|

市场调查报告书

商品编码

1928856

全球农业钙市场按类型、应用、形态、功能和地区划分-预测(至2030年)Agricultural Calcium Market by Type (Calcium Carbonate, Calcium Sulfate, Calcium Nitrate, Calcium Chloride, Calcium Oxide and Hydroxide, and Others), Application (Agriculture and Animal Feed), Form, Function, and Region - Global Forecast to 2030 |

||||||

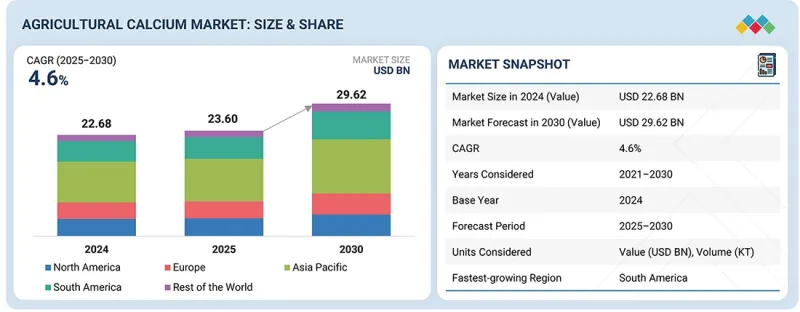

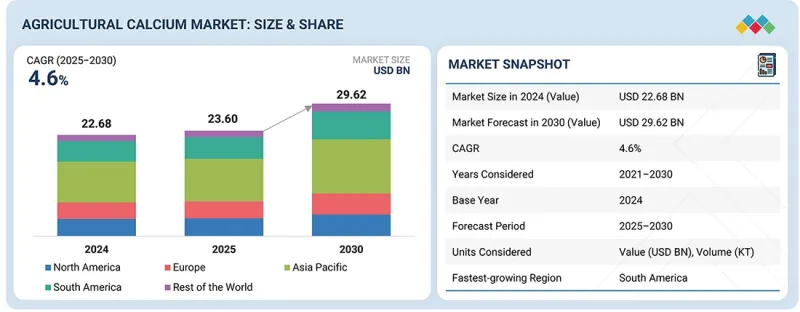

2025年全球农业钙市场规模预估为236亿美元,预估至2030年将达296.2亿美元,年复合成长率为4.6%。

由于向永续精密农业的转变、全球对矿物投入的永续性要求提高、全球土壤健康管理的新优先事项、对动物健康和生产力的关注以及鸡蛋和乳製品生产质量标准的加强,市场呈现显着增长。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 每千吨十亿美元 |

| 部分 | 类型、用途、形状、功能(定性)、区域 |

| 目标区域 | 北美、欧洲、亚太地区、南美及其他地区 |

此外,大量的农艺研究证实,施用钙肥可以改善土壤pH值、提高养分利用效率和增强土壤结构完整性,同时降低酸性土壤中的铝毒性,从而促进作物生长并提高长期田间生产力。研究还表明,钙肥能够调节矿物与有机质的相互作用,并透过减缓碳矿化速率来促进土壤碳的稳定,这表明其在气候适应型再生农业系统中具有重要意义。

然而,限制矿产资源依赖型产业未来发展的许多因素,以及氮肥和复合肥料对农民预算的竞争,预计将对农业钙市场构成挑战。此外,采矿活动带来的环境问题以及石灰加工过程中的高碳排放仍然是技术难题。

总体而言,特种作物产量的增加、高价值作物和可控环境农业(CEA)的广泛采用,以及精密农业和土壤诊断技术的改进,预计将推动钙的定向施用,为钙补充剂生产商提供巨大的增长机会,使他们能够占据相当大的市场份额。

“按类型划分,预计碳酸钙细分市场在预测期内将占据大部分市场份额。”

由于碳酸钙储量丰富、价格低廉且元素钙纯度高,是农业领域应用最广泛的钙源,预计将占据市场主导地位。碳酸钙在动物营养和土壤改良方面都有应用。此外,在畜禽饲料中,钙补充剂有助于家禽、乳牛、猪和水产养殖动物的骨骼发育、蛋壳形成和代谢功能。碳酸钙因其在农业和畜禽饲料行业的多样化功能,预计将占据市场主导地位。

“就农业应用而言,预计在预测期内,田间作物领域将引领农业钙市场。”

谷类、油籽和豆类的大规模种植对土壤肥力和结构完整性造成持续压力,因此这些作物成为农业钙的主要用途。石膏、碳酸钙和氧化钙等钙基矿物因此越来越多地应用于集约化田间种植系统中,有助于改善养分平衡、提高产量,并维持农业钙市场的持续需求。

“预计在预测期内,南美洲将占据全球农业钙市场的主要份额。”

南美洲预计将拥有全球第二大农业钙市场。该地区是多种农作物的主要生产地和出口地,包括大豆、玉米、小麦和棉花。钙补充剂在植物生长发育中发挥着至关重要的作用,其在该地区的重要性日益凸显。此外,商业化田间作物和出口导向园艺的快速发展,以及巴西和阿根廷积极采用土壤改良方法,也推动了该地区的市场成长。

本报告研究了全球农业钙市场,深入分析了关键驱动因素和限制因素、产品开发和创新以及竞争格局。

目录

第一章 引言

第二章执行摘要

第三章 主要发现

- 农业钙市场对企业而言极具吸引力的机会

- 按类型和地区分類的农业钙市场

- 农业钙市场:前三大类型

- 按应用分類的农业钙市场

- 按类型分類的农业钙市场

- 各国农业钙市场

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求和閒置频段

- 农业钙市场未满足的需求

- 閒置频段机会

- 相互关联的市场与跨产业机会

- 互联市场

- 跨职能机会

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 全球粮食需求不断增长和人口增长

- 不断发展的家禽和水产养殖业

- 价值链分析

- 研究与开发

- 采购

- 生产和加工

- 分配

- 行销与销售

- 最终用户

- 生态系分析

- 需求端

- 供应端

- 定价分析

- 按类型分類的市场参与企业平均销售价格

- 各地区农业钙平均售价趋势

- 贸易分析

- HS编码283650和2510的进口方案

- HS编码283650和2510的出口情景

- 重大会议和活动(2026-2027)

- 影响客户业务的趋势/颠覆性因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税对农业钙市场的影响

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端用户产业的影响

第六章:技术进步、人工智慧影响、专利、创新与未来应用

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 技术/产品蓝图

- 专利分析

- 未来应用

- 微粉化碳酸钙作为农作物防晒油。

- 新一代钙质土壤改良剂:奈米石膏用于治理盐化

- 用于农业智慧钙供应的刺激响应型纤维素水凝胶

- 电化学注入钙离子以提高土壤强度和稳定根际

- 钙和微生物的协同作用可提高作物品质和产量

- 人工智慧/人工智慧生成技术对农业钙市场的影响。

- 主要应用案例和市场潜力

- 农业钙处理的最佳实践

- 人工智慧在农业钙市场应用案例研究

- 相互关联的相邻生态系及其对市场参与者的影响

- 客户对农业钙领域采用生成式人工智慧的准备情况

- 成功案例和实际应用

- 人工智慧赋能的精密农业:小麦增产的成功案例

- 利用人工智慧进行家禽健康管理,以增强精准营养管理

第七章永续性与监管环境

- 地方法规和合规性

- 监管机构、政府机构和其他组织

- 业界标准

- 标籤检视要求和声明

- 未来5到10年预期监理变化

- 对永续性的承诺

- 永续采购

- 减少碳足迹的努力

- 循环经济模式

- 监管政策对永续性努力的影响

- 认证、标籤和环境标准

第八章:顾客状况与购买行为

- 决策流程

- 采购过程中的关键相关利益者及其评估标准

- 采购过程中的关键相关利益者

- 采购标准

- 招募障碍和内部挑战

- 供应链中各个应用产业尚未满足的需求

- 市场盈利

- 潜在收入

- 成本动态

- 按主要类型分類的利润机会

9. 按类型分類的农业钙市场

- 碳酸钙

- 硫酸钙

- 硝酸钙

- 氯化钙

- 氧化钙和氢氧化钙(生石灰和熟石灰)

- 柠檬酸钙

- 磷酸钙

- 天然矿物

第十章 按应用领域分類的农业钙市场

- 农业

- 动物饲料

第十一章 依形态分類的农业钙市场

- 粉末

- 颗粒

- 液体

- 颗粒

- 其他形状

第十二章 按功能分類的农业钙市场

- 农业

- 动物饲料

第十三章 各地区农业钙市场

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 其他地区

- 中东

- 非洲

第十四章 竞争格局

- 概述

- 主要企业的竞争策略/优势(2022-2025)

- 收入分析(2022-2024)

- 市占率分析(2024 年)

- 品牌/产品对比

- 企业评估矩阵:主要企业(2024)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 公司估值和财务指标

- 竞争场景

第十五章:公司简介

- 主要企业

- YARA INTERNATIONAL ASA(YARA)

- OMYA INTERNATIONAL AG

- SIBELCO

- CARMEUSE

- COROMANDEL INTERNATIONAL LTD.

- IMERYS

- SAINT-GOBAIN FORMULA

- MINERALS TECHNOLOGIES INC.

- GRAYMONT

- KEMIN INDUSTRIES, INC.

- CALC GROUP

- EUROCHEM GROUP

- GLC MINERALS, LLC.

- LHOIST

- HUBER ENGINEERED MATERIALS

- Start-Ups/中小企业

- MISSISSIPPI LIME COMPANY D/B/A MLC

- AZOMITE MINERAL PRODUCTS, INC.

- JILOCA INDUSTRIAL SA

- SIGMA MINERALS LTD.

- ASTRRA CHEMICALS

- CALCIUM PRODUCTS, INC.

- LONGCLIFFE QUARRIES LTD.

- BHAGVATI MINERALS

- ICL

- CULTIVACE & KWS DISTRIBUTING

第十六章调查方法

第十七章:邻近及相关市场

- 研究局限性

- 化肥市场

- 市场定义

- 市场概览

- 饲料添加剂市场

- 市场定义

- 市场概览

第十八章附录

The agricultural calcium market is estimated to be USD 23.60 billion in 2025 and is projected to reach USD 29.62 billion by 2030, at a CAGR of 4.6%. The market is experiencing significant growth, driven by the shift toward sustainable & precision agriculture, strengthened by global sustainability mandates for mineral inputs, emerging priorities in global soil health management, focus on animal health and productivity, and quality standards in egg and milk production.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Segments | By Type, Application, Form, Functions (qualitative), and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

Additionally, extensive agronomic studies confirm that calcium application improves soil pH, nutrient availability, and structural integrity while reducing aluminum toxicity in acidic soils, thereby strengthening crop performance and long-term field productivity. Calcium has also been shown to contribute to soil carbon stabilization by mediating mineral-organic interactions and reducing carbon mineralization rates, indicating its relevance in climate-resilient and regenerative agriculture systems.

However, critical constraints affecting the future of mineral-dependent industries and competition with nitrogen & complex fertilizers in farmer budgeting are expected to pose challenges in the agricultural calcium market. Furthermore, environmental concerns related to mining activities and the high carbon footprint of lime processing also remain a technical challenge.

Overall, growth in specialty crop production, expansion of high-value crops & controlled environment agriculture (CEA), and the rise of precision agriculture & soil diagnostics are expected to boost targeted calcium application, presenting substantial growth opportunities for calcium supplement manufacturers to gain a significant share in the market.

"By type, the calcium carbonate segment is expected to hold a dominant market share during the forecast period"

The calcium carbonate segment is estimated to dominate the market as it is the most widely used calcium source in agriculture because it is abundant, low-cost, and provides high elemental calcium across both animal nutrition and soil conditioning applications. Additionally, in the animal feed application, calcium supplement supports bone development, eggshell formation, and metabolic function in poultry, dairy, swine, and aquaculture. Due to its various functionalities in the agriculture and animal feed industry, calcium carbonate is considered to have a dominant market share.

"In agriculture application, the field crops segment is expected to lead the agricultural calcium market during the forecast period"

The types of field crops considered in the study include cereals & grains, oilseeds & pulses, and other field crops. It represents a core sub-application for agricultural calcium, as large-scale cultivation of cereals, oilseeds, and pulses places sustained pressure on soil fertility and structural integrity. Thus, calcium-based minerals such as gypsum, calcium carbonate, calcium oxide, and others are increasingly adopted in intensive field crop systems, contributing to improved nutrient balance, higher productivity, and sustained demand within the agricultural calcium market.

"South America is expected to hold a significant share in the global agricultural calcium market during the forecast period"

By region, South America is estimated to be the second-largest market for agricultural calcium. It is a major agricultural producer and exporter of several crops, such as soybeans, corn, wheat, and cotton. The use of calcium supplements has gained importance in the region due to their essential role in plant growth and development. The market growth in this region is also attributed to the rapid expansion of commercial row crops and export-oriented horticulture, combined with strong adoption of soil correction practices in Brazil and Argentina.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the agricultural calcium market.

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: CXOs - 25%, Managers - 35%, Others - 40%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 35%, South America - 10%, and Rest of the World -5%

Prominent companies in the market include Yara International (Norway), Omya International AG (Switzerland), Sibelco (US), Carmeuse (Belgium), Coromandel International Ltd. (India), Imerys (France), Saint-Gobain Formula (UK), Minerals Technologies Inc. (US), Graymont (Canada), Kemin Industries, Inc. (US), CALC Group (Poland), EuroChem Group (Switzerland), GLC Minerals, LLC. (US), Huber Engineered Materials (US), Mississippi Lime Company d/b/a MLC (US), AZOMITE Mineral Products, Inc. (US), Jiloca Industrial SA (Spain), Sigma Minerals Ltd. (India), Astrra Chemicals (India), Lhoist (Belgium), and others.

Research Coverage

This research report categorizes the agricultural calcium market by type (calcium carbonate [limestone], calcium sulfate [gypsum], calcium nitrate, calcium chloride, calcium oxide and hydroxide [lime & hydrated lime], calcium citrate, calcium phosphate, and natural mineral), application (agriculture and animal feed), form (powder, granules/grits, liquid, pellets, and other forms), function (qualitative) (agriculture [nutrient supplementation, soil structure improvement, disease prevention and plant health, fertilizer enhancement, and soil pH adjustment and liming] and animal feed [bone and muscle development, eggshell formation, milk production enhancement, and other functions]), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the agricultural calcium industry. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the agricultural calcium market. This report provides a competitive analysis of emerging startups in the agricultural calcium market ecosystem. Furthermore, the study covers industry-specific trends, including technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others.

Reasons to Buy This Report

The report provides market leaders/new entrants with information on the closest approximations of revenue numbers for the overall agricultural calcium and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (shift toward sustainable & precision agriculture strengthened by global sustainability mandates for mineral inputs), restraints (environmental concerns related to mining activities), opportunities (growth in specialty crop production & expansion of high-value crops & controlled environment agriculture (CEA)), and challenges (critical constraints affecting the future of mineral-dependent industries) influencing the growth of the agricultural calcium market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the agricultural calcium market

- Market Development: Comprehensive information about lucrative markets-analysis of agricultural calcium across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the agricultural calcium market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Yara International (Norway), Omya International AG (Switzerland), Sibelco (US), Carmeuse (Belgium), Coromandel International Ltd. (India), Imerys (France), Saint-Gobain Formula (UK), Minerals Technologies Inc. (US), Graymont (Canada), Kemin Industries, Inc. (US), CALC Group (Poland), EuroChem Group (Switzerland), GLC Minerals, LLC. (US), Huber Engineered Materials (US), Mississippi Lime Company d/b/a MLC (US), AZOMITE Mineral Products, Inc. (US), Jiloca Industrial SA (Spain), Sigma Minerals Ltd. (India), Astrra Chemicals (India), Lhoist (Belgium), and other players in the agricultural calcium market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AGRICULTURAL CALCIUM MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL CALCIUM MARKET

- 3.2 AGRICULTURAL CALCIUM MARKET, BY TYPE AND REGION

- 3.3 AGRICULTURAL CALCIUM MARKET, BY TOP 3 TYPES

- 3.4 AGRICULTURAL CALCIUM MARKET, BY APPLICATION

- 3.5 AGRICULTURAL CALCIUM MARKET, BY FORM

- 3.6 AGRICULTURAL CALCIUM MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Focus on animal health and productivity

- 4.2.1.2 Quality standards in egg and milk production

- 4.2.1.3 Shift toward sustainable and precision agriculture strengthened by global sustainability mandates for mineral inputs

- 4.2.1.3.1 Shift toward sustainable and precision agriculture

- 4.2.1.3.2 Sustainability mandates favoring mineral inputs

- 4.2.1.4 Emerging priorities in global soil health management

- 4.2.2 RESTRAINTS

- 4.2.2.1 Competition from alternative soil amendments

- 4.2.2.2 Environmental concerns related to mining activities

- 4.2.2.3 High carbon footprint of lime processing

- 4.2.2.4 Difficulty integrating calcium into liquid fertilizer systems

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Calcium as key input in climate-smart and regenerative farming systems

- 4.2.3.2 Rise of precision agriculture and soil diagnostics

- 4.2.3.3 Growth in specialty crop production and controlled environment agriculture (CEA)

- 4.2.3.4 Demand for functional feed additives and organic & non-GMO certified feed ingredients

- 4.2.3.5 Development of value-added co-products

- 4.2.4 CHALLENGES

- 4.2.4.1 Critical constraints affecting future of mineral-dependent industries

- 4.2.4.1.1 Environmental concerns related to mining activities

- 4.2.4.1.2 Dependence on mining regions creating supply imbalances

- 4.2.4.2 Competition with nitrogen and complex fertilizers in farmer budgeting

- 4.2.4.1 Critical constraints affecting future of mineral-dependent industries

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN AGRICULTURAL CALCIUM MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GROWING GLOBAL FOOD DEMAND AND POPULATION GROWTH

- 5.2.3 GROWING POULTRY AND AQUACULTURE INDUSTRIES

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 SOURCING

- 5.3.3 PRODUCTION & PROCESSING

- 5.3.4 DISTRIBUTION

- 5.3.5 MARKETING & SALES

- 5.3.6 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 DEMAND SIDE

- 5.4.2 SUPPLY SIDE

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF MARKET PLAYERS, BY TYPE

- 5.5.2 AVERAGE SELLING PRICE TREND OF AGRICULTURAL CALCIUM, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO OF HS CODE 283650 & 2510

- 5.6.2 EXPORT SCENARIO OF HS CODE 283650 & 2510

- 5.7 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CALCIUM PRODUCTS, INC.: TRANSITION FROM CONVENTIONAL AGLIME TO PELLETIZED LIMESTONE FOR PREDICTABLE SOIL PH MANAGEMENT

- 5.10.2 YARA: SOLUBLE CALCIUM FERTIGATION TO IMPROVE CROP QUALITY IN HIGH-VALUE CROPS

- 5.10.3 OMYA AVICARB - IMPROVING EGGSHELL QUALITY THROUGH CONTROLLED CALCIUM RELEASE IN LAYING HENS

- 5.11 IMPACT OF 2025 US TARIFF - AGRICULTURAL CALCIUM MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGY ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Purification technologies

- 6.1.1.2 Pelletization systems

- 6.1.1.3 Nano-calcium technologies

- 6.1.1.4 Solubilization technology

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 Precision agriculture

- 6.1.2.2 Farm management information systems

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 IoT and sensor technologies

- 6.1.3.2 Soil testing and mapping technologies

- 6.1.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.1.4.1 Short-term | Foundation & early commercialization

- 6.1.4.2 Mid-term | Expansion & standardization

- 6.1.4.3 Long-term | Precision nutrition & smart calcium solutions

- 6.1.1 KEY TECHNOLOGIES

- 6.2 PATENT ANALYSIS

- 6.2.1 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL CALCIUM MARKET, 2020-2025

- 6.3 FUTURE APPLICATIONS

- 6.3.1 MICRONIZED CALCIUM CARBONATE AS A CROP SUNSCREEN

- 6.3.2 NEXT-GENERATION CALCIUM AMENDMENTS: NANO-GYPSUM FOR SALINITY MANAGEMENT

- 6.3.3 STIMULUS-RESPONSIVE CELLULOSE HYDROGELS FOR SMART CALCIUM DELIVERY IN AGRICULTURE

- 6.3.4 ELECTROCHEMICAL INJECTION OF CALCIUM IONS FOR SOIL STRENGTH ENHANCEMENT AND ROOT-ZONE STABILITY

- 6.3.5 CALCIUM-MICROBIAL SYNERGIES FOR ENHANCED CROP QUALITY AND PRODUCTIVITY

- 6.4 IMPACT OF AI/GEN AI ON AGRICULTURAL CALCIUM MARKET

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES IN AGRICULTURAL CALCIUM PROCESSING

- 6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN AGRICULTURAL CALCIUM MARKET

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AGRICULTURAL CALCIUM

- 6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.5.1 AI-ENABLED PRECISION AGRICULTURE: A WHEAT YIELD SUCCESS STORY

- 6.5.2 AI-DRIVEN POULTRY HEALTH MANAGEMENT ENHANCING PRECISION NUTRITION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 LABELING REQUIREMENTS AND CLAIMS

- 7.1.4 ANTICIPATED REGULATORY CHANGES IN NEXT 5-10 YEARS

- 7.1.4.1 Mandatory Validation of CFU Viability & Functional Claims

- 7.1.4.2 Global Harmonization of Calcium Fertilizer & Soil Amendment Classifications

- 7.1.4.3 Strengthened Safety, Environmental & Contaminant Control Regulations

- 7.1.4.4 Digital Labeling, Traceability & QR-based Compliance Tracking

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 SUSTAINABLE SOURCING

- 7.2.2 CARBON FOOTPRINT REDUCTION INITIATIVES

- 7.2.3 CIRCULAR ECONOMY APPROACHES

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS APPLICATION INDUSTRIES ACROSS SUPPLY CHAIN

- 8.5 MARKET PROFITABILITY

- 8.6 REVENUE POTENTIAL

- 8.6.1 COST DYNAMICS

- 8.6.2 MARGIN OPPORTUNITIES, BY KEY TYPES

9 AGRICULTURAL CALCIUM MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.1.1 CALCIUM CARBONATE

- 9.1.1.1 Correcting soil acidity and enhancing crop productivity

- 9.1.2 CALCIUM SULFATE

- 9.1.2.1 Driving soil conditioning and nutrient availability

- 9.1.3 CALCIUM NITRATE

- 9.1.3.1 Supporting rapid plant growth and animal nutrition efficiency

- 9.1.4 CALCIUM CHLORIDE

- 9.1.4.1 Driving calcium availability across crop nutrition and livestock feed systems

- 9.1.5 CALCIUM OXIDE AND CALCIUM HYDROXIDE (LIME & HYDRATED LIME)

- 9.1.5.1 Improving soil conditioning and animal health management through lime-based calcium

- 9.1.6 CALCIUM CITRATE

- 9.1.6.1 Improving plant growth response and animal mineral absorption

- 9.1.7 CALCIUM PHOSPHATE

- 9.1.7.1 Supporting root development and skeletal health with calcium phosphate

- 9.1.7.2 Dicalcium phosphate

- 9.1.7.3 Monocalcium phosphate

- 9.1.7.4 Mono-dicalcium phosphate

- 9.1.7.5 Tricalcium phosphate

- 9.1.8 NATURAL MINERAL

- 9.1.8.1 Restoring soil health and improving feed trace mineral availability using rock-derived calcium

- 9.1.8.2 AZOMITE

- 9.1.8.3 Kelzyme

- 9.1.8.4 Calcium with trace minerals

- 9.1.1 CALCIUM CARBONATE

10 AGRICULTURAL CALCIUM MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 AGRICULTURE

- 10.1.1.1 Agricultural calcium supports soil health and crop productivity across diverse farming systems

- 10.1.1.2 Field crops

- 10.1.1.2.1 Cereals & grains

- 10.1.1.2.2 Oilseeds & pulses

- 10.1.1.2.3 Other field crops

- 10.1.1.3 Horticulture crops

- 10.1.1.3.1 Fruits

- 10.1.1.3.2 Vegetables

- 10.1.1.3.3 Plantation crops

- 10.1.1.4 Controlled Environment Agriculture (CEA)

- 10.1.1.4.1 Greenhouse farming

- 10.1.1.4.2 Hydroponics

- 10.1.1.5 Land, forest, & mining regeneration

- 10.1.2 ANIMAL FEED

- 10.1.2.1 Essential mineral nutrition powering animal health, productivity, and performance

- 10.1.2.2 Poultry

- 10.1.2.2.1 Broilers

- 10.1.2.2.2 Layers

- 10.1.2.2.3 Breeders

- 10.1.2.3 Ruminants

- 10.1.2.3.1 Dairy

- 10.1.2.3.2 Beef

- 10.1.2.3.3 Calf

- 10.1.2.3.4 Other ruminants

- 10.1.2.4 Swine

- 10.1.2.5 Aquatic animals

- 10.1.2.6 Pets

- 10.1.1 AGRICULTURE

11 AGRICULTURAL CALCIUM MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 POWDER

- 11.2.1 FEEDING HERDS, HEALING SOILS, AND FUELING FARM PRODUCTIVITY

- 11.3 GRANULES/GRITS

- 11.3.1 OFFERING PRACTICAL CALCIUM NUTRITION WITH PRECISION APPLICATION AND REDUCED LOSSES

- 11.4 LIQUID

- 11.4.1 SUPPORTING RAPID DEFICIENCY CORRECTION AND CONTROLLED NUTRIENT MANAGEMENT IN BOTH ANIMALS AND CROPS

- 11.5 PELLETS

- 11.5.1 ENSURING CLEAN HANDLING, PRECISE APPLICATION, AND SUSTAINED NUTRIENT AVAILABILITY FOR LONG-TERM PRODUCTIVITY

- 11.6 OTHER FORMS

12 AGRICULTURAL CALCIUM MARKET, BY FUNCTION

- 12.1 AGRICULTURE

- 12.1.1 NUTRIENT SUPPLEMENTATION

- 12.1.2 SOIL STRUCTURE IMPROVEMENT

- 12.1.3 DISEASE PREVENTION AND PLANT HEALTH

- 12.1.4 FERTILIZER ENHANCEMENT

- 12.1.5 SOIL PH ADJUSTMENT AND LIMING

- 12.2 ANIMAL FEED

- 12.2.1 BONE AND MUSCLE DEVELOPMENT

- 12.2.2 EGGSHELL FORMATION

- 12.2.3 MILK PRODUCTION ENHANCEMENT

- 12.2.4 OTHER FUNCTIONS

13 AGRICULTURAL CALCIUM MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 High-input farming and fertilizer-intensive agriculture to drive market

- 13.2.2 CANADA

- 13.2.2.1 Large-scale, export-driven farming and rising production intensity to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Increasing agricultural production and diverse agro-climatic conditions to drive market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Rising grain yields and increasingly intensive cereal cultivation to drive market

- 13.3.2 UK

- 13.3.2.1 Policy-driven soil sustainability targets and nutrient balancing needs to drive market

- 13.3.3 FRANCE

- 13.3.3.1 High-volume crop production and sustainability-led dairy farming to drive market

- 13.3.4 ITALY

- 13.3.4.1 Need for effective soil fertility management across both arable and perennial cropping systems to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Extensive cultivation of cereal and perennial crops and intensive livestock systems to drive market

- 13.3.6 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Public investment in food security and resource efficiency to support market growth

- 13.4.2 JAPAN

- 13.4.2.1 Continuous rice, wheat, and soybean cultivation under limited land availability to drive consistent adoption of calcium-based soil amendments

- 13.4.3 INDIA

- 13.4.3.1 Food security pressures and climate variability to strengthen demand for calcium in crop nutrition systems

- 13.4.4 AUSTRALIA & NEW ZEALAND

- 13.4.4.1 Soil restoration and nutrient efficiency goals to drive market

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Increasing production and export of agricultural products to drive market

- 13.5.2 ARGENTINA

- 13.5.2.1 Large-scale food exports and intensive cropping systems to drive market

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 REST OF THE WORLD

- 13.6.1 MIDDLE EAST

- 13.6.1.1 Agri-tech-led food security strategies to strengthen calcium use in high-efficiency farming systems

- 13.6.2 AFRICA

- 13.6.2.1 Yield improvement and soil restoration efforts to drive demand for agricultural calcium

- 13.6.1 MIDDLE EAST

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2022-2025

- 14.3 REVENUE ANALYSIS, 2022-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Regional footprint

- 14.6.5.3 Type footprint

- 14.6.5.4 Application footprint

- 14.6.5.5 Form footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8.1 COMPANY VALUATION

- 14.8.2 FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 YARA INTERNATIONAL ASA (YARA)

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 OMYA INTERNATIONAL AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 SIBELCO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 CARMEUSE

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 COROMANDEL INTERNATIONAL LTD.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 IMERYS

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.4 MnM view

- 15.1.7 SAINT-GOBAIN FORMULA

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.4 MnM view

- 15.1.8 MINERALS TECHNOLOGIES INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.4 MnM view

- 15.1.9 GRAYMONT

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.4 MnM view

- 15.1.10 KEMIN INDUSTRIES, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.4 MnM view

- 15.1.11 CALC GROUP

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.4 MnM view

- 15.1.12 EUROCHEM GROUP

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.4 MnM view

- 15.1.13 GLC MINERALS, LLC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.4 MnM view

- 15.1.14 LHOIST

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.4 MnM view

- 15.1.15 HUBER ENGINEERED MATERIALS

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.15.4 MnM view

- 15.1.1 YARA INTERNATIONAL ASA (YARA)

- 15.2 STARTUPS/SMES

- 15.2.1 MISSISSIPPI LIME COMPANY D/B/A MLC

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.4 MnM view

- 15.2.2 AZOMITE MINERAL PRODUCTS, INC.

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.4 MnM view

- 15.2.3 JILOCA INDUSTRIAL SA

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.4 MnM view

- 15.2.4 SIGMA MINERALS LTD.

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.4 MnM view

- 15.2.5 ASTRRA CHEMICALS

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.4 MnM view

- 15.2.6 CALCIUM PRODUCTS, INC.

- 15.2.7 LONGCLIFFE QUARRIES LTD.

- 15.2.8 BHAGVATI MINERALS

- 15.2.9 ICL

- 15.2.10 CULTIVACE & KWS DISTRIBUTING

- 15.2.1 MISSISSIPPI LIME COMPANY D/B/A MLC

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Breakdown of primary profiles

- 16.1.2.3 Key insights from industry experts

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 TOP-DOWN APPROACH

- 16.2.2 SUPPLY-SIDE ANALYSIS

- 16.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 16.3 DATA TRIANGULATION AND MARKET BREAKUP

- 16.4 RESEARCH ASSUMPTIONS

- 16.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

17 ADJACENT & RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 STUDY LIMITATIONS

- 17.3 FERTILIZERS MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 FEED ADDITIVES MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 MARKET OVERVIEW

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON AGRICULTURAL CALCIUM MARKET

- TABLE 3 ROLES OF COMPANIES IN AGRICULTURAL CALCIUM MARKET ECOSYSTEM

- TABLE 4 IMPORT SCENARIO FOR HS CODE: 283650, BY COUNTRY, 2020-2024 (TONS)

- TABLE 5 IMPORT SCENARIO FOR HS CODE: 2510, BY COUNTRY, 2020-2024 (TONS)

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 283650, BY COUNTRY, 2020-2024 (TONS)

- TABLE 7 EXPORT SCENARIO FOR HS CODE: 2510, BY COUNTRY, 2020-2024 (TONS)

- TABLE 8 AGRICULTURAL CALCIUM MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 12 AGRICULTURAL CALCIUM MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 13 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INTERNATIONAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 GLOBAL INDUSTRY STANDARDS IN AGRICULTURAL CALCIUM MARKET

- TABLE 20 LABELING REQUIREMENTS AND CLAIMS IN AGRICULTURAL CALCIUM MARKET

- TABLE 21 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN AGRICULTURAL CALCIUM MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AGRICULTURE AND ANIMAL FEED APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR TOP AGRICULTURE AND ANIMAL FEED APPLICATIONS

- TABLE 24 UNMET NEEDS IN AGRICULTURAL CALCIUM MARKET, BY APPLICATION INDUSTRIES ACROSS SUPPLY CHAIN

- TABLE 25 COST DYNAMICS IN AGRICULTURAL CALCIUM MARKET

- TABLE 26 MARGIN OPPORTUNITIES IN AGRICULTURAL CALCIUM MARKET, BY KEY TYPES

- TABLE 27 AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 30 AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 31 CALCIUM CARBONATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 CALCIUM CARBONATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 CALCIUM CARBONATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 34 CALCIUM CARBONATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 35 CALCIUM SULFATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 CALCIUM SULFATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 CALCIUM SULFATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 38 CALCIUM SULFATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 39 CALCIUM NITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 CALCIUM NITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CALCIUM NITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 42 CALCIUM NITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 43 CALCIUM CHLORIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 CALCIUM CHLORIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 CALCIUM CHLORIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 46 CALCIUM CHLORIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 47 CALCIUM OXIDE AND HYDROXIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 CALCIUM OXIDE AND HYDROXIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 CALCIUM OXIDE AND HYDROXIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 50 CALCIUM OXIDE AND HYDROXIDE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 51 CALCIUM CITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 CALCIUM CITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 CALCIUM CITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 54 CALCIUM CITRATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 55 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 58 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 59 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 60 CALCIUM PHOSPHATE: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 61 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 62 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 63 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 66 NATURAL MINERAL: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 67 AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 AGRICULTURE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 AGRICULTURE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 AGRICULTURE: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 72 AGRICULTURE: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 73 FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 74 FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 75 FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 CEREALS & GRAINS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 CEREALS & GRAINS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OILSEEDS & PULSES: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OILSEEDS & PULSES: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 OTHER FIELD CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 HORTICULTURE CROPS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 84 HORTICULTURE CROPS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 85 HORTICULTURE CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 HORTICULTURE CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 FRUITS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 FRUITS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 VEGETABLES: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 VEGETABLES: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 PLANTATION CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 PLANTATION CROPS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 CONTROLLED ENVIRONMENT AGRICULTURE (CEA): AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 94 CONTROLLED ENVIRONMENT AGRICULTURE (CEA): AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 95 CONTROLLED ENVIRONMENT AGRICULTURE (CEA): AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 CONTROLLED ENVIRONMENT AGRICULTURE (CEA): AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 GREENHOUSE FARMING: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 GREENHOUSE FARMING: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 HYDROPONICS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 HYDROPONICS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 LAND, FOREST, & MINING REGENERATION: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 LAND, FOREST, & MINING REGENERATION: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 ANIMAL FEED: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 ANIMAL FEED: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 ANIMAL FEED: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 106 ANIMAL FEED: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 107 POULTRY: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 POULTRY: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 POULTRY: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 110 POULTRY: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 111 RUMINANTS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 RUMINANTS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 RUMINANTS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 114 RUMINANTS: AGRICULTURAL CALCIUM MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 115 SWINE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 SWINE: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 AQUATIC ANIMALS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 AQUATIC ANIMALS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 PETS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 PETS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 122 AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 123 POWDER: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 POWDER: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 GRANULES/GRITS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 GRANULES/GRITS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 LIQUID: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 LIQUID: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 PELLETS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 PELLETS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 OTHER FORMS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 OTHER FORMS: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (KT)

- TABLE 136 AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (KT)

- TABLE 137 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 142 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 143 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR FIELD CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR FIELD CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 157 US: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 US: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 CANADA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 160 CANADA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 MEXICO: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 MEXICO: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 168 EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 169 EUROPE: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 EUROPE: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 EUROPE: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 176 EUROPE: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 EUROPE: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 EUROPE: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 EUROPE: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 EUROPE: AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 182 EUROPE: AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 183 GERMANY: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 GERMANY: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 UK: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 186 UK: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 187 FRANCE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 FRANCE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 ITALY: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 190 ITALY: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 191 SPAIN: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 192 SPAIN: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 REST OF EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 194 REST OF EUROPE: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 196 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 198 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 200 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 201 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 202 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2021-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 215 CHINA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 216 CHINA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 217 JAPAN: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 218 JAPAN: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 INDIA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 220 INDIA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 AUSTRALIA AND NEW ZEALAND: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 222 AUSTRALIA AND NEW ZEALAND: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 226 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 227 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 228 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 229 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 230 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 231 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 232 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 234 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 236 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 238 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 239 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 240 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 241 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2021-2024 (USD MILLION)

- TABLE 242 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2025-2030 (USD MILLION)

- TABLE 243 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 244 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 245 BRAZIL: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 246 BRAZIL: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 247 ARGENTINA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 248 ARGENTINA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 251 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 252 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 253 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 254 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 255 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 256 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 257 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 258 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 259 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 260 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY AGRICULTURE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 261 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 262 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR FIELD CROP, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 263 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 264 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR HORTICULTURE CROPS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 265 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 266 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET FOR CONTROLLED ENVIRONMENT AGRICULTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 267 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2021-2024 (USD MILLION)

- TABLE 268 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY ANIMAL FEED APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 270 REST OF THE WORLD: AGRICULTURAL CALCIUM MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 271 MIDDLE EAST: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 272 MIDDLE EAST: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273 AFRICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 274 AFRICA: AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 275 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURAL CALCIUM MARKET PLAYERS, 2022-2025

- TABLE 276 AGRICULTURAL CALCIUM MARKET: MARKET SHARE ANALYSIS, 2024

- TABLE 277 AGRICULTURAL CALCIUM MARKET: REGIONAL FOOTPRINT

- TABLE 278 AGRICULTURAL CALCIUM MARKET: TYPE FOOTPRINT

- TABLE 279 AGRICULTURAL CALCIUM MARKET: APPLICATION FOOTPRINT

- TABLE 280 AGRICULTURAL CALCIUM MARKET: FORM FOOTPRINT

- TABLE 281 AGRICULTURAL CALCIUM MARKET: STARTUPS/SMES, 2024

- TABLE 282 AGRICULTURAL CALCIUM MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 283 AGRICULTURAL CALCIUM MARKET: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 284 AGRICULTURAL CALCIUM MARKET: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 285 AGRICULTURAL CALCIUM MARKET: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 286 YARA: COMPANY OVERVIEW

- TABLE 287 YARA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 OMYA INTERNATIONAL AG: COMPANY OVERVIEW

- TABLE 289 OMYA INTERNATIONAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 OMYA INTERNATIONAL AG: PRODUCT LAUNCHES

- TABLE 291 OMYA INTERNATIONAL AG: EXPANSIONS

- TABLE 292 SIBELCO: COMPANY OVERVIEW

- TABLE 293 SIBELCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 CARMEUSE: COMPANY OVERVIEW

- TABLE 295 CARMEUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 COROMANDEL INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 297 COROMANDEL INTERNATIONAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 IMERYS: COMPANY OVERVIEW

- TABLE 299 IMERYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 SAINT-GOBAIN FORMULA: COMPANY OVERVIEW

- TABLE 301 SAINT-GOBAIN FORMULA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 MINERALS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 303 MINERALS TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 GRAYMONT: COMPANY OVERVIEW

- TABLE 305 GRAYMONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 GRAYMONT: DEALS

- TABLE 307 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 308 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 CALC GROUP: COMPANY OVERVIEW

- TABLE 310 CALC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 EUROCHEM GROUP: COMPANY OVERVIEW

- TABLE 312 1.1.2 EUROCHEM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 GLC MINERALS, LLC.: COMPANY OVERVIEW

- TABLE 314 GLC MINERALS, LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 LHOIST: COMPANY OVERVIEW

- TABLE 316 LHOIST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 HUBER ENGINEERED MATERIALS: COMPANY OVERVIEW

- TABLE 318 HUBER ENGINEERED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 HUBER ENGINEERED MATERIALS: DEALS

- TABLE 320 MISSISSIPPI LIME COMPANY D/B/A MLC: COMPANY OVERVIEW

- TABLE 321 MISSISSIPPI LIME COMPANY D/B/A MLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 AZOMITE MINERAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 323 AZOMITE MINERAL PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 JILOCA INDUSTRIAL SA: COMPANY OVERVIEW

- TABLE 325 JILOCA INDUSTRIAL SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SIGMA MINERALS LTD.: COMPANY OVERVIEW

- TABLE 327 SIGMA MINERALS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 ASTRRA CHEMICALS: COMPANY OVERVIEW

- TABLE 329 ASTRRA CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 MARKETS ADJACENT TO AGRICULTURAL CALCIUM MARKET

- TABLE 331 FERTILIZERS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 332 FERTILIZERS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 333 FEED ADDITIVES MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 334 FEED ADDITIVES MARKET, BY FORM, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SCENARIO

- FIGURE 2 GLOBAL AGRICULTURAL CALCIUM MARKET, 2021-2030

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AGRICULTURAL CALCIUM MARKET, 2020-2025

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF AGRICULTURAL CALCIUM MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS IN AGRICULTURAL CALCIUM MARKET

- FIGURE 6 SOUTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 7 FOCUS ON ANIMAL HEALTH AND PRODUCTIVITY AND EMERGING PRIORITIES IN GLOBAL SOIL HEALTH MANAGEMENT TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 8 CALCIUM CARBONATE SEGMENT AND ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARES IN 2025

- FIGURE 9 CALCIUM CARBONATE SEGMENT TO LEAD MARKET IN 2025

- FIGURE 10 AGRICULTURE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 POWDER SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 12 CHINA TO DOMINATE MARKET IN 2025

- FIGURE 13 AGRICULTURAL CALCIUM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 AGRICULTURAL CALCIUM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 GLOBAL POPULATION, 2020-2025

- FIGURE 16 AGRICULTURAL CALCIUM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 AGRICULTURAL CALCIUM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE OF MARKET PLAYERS, BY KEY TYPES, 2025 (USD)

- FIGURE 19 AVERAGE SELLING PRICE TREND OF AGRICULTURAL CALCIUM, BY REGION, 2021-2024 (USD/TON)

- FIGURE 20 IMPORT OF HS CODE 283650, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 21 IMPORT OF HS CODE 2510, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 22 EXPORT OF HS CODE 283650, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 23 EXPORT OF HS CODE 2510, BY KEY COUNTRY, 2020-2024 (TONS)

- FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO

- FIGURE 26 NUMBER OF PATENTS APPLIED AND GRANTED FOR AGRICULTURAL CALCIUM, 2015-2025

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AGRICULTURAL CALCIUM

- FIGURE 28 FUTURE APPLICATIONS

- FIGURE 29 AGRICULTURAL CALCIUM MARKET DECISION-MAKING FACTORS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AGRICULTURE AND ANIMAL FEED APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR AGRICULTURE AND ANIMAL FEED APPLICATIONS

- FIGURE 32 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 33 AGRICULTURAL CALCIUM MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 34 AGRICULTURAL CALCIUM MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 AGRICULTURAL CALCIUM MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 BRAZIL AND CHINA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC: AGRICULTURAL CALCIUM MARKET SNAPSHOT

- FIGURE 38 SOUTH AMERICA: AGRICULTURAL CALCIUM MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 40 MARKET SHARE ANALYSIS, 2024

- FIGURE 41 AGRICULTURAL CALCIUM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 AGRICULTURAL CALCIUM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 AGRICULTURAL CALCIUM MARKET: COMPANY FOOTPRINT

- FIGURE 44 AGRICULTURAL CALCIUM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 COMPANY VALUATION FOR MAJOR PLAYERS IN AGRICULTURAL CALCIUM MARKET, 2025

- FIGURE 46 EV/EBITDA OF MAJOR PLAYERS, 2025

- FIGURE 47 YARA: COMPANY SNAPSHOT

- FIGURE 48 SIBELCO: COMPANY SNAPSHOTS

- FIGURE 49 COROMANDEL INTERNATIONAL LTD.: COMPANY SNAPSHOT

- FIGURE 50 IMERYS: COMPANY SNAPSHOTS

- FIGURE 51 SAINT-GOBAIN FORMULA: COMPANY SNAPSHOT

- FIGURE 52 MINERALS TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 53 AGRICULTURAL CALCIUM MARKET: RESEARCH DESIGN

- FIGURE 54 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 55 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 56 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 57 AGRICULTURAL CALCIUM MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 58 DATA TRIANGULATION