|

市场调查报告书

商品编码

1237863

肺部给药系统市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Pulmonary Drug Delivery Systems Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,肺部给药系统市场预计将以 4% 的复合年增长率註册。

COVID-19 影响了肺部给药系统市场的增长。 已发现患有哮喘和慢性阻塞性肺病 (COPD) 等呼吸系统疾病的患者感染冠状病毒的风险增加。 出于这个原因,对合适的药物输送系统的需求不断增加,以向患者给药肺部药物。 例如,2022 年 3 月发表在 Pulmonary Medicine 上的一篇论文证实,COPD 患者感染冠状病毒后的预后更差。 生物因素也使 COPD 患者更容易受到病毒感染,更容易受到 COVID-19 的病理生理影响,如微血栓形成、肺内分流和随后的细菌感染。 因此,COPD 患者感染 COVID-19 的风险增加,增加了对吸入器和雾化器的需求,这影响了大流行期间对药物输送系统的需求。 因此,虽然 COVID-19 大流行最初对市场产生了积极影响,但随着大流行的消退,它现在已经失去了吸引力。 然而,预计在预测期内将稳定增长。

呼吸系统疾病患病率增加、技术进步以及越来越倾向于将肺部药物输送作为药物输送的替代途径等因素正在推动市场的增长。

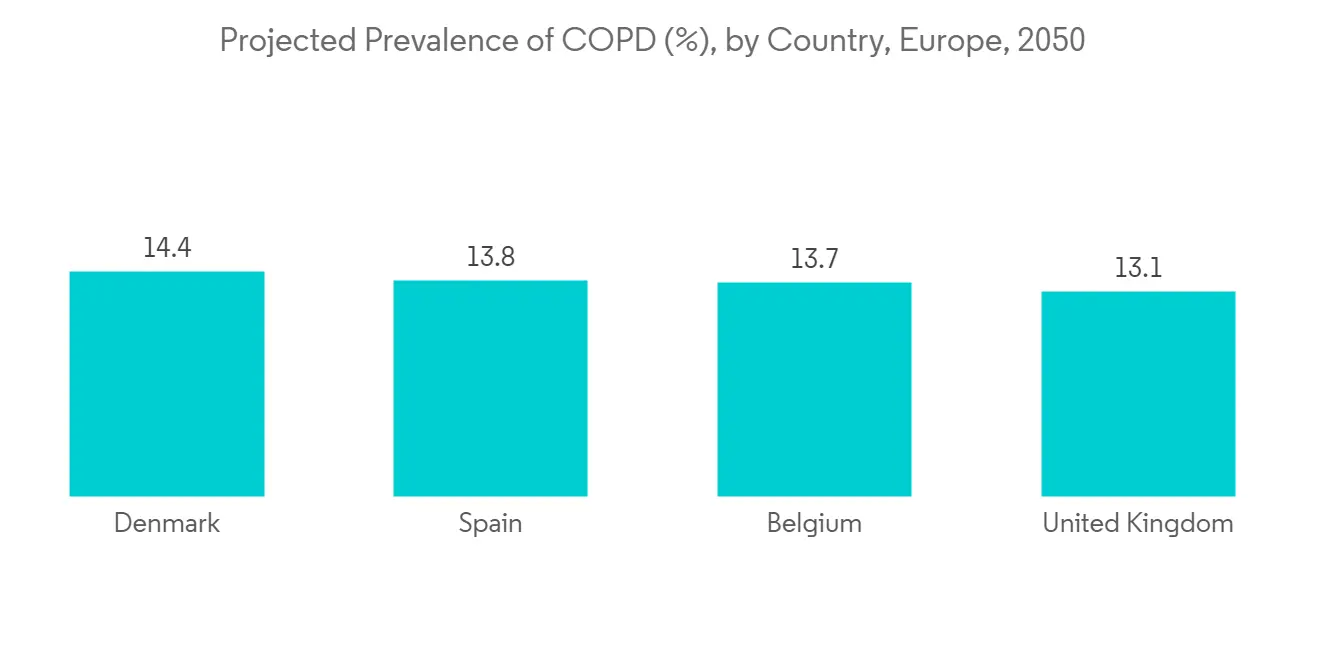

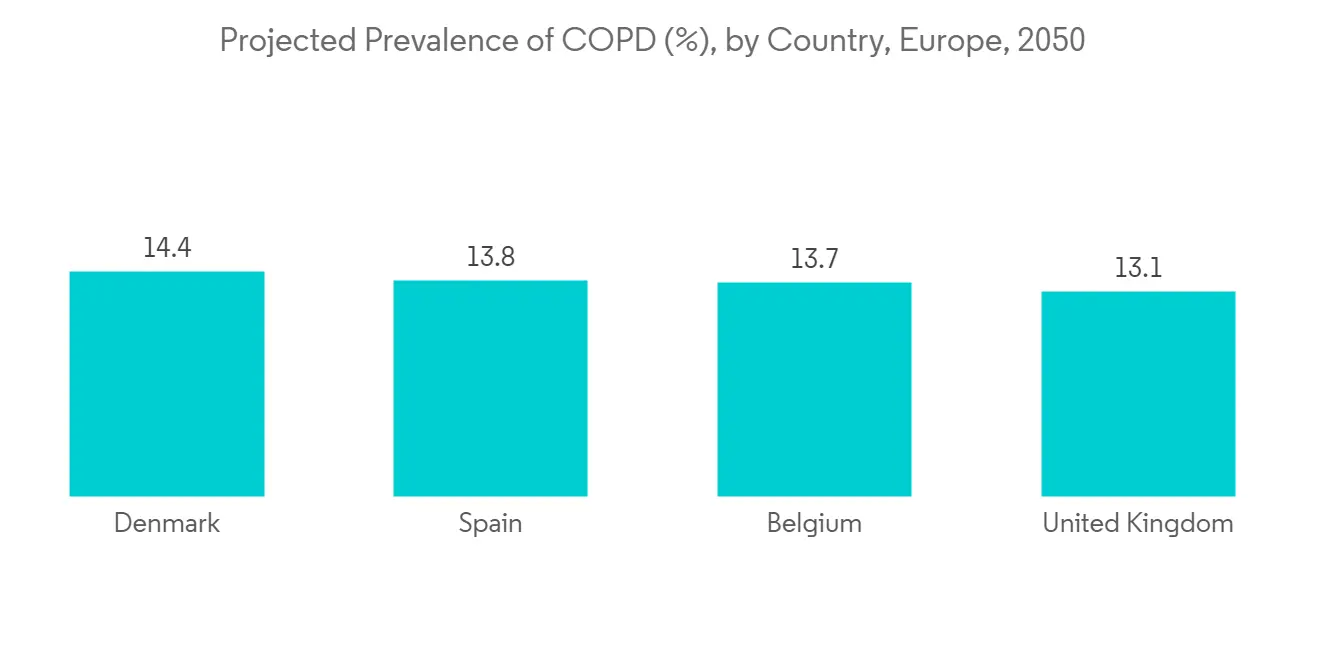

哮喘、慢性阻塞性肺病等呼吸系统疾病的患病率和发病率正在迅速增加,预计这将增加对肺部给药系统的需求,从而推动市场增长。我来了。 例如,根据 ERS □□Journal 发表的一篇论文,到 2022 年 8 月,到 2050 年将有大约 6.456 亿人(4.544 亿男性和 1.912 亿女性)患上 COPD。据称,全球患病率相对于 2019 年将增加 36%。前一年。 因此,慢性阻塞性肺病这一严重的公共卫生问题的患病率预计会上升,尤其是在新兴国家,这将推动对雾化器和吸入器等各种药物输送系统的需求。 预计这将在预测期内推动市场增长。

此外,由于肺泡表面积大、载药效率高,肺部血管数量多,是药物吸收的理想部位,肺部给药优于传统给药途径。 .

此外,预计在预测期内,公司在开发新型药物输送系统方面的活动增加以及产品发布的增加也将推动肺部药物输送系统市场的增长。 例如,2021 年 6 月,Glenmark Pharma 在英国推出了用于治疗慢性阻塞性肺疾病 (COPD) 的塞托溴铵干粉吸入器 Tiogiva。 2021 年 3 月,PARI Pharma GmbH 获得了 LAMIRA 雾化器系统在日本的上市许可,用于递送 Insmed 的药物 ARIKAYCE(阿米卡星脂质体吸入悬浮液)。

因此,由于呼吸系统疾病的高负担和产品发布的增加等因素,预计所研究的市场在预测期内将会增长。 然而,预计在预测期内,有关药物输送系统批准的监管问题将阻碍肺部药物输送系统市场的增长。

肺部给药系统市场趋势

COPD(慢性阻塞性肺病)细分市场预计在预测期内将出现显着增长

在预测期内,慢性阻塞性肺病领域的肺部给药系统市场预计将出现显着增长。 市场增长是由慢性阻塞性肺病在人群中日益加重的负担和对创新药物输送系统不断增长的需求推动的。

此外,由于与年龄相关的肺结构和功能变化,人口老龄化更容易患上慢性阻塞性肺病,预计在预测期内也将增加对 COPD 治疗领域的需求。 例如,根据联合国人口基金公布的2022年统计数据,可知到2022年,居住在日本的总人口中约有59%是15至64岁的老年人。 据同一消息来源称,到 2022 年,29% 的人口将超过 65 岁。

COPD 患病率和发病率的增加是推动肺部药物输送系统需求的主要因素,从而推动了这一领域的增长。 根据 2021 年 7 月发表在《欧洲呼吸杂誌》上的研究结果,由于吸烟和空气污染等风险因素增加,欧洲(包括荷兰)的慢性阻塞性肺病 (COPD) 患病率正在上升。预计 此外,根据 2021 年 11 月发表在《欧洲呼吸杂誌》上的一篇论文,预计到 2050 年将有约 49,453,852 名欧洲人患有慢性阻塞性肺病,而 2020 年这一数字为 36,580,965 人。 预计这将在预测期内推动细分市场的增长。

此外,该领域研发活动的增加和产品发布的增加预计将促进慢性阻塞性肺疾病领域的增长。 例如,2022 年 4 月,葛兰素史克製药公司推出了 Trelegy Ellipta,这是一种每日一次的吸入式单药三联疗法 (SITT),用于治疗印度慢性阻塞性肺病患者。 2021 年 10 月,Glenmark 在西班牙推出了塞托溴铵干粉吸入器(DPI)的生物等效物,用于治疗慢性阻塞性肺病(COPD)。

因此,由于慢性阻塞性肺病负担加重和产品发布增加等因素,预计该细分市场在预测期内将会增长。

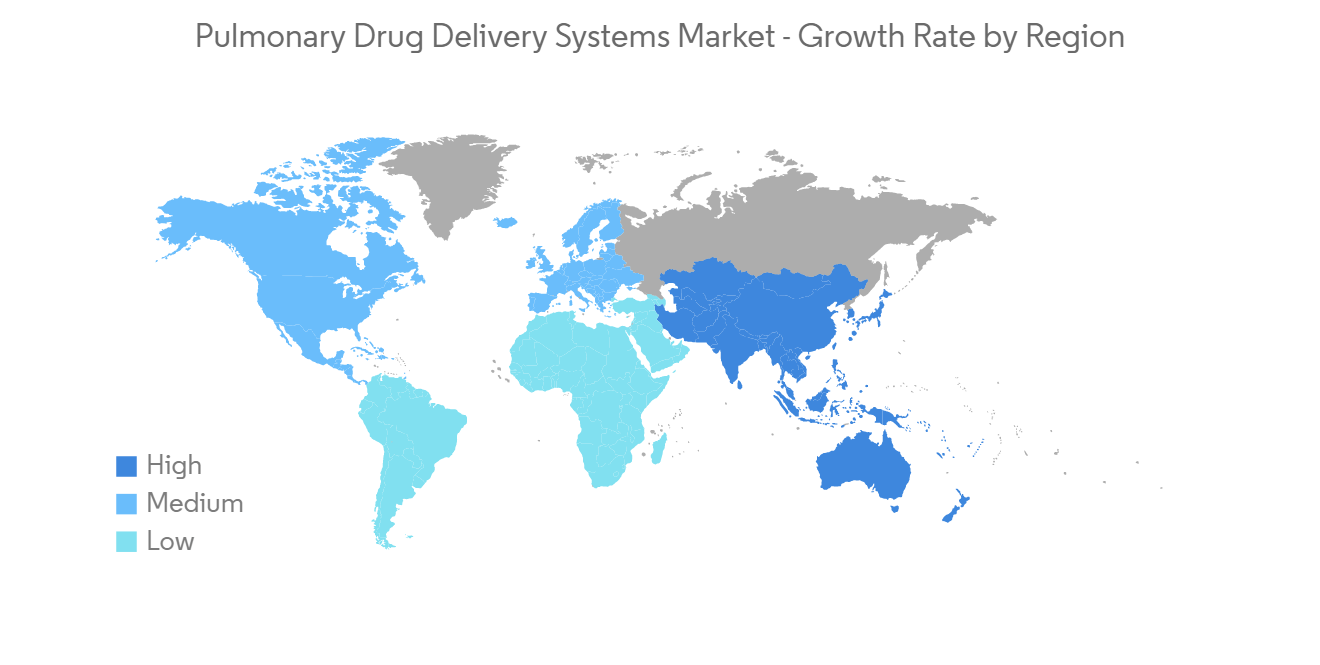

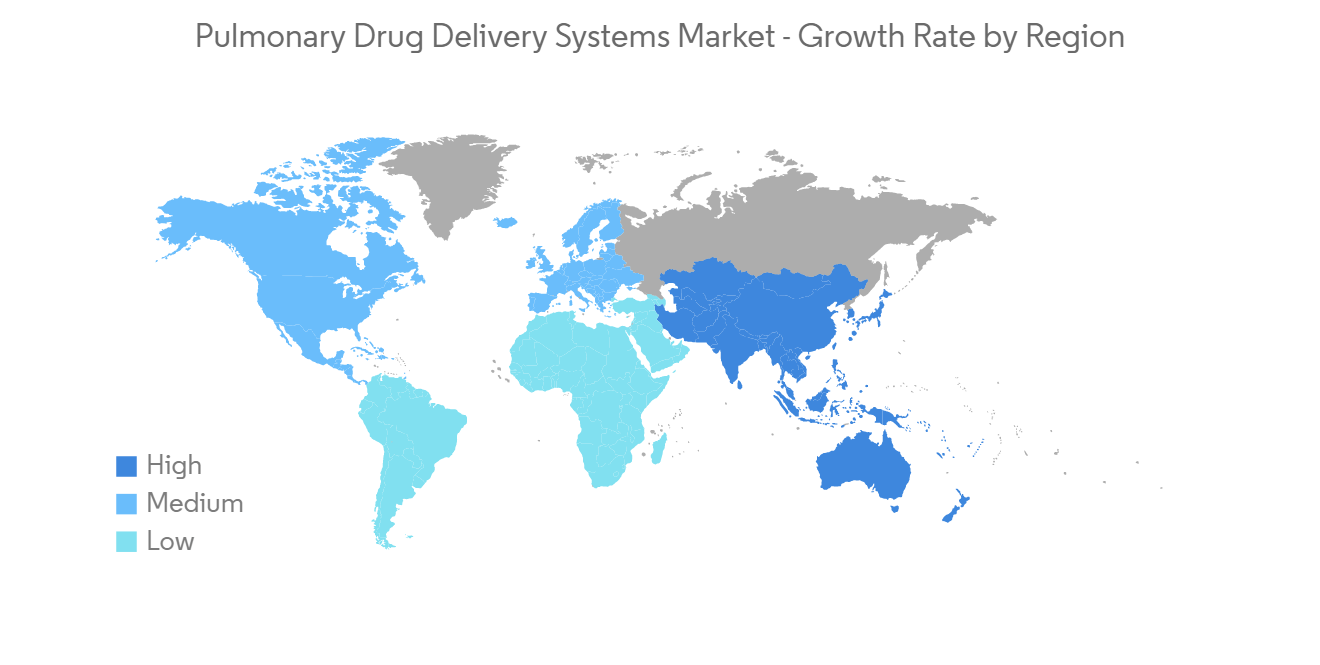

北美将占很大份额,预计在预测期内保持不变

在北美,诸如哮喘、过敏性鼻炎和慢性阻塞性肺病等呼吸系统疾病增加、老年人口增加、对诊断设备的需求增加、医疗保健支出增加、可支配收入高等因素预计在预测期内,肺部给药系统将实现健康增长。

呼吸系统疾病负担的增加是推动对用于治疗各种疾病的药物输送系统的需求的主要因素,从而促进了市场增长。 例如,MDPI 于 2021 年 11 月发表的一篇文章发现,墨西哥城患有哮喘的儿童与呼吸系统问题和交通相关的空气污染显着相关,加剧了患者的哮喘病情。 而根据IQAir公布的数据,2021年8月,墨西哥城美国AQI值为74,表明2021年初空气污染水平为“中等”。 此外,如该文献所示,汽车尾气中的一氧化碳、碳氢化合物、氮氧化物等“光化学氧化烟雾”的成分相当多地排放到大气中。 预计空气污染物排放量的增加会导致各种呼吸道过敏,例如哮喘和过敏性鼻炎。 因此,对创新和有效的肺部药物输送系统(如计量吸入器和雾化器)的需求不断增加,预计将推动市场增长。

此外,政府和非政府组织的不断努力也提高了整体销售额。 例如,CDC 的国家哮喘控制计划 (NACP) 提供资金来教育哮喘患者。 预计这些努力将提高人们对哮喘的认识,增加需求以及采用吸入器治疗哮喘,并推动市场增长。

此外,专注于开发有效肺部药物的主要国内市场参与者的存在以及越来越多地采用各种业务战略(例如协议、收购、合作伙伴关係和增加产品发布)的情况显而易见,预计将推动市场增长. 例如,2022 年 3 月,美国 FDA 批准了一种药物,用于治疗 6 岁及以上患者的哮喘,以及维持治疗和减少慢性阻塞性肺疾病 (COPD) 患者的气流阻塞加重,包括慢性支气管炎和/或肺气肿。批准了 Simcicort(布地奈德,富马酸福特罗二水合物)吸入气雾剂的第一个仿製药。

因此,在研究期间,呼吸系统疾病负担的增加以及该国企业活动和产品发布的增加将显着推动北美地区市场。

肺部给药系统市场竞争者分析

肺部药物输送系统市场竞争适中,由几家大型企业组成。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 技术进步

- 呼吸系统疾病增加,人们越来越关注肺部药物输送作为药物输送的替代途径

- 市场製约因素

- 关于批准给药装置的严格规定

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(市场规模 - 百万美元)

- 按产品分类

- 干粉吸入

- 定量喷雾器

- 雾化器

- 喷射雾化器

- 软雾雾化器

- 超声波雾化器

- 通过申请

- 囊性纤维化

- 支气管哮喘

- 过敏性鼻炎

- 慢性阻塞性肺疾病

- 其他用途

- 最终用户

- 医院

- 诊断中心

- 其他最终用户

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Koninklijke Philips NV

- GlaxoSmithKline PLC

- 3M

- Novartis AG

- Boehringer Ingelheim International GmbH

- AstraZeneca

- Cipla Inc.

- Merck & Co.

- GF Health Products Inc.

- Aerogen

- PARI GmbH

- Gilbert Technologies

第七章市场机会与未来趋势

The pulmonary drug delivery systems market is expected to register a CAGR of 4% during the forecast period.

COVID-19 impacted the growth of the pulmonary drug delivery systems market. Patients suffering from respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) were at high risk of getting coronavirus infection. This has increased the demand for proper drug delivery systems for administering pulmonary drugs to patients. For instance, according to an article published in Pulmonary Medicine, in March 2022, it was observed that COPD patients have worse outcomes from the coronavirus infection. Also, due to biological factors, COPD patients are more likely to acquire viral infections and suffer from COVID-19's pathophysiological effects, such as micro thrombosis, intrapulmonary shunting, and subsequent bacterial infection. Thus, the increasing risk of developing COVID-19 infection among COPD patients increased the demand for inhalers and nebulizers, which impacted the demand for drug delivery systems during the pandemic. Hence, the COVID-19 pandemic had a favorable impact on the market initially; currently, as the pandemic has subsided, the market has lost some traction. However, it is expected to have stable growth during the forecast period.

Factors such as the increasing incidence of respiratory diseases, growing technological advancements, and rising preference for pulmonary drug delivery as an alternate route of drug delivery are boosting market growth.

The prevalence and incidence of respiratory diseases such as asthma, chronic obstructive pulmonary diseases, and others among the population are increasing rapidly, which is anticipated to increase the demand for pulmonary drug delivery systems, hence propelling market growth. For instance, according to an article published in ERS Journal, in August 2022, it was projected that about 645.6 million people (454.4 million men and 191.2 million women) are expected to have COPD by 2050, representing a 36% relative increase in global prevalence as compared to the previous year. Thus, the prevalence of COPD, a serious public health issue, is expected to rise, especially in emerging countries which is anticipated to increase the demand for different drug delivery systems such as nebulizers and inhalers. This is expected to fuel the market growth over the forecast period.

In addition, pulmonary drug delivery methods are preferred to conventional drug administration approaches due to the large surface area of the alveolar sacs, the high drug loading efficiency, and the high vascularization of the lung, which makes it an ideal site for drug absorption.

Furthermore, the rising company activities in developing novel drug delivery systems and increasing product launches are also expected to increase the growth of the pulmonary drug delivery systems market over the forecast period. For instance, in June 2021, Glenmark Pharma launched Tiotropium Bromide Dry Powder Inhaler, Tiogiva, used in the treatment of chronic obstructive pulmonary disease (COPD) in the United Kingdom. Also, in March 2021, PARI Pharma GmbH received the market authorization of the LAMIRA Nebulizer System for the delivery of Insmed's drug product ARIKAYCE (amikacin liposome inhalation suspension) in Japan.

Therefore, owing to factors such as the high burden of respiratory diseases among the population and increasing product launches, the studied market is expected to grow over the forecast period. However, the regulatory issues regarding the approval for drug delivery systems are likely to hamper the growth of the pulmonary drug delivery systems market over the forecast period.

Pulmonary Drug Delivery Systems Market Trends

COPD Segment Expected to Register Significant Growth Over the Forecast Period

The chronic obstructive pulmonary diseases segment is expected to witness significant growth in the pulmonary drug delivery systems market over the forecast period. The factors attributing to the market growth are the increasing burden of COPD among the population and the growing demand for innovative drug delivery systems.

In addition, the rising geriatric population who are more prone to develop chronic obstructive pulmonary disease diseases due to the age-associated changes in the structure and function of the lung is also expected to increase the demand for the COPD drug segment over the forecast period. For instance, according to the 2022 statistics published by the United Nations Population Fund, about 59% of the total population living in Japan was aged between 15 and 64 in 2022. In addition, as per the same source, 29% of the population was aged 65 years and above in 2022.

The increasing prevalence and incidence of COPD is the key factor driving the demand for pulmonary drug delivery systems, hence propelling the segment's growth. According to a research study published in European Respiratory Journal in July 2021, it was found that the prevalence of chronic obstructive pulmonary disease (COPD) is anticipated to increase in Europe (including the Netherlands) due to rising risk factors like smoking and air pollution. Also, as per an article published in the European Respiratory Journal in November 2021, about 49,453,852 European are expected to suffer from COPD by 2050 as compared to 36,580,965 in 2020. This is expected to fuel the segment growth over the forecast period.

Moreover, the growing R&D activities and increasing product launches in the segment are expected to augment the growth of the chronic obstructive pulmonary diseases segment. For instance, in April 2022, GlaxoSmithKline Pharmaceuticals launched Trelegy Ellipta, a once-daily single-inhaler triple therapy (SITT) for treating patients suffering from chronic obstructive pulmonary diseases in India. Also, in October 2021, Glenmark launched a bioequivalent version of the Tiotropium Bromide dry powder inhaler (DPI) to treat chronic obstructive pulmonary disease (COPD) in Spain.

Therefore, owing to the factors such as the high burden of COPD and increasing product launches, the studied segment is expected to grow over the forecast period.

North America Holds Significant Share and Expected to do the Same in the Forecast Period

North America is expected to witness healthy growth in the pulmonary drug delivery systems over the forecast period owing to factors such as the increasing incidences of respiratory diseases such as asthma, allergic rhinitis, COPD, and others, the rising geriatric population, growing demand for diagnostic devices, increasing healthcare expenditure, and high disposable income.

The rising burden of respiratory diseases among the population is the key factor driving the demand for drug-delivery systems for treating various conditions, hence boosting market growth. For instance, according to an article published by MDPI in November 2021, it was observed that children with asthma in Mexico City are significantly correlated with respiratory problems and traffic-related air pollution, worsening the asthmatic condition in patients. Also, per the data published by IQAir, in August 2021, the US AQI value for Mexico City was 74, indicating "Moderate" levels of air pollution at the beginning of 2021. In addition, as per the same source, the components of "photochemical oxidizing smog" are discharged into the atmosphere in substantial amounts, including carbon monoxide, hydrocarbons, and nitrogen oxides from the exhaust of automobiles. Thus, the increasing discharge of pollutants in the air is expected to cause various respiratory allergies such as asthma, allergic rhinitis, and others among the population. This is anticipated to propel the demand for innovative and effective pulmonary drug delivery systems such as metered dose inhalers or nebulizers, hence bolstering market growth.

Furthermore, the rise in the number of initiatives undertaken by government and non-government organizations is increasing the overall revenue. For instance, CDC's National Asthma Control Program (NACP) provides funds for educating asthma-affected patients. Such initiatives are likely to increase awareness about asthma, which will increase the demand as well as the adoption of inhalers treating asthma, thereby propelling market growth.

Moreover, the presence of key market players in the country focusing on the development of effective pulmonary drugs as well as the rising adoption of various business strategies such as agreements, acquisitions, partnerships, and increasing product launches, are likely to boost the growth of the market. For instance, in March 2022, the US FDA approved the first generic of Symbicort (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol for the treatment of asthma in patients six years of age and older and the maintenance treatment of airflow obstruction and reducing exacerbations for patients with chronic obstructive pulmonary disease (COPD), including chronic bronchitis and/or emphysema.

Therefore, the rising burden of respiratory diseases and increasing company activities and product launches in the country will significantly drive the market in the North American region during the study period.

Pulmonary Drug Delivery Systems Market Competitor Analysis

The pulmonary drug delivery systems market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Koninklijke Philips NV, GlaxoSmithKline PLC, 3M, Novartis AG, Boehringer Ingelheim International GmbH, AstraZeneca, Cipla Inc., Merck & Co., and GF Health Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements

- 4.2.2 Increasing Incidence of Respiratory Diseases and Growing Preference for Pulmonary Drug Delivery as an Alternate Route of Drug Delivery

- 4.3 Market Restraints

- 4.3.1 Strict Regulations for Drug Delivery Devices Approval

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product

- 5.1.1 Dry Powder Inhalers

- 5.1.2 Metered Dose Inhalers

- 5.1.3 Nebulizers

- 5.1.3.1 Jet Nebulizers

- 5.1.3.2 Soft Mist Nebulizers

- 5.1.3.3 Ultrasonic Nebulizers

- 5.2 By Application

- 5.2.1 Cystic Fibrosis

- 5.2.2 Asthma

- 5.2.3 Allergic Rhinitis

- 5.2.4 COPD

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Centers

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Koninklijke Philips NV

- 6.1.2 GlaxoSmithKline PLC

- 6.1.3 3M

- 6.1.4 Novartis AG

- 6.1.5 Boehringer Ingelheim International GmbH

- 6.1.6 AstraZeneca

- 6.1.7 Cipla Inc.

- 6.1.8 Merck & Co.

- 6.1.9 GF Health Products Inc.

- 6.1.10 Aerogen

- 6.1.11 PARI GmbH

- 6.1.12 Gilbert Technologies