1.3.1 Key strengths

- 17.1.1.3.2 Strategic choices

- 17.1.1.3.3 Weaknesses and competitive threats

- 17.1.2 MCLAREN INDUSTRIES INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 MnM view

- 17.1.2.3.1 Key strengths

- 17.1.2.3.2 Strategic choices

- 17.1.2.3.3 Weaknesses and competitive threats

- 17.1.3 GLOBAL TRACK WAREHOUSE

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 CAMSO

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 MnM view

- 17.1.4.3.1 Key strengths

- 17.1.4.3.2 Strategic choices

- 17.1.4.3.3 Weaknesses and competitive threats

- 17.1.5 YOKOHAMA TWS

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 GRIZZLY RUBBER TRACKS

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.7 ASTRAK

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Other developments

- 17.1.8 SOUCY

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Other developments

- 17.1.9 MATTRACKS INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.10 JIAXING TAITE RUBBER CO., LTD.

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Other developments

- 17.1.11 VMT INTERNATIONAL

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.12 RUBBER TRACK SOLUTIONS INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.13 RIO RUBBER TRACK

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.1 BRIDGESTONE CORPORATION

- 17.2 OTHER KEY PLAYERS

- 17.2.1 TVH PARTS HOLDING NV

- 17.2.2 BALKRISHNA INDUSTRIES LIMITED (BKT)

- 17.2.3 XRTS RUBBER TRACKS & TIRES

- 17.2.4 RUBTRACK TRACKED VEHICLE SYSTEMS CO., LTD.

- 17.2.5 ACE VENTURA TYRES & TRACKS LLP

- 17.2.6 DRB INDUSTRIAL CO., LTD.

- 17.2.7 TRIDENT LIMITED

- 17.2.8 HINOWA

- 17.2.9 PROTIRE

- 17.2.10 EVERPADS CO., LTD

- 17.2.11 COHIDREX, S.L.

- 17.2.12 ITR BENELUX

- 17.2.13 GATOR TRACK

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 EUROPE TO BE MAJOR MARKET FOR RUBBER TRACKS

- 18.2 AGRICULTURE EQUIPMENT TO BE KEY FOCUS AREA FOR RUBBER TRACK MANUFACTURERS

- 18.3 C-PATTERN AND BLOCK-PATTERN RUBBER TRACKS ARE KEY TREAD PATTERN TYPES FOR RUBBER TRACK SUPPLIERS

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 RUBBER TRACKS MARKET, BY TRACK TYPE, AT THE COUNTRY LEVEL

- 19.4.2 RUBBER TRACKS MARKET, BY TREAD PATTERN, AT THE COUNTRY LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CURRENCY EXCHANGE RATES, BY COUNTRY, 2021-2024

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 3 GERMANY: EXPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 4 CHINA: EXPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 5 US: EXPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 POLAND: EXPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 ITALY: EXPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 US: IMPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 GERMANY: IMPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 MEXICO: IMPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 CHINA: IMPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 FRANCE: IMPORT DATA FOR HS CODE 401699-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 RUBBER TRACKS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 14 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 15 KEY PRODUCT-RELATED TARIFFS FOR RUBBER TRACKS

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USES DUE TO TARIFF IMPACT

- TABLE 17 COUNTRY-LEVEL IMPACT OF US TARIFFS

- TABLE 18 INDIA: AVERAGE SELLING PRICE TREND OF RUBBER TRACKS, BY APPLICATION, 2022-2024 (USD)

- TABLE 19 EUROPE: AVERAGE SELLING PRICE TREND OF RUBBER TRACKS, BY APPLICATION, 2022-2024 (USD)

- TABLE 20 AMERICAS: AVERAGE SELLING PRICE TREND OF RUBBER TRACKS, BY APPLICATION, 2022-2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 22 FUNDING DETAILS, 2023-2024

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 24 KEY BUYING CRITERIA FOR RUBBER TRACKS, BY APPLICATION

- TABLE 25 PATENTS APPLIED AND GRANTED

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 MIDDLE EAST AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 KEY SUSTAINABILITY INITIATIVES IN RUBBER TRACK RECYCLING

- TABLE 31 CIRCULAR ECONOMY PATHWAYS

- TABLE 32 RUBBER TRACKS MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 33 RUBBER TRACKS MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 34 RUBBER TRACKS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 RUBBER TRACKS MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 36 CONSTRUCTION & MINING: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 37 CONSTRUCTION & MINING: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 38 CONSTRUCTION & MINING: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 CONSTRUCTION & MINING: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 AGRICULTURE & HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 41 AGRICULTURE & HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 42 AGRICULTURE & HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 AGRICULTURE & HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 45 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 46 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 47 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 48 AGRICULTURE TRACTORS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 49 AGRICULTURE TRACTORS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 50 AGRICULTURE TRACTORS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 AGRICULTURE TRACTORS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 TYPICAL COMBINE HARVESTER CONFIGURATIONS IN NORTH AMERICA

- TABLE 53 MAJOR TRACK SUPPLIERS AND THEIR PARTNERSHIPS OR SUPPLY RELATIONSHIPS WITH COMBINE HARVESTER OEMS IN NORTH AMERICA

- TABLE 54 COMBINE HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 55 COMBINE HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 56 COMBINE HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 COMBINE HARVESTERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 COMPACT TRACK/MULTI-TERRAIN LOADERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 59 COMPACT TRACK/MULTI-TERRAIN LOADERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 60 COMPACT TRACK/MULTI-TERRAIN LOADERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 COMPACT TRACK/MULTI-TERRAIN LOADERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 62 MINI-EXCAVATORS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 63 MINI-EXCAVATORS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 64 MINI-EXCAVATORS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 MINI-EXCAVATORS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 OTHER EQUIPMENT TYPES: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 67 OTHER EQUIPMENT TYPES: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 68 OTHER EQUIPMENT TYPES: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 OTHER EQUIPMENT TYPES: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 RUBBER TRACKS MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 71 RUBBER TRACKS MARKET, BY SALES CHANNEL, 2025-2032 (USD MILLION)

- TABLE 72 OE: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 OE: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 AFTERMARKET: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 AFTERMARKET: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 RUBBER TRACKS MARKET, BY TREAD PATTERN, 2021-2024 (UNITS)

- TABLE 77 RUBBER TRACKS MARKET, BY TREAD PATTERN, 2025-2032 (UNITS)

- TABLE 78 RUBBER TRACKS MARKET, BY TREAD PATTERN, 2021-2024 (USD MILLION)

- TABLE 79 RUBBER TRACKS MARKET, BY TREAD PATTERN, 2025-2032 (USD MILLION)

- TABLE 80 BLOCK-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 81 BLOCK-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 82 BLOCK-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 BLOCK-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 84 C-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 85 C-PATTERN RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 86 C-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 C-PATTERN: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 STRAIGHT-BAR: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 89 STRAIGHT-BAR: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 90 STRAIGHT-BAR: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 STRAIGHT-BAR: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 MULTI-BAR: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 93 MULTI-BAR: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 94 MULTI-BAR: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 MULTI-BAR RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 ZIG-ZAG: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 97 ZIG-ZAG: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 98 ZIG-ZAG: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 ZIG-ZAG: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 OTHERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 101 OTHERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 102 OTHERS: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 OTHERS: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 RUBBER TRACKS MARKET, BY TRACK TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 105 RUBBER TRACKS MARKET, BY TRACK TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 106 RUBBER TRACKS MARKET, BY TRACK TYPE, 2021-2024 (USD MILLION)

- TABLE 107 RUBBER TRACKS MARKET, BY TRACK TYPE, 2025-2032 (USD MILLION)

- TABLE 108 OVERLAPPING/NON CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 109 OVERLAPPING/NON CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 110 OVERLAPPING/NON CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 OVERLAPPING/NON CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 112 CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 CONTINUOUS WIRE STRAND RUBBER: TRACKS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 114 CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 CONTINUOUS WIRE STRAND: RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 RUBBER TRACK PADS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 RUBBER TRACK PADS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 118 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- TABLE 119 EVERPADS CO., LTD: COMPANY OVERVIEW

- TABLE 120 RIO RUBBER TRACK: COMPANY OVERVIEW

- TABLE 121 ASTRAK: COMPANY OVERVIEW

- TABLE 122 TRACK PADS AUSTRALIA: COMPANY OVERVIEW

- TABLE 123 KMK RUBBER MANUFACTURING SDN BHD.: COMPANY OVERVIEW

- TABLE 124 GLOBAL TRACK WAREHOUSE: COMPANY OVERVIEW

- TABLE 125 SUPERIOR TIRE & RUBBER CORP.: COMPANY OVERVIEW

- TABLE 126 RUBBER TRACKS MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 127 RUBBER TRACKS MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 128 RUBBER TRACKS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 RUBBER TRACKS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 EUROPE: RUBBER TRACKS MARKET, BY COUNTRY/REGION, 2021-2024 (UNITS)

- TABLE 131 EUROPE: RUBBER TRACKS MARKET, BY COUNTRY/REGION, 2025-2032 (UNITS)

- TABLE 132 EUROPE: RUBBER TRACKS MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: RUBBER TRACKS MARKET, BY COUNTRY/REGION, 2025-2032 (USD MILLION)

- TABLE 134 GERMANY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 135 GERMANY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 136 GERMANY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 137 GERMANY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 138 FRANCE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 139 FRANCE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 140 FRANCE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 141 FRANCE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 142 UK: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 143 UK: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 144 UK: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 145 UK: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 146 ITALY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 147 ITALY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 148 ITALY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 149 ITALY: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 150 SPAIN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 151 SPAIN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 152 SPAIN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 153 SPAIN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 154 RUSSIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 155 RUSSIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 156 RUSSIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 157 RUSSIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 158 REST OF EUROPE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 159 REST OF EUROPE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 160 REST OF EUROPE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 161 REST OF EUROPE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 162 ASIA PACIFIC: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 163 ASIA PACIFIC: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 164 ASIA PACIFIC: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 166 CHINA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 167 CHINA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 168 CHINA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 169 CHINA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 170 JAPAN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 171 JAPAN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 172 JAPAN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 173 JAPAN: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 174 INDIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 175 INDIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 176 INDIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 177 INDIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 178 INDONESIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 179 INDONESIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 180 INDONESIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 181 INDONESIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 182 AMERICAS: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 183 AMERICAS: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 184 AMERICAS: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 AMERICAS: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 186 US: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 187 US: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 188 US: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 189 US: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 190 CANADA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 191 CANADA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 192 CANADA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 193 CANADA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 194 MEXICO: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 195 MEXICO: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 196 MEXICO: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 197 MEXICO: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 198 BRAZIL: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 199 BRAZIL: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 200 BRAZIL: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 201 BRAZIL: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 203 MIDDLE EAST & AFRICA: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 204 MIDDLE EAST & AFRICA: RUBBER TRACKS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: RUBBER TRACKS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 206 SOUTH AFRICA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 207 SOUTH AFRICA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 208 SOUTH AFRICA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 209 SOUTH AFRICA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 210 SAUDI ARABIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 211 SAUDI ARABIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 212 SAUDI ARABIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 213 SAUDI ARABIA: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 214 UAE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 215 UAE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (UNITS)

- TABLE 216 UAE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 217 UAE: RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 218 MARKET SHARE ANALYSIS, 2024

- TABLE 219 APPLICATION FOOTPRINT

- TABLE 220 EQUIPMENT TYPE FOOTPRINT

- TABLE 221 REGION FOOTPRINT

- TABLE 222 ASIA PACIFIC: LIST OF DEALERS/DISTRIBUTORS

- TABLE 223 EUROPE: LIST OF DEALERS/DISTRIBUTORS

- TABLE 224 MIDDLE EAST & AFRICA: LIST OF DEALERS/DISTRIBUTORS

- TABLE 225 AMERICAS: LIST OF DEALERS/DISTRIBUTORS

- TABLE 226 STRATEGIC PARTNERSHIPS & OEM TIE-UPS

- TABLE 227 RUBBER TRACKS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JUNE 2021- JANUARY 2024

- TABLE 228 RUBBER TRACKS MARKET: DEALS, JUNE 2021-JANUARY 2024

- TABLE 229 RUBBER TRACKS MARKET: OTHER DEVELOPMENTS, JUNE 2021-JANUARY 2024

- TABLE 230 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- TABLE 231 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 232 MCLAREN INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 233 MCLAREN INDUSTRIES INC.: PRODUCTS OFFERED

- TABLE 234 GLOBAL TRACK WAREHOUSE: COMPANY OVERVIEW

- TABLE 235 GLOBAL TRACK WAREHOUSE: PRODUCTS OFFERED

- TABLE 236 CAMSO: COMPANY OVERVIEW

- TABLE 237 CAMSO: PRODUCTS OFFERED

- TABLE 238 YOKOHAMA TWS: COMPANY OVERVIEW

- TABLE 239 YOKOHAMA TWS: PRODUCTS OFFERED

- TABLE 240 YOKOHAMA TWS: OTHER DEVELOPMENTS

- TABLE 241 GRIZZLY RUBBER TRACKS: COMPANY OVERVIEW

- TABLE 242 GRIZZLY RUBBER TRACKS: PRODUCTS OFFERED

- TABLE 243 ASTRAK: COMPANY OVERVIEW

- TABLE 244 ASTRAK: PRODUCTS OFFERED

- TABLE 245 ASTRAK.: OTHER DEVELOPMENTS

- TABLE 246 SOUCY: COMPANY OVERVIEW

- TABLE 247 SOUCY: PRODUCTS OFFERED

- TABLE 248 SOUCY: OTHER DEVELOPMENTS

- TABLE 249 MATTRACKS INC.: COMPANY OVERVIEW

- TABLE 250 MATTRACKS INC.: PRODUCTS OFFERED

- TABLE 251 JIAXING TAITE RUBBER CO., LTD.: COMPANY OVERVIEW

- TABLE 252 JIAXING TAITE RUBBER CO., LTD.: PRODUCTS OFFERED

- TABLE 253 JIAXING TAITE RUBBER CO., LTD.: OTHER DEVELOPMENTS

- TABLE 254 VMT INTERNATIONAL: COMPANY OVERVIEW

- TABLE 255 VMT INTERNATIONAL: PRODUCTS OFFERED

- TABLE 256 RUBBER TRACK SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 257 RUBBER TRACK SOLUTIONS INC.: PRODUCTS OFFERED

- TABLE 258 RIO RUBBER TRACK: COMPANY OVERVIEW

- TABLE 259 RIO RUBBER TRACK: PRODUCTS OFFERED

- TABLE 260 TVH PARTS HOLDING NV: COMPANY OVERVIEW

- TABLE 261 BALKRISHNA INDUSTRIES LIMITED (BKT): COMPANY OVERVIEW

- TABLE 262 XRTS RUBBER TRACKS & TIRES: COMPANY OVERVIEW

- TABLE 263 RUBTRACK TRACKED VEHICLE SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 264 ACE VENTURA TYRES & TRACKS LLP: COMPANY OVERVIEW

- TABLE 265 DRB INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 266 TRIDENT LIMITED: COMPANY OVERVIEW

- TABLE 267 HINOWA: COMPANY OVERVIEW

- TABLE 268 PROTIRE: COMPANY OVERVIEW

- TABLE 269 EVERPADS CO., LTD: COMPANY OVERVIEW

- TABLE 270 COHIDREX, S.L.: COMPANY OVERVIEW

- TABLE 271 ITR BENELUX: COMPANY OVERVIEW

- TABLE 272 GATOR TRACK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 9 RUBBER TRACKS MARKET DYNAMICS AND INDUSTRY TRENDS

- FIGURE 10 DISRUPTIVE TRENDS IMPACTING RUBBER TRACKS MARKET

- FIGURE 11 AGRICULTURE TRACTORS, CONTINUOUS WIRE STRAND, AND C-PATTERN SEGMENTS TO BE SIGNIFICANT MARKETS DURING FORECAST PERIOD

- FIGURE 12 EUROPE TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 INCREASING DEPLOYMENT OF COMPACT AND HIGH-HORSEPOWER TRACKED MACHINERY ACROSS CONSTRUCTION AND AGRICULTURE SECTORS TO DRIVE MARKET

- FIGURE 14 OE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 AGRICULTURE & HARVESTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 ZIG-ZAG SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 CONTINUOUS WIRE STRAND SEGMENT TO LEAD MARKET BY 2032

- FIGURE 18 EUROPE TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 19 RUBBER TRACKS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 FACTORS DRIVING REGIONAL ADOPTION OF RUBBER TRACKS

- FIGURE 21 BRIDGING GAPS IN RUBBER TRACKS MARKET

- FIGURE 22 SALES GROWTH TREND OF CONSTRUCTION EQUIPMENT, 2025 VS. 2030

- FIGURE 23 FARM TRACTOR GROWTH TREND, BY HP, 2025 VS. 2032

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 RUBBER TRACKS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF RUBBER TRACKS FOR AGRICULTURE & HARVESTERS, BY KEY COUNTRY/REGION, 2022-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE OF RUBBER TRACKS FOR CONSTRUCTION & MINING, BY KEY COUNTRY/REGION, 2022-2024 (USD)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 30 KEY BUYING CRITERIA FOR RUBBER TRACKS, BY APPLICATION

- FIGURE 31 KEY PATENTS, 2015-2025

- FIGURE 32 RUBBER TRACKS MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 33 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 34 RUBBER TRACKS MARKET, BY SALES CHANNEL, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 RUBBER TRACKS MARKET, BY TREAD PATTERN, 2025 VS. 2032 (USD MILLION)

- FIGURE 36 RUBBER TRACKS MARKET, BY TRACK TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 37 BOLT-ON TRACK PADS

- FIGURE 38 CHAIN-ON TRACK PADS

- FIGURE 39 CLIP-ON TRACK PADS

- FIGURE 40 TRACK PAD SELECTION GUIDE

- FIGURE 41 RUBBER TRACKS MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 EUROPE: RUBBER TRACKS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: RUBBER TRACKS MARKET SNAPSHOT

- FIGURE 44 AMERICAS: RUBBER TRACKS MARKET SNAPSHOT

- FIGURE 45 MARKET SHARE ANALYSIS, 2024

- FIGURE 46 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2021-2024 (USD BILLION)

- FIGURE 47 RUBBER TRACKS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 RUBBER TRACKS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 49 BRAND COMPARISON

- FIGURE 50 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 51 FINANCIAL METRICS, 2024 (USD BILLION)

- FIGURE 52 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 CAMSO: COMPANY SNAPSHOT

- FIGURE 54 YOKOHAMA TWS: COMPANY SNAPSHOT