|

市场调查报告书

商品编码

1848180

影音监控的全球市场(2025年~2030年)The Global Video Surveillance Business 2025 to 2030 - Cameras, Storage, Software & Analytics Market Analysis |

||||||

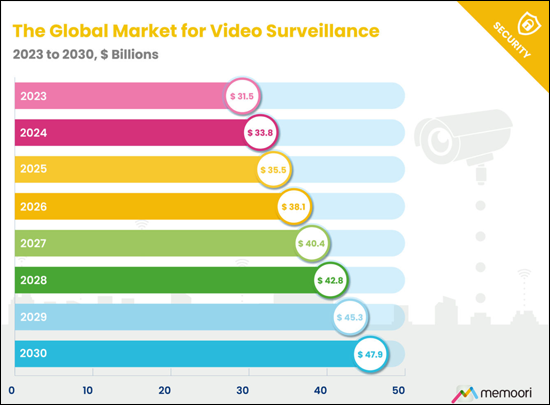

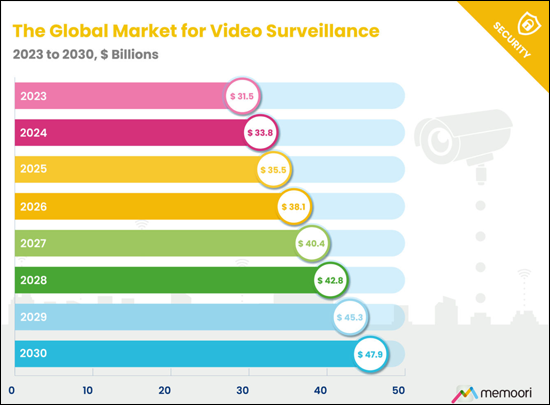

- 预计全球视讯监控设备和软体的总收入(以出厂价计算)将在2024年达到338亿美元,2025年达到355亿美元,到2030年达到479亿美元。这相当于约6%的复合年增长率,反映了该产业从被动式安全部署转向策略性、情报驱动的基础设施投资的转变。

- 我们的市场分析涵盖四个核心部分:视讯摄影机硬体、软体和分析、视讯储存以及配套硬体基础设施。这种细分揭示了该行业以软体功能和经常性收入模式为特征,其中分析和云端服务的成长速度是传统设备销售的两倍以上。

- 具备边缘处理能力的AI赋能摄影机预计在2025年占全球摄影机出货量的很大一部分。这些系统提供广泛的功能,从目标侦测和车牌识别到行为分析和隐私保护的重新编辑,从根本上改变了视讯监控,使其从被动录製转变为主动运行智慧。

- 无人机正成为扩展视讯监控能力的关键载体。 无人机可以将监控范围扩展到固定摄影机难以触及的区域,为事件回应提供快速部署能力,并支援对关键基础设施、大型园区和边境安全应用进行持续、广域的监控。将无人机与地面系统和即时犯罪中心结合,从根本上扩展了监控架构,使其从静态观察点扩展到动态的行动感测器网路。

地缘政治紧张局势持续重塑市场准入与竞争格局

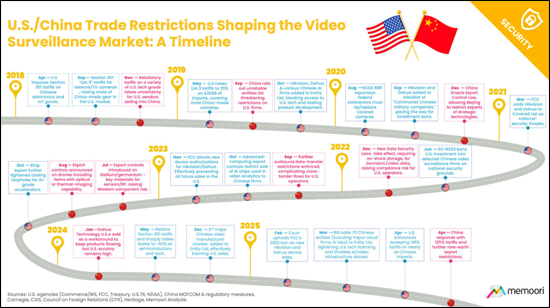

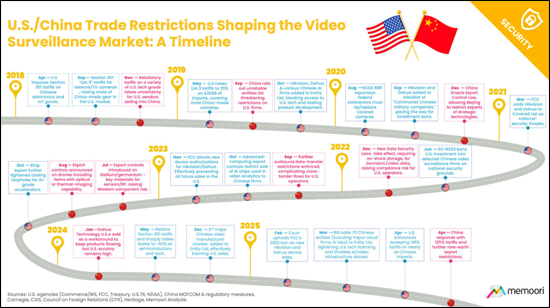

中西方之间的地缘政治紧张局势正在分裂市场,中国供应商面临美国采购禁令、FCC设备许可限制以及不断扩大的出口管制。这些法规为符合 "国防授权法案" (NDAA) 的替代方案创造了持续的机遇,这些替代方案将监管诚信和网路安全透明度作为核心品牌价值。

从2023年9月到2025年8月,共观察到24件併购交易。同期,投资活动总额达38亿美元,涉及38笔交易。主要趋势包括:整合硬体、软体和云端服务的平台整合;私募股权驱动的积极市场重组;策略重点从硬体转向软体和经常性收入;人工智慧的融合推动了对电脑视觉和隐私领域新创公司的收购。

本报告探索并分析了全球视讯监控市场,提供了有关市场规模和结构、人工智慧和边缘运算驱动的变革、地缘政治紧张局势的影响以及併购、投资和策略联盟发展情况的资讯。

目录

序文

摘要整理

第1章 影音监控商务的结构与形状

- 影音监控市场结构

- 企业的分类与市场占有率

- 群组A企业

- 群组B企业

- 群组C企业

- 群组D企业

- 销售·流通管道

第2章 影音监控市场

- 影音监控的采用与投资

- 市场营运状况

- 主要普及推动因素

- 实体安防支出计画及预算

- 影音监控的市场规模与成长预测

- 市场整体预测和轨道

- 市场预测的明细:不同类别的

- 市场规模,成长,趋势:各主要地区

- 北美

- 南美·加勒比海地区

- 中国

- 其他的亚太地区

- 欧洲

- 中东·非洲

- 市场规模,趋势:各业界

- 公共基础设施·城市监视

- 办公室

- 零售

- 运输

- 医疗

- 教育

- 製造·物流

- 饭店

- 资料中心

- 摄影机

- 影音监控相机

- 市场动态

- IP vs. 类比

- 相机的尺寸规格

- 主要企业·业者情势

- 身体相机

- 市场规模与成长趋势

- 市场动态

- 主要企业·业者情势

- 热感相机

- 市场规模与成长趋势

- 市场动态

- 主要企业·业者情势

- 影音监控软体·分析

- 市场规模与成长趋势

- 市场动态

- 主要企业·业者情势

- VSaaS·云端

- 市场动态

- VSaaS经营模式和竞争情形

- 技术和运用相关考察

- 与成本法规要素

- 影像储存装置硬体设备·服务

- 市场规模与成长趋势

- 市场动态

- 主要企业·业者情势

- 影音监控用无人机

- 市场规模与成长趋势

- 市场动态

- 主要企业·业者情势

第3章 IP连接性·IoT

- IP 与物联网的融合

- 物联网视讯监控的优势

- 物联网成长与应用趋势

- 物联网应用面临的挑战

第4章 与AI机器学习

- 市场采用和成长预测

- 用途和使用案例

- 保全·安全

- 身份识别与存取管理

- ALPR/ANPR·行动

- 运用·商务见解

- 调查·自然地语言搜寻(NLS)

- 边缘设备·硬体设备启用

- AI晶片

- AI网路录影机(NVR)

- AI相机

- 影音监控的AI的课题

- 业者情势

- 新的趋势和未来预测

第5章 无线·蜂巢式技术

- 无线传送方式

- 4G

- Wi-Fi

- 5G

- 私人LTE/5G网路

- 主要的优点与使用案例

- 无线的课题与讨论事项

- 无线·5G相机

- 无线

- 5G

第6章 其他的值得注意的技术促进因素

- 画品质/解析度

- 市场采用与演进

- 特定用途的解析度必要条件

- 技术的考虑事项

- 低照度/红外线/暗视

- 强化可见光成像

- 整合红外线照明

- 专门性的成像与非视觉感测

- 多感测器设备

- 市场采用与演进

- 技术的考虑事项

- 先进的威胁侦测系统

- 功能和范畴

- 推动市场要素与采用趋势

- 关注的供应商与市场的提供

- 整合和互通性

- 互通性的优点

- 开放式平台的演变

- ONVIF规格

- 影音监控,实体安全,大楼系统的整合

第7章 地缘政治学的紧张和贸易壁垒

- 美国和中国的动态

- 其他的国家与地区的贸易限制

- 乌克兰战争

- 对市场的影响

- 竞争情形与地区市场重组

- 供应链的重组和生产地区

- 采购趋势与购买者的行动

- 价格趋势与成本结构

- 产品策略和技术蓝图

- 预测(~2030年)

第8章 供应链趋势

- 目前供应链状况

- 采购和生产的策略性转换

- 供应链预测(~2030年)

第9章 技术,人力资源,劳工

- 主要课题

- 新机会

第10章 网路安全

- 与主要的威胁漏洞

- 攻击载体

- 供应链和整合的风险

- 威胁形势

- 网路安全偶发事件和漏洞

- 法规和遵守

- 侵害和漏洞的明确指示

- 缓和的最佳业务实践

第11章 资料隐私和伦理

- 隐私相关考虑事项

- 隐私法规

- 脸部辨识:法律上的及运用上的阻碍因素

- 伦理性的实行与AI偏压

第12章 合併和收购

- 过去的M&A的市场动态

- 新M&A交易(2023年9月~2025年8月)

- M&A趋势与其影响

第13章 策略性联盟

- 过去的策略性联盟和市场动态

- 新策略性联盟(2023年9月~2025年8月)

- 策略性联盟的趋势与影响

第14章 投资趋势

- 过去的投资交易和投资的市场动态

- 新投资议案(2023年9月~2025年8月)

- 投资趋势的观察和暗示

This report is an in-depth study providing a detailed market analysis of video surveillance, with a specific focus on revenues generated by cameras, video storage, software & analytics.

This comprehensive study examines the current and anticipated landscape of the global video surveillance market through to 2030. Drawing on expertise in our previous Internet of Things, Artificial Intelligence, and Cybersecurity analysis, this report empowers professionals across the industry, from manufacturers to system integrators, from security consultants to facility managers and building owners.

Key Questions Addressed:

- What is the size and structure of the global video surveillance market in 2025? How is the market divided between cameras, storage, software, and analytics? Where are the dominant geographic markets? How are sales distributed across 12 different industry verticals?

- How are AI and edge computing transforming the industry? What percentage of cameras now ship with built-in AI capabilities? Which applications are driving adoption? How are vendors balancing edge processing with cloud analytics?

- What impact are geopolitical tensions having on market dynamics? How have US-China trade restrictions, NDAA compliance requirements, and supply chain restructuring reshaped competitive positioning? Which vendors are gaining or losing market share as a result?

- How are M&A, investment, and strategic alliances evolving? Which technology areas are attracting capital? How are private equity and strategic buyers reshaping market structure? What does the alliance landscape reveal about platform consolidation versus ecosystem flexibility?

Within its 246 Pages and 18 Charts, This Report Presents All the Key Facts and Draws Conclusions, so you can understand what is Shaping the Future of the Video Surveillance Industry:

- Total global revenues for video surveillance equipment and software at factory gate prices reached $33.8 billion in 2024, with projections of $35.5 billion in 2025 and growth to $47.9 billion by 2030. This represents a compound annual growth rate of nearly 6%, reflecting the sector's transition from reactive security deployments to strategic, intelligence-driven infrastructure investments.

- Our market analysis encompasses 4 core segments: video camera hardware, software and analytics, video storage, and supporting hardware infrastructure. This breakdown reveals an industry increasingly defined by software capabilities and recurring revenue models, with analytics and cloud services growing at more than twice the rate of traditional equipment sales.

- AI-enabled cameras capable of edge processing are projected to account for a significant percentage of global camera shipments in 2025. These systems deliver capabilities ranging from object detection and license plate recognition to behavior analysis and privacy-preserving redaction, fundamentally transforming video surveillance from passive recording to active operational intelligence.

- Drones are emerging as a significant expansion vector for video surveillance capabilities. Drones extend surveillance coverage to areas impractical for fixed cameras, provide rapid-deploy capability for incident response, and enable persistent wide-area monitoring for critical infrastructure, large campuses, and border security applications. The integration of drones with ground-based systems and real-time crime centers represents a fundamental expansion of surveillance architecture from static observation points to dynamic, mobile sensor networks.

At only USD $3,000 for an enterprise license, this report provides essential intelligence for strategic planning, competitive positioning, M&A evaluation, and technology roadmap development.

Geopolitical Tensions Continue to Reshape Market Access and Competitive Dynamics

Geopolitical tensions between China and the West have bifurcated the market, with Chinese vendors facing US procurement bans, FCC equipment authorization restrictions, and expanding export controls. These restrictions have created sustained opportunities for NDAA-compliant alternatives that position regulatory alignment and cybersecurity transparency as core brand values.

Between September 2023 and August 2025, 24 M&A transactions were observed. Investment activity totaled $3.8 billion across 38 deals during the same time period. Key trends include platform consolidation integrating hardware, software, and cloud services; private equity actively reshaping market structure; strategic focus shifting from hardware toward software and recurring revenue; and AI integration driving acquisitions of computer vision and privacy-preserving startup firms.

Who Should Buy This Report?

This report delivers critical intelligence for:

- Security manufacturers and vendors developing product roadmaps, positioning strategies, and go-to-market plans.

- System integrators and service providers evaluating technology partnerships, training investments, and service offerings.

- Private equity and strategic investors assessing M&A targets, market positioning, and competitive dynamics.

- Building owners, facility managers, and corporate security leaders planning capital investments and technology refresh cycles.

- Consultants and advisors supporting clients across procurement, compliance, and strategic planning.

Table of Contents

Preface

Executive Summary

1. The Structure & Shape of the Video Surveillance Business

- 1.1. Video Surveillance Market Structure

- 1.2. Company Classifications & Market Share

- Group A Companies

- Group B Companies

- Group C Companies

- Group D Companies

- 1.3. Sales & Distribution Channels

2. The Video Surveillance Market

- 2.1. Video Surveillance Adoption & Investment

- 2.1.1. Market Operation Conditions

- 2.1.2. Key Adoption Drivers

- 2.1.3. Physical Security Spending Plans & Budgets

- 2.2. Video Surveillance Market Size & Growth Forecasts

- 2.2.1. Overall Market Projections and Trajectory

- 2.2.2. Market Forecast Breakdown by Category

- 2.3. Market Size, Growth & Trends by Major Region

- 2.3.1. North America

- 2.3.2. Latin America & The Caribbean

- 2.3.3. China

- 2.3.4. The Rest of Asia Pacific

- 2.3.5. Europe

- 2.3.6. Middle East & Africa

- 2.4. Market Size & Trends by Vertical

- 2.4.1. Public Infrastructure & City Surveillance

- 2.4.2. Offices

- 2.4.3. Retail

- 2.4.4. Transport

- 2.4.5. Healthcare

- 2.4.6. Education

- 2.4.7. Manufacturing & Logistics

- 2.4.8. Hospitality

- 2.4.9. Data Centers

- 2.5. Video Cameras

- 2.6. Video Surveillance Cameras

- 2.6.1. Market Dynamics

- 2.6.2. IP vs Analog

- 2.6.3. Camera Form Factors

- 2.6.4. Key Players & Vendor Landscape

- 2.7. Body Worn Cameras

- 2.7.1. Market Size & Growth Trends

- 2.7.2. Market Dynamics

- 2.7.3. Key Players & Vendor Landscape

- 2.8. Thermal Cameras

- 2.8.1. Market Size & Growth Trends

- 2.8.2. Market Dynamics

- 2.8.3. Key Players & Vendor Landscape

- 2.9. Video Surveillance Software & Analytics

- 2.9.1. Market Size & Growth Trends

- 2.9.2. Market Dynamics

- 2.9.3. Key Players & Vendor Landscape

- 2.10. VSaaS & Cloud

- 2.10.1. Market Dynamics

- 2.10.2. VSaaS Business Models and Competitive Landscape

- 2.10.3. Technology and Operational Insights

- 2.10.4. Cost and Regulatory Factors

- 2.11. Video Storage Hardware & Services

- 2.11.1. Market Size & Growth Trends

- 2.11.2. Market Dynamics

- 2.11.3. Key Players & Vendor Landscape

- 2.12. Drones for Video Surveillance

- 2.12.1. Market Size & Growth Trends

- 2.12.2. Market Dynamics

- 2.12.3. Key Players & Vendor Landscape

3. IP Connectivity & the IoT

- 3.1. The Convergence of IP and IoT

- 3.2. The Benefits of IoT-Enabled Video Surveillance

- 3.3. IoT Growth & Adoption Trends

- 3.4. Challenges Associated with IoT adoption

4. AI & Machine Learning

- 4.1. Market Adoption & Growth Outlook

- 4.2. Applications and Use Cases

- 4.2.1. Security & Safety

- 4.2.2. Identity & Access Management

- 4.2.3. ALPR/ANPR & Mobility

- 4.2.4. Operational & Business Insight

- 4.2.5. Investigations & Natural-Language Search (NLS)

- 4.3. Edge Devices & Hardware Enablers

- 4.3.1. AI Chips

- 4.3.2. AI Network Video Recorders (NVRs)

- 4.3.3. AI Cameras

- 4.4. Challenges Associated with AI in Video Surveillance

- 4.5. Vendor Landscape

- 4.6. Emerging Trends & Future Outlook

5. Wireless & Cellular Technology

- 5.1. Wireless Transmission Methods

- 5.1.1. 4G

- 5.1.2. WiFi

- 5.1.3. 5G

- 5.1.4. Private LTE/5G Networks

- 5.2. Key Benefits & Use Cases

- 5.3. Challenges & Considerations for Wireless

- 5.4. Wireless & 5G Cameras

- 5.4.1. Wireless

- 5.4.2. 5G

6. Other Notable Technology Drivers

- 6.1. Image Quality/Resolution

- 6.1.1. Market Adoption and Evolution

- 6.1.2. Application-Specific Resolution Requirements

- 6.1.3. Technical Considerations

- 6.2. Low Light / Infra-Red / Night Vision

- 6.2.1. Enhanced Visible-Light Imaging

- 6.2.2. Integrated Infrared Illumination

- 6.2.3. Specialist Imaging and Non-Visual Sensing

- 6.3. Multi-sensor Devices

- 6.3.1. Market Adoption and Evolution

- 6.3.2. Technical Considerations

- 6.4. Advanced Threat Detection Systems

- 6.4.1. Capabilities and Categories

- 6.4.2. Market Drivers and Adoption Dynamics

- 6.4.3. Notable Vendors & Market Offerings

- 6.5. Integration & Interoperability

- 6.5.1. Benefits of Interoperability

- 6.5.2. The Evolution Toward Open Platforms

- 6.5.3. ONVIF Standards

- 6.5.4. Integration Between Video Surveillance, Physical Security, and Building Systems

7. Geopolitical Tensions & Trade Barriers

- 7.1. US/China Dynamics

- 7.2. Trade Restrictions in Other Countries and Regions

- 7.3. The War in Ukraine

- 7.4. Market Implications & Impacts

- 7.4.1. Competitive Landscape and Regional Market Realignment

- 7.4.2. Supply Chain Restructuring and Manufacturing Geography

- 7.4.3. Procurement Trends and Buyer Behavior

- 7.4.4. Pricing Dynamics and Cost Structures

- 7.4.5. Product Strategy and Technology Roadmaps

- 7.5. Outlook to 2030

8. Supply Chain Trends

- 8.1. Current Supply Chain Conditions

- 8.2. Strategic Shifts in Sourcing and Manufacturing

- 8.3. Supply Chain Outlook to 2030

9. Skills, Talent & Labor

- 9.1. Key Challenges

- 9.2. Emerging Opportunities

10. Cybersecurity

- 10.1. Key Threats and Vulnerabilities

- 10.1.1. Attack Vectors

- 10.1.2. Supply Chain and Integration Risks

- 10.1.3. Threat Landscape

- 10.2. Cybersecurity Incidents & Vulnerabilities

- 10.3. Regulations and Compliance

- 10.4. Breach and Vulnerability Disclosure

- 10.5. Mitigation Best Practices

11. Data Privacy & Ethics

- 11.1. Privacy Considerations

- 11.2. Privacy Regulations

- 11.3. Facial Recognition: Legal and Operational Constraints

- 11.4. Ethical Implementation and AI Bias

12. Mergers & Acquisitions

- 12.1. Historic M&A Market Dynamics

- 12.2. New M&A Deals (Sept 2023 to Aug 2025)

- 12.3. M&A Trends and Implications

13. Strategic Alliances

- 13.1. Historic Strategic Alliances & Market Dynamics

- 13.2. New Strategic Alliances (Sept 2023 to Aug 2025)

- 13.3. Strategic Alliance Trends and Implications

14. Investment Trends

- 14.1. Historic Investment Deals & Investment Market Dynamics

- 14.2. New Investment Deals (September 2023 - August 2025)

- 14.3. Investment Trend Observations & Implications

List of Charts and Figures

- Fig 1.1: Video Surveillance Market Structure

- Fig 1.2: Market Share of Global Video Surveillance Sales by Major Vendor 2024

- Fig 1.3: Video Surveillance Sales by Major Grouping, Number of Companies, % of Global Sales in 2024

- Fig 2.1: The Security Market Index (SMI) - Index Value & Overall Rating of Current Business Conditions

- Fig 2.2: The Global Market for Video Surveillance 2023 to 2030, $ Billions

- Fig 2.3: The Global Market for Video Surveillance by Category 2021 to 2030, $ Billions

- Fig 2.4: Video Surveillance Sales by Region in 2024, % of Total Video Surveillance Sales

- Fig 2.5: Video Surveillance Sales by Region 2021 to 2030, $Bn

- Fig 2.6: Video Surveillance Sales by Building Type in 2024, $Bn

- Fig 2.7: Global Sales of Video Surveillance Cameras by Type

- Fig 2.8: Global Video Surveillance Camera Market, Analog & IP Camera Market Share, 2021 to 2030, % of Total

- Fig 2.9: Global Video Surveillance Camera Shipments by Form Factor, 2024 % of Total Shipments

- Fig 2.10: Global Sales of Video Management Software (VMS) & Analytics

- Fig 2.11: Global Sales of Video Storage Hardware & Services 2021 to 2030, $Bn

- Fig 2.12: Global Sales of Drones for Video Surveillance 2024 to 2030 $Bn

- Fig 4.1: Global AI Video Surveillance Camera Shipments, % of Overall Video Surveillance Camera Shipments 2024 to 2030

- Fig 4.2: AI for Security and Access Control in Commercial Buildings, Number of Companies Serving Individual Use Cases

- Fig 7.1: US / China Trade Restrictions Shaping the Video Surveillance Market: A Timeline