|

市场调查报告书

商品编码

1887990

全球泌尿系统医疗设备市场(按产品、应用、最终用户和地区划分)-预测至2030年Urology Devices Market by Product (Dialysis, Laser, Lithotripsy, Robotic, Insufflators, Guidewires, Catheters, Stents, Implants), Application (Kidney Diseases, Cancer, Pelvic Organ Prolapse, BPH, Stones), End User and Region - Global Forecast to 2030 |

||||||

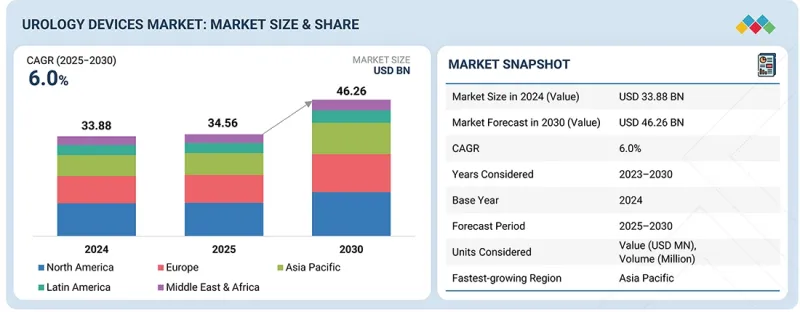

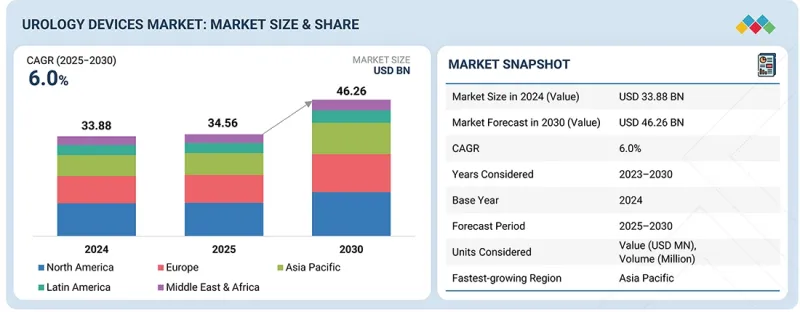

全球泌尿系统医疗设备市场预计到 2025 年将达到 345.6 亿美元,到 2030 年将达到 462.6 亿美元,预测期内复合年增长率为 6.0%。

慢性代谢性疾病和心血管疾病(包括糖尿病和高血压)的盛行率不断上升,导致泌尿系统疾病的发生率显着增加,需要及时进行诊断评估和手术干预。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 金额(十亿美元) |

| 部分 | 按产品、应用程式、最终用户和地区划分 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

即时实证临床管理对于预防疾病进展和优化患者预后至关重要。同时,微创泌尿系统技术(包括机器人辅助手术、内视镜介入和经皮治疗方法)的快速普及,显着提高了对精准泌尿系统医疗设备的需求,以确保手术安全、诊断准确和治疗有效。

按产品类型,预计在预测期内,泌尿系统医疗设备市场的耗材和配件细分市场将实现最高的成长率。

泌尿系统医疗设备市场依产品类型分为器械及耗材及配件两大类。预计耗材及配件细分市场将以更高的复合年增长率成长。此细分市场的高成长率主要归功于研发活动的增加,这些活动致力于开发创新解决方案,以应对日益普遍的慢性泌尿系统疾病。此外,对可重复使用耗材、设备标准化和手术流程效率的日益重视,也推动了全球医院、手术中心和门诊机构对耗材的需求。

根据最终用户划分,泌尿系统医疗设备市场可细分为医院、门诊手术中心 (ASC)、诊所、透析中心和居家医疗机构。透析中心的成长速度最快,这主要归因于对先进透析设备和末期肾功能衰竭(ESRD) 治疗所需专业设施的需求显着增长。全球慢性肾臟病盛行率的不断上升,以及糖尿病和高血压盛行率的增加,导致肾衰竭病例不断增加,从而迫切需要更多的透析中心和相关基础设施。此外,透析技术的进步、治疗通讯协定的改进以及患者意识的提高,都促使人们投资建造新的透析设施和购买最先进的设备,这使得透析中心成为全球泌尿系统医疗设备市场中成长最快的最终用户类别。

预计亚太地区在预测期内将实现最高的复合年增长率。推动该地区加速成长的因素包括:老年人口显着增加,需要接受先进的泌尿系统手术;肾臟疾病患病率上升;慢性肾臟病(CKD)全部区域数百万人带来沉重的疾病负担;医疗费用支出和人均收入水平快速增长;消费者对治疗技术的需求不断增长;私立医院网络战略性地向亚太地区服务不足的农村地区扩张;以及高增长潜力市场的巨大潜力。此外,医疗保健服务的可及性提高、政府支持医疗基础设施建设的倡议以及患者对先进泌尿系统治疗方案的认知度不断提高,所有这些因素都使亚太地区成为全球最具活力和增长最快的泌尿系统器械市场。

供应方初试面试细分(依公司类型、职位和地区划分):

- *依公司规模划分:一级(40%)、二级(30%)、三级(20%)

- *按职位:首席级别主管(27%)、总经理(18%)、其他(55%)

- 按地区划分:北美(51%)、欧洲(21%)、亚太地区(18%)、拉丁美洲(6%)、中东和非洲(4%)

本报告中提及的公司列表

- 费森尤斯医疗股份公司(德国)

- 波士顿科学公司(美国)

- 贝克顿·迪金森公司(美国)

- B.Braun Melsungen AG(德国)

- 康德乐(美国)

- 奥林巴斯株式会社(日本)

- 直觉外科(美国)

- 科乐普公司(丹麦)

- 史赛克公司(美国)

- 泰利福公司(美国)

- 康维泰克集团有限公司(英国)

- 美敦力公司(爱尔兰)

- 卡尔史托兹(德国)

- 库克医疗(美国)

- 理查德·沃尔夫有限公司(德国)

- CompactCath(美国)

- 多尼尔医疗科技(德国)

- 威领医疗(中国)

- ROCAMED(德国)

- Amniso International, Inc.(美国)

- Medispec(美国)

- Vimex Sp. z oo(波兰)

- Balton Sp. z oo(波兰)

- 亨特泌尿科(英国)

- 里贝尔国际有限公司(印度)

调查范围

本研究报告按产品类型(器械、耗材及配件)、应用领域(肾臟疾病、泌尿系统癌症、骨盆器官脱垂、良性前列腺增生、尿失禁、勃起功能障碍、尿道结石及其他应用)、医疗设备(泌尿系统、门诊手术中心及诊所、透析中心及居家医疗)及地区(北美、欧洲、亚太、医院、门诊手术中心及诊所、透析中心及家庭医疗保健)及地区(北美、欧洲、亚太、以及中东地区以及中东地区和非洲外科医疗设备市场(北美、欧洲、亚太、以及中东和非洲)。报告详细资讯阐述了影响泌尿系统医疗设备市场成长的关键因素,包括驱动因素、限制因素、成长机会和挑战。该报告还对主要产业参与企业进行了深入分析,涵盖其业务概况、解决方案及服务、关键策略、收购及合作协议。此外,报告还介绍了泌尿系统医疗设备市场的新产品发布和最新发展动态,并对泌尿系统医疗设备市场生态系统中的新兴新创Start-Ups进行了竞争分析。

购买本报告的主要益处

本报告为市场领导和新参与企业提供泌尿系统医疗设备市场及其细分市场最准确的收入规模估计值,帮助相关人员了解竞争格局,并提供洞察,以加强其市场定位和製定合适的打入市场策略。报告还概述了市场趋势,并提供了关键市场驱动因素、限制、挑战和机会的资讯。

本报告深入分析了以下内容:

- 对影响泌尿系统器材市场成长的关键市场驱动因素(泌尿泌尿系统疾病发病率上升、微创手术需求增加、技术进步和研发投入增加、医院和医疗设备中心数量增加)、限制因素(主要企业之间的高度整合)、机会(新兴经济体的潜在成长机会)和挑战(主要企业产品召回增加、泌尿系统

- 产品开发/创新:深入分析泌尿系统医疗设备市场即将出现的技术趋势、研发和新产品发表。

- 市场发展:关于盈利的市场的全面资讯-该报告分析了各个地区的泌尿系统医疗设备市场。

- 市场多元化:泌尿系统医疗设备市场的新产品、未开发地区、最新趋势和投资的全面资讯。

- 竞争评估:主要企业(如德国费森尤斯医疗股份公司、美国康德乐公司、美国波士顿科学公司、美国贝克顿·迪金森公司和美国贝朗医疗股份公司)的市场份额、成长策略和产品供应情况进行详细评估。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 影响客户业务的趋势/颠覆性因素

- 定价分析

- 价值链分析

- 供应链分析

- 生态系分析

- 投资和资金筹措方案

- 技术分析

- 专利分析

- 贸易分析

- 2025-2026 年主要会议和活动

- 监管分析

- 波特五力分析

- 主要相关人员和采购标准

- 人工智慧/生成式人工智慧对泌尿系统医疗设备市场的影响

- 2025年美国关税对泌尿系统医疗设备市场的影响

第六章泌尿系统医疗设备市场(依产品分类)

- 装置

- 耗材和配件

第七章泌尿系统医疗设备市场(依应用领域划分)

- 肾臟疾病

- 泌尿系统癌症

- 骨盆器官脱垂

- 良性摄护腺增生(BPH)

- 尿失禁(UI)

- 勃起功能障碍

- 尿道结石

- 其他的

第八章泌尿系统医疗设备市场-流行病学和盛行率分析,2023-2030 年(病例数/盛行率)

第九章泌尿系统医疗设备市场(依最终用户划分)

- 医院

- 门诊手术中心

- 诊所

- 透析中心

- 居家照护

第十章泌尿系统医疗设备市场(按地区划分)

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 印度

- 其他的

- 拉丁美洲

- 宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 中东和非洲宏观经济展望

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势,2022-2025年

- 2022-2024年收入分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- FRESENIUS MEDICAL CARE AG & CO. KGAA

- BOSTON SCIENTIFIC CORPORATION

- B. BRAUN MELSUNGEN AG

- BECTON, DICKINSON AND COMPANY

- OLYMPUS CORPORATION

- CARDINAL HEALTH

- INTUITIVE SURGICAL

- COLOPLAST A/S

- STRYKER

- TELEFLEX INCORPORATED

- CONVATEC GROUP PLC

- MEDTRONIC PLC

- 其他公司

- KARL STORZ

- COOK MEDICAL

- RICHARD WOLF GMBH

- COMPACTCATH

- DORNIER MEDTECH

- NIKKISO CO., LTD.

- DIALIFE SA

- ERBE VISION

- WELL LEAD MEDICAL CO., LTD.

- ROCAMED

- ENDOMED SYSTEMS GMBH

- AMSINO INTERNATIONAL, INC.

- MEDISPEC

- VIMEX SP. Z OO

- BALTON SP. Z OO

- HUNTER UROLOGY

- RIBBEL INTERNATIONAL LIMITED

第十三章附录

The global urology devices market is valued at an estimated USD 34.56 billion in 2025 and is projected to reach USD 46.26 billion by 2030, at a CAGR of 6.0% during the forecast period. The rising prevalence of chronic metabolic and cardiovascular diseases, including diabetes mellitus and hypertension, has significantly escalated the incidence of urological pathologies that necessitate prompt diagnostic assessment and surgical intervention.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa |

Immediate and evidence-based clinical management is essential to prevent disease progression and optimize patient outcomes. Concurrently, the accelerating adoption of minimally invasive urological techniques, encompassing robotic-assisted procedures, endoscopic interventions, and percutaneous therapies, has substantially increased the demand for precision urology devices that ensure procedural safety, diagnostic accuracy, and therapeutic efficacy.

The consumables & accessories segment is projected to register the fastest growth rate in the urology devices market, by product category, during the forecast period.

The urology devices market is bifurcated into instruments and consumables & accessories based on product. The consumables & accessories segment is expected to expand at a higher compound annual growth rate. The high growth rate of the consumables & accessories segment is due to increased research and development initiatives focused on developing innovative solutions for managing the rising prevalence of chronic urological diseases. Additionally, the growing emphasis on reusable consumables, device standardization, and procedural efficiency has increased demand for consumables across hospitals, surgical centers, and outpatient facilities globally.

The dialysis centers segment is projected to register the highest growth rate in the urology devices market.

Based on end users, the urology devices market is segmented into hospitals, ASCs, clinics, dialysis centers, and home care settings. Dialysis centers are experiencing the highest growth rate. This accelerated growth can be attributed to the substantially increased demand for advanced dialysis equipment and specialized facilities required for managing end-stage renal disease (ESRD). The rising prevalence of chronic kidney disease globally, coupled with the escalating incidence of diabetes and hypertension driving renal failure cases, has created urgent demand for more dialysis centers and upgraded facility infrastructure. Additionally, technological advancements in dialysis technology, improved treatment protocols, and growing patient awareness are collectively driving investment in new dialysis facilities and modern equipment, thereby propelling the dialysis centers segment to emerge as the fastest-growing end-user category in the global urology devices market.

Asia Pacific is expected to be the fastest-growing region in the global urology devices market.

The Asia Pacific region is projected to register the highest CAGR during the forecast period. This accelerated regional growth is propelled by multiple interconnected factors, including the substantially rising geriatric population requiring advanced urological interventions, escalating prevalence of kidney disease, significant disease burden from chronic kidney disease (CKD) affecting millions across the region, rapidly increasing healthcare spending and per capita income levels, growing consumer demand for therapeutic technologies, strategic expansion of private-sector hospital networks into underserved rural areas across Asia Pacific countries, and the presence of emerging high-growth markets with untapped potential. Additionally, improvements in healthcare accessibility, government initiatives supporting the development of healthcare infrastructure, and rising patient awareness of advanced urological treatment options are collectively positioning the Asia Pacific region as the most dynamic and fastest-growing market for urology devices globally.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- * By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (20%)

- * By Designation: C Level (27%), Director Level (18%), and Others (55%)

- * By Region: North America (51%), Europe (21%), Asia Pacific (18%), Latin America (6%), and Middle East & Africa (4%)

List of Companies Profiled in the Report

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Boston Scientific Corporation (US)

- Becton, Dickinson and Company (US)

- B. Braun Melsungen AG (Germany)

- Cardinal Health (US)

- Olympus Corporation (Japan)

- Intuitive Surgical (US)

- Coloplast A/S (Denmark)

- Stryker Corporation (US)

- Teleflex Incorporated (US)

- Convatec Group PLC (UK)

- Medtronic PLC (Ireland)

- Karl Storz (Germany)

- Cook Medical (US)

- Richard Wolf GmbH (Germany)

- CompactCath (US)

- Dornier MedTech (Germany)

- Well Lead Medical Co., Ltd. (China)

- ROCAMED (Germany)

- Amniso International, Inc. (US)

- Medispec (US)

- Vimex Sp. z o.o. (Poland)

- Balton Sp. z o.o. (Poland)

- Hunter Urology (UK)

- Ribbel International Ltd. (India)

Research Coverage

This research report categorizes the urology devices market by product (instruments and consumables & accessories), application (kidney diseases, urological cancer, pelvic organ prolapse, benign prostatic hyperplasia, urinary incontinence, erectile dysfunction, urinary stones and other applications), end user (hospitals, ASCS & clinics, dialysis centers and home care settings), and region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the urology devices market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions and services, key strategies, acquisitions, and agreements. New product launches and recent developments associated with the urology devices market. Competitive analysis of upcoming startups in the urology devices market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall urology devices market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising incidence of urological diseases, Growing preference for minimally invasive procedures, Technological advancements and increased R&D investments, Increasing number of hospitals and surgical centers) restraints (High degree of consolidation among key players), opportunities (Potential growth opportunities in emerging economies) and challenges (Increasing number of product recalls by key players, Shortage of urologists and trained professionals) influencing the growth of the urology devices market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the urology devices market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the urology devices market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the urology devices market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players, such as Fresenius Medical Care AG & Co. KGaA (Germany), Cardinal Health (US), Boston Scientific Corporation (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), among others in the urology devices market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 List of primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Revenue estimation of key players

- 2.2.1.2 Annual reports and investor presentations

- 2.2.1.3 Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 PARAMETRIC ASSUMPTIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

- 2.4.3 SCOPE-RELATED ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UROLOGY DEVICES MARKET

- 4.2 ASIA PACIFIC UROLOGY DEVICES MARKET, BY END USER AND COUNTRY

- 4.3 UROLOGY DEVICES MARKET, BY COUNTRY

- 4.4 UROLOGY DEVICES MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of urological diseases

- 5.2.1.2 Growing preference for minimally invasive procedures

- 5.2.1.3 Technological advancements and increased R&D investments

- 5.2.1.4 Increasing number of hospitals and surgical centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High degree of consolidation among key players

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing number of product recalls by key players

- 5.2.4.2 Shortage of urologists and trained professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Antimicrobial-coated catheters

- 5.9.1.2 Portable hemodialysis

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Smart catheters

- 5.9.2.2 Connected health & remote sensors

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Wearable artificial kidney

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 841920

- 5.11.2 EXPORT DATA FOR HS CODE 841920

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.1.2 Canada

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 China

- 5.13.2.3.2 Japan

- 5.13.2.3.3 India

- 5.13.2.4 Latin America

- 5.13.2.4.1 Brazil

- 5.13.2.4.2 Mexico

- 5.13.2.5 Middle East

- 5.13.2.6 Africa

- 5.13.2.1 North America

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON UROLOGY DEVICES MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 POTENTIAL OF AI

- 5.16.3 IMPACT OF AI

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI

- 5.17 IMPACT OF 2025 US TARIFF ON UROLOGY DEVICES MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Hospitals

- 5.17.5.2 Clinics

- 5.17.5.3 Ambulatory Surgical Centers (ASCs)

- 5.17.5.4 Dialysis centers

- 5.17.5.5 Home care settings

6 UROLOGY DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 INSTRUMENTS

- 6.2.1 DIALYSIS DEVICES

- 6.2.1.1 Hemodialysis devices

- 6.2.1.1.1 Increasing use of dialysis machines to spur growth

- 6.2.1.2 Peritoneal dialysis devices

- 6.2.1.2.1 Rising technological advancements and increasing product approvals to propel market

- 6.2.1.1 Hemodialysis devices

- 6.2.2 ENDOSCOPES

- 6.2.2.1 Laparoscopes

- 6.2.2.1.1 Lower surgical site infections to support growth

- 6.2.2.2 Ureteroscopes

- 6.2.2.2.1 Increased usage of ureteroscopy for kidney stones to drive market

- 6.2.2.3 Nephroscopes

- 6.2.2.3.1 High cost of maintenance to restrain market growth

- 6.2.2.4 Resectoscopes

- 6.2.2.4.1 High prevalence of prostate, kidney, and bladder cancers to fuel market

- 6.2.2.5 Cystoscopes

- 6.2.2.5.1 Growing incidence of urological cancers to boost market

- 6.2.2.1 Laparoscopes

- 6.2.3 LASER & LITHOTRIPSY DEVICES

- 6.2.3.1 Associated benefits of lithotripsy devices to support growth

- 6.2.4 ENDOVISION & IMAGING SYSTEMS

- 6.2.4.1 Need for high-resolution images to aid growth

- 6.2.5 ROBOTIC SYSTEMS

- 6.2.5.1 Growing industry-academia collaborations to fuel market

- 6.2.6 INSUFFLATORS

- 6.2.6.1 Increasing volume of laparoscopic procedures to boost market

- 6.2.7 ENDOSCOPY FLUID MANAGEMENT SYSTEMS

- 6.2.7.1 Growing incidence of chronic diseases to drive market

- 6.2.8 URODYNAMIC SYSTEMS

- 6.2.8.1 Rising patient pool to support growth

- 6.2.9 OTHER INSTRUMENTS

- 6.2.1 DIALYSIS DEVICES

- 6.3 CONSUMABLES & ACCESSORIES

- 6.3.1 DIALYSIS CONSUMABLES

- 6.3.1.1 Growing number of dialysis procedures to fuel market

- 6.3.2 CATHETERS

- 6.3.2.1 Intermittent catheters

- 6.3.2.1.1 Rising clinical adoption of intermittent catheters to support growth

- 6.3.2.2 Indwelling catheters

- 6.3.2.2.1 Increased use in hospitals and home care settings to facilitate growth

- 6.3.2.3 External catheters

- 6.3.2.3.1 Growing preference for home-based management of chronic urinary conditions to drive market

- 6.3.2.1 Intermittent catheters

- 6.3.3 GUIDEWIRES

- 6.3.3.1 Increasing number of surgeries and development of next-generation hybrid guidewires to drive market

- 6.3.4 RETRIEVAL DEVICES & EXTRACTORS

- 6.3.4.1 Growing number of kidney stone removal surgeries to fuel market

- 6.3.5 SURGICAL DISSECTORS, FORCEPS & NEEDLE HOLDERS

- 6.3.5.1 Rise in urology procedures to support growth

- 6.3.6 DILATOR SETS & URETHRAL ACCESS SHEATHS

- 6.3.6.1 Increasing demand for effective endoscopic management of ureteral and renal calculi to aid growth

- 6.3.7 STENTS & IMPLANTS

- 6.3.7.1 Growing prevalence of urological, kidney-related disorders, and erectile dysfunction to propel market

- 6.3.8 BIOPSY DEVICES

- 6.3.8.1 High incidence of prostate cancer to contribute to growth

- 6.3.9 TUBES & DISTAL ATTACHMENTS

- 6.3.9.1 Increasing demand for endoscopy to boost market

- 6.3.10 DRAINAGE BAGS

- 6.3.10.1 Increasing prevalence of urinary incontinence and chronic kidney disease to foster growth

- 6.3.11 OTHER CONSUMABLES & ACCESSORIES

- 6.3.1 DIALYSIS CONSUMABLES

7 UROLOGY DEVICE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 KIDNEY DISEASES

- 7.2.1 GROWING PREVALENCE OF DIABETES AND HYPERTENSION TO DRIVE MARKET

- 7.3 UROLOGICAL CANCER

- 7.3.1 RISING PREVALENCE OF UROLOGICAL CANCER TO CONTRIBUTE TO GROWTH

- 7.4 PELVIC ORGAN PROLAPSE

- 7.4.1 HIGH COSTS INVOLVED IN SURGERIES & HIGH REOCCURRENCE RATES TO RESTRAIN GROWTH

- 7.5 BENIGN PROSTATIC HYPERPLASIA (BPH)

- 7.5.1 INCREASING ELDERLY POPULATION TO AID GROWTH

- 7.6 URINARY INCONTINENCE (UI)

- 7.6.1 NEED FOR PROPER DIAGNOSIS AND TREATMENT TO SUPPORT GROWTH

- 7.7 ERECTILE DYSFUNCTION

- 7.7.1 INCREASING PREVALENCE OF PROSTATE CANCER TO AID GROWTH

- 7.8 URINARY STONES

- 7.8.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES TO FUEL MARKET

- 7.9 OTHER APPLICATIONS

8 UROLOGY DEVICES MARKET - EPIDEMIOLOGY AND PREVALENCE ANALYSIS, 2023-2030 (NO. OF CASES/PREVALENCE)

9 UROLOGY DEVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 INCREASING NUMBER OF HOSPITALS IN EMERGING ECONOMIES TO EXPEDITE GROWTH

- 9.3 AMBULATORY SURGERY CENTERS

- 9.3.1 LOWER COST AND SHORTER PATIENT STAYS TO PROMOTE GROWTH

- 9.4 CLINICS

- 9.4.1 GROWING INTEGRATION OF ADVANCED TECHNOLOGY IN UROLOGY CLINICS TO PROPEL MARKET

- 9.5 DIALYSIS CENTERS

- 9.5.1 RISING DEMAND FOR ADVANCED DIALYSIS AND END-STAGE RENAL DISEASE TREATMENTS TO AID GROWTH

- 9.6 HOME CARE SETTINGS

- 9.6.1 LOWER COST AND SHORTER HOSPITAL STAYS TO BOOST MARKET

10 UROLOGY DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Presence of large dialysis patient base and robust infrastructure to promote growth

- 10.2.3 CANADA

- 10.2.3.1 Increasing focus on preventing target diseases to expedite growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Presence of major urology device manufacturers to contribute to growth

- 10.3.3 UK

- 10.3.3.1 Rising incidence of kidney conditions to bolster growth

- 10.3.4 FRANCE

- 10.3.4.1 Favorable government initiatives and shifting demographic trends to aid growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing cases of chronic diseases to spur growth

- 10.3.6 SPAIN

- 10.3.6.1 Rising geriatric population to accelerate growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Rising incidence of target health conditions and decreasing mortality rate to facilitate growth

- 10.4.3 JAPAN

- 10.4.3.1 Large geriatric population and established healthcare system to support growth

- 10.4.4 INDIA

- 10.4.4.1 Large patient pool and rapidly growing healthcare sector to drive market

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Rising cases of metabolic diseases to support growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing prevalence of diabetes and kidney disorders to expedite growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 BOSTON SCIENTIFIC CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 B. BRAUN MELSUNGEN AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BECTON, DICKINSON AND COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 OLYMPUS CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.6 CARDINAL HEALTH

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 INTUITIVE SURGICAL

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.8 COLOPLAST A/S

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.9 STRYKER

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.10 TELEFLEX INCORPORATED

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.11 CONVATEC GROUP PLC

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 MEDTRONIC PLC

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Expansions

- 12.1.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

- 12.2 OTHER PLAYERS

- 12.2.1 KARL STORZ

- 12.2.2 COOK MEDICAL

- 12.2.3 RICHARD WOLF GMBH

- 12.2.4 COMPACTCATH

- 12.2.5 DORNIER MEDTECH

- 12.2.6 NIKKISO CO., LTD.

- 12.2.7 DIALIFE SA

- 12.2.8 ERBE VISION

- 12.2.9 WELL LEAD MEDICAL CO., LTD.

- 12.2.10 ROCAMED

- 12.2.11 ENDOMED SYSTEMS GMBH

- 12.2.12 AMSINO INTERNATIONAL, INC.

- 12.2.13 MEDISPEC

- 12.2.14 VIMEX SP. Z O. O.

- 12.2.15 BALTON SP. Z O.O.

- 12.2.16 HUNTER UROLOGY

- 12.2.17 RIBBEL INTERNATIONAL LIMITED

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 UROLOGY DEVICES MARKET: SCOPE-RELATED ASSUMPTIONS

- TABLE 2 UROLOGY DEVICES MARKET: RISK ANALYSIS

- TABLE 3 GLOBAL INCIDENCE OF UROLOGICAL CANCER, 2022

- TABLE 4 LIST OF PRODUCT RECALLS BY KEY PLAYERS, 2022-2023

- TABLE 5 AVERAGE SELLING PRICING TREND OF UROLOGY DEVICES, BY TYPE, 2023-2025 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF UROLOGY DEVICES, BY KEY PLAYER, 2023-2025 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF UROLOGY DEVICES PRODUCTS, BY REGION, 2023-2025 (USD)

- TABLE 8 UROLOGY DEVICES MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 9 KEY PATENTS IN UROLOGY DEVICES MARKET, 2022-2025

- TABLE 10 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 UROLOGY DEVICES MARKET: KEY CONFERENCES AND EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 UROLOGY DEVICES MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 KEY COMPANIES IMPLEMENTING AI IN UROLOGY DEVICES MARKET

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 23 UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 25 UROLOGY DEVICES MARKET FOR DIALYSIS DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 UROLOGY DEVICES MARKET FOR DIALYSIS DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 UROLOGY DEVICES MARKET FOR HEMODIALYSIS DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 UROLOGY DEVICES MARKET FOR PERITONEAL DIALYSIS DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 UROLOGY DEVICES MARKET FOR ENDOSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 UROLOGY DEVICES MARKET FOR ENDOSCOPES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 31 UROLOGY DEVICES MARKET FOR LAPAROSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 UROLOGY DEVICES MARKET FOR URETEROSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 UROLOGY DEVICES MARKET FOR NEPHROSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 UROLOGY DEVICES MARKET FOR RESECTOSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 UROLOGY DEVICES MARKET FOR CYSTOSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 UROLOGY DEVICES MARKET FOR LASER & LITHOTRIPSY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 UROLOGY DEVICES MARKET FOR ENDOVISION & IMAGING SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 UROLOGY DEVICES MARKET FOR ROBOTIC SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 UROLOGY DEVICES MARKET FOR INSUFFLATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 UROLOGY DEVICES MARKET FOR ENDOSCOPY FLUID MANAGEMENT SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 UROLOGY DEVICES MARKET FOR URODYNAMIC SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 UROLOGY DEVICES MARKET FOR OTHER INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 45 UROLOGY DEVICES MARKET FOR DIALYSIS CONSUMABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 UROLOGY DEVICES MARKET FOR CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 UROLOGY DEVICES MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 48 UROLOGY DEVICES MARKET FOR INTERMITTENT CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 UROLOGY DEVICES MARKET FOR INDWELLING CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 UROLOGY DEVICES MARKET FOR EXTERNAL CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 UROLOGY DEVICES MARKET FOR GUIDEWIRES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 UROLOGY DEVICES MARKET FOR RETRIEVAL DEVICES & EXTRACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 UROLOGY DEVICES MARKET FOR SURGICAL DISSECTORS, FORCEPS & NEEDLE HOLDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 UROLOGY DEVICES MARKET FOR DILATOR SETS & URETHRAL ACCESS SHEATHS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 UROLOGY DEVICES MARKET FOR STENTS & IMPLANTS, BY REGION, 2023-2030 (USD MILLION

- TABLE 56 UROLOGY DEVICES MARKET FOR BIOPSY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 UROLOGY DEVICES MARKET FOR TUBES & DISTAL ATTACHMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 UROLOGY DEVICES MARKET FOR DRAINAGE BAGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 UROLOGY DEVICES MARKET FOR OTHER CONSUMABLES & ACCESSORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 61 UROLOGY DEVICES MARKET FOR KIDNEY DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 UROLOGY DEVICES MARKET FOR UROLOGICAL CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 UROLOGY DEVICES MARKET FOR PELVIC ORGAN PROLAPSE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 UROLOGY DEVICES MARKET FOR BENIGN PROSTATIC HYPERPLASIA (BPH), BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 UROLOGY DEVICES MARKET FOR BENIGN URINARY INCONTINENCE (UI), BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 UROLOGY DEVICES MARKET FOR ERECTILE DYSFUNCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 UROLOGY DEVICES MARKET FOR URINARY STONES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 UROLOGY DEVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 UROLOGY DEVICES MARKET: PREVALENCE OF EPIDEMIOLOGY, BY APPLICATION, 2023-2030

- TABLE 70 UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 UROLOGY DEVICES MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 UROLOGY DEVICES MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 UROLOGY DEVICES MARKET FOR CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 UROLOGY DEVICES MARKET FOR DIALYSIS CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 UROLOGY DEVICES MARKET FOR HOME CARE SETTINGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 UROLOGY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 78 NORTH AMERICA: UROLOGY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 US: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 83 US: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 US: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 US: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 US: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 CANADA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 88 CANADA: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 CANADA: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 CANADA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 CANADA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 93 EUROPE: UROLOGY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 101 GERMANY: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 UK: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 103 UK: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 UK: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 UK: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 106 UK: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 FRANCE: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 FRANCE: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 111 FRANCE: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 SPAIN: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SPAIN: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 SPAIN: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 128 ASIA PACIFIC: UROLOGY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 132 CHINA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 133 CHINA: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 CHINA: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CHINA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 CHINA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 JAPAN: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 138 JAPAN: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 JAPAN: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 JAPAN: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 JAPAN: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 INDIA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 INDIA: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 INDIA: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 INDIA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 INDIA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 153 LATIN AMERICA: UROLOGY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 155 LATIN AMERICA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 158 BRAZIL: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 BRAZIL: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 BRAZIL: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 BRAZIL: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 162 MEXICO: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 163 MEXICO: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 MEXICO: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 MEXICO: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 166 MEXICO: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: UROLOGY DEVICES MARKET FOR INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: UROLOGY DEVICES MARKET FOR CONSUMABLES & ACCESSORIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 173 MIDDLE EAST & AFRICA: UROLOGY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: UROLOGY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: UROLOGY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 176 UROLOGY DEVICES MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 177 UROLOGY DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 178 UROLOGY DEVICES MARKET: REGION FOOTPRINT

- TABLE 179 UROLOGY DEVICES MARKET: PRODUCT FOOTPRINT

- TABLE 180 UROLOGY DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 181 UROLOGY DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 182 UROLOGY DEVICES MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 183 UROLOGY DEVICES MARKET: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 184 UROLOGY DEVICES MARKET: EXPANSIONS, JANUARY 2022-NOVEMBER 2025

- TABLE 185 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 186 FRESENIUS MEDICAL CARE AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 187 FRESENIUS MEDICAL CARE AG & CO. KGAA: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 188 FRESENIUS MEDICAL CARE AG & CO. KGAA: EXPANSIONS, JANUARY 2022-NOVEMBER 2025

- TABLE 189 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 190 BOSON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 191 BOSON SCIENTIFIC CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 192 BOSON SCIENTIFIC CORPORATION: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 193 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

- TABLE 194 B. BRAUN MELSUNGEN AG: PRODUCTS OFFERED

- TABLE 195 B. BRAUN MELSUNGEN AG: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 196 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 197 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 198 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 199 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 200 OLYMPUS CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 201 OLYMPUS CORPORATION: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 202 OLYMPUS CORPORATION: EXPANSIONS, JANUARY 2022-NOVEMBER 2025

- TABLE 203 CARDINAL HEALTH: COMPANY OVERVIEW

- TABLE 204 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 205 CARDINAL HEALTH: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 206 INTUITIVE SURGICAL: COMPANY OVERVIEW

- TABLE 207 INTUITIVE SURGICAL: PRODUCTS OFFERED

- TABLE 208 INTUITIVE SURGICAL: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 209 COLOPLAST A/S: COMPANY OVERVIEW

- TABLE 210 COLOPLAST A/S: PRODUCTS OFFERED

- TABLE 211 COLOPLAST A/S: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 212 STRYKER: COMPANY OVERVIEW

- TABLE 213 STRYKER: PRODUCTS OFFERED

- TABLE 214 STRYKER: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 215 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 216 TELEFLEX INCORPORATED: PRODUCTS OFFERED

- TABLE 217 TELEFLEX INCORPORATED: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-NOVEMBER 2025

- TABLE 218 CONVATEC GROUP PLC: COMPANY OVERVIEW

- TABLE 219 CONVATEC GROUP PLC: PRODUCTS OFFERED

- TABLE 220 MEDTRONIC PLC: COMPANY OVERVIEW

- TABLE 221 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 222 MEDTRONIC PLC: EXPANSIONS, JANUARY 2022-NOVEMBER 2025

- TABLE 223 KARL STORZ: COMPANY OVERVIEW

- TABLE 224 COOK MEDICAL: COMPANY OVERVIEW

- TABLE 225 RICHARD WOLF GMBH: COMPANY OVERVIEW

- TABLE 226 COMPACTCATH: COMPANY OVERVIEW

- TABLE 227 DORNIER MEDTECH: COMPANY OVERVIEW

- TABLE 228 NIKKISO CO., LTD.: COMPANY OVERVIEW

- TABLE 229 DIALIFE SA: COMPANY OVERVIEW

- TABLE 230 ERBE VISION: COMPANY OVERVIEW

- TABLE 231 WELL LEAD MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 232 ROCAMED: COMPANY OVERVIEW

- TABLE 233 ENDOMED SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 234 AMSINO INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 235 MEDISPEC: COMPANY OVERVIEW

- TABLE 236 VIMEX SP. Z O.O.: COMPANY OVERVIEW

- TABLE 237 BALTON SP. Z O.O.: COMPANY OVERVIEW

- TABLE 238 HUNTER UROLOGY: COMPANY OVERVIEW

- TABLE 239 RIBBEL INTERNATIONAL LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 UROLOGY DEVICES MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 UROLOGY DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 UROLOGY DEVICES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 LIST OF PRIMARY SOURCES IN UROLOGY DEVICES MARKET

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 UROLOGY DEVICES MARKET: KEY INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 7 REVENUE ESTIMATION OF KEY PLAYERS IN UROLOGY DEVICES MARKET

- FIGURE 8 UROLOGY DEVICES MARKET: CAGR PROJECTIONS

- FIGURE 9 UROLOGY DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 10 UROLOGY DEVICES MARKET: DATA TRIANGULATION

- FIGURE 11 UROLOGY DEVICES MARKET: PARAMETRIC ASSUMPTIONS

- FIGURE 12 UROLOGY DEVICES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 UROLOGY DEVICES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 UROLOGY DEVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF UROLOGY DEVICES MARKET

- FIGURE 16 GROWING PREVALENCE OF UROLOGICAL DISEASES AND PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES TO DRIVE MARKET

- FIGURE 17 HOSPITALS SEGMENT AND CHINA LED ASIA PACIFIC MARKET IN 2024

- FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 UROLOGY DEVICES MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 CANADA: NUMBER OF TOTAL INCIDENTS OF END-STAGE RENAL DISEASE PATIENTS, BY AGE GROUP, 2022

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS IN UROLOGY DEVICES MARKET

- FIGURE 23 UROLOGY DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 UROLOGY DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 UROLOGY DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 UROLOGY DEVICES MARKET: FUNDING AND NUMBER OF DEALS, 2020-2025 (USD MILLION)

- FIGURE 27 UROLOGY DEVICES MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 28 UROLOGY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 31 IMPACT OF AI ON UROLOGY DEVICES MARKET

- FIGURE 32 NORTH AMERICA: UROLOGY DEVICES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: UROLOGY DEVICES MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 36 US: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 38 EV/EBITDA OF KEY VENDORS

- FIGURE 39 UROLOGY DEVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 UROLOGY DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 UROLOGY DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 42 UROLOGY DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 44 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 45 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2024)

- FIGURE 46 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 47 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 48 CARDINAL HEALTH: COMPANY SNAPSHOT (2024)

- FIGURE 49 INTUITIVE SURGICAL: COMPANY SNAPSHOT (2024)

- FIGURE 50 COLOPLAST A/S: COMPANY SNAPSHOT (2024)

- FIGURE 51 STRYKER: COMPANY SNAPSHOT (2024)

- FIGURE 52 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2024)

- FIGURE 53 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 54 MEDTRONIC PLC: COMPANY SNAPSHOT (2024)