|

市场调查报告书

商品编码

1237836

IT 设备市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)IT Device Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,IT 设备市场预计将以 2.4% 的复合年增长率增长。

由于对移动设备的需求增加,预计该市场在预测期内将会增长。 在 COVID-19 流行期间,随着企业和消费者需要更大的灵活性和移动性,对 PC 的需求增加了。

主要亮点

- 在过去几年中,随着全球个人消费的扩大,对手机的需求也在增加。 值得一提的是,智能手机的需求在机型和市场规模上不断扩大。 去年,预计 40% 的人将拥有智能手机。 据爱立信称,全球智能手机用户数量已超过 60 亿,预计未来几年将增长数亿。 中国、印度和美国是智能手机用户最多的前三个国家。

- 此外,笔记本电脑的销量在美国和中国等主要国家/地区不断扩大。 主要笔记本电脑製造商报告说,自 COVID-19 大流行以来,PC 销量有所增加。 随着图形、连接性、重量、便携性等方面的不断更新,对最先进设备的需求始终是意料之中的。

- 但是,由于对笔记本电脑的需求增加,全球个人电脑销量正在萎缩。 由于在家工作和社会疏远规范,大流行后对个人电脑的需求也有所增加。 但是现在一切都恢復正常了,人们已经回到了他们的办公室和设施中。 因此,对个人电脑的需求正在放缓。 此外,预计全球 PC 销量在预测期内将进一步萎缩。

- 中国在全球 IT 设备市场处于领先地位,其次是美国、日本和印度。 去年,中国在手机领域的销售额最高。 根据 GSMA 移动智库的数据,今年早些时候,中国拥有 16.3 亿手机连接。 今年第二财季,荣耀和vivo的智能手机市场份额最高。

- 在 COVID-19 疫情期间,全球对个人电脑、笔记本电脑和手机等 IT 设备的需求有所增加。 需求的增加主要是由于全球社会距离和在家工作的规定导致对网络设备的需求增加。 然而,法规的逐步取消以及办公室和设施的重新开放减少了对 PC 的需求。 在 COVID-19 之后,对手机,尤其是智能手机的需求预计将保持稳定。

IT 设备市场趋势

移动领域的坚实贡献

- 在中国、印度等人口密度较高的国家,智能手机普及率仍在70%左右,智能手机市场还有很大的发展空间。 儘管销量一直低迷,但由于智能手机平均售价的上涨,全球智能手机市场的销量在过去几年有所增长。

- 手机市场广阔并将继续增长,可能会影响许多市场。 改善无线连接有助于将物联网、人工智能、增强现实和云计算等尖端技术集成到移动设备中。 因此,市场正在迅速将需求从传统无线电话转移到这些支持物联网的设备。

- 世界各地的人们现在都可以访问现在非常重要的移动网络背后的连接。 根据 GSMA 报告,去年全球有 42 亿移动互联网用户。 到 2025 年,这一数字预计将增长到 50 亿。 对互联网用户不断增长的需求推动了全球智能手机市场的发展。

- 根据今年的移动经济报告,去年独立移动用户数量为 53 亿,预计到 2025 年底将增至 57 亿。 此外,全球 SIM 连接数量预计将从去年的 83 亿大幅增长到 2025 年的 88 亿。 特别是,全球智能手机普及率预计将从去年的 75% 提高到 2025 年的 84%。

- GSMA 报告预测,到 2025 年全球将有 20 亿个 5G 连接,超过目前的 10 亿个连接。 5G 也已成为智能手机行业的重要存在,并有望改变我们今天使用智能手机的方式。 过去几个季度,全球具有 5G 功能的设备出货量显着增长。

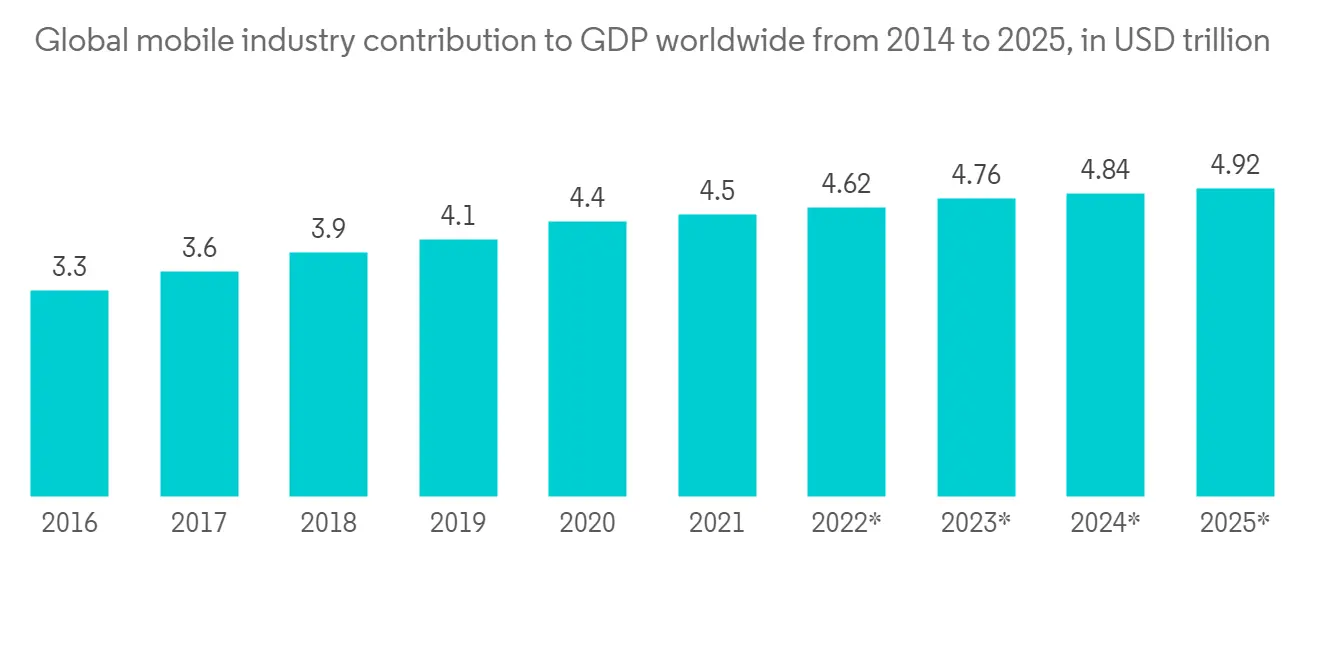

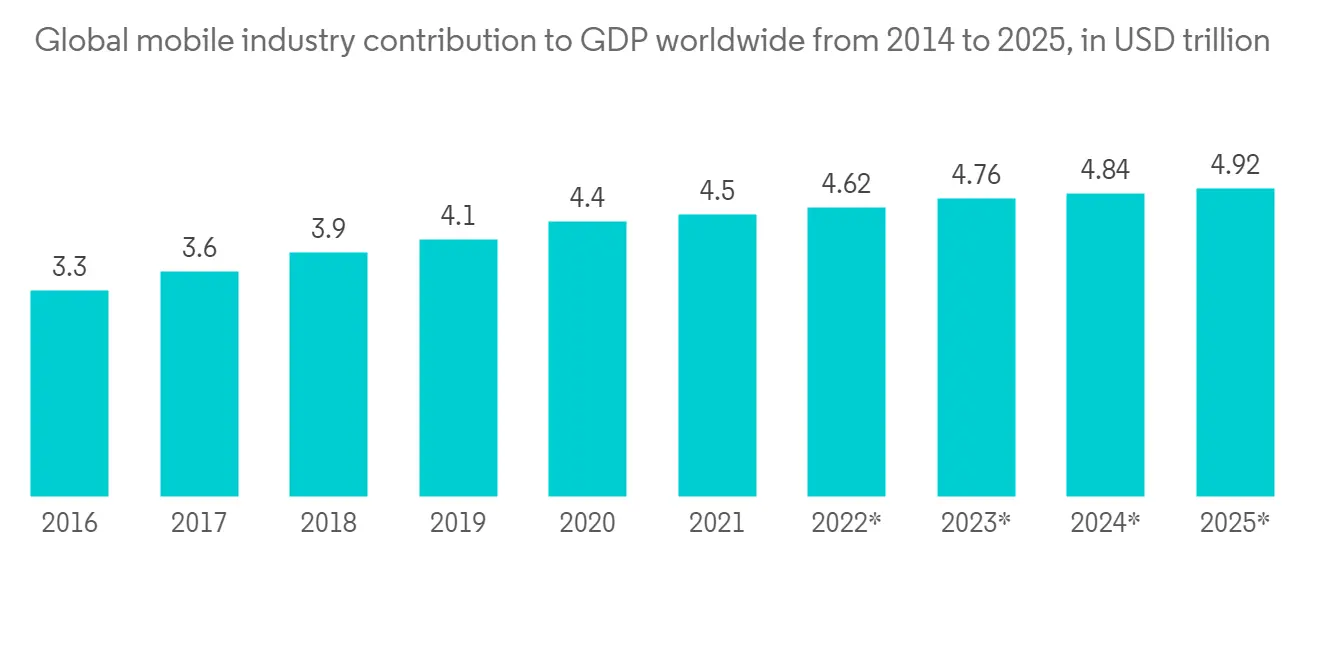

- 根据 GSMA 的数据,移动行业去年为全球 GDP 贡献了 4.5 万亿美元,占全球 GDP 的 5%。 据预测,到 2025 年,移动行业预计将贡献 4.9 万亿美元。

亚太地区占很大份额

- 亚太地区人口稠密地区预计在预测期内对 IT 设备的需求会增加。 这种增长主要是由于互联网使用量的增加、可支配收入的增加、消费者对尖端□□技术出现的意识增强,以及最重要的是该地区人口的增长。 这些因素正在推动市场扩张。

- 亚太地区经济继续从移动生态系统中获益匪浅,该生态系统目前占该地区 GDP 的 5% 和 7700 亿美元的额外经济价值。 据 GSMA 称,亚太地区的独立移动用户数量预计将从去年的 16 亿 (59%) 增长到 2025 年的 18 亿 (62%)。 该地区的移动互联网用户数量预计也将从去年的 12 亿 (44%) 激增至 2025 年的 15 亿 (52%)。 由于移动互联网用户的增加,未来对智能手机的需求预计会增加。

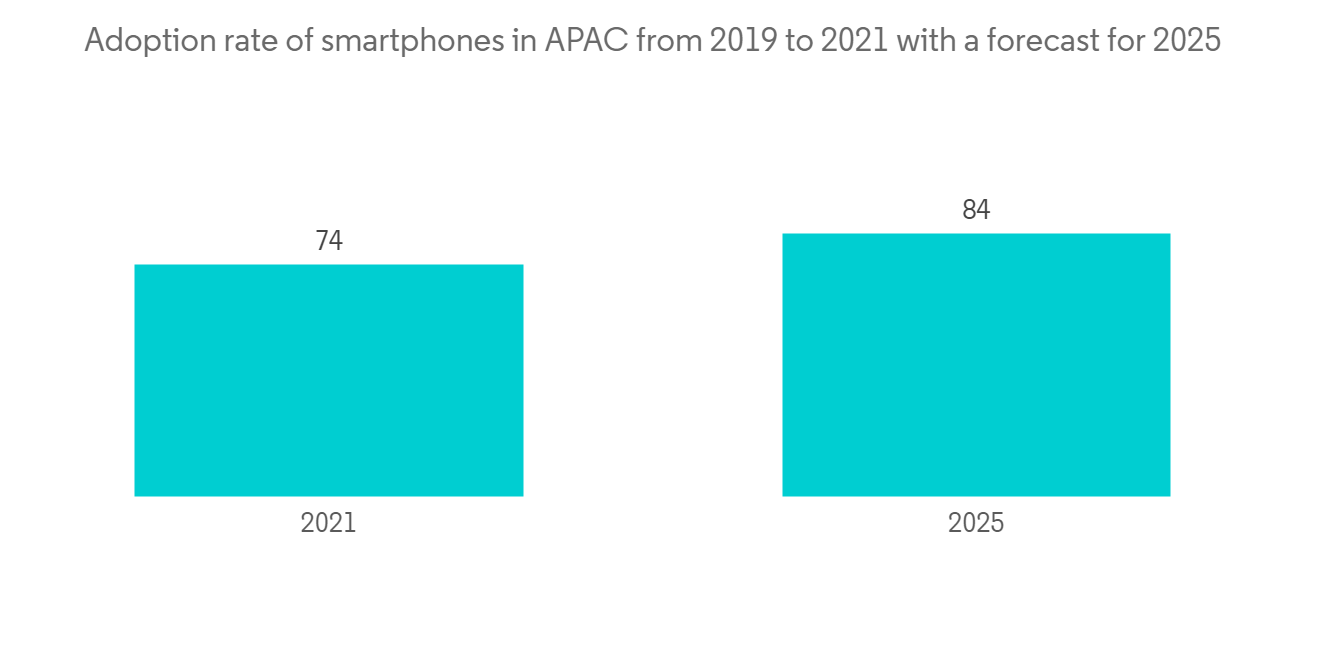

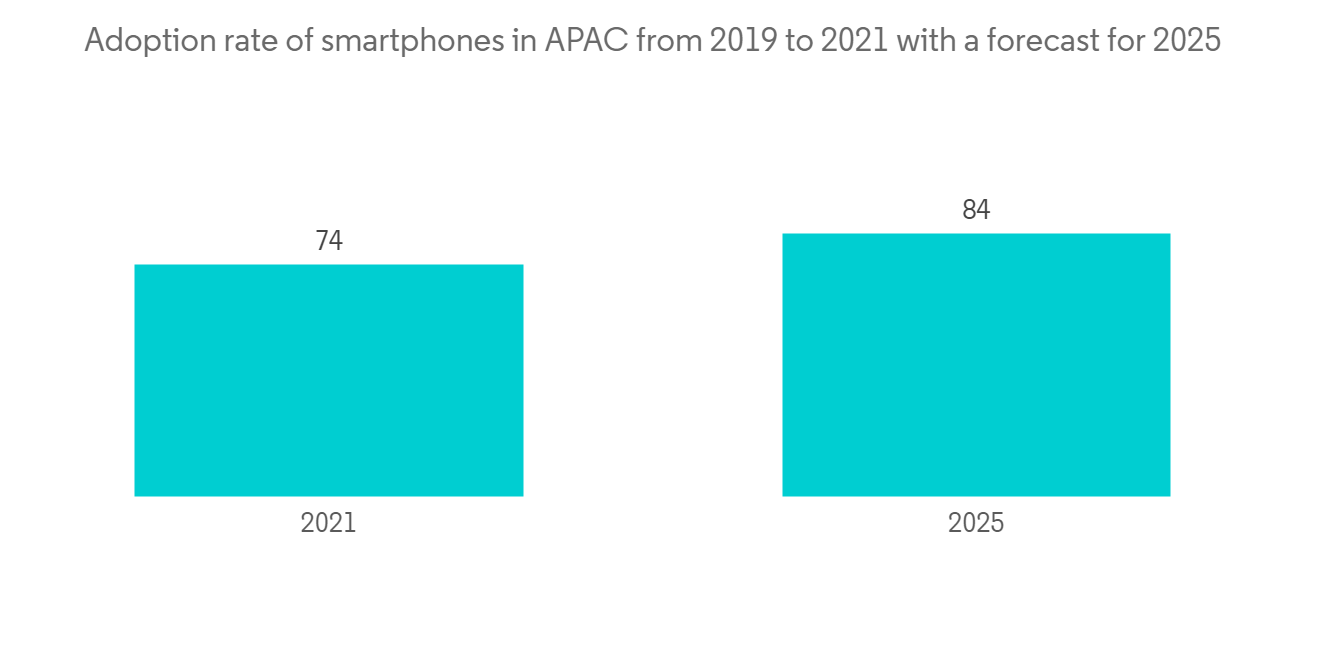

- 此外,根据 GSMA 报告,到 2025 年,亚太地区的智能手机普及率预计将从上一年的 74% 上升至 84%。 从 2020 年到 2025 年,预计全球将新增 5 亿用户,仅在亚太地区就贡献了约 1.88 亿新增用户。 然而,该地区人们在使用移动互联网连接方面存在很大差异,智能手机的普及还有进一步增长的空间。

- 自 2017 年 11 月以来,中国第八次成为世界上最快的超级计算机的第一拥有者。 这是因为最新一期的世界超级计算机500强榜单中包括了186台中国超级计算机,约占总榜单的40%。 到 2025 年,中国政府可能拥有多达 10 台百亿亿级超级计算机。 由于对处理能力的需求不断增长,超级计算机近年来发展迅速。

- 随着加强笔记本电脑製造和降低备件进口关税等政府举措的增加,预计中国和印度等国家/地区将推动市场扩张。 技术进步和趋势、快速更新的需求以及对新技术的响应能力也在推动亚太地区笔记本电脑市场的发展。

IT 设备市场竞争者分析

IT 设备市场目前高度分散,因为它由许多参与者组成。 市场上的主要参与者不断努力带来进步。 几家知名公司正在建立合作伙伴关係并扩大其在新兴市场的全球足迹,以巩固其市场地位。 该市场的主要参与者包括Dell Inc.、Lenovo Group Ltd.、Apple Inc.、Samsung Electronics、Microsoft Corporation。

2022 年 11 月,Microsoft 发布了新的 Surface 设备,这些设备将引领 Windows PC 计算的下一阶段。 从推出新的 Surface 产品开始,Microsoft 的顶级功能已整合到一个小工具中,每个人都可以参与、听到、看到并创造性地表达自己。

2022 年 10 月,先进内存技术的市场领导者Samsung电子宣布,其最新的 LPDDR5X DRAM 具有业界领先的每秒 8.5 吉比特 (Gbps) 的性能,已获准用于骁龙移动平台。 Samsung在 3 月份突破了此前 7.5Gbps 的最高速度,再次彰显其在内存行业的霸主地位。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估 COVID-19 对 IT 设备行业的影响

第 5 章市场动态

- 市场驱动因素

- 对 5G 兼容移动设备的需求不断扩大

- 移动宽带的普及仍在继续

- 亚太地区的技术进步

- 市场製约因素

- 对台式电脑的需求减少

第 6 章市场细分

- 按类型

- 电脑

- 笔记本电脑

- 台式电脑

- 平板设备

- 电话

- 固定电话

- 智能手机

- 功能手机

- 电脑

- 按地区

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 澳大利亚

- 中国

- 印度

- 日本

- 印度尼西亚

- 马来西亚

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 哥伦比亚

- 其他拉丁美洲地区

- 中东和非洲

- 沙特阿拉伯

- 阿拉伯联合酋长国

- 卡塔尔

- 科威特

- 南非

- 埃及

- 尼日利亚

- 其他中东和非洲地区

- 北美

第七章竞争格局

- 公司简介

- Lenovo Group Limited

- Dell Inc.

- Acer Inc.

- ASUSTek Computer Inc.

- Microsoft Corporation

- Razer Inc.

- Micro-Star International Co.

- Toshiba Corporation

- Samsung Electronics Co., Ltd

- Apple Inc.

- Honor Technology, Inc.

- Xiaomi Corporation

- Nokia Corp

- LG Corporation

- Vivo Communication Technology Co., Ltd

- Realme Mobile Telecommunications Corp. Ltd

第八章投资分析

第9章未来趋势

The IT device market is expected to grow at a CAGR of 2.4% during the forecast period. The market is expected to witness growth in the forecast period owing to the higher demand for mobile devices. During the COVID-19 epidemic, there was an increase in demand for PCs due to businesses' and consumers' growing flexibility and mobility requirements.

Key Highlights

- The demand for mobile phones has been growing over the past several years as consumer spending has increased globally. Notably, the smartphone demand has been continuously expanding in terms of models and market size. It was projected that 40% of people owned a smartphone last year. According to Ericsson, the number of smartphone subscribers globally has surpassed six billion and is projected to increase by several hundred million more over the next several years. China, India, and the United States are the top three nations with the most smartphone users.

- Notably, laptop sales are escalating in major countries, such as the United States and China. Major laptop manufacturers have reported an increase in sales of computers following the COVID-19 pandemic. Due to the continuous updates of graphics, connectivity, weight, and portability, the demand for the latest technology device is always anticipated.

- However, the higher demand for laptops has caused personal computer sales to be contracted across the globe. Also, after the pandemic, due to the work-from-home and social distancing norms, there was an upswing in demand for PCs. However, with everything back to normal, people have returned to their offices and institutions. Thus, the need for personal computers has slowed. Also, further contraction is expected in PC sales worldwide for the forecast period.

- China is leading the global IT device market, followed by the United States, Japan, and India. China had the highest revenue in the phone segment for the last year. At the beginning of this year, China had 1.63 billion mobile phone connections, according to data from GSMA Intelligence. During the second financial quarter of this year, Honor and Vivo held the highest smartphone market share.

- During the COVID-19 pandemic, the global demand for IT devices like PCs, laptop tablets, and phones grew. The surged demand mainly backed this growth for networking devices owing to social distancing and work-from-home regulations worldwide. However, the demand for personal computers fell with the gradual withdrawal of restrictions and the reopening of offices and institutions. Notably, the demand for mobile phones, especially smartphones, is expected to stabilize during the post-COVID-19 period.

IT Device Market Trends

Robust Contribution from Mobile Segment

- In many densely populated nations, such as China and India, the smartphone penetration rate is still around 70%, giving the market for smartphones significant room for development. Despite stagnant unit sales over the past several years, the worldwide smartphone market's revenue has increased because the average selling price of smartphones has increased.

- The mobile phone market is vast and will likely keep expanding and influencing many more markets. The improvement of wireless connectivity makes it easier to integrate cutting-edge technologies like IoT, AI, AR, and cloud computing into mobile devices. Thereby, there is a rapid demand shift in the market for these IoT-enabled devices from traditional wireless phones.

- People worldwide now have access to connections on the back of a significant mobile network. According to a GSMA report, globally, there were 4.2 billion subscribers to mobile internet last year. This number is expected to grow to 5 billion by 2025. The increased demand for internet subscribers has escalated the market for smartphones across the globe.

- As per Mobile Economy's this year's report, the number of unique mobile subscribers as of last year was 5.3 billion, which is expected to grow to 5.7 billion by the end of 2025. Also, the global sim connection is expected to grow remarkably from 8.3 billion last year to 8.8 billion in 2025. Notably, the global smartphone penetration is anticipated to increase from 75% last year to 84% in 2025.

- The GSMA's report predicts that by 2025, there will be 2 billion 5G connections worldwide, surpassing the current level of 1 billion connections. In the smartphone industry, 5G has also become a significant player, and it is expected to change how people use their phones today. Over the past several quarters, the shipment of devices with 5G capabilities has grown significantly worldwide.

- According to GSMA, the mobile industry contributed USD 4.5 trillion to the global GDP last year, or 5% of the entire global GDP. According to the forecast, the mobile industry is expected to witness a contribution of USD 4.9 trillion by 2025.

Asia-Pacific Holds a Significant Share

- Densely populated countries of the Asia-Pacific are expected to witness rising demand for IT devices during the forecast period. This growth is mainly attributable to the increasing levels of internet use, more disposable incomes, greater consumer awareness of the advent of cutting-edge technology, and, most importantly, the expanding population in this region. Such factors are driving the market's expansion.

- The Asia-Pacific region's economy continues to benefit significantly from the mobile ecosystem, which now accounts for 5% of the regional GDP and USD 770 billion in additional economic value. According to GSMA, the expected number of unique mobile subscribers in the Asia-Pacific would increase from 1.6 billion or 59% last year to 1.8 billion or 62% in 2025. Also, the number of mobile internet users in the region is anticipated to surge from 1.2 billion or 44% last year to 1.5 billion or 52% in 2025. From the upswing of mobile internet users, it can be forecasted that the demand for smartphones will be observed for the upcoming period.

- Additionally, as per the GSMA report, the smartphone adoption rate in the Asia-Pacific is expected to increase from 74% previous year to 84% in 2025. Also, from 2020 to 2025, there would be an expected addition of half a billion new mobile subscribers globally, which the Asia-Pacific alone would contribute to approximately 188 million additional subscribers. However, there is a substantial usage gap in the population's mobile internet connectivity in the region, which leaves scope for further growth in smartphone penetration.

- China is currently the No. 1 owner of the fastest supercomputers in the world for the eighth time since November 2017, owing to the inclusion of 186 Chinese supercomputers on the most recent list of the world's Top-500 supercomputers, which makes up about 40% of all those on the list. By 2025, the Chinese government may use up to 10 exascale supercomputers. Supercomputers have developed quickly in recent years due to the rising need for processing capacity.

- Encouragingly, through the projected period, countries like China and India are anticipated to propel market expansion on the back of increased government initiatives to enhance laptop manufacturing and lower import taxes on spare parts. Also, technological advancement and changing trends, the need for faster updates, and compatibility with emerging technologies are driving the laptop market in APAC.

IT Device Market Competitor Analysis

The IT Device market is highly fragmented as it currently consists of many players. Several key players in the market are in constant efforts to bring advancements. A few prominent companies are entering into collaborations and expanding their global footprints in developing regions to consolidate their positions in the market. The major players in this market include Dell Inc., Lenovo Group Limited, Apple Inc., Samsung Electronics Co., Ltd, and Microsoft Corporation.

In November 2022, Microsoft launched new Surface devices that ushered in the next phase of computing for Windows PCs. With the introduction of the new Surface products, Microsoft's top features are combined on a single gadget, allowing all users to participate, be heard, seen, and creatively express themselves.

In October 2022, Samsung Electronics Co., Ltd, the market leader in advanced memory technology, confirmed that the most recent LPDDR5X DRAM, which boasts the best performance in the industry at 8.5 gigabits per second (Gbps), has been approved for usage on Snapdragon mobile platforms. Samsung surpassed the previous maximum speed of 7.5Gbps in March, reiterating its dominance in the memory industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment Of The Impact Of COVID-19 On The IT Device Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for 5G Enabled Mobile Devices

- 5.1.2 Growing Mobile Broadband Penetration

- 5.1.3 Technology Advancement in the APAC Region

- 5.2 Market Restraints

- 5.2.1 Contracting Demand for Desktop Computers

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PC's

- 6.1.1.1 Laptops

- 6.1.1.2 Desktop PCs

- 6.1.1.3 Tablets

- 6.1.2 Phones

- 6.1.2.1 Landline Phones

- 6.1.2.2 Smartphones

- 6.1.2.3 Feature Phones

- 6.1.1 PC's

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 Australia

- 6.2.3.2 China

- 6.2.3.3 India

- 6.2.3.4 Japan

- 6.2.3.5 Indonesia

- 6.2.3.6 Malaysia

- 6.2.3.7 South Korea

- 6.2.3.8 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Colombia

- 6.2.4.5 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 Qatar

- 6.2.5.4 Kuwait

- 6.2.5.5 South Africa

- 6.2.5.6 Egypt

- 6.2.5.7 Nigeria

- 6.2.5.8 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lenovo Group Limited

- 7.1.2 Dell Inc.

- 7.1.3 Acer Inc.

- 7.1.4 ASUSTek Computer Inc.

- 7.1.5 Microsoft Corporation

- 7.1.6 Razer Inc.

- 7.1.7 Micro-Star International Co.

- 7.1.8 Toshiba Corporation

- 7.1.9 Samsung Electronics Co., Ltd

- 7.1.10 Apple Inc.

- 7.1.11 Honor Technology, Inc.

- 7.1.12 Xiaomi Corporation

- 7.1.13 Nokia Corp

- 7.1.14 LG Corporation

- 7.1.15 Vivo Communication Technology Co., Ltd

- 7.1.16 Realme Mobile Telecommunications Corp. Ltd