|

市场调查报告书

商品编码

1537690

汽车安全气囊:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Airbags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

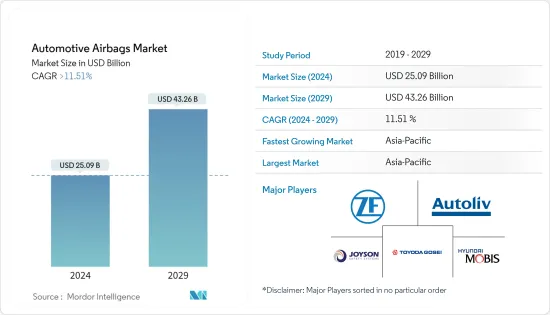

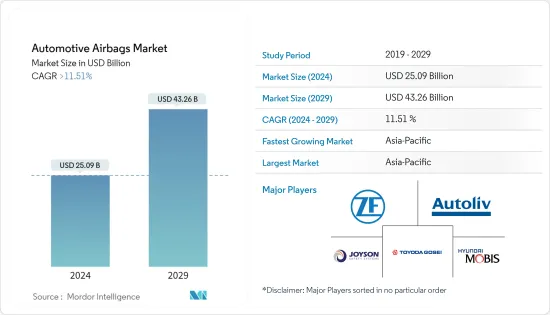

预计2024年汽车安全气囊市场规模为250.9亿美元,预计2029年将达432.6亿美元,在预测期内(2024-2029年)复合年增长率将超过11.51%。

从长远来看,汽车销售和产量的增加以及加强汽车安全系统的严格政府法规预计将成为全球汽车安全气囊市场成长的关键决定因素。消费者和当局安全意识的提高预计也将带来重大发展,从而提高安全性并减少道路事故造成的死亡。随着技术的进一步进步,市场期待汽车和商用车的安全气囊模组更安全、更可靠。

主要亮点

- 根据国际汽车工业协会(OICA)预测,2022年新型轻型商用车销量将达到1980万辆,而2021年为1860万辆,2021年至2022年与前一年同期比较增长7%。

- 同样,2022年全球客车产量达到253,100辆,而2021年为198,500辆,2021年至2022年年与前一年同期比较28%。

此外,高端和豪华汽车製造商越来越注重在已开发国家製造新产品和增强型产品,进一步推动了全球对汽车安全气囊的需求。在消费者对道路安全和政府法规意识不断增强的推动下,目标商标产品(OEM) 越来越多地设计新的车型结构,其中包含覆盖侧窗的帘式安全气囊。

然而,该行业面临的主要挑战之一是由于汽车和商用车安装有缺陷的安全气囊而导致的车辆召回,这对汽车製造商的品牌价值及其表现产生了负面影响。

主要亮点

- 2023年12月,起亚在美国召回2023款Seltos。焊接错误导致扩散器盘失效,导致帘式安全气囊在没有警告或指令展开的情况下膨胀。根据美国运输部国家公路交通安全管理局 (NHTSA) 的报告,总合4 个零件编号的侧帘式安全气囊模组出现问题,影响了 1,367 辆 Seltos 跨界车。

- 2023年5月,由于Takata驾驶侧安全气囊充气系统有缺陷,约9万辆宝马汽车收到了重大「请勿驾驶」警告。该公司表示,旧款宝马汽车的侧安全气囊有缺陷,如果乘客接触到任何东西,碎片可能会飞入车内并溅到前面的乘客身上,从而对驾驶员和其他乘客造成严重危险。

预计亚太地区将成为推动市场成长的主要地区,其次是欧洲和北美。由于严格的安全标准和政府法规,日本和韩国预计将为收益成长做出重大贡献。由于严重事故数量的增加和汽车持有的扩大,中国预计将成为安全气囊需求的主要国家之一。此外,消费者对新能源汽车的偏好正逐渐转向汽车製造商的汽车电气化策略,预计这将对未来几年对汽车安全气囊系统的需求产生积极影响。

汽车安全气囊市场趋势

乘用车领域将成为预测期内的驱动力

在大众、日产、通用和福特等主要汽车品牌的推动下,全球乘用车销售量正经历显着成长。随着乘用车市场的扩大,汽车製造商越来越关注安全性,以提供必要的安全解决方案来减少道路死亡人数,这对我所说的汽车安全气囊系统的快速增长的需求产生了积极的影响。

- 根据国际汽车工业协会(OICA)预测,2022年全球新乘用车销量将达到5,740万辆,而2021年为5,640万辆,2021年至2022年比与前一年同期比较增长1.9%。

都市化的提高和消费者人均可支配收入的增加正在推动乘用车的需求。乘客安全对政府和製造商来说至关重要。针对消费者安全的法规促使製造商在其车辆中安装安全装置。许多国家要求使用安全带和安全气囊。此外,製造商正在积极寻求与主要汽车製造商的合作伙伴关係,以提高其品牌影响力。我们正在推出满足新时代乘用车要求的新产品。

- 2023年5月,中国高性能电动车製造商蔚来汽车与汽车安全气囊和安全带领先製造商奥托立夫公司达成协议,生产安全产品。安全技术的发展预计将增加对充气安全带的需求,因为安全气囊只有在安全带紧固时才会展开。

随着全球汽车产量和销售量的增加,汽车乘员安全当局采取了各种安全法规来减少乘员伤害。

- 例如,2023年10月,印度道路运输和公路部强制要求乘用车配备六个安全气囊。本规定适用于八人座客车,以提高道路安全。由于全球供应链面临挑战,该规定自2023年10月起生效。最初,印度政府相关人员希望从 2022 年 10 月开始实施。

由于电动乘用车销量的成长和生产市场的扩大,预计在预测期内对乘用车安全气囊系统的需求将出现大规模。

预计亚太地区将成为预测期内成长最快的市场

亚太地区预计将成为成长最快的市场,其次是北美和欧洲。亚太地区是乘用车的庞大市场,印度和中国是全球最大的乘用车市场之一,占全球乘用车销售量的近30%。

- 根据电动车工业协会预测,2023年电动四轮车销量将达到48,105辆,而2022年为19,782辆,2022年至2023与前一年同期比较成长率为143.1%。

- 日本汽车经销商协会数据显示,2023年10月国内新车销量显着回升,从2022年10月的359,159辆增加至397,672辆,成长10.7%。 2024年1月,日本轻型车销量达33.4万辆。

消费者对安全性和舒适性的偏好不断提高,侧面安全气囊和帘式安全气囊在中型车辆中的普及率不断提高,以及对车辆安全功能的需求不断增加,正在推动亚太地区乘用车和商用车对高级安全性的需求。由于政府采取措施提高乘客安全以及系统和零件成本下降,预计预测期内对安全气囊的需求也会增加。

此外,该地区各国政府越来越重视减少道路事故和死亡人数,刺激了汽车安全气囊系统的需求。安全气囊对于任何车辆来说都是必不可少的,以缓衝事故的影响,因此整合先进的安全气囊模组对于提高该地区的道路安全至关重要。

- 根据印度政府统计,2022年印度共发生461,312起道路交通事故,造成168,491人死亡、443,366人受伤。

随着主要汽车製造商策略性地扩大业务并在中国和印度等国家推出新车型,预计整个亚太地区对汽车安全气囊系统的需求将出现大规模。

汽车安全气囊产业概况

汽车安全气囊市场高度整合且竞争激烈。少数参与者占据了大部分市场占有率。主要参与者包括采埃孚、奥托立夫、丰田合成、均胜安全系统、现代摩比斯、大陆集团、住友商事株式会社和足森工业。这些公司在研发方面投入大量资金,以持续生产出能够提高驾驶因素安全性的创新安全气囊解决方案。例如

- 2023 年 7 月,采埃孚集团与中国中部湖北省武汉经济开发区 (WEDZ) 签署协议,投资兴建专门生产和开发汽车安全气囊的新工厂。该工厂将被称为「采埃孚武汉汽车安全系统(武汉)」。一旦运作,该中心预计年产值将高达约30亿元人民币(42亿美元)。

- 2023年6月,奥托立夫宣布推出基于伯努利原理的新型安全气囊技术。其原理是,随着流体速度的增加,静压降低,允许更多的环境空气参与安全气囊充气过程。开创性的伯努利安全气囊在美国密西根州奥本山举行的奥托立夫投资者日上亮相。

随着竞争对手製定策略以获得竞争优势,汽车安全气囊模组市场预计将迅速扩大。大公司寻求与汽车製造商建立长期合作伙伴关係以提高盈利。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 乘用车和商用车销售成长推动成长

- 市场限制因素

- 安全气囊缺陷和召回阻碍成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:美元)

- 按车型

- 客车

- 商用车

- 按类型

- 前座安全气囊

- 充气安全带

- 帘式安全气囊

- 侧边安全气囊

- 膝部安全气囊

- 按销售管道

- 目的地设备製造商(OEM)

- 更换/售后

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- ZF Friedrichshafen AG

- Autoliv Inc.

- Yanfeng(Huayu Automotive Systems Co. Ltd)

- Toyoda Gosei Co. Ltd

- Continental AG

- Joyson Safety Systems

- Hyundai Mobis Co. Ltd

- Sumitomo Corporation

- Jinzhou Jinheng Automotive Safety System Co. Ltd

- Ashimori Industry Co. Ltd

第七章 市场机会及未来趋势

- 政府积极推动强化车辆安全系统,推动市场需求

第八章 供应商资讯

The Automotive Airbags Market size is estimated at USD 25.09 billion in 2024, and is expected to reach USD 43.26 billion by 2029, growing at a CAGR of greater than 11.51% during the forecast period (2024-2029).

Over the long term, the increasing vehicle sales and production, coupled with the government's stringent regulations to enhance the safety system of vehicles, is expected to serve as the major determinant for the growth of the global automotive airbags market. The increasing awareness about safety among consumers and authorities is also anticipated to lead to significant developments, resulting in improved security and reduced accident fatalities on the road. With further technological advancements, the market is expecting even safer and more reliable airbag modules in cars and commercial vehicles.

Key Highlights

- According to the International Organization of Motor Vehicle Manufacturers (OICA), new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7% between 2021 and 2022.

- Similarly, bus and coach production worldwide reached 253.1 thousand units in 2022 compared to 198.5 thousand units in 2021, recording a Y-o-Y growth of 28% between 2021 and 2022.

In addition, the growing focus by premium and luxury car manufacturers on manufacturing new products with enhanced features in developed countries is further fostering the demand for automotive airbags worldwide. With growing awareness of road safety among consumers and a push from government regulations, original equipment manufacturers (OEM) are focusing on designing their new model structures to incorporate curtain airbags covering the side windows.

However, one of the major challenges faced by the industry is vehicle recalls due to faulty airbags being incorporated in cars and commercial vehicles, which negatively impacts the brand value of automakers, affecting their business performance.

Key Highlights

- In December 2023, Kia recalled the 2023 Seltos in the United States due to a welding error, causing the diffuser disk to break, resulting in the curtain airbags inflating without warning or deployment command. As per the National Highway Traffic Safety Administration (NHTSA) report, a total of 4-part numbers for the side curtain airbag modules had the issue, affecting 1,367 units of the Seltos crossover.

- In May 2023, a major "do not drive" warning was reported for nearly 90,000 BMW vehicles due to a faulty Takata driver-side airbag inflator system. The company stated that the older models of BMW fitted with faulty side airbags could send shrapnel flying into the cabin, in the direction of the front passengers, if nudged, which can pose a serious risk to drivers and other passengers.

Asia-Pacific is anticipated to be a major region contributing to the market's growth, followed by Europe and North America. Japan and South Korea are expected to contribute significantly to the growth in terms of revenue due to safety norms and firm government regulations. Due to an increase in the number of serious accidents and an expanded fleet, China is expected to emerge as one of the major countries that contribute significantly to the demand for airbags. Moreover, the preference of consumers toward new-energy vehicles is witnessing a gradual shift in automakers strategizing to electrify their vehicle fleets, which is expected to positively influence the demand for automotive airbag systems in the coming years.

Automotive Airbags Market Trends

Passengers Cars Segment to Gain Traction during the Forecast Period

Passenger car sales are witnessing tremendous growth globally, with leading car brands including Volkswagen, Nissan, General Motors, and Ford. With the expanding passenger car market, there exist rising safety concerns among automakers to ensure that their vehicle models can provide all necessary safety solutions that can mitigate road fatalities, which is positively impacting the surging demand for automotive airbag systems.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger car sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a year-on-year growth of 1.9% between 2021 and 2022.

The rising urbanization rate and increasing per capita disposable income of consumers are aiding the demand for passenger cars as these consumers prefer private transportation mediums for their commuting purposes. Passenger safety is of utmost importance to governments and manufacturers. Regulations toward consumer safety and security have made manufacturers install safety devices in cars. Many countries have made using seat belts and airbags mandatory. Moreover, manufacturers are actively focusing on forming partnerships with major automakers to enhance their brand presence. They are introducing new products that can suit the requirements of new-age passenger cars.

- In May 2023, NIO, a Chinese-based high-performance electric vehicle manufacturer, reached an agreement with Autoliv Inc., the leading manufacturer of automotive airbags and seat belts, to manufacture safety products for electric vehicles. This development of safety technologies will increase the demand for inflatable seat belts, as airbag deployment works only when the seat belts are intact.

With the rising automobile vehicle production and sales worldwide, the automotive passenger safety authorities are adopting various safety regulations to reduce passenger injuries.

- For instance, in October 2023, the Ministry of Road Transport and Highways India made six airbags mandatory for automotive passenger vehicles. This rule will apply to eight-seater passenger cars to make road travel safer. Due to the challenges faced in the global supply chain, this rule has been in effect since October 2023. Initially, the Indian government officials wanted to roll it out in October 2022.

With the growth in electric passenger car sales and the expanding production market, a massive demand for automotive airbag systems for passenger cars is projected during the forecast period.

Asia-Pacific Region is Expected to be Fastest-Growing Market During Forecast Period

Asia-Pacific is expected to be the fastest-growing region in the market, followed by North America and Europe. Asia-Pacific is a huge market for passenger vehicles, with India and China being some of the world's largest markets for passenger vehicles, contributing to almost 30% of worldwide passenger vehicle sales.

- According to the Society of Manufacturers of Electric Vehicles, electric four-wheeler sales touched 48,105 units in FY 2023 compared to 19,782 units in FY 2022, representing a Y-o-Y growth of 143.1% between FY 2022 and FY 2023.

- According to the Japan Automobile Dealers Association, in October 2023, the new vehicle market in Japan made a strong recovery, with sales rising by 10.7% to 397,672 units from 359,159 units in October 2022. In January 2024, mini vehicle sales in Japan touched 334 thousand units.

The increased consumer preference for safety and comfort features, the increased penetration of side and curtain airbags in mid-level cars, and the rising demand for safety features in vehicles are primarily responsible for the growth of advanced safety in passenger cars and commercial vehicles in Asia-Pacific. The demand for airbags is also anticipated to increase over the forecast period due to government initiatives to improve passenger safety and falling system and component costs.

Furthermore, governments in the region are increasing their focus on reducing road accidents and fatalities, fueling the demand for automotive airbag systems. Airbags are crucial in any vehicle to mitigate the impact of an accident, and therefore, integrating advanced airbag modules is a necessity that can enhance road safety in the region.

- According to the Indian government, 461,312 road accidents were reported in the country in 2022, resulting in 168,491 fatalities and injuries to 443,366 individuals, suggesting a growing need for airbags.

With major automakers strategizing to expand their operations and launch new vehicle models in countries such as China and India, a massive demand for automotive airbag systems across Asia-Pacific is expected during the forecast period.

Automotive Airbags Industry Overview

The automotive airbags market is highly consolidated and competitive. A few players capture most of the market share. Some of the major players include ZF Friedrichshafen AG, Autoliv Inc., Toyoda Gosei Co. Ltd, Joyson Safety Systems, Hyundai Mobis Co. Ltd, Continental AG, Sumitomo Corporation, and Ashimori Industry Co. Ltd, among others. These players are investing hefty sums in research and development to constantly manufacture innovative airbag solutions that can enhance the safety of drivers. For instance,

- In July 2023, ZF Group finalized a deal with the Wuhan Economic Development Zone (WEDZ) located in Hubei province, central China, to invest in a new facility focused on producing and developing automotive airbags. The establishment will be known as ZF Wuhan Automotive Safety Systems (Wuhan) Co. Ltd. Once operational, this center is projected to achieve a maximum yearly production value of approximately CNY 3 billion (USD 4,200 million)

- In June 2023, Autoliv unveiled its new airbag technology based on the Bernoulli Principle, which states that, as the speed of a fluid increases, the static pressure decreases, which assists in significantly incorporating surrounding air into the airbag's inflation process. The pioneering 'Bernoulli airbag' was showcased at Autoliv's Investor Day in Auburn Hills, Michigan, United States.

The market is anticipated to witness rapid enhancement in automotive airbag modules as competitors strategize to gain a competitive edge. Major players seek to form long-term partnerships with automakers to boost their profitability prospects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Passenger and Commercial Vehicle Sales to Foster Growth

- 4.2 Market Restraints

- 4.2.1 Airbag Malfunction and Recall Deters Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Type

- 5.2.1 Front Airbags

- 5.2.2 Inflatable Seat Belts

- 5.2.3 Curtain Airbags

- 5.2.4 Side Airbags

- 5.2.5 Knee Airbags

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Replacement/Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Autoliv Inc.

- 6.2.3 Yanfeng (Huayu Automotive Systems Co. Ltd)

- 6.2.4 Toyoda Gosei Co. Ltd

- 6.2.5 Continental AG

- 6.2.6 Joyson Safety Systems

- 6.2.7 Hyundai Mobis Co. Ltd

- 6.2.8 Sumitomo Corporation

- 6.2.9 Jinzhou Jinheng Automotive Safety System Co. Ltd

- 6.2.10 Ashimori Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Government's Aggressive Push to Enhance Vehicle Safety Systems to Propel the Market Demand