|

市场调查报告书

商品编码

1928852

全球蛋白质及蛋白质晶体市场按产品类型、应用、最终用户及地区划分-预测至2030年Proteins & Protein Crystals Market by Product Type, Structural, Specialty, Application, End User - Global Forecast to 2030 |

||||||

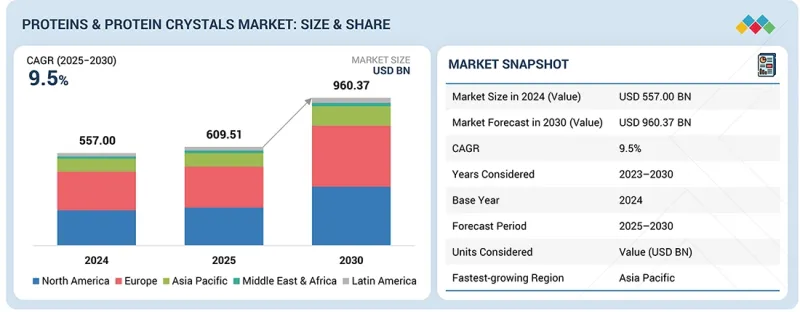

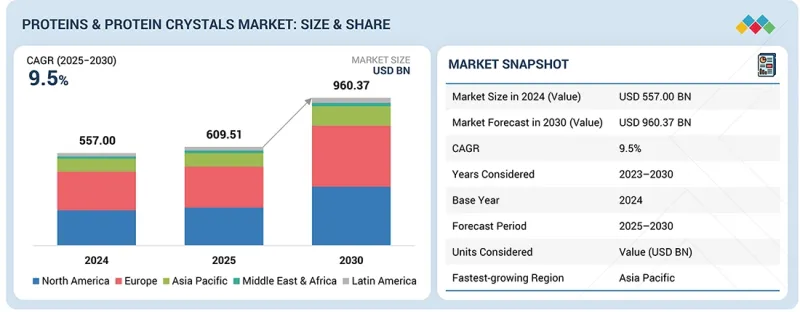

全球蛋白质和蛋白质晶体市场预计到 2030 年将达到 9,603.7 亿美元,高于 2025 年的 6,095.1 亿美元。

预计2025年至2030年的年复合成长率(CAGR)为9.5%。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 金额(十亿美元) |

| 部分 | 按产品类型、应用程式、最终用户和地区划分 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

蛋白质及蛋白质晶体市场的主要驱动力来自生物製药需求的成长、结构生物学和药物研发的不断深入,以及蛋白质在诊断、治疗和工业应用上日益广泛的用途。酶蛋白因其在治疗药物、工业生物催化和高通量筛检等领域的广泛应用而占据市场主导地位。同时,重组蛋白和单株蛋白凭藉其特异性和可扩展性,正在推动药物开发和个人化医疗领域的需求。

此外,蛋白质结晶试剂盒、试剂和用于结构分析的自动化结晶平台的日益普及也推动了市场的发展。研究人员和製药公司越来越依赖这些产品来阐明蛋白质结构、加速药物发现过程并简化基于酵素的工业流程。

按产品类型划分,结构蛋白细分市场预计将在蛋白质和蛋白质晶体市场中占据最高的复合年增长率 (CAGR)。结构蛋白细分市场在蛋白质和蛋白质晶体市场中的成长受到研究、医疗和工业应用等多个因素的驱动。肌动蛋白和微管蛋白等研究蛋白在结构生物学、高通量晶体学和药物研发领域需求旺盛,可用于精确测定蛋白质结构和进行合理药物研发。膜蛋白作为生物製药和精准医疗开发中的重要治疗标靶,正日益受到关注。胶原蛋白、弹性蛋白、层粘连蛋白和蛋白聚醣等结缔组织和细胞外基质蛋白则推动了生物材料、组织工程、再生医学以及化妆品和保健产品领域的需求。

由于对治疗性蛋白质、单株抗体、疫苗和诊断酶的需求不断增长,预计医疗应用领域将成为蛋白质和蛋白质晶体市场中复合年增长率最高的领域。慢性病、癌症和代谢紊乱的日益普遍推动了生物製药的开发和应用,而结构生物学和蛋白质晶体学的进步则加速了药物发现和标靶治疗。生物製药研发、临床研究和高通量蛋白质分析领域的投资增加,推动了蛋白质晶体及相关产品在医疗领域的应用,其成长速度超过了工业、食品和科研应用领域。治疗性和结构性蛋白质在生物製药开发中的应用日益广泛,而遗传性疾病和慢性病发病率的上升则推动了对基于蛋白质的治疗方法的需求。蛋白质晶体学的进步使得基于结构的精准药物发现成为可能,推动了生物製药领域的创新。临床应用范围的扩大和研发投入的增加也促进了该市场的成长。

亚太地区预计将成为蛋白质及蛋白质晶体市场复合年增长率最高的地区,这主要得益于医疗保健、科学研究及其他应用领域的强劲成长。在医疗保健领域,生物製药研发的增加、慢性病盛行率的上升以及个人化医疗的普及,推动了对治疗性蛋白质、单株抗体和蛋白质诊断试剂的需求。在科研和学术领域,生命科学基础设施的扩建、合约研究组织(CRO)数量的增长以及结构生物学倡议的开展,推动了蛋白质结晶试剂盒和试剂的使用。其他应用领域也促进了市场成长。在农业和动物健康领域,蛋白质和酵素被用于饲料添加剂、疫苗和疾病管理。在化妆品领域,胶原蛋白和弹性蛋白等结构蛋白被用于抗衰老和护肤产品。在生质能源,酵素能够促进生物质转化和生质燃料生产。来自医疗保健、科学研究、农业、动物健康、化妆品和生质能源等领域的综合需求,正在推动亚太地区市场的快速成长。

市场的主要企业包括丹纳赫(美国)、赛默飞世尔科技(美国)、赛诺菲(法国)、安捷伦(美国)、武田药品工业株式会社(日本)、国际香料香精公司(美国)、百康(印度)、瑞生生物科技(美国)、默克集团(美国)、赛诺菲(法国)、安捷伦(美国)、武田药品工业株式会社(日本)、国际香料香精公司(美国)、百康(印度)、瑞生生物科技(美国)、默克集团(德国)、安进(美国)、礼来(美国)、罗氏(瑞士)、诺和诺德(丹麦)和辉瑞(美国)。

调查范围

蛋白质及蛋白质晶体市场按产品类型、应用、最终用户和地区进行细分。影响市场成长的关键因素包括相关人员的驱动因素、限制因素、机会和挑战。该报告也回顾了蛋白质及蛋白质晶体市场的主要企业。透过微观层面的分析,可以检验市场趋势、成长机会和市场贡献。报告也重点介绍了五个主要地区各个细分市场的潜在收入成长机会。

购买本报告的主要益处

本报告对蛋白质及蛋白质晶体市场的新进业者极具价值,因为它提供了全面的市场资讯。这些资讯对于了解各种投资机会至关重要。报告深入分析了市场中的主要企业参与者和小型企业,有助于在进行投资决策时建立坚实的风险分析基础。依最终用户和地区进行的精准市场细分,能够提供针对特定细分市场的深入见解。此外,详尽的分析突显了关键趋势、挑战、驱动因素和成长机会,从而为策略决策提供支援。

本报告深入分析了以下内容:

- 关键驱动因素(对治疗性蛋白质的需求不断增长、蛋白质结晶和结构生物学的进步以及在食品加工和工业生物技术领域不断扩大的应用)、阻碍因素(生产和纯化成本高、蛋白质产品的稳定性和保质期有限)、机会(人工智能和自动化在蛋白质晶体学中的兴起、混合和 3D 打印技术的整合、产晶技术的整合(可重复分析)

- 产品开发/创新:蛋白质和蛋白质晶体市场的新兴技术、研发、近期产品发布和核准情况。

- 市场成长:对各个地区的蛋白质和蛋白质晶体市场进行分析,并提供一份关于这个盈利的市场的详细分析报告。

- 市场多元化:深入分析蛋白质和蛋白质晶体市场的新产品、前沿领域、最新趋势和投资。

- 竞争评估:主要企业(丹纳赫(美国)、赛默飞世尔科技公司(美国)、罗氏公司(瑞士)、罗氏有限公司(德国)、安进公司(美国)、默克集团(德国)等)的市场份额、服务产品和关键策略进行详细评估。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 未满足的需求

- 相互关联的市场与跨产业机会

- 1/2/3级玩家的策略倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 供应链分析

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 2025-2026 年主要会议和活动

- 影响客户业务的趋势/颠覆性因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税对蛋白质和蛋白质晶体市场的影响

第六章:科技、专利、数位化和人工智慧应用带来的策略颠覆

- 关键新兴技术

- 互补技术

- 专利分析

- 人工智慧/生成式人工智慧对蛋白质和蛋白质晶体市场的影响

- 成功案例和实际应用

- 监管状态

- 业界标准

- 认证、标籤和环境标准

- 客户状况与购买行为

- 主要相关人员和采购标准

- 招募障碍和内部挑战

- 来自各个终端使用者产业的未满足需求

7. 按产品类型分類的蛋白质和蛋白质晶体市场

- 酵素蛋白

- 治疗性蛋白质

- 结构蛋白

- 特殊蛋白质

8. 按应用分類的蛋白质和蛋白质晶体市场

- 卫生保健

- 组织工程

- 农业和动物营养

- 工业加工

- 生质能源与环境

- 化妆品和营养补充剂

- 其他的

9. 按最终用户分類的蛋白质和蛋白质晶体市场

- 製药业

- 生技产业

- 研究、学术和跨领域

- 食品饮料业

- 其他的

第十章:各地区蛋白质及蛋白质结晶市场

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他的

- 拉丁美洲

- 巴西

- 墨西哥

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 其他的

第十一章 竞争格局

- 主要参与企业的策略/优势

- 2021-2024年收入分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 主要参与企业

- DANAHER CORPORATION

- RAYBIOTECH, INC.

- MERCK & CO., INC.

- AMGEN INC.

- ELI LILLY AND COMPANY

- F. HOFFMANN-LA ROCHE LTD.

- NOVO NORDISK A/S

- PFIZER INC.

- THERMO FISHER SCIENTIFIC INC.

- SANOFI

- AGILENT TECHNOLOGIES, INC.

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- INTERNATIONAL FLAVOURS & FRAGRANCES INC.(IFF)

- BIOCON

- 其他公司

- AMANO ENZYME INC.

- ULTREZE ENZYMES

- NEOGEN

- BIOLAXI ENZYMES PVT. LTD.

- GENSCRIPT

- BIOSEUTICA

- KERRY GROUP PLC

- ASSOCIATED BRITISH FOODS PLC

- K-GENIX GROUP

- NAGASE & CO., LTD.

- GRIFOLS, SA

- BASF

- BIO-CAT

- AMCO PROTEINS

- PROTALIX BIOTHERAPEUTICS

第十三章调查方法

第十四章附录

The global protein and protein crystals market is projected to reach USD 960.37 billion by 2030 from USD 609.51 billion in 2025, at a CAGR of 9.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The protein and protein crystals market is primarily driven by the growing demand for biopharmaceuticals, increasing R&D in structural biology and drug discovery, and the rising use of proteins in diagnostics, therapeutics, and industrial applications. Enzymatic proteins lead the market due to their wide use in therapeutics, industrial biocatalysis, and high-throughput screening, while recombinant and monoclonal proteins drive demand in drug development and personalized medicine because of their specificity and scalability.

Additionally, the growing adoption of protein crystallization kits, reagents, and automated crystallization platforms for structural studies further fuels the market, as researchers and pharmaceutical companies increasingly rely on these products to determine protein structures, accelerate drug design, and enhance enzyme-based industrial processes.

By product type, the structural proteins segment is expected to register the highest CAGR during the forecast period.

By product type, the structural proteins segment is expected to account for the highest CAGR in the protein and protein crystals market. The growth of the structural proteins segment in the protein and protein crystals market is driven by multiple factors across research, healthcare, and industrial applications. Research proteins such as actin and tubulin are in high demand for structural biology, high-throughput crystallography, and drug discovery, enabling precise protein structure determination and rational drug design. Membrane proteins are increasingly sought after as critical therapeutic targets in the development of biologics and precision medicine. Connective tissue and extracellular matrix proteins, including collagen, elastin, laminins, and proteoglycans, are fueling demand in biomaterials, tissue engineering, and regenerative medicine, as well as in cosmetic and healthcare products.

By application, the healthcare segment accounted for the highest CAGR of the market in 2024.

The healthcare application segment is expected to register the highest CAGR in the proteins and protein crystals market due to the increasing demand for therapeutic proteins, monoclonal antibodies, vaccines, and diagnostic enzymes. Growing prevalence of chronic diseases, cancer, and metabolic disorders is driving the development and use of protein-based biologics, while advances in structural biology and protein crystallography are accelerating drug discovery and targeted therapy. Rising investments in biopharmaceutical R&D, clinical research, and high-throughput protein analysis are fueling the adoption of protein crystals and related products in healthcare, making this segment the fastest-growing compared with industrial, food, and research applications. as therapeutic and structural proteins are increasingly being used in biologics development. The rising incidence of hereditary and chronic diseases is driving the need for protein-based treatments. Precise structure-based drug design is made possible by developments in protein crystallography, which drives biopharmaceutical innovation. Expanding clinical applications and higher R&D expenditures also contribute to this market's growth.

Asia Pacific is expected to register the highest growth rate in the market during the forecast period.

The Asia-Pacific region is expected to register the highest CAGR in the protein and protein crystals market due to strong growth across healthcare, research, and other applications. In healthcare, increasing biopharmaceutical R&D, rising prevalence of chronic diseases, and adoption of personalized medicine are driving demand for therapeutic proteins, monoclonal antibodies, and protein-based diagnostics. In research and academia, expanding life sciences infrastructure, CROs, and structural biology initiatives boost the use of protein crystallization kits and reagents. Other applications are contributing to market growth, in agriculture and animal health, proteins and enzymes are used for feed additives, vaccines, and disease management; in cosmetics, structural proteins like collagen and elastin are applied in anti-aging and skincare products; and in bioenergy, enzymes facilitate biomass conversion and biofuel production. The combined demand across healthcare, research, agriculture, animal health, cosmetics, and bioenergy is fueling rapid market growth in Asia-Pacific.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

The prominent players in this market are Danaher (US), Thermo Fischer Scientific inc. (US), Sanofi (France), Agilent (US), Takeda Pharmaceutical Company (Japan), International Flavours and Fragrances (US), Biocon (India), RayBiotech (US), Merck KGaA (Germany), Amgen (US), Eli lilly (US), Roche (Switzerland), Novo Nordisk (Denmark), and Pfizer (US), among others.

Research Coverage

The protein and protein crystals market is segmented by product type, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the Protein and Pprotein Ccrystals market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the protein and protein crystals market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report provides insights into both key and smaller players in the market, which can help create a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following points:

- Key drivers (Rising demand for therapeutic proteins, Advancements in protein crystallization and structural biology, increasing applications in food processing and industrial biotechnology), restraints (High production and purification costs, Limited stability and storage of protein-based products), opportunities (Emergence of AI and automation in protein crystallography, Integration of hybrid and 3D printing technologies, Collaborations between academia and industry), and challenges (reproducibility issues in protein crystallization, Competition from alternative analytical techniques)

- Product Development/Innovation: Emerging technologies in space, R&D, recent product launches & approvals in the protein and protein crystals market.

- Market Growth: In-depth insights into remunerative markets report analyze the protein and protein crystals market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the protein and protein crystals market

- Competitive Assessment: Detailed assessment of market share, service offerings, leading strategies of major players such as Danaher (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La F. Hoffmann-La Roche AG (Switzerland), Roche Ltd (Germany), Amgen (US) and Merck KGaA (Germany), among others..

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS & KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PROTEINS & PROTEIN CRYSTALS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 PROTEINS & PROTEIN CRYSTALS MARKET OVERVIEW

- 3.2 VALUE CHAIN ANALYSIS OF PROTEINS & PROTEIN CRYSTALS MARKET

- 3.3 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION AND END USER, 2025

- 3.4 GEOGRAPHIC SNAPSHOT OF PROTEINS & PROTEIN CRYSTALS MARKET

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing emphasis on structure-based drug discovery and development

- 4.2.1.2 Rising demand for protein-based drug development

- 4.2.1.3 Increasing demand for therapeutic proteins

- 4.2.1.4 Technological advancements in crystallization methods

- 4.2.2 RESTRAINTS

- 4.2.2.1 High technical complexity and low success rates in protein crystallization

- 4.2.2.2 Exposure to ionizing radiation and contrast-related concerns among vulnerable populations

- 4.2.2.3 Need for high costs, technical expertise, and advanced infrastructure for commercialization

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of AI-enabled innovations

- 4.2.3.2 Collaboration between academia and industry

- 4.2.3.3 High investment and funding in structural biology, biopharmaceuticals, and advanced drug development

- 4.2.4 CHALLENGES

- 4.2.4.1 Reproducibility issues in protein crystallization

- 4.2.4.2 Scalability concerns in recombinant protein production

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF BUYERS

- 5.1.2 BARGAINING POWER OF SUPPLIERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 GDP TRENDS & FORECAST

- 5.2.2 TRENDS IN GLOBAL ENVIRONMENTAL INDUSTRY

- 5.2.3 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.3.3 END USERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 MANUFACTURING

- 5.4.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF PROTEINS & PROTEIN CRYSTALS, BY PRODUCT, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF PROTEINS & PROTEIN CRYSTALS, BY REGION, 2022-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 3507, 2021-2024

- 5.7.2 EXPORT DATA FOR HS CODE 3507, 2021-2024

- 5.7.3 TRADE ANALYSIS FOR HS CODE 293719

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.10 INVESTMENT & FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 COMPUTATIONAL DESIGN OF HIGH-AFFINITY MINIBINDER PROTEINS FOR THERAPEUTIC TARGETS

- 5.12 IMPACT OF 2025 US TARIFF ON PROTEINS & PROTEIN CRYSTALS MARKET

- 5.12.1 KEY TARIFF RATES

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 North America

- 5.12.4.1.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.4.1 North America

- 5.12.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CRYO-CRYSTALLIZATION

- 6.1.2 X-RAY FREE-ELECTRON LASERS (XFELS)

- 6.1.3 COMPUTATIONAL PROTEIN DESIGN TOOLS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MICROFLUIDICS AND LAB-ON-A-CHIP (LOC) TECHNOLOGIES

- 6.2.2 NUCLEAR MAGNETIC RESONANCE (NMR) SPECTROSCOPY

- 6.3 PATENT ANALYSIS

- 6.4 IMPACT OF AI/GEN AI ON PROTEINS & PROTEIN CRYSTALS MARKET

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES IN PROTEINS & PROTEIN CRYSTALS MARKET

- 6.4.3 CASE STUDIES

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENT'S READINESS TO ADOPT GEN AI IN PROTEINS & PROTEIN CRYSTALS MARKET

- 6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6 REGULATORY LANDSCAPE

- 6.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7 INDUSTRY STANDARDS

- 6.8 CERTIFICATIONS, LABELLING, AND ECO-STANDARDS

- 6.8.1 CERTIFICATIONS & GOOD MANUFACTURING/QUALITY STANDARDS

- 6.8.2 LABELLING & TRACEABILITY

- 6.8.3 ECO-STANDARDS/ENVIRONMENTAL/SUSTAINABILITY CERTIFICATION

- 6.9 CUSTOMER LANDSCAPE & BUYER BEHAVIOUR

- 6.9.1 DECISION-MAKING PROCESS

- 6.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.10.2 KEY BUYING CRITERIA

- 6.11 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 6.12 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

7 PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 ENZYMATIC PROTEINS

- 7.2.1 INDUSTRIAL ENZYMES

- 7.2.1.1 Focus on green manufacturing and sustainable solutions to aid adoption

- 7.2.2 FOOD ENZYMES

- 7.2.2.1 Expansion of food-based technologies to propel market growth

- 7.2.1 INDUSTRIAL ENZYMES

- 7.3 THERAPEUTIC PROTEINS

- 7.3.1 MONOCLONAL ANTIBODIES

- 7.3.1.1 Advancing disease targeting and treatment through monoclonal antibody technologies to spur adoption

- 7.3.2 INSULIN

- 7.3.2.1 Strengthening investment scenario for insulin development to fuel market growth

- 7.3.3 HORMONES

- 7.3.3.1 Introduction of new drugs and therapies for hormonal diseases to propel segment growth

- 7.3.4 COAGULATION FACTORS

- 7.3.4.1 Enhanced hemostasis therapies through advanced coagulation protein technologies to augment market growth

- 7.3.1 MONOCLONAL ANTIBODIES

- 7.4 STRUCTURAL PROTEINS

- 7.4.1 RESEARCH PROTEINS

- 7.4.1.1 Research proteins to empower drug discovery and molecular research with AI integration

- 7.4.2 STRUCTURAL PROTEINS

- 7.4.2.1 Advancements in structural protein through collagen and connective tissue insights to fuel market growth

- 7.4.1 RESEARCH PROTEINS

- 7.5 SPECIALTY PROTEINS

- 7.5.1 INDUSTRIAL PROTEINS

- 7.5.1.1 Industrial proteins to optimize industrial processes through advanced protein technologies

- 7.5.2 NUTRITIONAL PROTEINS

- 7.5.2.1 Nutritional proteins to enable evidence-based, disease-specific nutrition for complementing pharmaceutical therapies

- 7.5.3 ANALYTICAL PROTEINS

- 7.5.3.1 Analytical proteins to support quality control and scientific discovery

- 7.5.4 COSMECEUTICAL PROTEINS

- 7.5.4.1 Focus on innovative personal care products to support segment growth

- 7.5.5 FUNTIONAL FOOD PROTEINS

- 7.5.5.1 Functional foods & beverages with advanced proteins to improve digestibility of nutritional profile

- 7.5.1 INDUSTRIAL PROTEINS

8 PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE

- 8.2.1 ADVANCEMENTS IN PROTEIN ENGINEERING, STRUCTURAL BIOLOGY, AND HIGH-THROUGHPUT CRYSTALLIZATION TO SPUR MARKET

- 8.3 TISSUE ENGINEERING

- 8.3.1 DEVELOPMENT OF ADVANCED REGENERATIVE MEDICINE THROUGH PROTEIN-BASED TISSUE ENGINEERING TO AID MARKET GROWTH

- 8.4 AGRICULTURE & ANIMAL NUTRITION

- 8.4.1 FOCUS ON BETTER AGRICULTURAL PRODUCTIVITY AND ANIMAL HEALTH THROUGH PROTEIN-BASED SOLUTIONS TO DRIVE MARKET

- 8.5 INDUSTRIAL PROCESSING

- 8.5.1 GROWING DEMAND FOR HIGH-PERFORMANCE AND ECO-FRIENDLY PRODUCTS TO DRIVE MARKET GROWTH

- 8.6 BIOENERGY & ENVIRONMENTAL

- 8.6.1 GROWING DEMAND FOR SUSTAINABLE ENERGY AND ECO-FRIENDLY SOLUTIONS TO BOOST MARKET GROWTH

- 8.7 COMECEUTICALS & NUTRACEUTICALS

- 8.7.1 ADVANCEMENTS IN PROTEIN-BASED NUTRACEUTICALS TO ENHANCE DIGESTIBILITY AND NUTRIENT DELIVERY

- 8.8 OTHER APPLICATIONS

9 PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMA INDUSTRY

- 9.2.1 DRUG DEVELOPMENT

- 9.2.1.1 Increased internal biologics discovery and process-development activity to augment market growth

- 9.2.2 FORMULATION/MANUFACTURING

- 9.2.2.1 Advancing protein therapeutics through optimized formulation and manufacturing to propel segment growth

- 9.2.3 STORAGE/INVENTORY MANAGEMENT

- 9.2.3.1 Optimal storage/inventory management to optimize supply, reduce waste, and prevent stockouts

- 9.2.1 DRUG DEVELOPMENT

- 9.3 BIOTECHNOLOGY INDUSTRY

- 9.3.1 DRUG DEVELOPMENT

- 9.3.1.1 Growth of precision/personalized medicines and advanced therapeutics to aid segment growth

- 9.3.2 FORMULATION/MANUFACTURING

- 9.3.2.1 Expansion of manufacturing facilities in biotechnology industry leading to support market growth

- 9.3.3 STORAGE/INVENTORY MANAGEMENT

- 9.3.3.1 Optimizing storage and inventory management for proteins and protein crystals to enhance safety, quality, and accessibility

- 9.3.1 DRUG DEVELOPMENT

- 9.4 RESEARCH, ACADEMIA, AND CROS

- 9.4.1 DRUG DEVELOPMENT & DISCOVERY

- 9.4.1.1 Focus on accelerating advancements protein & protein crystal applications to fuel segment growth

- 9.4.2 LIFE SCIENCE RESEARCH

- 9.4.2.1 Expanding scope of research for formulating targeted treatment strategies to boost Market

- 9.4.1 DRUG DEVELOPMENT & DISCOVERY

- 9.5 FOOD & BEVERAGE INDUSTRY

- 9.5.1 INCREASING DEMAND FOR HIGH PROTEIN DIETS, NUTRITIONAL SUPPLEMENTS, AND FUNCTIONAL FOODS TO AID MARKET GROWTH

- 9.6 OTHER END USERS

10 PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 US to dominate North American proteins & protein crystals market during study period

- 10.2.2 CANADA

- 10.2.2.1 Innovations in protein AI to drive advanced protein design and structure prediction

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Favorable healthcare policies and regulatory landscape to drive market

- 10.3.2 UK

- 10.3.2.1 Favorable regulatory scenario for protein & protein crystal development to support market growth

- 10.3.3 FRANCE

- 10.3.3.1 Increased healthcare funding by government bodies to aid market growth

- 10.3.4 ITALY

- 10.3.4.1 Increased availability of reimbursement coverage for proteins and protein crystals to augment market growth

- 10.3.5 SPAIN

- 10.3.5.1 Ongoing research linking crystallography to disease mechanisms and infrastructure development to aid market growth

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Emphasis on modernization and expansion of healthcare infrastructure to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Rise in research applications using proteins & protein crystals to propel market growth

- 10.4.3 INDIA

- 10.4.3.1 Investments and funding activities in Indian biotechnology and biopharma industry to augment market growth

- 10.4.4 AUSTRALIA

- 10.4.4.1 Rising investments in healthcare infrastructure to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Strong academic & research infrastructure and favorable national funding programs to aid market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 LATIN AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Growing adoption of proteins in research centers and workshops to propel market growth

- 10.5.2 MEXICO

- 10.5.2.1 Increasing investments and funding for development and manufacturing of protein-based APIs to drive market

- 10.5.3 REST OF LATIN AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Government initiatives for better digital health and improved telemedicine to drive market

- 10.6.2 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION & FINANCIAL METRICS

- 11.5.1 FINANCIAL METRICS

- 11.5.2 COMPANY VALUATION

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DANAHER CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 RAYBIOTECH, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MERCK & CO., INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 AMGEN INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 ELI LILLY AND COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product approvals

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 F. HOFFMANN-LA ROCHE LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & approvals

- 12.1.6.4 Recent developments

- 12.1.6.4.1 Deals

- 12.1.7 NOVO NORDISK A/S

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 PFIZER INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product approvals

- 12.1.8.3.2 Deals

- 12.1.9 THERMO FISHER SCIENTIFIC INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 SANOFI

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 AGILENT TECHNOLOGIES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.12 TAKEDA PHARMACEUTICAL COMPANY LIMITED

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product approvals

- 12.1.13 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF)

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches & approvals

- 12.1.13.3.2 Deals

- 12.1.13.3.3 Expansions

- 12.1.14 BIOCON

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product approvals

- 12.1.14.3.2 Deals

- 12.1.1 DANAHER CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 AMANO ENZYME INC.

- 12.2.2 ULTREZE ENZYMES

- 12.2.3 NEOGEN

- 12.2.4 BIOLAXI ENZYMES PVT. LTD.

- 12.2.5 GENSCRIPT

- 12.2.6 BIOSEUTICA

- 12.2.7 KERRY GROUP PLC

- 12.2.8 ASSOCIATED BRITISH FOODS PLC

- 12.2.9 K-GENIX GROUP

- 12.2.10 NAGASE & CO., LTD.

- 12.2.11 GRIFOLS, S.A

- 12.2.12 BASF

- 12.2.13 BIO-CAT

- 12.2.14 AMCO PROTEINS

- 12.2.15 PROTALIX BIOTHERAPEUTICS

13 RESEARCH METHODOLOGY

- 13.1 RESEARCH DATA

- 13.1.1 SECONDARY RESEARCH

- 13.1.1.1 Key secondary sources

- 13.1.1.2 Objectives of secondary research

- 13.1.1.3 Key data from secondary sources

- 13.1.2 PRIMARY RESEARCH

- 13.1.2.1 Key primary sources

- 13.1.2.2 Key objectives of primary research

- 13.1.2.3 Key industry insights

- 13.1.1 SECONDARY RESEARCH

- 13.2 MARKET SIZE ESTIMATION APPROACH

- 13.2.1 COMPANY REVENUE ESTIMATION APPROACH

- 13.2.2 CUSTOMER-BASED MARKET ESTIMATION

- 13.2.3 TOP-DOWN APPROACH

- 13.3 MARKET FORECASTING APPROACH

- 13.4 DATA TRIANGULATION

- 13.5 MARKET SHARE ASSESSMENT

- 13.6 STUDY ASSUMPTIONS

- 13.7 RESEARCH LIMITATIONS

- 13.8 RISK ANALYSIS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PROTEINS & PROTEIN CRYSTALS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 UNMET NEEDS IN PROTEINS & PROTEIN CRYSTALS MARKET

- TABLE 3 PROTEINS & PROTEIN CRYSTALS MARKET: PORTER'S FIVE FORCES

- TABLE 4 AVERAGE SELLING PRICE OF PROTEINS & PROTEIN CRYSTALS, BY KEY PLAYER, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF PROTEINS & PROTEIN CRYSTALS, BY REGION, 2022-2024 (USD)

- TABLE 6 IMPORT DATA FOR HS CODE 3507, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 3507, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 8 IMPORT DATA FOR HS CODE 293719, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 293719, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 LIST OF MAJOR CONFERENCES & EVENTS IN PROTEINS & PROTEIN CRYSTALS MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 11 CASE STUDY: COMPUTATIONAL DESIGN OF HIGH-AFFINITY MINIBINDER PROTEINS FOR THERAPEUTIC TARGETS

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 CASE STUDY: ALPHAFOLD BY DEEPMIND

- TABLE 14 KEY REGULATORY AGENCIES

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 INDUSTRY STANDARDS FOR PROTEINS & PROTEIN CRYSTALS MARKET

- TABLE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS IN PROTEINS & PROTEIN CRYSTALS MARKET (%)

- TABLE 23 KEY BUYING CRITERIA FOR MAJOR END USERS IN PROTEINS & PROTEIN CRYSTALS MARKET

- TABLE 24 PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 25 ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 26 ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 27 ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET FOR INDUSTRIAL ENZYMES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 28 ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET FOR FOOD ENZYMES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 29 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 30 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 31 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 32 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET FOR INSULIN, BY REGION, 2023-2030 (USD BILLION)

- TABLE 33 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET FOR HORMONES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 34 THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET FOR COAGULATION FACTORS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 35 STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 36 STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 37 STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET FOR RESEARCH PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 38 STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET FOR STRUCTURAL PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 39 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 40 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 41 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET FOR INDUSTRIAL PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 42 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET FOR NUTRITIONAL PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 43 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET FOR ANALYTICAL PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 44 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET FOR COSMECEUTICAL PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 45 SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET FOR FUNCTIONAL FOOD PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 46 PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 47 PROTEINS & PROTEIN CRYSTALS APPLICATIONS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 48 PROTEINS & PROTEIN CRYSTALS MARKET FOR HEALTHCARE, BY REGION, 2023-2030 (USD BILLION)

- TABLE 49 PROTEINS & PROTEIN CRYSTALS MARKET FOR TISSUE ENGINEERING, BY REGION, 2023-2030 (USD BILLION)

- TABLE 50 PROTEINS & PROTEIN CRYSTALS MARKET FOR AGRICULTURE & ANIMAL NUTRITION, BY REGION, 2023-2030 (USD BILLION)

- TABLE 51 PROTEINS & PROTEIN CRYSTALS MARKET FOR INDUSTRIAL PROCESSING, BY REGION, 2023-2030 (USD BILLION)

- TABLE 52 PROTEINS & PROTEIN CRYSTALS MARKET FOR BIOENERGY & ENVIRONMENTAL, BY REGION, 2023-2030 (USD BILLION)

- TABLE 53 PROTEINS & PROTEIN CRYSTALS MARKET FOR COSMECEUTICAL & NUTRACEUTICALS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 54 PROTEINS & PROTEIN CRYSTALS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 55 PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 56 PROTEINS & PROTEIN CRYSTALS MARKET FOR PHARMA INDUSTRY, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 57 PROTEINS & PROTEIN CRYSTALS MARKET FOR PHARMA INDUSTRY, BY REGION, 2023-2030 (USD BILLION)

- TABLE 58 PHARMA INDUSTRY MARKET FOR DRUG DEVELOPMENT, BY REGION, 2023-2030 (USD BILLION)

- TABLE 59 PHARMA INDUSTRY MARKET FOR FORMULATION/MANUFACTURING, BY REGION, 2023-2030 (USD BILLION)

- TABLE 60 PHARMA INDUSTRY MARKET FOR STORAGE/INVENTORY MANAGEMENT, BY REGION, 2023-2030 (USD BILLION)

- TABLE 61 PROTEINS & PROTEIN CRYSTALS MARKET FOR BIOTECHNOLOGY INDUSTRY, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 62 PROTEINS & PROTEIN CRYSTALS MARKET FOR BIOTECHNOLOGY INDUSTRY, BY REGION, 2023-2030 (USD BILLION)

- TABLE 63 BIOTECHNOLOGY INDUSTRY MARKET FOR DRUG DEVELOPMENT, BY REGION, 2023-2030 (USD BILLION)

- TABLE 64 BIOTECHNOLOGY INDUSTRY MARKET FOR FORMULATION/MANUFACTURING, BY REGION, 2023-2030 (USD BILLION)

- TABLE 65 BIOTECHNOLOGY INDUSTRY MARKET FOR STORAGE/INVENTORY MANAGEMNET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 66 PROTEINS & PROTEIN CRYSTALS MARKET FOR RESEARCH, ACADEMIA, AND CROS, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 67 PROTEINS & PROTEIN CRYSTALS MARKET FOR RESEARCH, ACADEMIA, AND CROS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 68 RESEARCH, ACADEMIA, AND CROS MARKET FOR DRUG DEVELOPMENT & DISCOVERY, BY REGION, 2023-2030 (USD BILLION)

- TABLE 69 RESEARCH, ACADEMIA, AND CROS MARKET FOR LIFE SCIENCE RESEARCH, BY REGION, 2023-2030 (USD BILLION)

- TABLE 70 PROTEINS & PROTEIN CRYSTALS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2023-2030 (USD BILLION)

- TABLE 71 PROTEINS & PROTEIN CRYSTALS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 72 PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 73 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 74 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 75 NORTH AMERICA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 76 NORTH AMERICA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 77 NORTH AMERICA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 78 NORTH AMERICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 79 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 80 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 81 US: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 82 US: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 83 US: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 84 US: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 85 US: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 86 CANADA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 87 CANADA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 88 CANADA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 89 CANADA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 90 CANADA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 91 EUROPE: PROTEINS & PROTEIN CRYSTALS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 92 EUROPE: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 93 EUROPE: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE 2023-2030 (USD BILLION)

- TABLE 94 EUROPE: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 95 EUROPE: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE 2023-2030 (USD BILLION)

- TABLE 96 EUROPE: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 97 EUROPE: PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 98 EUROPE: PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 99 GERMANY: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 100 GERMANY: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 101 GERMANY: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 102 GERMANY: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 103 GERMANY: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 104 UK: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 105 UK: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 106 UK: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 107 UK: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 108 UK: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 109 FRANCE: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 110 FRANCE: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 111 FRANCE: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 112 FRANCE: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 113 FRANCE: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 114 ITALY: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 115 ITALY: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 116 ITALY: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 117 ITALY: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 118 ITALY: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 119 SPAIN: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 120 SPAIN: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 121 SPAIN: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 122 SPAIN: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 123 SPAIN: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 124 REST OF EUROPE: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 125 REST OF EUROPE: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 126 REST OF EUROPE: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 127 REST OF EUROPE: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 128 REST OF EUROPE: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 129 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 130 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 131 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 132 ASIA PACIFIC: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 133 ASIA PACIFIC: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 134 ASIA PACIFIC: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 135 ASIA PACIFIC: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 136 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 137 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 138 CHINA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 139 CHINA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 140 CHINA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 141 CHINA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 142 CHINA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 143 JAPAN: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 144 JAPAN: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 145 JAPAN: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 146 JAPAN: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 147 JAPAN: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 148 INDIA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 149 INDIA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 150 INDIA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 151 INDIA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 152 INDIA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 153 AUSTRALIA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 154 AUSTRALIA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 155 AUSTRALIA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 156 AUSTRALIA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 157 AUSTRALIA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 158 SOUTH KOREA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 159 SOUTH KOREA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 160 SOUTH KOREA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 161 SOUTH KOREA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 162 SOUTH KOREA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 163 REST OF ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 164 REST OF ASIA PACIFIC: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 165 REST OF ASIA PACIFIC: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 166 REST OF ASIA PACIFIC: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 167 REST OF ASIA PACIFIC: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 169 LATIN AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 170 LATIN AMERICA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 171 LATIN AMERICA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 172 LATIN AMERICA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 173 LATIN AMERICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 174 LATIN AMERICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 175 LATIN AMERICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 176 BRAZIL: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 177 BRAZIL: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 178 BRAZIL: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 179 BRAZIL: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 180 BRAZIL: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 181 MEXICO: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 182 MEXICO: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 183 MEXICO: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 184 MEXICO: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 185 MEXICO: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 186 REST OF LATIN AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 187 REST OF LATIN AMERICA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 188 REST OF LATIN AMERICA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 189 REST OF LATIN AMERICA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 190 REST OF LATIN AMERICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 191 MIDDLE EAST & AFRICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 192 MIDDLE EAST & AFRICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 193 MIDDLE EAST & AFRICA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 194 MIDDLE EAST & AFRICA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 195 MIDDLE EAST & AFRICA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 196 MIDDLE EAST & AFRICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 197 MIDDLE EAST & AFRICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 198 MIDDLE EAST & AFRICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 199 GCC COUNTRIES: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 200 GCC COUNTRIES: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 201 GCC COUNTRIES: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 202 GCC COUNTRIES: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 203 GCC COUNTRIES: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: ENZYMATIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: THERAPEUTIC PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: STRUCTURAL PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: SPECIALTY PROTEINS & PROTEIN CRYSTALS MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 209 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN PROTEINS & PROTEIN CRYSTALS MARKET

- TABLE 210 PROTEINS & PROTEIN CRYSTALS MARKET: DEGREE OF COMPETITION

- TABLE 211 PROTEINS & PROTEIN CRYSTALS MARKET: REGION FOOTPRINT

- TABLE 212 PROTEINS & PROTEIN CRYSTALS MARKET: PRODUCT FOOTPRINT

- TABLE 213 PROTEINS & PROTEIN CRYSTALS MARKET: APPLICATION FOOTPRINT

- TABLE 214 PROTEINS & PROTEIN CRYSTALS MARKET: END-USER FOOTPRINT

- TABLE 215 PROTEINS & PROTEIN CRYSTALS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 216 PROTEINS & PROTEIN CRYSTALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY REGION

- TABLE 217 PROTEINS & PROTEIN CRYSTALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY PRODUCT TYPE

- TABLE 218 PROTEINS & PROTEIN CRYSTALS MARKET: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 219 PROTEINS & PROTEIN CRYSTALS MARKET: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 220 PROTEINS & PROTEIN CRYSTALS MARKET: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 221 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 222 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 223 DANAHER CORPORATION: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 224 DANAHER CORPORATION: EXPANSIONS, JANUARY 2022-DECEMBER 2025

- TABLE 225 RAYBIOTECH, INC.: COMPANY OVERVIEW

- TABLE 226 RAYBIOTECH, INC.: PRODUCTS OFFERED

- TABLE 227 RAYBIOTECH, INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 228 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 229 MERCK & CO., INC.: PRODUCTS OFFERED

- TABLE 230 MERCK & CO., INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 231 AMGEN INC.: COMPANY OVERVIEW

- TABLE 232 AMGEN INC.: PRODUCTS OFFERED

- TABLE 233 AMGEN INC.: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 234 AMGEN INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 235 ELI LILLY AND COMPANY: COMPANY OVERVIEW

- TABLE 236 ELI LILLY AND COMPANY: PRODUCTS OFFERED

- TABLE 237 ELI LILLY AND COMPANY: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 238 ELI LILLY AND COMPANY: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 239 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 240 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS OFFERED

- TABLE 241 F. HOFFMANN-LA ROCHE LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 242 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 243 NOVO NORDISK A/S: COMPANY OVERVIEW

- TABLE 244 NOVO NORDISK A/S: PRODUCTS OFFERED

- TABLE 245 NOVO NORDISK A/S: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 246 PFIZER INC.: COMPANY OVERVIEW

- TABLE 247 PFIZER INC.: PRODUCTS OFFERED

- TABLE 248 PFIZER INC.: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 249 PFIZER INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 250 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 251 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 252 SANOFI: COMPANY OVERVIEW

- TABLE 253 SANOFI: PRODUCTS OFFERED

- TABLE 254 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 255 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 256 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 257 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2022-DECEMBER 2025

- TABLE 258 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 259 TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 260 TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 261 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): COMPANY OVERVIEW

- TABLE 262 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): PRODUCTS OFFERED

- TABLE 263 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 264 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 265 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): EXPANSIONS, JANUARY 2022-DECEMBER 2025

- TABLE 266 BIOCON: COMPANY OVERVIEW

- TABLE 267 BIOCON: PRODUCTS OFFERED

- TABLE 268 BIOCON: PRODUCT APPROVALS, JANUARY 2022-DECEMBER 2025

- TABLE 269 BIOCON: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 270 AMANO ENZYME INC.: COMPANY OVERVIEW

- TABLE 271 ULTREZE ENZYMES: COMPANY OVERVIEW

- TABLE 272 NEOGEN: COMPANY OVERVIEW

- TABLE 273 BIOLAXI ENZYMES PVT. LTD.: COMPANY OVERVIEW

- TABLE 274 GENSCRIPT: COMPANY OVERVIEW

- TABLE 275 BIOSEUTICA: COMPANY OVERVIEW

- TABLE 276 KERRY GROUP PLC: COMPANY OVERVIEW

- TABLE 277 ASSOCIATED BRITISH FOODS PLC: COMPANY OVERVIEW

- TABLE 278 K-GENIX GROUP: COMPANY OVERVIEW

- TABLE 279 NAGASE & CO., LTD.: COMPANY OVERVIEW

- TABLE 280 GRIFOLS, S.A : COMPANY OVERVIEW

- TABLE 281 BASF: COMPANY OVERVIEW

- TABLE 282 BIO-CAT: COMPANY OVERVIEW

- TABLE 283 AMCO PROTEINS: COMPANY OVERVIEW

- TABLE 284 PROTALIX BIOTHERAPEUTICS: COMPANY OVERVIEW

- TABLE 285 PROTEINS & PROTEIN CRYSTALS MARKET: STUDY ASSUMPTIONS

- TABLE 286 PROTEINS & PROTEIN CRYSTALS MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 PROTEINS & PROTEIN CRYSTALS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 PROTEINS & PROTEIN CRYSTALS MARKET: YEARS CONSIDERED

- FIGURE 3 MARKET SCENARIO FOR PROTEINS & PROTEIN CRYSTALS MARKET

- FIGURE 4 GLOBAL PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT, 2024-2030 (USD BILLION)

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET, 2021-2024

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF PROTEINS & PROTEIN CRYSTALS MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN PROTEINS & PROTEIN CRYSTALS MARKET, 2025-2030

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 RAPID EXPANSION OF BIOLOGICS AND RECOMBINANT PROTEIN THERAPEUTICS TO PROPEL MARKET GROWTH

- FIGURE 10 GLOBAL FORMULATIONS/END PRODUCTS, PROTEINS & PROTEIN CRYSTALS & CRYSTAALLOGRAPHY MARKET, BY PRODUCT SEGMENT, 2025-2030 (USD BILLION)

- FIGURE 11 US AND PHARMA INDUSTRY COMMANDED LARGEST MARKET SHARE IN 2025

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 13 PROTEINS & PROTEIN CRYSTALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 PROTEINS & PROTEIN CRYSTALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PROTEINS & PROTEIN CRYSTALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 16 PROTEINS & PROTEIN CRYSTALS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 PROTEINS & PROTEIN CRYSTALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE OF PROTEINS & PROTEIN CRYSTALS, BY PRODUCT, 2024 (USD)

- FIGURE 19 AVERAGE SELLING PRICE OF PROTEINS & PROTEIN CRYSTALS, BY REGION, 2024 (USD THOUSAND)

- FIGURE 20 PROTEINS & PROTEIN CRYSTALS MARKET: IMPORT DATA FOR HS CODE 3507, 2021-2024

- FIGURE 21 PROTEINS & PROTEIN CRYSTALS MARKET: EXPORT DATA FOR HS CODE 3507, 2021-2024

- FIGURE 22 PROTEINS & PROTEIN CRYSTALS MARKET: IMPORT SCENARIO FOR HS CODE 293719, 2021-2024

- FIGURE 23 PROTEINS & PROTEIN CRYSTALS MARKET: EXPORT SCENARIO FOR HS CODE 293719, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 24 PROTEINS & PROTEIN CRYSTALS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 25 FUNDING AND NUMBER OF DEALS IN PROTEINS & PROTEIN CRYSTALS MARKET, 2019-2023 (USD MILLION)

- FIGURE 26 NUMBER OF INVESTOR DEALS IN PROTEINS & PROTEIN CRYSTALS MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 27 VALUE OF INVESTOR DEALS IN PROTEINS & PROTEIN CRYSTALS MARKET, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 28 PATENT ANALYSIS FOR PROTEINS & PROTEIN CRYSTALS MARKET (JANUARY 2014-NOVEMBER 2025)

- FIGURE 29 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS IN PROTEINS & PROTEIN CRYSTALS MARKET

- FIGURE 30 KEY BUYING CRITERIA FOR MAJOR END USERS IN PROTEINS & PROTEIN CRYSTALS MARKET

- FIGURE 31 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: PROTEINS & PROTEIN CRYSTALS MARKET SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET, 2021-2024 (USD MILLION)

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET (2024)

- FIGURE 35 RANKING OF KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET (2024)

- FIGURE 36 EV/EBITDA OF KEY VENDORS

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 38 PROTEINS & PROTEIN CRYSTALS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 39 PROTEINS & PROTEIN CRYSTALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 PROTEINS & PROTEIN CRYSTALS MARKET: COMPANY FOOTPRINT

- FIGURE 41 PROTEINS & PROTEIN CRYSTALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 MERCK & CO., INC.: COMPANY SNAPSHOT

- FIGURE 44 AMGEN INC.: COMPANY SNAPSHOT

- FIGURE 45 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

- FIGURE 46 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT

- FIGURE 47 NOVO NORDISK A/S: COMPANY SNAPSHOT

- FIGURE 48 PFIZER INC.: COMPANY SNAPSHOT

- FIGURE 49 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 50 SANOFI: COMPANY SNAPSHOT

- FIGURE 51 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 52 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 53 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF): COMPANY SNAPSHOT

- FIGURE 54 BIOCON: COMPANY SNAPSHOT

- FIGURE 55 PROTEINS & PROTEIN CRYSTALS MARKET: RESEARCH DESIGN

- FIGURE 56 PROTEINS & PROTEIN CRYSTALS MARKET: KEY SECONDARY SOURCES

- FIGURE 57 PROTEINS & PROTEIN CRYSTALS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 58 PROTEINS & PROTEIN CRYSTALS MARKET: PRIMARY SOURCES (SUPPLY AND DEMAND SIDES)

- FIGURE 59 PROTEINS & PROTEIN CRYSTALS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 61 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 62 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 63 PROTEINS & PROTEIN CRYSTALS MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 64 PROTEINS & PROTEIN CRYSTALS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 65 PROTEINS & PROTEIN CRYSTALS MARKET: TOP-DOWN APPROACH

- FIGURE 66 GLOBAL PROTEINS & PROTEIN CRYSTALS MARKET GROWTH PROJECTIONS

- FIGURE 67 PROTEINS & PROTEIN CRYSTALS MARKET: DATA TRIANGULATION METHODOLOGY