|

市场调查报告书

商品编码

1237832

电动汽车电机微控制器市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Electric Vehicle Motor Micro Controller Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

目前,电动汽车电机微控制器市场规模为33.6亿美元,预计未来5年将达到69.3亿美元,复合年增长率为15.58%。

由于全球冠状病毒大流行,电动汽车电机微控制器市场受到严重停产、销量下降和汽车生产停顿的不利影响。 EVM(电动汽车电机)控制器市场受到封锁实施和冠状病毒世界迅速蔓延的沉重打击。 汽车行业的製造商正在弥补因生态系统中断和电动汽车销量下降而造成的损失。

与此同时,虽然全球汽车行业正在从 COVID-19 的销量下滑中復苏,但另一场危机正在阻碍其复苏。 全球半导体短缺可能会扰乱全球汽车生产并延迟新车销售。 微控制器是现代信息娱乐系统、ADAS(高级驾驶辅助系统)、ABS(防抱死制动系统)和其他电子稳定係统中使用的电子控制单元的重要组成部分,其短缺导致汽车製造商被迫减产。 因此,汽车製造商正在暂停某些地区的生产,直到短缺情况有所改善。 另一方面,预计市场将在不久的将来快速发展。

随着自动化的进步,对负责自动化汽车任务的微控制器的需求量很大。 MCU 在汽车中用于执行自动化任务,例如将电力分配到车辆的各个部分、保持排气系统清洁以及减少燃料使用。 电动汽车以其重量轻、性能高、油耗低等优点在发展中国家越来越受欢迎。 由于排放量低,电池驱动的电动汽车越来越受到消费者的欢迎。 为了在电动汽车中使用最先进的组件,主要汽车製造商正在投资并提高产能。

此外,随着车辆的电气化,对专为电动汽车 (EV) 要求量身定制的新型专用 MCU 的需求不断增长。 行业公司正在开发尖端产品并大力投资研发以满足对电动汽车的需求激增。

电动汽车电机微控制器的市场趋势

电动汽车在全球日益普及

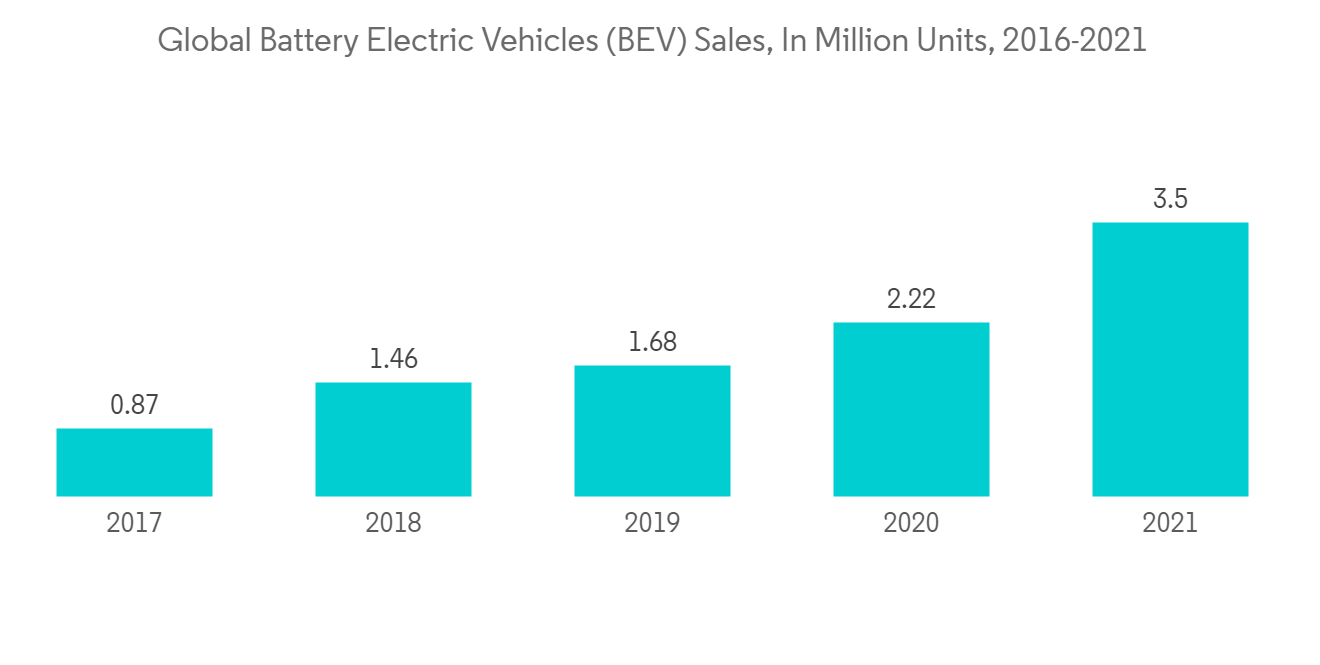

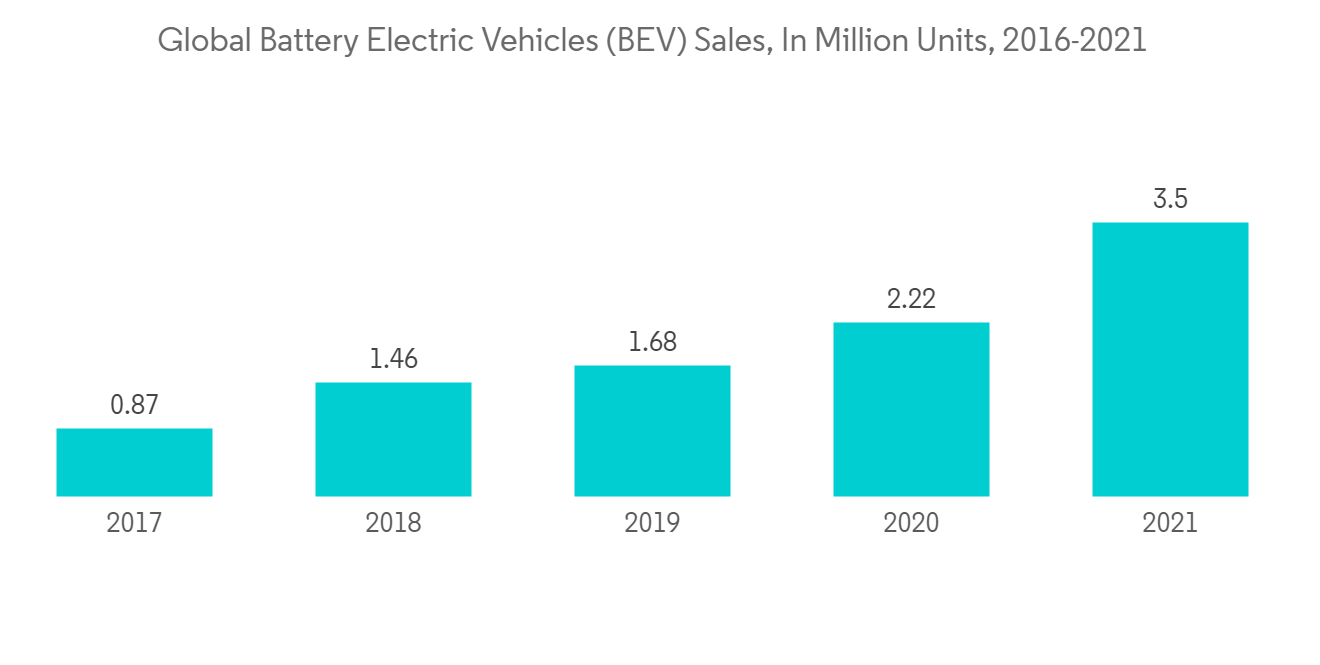

BEV 和 PHEV 销量的增长,以及由于材料和包装改进的进步而导致的动力总成部件成本的降低正在推动市场。 此外,由于电池成本高昂,需要加强车辆性能和电力电子。

此外,世界各国政府正在实施各种计划和政策,以鼓励消费者选择电动汽车而非传统汽车。 加州的 ZEV 计划旨在到 2025 年拥有 150 万辆电动汽车,这就是鼓励购买电动汽车的此类举措之一。 此外,印度、中国、英国、韩国、法国、德国、挪威、荷兰等国也采取了各种优惠措施。

COVID-19 传播后,电动汽车销量大幅增加。 世界各地的政府封锁令经济放缓,并损害了电动汽车和充电基础设施系统的销售。 逆变器和锂离子电池组等附加组件的可用性受到影响。 电动汽车的一个重要组成部分是功率逆变器。 电动汽车的一个组成部分是功率逆变器,它将电池的能量转换为使用牵引电机来推动车辆。

电动汽车製造商面临消费者接受度的重大挑战。 缺乏充电基础设施和电动汽车的高成本(电动汽车的成本与入门级豪华车大致相同)使消费者不愿购买电动汽车,儘管它们提供了好处。 由于 COVID-19,包括印度在内的多个国家/地区被迫搁置了建造 50,000 多个充电站和改善其充电基础设施的计划。

重要的是,一些原始设备製造商打算重组其产品线以生产电动汽车。 例如,General Motors在 2021 年宣布,到 2025 年将在电动和自动驾驶汽车上投入 200 亿美元。 到2023年,公司计划推出20款电动汽车新车型,每年在中国和美国销售超过100万辆电动汽车。

到 2024 年,Volkswagen计划在其大众市场品牌的电动汽车上投资 360 亿美元。 Volkswagen声称,到 2025 年,电动汽车将占全球销量的 25% 以上。

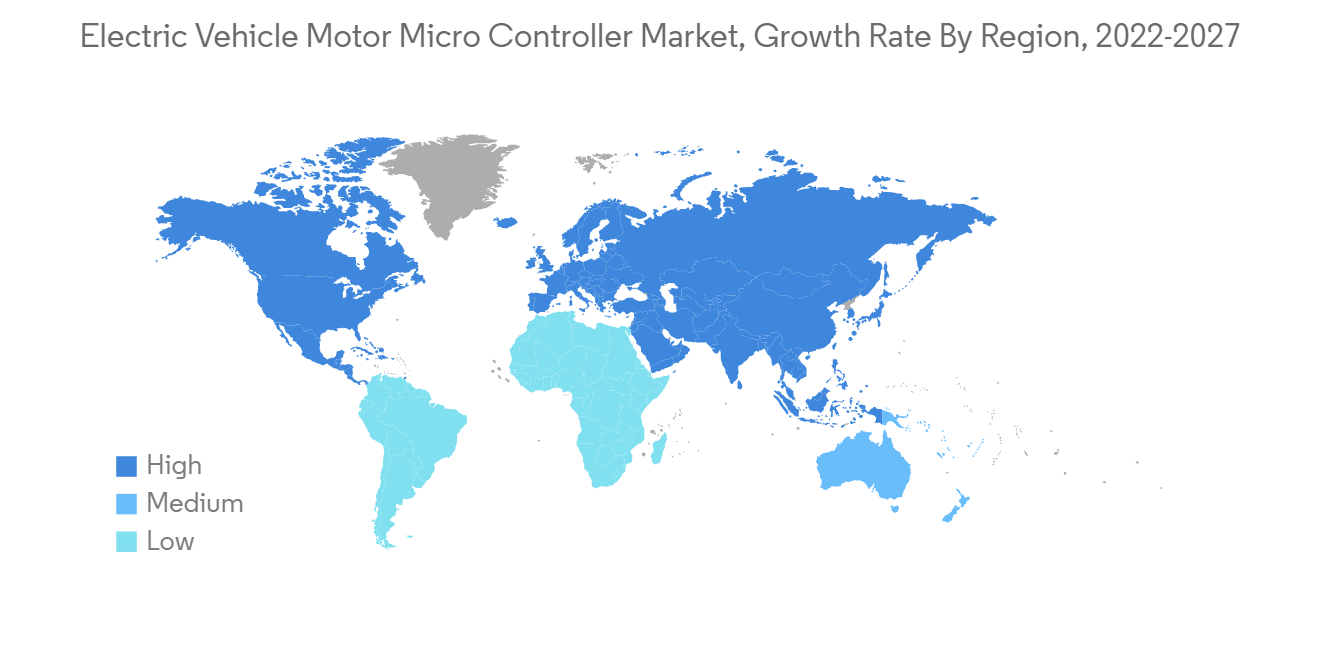

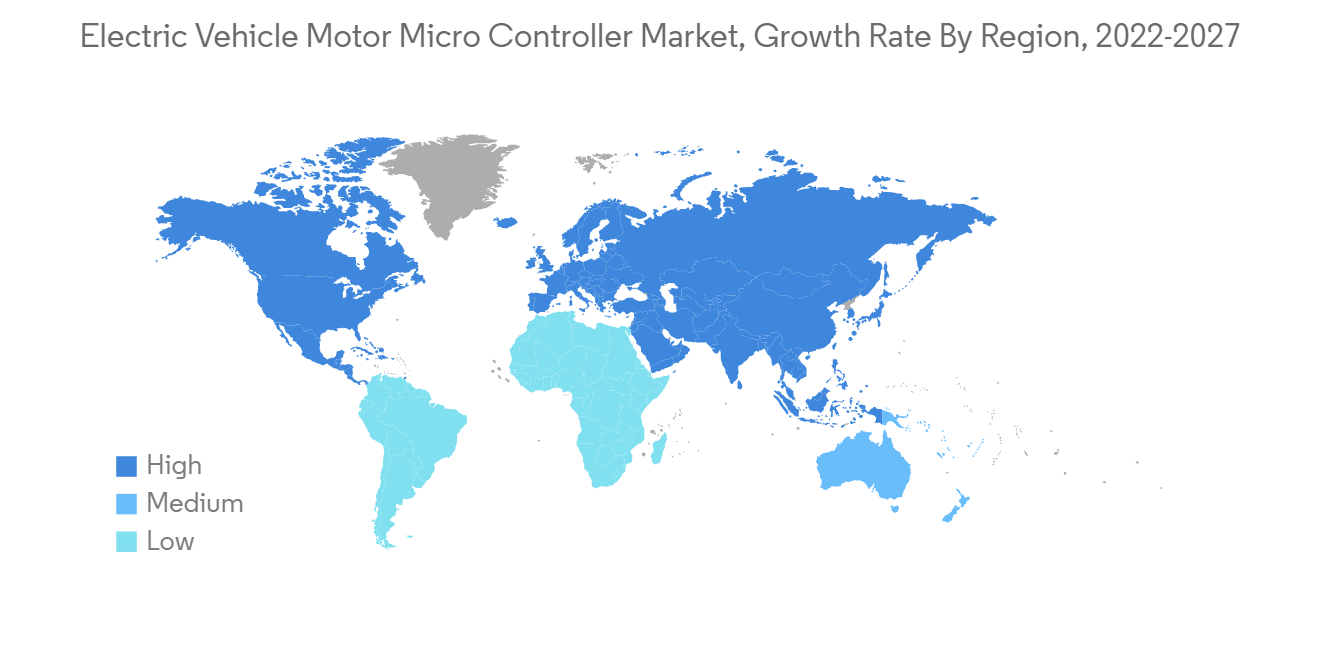

亚太地区引领市场

全球电动汽车市场以亚太地区为主。 预计该市场在预测期内将显着增长,中国将引领电动汽车的销售。

中国和日本正在支持最先进电动汽车的开发和技术进步。 印度尼西亚等国家也在实施重要的电动汽车项目。

中国是全球电动汽车行业的主要参与者。 此外,中国政府正在鼓励人们引进电动汽车。 该国计划到 2040 年完全转向电动汽车。 中国的电动乘用车市场也是世界上最大的市场之一,并且近年来一直呈上升趋势。 预计在预测期内也将有更高的增长,这将对电动汽车连接器的需求产生有利影响。

随着形势趋于正常化,日本对电动汽车的需求也出现增长迹象。 合作伙伴关係、合资企业和合併预计将促进日本电动汽车零部件的销售,以满足不断增长的需求。

- 2022 年 4 月:HONDA与General Motors合作开发经济实惠的电动汽车。 该汽车製造商计划基于General Motors的 Ultium EV 电池构建新架构,主要用于小型跨界 SUV。

印度的电动汽车市场正处于增长阶段。 TATA、Mahindra 和 MG 等印度汽车製造商正在努力提供价格适中的电动汽车。 此外,政府还支持电动汽车以减少该国的温室气体排放。

韩国政府为未来十年的电动汽车行业设定了雄心勃勃的目标。 该国大力投资于车辆和支持它们的基础设施。 例如,韩国政府也对购买电动汽车进行补贴。 首尔政府为每辆电动汽车提供大约 7,500 美元的补贴。

汽车製造商也在投资扩大对电动汽车不断增长的需求。 例如:

- 现代计划投资 160 亿美元,以在 2023 年之前扩大其全球市场份额。 随着新产品的製造和推出,预计未来几年对微控制器的需求将会增长。

电动汽车电机微控制器市场竞争者分析

电动汽车电机微控制器市场包括 Continental AG、Infineon Technologies AG、Toyota Industries Corporation、Robert Bosch GmbH 和 BorgWarner Inc 等知名企业。 竞争、消费者偏好的频繁变化以及技术的快速进步预计将在预测期内威胁到市场的增长。

全球电动汽车电机微控制器市场的主要参与者正在通过併购和建设新设施来扩大影响力。 例如:

- 2022年10月:根据GreatWall公告,芯东半导体科技将在江苏省无锡市成立,由WEI董事长建军和闻盛科技(天津)(Wensheng Technology)牵头。 该合资企业註册资本为人民币 5000 万元(约合 420 万美元),主要从事集成电路设计和微控制器生产。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场驱动因素

- 市场製约因素

- 搬运工 5 力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分

- 按类型

- 交流永磁同步电机控制器

- 交流异步电机控制器

- 直流电机控制器

- 功率输出

- 1~20KW

- 21~40KW

- 41~80KW

- 80KW以上

- 按推进类型

- 插电式混合动力车

- 纯电动车

- 燃料电池电动车

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳大利亚

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美

第六章竞争格局

- 供应商市场份额

- 公司简介

- BorgWarner Inc.

- Continental AG

- Delphi Technologies PLC.

- Denso Corporation

- FUJITSU

- Hitachi Automotive Systems

- Mitsubishi Electric

- Robert Bosch GmbH

- Siemens AG

- Texas Instruments

- Toyota Industries Corporation

- Infineon Technology AG

- Delta Electronics

- Renesas Electronics Corporation

第七章市场机会与未来趋势

Currently, the Electric Vehicle Motor Micro Controller Market is valued at USD 3.36 Billion and is expected to reach USD 6.93 Billion over the next five years at a CAGR of 15.58%.

The global coronavirus pandemic has had a negative impact on the market for Electric Vehicle Motor (EVM) controllers due to severe lockdowns, decreased sales, and a halt in automobile production. The market for Electric Vehicle Motor (EVM) controllers has suffered due to the widespread implementation of lockdowns and the rapid global spread of the coronavirus. Manufacturers in the automotive industry are making up for losses caused by the disruption of the ecosystem and the decline in sales of electric vehicles.

On the other hand, while the global automotive industry is recovering from the COVID-19 sales drop, another crisis is preventing its revival. Production of automobiles around the world is disrupted by a worldwide shortage of semiconductors, which may delay the sales of new vehicles. The scarcity of microcontrollers, which are an essential component of the electronic control units that are utilized in contemporary infotainment systems, Advanced Driver Assist Systems (ADAS), Anti-lock Braking Systems (ABS), and other electronic stability systems, has forced automobile manufacturers to reduce production. As a result, automakers halt production at specific locations until the shortage improves. On the other hand, the market is anticipated to move quickly in the near future.

Microcontrollers that are in charge of automating vehicle tasks are in high demand due to the development of automation. MCUs are employed in automobiles to carry out automatic tasks like distributing electricity to various vehicle components, keeping the exhaust system clean, and lowering fuel usage. Due to their low weight, high performance, and low fuel consumption, electric cars are becoming increasingly popular in developing nations. Battery-powered electric vehicles are becoming increasingly popular with consumers due to their low emissions. To use cutting-edge components for electric vehicles, major automakers are investing and expanding their production capacity.

Additionally, as vehicles become electrified, there is a growing demand for fresh, specialized MCUs that are tailored to meet the requirements of Electric Vehicles (EVs). Companies in the industry are developing cutting-edge goods and funding great R&D efforts to meet the spike in demand for EVs.

Electric Vehicle Motor Micro Controller Market Trends

Increased Electric Vehicle Adoption Globally

The market is being driven by increased sales of BEVs and PHEVs, as well as lower costs for powertrain components due to material advancements and improved packaging arrangement. In addition, the high cost of batteries has necessitated enhancements to vehicle performance as well as power electronics.

In addition, various programs and policies have been implemented by governments worldwide to encourage consumers to choose electric vehicles over conventional ones. The California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative that encourages the purchase of electric vehicles. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are additional nations that provide various incentives.

After COVID-19 spread, sales of electric vehicles increased significantly. Lockdowns imposed by governments worldwide have slowed the economy and hurt sales of electric vehicles and charging infrastructure systems. The availability of additional components, such as inverters and lithium-ion battery packs, was affected. An integral component of electric vehicles is a power inverter. It uses a traction motor to propel the vehicle by converting energy from the batteries.

Manufacturers of electric vehicles have faced a significant challenge in gaining consumer acceptance. Due to factors such as a lack of charging infrastructure and the high cost of EVs (EV costs are almost the same as those of entry-level luxury cars), consumers have been reluctant to purchase electric vehicles despite the benefits they provide. Due to COVID-19, several nations, including India, had to put their plans to construct over 50,000 charging stations and improve the charging infrastructure on hold.

Significantly, several OEMs intend to restructure their product lines solely to produce electric automobiles. For instance, General Motors announced in 2021 that by 2025, it would spend USD 20 billion on electric and autonomous vehicles. By 2023, the company intends to introduce 20 new electric models and sell more than 1 million electric cars annually in China and the United States.

By 2024, Volkswagen intends to invest USD 36 billion in electric vehicles across its mass-market brands. The business claims that by 2025, electric vehicles will account for at least 25% of its global sales.

Asia-Pacific is Leading the Market

Asia-Pacific accounts for the majority of the global market for electric vehicles. Over the forecast period, the market is expected to grow significantly, with China leading the sales of electric vehicles.

China and Japan support cutting-edge electric vehicle development and technological advancement. Significant electric mobility projects are also being implemented in nations like Indonesia.

China is a key player in the global electric vehicle industry. Moreover, the government of China is encouraging people to adopt electric vehicles. The country is planning to switch to electric mobility by 2040 completely. The Chinese electric passenger car market is also one of the largest worldwide and has been increasing over the last few years. It is expected to grow higher in the forecast period, which will also positively impact the demand for electric vehicle connectors.

As the situation is normalizing, the demand for electric vehicles in Japan shows signs of growth. To cater to the rising demand, partnerships, ventures, and mergers are expected to boost the sales of electric cars components in Japan; for instance,

- April 2022: Honda partnered with General Motors to develop affordable electric vehicles. Automakers plan to create a new architecture based on GM's Ultium EV battery, primarily for small crossover SUVs.

The Indian electric vehicle market is in its growing stage. Automobile manufacturers in India, such as TATA, Mahindra, MG, etc., are taking initiatives to provide affordable electric driving options. Moreover, the government is also supporting electric mobility to reduce the exhaust emissions of greenhouse gases in the country.

The South Korean government has set high goals for its electric vehicle industry over the next ten years. The country is making heavy investments in vehicles and infrastructure to support them. For instance, the government of South Korea is also supporting the purchase of electric cars with a subsidy. The Seoul government is providing a subsidy of approximately USD 7,500 for each electric passenger car.

Car manufacturers are also investing to scale up the growing demand for electric vehicles. For instance,

- Hyundai Motors plans to invest USD 16 billion to increase its market share in the world by 2023. With the increase in the manufacturing and launching of new products, the demand for microcontrollers is bound to grow in the upcoming years.

Electric Vehicle Motor Micro Controller Market Competitor Analysis

The Electric Vehicle Motor Micro Controller Market has a presence of prominent players like Continental AG, Infineon Technologies AG, Toyota Industries Corporation, Robert Bosch GmbH, BorgWarner Inc., etc. The competition, frequent changes in consumer preferences, and rapid technological advancements are expected to pose a threat to the market's growth during the forecast period.

Major players in the global market for Electric Vehicle Motor (EVM) controllers are expanding their presence through mergers and acquisitions or the construction of new facilities. For instance,

- October 2022: Xindong Semiconductor Technology Co., Ltd. will be established in Wuxi, Jiangsu, with Jianjun WEI, its chairman, and Wensheng Technology (Tianjin) Co., Ltd. (Wensheng Technology), according to Great Wall Motor's announcement. With a registered capital of CNY 50 million (around USD 4.20 million), the joint venture will primarily focus on integrated circuit design and the production of microcontrollers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 AC Permanent Magnet Synchronous Motor Controller

- 5.1.2 AC Asynchronous Motor Controller

- 5.1.3 DC Motor Controller

- 5.2 Power Output

- 5.2.1 1 to 20 KW

- 5.2.2 21 to 40 KW

- 5.2.3 41 to 80 KW

- 5.2.4 Above 80 KW

- 5.3 By Propulsion Type

- 5.3.1 Plug-in Hybrid Vehicle

- 5.3.2 Battery Electric Vehicle

- 5.3.3 Fuel Cell Electric Vehicle

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 BorgWarner Inc.

- 6.2.2 Continental AG

- 6.2.3 Delphi Technologies PLC.

- 6.2.4 Denso Corporation

- 6.2.5 FUJITSU

- 6.2.6 Hitachi Automotive Systems

- 6.2.7 Mitsubishi Electric

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Siemens AG

- 6.2.10 Texas Instruments

- 6.2.11 Toyota Industries Corporation

- 6.2.12 Infineon Technology AG

- 6.2.13 Delta Electronics

- 6.2.14 Renesas Electronics Corporation