|

市场调查报告书

商品编码

1312427

青光眼手术设备的全球市场(2023年):2022年~2028年的分析2023 Glaucoma Surgical Device Market Report: Global Analysis for 2022 to 2028 |

||||||

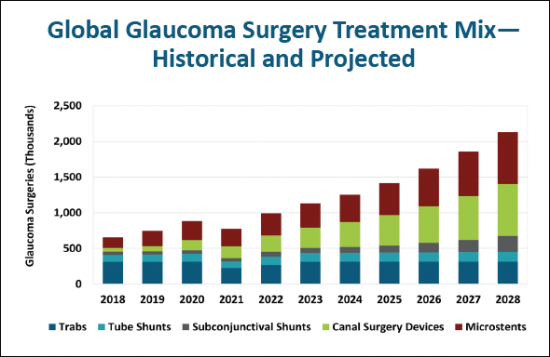

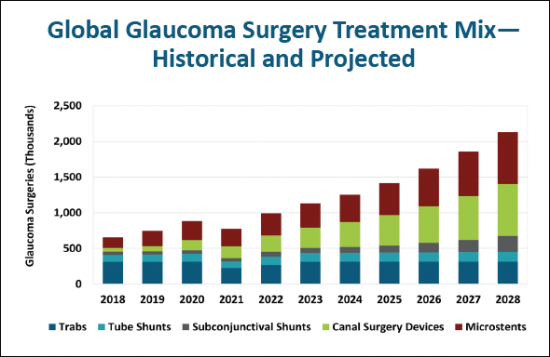

在过去几年中,手术器械的选择增加了一倍多,随着新器械数量的开发,预计未来五年将继续快速扩张。该报告分析了这些竞争对手产品数量的成长情况,并按类型绘製了预期成长情况。还在单独部分中追踪持续给药装置的发展。

范例视图

本报告提供全球青光眼手术设备市场相关调查,提供市场概要,以及今后5年的市场预测,重要的未来趋势,及加入此市场的主要企业的竞争分析等资讯。

目录

- 青光眼,青光眼人口,青光眼诊断相关背景资讯。

- 青光眼手术设备的含目前销售额估计·预测销售额(平均价格和总收入)

- 眼科医生,眼科专门医生,验光师,含一般医生的设备购买预定者的简介

- 厂商相关资讯

- 目前偿付率

What's New:

The "2023 Glaucoma Surgical Device Market Report" analyzes a new trend in the treatment of glaucoma patients: earlier surgical intervention. The report projects market growth through 2028 and discusses the mix of combination cataract/glaucoma surgeries and standalone glaucoma procedures for eight regions of the world.

SAMPLE VIEW

Glaucoma laser technologies in development or early commercialization are expected to significantly increase overall laser penetration. The new report highlights some of these technologies, including the Belkin laser, ViaLase femtosecond laser, Elios excimer laser, and IOPtimate CO2 laser.

Surgical device options in the past few years have more than doubled, and rapid expansion is expected to continue over the next five years, based on the number of new devices in development. The report analyzes this growing number of products from each competitor and illustrates the expected increase by type. It also tracks the progress being made in sustained drug delivery devices in a separate section.

The "2023 Glaucoma Surgical Device Market Report" offers a comprehensive analysis of the current global market for glaucoma devices, as well as a discussion of important trends and key factors shaping future success. The report covers prevalence for glaucoma worldwide and discusses the ophthalmologists who treat glaucoma. It also examines the role of surgical intervention, the market dynamics for currently commercialized products, and the pipeline of investigational devices that may offer improved outcomes. Product demand is forecast in units and dollars, and market shares are analyzed by product category. Twenty-four market competitors are profiled, with discussion of their products, strategic market position, background, and outlook.

Contents:

The report mainly focuses on the product categories of microstents, formerly referred to as minimally invasive glaucoma surgery (MIGS) devices; subconjunctival shunts; canal surgery devices; and tube shunts. It also examines lasers used in glaucoma procedures. Each segment provides an analysis of market competitors and five-year market forecasts for units and dollars.

Also included in the report:

- Background information about glaucoma, glaucoma populations, and glaucoma diagnosis.

- Estimates of current sales and sales forecasts for glaucoma devices, including average prices and total revenue.

- Profiles of prospective device buyers, including ophthalmologists, ophthalmic specialists, optometrists, and general medical doctors.

- Information about manufacturers.

- Current reimbursement rates.

Author Profile:

William Freeman

Bill Freemanhas more than 35 years of experience developing, manufacturing, and marketing cataract surgery products. He has held key executive positions at four firms that produce ophthalmic surgical devices.

Bill's career in ophthalmology began in the 1970s. As president of Cavitron Surgical Systems, he worked with Dr. Charles Kelman in developing and marketing the world's first phacoemulsifier system. While highly controversial in the 1970s, phacoemulsification gradually became the preferred cataract removal technique in the early 1980s. For many years, Cavitron led the cataract instrumentation market.

CooperVision purchased Cavitron in the early 1980s, and Bill joined the company as president of the surgical division. CooperVision expanded its product line to include a wide variety of cataract surgical products-IOLs, viscoelastic solutions, disposable devices, lasers, and custom packs-and became the market leader in many product categories.

In 1989, Alcon acquired CooperVision in an effort to build a strong presence in cataract surgical devices. Bill joined Alcon as general manager of the Irvine Technology Center, where a number of the company's cataract devices, including the Legacy 20000 phacoemulsifier and a broad line of disposable items, were designed and manufactured.

Bill remained with Alcon until 1995. He then joined Mentor Ophthalmics as president of the ophthalmology division. At Mentor, he was responsible for the company's ophthalmic products including IOLs, cautery devices, and surgical instruments.

After leaving Mentor in 1999, Bill joined Market Scope in 2000 and now serves as executive vice president focusing on ophthalmic surgical cataract, retinal and glaucoma devices.