|

市场调查报告书

商品编码

1644424

自动驾驶汽车中的感测器融合 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Sensor Fusion in Autonomous Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

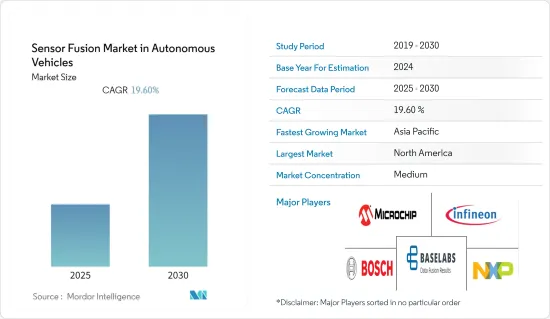

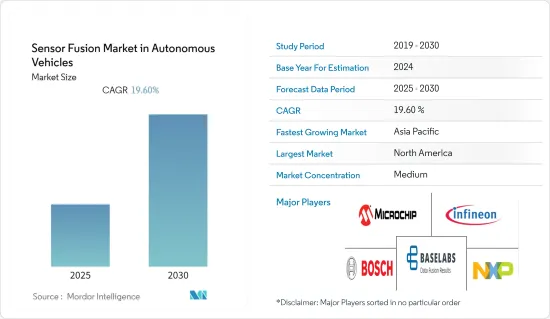

预测期内,自动驾驶汽车感测器融合市场预计将实现 19.6% 的复合年增长率

关键亮点

- 解决感测器之间的衝突、同步感测器、预测物体的未来位置以及实现自动驾驶的安全要求是自动驾驶汽车应用中感测器融合的一些关键目标。据世界经济论坛称,到 2035 年,预计每年全自动驾驶汽车的销量将超过 1,200 万辆。自动驾驶汽车将占全球汽车市场的25%。据英特尔称,每辆自动驾驶汽车平均每天会产生Terabyte的资料。感测器融合解决方案在即时利用如此大量资料发挥关键作用。

- 随着ADAS的发展,越来越多地采用GPS-IMU(惯性测量单元)融合原理,有助于解决航位推算在绝对位置测量区间内累积的误差。特斯拉的自动驾驶功能「Autopilot」就是 ADAS 的一个例子,它可以执行诸如透过使用从前置摄影机和感测器收集的资料来计算车辆的精确位置,使车辆保持在高速公路上车道的中央等功能。

- 汽车和软体公司之间的合作是市场上的普遍趋势。例如,2021年4月,光达感测器供应商RoboSense与智慧汽车作业系统及伙伴关係供应商斑马网路科技、中国领先的机器人计程车业者AutoX达成合作,共同打造智慧汽车高阶自动驾驶平台。此次伙伴关係旨在推动智慧驾驶座和自动驾驶系统的整合,主要透过人工智慧功能、硬体和软体的整合。

- 全球各地严格的政府监管也刺激了所调查市场对产品的需求。例如,欧洲新车评估计画 (Euro NCAP) 要求至少包含一个驾驶辅助系统。日本、美国等国家也在其国家 NCAP 法规中采用了类似的标准。

- 人们对自动驾驶技术的安全担忧日益加剧,这不仅可能限制自动驾驶汽车的采用,而且还会对感测器融合解决方案的可靠性提出质疑。标准化是阻碍感测器融合系统发展的因素之一。如果没有全球标准,设备和积体电路的复杂性预计会呈指数级增长。

- 新冠肺炎疫情对全球汽车产业影响日益严重。由于户外活动减少,汽车需求在疫情初期急剧下降。此外,汽车零件供应减少和生产设施停产导致汽车製造商的营运资金减少,从而推迟或减少了对新技术的投资。然而,随着汽车产业从疫情中復苏,感测器融合解决方案供应商正面临新的机会。

自动驾驶汽车感测器融合的市场趋势

乘用车占很大市场占有率

- 由于对具有高端功能的汽车的需求不断增长,乘用车製造商对开发自动驾驶汽车的兴趣日益浓厚。汽车製造商、科技公司和研究人员正在不断致力于进一步开发自动驾驶汽车的基础技术。由于这些车辆配备了可收集大量资料的多个感测器,因此感测器融合已成为理想的解决方案,使供应商能够智慧地利用感测器资料。

- 近年来,乘用车产销持续上升。虽然疫情造成了影响,但其影响是短期的,预计将成为未来几年的驱动力。这些趋势预计将成为市场成长的主要驱动力。

- 自动驾驶汽车的关键方面之一是路径规划。感测器融合在这里起着关键作用,透过结合感测器读数来准确了解车辆的状态并预测周围物体的轨迹。因此,随着未来自动驾驶乘用车销售量的增加,采用率也可能会增加。

- 此外,自动紧急煞车 (AEB) 是一种增强型主动式安全系统,可协助驾驶避免或减轻与其他车辆和弱势道路使用者的碰撞。通常需要多个感测器来提供准确、可靠和稳定的检测,同时最大限度地减少误报。随着安全性成为汽车产业,尤其是乘用车领域日益突出的问题,AEB 系统的采用正在增加,这预计将对感测器融合系统的需求产生积极影响。

北美保持较大市场占有率

- 北美是世界上最大的汽车製造地之一。该地区的经济成长影响了乘用车和商用车的销售。美国是北美地区主要的汽车製造国之一,除了国内消费量高之外,也向全球出口汽车。例如,根据美国国际贸易委员会的数据,2021年轻型车出口量达1,619,350辆。

- 该地区也是采用 ADAS 车辆和自动运输解决方案的先驱之一。根据德意志银行预测,2021年美国ADAS产量将达1,845万台。 ADAS(高级驾驶辅助系统)可以支援主动车距控制巡航系统(ACC)、自动紧急煞车(AEB)、车道偏离、盲点侦测、360°环景显示等,并且由于在设计ADAS系统时使用了大量感测器,这些趋势预计将推动该国对感测器融合解决方案的需求。

- 根据ITA统计,加拿大是北美第二大汽车市场,进口车约占新车市场的四分之三。 2021年乘用车进口额年增与前一年同期比较26%至278亿美元。中国对自动驾驶汽车的接受度正在显着提高,这鼓励了汽车製造商加大投资。例如,特斯拉、优步、丰田、宝马、通用和日产等科技公司和汽车製造商正在竞相为加拿大消费者开发自动驾驶汽车。

- 此外,依靠强大的先进感测技术(包括多个光达)来安全行驶在复杂城市环境中的 Robotaxis 尚未实现这一目标。儘管如此,Waymo、Cruise 和 Uber 仍在美国大力投资并经营实验车队。

自动驾驶汽车感测器融合产业概览

自动驾驶汽车感测器融合市场竞争较为激烈,既有博世、义法半导体、恩智浦半导体等大型企业,也有专门从事此技术的新参与企业。供应商越来越注重开发技术以支援未来的自动驾驶汽车并使其更加实惠。

2022 年 10 月 -美国领先的汽车感测器解决方案供应商MicroVision 在布鲁塞尔的 AutoSens 2022 展会上推出了其动态视图雷射雷达系统 MAVIN DR。 MAVIN DR 光达系统的特点是动态视野。它具有低延迟的高分辨率,使新 ADAS 安全功能的设计人员能够提供OEM所需的正确的高速公路驾驶功能。

2022 年 4 月-大众汽车集团旗下软体公司 CARIAD 收购感测器资料融合Intenta GmbH 的汽车部门。此次收购符合该公司大幅扩大其在软体和硬体开发方面的垂直价值创造的策略,使其能够内部开发关键软体元件并提高其在关键开发领域的附加价值深度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 技术简介

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 自动驾驶汽车需求不断成长

- 高效的即时资料处理和资料共用能力推动需求

- 市场限制

- 感测器融合技术缺乏标准化

第六章 主要市场趋势

- 主要专利和研究活动

- 主要和新兴应用

- 主动车距控制巡航系统(ACC)

- 自动紧急煞车 (AEB)

- 电子稳定控制系统 (ESC)

- 前方碰撞警报(FCW)

- 其他的

第七章 市场区隔

- 按车型

- 搭乘用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

- 其他自动驾驶汽车

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Robert Bosch GmbH

- Microchip Technology Inc.

- Infineon Technologies AG

- BASELABS GmbH

- NXP Semiconductor

- STMicroelectronics NV

- Aimotive kft

- Kionix Inc(Rohm Co. Ltd)

- TDK Corporation

- CEVA Inc.

第九章投资分析

第十章:投资分析市场未来展望

The Sensor Fusion Market in Autonomous Vehicles Industry is expected to register a CAGR of 19.6% during the forecast period.

Key Highlights

- Resolving contradictions between sensors, synchronizing sensors, predicting the future positions of objects, and achieving automated driving safety requirements are some of the primary objectives of sensor fusion in an autonomous vehicle application. According to the World Economic Forum, more than 12 million fully autonomous cars are expected to be sold annually by 2035. Autonomous vehicles will account for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day. Sens fusion solutions can play a significant role in utilizing this massive data in real time.

- The growing development in ADAS and increasing utilization of the principle of GPS-IMU (Inertial Measurement Unit) fusion helps solve accumulated errors of dead reckoning in intervals with absolute position readings. Tesla's Autopilot automated driving feature is an example of an ADAS that can perform functions such as keeping the vehicle center in a highway lane by determining its precise position from data collected from a forward-facing camera and sensors.

- Collaboration between automotive and software companies is a common trend in the market. For instance, in April 2021, RoboSense, a lidar sensor provider, formed a partnership with Banma Network Technology, an intelligent automobile operating system and solution provider, and AutoX, China's leading robotaxi operator, to build a high-level autonomous driving platform for intelligent vehicles. The partnership was established primarily to promote the integration of intelligent cockpits with autonomous driving systems through the fusion of AI Capabilities, hardware, and software.

- Stringent government regulations globally also fuel the demand for the products in the market studied. For instance, Euro NCAP (European New Car Assessment Program) mandates the deployment of at least one driver assistance system. Countries like Japan and the United States also adopt similar criteria in their national NCAP rules.

- The growing safety issue of autonomous technology can not only limit the adoption of autonomous vehicles but could claim the authenticity of sensor fusion solutions. Standardization is one of the factors hindering the evolution of sensor fusion systems. Without global standards, the level of complexity of devices and ICs is expected to increase exponentially.

- The COVID-19 outbreak increasingly affected the automotive sector globally. Due to reduced outdoor activities, the demand for automobiles declined significantly, primarily during the initial phase of the pandemic. Furthermore, the reduced supply of automotive parts and shutdown of production facilities fell the working capital of automobile manufacturers, resulting in a delay or reduction in investments in new technologies. However, with the automotive sector recovering from the pandemic, new opportunities are on the horizon for sensor fusion solution providers.

Autonomous Vehicles Sensor Fusion Market Trends

Passenger Cars to Hold a Significant Market Share

- There is an increasing interest among passenger car makers in developing autonomous cars, owing to the growing demand for vehicles with premium features. Car manufacturers, technology companies, and researchers are continuously working on further developing the technologies behind the autonomous car. As these vehicles include multiple sensors that gather massive amounts of data, sensor fusion emerged as an ideal solution to enable vendors to use the sensor data intelligently.

- Recent years have witnessed an upward growth trend in passenger vehicle sales. Although the pandemic affected the growth, the impact is more in the short term, which is expected to gain traction in the next few years. Such trends are expected to act as a significant driving factor for the growth of the studied market.

- One crucial aspect of autonomous vehicles is path planning. Sensor fusion plays an essential role here by integrating the sensor readings to construct a precise picture of the vehicle's state and predict the trajectories of the surrounding objects. Hence, the adoption would increase with the increase in passenger car sales, which are autonomous in the coming times.

- Furthermore, Autonomous Emergency Braking (AEB) is an enhanced active safety system that helps drivers avoid or mitigate collisions with other vehicles or vulnerable road users. Multiple sensors are often needed for accurate, reliable, and robust detections while minimizing false positives. With safety becoming an increasingly important issue in the automotive industry, especially in the passenger vehicle segment, the increasing adoption of AEB systems is expected to impact the demand for sensor fusion systems positively.

North America to Retain a Significant Market Share

- North America is among the largest automotive manufacturing hubs in the world. The economic growth of the region posed an impact on the sale of passenger cars and commercial vehicles. The United States is among the leading automobile manufacturers in the North American region; apart from high domestic consumption, the country also exports automobiles globally. For instance, according to the US International Trade Commission, the export volume of light vehicles reached 1,619.35 thousand units in 2021.

- The region is also among the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Deutsche Bank, the US ADAS unit production volume was forecasted to reach 18.45 million by 2021. ADAS (advanced driver-assistance systems) is capable of supporting adaptive cruise control (ACC), automatic emergency braking (AEB), lane departure, blind-spot detection, 360° surround view, etc., as a lot of sensors are used in designing the ADAS systems, such trends are expected to drive the demand for sensor fusion solutions in the country.

- According to ITA, Canada is the second largest automotive market in the North American region, where imports represent about three-quarters of the new vehicles market. In 2021, the import value of passenger vehicles increased by about 26% (compared to the last year) to USD 27.8 billion. The country's acceptance of autonomous cars is growing significantly, encouraging automobile manufacturers to increase their investment. For instance, tech and motor companies like Tesla, Uber, Toyota, BMW, GM, and Nissan are all in the race to develop autonomous vehicles for Canadian consumers.

- Furthermore, Robotaxis (relying on a powerful array of advanced sensing technologies that include multiple LiDARs to maneuver complex urban environments safely) is not quite here. Still, Waymo, Cruise, and Uber are investing heavily in and operating experimental fleets in the United States, which is expected to create future opportunities.

Autonomous Vehicles Sensor Fusion Industry Overview

The Sensor Fusion Market in Autonomous Vehicles is moderately competitive, owing to the mixed presence of both large-scale companies, such as Bosch, STMicroelectronics, and NXP Semiconductors NV, as new players specifically focused on this technology. The vendors are increasingly focusing on developing the technology to prepare it for future autonomous vehicles and make it affordable.

October 2022 - MicroVision, a leading American automotive sensor solution provider, unveiled MAVIN DR, a dynamic view lidar system, at the AutoSens 2022 Show in Brussels. The MAVIN DR lidar system features a dynamic field of view. It delivers high resolution with low latency, enabling new ADAS safety feature designers to achieve the proper highway-pilot functionality that OEMs demand.

April 2022 - CARIAD, the Volkswagen Group's software company, acquired the automotive division of Intenta GmbH, which works in sensor data fusion. The acquisition is in line with the company's strategy to massively increase its vertical value creation in software and hardware development to enable itself to develop critical software components in-house and increase the depth of value added in key development areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Autonomous Vehicles

- 5.1.2 Efficient Real Time Data Processing and Data Sharing Capabilities to Drive the Demand

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Sensor Fusion Technology

6 KEY MARKET TRENDS

- 6.1 Key Patents and Research Activities

- 6.2 Major and Emerging Applications

- 6.2.1 Adaptive Cruise Control (ACC)

- 6.2.2 Autonomous Emergency Braking (AEB)

- 6.2.3 Electronic stability control (ESC)

- 6.2.4 Forward Collision Warning (FCW)

- 6.2.5 Other Applications

7 MARKET SEGMENTATION

- 7.1 By Types of Vehicle

- 7.1.1 Passenger Cars

- 7.1.2 Light Commercial Vehicle (LCV)

- 7.1.3 Heavy Commercial Vehicle (HCV)

- 7.1.4 Other Autonomous Vehicles

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Robert Bosch GmbH

- 8.1.2 Microchip Technology Inc.

- 8.1.3 Infineon Technologies AG

- 8.1.4 BASELABS GmbH

- 8.1.5 NXP Semiconductor

- 8.1.6 STMicroelectronics NV

- 8.1.7 Aimotive kft

- 8.1.8 Kionix Inc (Rohm Co. Ltd)

- 8.1.9 TDK Corporation

- 8.1.10 CEVA Inc.