|

市场调查报告书

商品编码

1284313

占用分析和室内定位服务:商业办公空间(2023-2028)Occupancy Analytics & In-Building Location-Based Services: Commercial Office Space 2023 to 2028 |

||||||

商业办公室占用分析市场预计将从 2022 年的 32.5 亿美元增长到 2028 年的 70.7 亿美元,复合年增长率为 13.8%。

本报告对商业办公空间入住率分析及楼内位置信息服务市场进行调查,包括市场规模变化与预测、市场影响因素分析、竞争格局、併购及融资趋势等。正在拼凑。

上市公司(不限于此):

|

|

内容

简介

执行摘要

第一章混合工作

第 2 章用例

- 空间管理和优化指标

- 入住计划或预测

- 出勤分析

- 人员占用人数

- 室内测绘和位置分析

- 基于占用的设施管理

第 3 章占用分析解决方案:按功能

- 空间利用和规划

- 资源调度

- 综合工作场所管理系统 (IWMS)

- 室内测绘和位置分析

- 建筑物物联网解决方案

- 访客管理

- 基于占用的设施管理

第 4 章全球办公楼占用分析市场

- 办公室的物联网市场

- 智能商业建筑的空间、占用和人员流动应用市场

- 世界份额分析市场:市场规模的转变和预测

- 按地区细分

第五章竞争格局

- 占用分析初创公司

第六章併购、投资和合作

- 併购

- 风险投资融资/私募股权投资

附录

This Report is a new 2023 Study which makes an Objective Assessment of the Market for Occupancy Analytics & In-Building Location Based Services in Commercial Office Space to 2028.

Memoori presents a new Occupancy Analytics report, building on our portfolio of building technology and workplace-related research. It is our 4th comprehensive evaluation of Occupancy Analytics and Location-Based Services for commercial office space since 2018.

This report offers valuable insights and analysis into workplace software and hardware used in commercial real estate to manage office occupancy and hybrid working. It highlights the diversity and range of suppliers in the marketplace, backed up by three appendices listing over 200 companies, segmented by major functionality, and M&A and funding activity over the last two years.

KEY QUESTIONS ADDRESSED:

- What is the Size of the Global Occupancy Analytics Market? The global occupancy analytics market in commercial office space is anticipated to grow from $3.25 billion in 2022 to $7.07 billion by 2028, a CAGR of 13.8%.

- What is Driving the Market? Growth is being driven by businesses exploring reconfigured solutions for hybrid workspaces and an emphasis on real-time occupancy data to inform future space requirements.

- What does the Competitive Landscape look like? The competitive landscape remains diverse and potentially confusing for the buyer, with numerous vendors offering point solutions and platforms. Notably, 58% (121) of the occupancy analytics companies identified were founded in the last decade, indicating low entry barriers and the disruptive influence of software, analytics, and IoT in smart buildings.

At Memoori, we have decades of experience in the evaluation of building services markets, and regularly publish reports on several building technology areas including The Market for IoT in Smart Commercial Buildings 2023 to 2028, The Smart Building Startup Landscape 2023, Startups in Smart Buildings 2023, IoT Devices in Smart Commercial Buildings 2023 to 2028, and The Global Market for Workplace Experience Apps 2020 to 2025. This has given us a solid grounding on which to build our growth projections.

This report is the first instalment of a two-part series covering Workplace Technology. Part 2, covering Workplace Experience Apps, Tenant Engagement Platforms and Mobile Access Control, is to be published later in Q2 2023. Both these reports are included in Memoori's 2023 Premium Subscription Service.

WITHIN ITS 115 PAGES AND 33 CHARTS AND TABLES, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY WHAT IS SHAPING THE FUTURE OF OCCUPANCY ANALYTICS IN COMMERCIAL OFFICE SPACE;

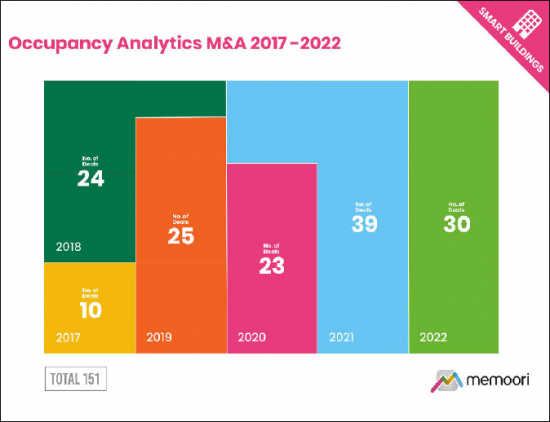

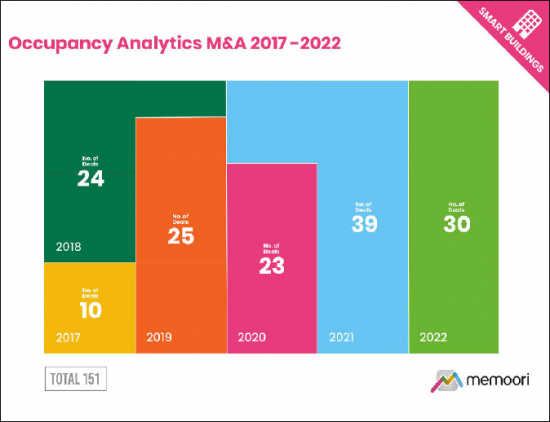

- Both M&A and venture capital funding reached record-breaking highs in 2021, signifying a vibrant and active market environment. Workplace technology deals also made up a substantial portion of transactions in the smart buildings space in 2022.

- This report identified 151 acquisitions in these sectors over the past six years, a trend that aligns with the record-breaking levels of M&A activity observed in the broader smart buildings space.

- Challenging conditions in the commercial real estate (CRE) sector could start to limit investment. As of March 2023, offices saw a global average occupancy of 33%, according to the Freespace Index, a monthly analysis of workplace trends using anonymized data from over 100,000 occupancy sensors in offices around the world.

This report provides valuable information so companies can improve their strategic planning exercises AND look at the potential for developing their business through merger, acquisition and alliance.

WHO SHOULD BUY THIS REPORT?

The information contained in this report will help all investors and stakeholders in commercial real estate to understand the market for spatial and location analytics, a rapidly evolving technology sector. The market is maturing, having seen considerable growth and investment activity over the past three years, accelerated by the COVID-19 pandemic.

Companies Mentioned INCLUDE (but NOT Limited to):

|

|

Table of Contents

Introduction

Executive Summary

1. Hybrid Working

2. Use Cases

- 2.1. Space Management and Optimization Metrics

- 2.2. Planned or Forecast Occupancy

- 2.3. Attendance Analytics

- 2.4. People Counting Occupancy

- 2.5. Indoor Mapping and Location Analytics

- 2.6. Occupancy-Based Facilities Management

3. Occupancy Analytics Solutions by Functionality

- 3.1. Space Utilization and Planning

- 3.2. Resource Scheduling

- 3.3. Integrated Workplace Management Systems (IWMS)

- 3.4. Indoor Mapping and Location Analytics

- 3.5. IoT Solutions for Buildings

- 3.6. Visitor Management

- 3.7. Occupancy-Based Facilities Management

4. The Global Occupancy Analytics Market in Office Buildings

- 4.1. The Market for the Internet of Things in Offices

- 4.2. The Market for Space, Occupancy & People Movement Applications in Smart Commercial Buildings

- 4.3. The Global Occupancy Analytics Market Size 2022 and Forecast to 2028

- 4.4. Breakdown of Geographic Regions

5. Competitive Landscape

- 5.1. Occupancy Analytics Startups

6. M&A, Investments and Partnerships

- 6.1. Mergers and Acquisitions

- 6.2. Venture Capital Funding and Private Equity Investments

Appendix

- A1 - Occupancy Analytics Supplier Listing by Solution Functionality

- A2 - Mergers and Acquisitions Jan 2021 - Apr 2023

- A3 - Venture Capital and Private Equity Funding Jan 2021 - Apr 2023

List of Charts and Figures

- Fig 3.1. Occupancy Analytics Solutions by Functionality

- Fig 3.2. Space Utilization and Planning Vendors

- Fig 3.3. Notable Space Utilization and Planning M&A in 2021 and 2022

- Fig 3.4. Notable Space Utilization and Planning Funding in 2022 and 2023

- Fig 3.5. Notable Space Utilization and Planning Funding in 2021

- Fig 3.6. Resource Scheduling Vendors

- Fig 3.7. Notable Resource Scheduling Funding in 2022 and 2023

- Fig 3.8. Microsoft Places Connected Workplace Ecosystem of Partners

- Fig 3.9. Vendors of Integrated Workplace Management Systems (IWMS)

- Fig 3.10. Notable IWMS M&A in 2021 and 2022

- Fig 3.11. Eptura Workplace Technology and Software Portfolio

- Fig 3.12. Vendors of Indoor Mapping and Location Analytics Solutions

- Fig 3.13. Notable Indoor Mapping & Location Analytics Funding 2021 - 2023

- Fig 3.14. Vendors of Building IoT Software and Devices

- Fig 3.15. Notable BIoT Hardware and Software Funding 2022 - 2023

- Fig 3.16. Vendors of Visitor Management Software

- Fig 3.17. Visitor Management Software Acquisitions 2020 - 2022

- Fig 3.18. Vendors of Occupancy-Based Facilities Management Solutions

- Fig 4.1. Commercial Smart Building IoT Device Projections by Vertical Market 2023 to 2028

- Fig 4.2. The Market for the IoT in Smart Commercial Buildings Market by Application

- Fig 4.3. Global Occupancy Analytics Market 2022 to 2028 ($B)

- Fig 4.4. Occupancy Analytics Market by Region, Office Buildings, 2022 to 2028 ($M)

- Fig 4.5. Patent Applications by Country, May 2023

- Fig 5.1. Geographic Distribution of Occupancy Analytics Vendors 2023

- Fig 5.2. Smart Building Startups by Segment

- Fig 5.3. Occupancy Analytics Startups Gaining Traction

- Fig 6.1. Range of Buyers and Investors Circling the Smart Commercial Office Space

- Fig 6.2. Occupancy Analytics M&A 2017 to 2022

- Fig 6.3. Occupancy Analytics VC & PE Funding 2017 to 2022 ($M)