|

市场调查报告书

商品编码

1237860

下腔静脉过滤器市场——增长、趋势和预测 (2023-2028)Inferior Vena Cava Filter Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,下腔静脉过滤器市场预计将以约 9.1% 的复合年增长率增长。

COVID-19 显着增加了患者肺栓塞的发生率,从而显着影响了所研究的市场。 由于下腔静脉 (IVC) 过滤器通常用于治疗肺栓塞,因此在早期流行期间这种疾病的发病率增加也增加了 IVC 过滤器的使用。 例如,在 BMC Respiratory Research 于 2021 年 11 月发表的一篇论文中,一项在法国进行的研究发现,在大流行初期,因肺栓塞住院的患者人数总体增加了约 16%。 这些增加主要是由于 COVID-19 浪潮,并与 COVID-19 患者的肺栓塞住院有关。 因此,大流行最初对市场产生了重大影响。 然而,随着大流行现在已经消退并且患肺栓塞的风险已经降低,我们预计在本研究的预测期内会稳定增长。

心脏病患病率上升和对微创技术的需求增加等因素是推动市场增长的主要因素。 肺栓塞 (PE) 和静脉血栓栓塞 (VTE) 是 IVC 过滤器用于治疗的两种疾病。 这些疾病在全球范围内的流行率上升是推动市场增长的主要因素。 例如,根据 JAMA 网络 2022 年 10 月发表的一篇论文,肺栓塞 (PE) 通常是由肺动脉血流阻塞引起的,通常是由从下肢静脉迁移的血块引起的。。 PE 通常由从下肢静脉迁移的血栓引起,其发病率估计在全世界每年每 100,000 人中约有 60-120 例。

此外,根据 Frontiers 于 2022 年 3 月发表的一篇论文,静脉血栓栓塞症 (VTE) 常伴随肺栓塞 (PE) 和深静脉血栓形成 (DVT) 增加。 据估计,美国每年有 375,000 至 425,000 名新诊断出患有这些疾病的患者。 因此,预计这些疾病的患病率上升将增加 IVC 过滤器的使用。

此外,使用 IVC 滤器治疗 VTE 的优势也在推动市场增长。 例如,根据 NCBI 2022 年 8 月更新的一篇文章,美国心臟协会 (AHA) 和美国胸科医师协会 (ACCP) 等全球各种组织已经开展了静脉血栓栓塞症 (VTE) 和抗凝治疗。我们建议对有药物禁忌症的患者使用下腔静脉 (IVC) 滤器。

因此,上述因素,例如肺栓塞 (PE) 和静脉血栓栓塞 (VTE) 患病率的增加以及 IVC 过滤器的优势,预计将推动市场增长。 然而,与设备故障相关的风险和新兴市场的低认可度预计会阻碍市场增长。

主要市场趋势

预计在预测期内预防肺栓塞将占很大份额

肺栓塞 (PE) 是一种疾病,当血凝块滞留在肺动脉中并阻止血液流向部分肺部时,通常会发生这种疾病。 血凝块通常起源于腿部并通过心臟右侧到达肺部。 下腔静脉滤器 (IVC) 通常用于治疗肺栓塞。 肺栓塞患病率上升、老年人口增加以及对微创技术的需求增加等因素预计将推动这一领域的增长。

肺栓塞患病率的增加导致 IVC 过滤器的使用增加,这是推动该细分市场增长的主要因素。 例如,Lung India 于 2021 年 11 月发表的一篇文章发现,在印度和韩国进行的研究表明,肺栓塞的患病率分别为 2% 和 5%。 患有心动过速、呼吸急促和呼吸性碱中毒的患者发生 PE 的可能性明显更高。

此外,根据澳大利亚卫生与老年护理部2021年6月公布的数据,估计每年将有超过17000名澳大利亚人患上肺栓塞,且发病率随着年龄的增长而呈上升趋势. 栓塞风险高的人群是老年人、癌症患者和行动不便(例如住院)的人。 因此,高肺栓塞预计会增加 IVC 过滤器的使用,从而导致该细分市场的增长。

此外,肺栓塞常发生在老年人身上,老年人口的增加是推动市场增长的主要因素。 例如,根据 MDPI 于 2022 年 8 月发表的一篇文章,肺栓塞 (PE) 和深静脉血栓形成 (DVT) 是静脉血栓栓塞症 (VTE) 的两种症状,而这些疾病会影响儿童是罕见的,通常被认为是一种疾病老年病。

因此,肺栓塞患病率上升和老年人口增加等因素预计将推动这一细分市场的增长。

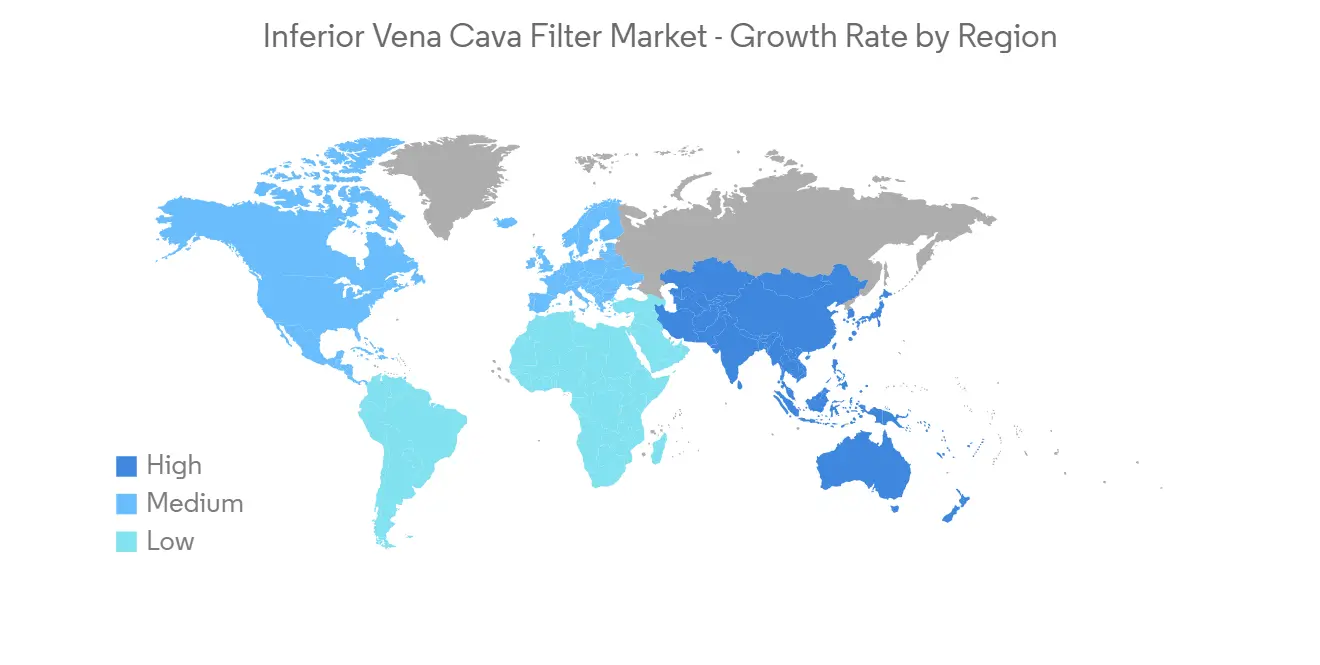

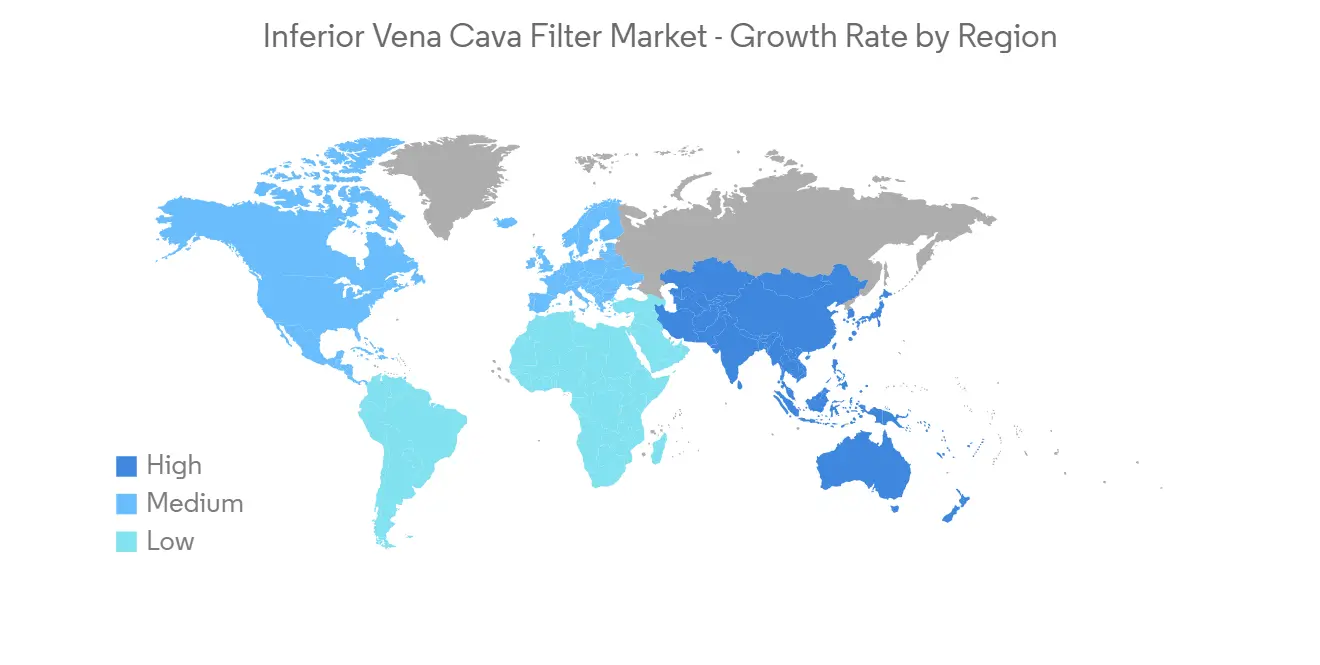

预计在预测期内北美将占据很大的市场份额

由于 IVC 滤器在治疗静脉血栓栓塞症 (VTE) 和肺栓塞 (PE) 中的使用增加、VTE 和 PE 患病率增加以及老年人口不断增加,北美成为市场领导者。预计将拥有大量分享。 例如,美国疾病控制和预防中心在 2022 年 6 月更新的数据估计,美国每年可能有多达 90 万人患有深静脉血栓 (DVT) 或肺栓塞 (PE)。。 因此,预计该地区 PE 的高流行将推动 IVC 过滤器的使用,从而导致市场增长。

此外,根据 NCBI 于 2022 年 8 月更新的一篇论文,美国肺栓塞 (PE) 的发病率为每年每 10 万人 39-115 人,DVT 为每 10 万人 53-100,000 人。 162 . 也有人指出,PE 在男性中的发生率高于女性。 预计此类疾病发病率的增加将推动该地区的市场增长。

此外,VTE 和 PE 与老年相关,因此该地区不断增长的老年人口也是推动市场增长的主要因素。 例如,根据加拿大统计局2022年7月公布的数据,加拿大约有7,330,605人超过65岁,估计占总人口的18.8%。

这样,由于上述因素,例如 VTE 和 PE 患病率的增加以及老年人口的增加,预计该地区的市场将会增长。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 研究假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 心脏病患病率上升

- 对微创技术的需求不断增长

- 市场製约因素

- 与设备故障相关的风险

- 在新兴国家缺乏认可

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(按金额计算的市场规模 - 百万美元)

- 通过申请

- 静脉血栓栓塞症的治疗

- 预防肺栓塞

- 按产品类型

- 可检索

- 常任

- 最终用户

- 医院

- 门诊手术中心

- 其他

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Adient Medical Inc.

- ALN

- Argon Medical

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Braile Biomedica

- Cardinal Health

- Cook Medical

- Cordis

- Volcano Corporation

第七章市场机会与未来趋势

The inferior vena cava filter market is anticipated to grow with a CAGR of nearly 9.1%, during the forecast period.

COVID-19 had a significant impact on the studied market as it significantly increased the incidence of pulmonary embolism among patients. Inferior vena cava (IVC) filters are often used for treating pulmonary embolism, so the rising incidence of the disease during the early pandemic also increased the usage of IVC filters. For instance, according to an article published by BMC Respiratory Research in November 2021, a study was conducted in France which showed that the overall number of patients hospitalized with pulmonary embolism increased by approximately 16% during the early pandemic. These increases were mostly attributed to COVID-19 waves, which were associated with pulmonary embolism hospitalization in COVID-19 patients. Hence, the pandemic had a significant impact on the market initially. However, as the pandemic has currently subsided, the risk of getting a pulmonary embolism has also decreased, thus the studied market is expected to have stable growth during the forecast period of the study.

Factors such as the rising prevalence of cardiac ailments and the growing demand for minimally invasive techniques are the major factors driving the market growth. Pulmonary embolism (PE) and venous thromboembolism (VTE) are the two diseases where IVC filters are used for treatment. The rising prevalence of these diseases around the world is a major factor driving the growth of the market. For instance, according to an article published by the JAMA Network in October 2022, pulmonary embolism (PE) is often characterized by occlusion of blood flow in a pulmonary artery, which happens typically due to a thrombus that travels from a vein in a lower limb. The incidence of PE is estimated to be approximately 60 to 120 per 100,000 people per year globally.

Furthermore, according to an article published by Frontiers in March 2022, Venous thromboembolism (VTE) is often associated with pulmonary embolism (PE) and deep venous thrombosis (DVT). It is estimated that there are 375,000 - 425,000 newly diagnosed patients per year in the United States that are suffering from these diseases. Hence, the rising prevalence of such diseases is expected to increase the usage of IVC filters.

Additionally, the advantages of the treatment of VTE using IVC filters are also enhancing the market growth. For instance, according to an article updated by NCBI in August 2022, various organizations around the world such as the American Heart Association (AHA) and American College of Chest Physicians (ACCP) recommend the use of inferior vena cava (IVC) filters in patients that have the venous thromboembolic disease (VTE) and having a contraindication to anticoagulant medications.

Thus, the above-mentioned factors such as the increasing prevalence of pulmonary embolism (PE) and venous thromboembolism (VTE), and the advantages of IVC filters, are expected to boost the growth of the market. However, the risks associated with device malfunction and the lack of awareness in developing countries are expected to impede market growth.

Key Market Trends

Prevention of Pulmonary Embolism is Expected to Hold a Significant Share Over the Forecast Period

Pulmonary embolism (PE) is a disease that often occurs when a blood clot gets stuck in an artery in the lung, blocking blood flow to part of the lung. Blood clots most often start in the legs and travel up through the right side of the heart and into the lungs. Inferior vena cava (IVC) filters are often used for the treatment of pulmonary embolism. Factors such as the rising prevalence of pulmonary embolism, rising geriatric populations, and the increasing demand for minimally invasive techniques are expected to boost segment growth.

The increasing prevalence of pulmonary embolism is a major factor driving the segment growth, as it leads to more usage of IVC filters. For instance, according to an article published by Lung India in November 2021, a study was conducted in India and South Korea which showed the prevalence of pulmonary embolism to be 2% and 5%, respectively. The likelihood of getting PE was significantly higher in patients who were suffering from tachycardia, tachypnea, and respiratory alkalosis.

Furthermore, according to the data published by The Department of Health and Aged Care of Australia in June 2021, it is estimated that more than 17,000 Australians every year will have a pulmonary embolism, and the incidence is increasing as the population ages. Groups at higher risk of embolism are older people, people who have cancer, and people who are immobilized (for example, hospitalized). Hence, the high prevalence of pulmonary embolism is expected to increase the usage of IVC filters, thus leading to segment growth.

Moreover, old age is often associated with pulmonary embolism cases, and the rising geriatric population thus becomes a major factor driving the growth of the market. For instance, according to an article published by MDPI in August 2022, Pulmonary embolism (PE) and deep-vein thrombosis (DVT) are the two manifestations of Venous thromboembolism (VTE), and these diseases are uncommon in children and are often considered as an old age disease.

Hence, the factors such as the rising prevalence of pulmonary embolism and the rising geriatric population are expected to boost segment growth.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant share of the market due to the increasing usage of IVC filters for the treatment of venous thromboembolism (VTE) and pulmonary embolism (PE), the increasing prevalence of VTE and PE, and the rising geriatric population. For instance, according to the data updated by CDC in June 2022, it is estimated that as many as 900,000 people could be affected with deep vein thrombosis (DVT) or pulmonary embolism (PE) each year in the United States. Hence, the high prevalence of PE in the region is expected to boost the usage of IVC filters, leading to market growth.

Furthermore, according to an article updated by NCBI in August 2022, the incidence of pulmonary embolism (PE) ranges from 39 to 115 per 100,000 population annually, and for DVT, the incidence ranges from 53 to 162 per 100,000 people in the United States. The incidence of PE is noted to be more in males as compared to that females. Thus, the increasing incidence of such diseases is expected to boost market growth in the region.

Moreover, as VTE and PE are associated with old age, the rising geriatric population in the region is also a major factor driving the growth of the market. For instance, according to the data published by Statistics Canada in July 2022, it is estimated that around 7,330,605 people are aged 65 years or older in Canada, and this accounts for 18.8% of the total population.

Thus, due to the above mentioned factors such as the rising prevalence of VTE and PE, and the rising geriatric population, the market is expected to experience growth in the region.

Competitive Landscape

The inferior vena cava filter market is fragmented in nature and consists of a few major players. The companies have been following various strategies such as acquisitions, partnerships, investments in research activities, and new product launches to sustain themselves among the competitors in the global market. Companies like ALN, Argon Medical, B. Braun Melsungen AG, Becton, Dickinson and Company, Boston Scientific Corporation, Braile Biomedica, Cardinal Health, Cook Medical, and Volcano Corporation, among others, hold a substantial share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Cardiac Ailments

- 4.2.2 Growing Demand of Minimally Invasive Techniques

- 4.3 Market Restraints

- 4.3.1 Risks associated with the Device Malfunction

- 4.3.2 Lack of Awareness in Developing Countries

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Application

- 5.1.1 Treatment of Venous Thromboembolism

- 5.1.2 Prevention of Pulmonary Embolism

- 5.2 By Product Type

- 5.2.1 Retrievable

- 5.2.2 Permanent

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Adient Medical Inc.

- 6.1.2 ALN

- 6.1.3 Argon Medical

- 6.1.4 B. Braun Melsungen AG

- 6.1.5 Becton, Dickinson and Company

- 6.1.6 Boston Scientific Corporation

- 6.1.7 Braile Biomedica

- 6.1.8 Cardinal Health

- 6.1.9 Cook Medical

- 6.1.10 Cordis

- 6.1.11 Volcano Corporation