|

市场调查报告书

商品编码

1642125

热昇华印刷:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Dye Sublimation Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

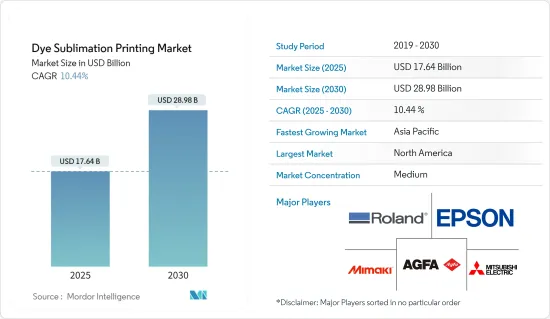

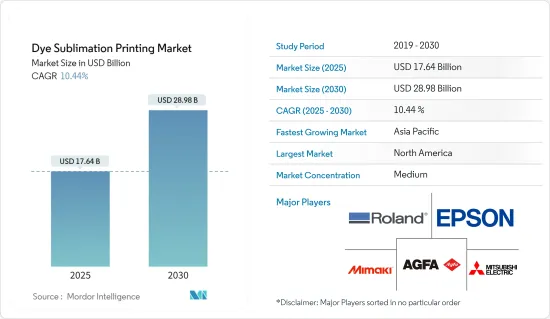

预计 2025 年染料昇华列印市场规模为 176.4 亿美元,到 2030 年将达到 289.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.44%。

关键亮点

- 热昇华列印以产生高品质的摄影效果而闻名,它利用热量将彩色染料颜料从载体膜转移到 PVC 列印表面,然后它们在那里发生化学键合。这种方法在促销产品市场上迅速流行起来,因为它可以用于从织物到硬质材料等许多产品。与传统印刷不同,染料昇华会将颜色永久地固定在材料中,因此即使经过多次清洗,影像仍会保持完整,不会褪色或破裂。

- 近年来,染料昇华印表机的需求大幅成长,刺激印表机供应商生产用于工业用途的高速、大容量系统。这些印表机具有更好的设计、改进的列印头和其他组件,需求不断增加。现代印字头列印速度更快,并具有自动再循环系统,减少了印字头喷嘴堵塞(停机的常见原因)。

- 服饰越来越多地选择染料热昇华印花解决方案。主要原因之一是它比传统网版印刷具有更大的设计灵活性。亚历山大·麦昆 (Alexander McQueen) 和玛丽·卡特兰佐 (Mary Katrantzou) 等大牌设计师更喜欢使用数位印刷来製作小件印刷品,因为它更具成本效益。

- 此外,市场对新参与企业和新兴企业的资金增加,支持了其成长。例如,2024 年 5 月,汉拓科技筹集 3 亿元人民币(4,150 万美元)在中国建造新的生产工厂。该工厂预计将生产约300万台智慧列印设备。 Hunt 计划利用这笔资金进行技术研发和产品开发,以扩大其喷墨、染料昇华和雷射印表机的产品范围。

- 然而,以品质卓越而闻名的染料热昇华印表机却比喷墨印表机慢。此外,确保高品质列印所需的复杂染料昇华过程也增加了成本。高成本是市场成长的一大障碍。

热昇华列印市场趋势

家用纺织品装饰转型带动市场成长

- 热昇华印花适用于窗帘、垫子和其他自订配件等家用纺织品。该方法也适用于阻燃织物,并且印刷后不需要任何额外的处理,使其成为室内装潢和合约家具行业的理想选择。

- 世界各地的合约家具公司都在使用染料热昇华列印,这推动了对这些印表机的需求。例如,英国的Meshtex印刷服务公司提供一系列采用此技术印刷的户外产品,包括家具罩和雨伞。此外,随着越来越多的人寻求独特的家具,市场预计还会扩大。

- 都市化进程加快和可支配收入增加是推动家居装饰产品需求的关键因素。这种转变正在改变世界各地的社会规范,而城市文化也变得更加主导。根据美国人口普查局的数据,2023 年 2 月美国服饰和配件商店的零售额将达到 209.4 亿美元,高于 2022 年的 201.5 亿美元。

- 各种供应商都在透过新的印表机和解决方案扩展其产品线,以满足日益增长的需求。例如,领先的染料昇华印表机供应商精工爱普生公司已将 76 吋工业级纺织印表机 SC-F1,0000H 添加到其产品线中。

- 但家用纺织品印花布的需求量正在增加,而墙面覆盖产品的需求量却在减少。造成这种下降的主要原因是去除现有壁纸的难度,这需要特殊的工具和化学物质。这个过程往往费力又耗时,使得许多消费者在选择壁纸时犹豫不决。由于消费者偏好的变化,传统壁纸产品的受欢迎程度稳定下降,影响了市场成长。

亚太纺织业推动染料热昇华印花市场成长

- 受亚太地区纺织业扩张的推动,亚太地区的染料热昇华印花市场正在不断扩大。主要原因包括时尚週期缩短、新技术的快速采用以及电子商务领域的成长。

- 根据国家统计局数据,中国服饰布料产量从2023年12月的27.7亿公尺增加到约2024年1月和2月的48.1亿公尺。这一增长很大程度上是由中国数位印刷行业的成长所推动的。

- IBEF 专注于印度纺织业,这是印度最古老的产业之一,预计到 2029 年该产业的产值将达到 2,090 亿美元。由于客户要求更快的结果,该地区的数位印刷正在增加。随着终端用户领域(尤其是纺织领域)寻求更多创新成果,数位印刷将变得越来越重要,最终影响染料昇华印刷市场的成长。

- 十年前,印度板球超级联赛 (IPL)宣传活动之后,印度对染料昇华印刷的兴趣日益浓厚,爱普生在其 Surecolor SC-F6070 和 SC-F 7070 打印机上推出了以 IPL 为主题的 T 恤。随着此类活动越来越受欢迎,预计未来染料热昇华列印市场将进一步成长。

- 该地区的公司致力于透过先进的、环保的印表机实现永续发展。例如,Colorjet集团于2024年5月推出3.2米弱溶剂印表机「Polo Earth」。此举体现了公司对环保大尺寸印刷的承诺,并满足了对永续解决方案日益增长的需求。

热昇华印製产业概况

热昇华列印市场半固化状态,主要由几家大型公司主导。随着越来越多的纺织业采用染料热昇华印花,市场正在蓬勃发展。市场的主要参与企业包括精工爱普生公司、Roland DGA 公司、爱克发吉华集团、御牧工程、三菱电机公司、惠普开发公司 LP 和 Mutoh Europe NV。该市场中的参与企业正专注于透过产品推出和收购来扩大市场占有率。

2024 年 4 月,精工爱普生公司宣布推出两款新型工业 SureColor F 系列染料昇华印表机,以提高纺织品印花供应商的生产效率和生产力。新型印表机将帮助您跟上不断变化的纺织趋势并满足市场需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 地缘政治情境对产业的影响评估

第五章 市场动态

- 市场驱动因素

- 服饰市场成长

- 行销和广告成本增加

- 市场限制

- 资本投资和消耗成本

第六章 市场细分

- 按应用

- 服饰

- 技术纺织品

- 适合家庭使用

- 视觉传达

- 硬纤维

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Seiko Epson Corporation

- Roland DGA Corporation

- Agfa-Gevaert Group

- Mimaki Engineering Co. Ltd

- Mitsubishi Electric Corporation

- Colorjet Group

- Sawgrass Technologies Inc.

- HP Development Company LP

- Gandy Digital Ltd

- Klieverik Heli BV

- Mutoh Europe NV

- Dai Nippon Printing Co. Ltd

第八章投资分析

第九章:市场的未来

The Dye Sublimation Printing Market size is estimated at USD 17.64 billion in 2025, and is expected to reach USD 28.98 billion by 2030, at a CAGR of 10.44% during the forecast period (2025-2030).

Key Highlights

- Dye sublimation printing, known for its high-quality photographic results, uses heat to transfer colored dye pigments from a carrier film to the PVC printing surface, where they bond chemically. This method is quickly becoming popular in the promotional products market because it can be used on many products, from fabrics to hard materials. Unlike traditional printing, dye sublimation embeds colors permanently into the material, ensuring they do not fade or crack, even after multiple washes, with images remaining intact.

- In recent years, the demand for dye sublimation printers has grown significantly, leading printer vendors to produce high-speed, high-volume systems for industrial use. These printers have better designs, improved printheads, and other components, which increase demand. The latest printheads offer faster print speeds and an automatic circulation system, reducing printhead nozzle clogs, a common cause of downtime.

- The garment industry is increasingly choosing dye sublimation printing solutions. One key reason is its design flexibility, which is better than traditional screen printing. Famous designers like Alexander McQueen and Mary Katrantzou prefer digital printing for smaller prints because it is cost-effective.

- Additionally, the market is seeing more funding for new players and start-ups, supporting its growth. For example, in May 2024, Hannto Technology Co. Ltd raised CNY 300 million (USD 41.5 million) to build a new production facility in China. This facility is expected to produce around 3 million intelligent printing devices. Hannto plans to use the funds for technology research and development (R&D) and product development to expand its range of inkjet, dye sublimation, and laser printers.

- However, dye sublimation printers, known for their excellent quality, are slower than inkjet printers. Additionally, the complex multi-step dye-sublimation process, which ensures high-quality prints, increases costs. This higher expense is a significant obstacle to market growth.

Dye Sublimation Printing Market Trends

Transformation of Home Textile Decor Landscape Aiding the Market Growth

- Dye sublimation printing is excellent for home textiles like curtains, cushions, and other custom accessories. This method works well on flame-resistant fabrics and does not need extra steps after printing, making it ideal for the upholstery and contract furnishing industry.

- Contract furnishing companies worldwide use dye sublimation printing, increasing the demand for these printers. For example, Meshtex Printing Services in the United Kingdom offers various outdoor items, like furniture covers and umbrellas, printed with this technology. Also, as more people want personalized furnishings, the market is expected to grow.

- The rise in urbanization and higher disposable incomes are significant factors driving the demand for home decor. This shift is changing global social norms, with urban culture becoming more dominant. According to the US Census Bureau, retail sales for clothing and accessories stores in the United States reached USD 20.94 billion in February 2023, up from USD 20.15 billion in 2022.

- Various vendors are expanding their product lines with new printers and solutions to meet the growing demand. For instance, Seiko Epson Corporation, a leading dye sublimation printer provider, added the SC-F10000H, a 76-inch industrial-grade textile printer, to its range.

- However, the demand for printed fabrics in home textiles is increasing, and the demand for wall-covering products has declined. This decline is primarily due to the challenges of removing existing wallpaper, which requires specific tools and chemicals. The process is often labor-intensive and time-consuming, deterring many consumers from opting for wallpaper. This shift in consumer preference has led to a steady decrease in the popularity of traditional wall-covering products, impacting the market growth.

Asia-Pacific's Textile Sector Fuels Dye Sublimation Printing Market Growth

- The dye sublimation printing market in Asia-Pacific is increasing, driven by the region's expanding textile industry. Key reasons include the trend toward shorter fashion cycles, the rapid adoption of new technologies, and the growth of the e-commerce sector.

- The National Bureau of Statistics reports that China's clothing fabric production increased from 2.77 billion meters in December 2023 to approximately 4.81 billion meters in January and February 2024. China's growing digital printing sector significantly supports this growth.

- The IBEF highlights India's textile sector, one of the country's oldest industries, and it is expected to reach a value of USD 209 billion by 2029. The region is seeing more digital printing because customers want quicker results. As end-user sectors, especially textiles, demand more innovative results, digital printing's importance is set to rise, ultimately impacting the dye sublimation printing market's growth.

- India's interest in dye sublimation printing grew a decade ago after the IPL's campaign when Epson introduced IPL-themed t-shirts through its Surecolor SC-F6070 and SC-F 7070 printers. With such events becoming more popular, the market for dye sublimation printing is expected to grow further in the coming years.

- The region's companies focus on sustainable practices with advanced, eco-friendly printers. For example, in May 2024, the Colorjet Group launched the Polo Earth, a 3.2-meter eco-solvent printer. This move shows the company's commitment to eco-friendly large-format printing, meeting the rising demand for sustainable solutions.

Dye Sublimation Printing Industry Overview

The dye sublimation printing market is semi-consolidated due to a few significant players. The market is rapidly growing with the textile sector's increasing adoption of dye sublimation printing. The key players in the market are Seiko Epson Corporation, Roland DGA Corporation, Agfa-Gevaert Group, Mimaki Engineering Co. Ltd, Mitsubishi Electric Corporation, HP Development Company LP, and Mutoh Europe NV. The players in the market are focusing on increasing their market share through product launches and acquisitions.

April 2024: Seiko Epson Corporation announced the launch of two new industrial SureColor F-Series dye-sublimation printers to increase production efficiency and productivity for textile print vendors. The new printers will help clients adapt to changing textile trends and meet market demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of Impact of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Apparel Market

- 5.1.2 Increase in Marketing and Advertisement Spending

- 5.2 Market Restraint

- 5.2.1 Capital Expenditure and Consumption Cost

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Garments

- 6.1.2 Technical Textiles

- 6.1.3 Household

- 6.1.4 Visual Communication

- 6.1.5 Rigids

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.3.1 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Seiko Epson Corporation

- 7.1.2 Roland DGA Corporation

- 7.1.3 Agfa-Gevaert Group

- 7.1.4 Mimaki Engineering Co. Ltd

- 7.1.5 Mitsubishi Electric Corporation

- 7.1.6 Colorjet Group

- 7.1.7 Sawgrass Technologies Inc.

- 7.1.8 HP Development Company LP

- 7.1.9 Gandy Digital Ltd

- 7.1.10 Klieverik Heli BV

- 7.1.11 Mutoh Europe NV

- 7.1.12 Dai Nippon Printing Co. Ltd