|

市场调查报告书

商品编码

1237857

BTX(苯甲苯二甲苯)市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Benzene-Toluene-Xylene (Btx) Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

全球 BTX(苯-甲苯-二甲苯)市场预计在预测期内的复合年增长率超过 3.5%。

COVID-19 对 2020 年的市场产生了负面影响。 但市场估计已达到疫情前水平,有望稳步增长。

主要亮点

- 苯和甲苯在各种化学应用中越来越重要,预计将在预测期内推动市场增长。

- 另一方面,BTX(苯甲苯二甲苯)的毒性预计会阻碍市场增长。

- 此外,越来越多地使用生物基 BTX(苯-甲苯-二甲苯)有望在未来几年带来市场机遇。

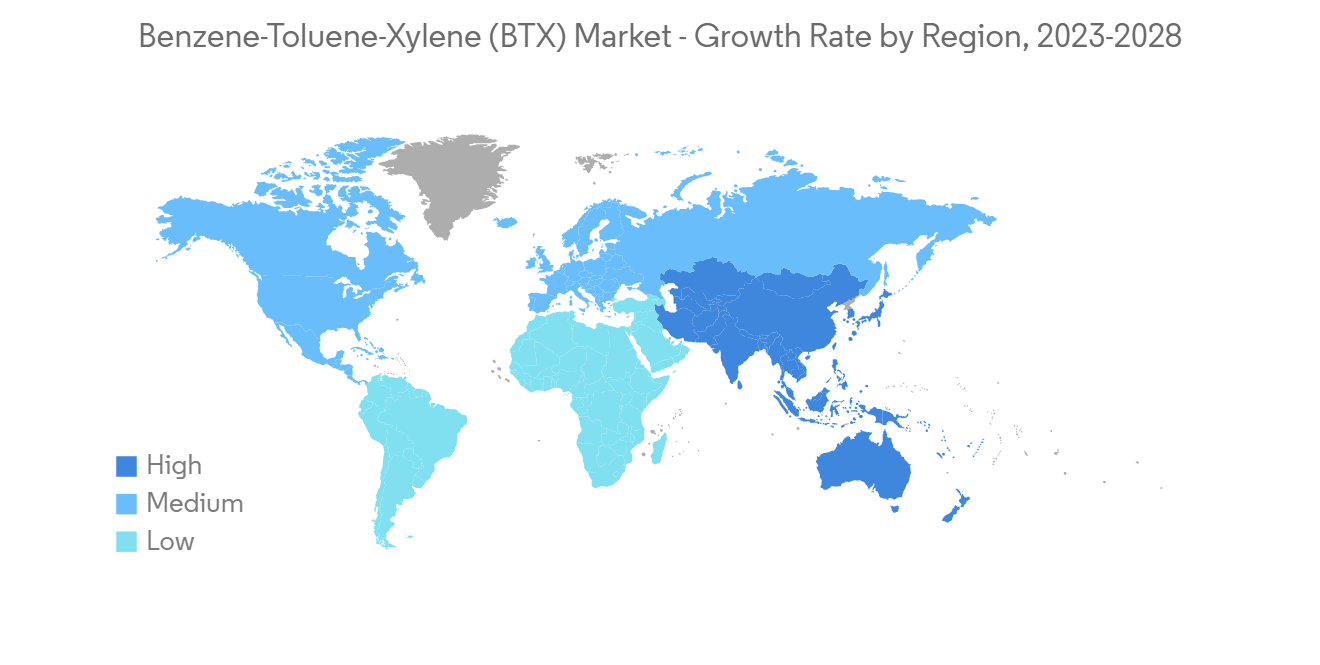

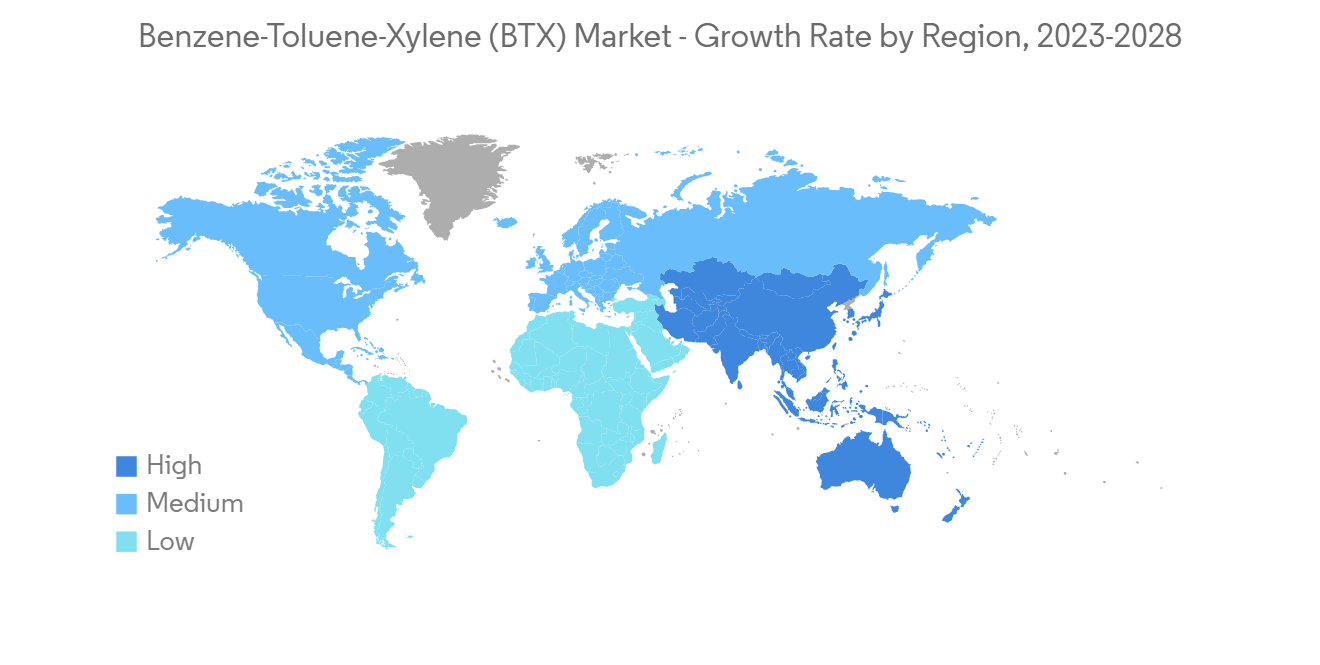

- 由于印度、中国和日本等主要国家/地区的市场发展,预计亚太地区在预测期内将主导市场。

BTX(苯-甲苯-二甲苯)市场趋势

乙苯主导苯应用领域

- 乙苯是通过苯与乙烯的酸催化烷基化得到的。 乙苯(EB)是生产苯乙烯的重要中间体,通过乙苯催化脱氢生成氢气和苯乙烯。

- 乙苯作为抗爆剂添加到汽油中,以减少发动机爆震并提高辛烷值。 乙苯也大量存在于其他製成品中,例如杀虫剂、醋酸纤维素、合成橡胶、油漆和油墨。

- 苯乙烯主要用于生产聚苯乙烯、丙烯□-丁二烯-苯乙烯 (ABS) 树脂、苯乙烯-丙烯□ (SAN) 树脂、苯乙烯-丁二烯弹性体、乳胶和不饱和聚酯树脂等聚合物。

- 苯乙烯行业的主要市场包括包装、电气和电子设备、建筑、汽车和消费品。 根据中国汽车工业协会的数据,2022 年 12 月中国新能源汽车产量同比增长 96.9%。 因此,它对市场产生了积极的影响。

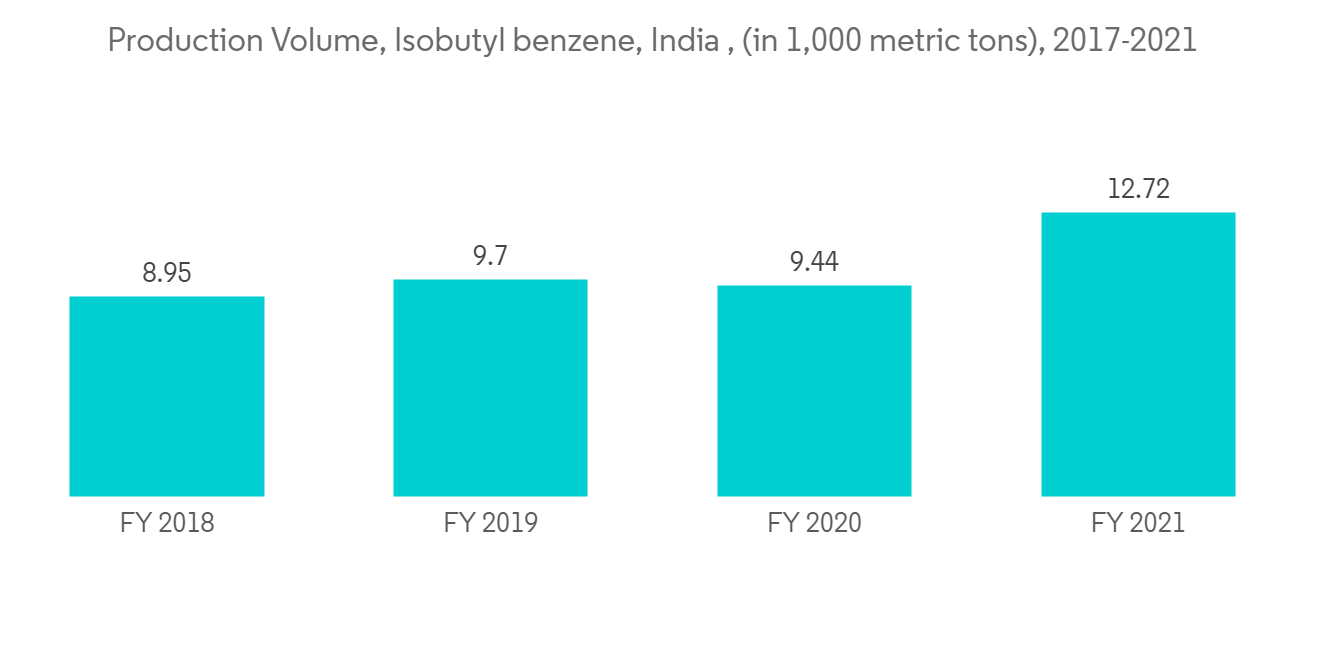

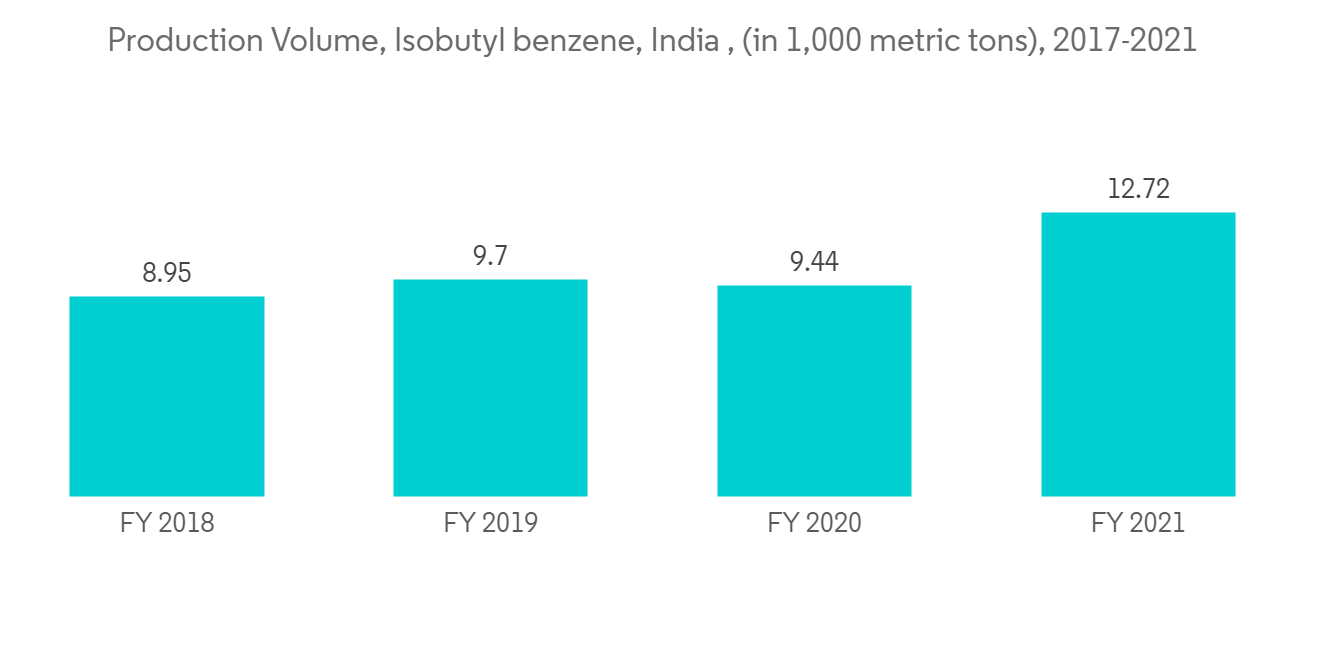

- 2021 财年,印度的异丁苯产量约为 12,720 公吨,比 2021 年增长 35%。

- 此外,印度是世界领先的化学工业之一,每年生产 80,000 多种化学产品。

- 因此,预计上述所有因素都会对预测期内的市场增长产生重大影响。

亚太地区主导市场

- 亚太地区在整个市场中所占份额最大,预计在市场估计和预测期内是增长最快的地区。

- 在亚太地区,苯和甲苯在各种化学应用中的重要性与日俱增,二甲苯作为溶剂和单体的使用也在不断增加,这推动了所研究市场的增长。

- 二甲苯是 BTX 的一种成分。 二甲苯的大部分用作溶剂,其次是单体(主要用于塑料和聚合物)。 其强溶剂性能用于印刷、橡胶和皮革加工。

- 中国是世界上最大的塑料生产国,约占全球产量的三分之一。 据中国国家统计局数据,2021年全国塑料製品产量为8000万吨,同比增长5.27%,将拉动市场增长。

- 根据 IBEF 的数据,从 2022 年 4 月到 2022 年 9 月,印度的塑料出口总额为 63.8 亿美元。 因此,它在预测期内为市场带来了正利润。

- 此外,印度最大的出口类别是塑料原材料,占 2021-2022 年出口总值的 30.7%,比上一年增长 26.5%。

- 鑑于上述所有因素,该地区的 BTX 市场预计在预测期内将显着增长。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 苯和甲苯在化学应用中的重要性与日俱增

- 扩大使用二甲苯作为溶剂和单体

- 约束因素

- 关于 BTX(苯-甲苯-二甲苯)的有害影响

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章市场细分(市场规模(基于数量)

- 类型

- 苯

- 甲苯

- 二甲苯

- 正交

- 元

- 段

- 产品 - 按应用

- 使用苯

- 乙苯

- 环己烷

- 烷基苯

- 库门

- 硝基苯

- 其他用途

- 应用中的甲苯

- 油漆和涂料

- 粘合剂/油墨

- 炸药

- 化学工业

- 其他用途

- 应用二甲苯

- 溶剂

- 单体

- 其他用途

- 使用苯

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要参与者采用的策略

- 公司简介

- BASF SE

- Chevron Phillips Chemical Company LLC

- CNOOC Ltd

- Dow

- Exxon Mobil Corporation

- INEOS

- IRPC Public Company Limited

- JX Nippon Oil & Gas Exploration Corporation

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- OCI COMPANY Ltd.

- PetroChina Company Limited

- Reliance Industries Limited

- Shell plc

- China Petrochemical Corporation

- SABIC

- S-OIL Corporation

- SK innovation Co., Ltd.

第七章市场机会与未来趋势

- Bio BTX(苯-甲苯-二甲苯)

简介目录

Product Code: 72458

The Global Benzene-Toluene-Xylene (BTX) Market is projected to register a CAGR of more than 3.5% during the forecast period. COVID-19 negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The growing significance of benzene and toluene in various chemical applications is expected to fuel the market growth during the forecast period.

- On the flip side, the harmful effects of benzene-toluene-xylene (BTX) are expected to hinder the market's growth.

- Moreover, the increasing usage of bio-based Benzene-Toluene-Xylene (BTX) is expected to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market during the forecast period owing to its growing development in major countries such as India, China, and Japan.

Benzene-Toluene-Xylene (BTX) Market Trends

Ethylbenzene to Dominate the Benzene Application Segments

- Ethylbenzene is obtained through acid-catalyzed alkylation of benzene with ethylene. Ethylbenzene (EB) is the critical intermediate in the production of styrene, produced by the catalytic dehydrogenation of ethylbenzene, which gives hydrogen and styrene.

- Ethylbenzene is added to gasoline as an anti-knock agent to reduce engine knocking and increase the octane rating. Ethylbenzene is often found in other manufactured products, including pesticides, cellulose acetate, synthetic rubber, paints, and inks.

- Styrene is used primarily in polymer production for polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers, and latexes, and unsaturated polyester resins.

- The major styrene industry markets include packaging, electrical and electronic appliances, construction, automotive, and consumer products. According to the China Association of Automobile Manufacturing, the production of New Energy Vehicles in the country witnessed a year-on-year increase of 96.9% in December 2022. Hence, impacting the market positively.

- In the fiscal year 2021, India produced around 12,720 metric tons of isobutyl benzene, representing an increase of 35% compared to 2021.

- Moreover, India is one of the major chemical industries in the world, producing more than 80,000 chemical products annually.

- Therefore, all factors above are expected to significantly impact the market's growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the market studied, with the largest share of the total market volume, and is estimated to be the fastest-growing region during the forecast period.

- In the Asia-Pacific region, the growing significance of benzene and toluene in various chemical applications and the growing usage of xylene as solvents and monomers are driving the growth of the market studied.

- Xylene is a component of BTX. Xylene's majority share is used as a solvent, followed by monomers (mainly used in plastics and polymers). Its powerful solvent properties are used in printing, rubber, and leather processing.

- China is the world's largest plastics manufacturer, accounting for approximately one-third of worldwide production. According to the National Bureau of Statistics of China, the country produced 80 million metric tons of plastic products in 2021, an increase of 5.27 % compared to the previous year, which in turn is fueling the market growth.

- According to IBEF, in India, the total value of plastics exported between April and September 2022 was USD 6.38 billion. Thus benefiting the market positively during the forecast period.

- Further, the largest export category in India was plastic raw materials, which accounted for 30.7% of all exports in 2021-2022 and increased by 26.5% from the previous year.

- Owing to all the factors above, the market for BTX in the region is projected to grow significantly during the forecast period.

Benzene-Toluene-Xylene (BTX) Market Competitor Analysis

The global benzene toluene xylene (BTX) market is partially consolidated in nature. Some of the major players in the market include China Petrochemical Corporation, Exxon Mobil Corporation, SABIC, Reliance Industries Limited, and PetroChina Company Limited, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Significance of Benzene, Toluene in Various Chemical Applications

- 4.1.2 Growing Usage of Xylene as Solvents and Monomers

- 4.2 Restraints

- 4.2.1 Harmful Effects of Benzene-Toluene-Xylene (BTX)

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Benzene

- 5.1.2 Toluene

- 5.1.3 Xylene

- 5.1.3.1 Ortho

- 5.1.3.2 Meta

- 5.1.3.3 Para

- 5.2 Product - By Application

- 5.2.1 Benzene By Application

- 5.2.1.1 Ethylbenzene

- 5.2.1.2 Cyclohexane

- 5.2.1.3 Alkylbenzene

- 5.2.1.4 Cumene

- 5.2.1.5 Nitrobenzene

- 5.2.1.6 Other Applications

- 5.2.2 Toluene By Application

- 5.2.2.1 Paints and Coatings

- 5.2.2.2 Adhesives and Inks

- 5.2.2.3 Explosives

- 5.2.2.4 Chemical Industry

- 5.2.2.5 Other Applications

- 5.2.3 Xylene By Application

- 5.2.3.1 Solvent

- 5.2.3.2 Monomer

- 5.2.3.3 Other Applications

- 5.2.1 Benzene By Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 CNOOC Ltd

- 6.4.4 Dow

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 INEOS

- 6.4.7 IRPC Public Company Limited

- 6.4.8 JX Nippon Oil & Gas Exploration Corporation

- 6.4.9 MITSUBISHI GAS CHEMICAL COMPANY, INC

- 6.4.10 OCI COMPANY Ltd.

- 6.4.11 PetroChina Company Limited

- 6.4.12 Reliance Industries Limited

- 6.4.13 Shell plc

- 6.4.14 China Petrochemical Corporation

- 6.4.15 SABIC

- 6.4.16 S-OIL Corporation

- 6.4.17 SK innovation Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Bio-based Benzene-Toluene-Xylene (BTX)

02-2729-4219

+886-2-2729-4219