|

市场调查报告书

商品编码

1244365

全球医疗保健 IT 供应商市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Healthcare IT Provider Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球医疗保健 IT 提供商市场预计将以 13.5% 的复合年增长率增长。

COVID-19 对医疗保健 IT 提供商市场产生了重大影响,原因包括越来越多地采用远程医疗而不是医生面对面的咨询。 在全球停电之后,旅行限制减少了去医院的次数。 人们越来越不愿意去医院和诊所就诊,这也推动了数字医疗保健的发展。

根据 2022 年 4 月在 PubMed 上发表的一篇论文,CDSS 将提供优质服务,消除不必要的测试,提高 COVID-19 患者的安全性,并可能预防代价高昂的并发症。 由于医院对医疗保健 IT 技术的需求增加以及政府对医疗保健 IT 平台开发的资金增加等因素,预计未来几年市场将出现增长。

此外,根据 2021 年 10 月在 Research Gate 上发表的一篇文章,COVID-19 已成为数字医疗创新的催化剂和加速器。 在大流行期间,美国已批准立法以允许更无缝的数据流。 欧盟整合了成员国之间的数据,以实现 EHR 的跨境交换。 因此,全球对医疗保健 IT 的日益接受预计将成为未来几年市场增长的推动力。

其他驱动因素包括对无纸化的需求不断增长、社交媒体的出现及其对医疗保健 IT 行业的影响,以及政府对医疗保健服务和基础设施的资助不断增加。 随着 EHR 在欧洲国家的实施,CDSS 的使用正在扩大。 2022 年 6 月,欧盟委员会通过了一项关于欧洲电子健康记录交换格式的建议,以解锁跨境健康数据的流动。 预计该采用将促进欧洲电子健康记录 (EHR) 的跨境互操作性。 因此,由于欧盟委员会对采用 EHR 的新规定,预计医疗保健 IT 提供商市场将显着增长。

此外,2021 年,总部位于旧金山的医疗保健技术初创公司 Innovaccer 和总部位于蒙大拿州的非营利性医疗保健系统 St. Peter's Health 将推出后者的医疗保健云平台。这些平台将被整合到护理中心,并正在合作加强护理管理。 同样,为了改善临床决策支持,佛罗里达州棕榈滩县的索莫医疗中心将于 2021 年开始实施由健康 IT 供应商 eClinicalWorks (CDS) 提供的基于云的 EHR。 部署基于云的 EHR 系统比内部 EHR 系统便宜得多。

医疗保健 IT 提供商的战略合作伙伴关係和收购预计也将提高对其产品的可用性和需求,从而推动市场增长。 例如,2022 年 6 月,Cerner 收购了甲骨文,甲骨文是医院和医疗保健系统中使用的数字信息系统提供商,旨在帮助医疗保健专业人员提供更好的医疗保健服务。

因此,由于对无纸化的需求不断增加、政府对医疗保健服务和基础设施的资助增加以及主要参与者的合作和收购激增,我们预计医疗保健 IT 提供商市场在预测期内将会增长。您可以 然而,熟练劳动力短缺和高维护成本预计将抑制市场增长。

医疗保健 IT 供应商市场趋势

临床决策支持系统 (CDSS) 部分有望推动市场发展。

临床决策支持系统 (CDSS) 部分预计将在预测期内推动市场增长。 这是因为 CDSS 工具使开处方者能够访问实时患者数据,从而获得理想的结果,例如提高患者安全性和用药准确性。 这些措施可能会减少医疗支出,从而在预测期内提振 CDSS 行业。

根据英联邦基金 2021 年 8 月的更新,不断上涨的医疗保健成本是州政府及其选民的担忧,因为他们面临着更高的自付费用和保费。 将 CDS 警报集成到医院 EHR 中旨在降低成本。 欧盟委员会在其 2022 年 6 月的报告中发布了有关欧洲电子病历交换标准的建议,以实现健康数据的跨境传输。 为此,我们支持欧盟国家的努力,使公民能够从欧盟任何地方安全地访问和交换他们的健康数据。 与此类医疗保健进步相关的举措预计将在预测期内推动该细分市场的增长。

此外,政府整合 CDSS 系统和医院指南更新的举措将在预测期内推动市场增长。 例如,2022 年 9 月,FDA 发布了一份关于临床决策支持软件的指导文件,指出符合设备定义的软件功能,包括那些旨在供患者或护理人员使用的功能,继续符合 FDA 当前的数字健康标准. 强调它受制于

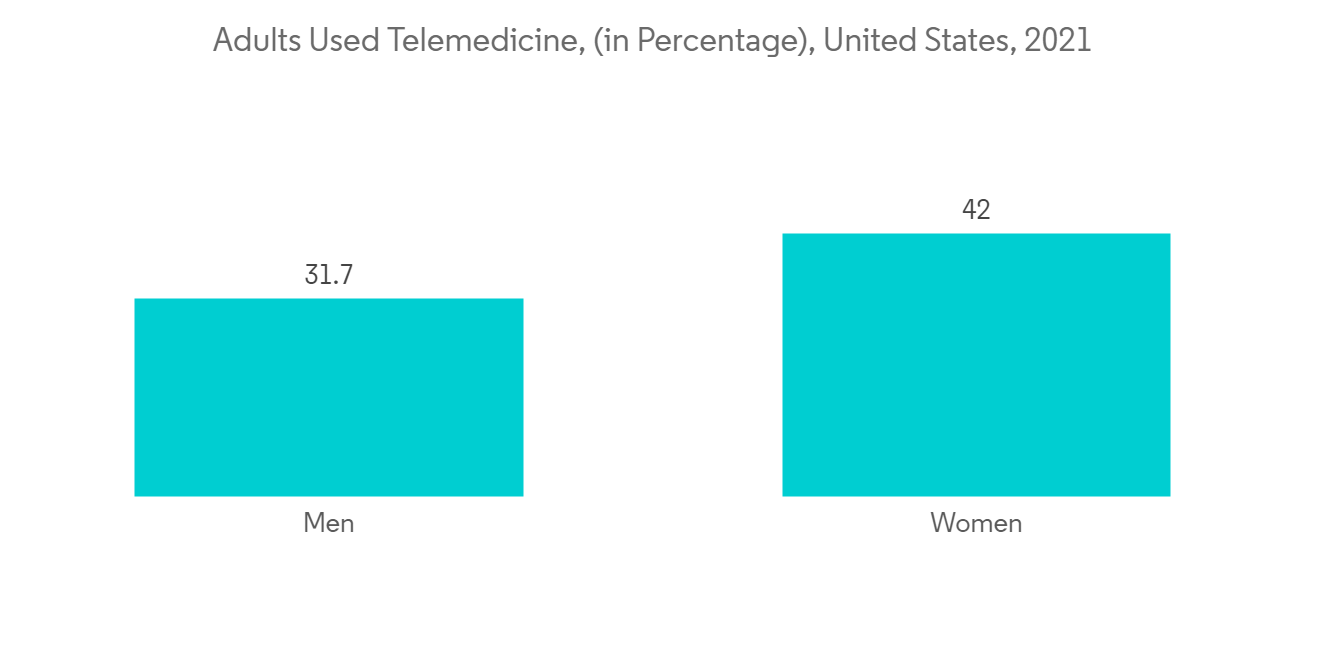

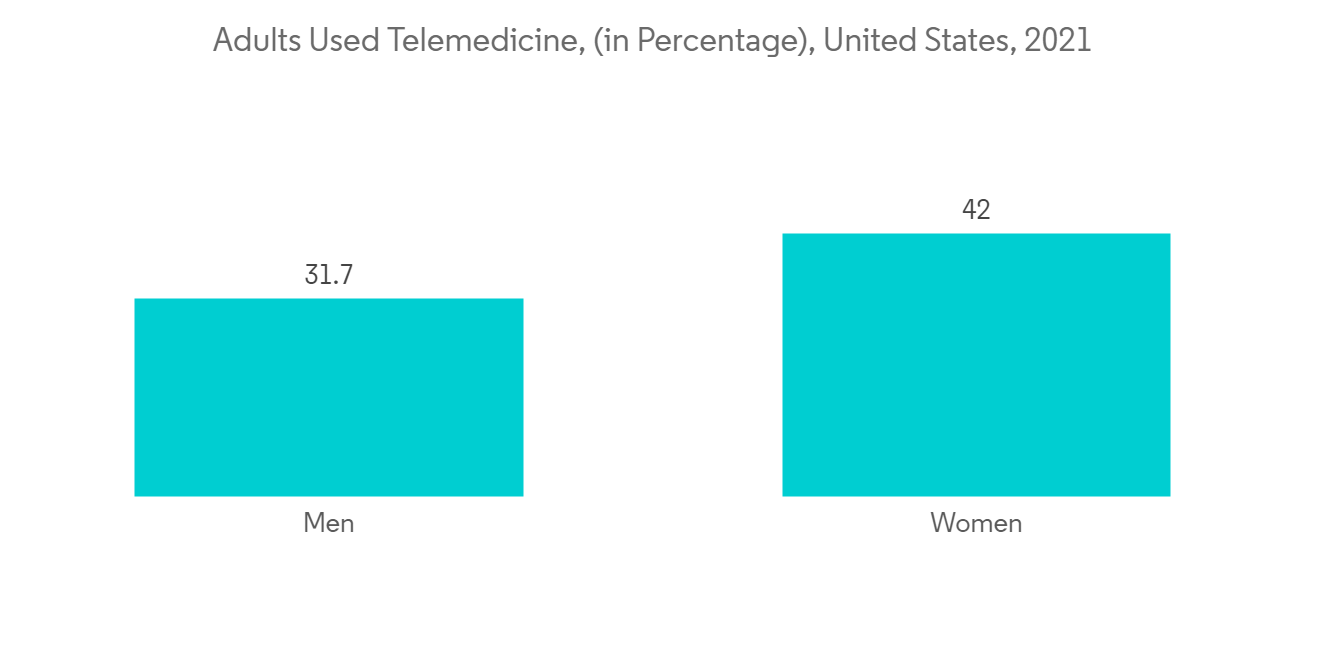

此外,2022 年 8 月,帕鲁鲁大学的组成大学帕鲁鲁医学科学研究所与 Walters Kluwer 联手。 作为此次合作的一部分,Walters Kluwer 在研究所部署了临床决策支持系统 (CDSS),以提高循证医疗服务的质量。 研究所根据该协议推出的产品包括 UpToDate、UpToDate Advanced 和 Lexicomp。 此外,通过使患者和临床医生能够在復杂疾病的持续治疗过程中共同做出决策,远程医疗和临床决策支持的结合有可能成为未来的一个很好的选择。 根据国家卫生统计中心的《2021 年全国健康访谈调查》,2021 年美国将有 37% 的人口使用远程医疗。

因此,由于医疗保健行业对 CDSS 实施的需求不断增长,以及政府对医疗保健服务和基础设施的资助不断增加,CDSS 细分市场在预测期内可能会出现增长。

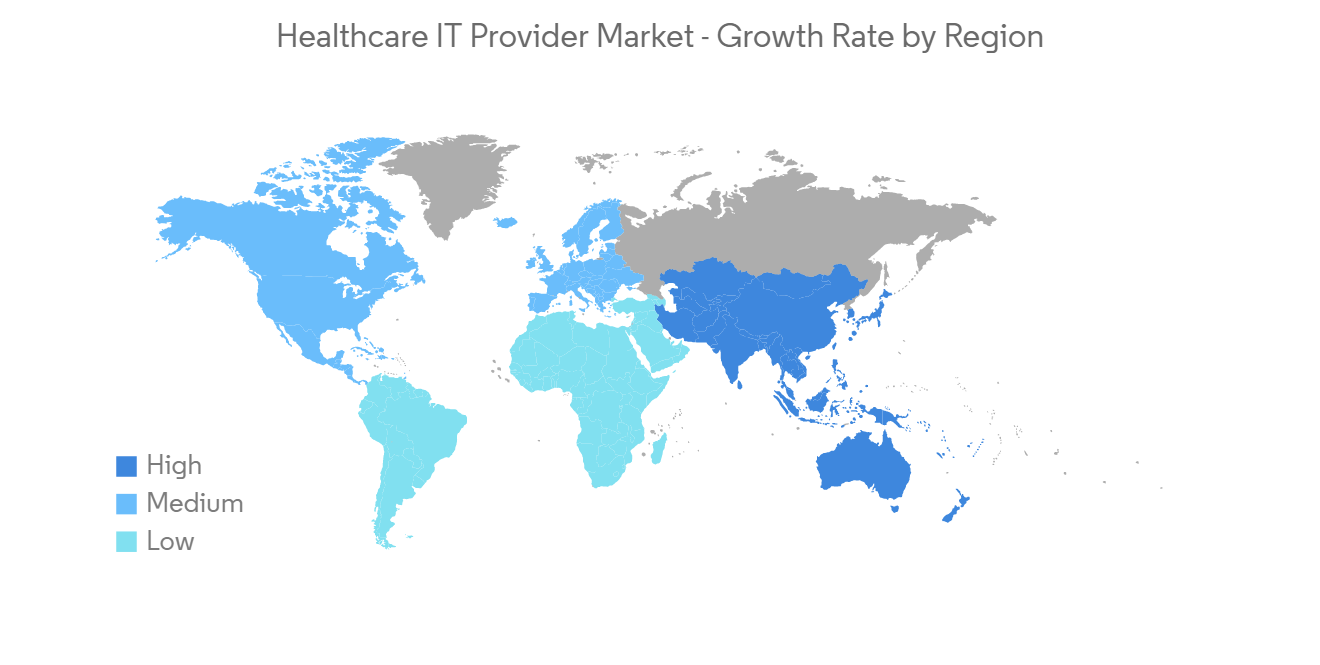

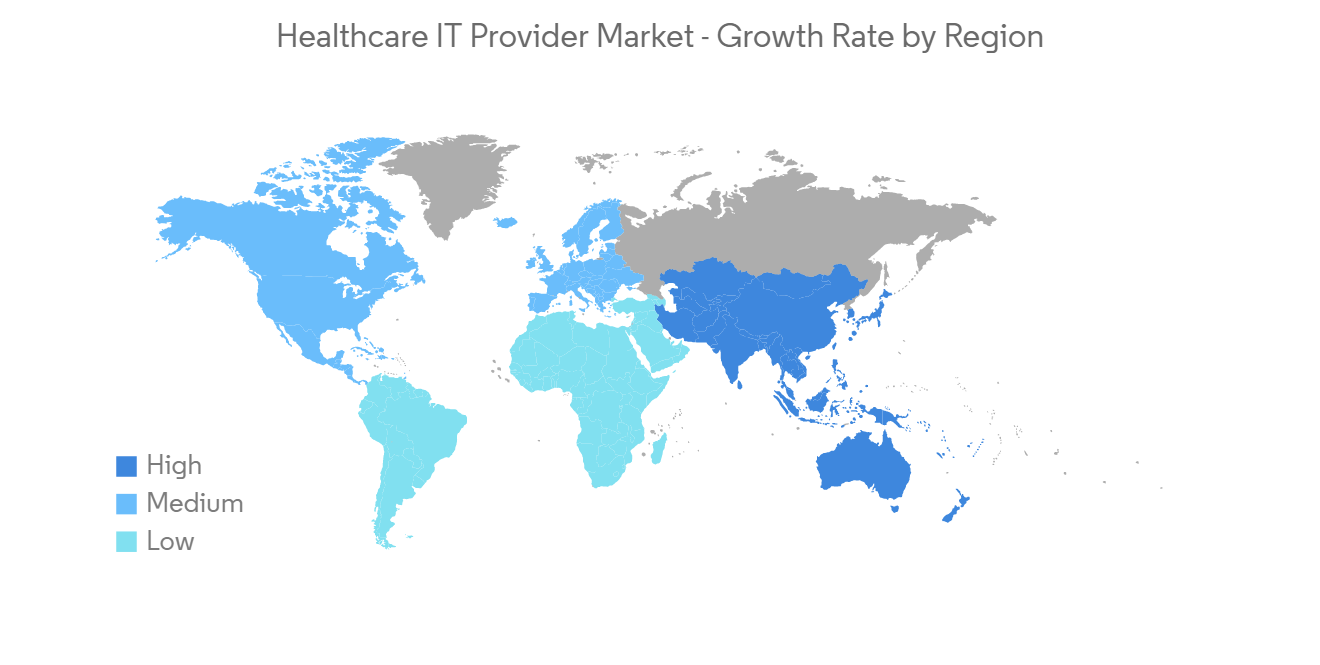

北美市场有望增长

在北美,医疗保健 IT 供应商市场预计将在预测期内增长,因为医疗行业发达,医疗机构越来越多地采用 IT 服务。 主要医疗保健供应商的集中以及政府对医疗保健 IT 服务和基础设施的资助增加也推动了北美市场的增长。

2021 年 2 月,Northern Inyo Healthcare District 与 Cerner Corporation 合作进行电子健康记录 (EHR) 转型。 在这次合作中,北部 Inyo 医疗保健区过渡到现代电子系统,支持医生、护士和临床医生在多个地区办事处共享数据。

同样,在 2022 年 5 月,根据拜登政府增加获得 COVID-19 药物的倡议,总部位于威斯康星州的 Epic Systems 将使用 EHR 来帮助患有 COVID-19 的患者和医生19,试图让寻找抗病毒治疗变得更容易。 Epic 的软件用于在常规临床和大规模疫苗接种环境中每天提供大约 500,000 次免疫接种。

此外,软件和服务在该国的扩张预计将推动市场的增长。 例如,2022 年 2 月,Hoy Health 在墨西哥最重要的国家供应社区之一墨西哥城 Central de Abastos 通过 HoyDOCO 平台提供了远程医疗服务。 商业区占地 304 英亩,拥有由 2,000 多家企业、生产商、批发商、零售商和消费者组成的综合供应炼网络。 Hoy Health 是一家健康科技公司,通过远程患者监控、远程医疗和药物获取,引领数字健康行业的初级保健。

因此,由于对医疗保健 IT 服务的需求不断增加以及政府对医疗保健服务和基础设施的资助不断增加,预计在预测期内北美的医疗保健 IT 提供商市场将出现增长。

医疗保健 IT 提供商行业概览

医疗保健 IT 提供商市场本质上是分散的。 市场参与者正专注于技术进步,并对医院基础设施和患者管理进行大量投资。 市场上的主要参与者包括 Allscripts Healthcare Solutions、Oracle(Cerner Corporation)、IBM Corporation、Siemens Healthineers 和 Philips Healthcare。

额外福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第2章研究方法论

第 3 章执行摘要

第4章市场动态

- 市场概览

- 市场驱动因素

- 无纸化需求增加

- 社交媒体的出现及其对医疗保健 IT 行业的影响

- 增加用于医疗保健服务和基础设施的政府预算

- 市场製约因素

- 缺乏技术工人

- 维护成本高

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(市场规模 - 百万美元)

- 按业务部门

- 实验室信息系统 (LIS)

- 放射学信息系统 (RIS)

- 心血管信息系统 (CVIS)

- 电子健康记录 (EHR)

- 远程医疗

- 临床决策支持系统 (CDSS)

- 图像存储通信系统 (PACS) 和供应商中立存檔 (VNA) | Hitachi Solutions, Ltd.

- 其他业务部门

- 按组件

- 软件

- 硬件

- 服务详情

- 按送货方式

- 本地

- 基于云

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章 竞争情势

- 企业檔案

- Allscripts Healthcare Solutions Inc.

- Oracle(Cerner Corporation)

- General Electric Company(GE Healthcare)

- Epic Systems Corporation

- IBM Corporation

- Koninklijke Philips NV

- Mckesson Corporation

- Siemens Healthineers

- SAS Institute Inc.

- Wipro

- 3M

- Optum Inc.

第7章 市场机会与今后动向

The healthcare IT provider market is expected to register a CAGR of 13.5% over the forecast period.

COVID-19 significantly impacted the healthcare IT provider market, owing to factors such as the rise in the adoption of teleconsultation instead of face-to-face physician consultations. Due to the global lockdown, travel restrictions decreased hospital visits. Similarly, people's hesitation in going to hospitals and clinics boosted digital healthcare.

As per the article published in April 2022 in PubMed, CDSSs provided quality services, eliminated unnecessary testing, increased patient safety from COVID-19, and prevented potentially dangerous and expensive complications. The market is anticipated to witness growth in the coming years owing to the factors such as a rise in demand for healthcare IT technologies in hospitals and an increase in government funding for developing healthcare IT platforms.

Furthermore, as per the article published in Research Gate in October 2021, COVID-19 served as a catalyst and accelerator for digital healthcare innovation. During the pandemic, the United States approved legislation allowing a more seamless data flow. The European Union integrated data across member states to permit the interchange of EHRs across borders. Such instances of increase in acceptance of healthcare IT across the globe are likely to drive market growth in the coming years.

Other driving factors include the rise in the demand for paperless technology, the emergence of social media and its impact on the healthcare IT industry, and increased government funding for healthcare services and infrastructure. With the rising adoption of EHR across the European countries, there is a growing use of CDSS. In June 2022, the European Commission adopted a Recommendation for the European electronic health record exchange format to unlock the flow of health data across borders. This adoption will likely facilitate cross-border interoperability of electronic health records (EHRs) in the European countries. Hence, with the new regulations from the European Commission for adopting EHR, the healthcare IT provider market is anticipated to grow significantly.

Furthermore, in 2021, San Francisco-based healthcare technology startup Innovaccer, and Montana-based non-profit health system St. Peter's Health, collaborated to integrate the latter's healthcare cloud platform into care locations and enhance care management. Similarly, to improve clinical decision support, in 2021, Somo Medical Center in Palm Beach County, Florida, started a cloud-based EHR deployment from health IT vendor eClinicalWorks (CDS). Implementing a cloud-based EHR system is much cheaper than an in-house EHR system.

Strategic partnerships and acquisitions by healthcare IT providers are also anticipated to increase the availability and demand for their products, promoting the market growth. For instance, in June 2022, Cerner acquired Oracle, the provider of digital information systems used within hospitals and health systems to enable medical professionals to deliver better healthcare services.

Thus, due to the rise in the demand for paperless technology, increased government funding for healthcare services and infrastructure, and the surge in collaborations and acquisitions by the key players, the healthcare IT provider market is likely to witness growth over the forecast period. However, a lack of skilled labor and high maintenance costs are anticipated to restrain the market growth.

Healthcare IT Provider Market Trends

Clinical Decision Support System (CDSS) Segment Expected to Drive the Market

The clinical decision support system (CDSS) segment is anticipated to drive market growth during the forecast period, owing to the factors such as CDSS tools enabling prescribers to access real-time patient data, ideally resulting in enhanced patient safety and medication accuracy. These measures will likely reduce healthcare expenditure, thereby boosting the CDSS segment over the forecast period.

According to the August 2021 update from Commonwealth Fund, rising healthcare spending is a concern for state governments and their constituents, who face higher out-of-pocket costs and premiums. By integrating CDS alerts into EHRs in hospitals, expenses are intended to be reduced. As per the European Commission June 2022 report, the European Commission issued a Recommendation on a European electronic health record exchange standard to enable the transfer of health data across borders. It accomplished this by supporting EU nations in their initiatives to ensure that residents can safely access and exchange their health data from any location within the EU. Such initiatives associated with the advancements in healthcare are anticipated to boost segment growth over the forecast period.

Additionally, government initiatives incorporating CDSS systems and updated hospital guidelines will boost market growth during the forecast period. For instance, in September 2022, the FDA released a guidance document for Clinical Decision Support Software which emphasized that software features that satisfy the definition of a device, including those intended for use by patients or caregivers, continue to be subject to the FDA's current digital health standards.

Furthermore, in August 2022, the Parul Institute of Medical Sciences and Research, a constituent college of Parul University, joined hands with Wolters Kluwer. As a part of this collaboration, Wolters Kluwer deployed its Clinical Decision Support System (CDSS) at the institute to enhance the quality of evidence-based care delivery. The products deployed by the institute under this deal include UpToDate, UpToDate Advanced, and Lexicomp. Moreover, by allowing patients and clinicians to collaborate on decisions throughout the continuum of treatment for complicated diseases, the combination of telemedicine and clinical decision support is likely to be a great option in the coming future. As per the National Center for Health Statistics, National Health Interview Survey, 2021, telemedicine was used by 37% of the population in the United States in 2021.

Thus, due to the rise in the demand for CDSS implementation in the healthcare industry and increased government funding for healthcare services and infrastructure, the CDSS segment is likely to witness growth over the forecast period.

North America Anticipated to Witness Growth in the Market

North America is anticipated to observe growth in the healthcare IT provider market during the forecast period, owing to the factors such as the region's well-established healthcare industry and the early adoption of IT services across healthcare settings. In addition, the high concentration of key healthcare providers and increased government funding for healthcare IT services and infrastructure also drive market growth in North America.

In February 2021, Northern Inyo Healthcare District collaborated with Cerner Corporation to transform its electronic health record (EHR). The collaboration involved Northern Inyo Healthcare District moving to an updated electronic system that supports physicians, nurses, and clinicians to share data across the district's multiple offices.

Similarly, in May 2022, based on a Biden administration initiative to increase access to COVID-19 medication, Wisconsin-based Epic Systems attempted to make it simpler for patients and physicians to find COVID-19 antiviral treatments using its EHR. Epic software was used to administer roughly 500,000 daily vaccinations across traditional clinical settings and mass vaccination sites.

Furthermore, software and services expansions across the country are anticipated to drive market growth. For instance, in February 2022, Hoy Health offered telemedicine services via its HoyDOCO platform at the Central de Abastos in Mexico City, one of the most important Mexican national supply communities. The commercial district spans 304 acres and facilitates a comprehensive supply chain network of over 2,000 businesses, producers, wholesalers, retailers, and consumers. Hoy Health is a health tech company that is leading primary care in the digital health industry via remote patient monitoring, telehealth, and medication access.

Thus, due to the rise in the demand for Healthcare IT services and the increase in government funding for healthcare services and infrastructure, North America is anticipated to witness growth in the healthcare IT provider market over the forecast period.

Healthcare IT Provider Industry Overview

The healthcare IT provider market is fragmented in nature. The major market players are focusing on technological advancements and high investments in hospital infrastructure and patient management. Some of the major players in the market are Allscripts Healthcare Solutions, Oracle (Cerner Corporation), IBM Corporation, Siemens Healthineers, and Philips Healthcare, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in the Demand for Paper-less Technology

- 4.2.2 Emergence of Social Media and its Impact on the Healthcare IT Industry

- 4.2.3 Increased Government Funding on Healthcare Services and Infrastructure

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Labor

- 4.3.2 High Maintenance Costs

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Business Segment

- 5.1.1 Laboratory Information Systems (LIS)

- 5.1.2 Radiology Information Systems (RIS)

- 5.1.3 Cardiovascular Information System (CVIS)

- 5.1.4 Electronic Health Records (EHR)

- 5.1.5 Telemedicine

- 5.1.6 Clinical Decision Support System (CDSS)

- 5.1.7 Picture Archiving and Communication System (PACS) & Vendor Neutral Archive (VNA)

- 5.1.8 Other Business Segments

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Hardware

- 5.2.3 Services

- 5.3 By Delivery Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allscripts Healthcare Solutions Inc.

- 6.1.2 Oracle (Cerner Corporation)

- 6.1.3 General Electric Company (GE Healthcare)

- 6.1.4 Epic Systems Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Koninklijke Philips NV

- 6.1.7 Mckesson Corporation

- 6.1.8 Siemens Healthineers

- 6.1.9 SAS Institute Inc.

- 6.1.10 Wipro

- 6.1.11 3M

- 6.1.12 Optum Inc.