|

市场调查报告书

商品编码

1690900

不断电系统(UPS):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

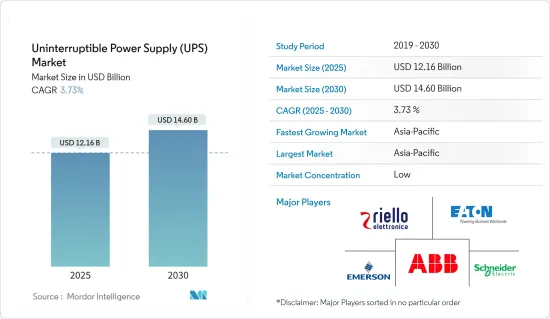

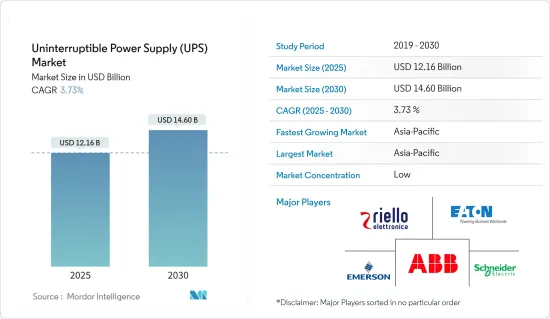

不断电系统(UPS) 市场规模预计在 2025 年为 121.6 亿美元,预计到 2030 年将达到 146 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.73%。

主要亮点

- 从中期来看,资料中心对备份应用的需求不断增长,以及由于停电次数增加而对 UPS 的需求不断增加,预计将推动所研究市场的成长。

- 另一方面,UPS 系统的高资本和营运成本会阻碍市场成长,这是市场的主要限制因素之一。

- UPS 电池系统的技术进步,例如具有更高动作温度的新型锂离子 (Li-ion) 电池,预计将在传统资料中心创造巨大的市场机会。可安装 UPS 系统作为电网故障时的备用系统。预计预测期内将提供成长机会。

- 亚太地区占据市场主导地位,并可能在预测期内实现最高的复合年增长率。支持采用 5G 网路和增加对资料中心技术的投资的现有政策框架将推动这一成长。

不断电系统(UPS)市场趋势

备用 UPS 系统可望占据市场主导地位

- 备用 UPS 系统(也称为离线 UPS 系统)提供 UPS 系统的基本功能。提供电池备援和突波保护。备用 UPS 系统将防止断电并快速切换到电池以应对短时间的断电,并且备用 UPS 系统将防止大多数电压尖峰。备用 UPS 系统还可以防止大多数电压尖峰。但是,它们无法在电压骤降或突波时维持全部功率。

- 与其他 UPS 系统相比,全球对家用电器的需求不断增长是备用 UPS 系统的主要驱动力之一。备用式UPS系统是家用电器的首选,因为它们对于低功耗设备来说是最经济的选择。

- 例如,根据国际资料中心公司(IDC)的数据,2021年全球桌上型电脑出货量将从2020年的7,980万台增加到约8,827万台。此外,国际资料中心预测,个人电脑出货量将从2022年的2.518亿台成长13.1%至2027年的2.85亿台,年增率为3.1%。

- 预测期内,游戏机的需求预计会增加。此外,疫情期间家庭娱乐需求激增。根据 VGChartz 的数据,到 2023 年 11 月,现世代游戏机的累计销售量从 1,312 万台增加到 3,610 万台。在电力频繁波动的地区,游戏机需要配备备用 UPS,因为不安全的电力水平可能会损坏您的系统。

- 预计备用式UPS系统的需求将主要集中在家用电器中,因为离线UPS系统为设备提供电源备援和保护。由于对桌上型电脑和游戏机的需求不断增加,预计预测期内需求将会增加。

亚太地区可望主导市场

- *亚太地区经常出现停电和电源不稳定的情况,尤其是马来西亚、柬埔寨和菲律宾等国家。该地区 UPS 系统的主要最终用户是蓬勃发展的通讯、商业、工业、製造和住宅领域。

- *该地区的製造业对经济贡献巨大,其中中国是最大的製造业基地。日本、韩国、印度和印尼是亚太地区的主要贡献者。另一方面,马来西亚、越南和新加坡等国家预计将在预测期内增加其份额。

- *工业对 UPS 系统的需求是由製造业的自动化所推动的,包括基于电脑的控制系统、可程式逻辑控制 (PLC) 单元和製程控制应用。

- UPS 系统在停电期间提供备用电源,并保护设备突波、欠压、电压骤降、过电压、线路杂讯、频率波动、开关瞬变和谐波失真等电源干扰的影响。这使得 UPS 系统对几乎所有行业都至关重要,包括工程、电信、研发、教育、医疗保健、IT、BPO、航空、製造、银行等等。

- 製造业包括汽车、食品加工、钢铁、半导体和其他需要 UPS 系统等电能品质设备才能平稳运行的行业,因为电源波动和中断可能导致重大的财务损失。

- 停电和电力供应不稳定会对严重依赖优质电力顺利运作的产业和企业造成巨大损害。但在印度和中国等新兴国家,维持良好的电力品质对当局来说很困难。

- 例如,根据投资印度 (Invest India) 的数据,到 2026-27 年,印度的发电装置容量预计将接近 620 吉瓦,其中 38% 为煤炭,44% 为可再生。印度的目标是透过大幅提高可再生能源发电能力,实现能源来源多元化并实现全天候电力供应。预计在预测期内,电力需求的增加、可支配收入的提高以及对可靠电力供应的需求将支撑印度的 UPS 市场。

- 因此,基于上述因素,预计亚太地区将成为预测期内成长最快的UPS市场。

不断电系统(UPS) 产业概况

不断电系统(UPS)市场比较分散。主要企业(不分先后顺序)包括 Riello Elettronica SpA、EATON Corporation PLC、Emerson Electric Co.、ABB Ltd 和 Schneider Electric SE。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 资料中心对备份应用程式的需求不断增加

- 停电次数增加导致 UPS 需求增加

- 限制因素

- UPS 系统的资本和营运成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 按容量

- 小于10kVA

- 10至100kVA以下

- 100kVA以上

- 按类型

- 后备式UPS系统

- 线上UPS系统

- 线上互动式 UPS 系统

- 按应用

- 资料中心

- 通讯

- 医疗保健(医院、诊所等)

- 产业

- 其他用途

- 按地区(区域市场分析{到 2029 年的市场规模和需求预测(仅按地区)})

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 北欧的

- 土耳其

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Riello Elettronica SpA

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- ABB Ltd

- Schneider Electric SE

- Hitachi Ltd

- Mitsubishi Electric Corporation

- General Electric Company

- Cyber Power Systems Inc.

- Aspex Inc.

- 市场排名分析

第七章 市场机会与未来趋势

- UPS 电池系统的技术进步日新月异

简介目录

Product Code: 72364

The Uninterruptible Power Supply Market size is estimated at USD 12.16 billion in 2025, and is expected to reach USD 14.60 billion by 2030, at a CAGR of 3.73% during the forecast period (2025-2030).

Key Highlights

- During the medium term, the increasing demand for backup applications in data centers and rising power outages to increase the demand for UPS are expected to drive the growth of the market studied.

- On the other hand, the high capital cost and operation expenditure of UPS systems may hinder the market's growth, which is one of the major restraints for the market.

- Technological advancements in UPS battery systems, such as new lithium-ion (Li-ion) batteries with high operating temperatures, are expected to create immense market opportunities in traditional data centers. UPS systems can be installed as backup systems when the electricity grid fails. They are expected to provide growth opportunities during the forecast period.

- Asia-Pacific dominates the market and is likely to register the highest CAGR during the forecast period. The growth may be driven by the existing policy framework supporting the adoption of 5G networks and increasing investments in data center technologies.

Uninterruptible Power Supply (UPS) Market Trends

Standby UPS System is Expected to Dominate the Market

- A standby UPS system, also called the offline UPS system, provides the essential features of a UPS system. It provides battery backup and surge protection. Standby UPS systems switch to a battery fast enough to prevent power anomalies and ride out short outages, and a standby UPS system protects against most voltage spikes. Still, it does not maintain perfect power during sags and sages.

- The growing demand for consumer electronics worldwide is one of the major drivers for standby UPS systems compared to other UPS systems. Standby UPS systems are the most preferred option for consumer electronics as they are the most economical option for devices with low power consumption.

- For instance, according to the International Data Center (IDC), the global shipment of desktop computers increased to about 88.27 million units in 2021 compared to 79.8 million in 2020. Moreover, the International Data Center predicts that personal computer shipment is expected to increase by 13.1% by 2027, rising from 251.8 million units shipped in 2022 to 285 million units in 2027, growing annually by 3.1%.

- The demand for gaming consoles is expected to increase during the forecast period. Moreover, during the pandemic, there was a surge in demand for home entertainment. According to VGChartz, the cumulative sales of current-generation consoles increased from 13.12 million units to 36.1 million units in November 2023. A standby UPS is necessary for gaming consoles in areas with frequent power fluctuations, as unsafe levels of electricity can damage the system.

- Overall, the demand for standby UPS systems is primarily expected from consumer electronics, as offline UPS systems provide devices with power backup and protection. The demand is expected to increase during the forecast period due to the increasing demand for desktop PCs and gaming consoles.

Asia-Pacific is Expected to Dominate the Market

- * Asia-Pacific witnesses frequent blackouts and unstable power supply, especially in countries like Malaysia, Cambodia, and the Philippines. Major end users of UPS systems in the region include its booming telecom, commercial, industrial, manufacturing, and residential sectors.

- * The region's manufacturing sector is one of the major contributors to its economy, with China being the largest hub of the manufacturing sector. Japan, South Korea, India, and Indonesia are a few major contributors to Asia-Pacific. On the other hand, countries like Malaysia, Vietnam, and Singapore are expected to witness an increased share during the forecast period.

- * The need for UPS systems in industries has been prompted by automation in the manufacturing sector involving computer-based control systems, Programmable Logic Control (PLC) units, and process control applications.

- UPS systems offer backup during electric power failure and protect equipment from power glitches like surges, under voltage, power sags, over-voltage, line noise, frequency variations, and switching transient and harmonic distortions. Therefore, UPS systems have become essential to almost all industries like engineering, telecom, R&D, education, medicine, IT, BPO, aviation, manufacturing, and banking.

- The manufacturing sector encompasses industries like automotive, food processing, steel manufacturing, and semiconductors, all requiring power quality equipment like UPS systems for smooth operations as fluctuating and disruptive power causes monetary losses significantly.

- Power cuts and variable power supply cause significant damage to industries and businesses that rely heavily on good quality electricity for smooth operations. However, maintaining good quality power in developing countries like India and China is difficult for the authorities.

- For instance, according to Invest India, by 2026-27, India's power generation installed capacity will likely be nearly 620 GW, 38% of which will be from coal and 44% from renewable energy. India's aim is to diversify its energy sources and the target is to provide a 24x7 electricity supply by making a large addition of renewable energy generation capacities, which is estimated to be a significant driver for the market. The growing electricity demand, increasing disposable income, and the need for a reliable power supply are expected to support the UPS market in India during the forecast period.

- Therefore, based on the above mentioned factors, Asia-Pacific is expected to become the fastest-growing UPS market during the forecast period.

Uninterruptible Power Supply (UPS) Industry Overview

The uninterruptible power supply (UPS) market is fragmented. Some of the major players (in no particular order) include Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., ABB Ltd, and Schneider Electric SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Backup Applications in Data Centers

- 4.5.1.2 Rising Power Outages to Increase the Demand for UPS

- 4.5.2 Restraints

- 4.5.2.1 High Capital Cost and Operation Expenditure of UPS Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 Less than 10 kVA

- 5.1.2 10-100 kVA

- 5.1.3 Above 100 kVA

- 5.2 By Type

- 5.2.1 Standby UPS System

- 5.2.2 Online UPS System

- 5.2.3 Line-interactive UPS System

- 5.3 By Application

- 5.3.1 Data Centers

- 5.3.2 Telecommunications

- 5.3.3 Healthcare (Hospitals, Clinics, etc.)

- 5.3.4 Industrial

- 5.3.5 Other Applications

- 5.4 By Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 NORDIC

- 5.4.2.8 Turkey

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Malaysia

- 5.4.3.7 Thailand

- 5.4.3.8 Indonesia

- 5.4.3.9 Vietnam

- 5.4.3.10 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Riello Elettronica SpA

- 6.3.2 EATON Corporation PLC

- 6.3.3 Emerson Electric Co.

- 6.3.4 Delta Electronics Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Schneider Electric SE

- 6.3.7 Hitachi Ltd

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 General Electric Company

- 6.3.10 Cyber Power Systems Inc.

- 6.3.11 Aspex Inc.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Technological Advancements in UPS Battery Systems

02-2729-4219

+886-2-2729-4219