|

市场调查报告书

商品编码

1444051

汽车暖通空调:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Automotive HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

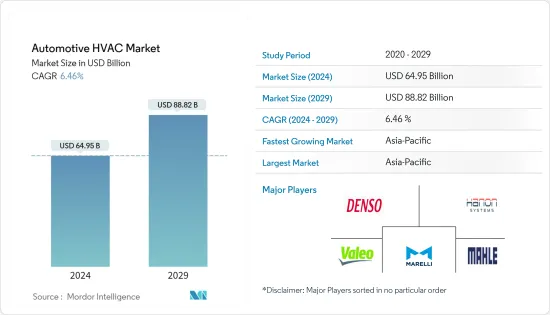

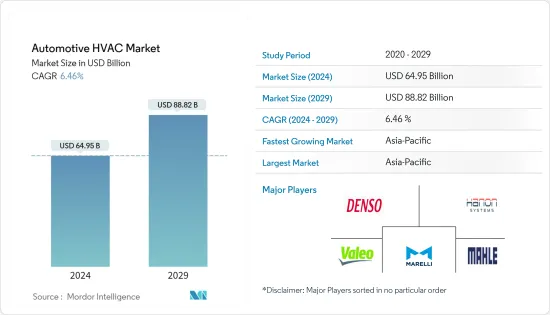

2024年汽车HVAC市场规模预计为649.5亿美元,预计到2029年将达到888.2亿美元,预测期内(2024-2029年)复合年增长率为6.46%。

汽车用品和供应链市场受到 COVID-19 的严重影响。汽车暖通空调系统市场受到疫情爆发的影响。 2020年小客车和商用车销量下降以及整车及零件生产设施暂时停产的主要原因是地方政府采取了严格的封锁措施。

从长远来看,透过采用 HVAC 系统对热舒适性和提高安全性的需求不断增长,预计将推动汽车 HVAC 市场的成长。系统尺寸和重量的减小可能会支持未来几年的市场成长。电子设备、感测器和自动气候控制功能的低成本整合正在增加 HVAC 装置在小客车中的采用。车辆电动程度的提高可能会导致先进的舒适性和安全性功能更多地整合到车辆中。

对创新和研发倡议的大量投资预计将增强参与者的产品和技术能力。此外,采用环保冷媒和生产更便宜的暖通空调系统为汽车暖通空调市场的参与者提供了利润丰厚的成长机会。领先的公司正在其车辆中安装先进的暖通空调系统,以帮助对抗车内的颗粒物。

由于中国、印度和日本等国家的汽车生产水准较高,亚太地区预计将成为汽车暖通空调市场最大的部分。预计北美将在未来几年为製造商创造新的成长前景。欧洲市场表现出缓慢但稳定的成长,预计未来五年将达到危机前的水平。

汽车暖通空调市场趋势

小客车提供长期动力

小客车销售一直是所有车型暖通空调市场的主要动力。 2021 年全球汽车销量约 6,670 万辆,而 2020 年为 6,380 万辆。全球大流行影响了世界各地的经济活动,包括世界各地的汽车销售,多个国家实施了严格的封锁措施以阻止病毒的传播。受此影响,2020年汽车销量较2019年下降14.8%。由于这些车辆的销售,OEM的当前产品配备了先进的 HVAC 和气候控制系统,整合到所提供的车型中。例如:

- 2022年10月,Polestar在全球市场推出三款电动SUV车型。这款SUV配备了先进的空调系统,即使在长途旅行中也能为乘客提供舒适感。

全球汽车领域的研发不断加强,市场相关人员的技术能力不断提升。这些市场相关人员正在引入汽车暖通空调领域的先进技术来开发新产品,使其在市场上更具竞争力。市场上的竞争对手正在开发符合严格的政府排放气体法规的环保产品。能源效率是推动暖通空调系统发展的另一个参数。製造商越来越多地利用绿色技术来开发环保且节能的汽车暖通空调系统。例如,

- 2021年11月,马瑞利公司开发了室内空气品质(IAQ)净化系统,可杀死车辆和室内环境中的细菌和病毒。该系统利用 UV-A 和 UV-C 光与二氧化钛 (TiO2) 过滤器结合,消灭空气中的细菌和病毒,包括 COVID-19,在 15 分钟内有效率超过 99%。

市场相关人员参与併购以扩大其在市场上的影响力。例如,Denso与丰田合作开发了普锐斯,混合技术。此外,对全球暖化的日益担忧也对汽车暖通空调市场产生了一些影响。因此,世界上许多国家已开始采取措施减少碳排放,这可能会减少该行业的暖通空调需求。

亚太地区预计将出现高成长

由于主要汽车製造商邻近、大规模汽车生产以及印度、韩国和中国等製造国汽车需求的激增,亚太市场可能会显着发展。政府需要采取行动重振汽车业务,以推动明年的市场发展。例如,印度政府透过汽车产业的课程来鼓励外国投资,为市场带来新的创新。

2022年4月,中国小客车产量达99.6万辆,销量达96.5万辆。产销量与前一年同期比较分别下降41.9%和43.4%。 2022年1月至4月小客车产量也与前一年同期比较下降2.6%至64.94亿辆。

中国是最大的市场之一,对这些汽车暖通空调系统的需求贡献巨大。印度、中国和亚太地区其他国家对小客车的需求不断增长,是人们对舒适性和安全性日益增长的偏好的结果。预计这些因素将有助于该地区的市场成长。消费者越来越多地寻找具有相当舒适性的高规格汽车。此外,泰国和马来西亚等国的外国公司汽车产量正在迅速增加。

根据中国汽车流通协会(CADA)统计,2021年8月国内豪华车经销商销量27.8万辆,较去年与前一年同期比较下降9.4%。另外还有100万台。 2021年,BMW以815,691辆的销量支持中国高端汽车销售。这使得宝马成为中国最畅销的豪华汽车製造商。同样,宾士和奥迪的豪华车销售也出现下滑。

考虑到这些因素和持续的需求,预计市场在预测期内将呈现高成长率。

汽车暖通空调产业概况

汽车暖通空调市场整合,全球顶尖企业占大部分市场占有率。併购、与区域暖通空调设备製造商结盟以及与汽车製造商建立和巩固联盟是塑造市场竞争形势的一些驱动力。例如:

- 2021 年 11 月,Hanon Systems 在匈牙利开设了两个新工厂:位于佩奇的新待开发区生产工厂和位于雷札格的建筑扩建工厂。该工厂将提供 22,464平方公尺的製造空间,并配备用于成型、硬焊、焊接、弯曲、组装和测试汽车空调(A/C) 线的设备。

- 2021 年 8 月,法雷奥推出了一款新型法雷奥热泵,其三分之二的能源需求来自周围空气,限制了从汽车电池获取能源的需求,并使用天然冷媒。与配备传统加热系统的电动车相比,配备该设备的电动车在 -15 度C下的运行时间最多可延长 30%。

- 2021年2月,先前宣布的海立国际(香港)有限公司与Marelli Corporation KK合资成立的海立马瑞利控股公司(Highly Marelli Holdings)成立。海瑞马瑞利致力于在压缩机电动、热泵系统、供暖、通风和空调(“HVAC”)以及电动压缩机(“EDC”)系统领域为其客户和供应商提供世界一流的解决方案。会去的

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(市场规模、金额)

- 依技术类型

- 手动/半自动

- 自动的

- 按车型

- 小客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Valeo Group

- Denso Corporation

- Mahle GmbH

- Marelli Corporation

- Sanden Corporation

- Keihin Corporation

- Japan Climate Systems Corporation

- Mitsubishi Heavy Industries Ltd

- Hanon Systems Corp.

- Samvardhana Motherson Group

- Hella GmbH & KGaA

第七章市场机会与未来趋势

The Automotive HVAC Market size is estimated at USD 64.95 billion in 2024, and is expected to reach USD 88.82 billion by 2029, growing at a CAGR of 6.46% during the forecast period (2024-2029).

The automotive goods and supply chain market were drastically impacted by COVID-19. The automotive HVAC system market was affected due to the outbreak of the pandemic. The decline in passenger car and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities were primarily attributed to the stringent lockdown measures prevailed by regional governments.

The regional markets were exposed to several challenges in terms of supply chain and raw material sources which got highlighted during the same period. Although 2021 has marked itself as the year of transition where the auto sector revamped its production units, and with the decline in the cases, production facilities are back in operation, and vehicle sales have increased across major geographies creating a positive outlook for the HVAC component manufacturing and sales.

Over the long term, a rise in demand for thermal comfort and an increase in safety due to the adoption of HVAC systems are expected to boost the growth of the automotive HVAC market. A reduction in system size and weight of the system may support the growth of the market over the coming years. The integration of electronics, sensors, and automated climate control features at a lesser cost is translating into greater adoption of HVAC units in passenger vehicles. Rising vehicle electrification is likely to increase the integration of advanced comfort and safety features in vehicles.

Technological innovations and substantial investments in R&D initiatives are poised to enhance players' offerings and technological capabilities. Furthermore, the adoption of eco-friendly refrigerants and the production of cheaper HVAC systems provide lucrative growth opportunities for the players operating in the automotive HVAC market. Major players are introducing advanced HVAC system in vehicle which help to fight against fine particulates in vehicle cabin.

The Asia-Pacific region is expected to be the largest segment in the automotive HVAC market owing to the large vehicle production levels in countries such as China, India, and Japan. North America is forecasted to create new growth prospects for the manufacturers in the coming years. The European market is showing slow but steady growth and is expected to reach pre-meltdown levels over the period of the next five years.

Automotive HVAC Market Trends

Passenger Car to Provide Longer Term Momentum

Passenger car sales have deeply driven the market of HVAC across all car models. In 2021, global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales across the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower when compared to 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive steering sensor market growth in the forecast period. Owing to these vehicle sales, the present offering by OEM carries advanced HVAC and climate control systems integrated into their offered models. For instance:

- In October 2022, Polestar introduced its 3 electric SUV models in the global market. The SUV is equipped with an advanced climate control system to provide passenger comfort during long-duration journeys.

The augmenting research and developments in the automotive sector across the world are set to enhance the technological capabilities of the market players. These market players are introducing advanced technologies in automotive HVAC to develop new products that impart a competitive edge in the market. The competitors in the market are developing eco-friendly products to fall in line with the stringent government regulations regarding emissions. Energy efficacy is the other parameter driving growth in HVAC systems. Manufacturers are increasingly using green technologies to develop eco-friendly and energy-efficient automotive HVAC systems. For Instance,

- In November 2021, Marelli Corporation has developed an Indoor Air Quality (IAQ) Purification System, which kills bacteria and viruses in vehicles and indoor environments. The system utilizes UV-A and UV-C light combined with a titanium dioxide (TiO2) filter to destroy airborne bacteria and viruses, including COVID-19, with greater than 99% effectiveness within 15 minutes.

Market players are involved in mergers and acquisitions to expand their market presence. For instance, Denso collaborated with Toyota to develop Prius, a hybrid technology promoting safety, fuel efficiency, and green technology in vehicles. Furthermore, growing concerns about global warming have slightly impacted the automotive HVAC market. Consequently, many nations worldwide have started taking measures to reduce their carbon footprints which might reduce the HVAC deman in the segment.

High Growth Anticipated in the Asia-Pacific Region

The Asia-Pacific market is probably going to observe huge development attributable to the nearness of key automotive makers, vast scale generation of vehicles, and spiraling vehicle requests in the manufacturing countries, like India, South Korea, and China. Government activities to restore the automotive business are required to drive the market during the forthcoming year. For example, the Government of India is encouraging foreign investments through programmed courses in the automotive area to bring new innovations to market.

In April 2022, Chinese passenger car production reached 996,000 units with sales registering 965,000 units. This accounts the downfall of 41.9% and 43.4% respectively in production and sales compared to previous year. In 2022, January to April, passenger car production also decreased with 2.6% year-on-year registering 6,494 million units.

China is one of the largest markets and contributes significantly to the demand for these automotive HVAC systems. The increasing demand for passenger vehicles from India, China, and their other counterparts in the Asia-Pacific region is a result of the growing preferences of people for comfort and safety. These factors are expected to contribute to the market growth in the region. Consumers are aligning toward high-specification vehicles that offer par comfort features. In addition, there is an upsurge in vehicle production by foreign companies in countries, including Thailand and Malaysia.

According to the China Automobile Dealers Association (CADA), the luxury car dealers in the country sold 278,000 vehicles in August 2021, an 9.4% decrease year-on-year. In addition, llion units. In 2021, BMW backed up China's premium segment car sales registering 815, 691 units. This made BMW to become China's top selling luxury car maker. On similar lines Mercedes Benz and Audi witnessed decline in their premium car sales.

Considering these factors and ongoing demand, market is anticpated to witness high growth rate during the forecast period.

Automotive HVAC Industry Overview

The automotive HVAC market is consolidated, with the top global players accounting for most of the market share. The major companies in the air-conditioning market include MAHLE GmbH, DENSO Corporation, Mitsubishi Heavy Industries Ltd, and Hanon Systems. Mergers and acquisitions, partnerships with regional HVAC equipment manufacturers, and establishing and ensuring tie-ups with car manufacturers are some of the dynamics shaping the market's competitive landscape. For instance:

- In November 2021, Hanon System inaugurated its two new establishments in Hungary - a new greenfield production facility in Pecs and a building expansion in Retsag. The facility provides 22,464 square meters of manufacturing space and accommodates equipment including forming, brazing, welding and bending, assembly lines and testing for automotive air conditioning (A/C) lines.

- In August 2021, Valeo announced New Valeo heat pump that procures two-thirds of its energy demand from the ambient air, thereby limiting the need to draw energy from the onboard batteries, and uses a natural refrigerant. EVs equipped with the device can travel up to 30% further at -15°C than those fitted with more conventional heating systems.

- In February 2021, Highly Marelli Holdings Co., Ltd., a previously announced joint venture between Highly International (Hong Kong) Limited and Marelli Corporation K.K., has been formed. Highly Marelli will concentrate on providing world-class solutions for clients and suppliers in the areas of compressor electrification, heat pump systems, heating, ventilation, and air conditioning ("HVAC") and electric driven compressor ("EDC") systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Technology Type

- 5.1.1 Manual/Semi-automatic HVAC

- 5.1.2 Automatic HVAC

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Valeo Group

- 6.2.2 Denso Corporation

- 6.2.3 Mahle GmbH

- 6.2.4 Marelli Corporation

- 6.2.5 Sanden Corporation

- 6.2.6 Keihin Corporation

- 6.2.7 Japan Climate Systems Corporation

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.9 Hanon Systems Corp.

- 6.2.10 Samvardhana Motherson Group

- 6.2.11 Hella GmbH & KGaA