|

市场调查报告书

商品编码

1237839

氢氧化镁市场 - 增长、趋势、COVID-19 的影响和预测 (2023-2028)Magnesium Hydroxide Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,氢氧化镁市场的复合年增长率将超过 7%。

在 COVID-19 疫情期间,由于全国范围内的封锁和严格的社会隔离规定,市场关闭,对各种化学产品的需求直线下降。 然而,由于製药行业的需求不断增加,预计该市场将稳步增长。

主要亮点

- 推动市场发展的主要因素是对医药、工业化学品、中间体等的需求。

- 氢氧化钠和氢氧化钙等碱性大宗化学品的供应阻碍了市场增长。

- 对废水处理化学品的需求不断增长是一个重大的市场机遇。

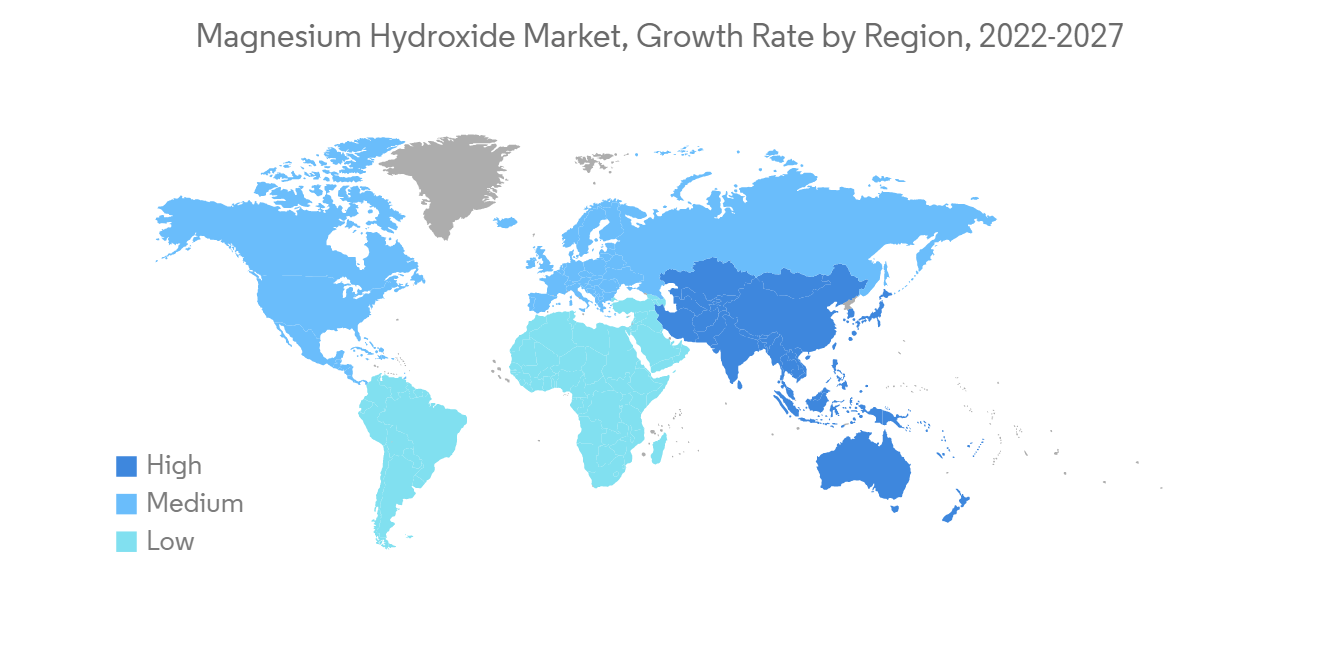

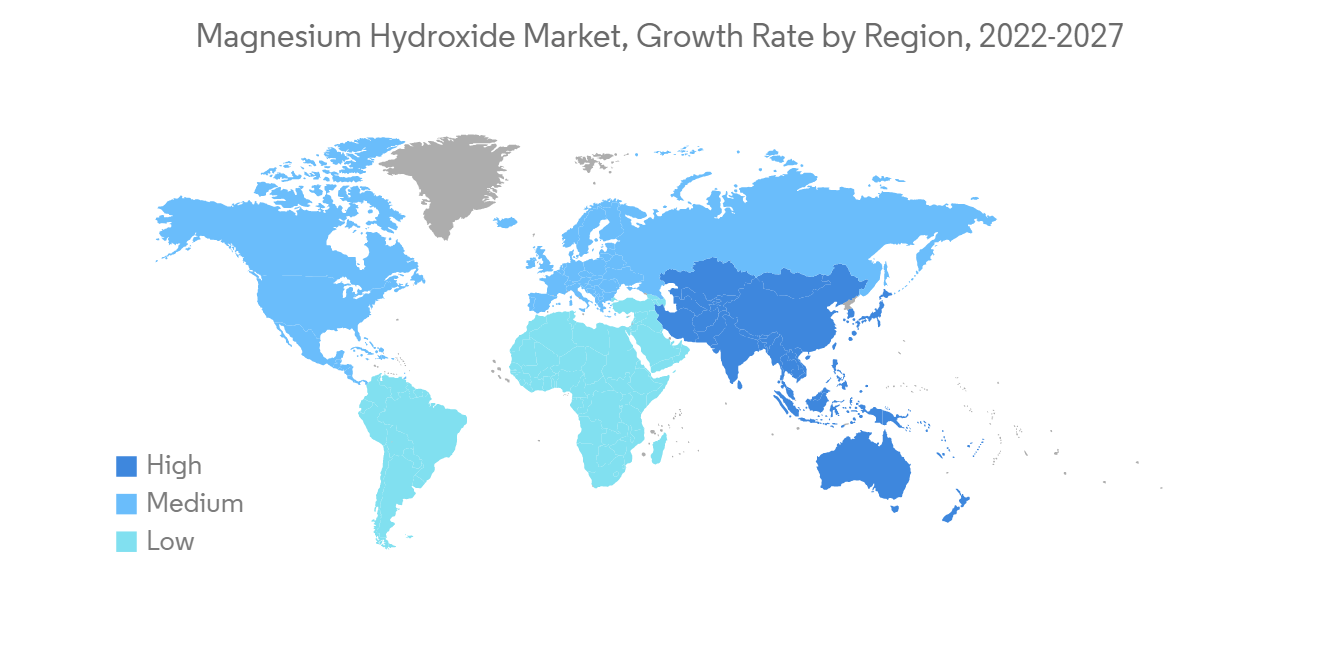

- 亚太地区主导着全球市场,其中中国和印度的消费最为突出。

氢氧化镁市场趋势

工业製造需求增加

- 氢氧化镁通常用于工业製造设备中的脱硫和废水处理。 此外,氢氧化镁在医药领域主要用作抗酸剂。

- 氢氧化镁还用于石油化工、电子涂料等。

- 全球工业部门的扩张预计会增加对氢氧化镁的需求,氢氧化镁可提供废水处理和脱硫作用,并可提高工业过程的性能和效率。

- 亚太地区持续的经济实力以及由此产生的对基础设施、机械和製造设备不断增长的需求将推动该地区对工业化学品的需求。 此外,由于生产设施的扩张和投资的增加,钢铁、化工、石油和天然气、製造和建筑等最终用户行业有望出现新的商机。

- 越来越多的全球公司正在将其生产基地转移到其他亚太国家/地区,例如台湾、印度、马来西亚、菲律宾、泰国、新加坡和印度尼西亚。 这些国家在各个领域都获得了外国直接投资(FDI),并在製造业方面享有盛誉。 此外,各国政府的政策也吸引了外国玩家,促进了工厂的建立。

- 欧洲拥有许多大型涂料工业,以德国、法国、意大利和西班牙等四个主要经济区为中心。 由于该地区有几家老牌公司,工业涂料领域预计将在预测期内扩大。 工业发展预计将有利于工业部门对氢氧化镁的需求,以提高工业设备和其他机械的性能。

- 由于结构改革取得进展,预计中东和非洲对工业化学品的需求强劲。 同样在沙特阿拉伯,“2030 年愿景”和随之而来的国家转型计划 (NTP) 的公布、对医疗保健和教育等各个领域的投资增加预计将在预测期内推动对氢氧化镁的需求。看来。

- 因此,上述因素预计将影响工业化学品的市场需求。

亚太地区主导市场

- 在亚太地区,中国的实际 GDP 将在 2020 年和 2021 年分别增长 2.2% 和 8.1%,这主要是受疫情后消费支出复苏的推动。

- 中国在过去五年中对公立医院的投入翻了一番,达到 380 亿美元。 它还旨在到 2030 年将医疗保健行业的规模扩大一倍以上,达到 2.3 万亿美元。

- 此外,中国政府出台了支持和鼓励国内医疗器械创新的政策,为市场研究提供了机会。 “中国製造2025”倡议将提高行业效率、产品质量和品牌美誉度,促进国内製药企业发展,增强竞争力。

- 中国是世界第二大医疗保健市场。 但是,该国从发达国家进口技术高端的植入物。 该国的公立医院是该国医疗设备的主要消费者。 2021年公共医疗卫生支出1.92万亿元。

- 根据国际货币基金组织 (IMF) 的预测,印度的 GDP 到 2021 年将增长 8.9%。 该国正在恢復工业活动,预计将在预测期的下半年成为经济增长的引擎。 2022年GDP有望达到8.2%。

- 在印度,2021 年底,英联邦卫生部长宣布了印度政府改善该国医疗设施的多项计划。 政府计划在未来六年内在该国的医疗保健领域投资 6418 亿卢比。 政府计划加强现有的“国家卫生使命”,以发展初级、二级和三级卫生系统以及检测和治疗新出现疾病的机构能力。

- 由于 COVID-19 流行病,各种药品的需求不断增加,预计将在预测期内推动医用弹性体市场。

氢氧化镁市场竞争者分析

氢氧化镁市场具有分散性,由少数知名企业和许多本地企业主导。 市场上的主要参与者包括 Elementis PLC、Kyowa Chemical Industry、NikoMag、Premier Magnesia 和 Israel Chemicals Ltd 等公司。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 工业製造的需求增加

- 製药行业的需求不断增长

- 约束因素

- 处理其他碱性散装化学品

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

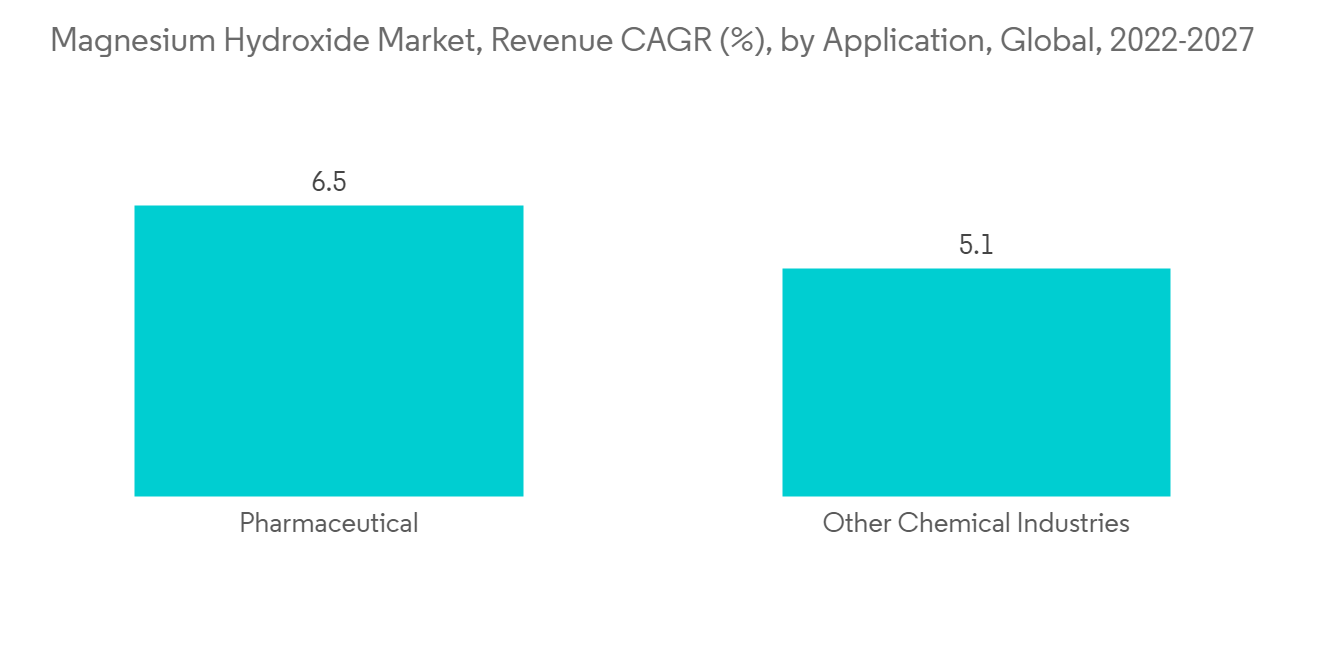

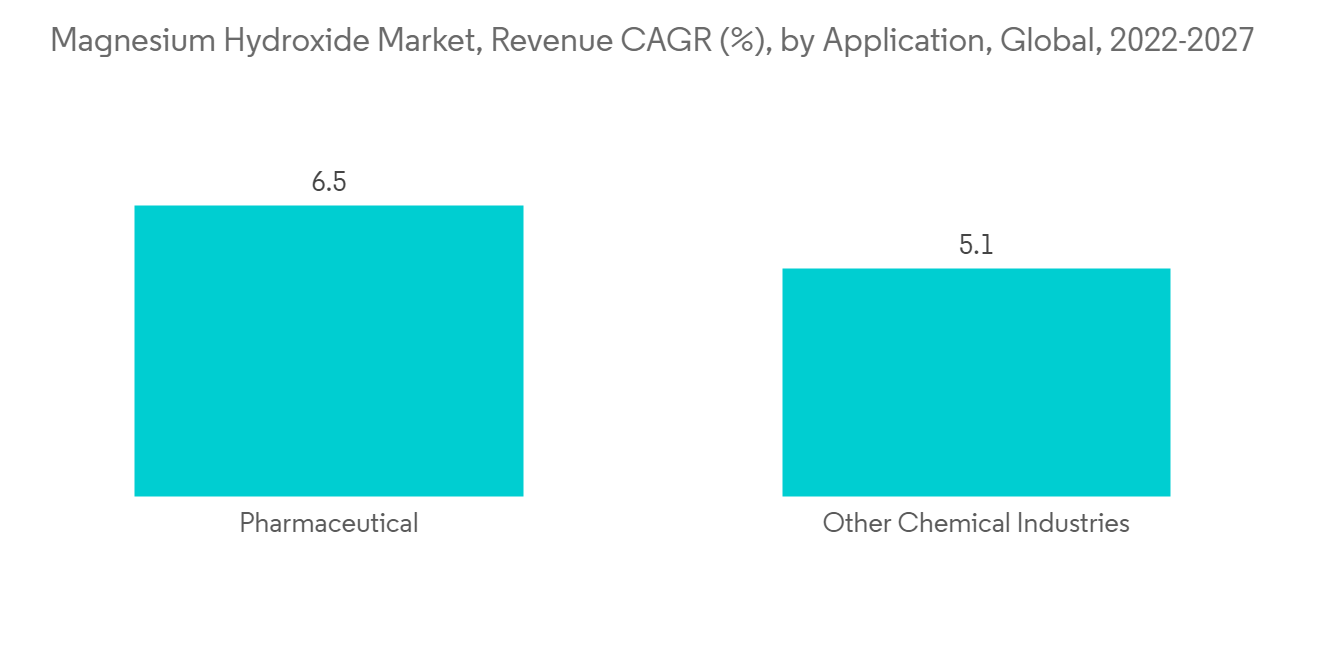

- 用法

- 工业製造

- 医药行业

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要参与者采用的策略

- 公司简介

- Elementis

- Huber Engineered Materials

- Israel Chemicals Ltd

- Konoshima Chemical Co. Ltd

- Kyowa Chemical Industry Co. Ltd

- Lehmann&Voss&Co

- Martin Marietta Magnesia Specialti

- NikoMag

- Xinyang Minerals Group

- Ube Industries Ltd

- PremierMagnesia LLC

- Tateho Chemical Industries Co. Ltd

第七章市场机会与未来趋势

- 在一些经济体中,人们对实现绝对废水处理越来越感兴趣

- 其他机会

The magnesium hydroxide market is expected to register a CAGR of more than 7% during the forecast period.

During the COVID-19 pandemic period, the demand for different chemical products reduced drastically because of the nationwide lockdown and stringent social distancing mandate, which caused the closure of markets. However, the market is expected to grow steadily owing to increasing demand from the pharmaceutical industry.

Key Highlights

- The primary factor driving the market is the demand for pharmaceuticals, industrial chemicals, and intermediaries.

- The availability of alkaline bulk chemicals such as sodium and calcium hydroxide will hinder market growth.

- The increasing demand for wastewater treatment chemicals is the key market opportunity.

- Asia-Pacific dominated the global market, with the most significant consumption in China and India.

Magnesium Hydroxide Market Trends

Increase in Demand from Industrial Manufacturing Industry

- Magnesium hydroxide is significantly used in desulphurization and wastewater treatment in industrial manufacturing units. Furthermore, magnesium hydroxide is majorly used as an antacid in the pharmaceutical segment.

- Magnesium hydroxide is also used in petrochemicals, electronic coatings, and others.

- The expansion of the industrial sector across the world is likely to boost the demand for magnesium hydroxide to offer wastewater treatment and desulphurization and improve the performance and efficiency of industrial processes.

- Asia-Pacific region's continuing economic strength and corresponding increasing need for infrastructure, machinery, manufacturing units, and others are likely to propel the demand for industrial chemicals in the region. In addition, expanding production units and increasing investments in the area are expected to offer newer opportunities in the end-user industries such as iron and steel, chemical, oil and gas, manufacturing, construction, and others.

- A growing number of global companies are moving production to other Asian-Pacific countries, such as Taiwan, India, Malaysia, Philippines, Thailand, Singapore, and Indonesia. These countries have gained a reputation for manufacturing, with foreign direct investment (FDI) in various sectors. In addition, the government policies in the countries attract foreign players and facilitate the setup of plants.

- Europe is home to many large paint industries, with the four largest mainland economies, including Germany, France, Italy, and Spain. The presence of several well-established players in the region is projected to expand the industrial coatings segment over the forecast period. Development of the industrial sector is anticipated to benefit the demand for magnesium hydroxide in the industrial sector to enhance the performance of industrial equipment and other machinery.

- The Middle East and Africa are anticipated to witness strong demand for industrial chemicals due to the region's increasing structural reforms. In addition, the announcement of Vision 2030, coupled with the associated National Transformation Plan (NTP), and increased investments in various sectors, including healthcare and education in Saudi Arabia, are likely to propel the demand for magnesium hydroxide over the forecast period.

- Therefore, owing to the abovementioned factors, industrial chemicals are likely to affect the demand for the market.

Asia Pacific to Dominate the Market

- In the Asia-Pacific region, China's real GDP grew by 2.2% in 2020 and by 8.1% in 2021, largely driven by consumer spending rebound post-pandemic.

- China has doubled the amount, it had been pouring into public hospitals in the last five years, to USD 38 billion. It aims to raise the healthcare industry's value to USD 2.3 trillion by 2030, more than twice its size now.

- Furthermore, the Chinese government has started policies to support and encourage domestic medical device innovation providing opportunities for the market studied. The "Made in China 2025" initiative improves industry efficiency, product quality, and brand reputation, which will spur the development of domestic pharmaceutical manufacturers and will increase competitiveness.

- China is the second-largest healthcare market in the world. However, the country imports technologically high-end implants from advanced economies. The public hospitals in the country are leading consumers of medical devices in the country. In 2021, the public expenditure done on healthcare was Yuan 1.92 trillion.

- According to the International Monitory Fund (IMF) projections, the GDP of India grew by 8.9% by 2021. The country has resumed its industrial activities which are expected to drive economic growth during the latter part of the forecast period. The GDP for the year 2022 is expected to reach 8.2%.

- In India, in late 2021, the Union Health Minister announced various plans of the Indian government to improve healthcare facilities in the country. The government plans to invest INR 64,180 crore in healthcare sector over the next six years in the country. The government plans to strengthen the existing 'National Health Mission' by developing capacities of primary, secondary, and tertiary healthcare systems and institutions for detection and cure of new and emerging diseases.

- The increasing demand from various pharmaceuticals due to the COVID-19 outbreak is estimated to drive the market for medical elastomers during the forecast period.

Magnesium Hydroxide Market Competitor Analysis

The magnesium hydroxide market is fragmented in nature, with the dominance of a few prominent players and the existence of many local players. Some of the major players in the market include Elementis PLC, Kyowa Chemical Industry, NikoMag, Premier Magnesia, Israel Chemicals Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Industrial Manufacturing Industry

- 4.1.2 Growing Demand from Pharmaceutical Industry

- 4.2 Restraints

- 4.2.1 Availability of Other Alkaline Bulk Chemicals

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Industrial Manufacturing

- 5.1.2 Pharmaceutical Industry

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Elementis

- 6.4.2 Huber Engineered Materials

- 6.4.3 Israel Chemicals Ltd

- 6.4.4 Konoshima Chemical Co. Ltd

- 6.4.5 Kyowa Chemical Industry Co. Ltd

- 6.4.6 Lehmann&Voss&Co

- 6.4.7 Martin Marietta Magnesia Specialti

- 6.4.8 NikoMag

- 6.4.9 Xinyang Minerals Group

- 6.4.10 Ube Industries Ltd

- 6.4.11 PremierMagnesia LLC

- 6.4.12 Tateho Chemical Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Achieving Absolute Wastewater Treatment By Several Economies

- 7.2 Other Opportunities