|

市场调查报告书

商品编码

1640406

钛合金 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Titanium Alloy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

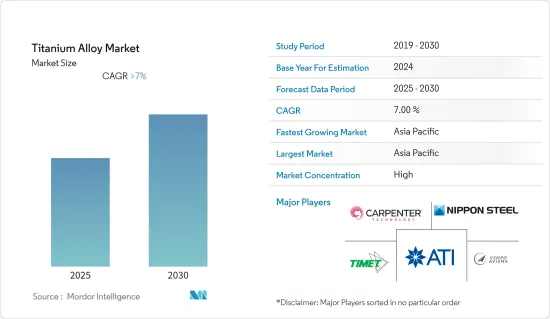

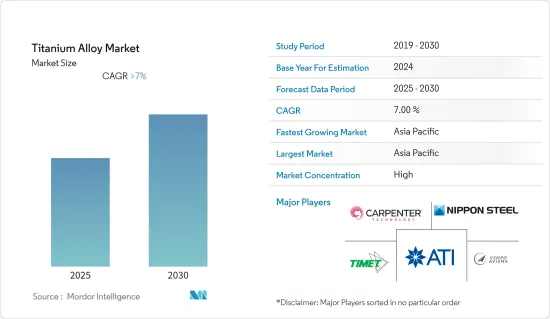

预计钛合金市场在预测期内复合年增长率将超过7%。

儘管疫情对市场产生了负面影响,但该市场已于 2021 年恢復,预计在预测期内将进一步成长。

主要亮点

- 短期来看,钛合金在航太领域的应用不断扩大,以及战车对钛合金取代钢和铝的需求不断增加,是市场成长的主要动力。

- 另一方面,合金的高反应活性在生产过程中需要特别小心。预计这将成为限制市场的因素。

- 此外,创新产品的开发预计在预测期内对市场来说是个好兆头。

- 中国在亚太地区市场占据主导地位,预计在预测期内将继续占据主导地位。这一优势得益于化工、高端航太、汽车、医疗和环保领域的需求增加。

钛合金市场趋势

航太业对钛合金的需求增加

- 钛是航太工业最重要的原料之一。钛合金在航太材料市场中占据最大份额,其次是铝合金。

- 考虑到原材料的重量,钛合金是航太工业中第三重要的原材料。大约75%的高檔海绵钛用于航太工业。用于飞机引擎、叶片、轴心和机身应用(起落架、紧固件、翼梁)。

- 此外,钛合金可在从冰点以下到 600 摄氏度以上的恶劣温度下使用,这使得它们可用于飞机引擎箱和其他应用。其高强度和低密度使其非常适合在飞机上使用。飞机领域,Ti-6Al-4V合金应用最多。

- 波音和空中巴士是世界顶尖的两家公司,从事飞机、喷射机、直升机等製造。因此,这些企业是航太领域钛合金的主要消费者。 2021年,空中巴士订单。相较之下,波音公司收到的 771 架飞机订单总额比 2020 年翻了一番。

- 此外,根据国际航空运输协会(IATA)的数据,2020年全球商业航空公司收入为3,730亿美元,预计2021年将达到4,720亿美元,与前一年同期比较增26.7%。此外,预计到2022年将达到6,580亿美元。这些因素可能会增加未来几年航太零件製造对钛合金的需求。

- 飞机製造商目前正在寻找加快生产的方法,以填补积压订单。例如,波音《2022-2041 年商业展望》预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。截至 2019 年,全球飞机持有约为 25,900 架,到 2041 年可能会达到 47,080 架。

中国主导亚太

- 中国在亚太钛合金市场占据主导地位,由于化学、高端航太、医疗和环保领域的需求不断增加,预计这种情况在预测期内将持续下去。

- 中国新疆新材和朝阳百盛新生产设施的推出预计将在提高钛产量方面发挥重要作用。

- 中国航太工业对钛合金的需求主要是由中国航太製造活动的成长所推动的。航太是该国的优先产业,政府正在投入巨额投资以提高国内製造能力。

- 中国的航太政策是进入航太研发生产顶级水准的最全面的尝试之一。预计未来20年中国将成为全球最大的民航机销售单一国家市场。例如,根据波音公司《2022-2041年商业展望》,到2041年,中国将交付约8,485架新飞机,市场服务价值将达5,450亿美元。

- 此外,钛在汽车工业中也用于连桿、引擎阀门、涡轮增压器轮、排气系统和悬吊弹簧等应用。无论从年销量或製造产量来看,中国仍是全球最大的汽车市场。根据OICA(国际汽车製造商组织)预测,2021年中国汽车产量将达2,609万辆,比2020年同期成长3%。

钛合金产业概况

钛合金市场细分为:主要企业(排名不分先后)包括 VSMPO-AVISMA Corporation、NIPPON STEEL CORPORATION、Allegheny Technologies Inc. (ATI)、TIMET (Precision Castparts Corp.) 和 CRS Holdings, LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大钛合金在航太领域的应用

- 战车对钛合金替代钢和铝的需求增加

- 抑制因素

- 由于合金的高反应活性,在製造过程中需要特别小心

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 按微观结构分

- 阿尔法和近阿尔法合金

- αβ合金

- β合金

- 按最终用户产业

- 航太

- 汽车/造船

- 化学

- 电力和海水淡化

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 其他的

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMG Advanced Metallurgical Group NV

- ATI

- BRISMET

- CRS Holdings, LLC.

- Daido Steel Co., Ltd.

- Eramet

- Hermith GmbH

- Howmet Aerospace

- KOBE STEEL, LTD.

- M/s Bansal Brothers

- Mishra Dhatu Nigam Limited

- Perryman Company

- TIMET(Precision Castparts Corp.)

- Toho Titanium Co., Ltd.

- VSMPO-AVISMA Corporation

- Weber Metals(OTTO FUCHS COMPANY)

第七章市场机会与未来趋势

- 创新产品开发

简介目录

Product Code: 52580

The Titanium Alloy Market is expected to register a CAGR of greater than 7% during the forecast period.

The pandemic had a negative effect on the market, which recovered in 2021 and is expected to grow further in the forecast period.

Key Highlights

- Over the short term, the market's growth is majorly driven by the growing usage of titanium alloys in the aerospace sector and increasing demand for titanium alloys for combat vehicles to replace steel and aluminum.

- On the flip side, the high reactivity of the alloy demands specialized care during production. This is expected to act as a restraint for the market.

- Furthermore, innovative product development will likely be an opportunity for the market during the forecast period.

- China dominates the market in the Asia-Pacific region, and it is expected to continue to do so during the forecast period. This dominance is attributed to the increasing demand from the chemical, high-end aerospace, automotive, medical, and environmental protection sectors.

Titanium Alloy Market Trends

Increasing Demand of Titanium Alloys in the Aerospace Industry

- Titanium is one of the most important raw materials for the aerospace industry. Titanium alloys account for the largest share of the aerospace raw material market, closely followed by aluminum alloys.

- Titanium alloys form the third-most important raw materials used in the aerospace industry when considering the weight of raw materials. Around 75% of the high-grade titanium sponge is used in the aerospace industry. It is used in aircraft engines, blades, shafts, and airframe applications (landing gear, fasteners, and wing beams).

- Furthermore, the ability of titanium alloys to operate at severe temperatures ranging from sub-zero to over 600°C makes them valuable in aircraft engine casings and other uses. They are perfect for usage in airframes due to their great strength and low density. The aircraft sector uses Ti-6Al-4V alloys the most.

- The top two companies in the world, Boeing and Airbus, are engaged in producing airplanes, jets, helicopters, etc. Therefore, these companies are the major consumers of titanium alloys in the aerospace industry. In 2021, Airbus took gross orders for 909 aircraft. In comparison, Boeing earned 771 gross orders, a twofold increase from 2020.

- Furthermore, according to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 373 billion in 2020 and was estimated at USD 472 billion in 2021, registering a growth rate of 26.7% Y-o-Y. Furthermore, the revenue was expected to reach USD 658 billion by 2022. Such factors are likely to increase the demand for titanium alloy from aerospace parts manufacturing, in the years to come.

- Aircraft manufacturers are now looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. The global airplane fleet amounted to around 25,900 units as of the year 2019 and the fleet number is likely to reach 47,080 units by 2041.

China to Dominate the Asia-Pacific Region

- China dominates the titanium alloy market in the Asia-Pacific region, which is expected to continue during the forecast period, owing to the increasing demand from the chemical, high-end aerospace, medical, and environmental protection sectors.

- The launch of new production facilities by Xinjiang New Material Co. Ltd and Chaoyang Baisheng Co. Ltd in China is expected to have a major role in boosting the production rate of titanium.

- The demand for titanium alloy in the aerospace industry in China is mainly driven by the growing manufacturing activities of the aerospace industry in the country. Aerospace is a priority industry for the country, with the government investing huge amounts to increase its domestic manufacturing capabilities.

- The Chinese aerospace policy represents one of the most comprehensive attempts to enter the top levels of aerospace development and production. China is expected to be the world's largest singlecountry market for civil aircraft sales over the next 20 years. For instance, in China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- Furthermore, titanium is used in the automotive industry for applications in connecting rods, engine valves, turbo charger wheels, exhaust systems, and suspension springs, among others. China continues to be the world's largest automotive market by both annual sales and manufacturing output. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), the vehicle production of China reached a total of 26.09 million units in 2021 which is an increase of 3% over 2020 for the same period.

Titanium Alloy Industry Overview

The titanium alloy market is partially fragmented. The major companies (not in particular order) include VSMPO-AVISMA Corporation, NIPPON STEEL CORPORATION, Allegheny Technologies Inc. (ATI), TIMET (Precision Castparts Corp.), and CRS Holdings, LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Titanium Alloys in the Aerospace Sector

- 4.1.2 Increasing Demand for Titanium Alloys for Combat Vehicles to Replace Steel and Aluminum

- 4.2 Restraints

- 4.2.1 High Reactivity of Alloy Demands Specialized Care During Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Microstructure

- 5.1.1 Alpha and Near-alpha Alloy

- 5.1.2 Alpha-beta Alloy

- 5.1.3 Beta Alloy

- 5.2 By End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive and Shipbuilding

- 5.2.3 Chemical

- 5.2.4 Power and Desalination

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMG Advanced Metallurgical Group N.V.

- 6.4.2 ATI

- 6.4.3 BRISMET

- 6.4.4 CRS Holdings, LLC.

- 6.4.5 Daido Steel Co., Ltd.

- 6.4.6 Eramet

- 6.4.7 Hermith GmbH

- 6.4.8 Howmet Aerospace

- 6.4.9 KOBE STEEL, LTD.

- 6.4.10 M/s Bansal Brothers

- 6.4.11 Mishra Dhatu Nigam Limited

- 6.4.12 Perryman Company

- 6.4.13 TIMET (Precision Castparts Corp.)

- 6.4.14 Toho Titanium Co., Ltd.

- 6.4.15 VSMPO-AVISMA Corporation

- 6.4.16 Weber Metals (OTTO FUCHS COMPANY)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovative Product Development

02-2729-4219

+886-2-2729-4219