|

市场调查报告书

商品编码

1637742

Memristor -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Memristors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

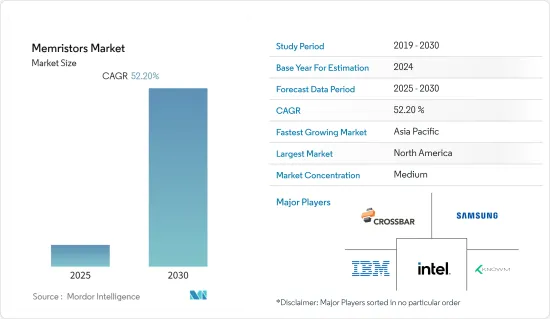

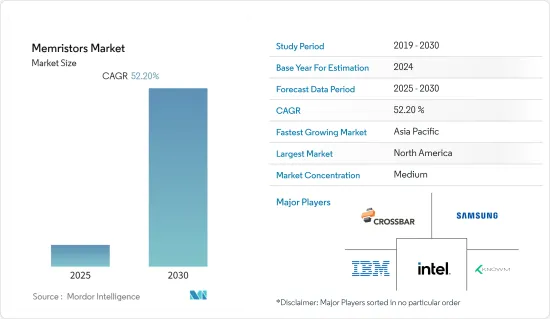

忆阻器市场预计在预测期内复合年增长率为 52.2%

主要亮点

- 过去 50 年来,忆阻器技术一直在不断发展。在此期间,英特尔、松下、美光等公司在这一领域不断创新。凭藉节能、高性能、频宽需求、节省空间和提高资料传输速度等前景广阔的特性,忆阻器预计将在预测期结束时成为主流产品。

- 基于忆阻器的记忆体可实现低功耗、快速写入速度、良好的可扩展性、 3D整合、低成本以及与CMOS製造製程的兼容性等优越性能,使其成为储存级记忆体中CMOS的有吸引力的选择。此外,该技术的商业化将产生一些新的使用案例使用案例,因为许多材料(大致分为二维材料、金属氧化物、新兴材料、有机物等)表现出忆阻效应,可以促进生长。

- 此技术可主要在ReRAM、混合电路、突触、神经型态形态架构、深度学习和可重构逻辑等领域实现商业化。电阻式 RAM (ReRAM) 是基于忆阻器的技术中最成熟的。多年来,ReRAM 已经推出了许多纸本版本,并已获得多项专利。

- 然而,这项技术是新技术,面临许多挑战,包括与时间相关的状态保留能力的兼容性问题、与忆阻器框架兼容的新材料的发现、模拟和数位领域的应用、对读/写刺激的响应以及功率要求我有一个挑战。

- 儘管COVID-19的爆发对忆阻器市场的影响很小,但这种流行病显着提高了消费者对数位和先进技术的认识,这意味着忆阻器将自己定位为一种有前途的下一代技术。

忆阻器市场趋势

IT/通讯领域占主要市场占有率

- 忆阻器有望成为 IT 和电讯领域的突破性技术,因为它们有潜力增强积体电路设计和运算的多个领域。忆阻器可用于伺服器、超级电脑、资料中心、便携式电子产品、工业机器人等。考虑到这些优势,各大半导体和记忆体公司都在投资忆阻器市场,预计将推动市场成长。

- 电子业、IT和通讯业占据Mimrista很大的市场占有率。由于在保持成本的同时对高处理能力和记忆体密度的需求不断增加,IT 领域对高速效能的需求持续成长。此外,更高效能图形系统的出现进一步增加了对提高处理速度的需求,从而导致对忆阻器的需求增加。

- 忆阻器相对于其他储存组件的优势在于易于製造具有神经架构的设备。随着神经架构搜寻(NAS)等趋势在资料中心产业中占据越来越重要的地位,忆阻器是帮助产业实现此类技术潜力的重要一步,它可以成为重要的技术推动者。

- 此外,人们对云端运算等数位技术的认识和接受度不断提高,预计将为忆阻器市场的成长创造有利的市场前景。例如,根据欧盟委员会的数据,到 2021 年,欧盟 (EU) 约 41% 的公司将使用云端运算。此外,根据衡量欧洲创新的各种指标的欧洲创新记分牌,芬兰在资讯科技领域的创新得分最高。预计这些趋势将对预测期内所研究市场的成长产生正面影响。

北美占最大市场占有率

- 与其他地区相比,北美是忆阻器最重要的市场之一,因为当地参与企业的研发投资率很高,而且忆阻器组件整合商可以获得大量资讯。许多着名的市场参与企业都位于美国,该国最近也加入了 Mimrista 的大部分应用,包括神经形态运算、汽车、软性电子产品、物联网、边缘运算和工业机器人,它也是最多的国家之一。国。

- 与世界其他地区相比,该地区对边缘运算和先进电子产品等市场的投资明显较高。根据Linux基金会发布的边缘现况报告,由于北美在网路和云端运算产业的主导地位,预计到2028年,全球约20.5%的基础设施边缘将部署在北美。

- 北美地区对智慧型手机、电脑和其他智慧家庭产品等先进消费产品也有很高的需求。 Mimrista 的实施是实现强大且廉价的分散式感测和处理解决方案的一步,预计在预测期内,其需求将进一步成长。

- 此外,该地区神经形态运算、物联网和储存记忆体市场的新兴市场开发,特别是当地公司的技术创新,预计将不仅在该地区而且在全球范围内促进 Mimrista 技术的市场成长。此外,资料中心和工业应用等各种最终用户产业的采用预计将扩大,据报道,这些产业在北美地区正在快速成长。

忆阻器产业概况

随着新参与企业进入忆阻器市场,忆阻器市场的竞争正在加剧。儘管在市场上占据重要地位的参与企业很少,但随着技术的进步,预计会有更多的参与企业进入市场,从而加剧市场竞争。为了进一步提高在市场上的影响力,供应商越来越多地扩大研发足迹,以开发创新的解决方案。市场上一些主要企业包括 Crossbar Inc.、IBM Corporation 和 Knowm Inc.。

2022 年 7 月,由 IIT Jodhpur主导的多机构计划的研究人员成功创建了一种具有超低功耗的高性能电阻式储存(忆阻器)装置。该装置由硒化镉(CdSe)量子点(QD)组成,具有高开/关比、优异的RAM性能、快速运行和长保留时间。此元件能够以高运转速度执行逻辑运算,适合高密度资料储存应用。

2022 年 5 月,苏黎世联邦理工学院、苏黎世大学和 Empa 的研究人员开发了一种可用于广泛应用的电子元件新材料。该组件有助于创建更有效率的电子电路来执行机器学习任务。此外,开发的忆阻器由卤化物钙钛矿结晶製成,这是一种主要用于光伏电池的半导体材料。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 对物联网、云端运算和巨量资料的需求不断增长

- 自动化机器人应用需求快速成长

- 市场限制因素

- 技术应用的复杂性

- 技术简介

- 分子薄膜和离子薄膜

- 旋转底座与磁忆阻器

第六章 市场细分

- 按用途

- 非挥发性记忆体

- 神经型态和生物系统

- 可程式逻辑和讯号处理

- 按最终用户产业

- 消费性电子产品

- 资讯科技和电讯

- 车

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Crossbar Inc.

- Panasonic Corporation

- 4DS Memory Limited

- Adesto Technology

- Micron Technologies Inc.

- Samsung Group

- Sony Corporation

- Western Digital Corporation

- Knowm Inc.

- Intel Corporation

- IBM Corporation

- SK Hynix Inc.

- Weebit Nano Ltd

- Fujitsu Ltd

- Toshiba Corp.

- Honeywell International Ltd

- Everspin Technologies Inc.

- ST Microelectronics NV

- Avalanche Technology Inc.

第八章投资分析

第9章市场的未来

The Memristors Market is expected to register a CAGR of 52.2% during the forecast period.

Key Highlights

- Memristor technology has seen a series of developments over the last 50 years. During this period, companies like Intel, Panasonic, and Micron, among others, have continued to innovate in this field. Given the promising features to improve power saving, performance, bandwidth requirement, and space-saving augmented with data transfer rate, memristors are expected to become a mainstream product by the end of the forecast period.

- Memristor-based memories are considered the more extensive prospect to replace CMOS in the storage class memory, as they are capable of delivering outstanding performance, such as low power consumption, fast write speed, great scalability, three-dimensional integration, low cost, and compatibility with the CMOS fabrication process. Furthermore, because many materials are showing memristive effects, broadly classified as 2D materials, metal oxides, emerging materials, and organics, commercialization of this technology can open several new use cases, driving the growth of the studied market.

- Technology commercialization is possible, mainly in areas like ReRAM, hybrid circuits, synapses, neuromorphic architectures, deep learning, and reconfigurable logic. Resistive RAM, or ReRAM, has been the most developed among all the memristor-based technologies. ReRAM has had many papers published and several patents granted over the years.

- However, the technology is new and poses many challenges like state retention capacity concerning time, finding new material which fits into memristive framework, applications in analog and digital domains, response to reading/write stimulus, and compatibility issues in terms of power requirement, among others.

- Although the outbreak of COVID-19 had a minimal impact on the memristors market, the fact that the pandemic has significantly increased consumers' awareness about digital and advanced technologies is expected to have a long-term effect on the growth of the studied market as memristor presents itself as promising next-generation technology, which is expected to have a high impact on the future trends of the electronics and related industries.

Memristors Market Trends

IT and Telecom Sector to Hold a Significant Market Share

- Memristors are expected to be a breakthrough technology for the IT and Telecom sector as they have the potential to enhance several areas of integrated circuit design and computing. Memristors can be used in servers, supercomputers, data centers, portable electronics, and industrial robotics. Considering the benefits, leading semiconductor and memory companies are investing in the memristor market, which is expected to boost the market's growth.

- The electronic, IT, and telecommunications industries hold significant market shares for memristors. The requirements for high-speed performance are continuously increasing in the IT sector, owing to the rising need for high processing power and memory density while maintaining the cost. Additionally, the arrival of higher graphics systems further drives the need for better processing speeds, thus driving the demand for memristors.

- Memristors' advantage over other memory components is that they make it easier to produce devices with neural architecture. With trends such as Neural Architecture Search (NAS) increasingly making space in the data center industry, memristors can be a key technology enabler to help the industry realize the potential of such technologies.

- Furthermore, the increasing awareness and acceptance of digital technologies, such as cloud computing, are expected to create a good market scenario for the growth of the memristors market. For instance, according to the European Commission, about 41% of enterprises in the European Union used cloud computing in 2021. Furthermore, according to the European innovation scoreboard, which measures innovation in Europe through various indicators, Finland had the highest innovation scores in information technologies. Such trends will positively impact the growth of the studied market during the forecast period.

North America to Hold the Largest Market Share

- North America is one of the most significant markets for memristors, owing to the high rate of investment in R&D by local players and the highly informed integrator base of memristor components compared to other regions. Many of the prominent market players are US-based, and the country is also one of the most prominent contributors to a majority of the applications of memristors, including neuromorphic computing, automotive, flexible electronics, IoT, edge computing, and industrial robotics in the recent past.

- The region's investment in markets like edge computing and advanced electronics is significantly higher compared to other parts of the world. According to The State of Edge report published by the Linux Foundation, it is estimated that about 20.5% of the global Infrastructure Edge will be deployed in North America by 2028, owing to its dominance in the internet and cloud computing industry.

- The North American region also highly demands advanced consumer products such as smartphones, computers, and other intelligent home gadgets. As the implementation of memristors takes a step further to creating powerful and cheap distributed solutions for sensing and processing, their demand is expected to grow further during the forecast period.

- Furthermore, the developments and innovations in the regional neuromorphic computing, IoT, and storage memory market, especially by local players, are anticipated to augment the market growth for the memristor technology not only in the region but also globally. Also, it will expand its adoption across various end-user industries, including data centers and industrial, which are also reporting rapid growth in the North American region.

Memristors Industry Overview

The memristors market is growing in competition as new players are inclining toward it. Few players hold a significant presence in the market; however, with technological advancements, more and more players are expected to enter the market, driving the market's competition. To further consolidate their market presence, the vendors are increasingly focusing on expanding their R&D footprint into developing innovative solutions. Some major players in the market include Crossbar Inc., IBM Corporation, and Knowm Inc.

In July 2022, researchers working on a multi-institutional project led by IIT Jodhpur successfully fabricated high-performance resistive memory (memristor) devices with ultralow power consumption. The fabricated device comprises cadmium selenide (CdSe) quantum dots (QDs) with a high on/off ratio, good RAM performance, fast operation speed, and long retention time. This device is suitable for high-density data storage applications as it can perform logical operations with fast operation speed.

In May 2022, a new material for an electronic component that can be used in broad applications ranges was developed by researchers from ETH Zurich, the University of Zurich, and Empa. These components will help create more efficient electronic circuits to perform machine-learning tasks. Furthermore, the memristors developed are made of halide perovskite nanocrystals, a semiconductor material known primarily for its use in photovoltaic cells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for IoT, Cloud Computing, and Big Data

- 5.1.2 Surging Demand for Application of Automation Robots

- 5.2 Market Restraints

- 5.2.1 Complexity in Technological Application

- 5.3 Technology Snapshot

- 5.3.1 Molecular and Ionic Thin Film

- 5.3.2 Spin-based and Magnetic Memristor

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Non-volatile Memory

- 6.1.2 Neuromorphic and Biological System

- 6.1.3 Programmable Logic and Signal Processing

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 IT and Telecom

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crossbar Inc.

- 7.1.2 Panasonic Corporation

- 7.1.3 4DS Memory Limited

- 7.1.4 Adesto Technology

- 7.1.5 Micron Technologies Inc.

- 7.1.6 Samsung Group

- 7.1.7 Sony Corporation

- 7.1.8 Western Digital Corporation

- 7.1.9 Knowm Inc.

- 7.1.10 Intel Corporation

- 7.1.11 IBM Corporation

- 7.1.12 SK Hynix Inc.

- 7.1.13 Weebit Nano Ltd

- 7.1.14 Fujitsu Ltd

- 7.1.15 Toshiba Corp.

- 7.1.16 Honeywell International Ltd

- 7.1.17 Everspin Technologies Inc.

- 7.1.18 ST Microelectronics NV

- 7.1.19 Avalanche Technology Inc.