|

市场调查报告书

商品编码

1237849

表面处理化学品市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Surface Treatment Chemicals Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,表面处理化学品市场的复合年增长率将超过 5%。

COVID-19 的爆发对錶面处理化学品的市场增长产生了积极影响。 在 COVID-19 大流行期间,开发了新的表面处理化学品来对抗病毒。 例如,ALANOD GmbH 的 MIRO UV-C 产品可有效破坏 COVID-19 病毒,并用作消毒设备的反射材料。 另一项重大进展是可用于製造针对 COVID-19 病毒的面罩的高性能医疗级透明薄膜。

主要亮点

- 短期内,在消费者需求和使用表面处理化学品减轻传染病影响的推动下,汽车行业的增长将推动预测期内的市场增长。

- 但是,人们越来越担心化学表面处理的影响,这促使人们从化学品转向生物基(绿色)产品,以遵守引入该行业的法规。 环境可持续性、能源效率和多种应用能力可能会限制製造商开发利基产品,进一步阻碍市场增长。

- 但是,表面处理化学品在商业和住宅基础设施建设中的使用,以及对生物基和无铬表面处理化学品日益增长的兴趣,将为未来提供充足的增长机会。 预计市场将在预测期内创造有利可图的机会。

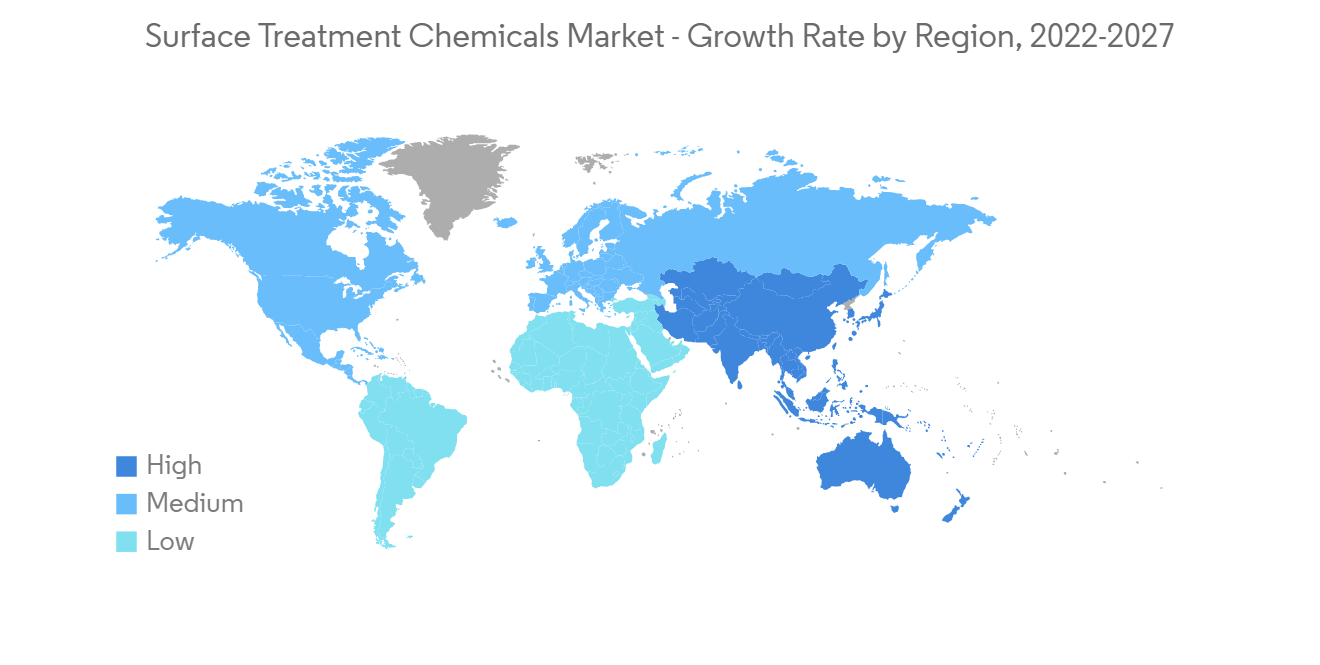

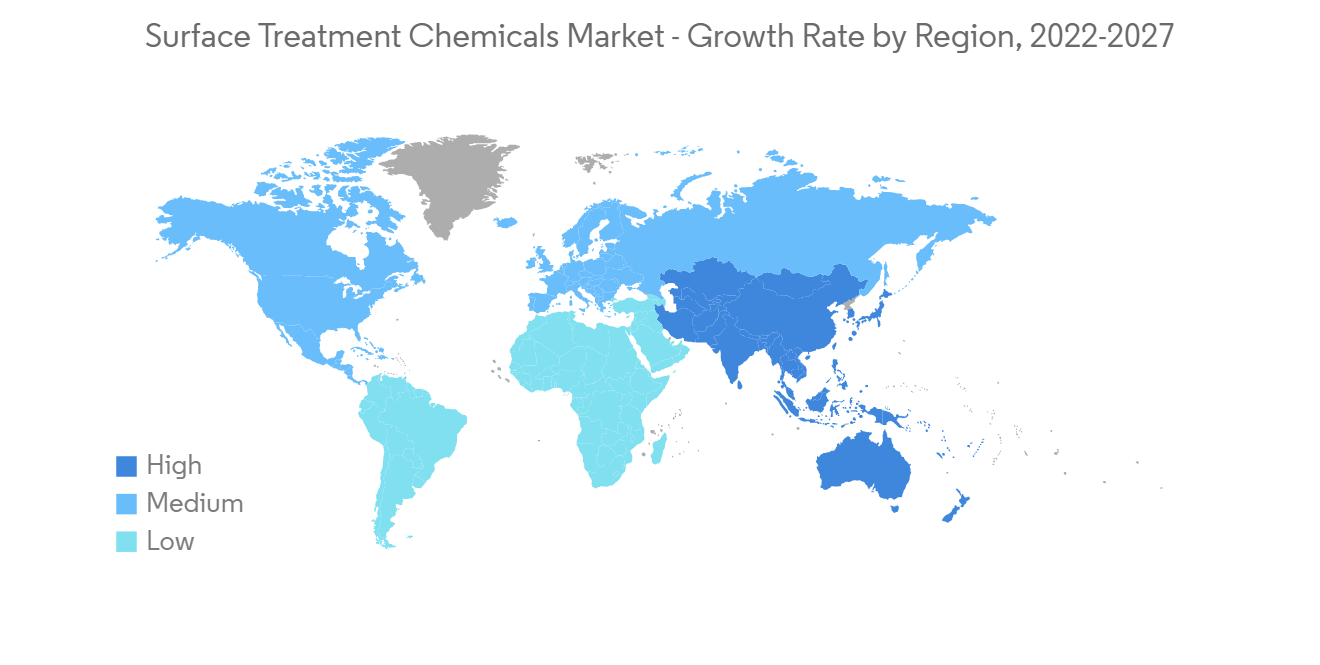

- 在收入和预测方面,预计亚太地区将在预测期内主导全球市场,在全球表面处理化学品市场中占据最高市场份额。

表面处理化学品市场趋势

汽车及交通装备领域有望占据较大份额

- 随着电动汽车、轻型汽车、自动驾驶汽车、人工智能、互联互通等领域的进步,汽车行业正处于最具颠覆性的旅程中。 事实证明,用于製造车辆及其部件的材料对于实现车辆的整体性能至关重要。

- 表面处理化学品被认为对汽车零部件的整体性能有重大影响。

- 在其他行业中,长期以来,汽车行业对錶面处理化学品的需求最大。 所有主要公司都为汽车行业提供表面处理化学品。

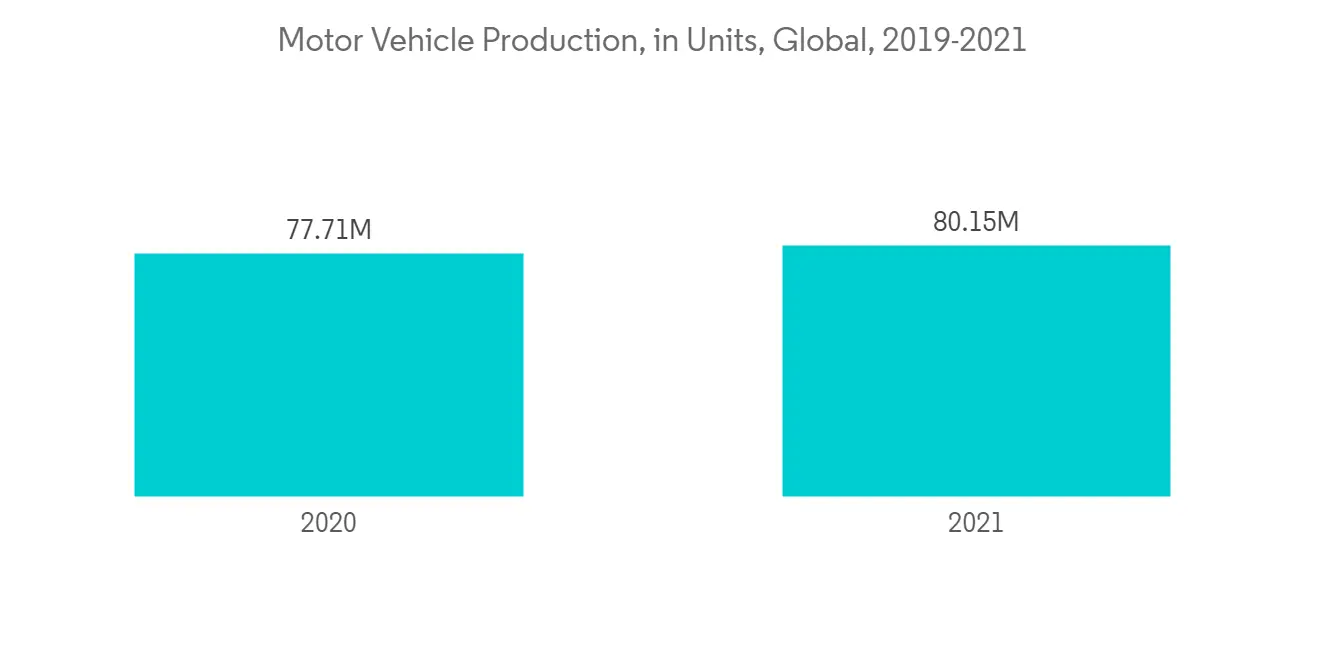

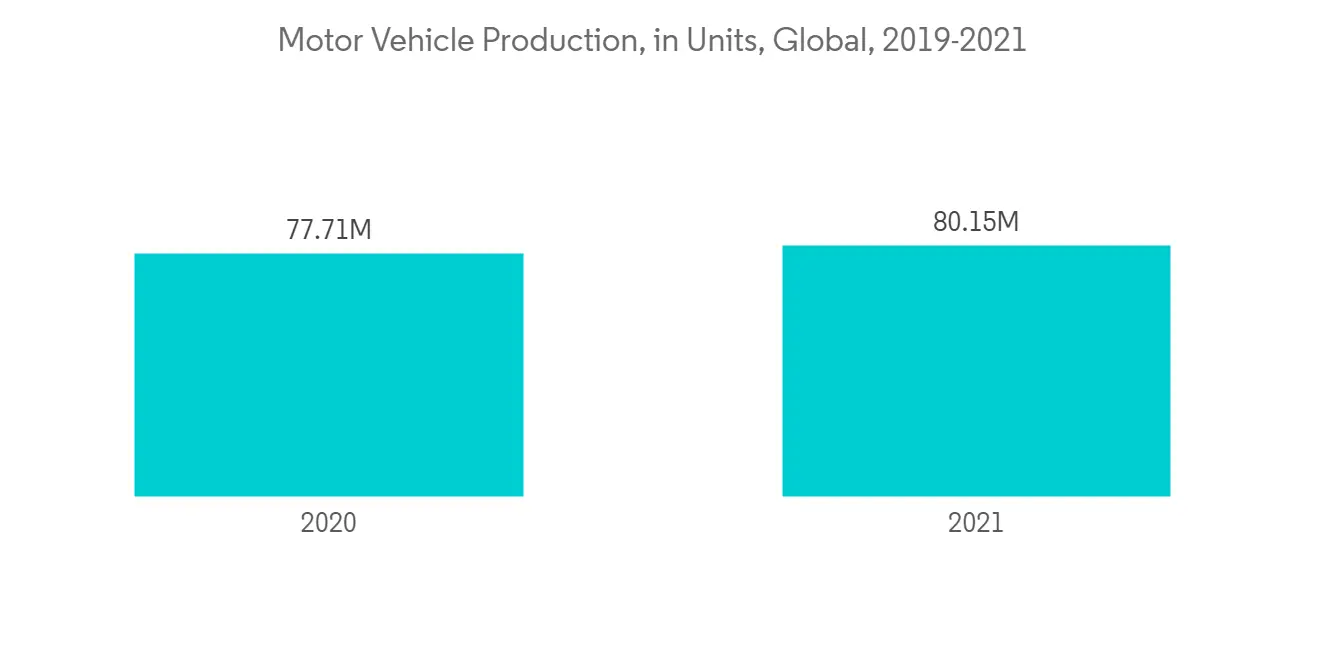

- 根据国际汽车製造商组织 (OICA) 的数据,2021 年全球汽车产量约为 8015 万辆,而 2020 年为 7771 万辆。

- 根据世界贸易组织 (WTO) 的数据,2021 年汽车产品的进口额约为 2860 亿美元,其中美国是第二大进口国。 与此同时,该国出口了价值约 1260 亿美元的汽车产品。

- 上述所有因素预计将推动汽车和运输行业,从而在预测期内增加对錶面处理化学品的需求。

亚太地区主导市场

- 亚太地区在市场份额和市场收入方面主导着表面处理化学品市场。 预计该地区将在预测期内继续保持其主导地位。

- 在该地区,尤其是在中国,表面处理化学品不仅用于住宅,还用于商业设施的建设,预计这将推动该地区的市场。

- 木材、玻璃、珠宝和医疗等多个行业对耐用、耐磨产品的需求不断增长。 在建筑行业评价中,该产品的需求量很大。 随着汽车行业的扩张,表面处理化学品正在经历更大的扩张。

- 根据中国国家统计局的数据,中国建筑业继续扩张,预计 2021 年总产值将达到约 25.9 万亿元人民币(3.82 万亿美元)。。 借助城市化的兴起,中国建筑业同年创造了超过 29 万亿元人民币(4.28 万亿美元)的产值。

- 根据国际汽车建设组织 (OICA) 的数据,中国的汽车产量将从 2020 年的 2522 万辆增长到 2021 年的 2608 万辆。

- 工业化也在影响市场需求。 重型设备需要定期保护,因此生产商对其进行表面处理以防止生锈和其他损坏。

- 此外,印度和日本等国家/地区也为所研究市场的增长做出了贡献。 因此,预计在预测期内,表面处理化学品市场的需求将进一步增加。

表面处理化学品市场竞争分析

表面处理化学品市场本质上是分散的。 市场上的主要製造商包括 PPG Industries Inc.、Atotech Deutschland GmbH、Henkel AG &、DOW、Chemetall Inc. 等(排名不分先后)。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 汽车行业的发展

- 关于使用表面处理化学品来减少传染病的影响

- 约束因素

- 从化学产品转向生物基(绿色)产品

- 关于有害铬成分排放的严格环境法规

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 化学类型

- 电镀化学品

- 清洁工

- 转化膜

- 其他(冷却水、脱漆剂等)

- 基材

- 金属

- 塑料

- 其他基材(玻璃、合金、木材)

- 最终用户行业

- 汽车和运输设备

- 建筑

- 电子产品

- 工业机械

- 其他(油气管道、电力、弹药、包装等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 南非

- 沙特阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要参与者采用的策略

- 公司简介

- Aalberts Surface Technologies

- ALANOD GmbH & Co. KG

- Atotech

- Atotech Deutschland GmbH

- Bulk Chemicals Inc.

- Chemetall Inc.

- ChemTech Surface Finishing Pvt. Ltd.

- DOW

- Henkel AG & Co. Ltd.

- IONICS

- Nippon Paint Holdings Co., Ltd.

- OC Oerlikon Management AG

- PPG Industries Inc.

- Quaker Chemical Corporation

- The Sherwin-Williams Company

- YUKEN Surface Technology, S.A. de C.V.

第七章市场机会与未来趋势

- 关于表面处理剂在建筑行业的使用

- 对生物基和无铬表面处理化学品的兴趣与日俱增

- 印刷线路板表面处理化学品的消耗量增加

The Surface Treatment Chemicals market is expected to register a CAGR of over 5% during the forecast period.

The outbreak of COVID-19 has positively impacted the market growth for surface treatment chemicals. During the COVID-19 pandemic, new surface treatment chemicals were developed to counteract the virus. For example, ALANOD GmbH's MIRO UV-C product effectively destroyed the COVID-19 virus and is utilized as a material for reflectors in sanitizing equipment. Another significant development in the fight against the COVID-19 virus has been the availability of high-performance and medical-grade transparent film to produce face shields.

Key Highlights

- Over the short term, the growth in the automotive industry due to the demand for consumers and the use of surface treatment chemicals to reduce the impact of infections is propelling the market growth during the forecast period.

- However, the growth in concerns regarding the effects of chemical surface treatment has led to the shift from chemicals to bio-based (green) products to abide by the regulations brought into the industry. Environmental sustainability, energy efficiency, and multiple application capabilities restrain manufacturers in niche product development and will further hamper market growth.

- Nevertheless, using surface-treating chemicals in construction for commercial and residential infrastructure and growing interest in bio-based and chromium-free surface-treatment chemicals will provide ample growth opportunities in the future. They will likely create lucrative opportunities for the market over the forecast period.

- In terms of revenue, Asia-Pacific is expected to dominate the global market during the forecast period and dominate the highest market share in the global surface treatment chemicals market.

Surface Treatment Chemicals Market Trends

The Automotive and Transport Segment is Anticipated to Hold a Significant Share

- The automotive sector is through the most disruptive journey, with advances in electric vehicles, lightweight vehicles, autonomous vehicles, artificial intelligence, and connectivity. The materials used to manufacture automobiles and their components proved critical in achieving overall vehicle performance.

- Surface treatment chemicals are thought to have a significant impact on the overall performance of automobile parts.

- Among numerous industries, the automotive industry has long been the most significant demand generator for surface treatment chemicals. All the major firms supply surface treatment chemicals to the car sector.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), world motor vehicle production in 2021 was about 80.15 million, compared to 77.71 million units in 2020.

- According to the World Trade Organization (WTO), with a value of about USD 286 billion in 2021, the United States was the second largest importer of automotive products. Simultaneously, the country exported automotive products worth around USD 126 billion.

- All the factors above are expected to drive the automotive and transport segment, enhancing the demand for surface treatment chemicals during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominates the surface treatment chemicals market in terms of market share and market revenue. The region is set to continue to flourish in its dominance over the forecast period.

- The growing adoption of surface treatment chemicals in construction for commercial as well as residential infrastructure in the region, especially in China, is expected to boost the market in the region.

- Rising demand for long-lasting and wear-resistant products is employed in a variety of industries, including wood, glass, jewelry, medicine, and others. In construction ratings, the product is in high demand. Surface treatment chemicals are experiencing greater expansion as the automobile sector expands.

- According to the National Bureau of Statistics of China, China's construction industry has been continuously expanding, with a total production value of roughly CNY 25.9 trillion (USD 3.82 trillion) in 2021. Taking advantage of growing urbanization, China's construction sector generated more than CNY 29 trillion (USD 4.28 trillion) in production that year.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), motor vehicle production in China was 26.08 million units in 2021, compared to 25.22 million units in 2020.

- The industrialization has also had an impact on market demand. Heavy machinery requires regular protection, so producers coat it with surface treatment chemicals to prevent rust and other problems.

- Furthermore, countries like India and Japan have also been contributing to the growth of the market studied. This is expected to further drive the demand for the surface treatment chemicals market over the forecast period.

Surface Treatment Chemicals Market Competitor Analysis

The Surface Treatment Chemicals market is fragmented in nature. Some major manufacturers in the market include PPG Industries Inc., Atotech Deutschland GmbH, Henkel AG & Co. Ltd., DOW, Chemetall Inc., and others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Automotive Industry

- 4.1.2 The Use of Surface Treatment Chemicals to Reduce the Impact of Infections

- 4.2 Restraints

- 4.2.1 Shift from Chemicals to Bio-based (Green) Products

- 4.2.2 Strict Environmental Regulations for the Emission of Hazardous Chromium Components

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemicals Type

- 5.1.1 Plating Chemicals

- 5.1.2 Cleaners

- 5.1.3 Conversion Coatings

- 5.1.4 Other Chemical Types (Coolants, Paint Strippers)

- 5.2 Base Material

- 5.2.1 Metals

- 5.2.2 Plastics

- 5.2.3 Other Base Materials (Glass, Alloys, Wood)

- 5.3 End-User Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction

- 5.3.3 Electronics

- 5.3.4 Industrial Machinery

- 5.3.5 Others (Oil and Gas Pipeline, Power, Military, Packaging, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aalberts Surface Technologies

- 6.4.2 ALANOD GmbH & Co. KG

- 6.4.3 Atotech

- 6.4.4 Atotech Deutschland GmbH

- 6.4.5 Bulk Chemicals Inc.

- 6.4.6 Chemetall Inc.

- 6.4.7 ChemTech Surface Finishing Pvt. Ltd.

- 6.4.8 DOW

- 6.4.9 Henkel AG & Co. Ltd.

- 6.4.10 IONICS

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 OC Oerlikon Management AG

- 6.4.13 PPG Industries Inc.

- 6.4.14 Quaker Chemical Corporation

- 6.4.15 The Sherwin-Williams Company

- 6.4.16 YUKEN Surface Technology, S.A. de C.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Surface-treating Chemicals in Construction

- 7.2 Growing Interest in Bio-Based and Chromium-Free Surface Treatment Chemicals

- 7.3 Increasing Surface Treatment Chemical Consumption in Printed Circuit Boards