|

市场调查报告书

商品编码

1244369

全球图像引导治疗系统市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Image Guided Therapy System Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球图像引导治疗系统市场预计将以 6.5% 的复合年增长率增长。

由于在 COVID 期间越来越多地采用图像引导疗法,COVID-19 在预测期内对市场增长产生了重大影响。 例如,在 2022 年 7 月发表在 RSNA 期刊上的一篇论文中,与普通人群相比,在大流行恢復期间接受图像引导皮质类固醇注射以控制疼痛的成年人出现症状的可能性要小得多。提到-19。 影像引导关节注射是一种具有抗炎作用的类固醇药物注射,通过透视和超声波来精确定位进针位置并显示进针进度。 此外,由于慢性病的增加、老年人口的增加以及癌症放射治疗的激增,预计未来几年图像引导治疗系统市场将出现增长。 例如,根据 2022 年 2 月发表的一篇论文,图像引导手术可以通过允许外科医生优化手术方法来促进肿瘤学安全并减少胃癌手术的并发症。一项新的发展显示了使用术中高光谱成像的前景 ( HSI)在术中组织诊断中的应用。

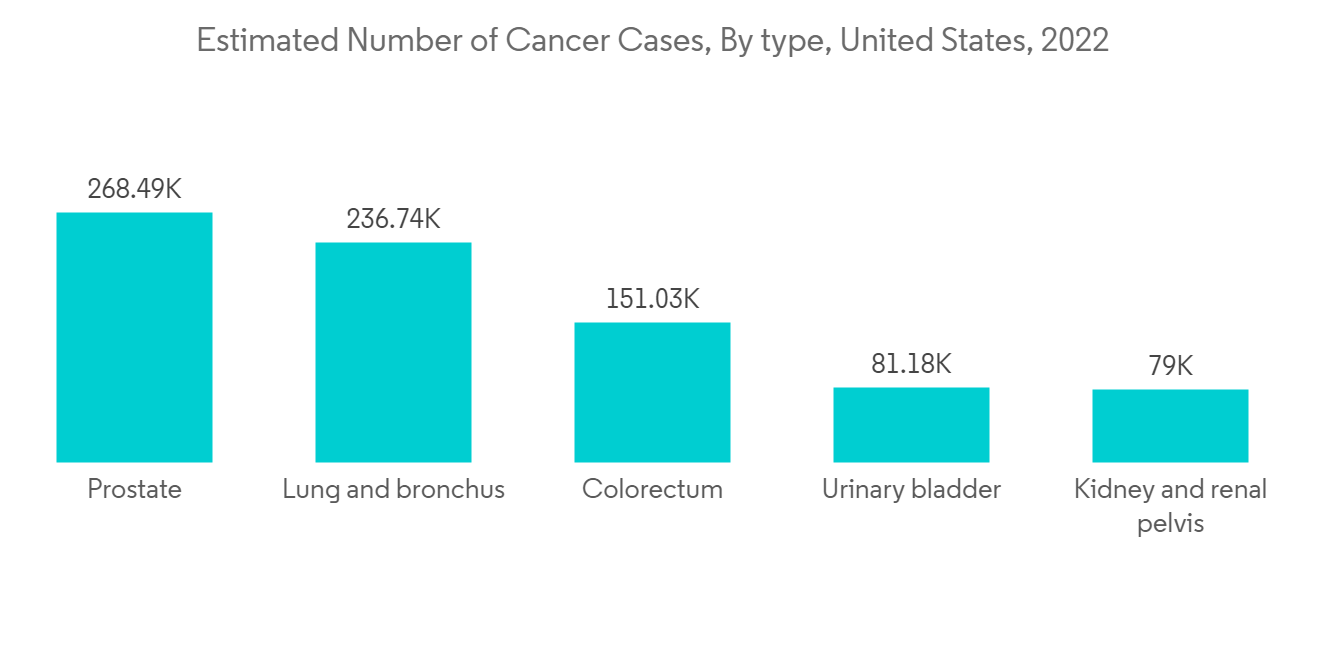

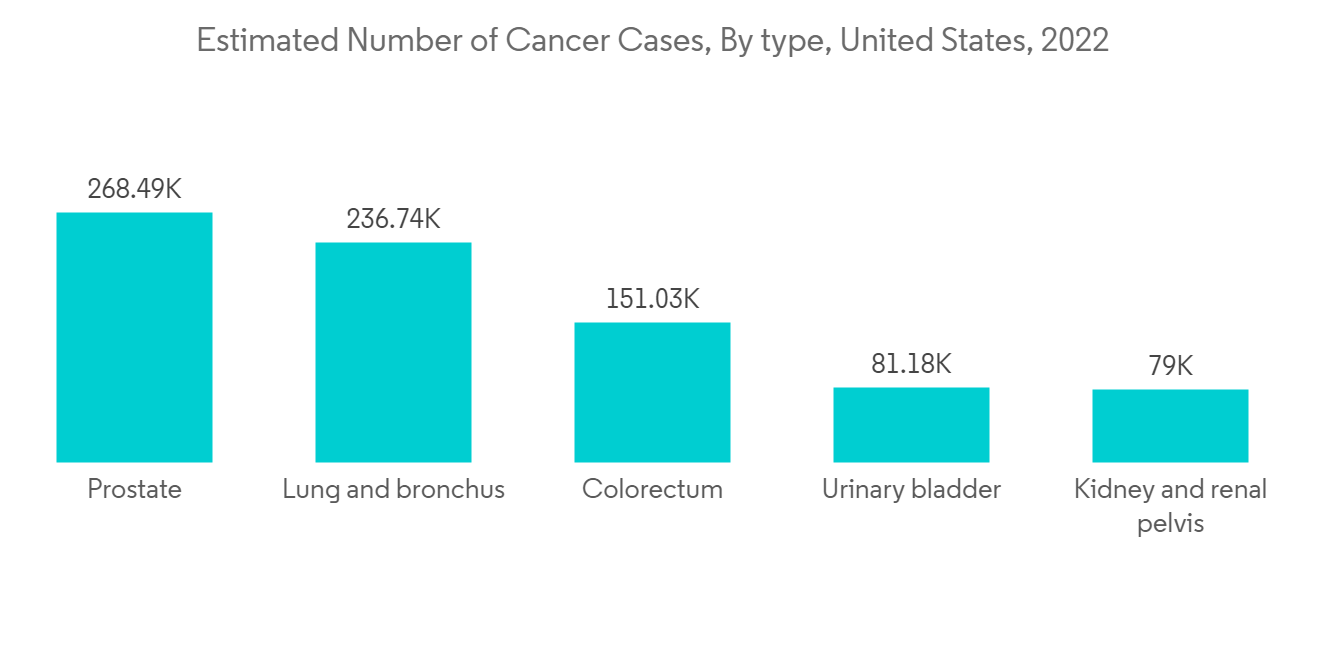

有几个因素正在推动图像引导治疗系统的发展,包括人口老龄化、慢性病负担增加以及癌症放射治疗工作的增加。 例如,根据美国癌症协会 2022 年更新,2022 年美国估计将有 190 万新癌症病例。 因此,癌症患者的高患病率导致对微创外科手术的需求增加,从而有助于预测期内图像引导治疗系统市场的增长。

此外,影像引导治疗方面的研究合作、合作伙伴关係和产品发布预计将在预测期内推动市场增长。 例如,2021 年 8 月,皇家飞利浦与 MedTech 中风护理公司 NICO.LAB 签署协议,为飞利浦图像引导治疗系统 Azurion 开发新的中风功能。 这一新的合作伙伴关係凸显了飞利浦致力于为中风患者带来改变的决心。 此外,2021 年 2 月,飞利浦推出了脊柱手术图像引导治疗解决方案 ClarifEye 增强现实手术导航。 该解决方案旨在推进飞利浦 Hybrid Suite 等混合手术室中的微创脊柱手术。

此外,由于老年人口增多,高血压、高血脂、癌症等多种慢性病发生的可能性很大。 例如,WPP 2022年发布的数据预测,到2050年,全球65岁及以上人口数量将是5岁以下儿童数量的两倍以上,与5岁以下儿童数量几乎持平。 12岁。它已经。 此外,微创图像引导治疗方法是首选,因为它们可以减少术后并发症并降低医疗费用。

因此,由于慢性病的增加、老年人口的高患病率以及微创手术的普及,预计图像引导治疗系统市场将在预测期内推动增长。

图像引导治疗系统市场趋势

内窥镜领域有望占据影像引导治疗市场的很大份额

在影像引导治疗系统市场中,内窥镜系统领域由于癌症和胃肠道疾病的增加等因素有望增长。 根据国际胃肠道疾病基金会 2022 年更新,估计全球 5-10% 的人口患有炎症性肠病。 据估计,美国每年有 2.4 至 350 万胃肠病学家就诊。 这些因素有望推动图像引导治疗系统的采用,并促进该领域的发展。 此外,大量内窥镜引导手术和越来越多地采用机器人辅助内窥镜引导手术进行诊断也是推动市场的重要因素。

此外,技术先进的内窥镜以及许多产品的开发和发布已经成为内窥镜领域的导火索。 例如,2022 年 8 月,美敦力推出了 GI Genius,这是一种用于治疗结肠癌的人工智能驱动内窥镜模块。 由于这些疗法在神经病学、放射肿瘤学和创伤治疗中的广泛使用,磁共振图像引导治疗领域也出现了显着的市场增长。 此外,2022 年 2 月,Ambu 在美国获得了 FDA 对 Ambu aScope Gastro 和 Ambu aBox 2的510(k)监管许可。 aScope Gastro 是 Ambu 的第一款无菌一次性胃镜,在结合了下一代显示和处理器技术的解决方案中融入了新的高级成像和设计功能。

因此,由于需要内窥镜检查的慢性疾病的增加、内窥镜产品推出的增加以及微创手术的采用增加,预计内窥镜领域将继续呈现市场增长。

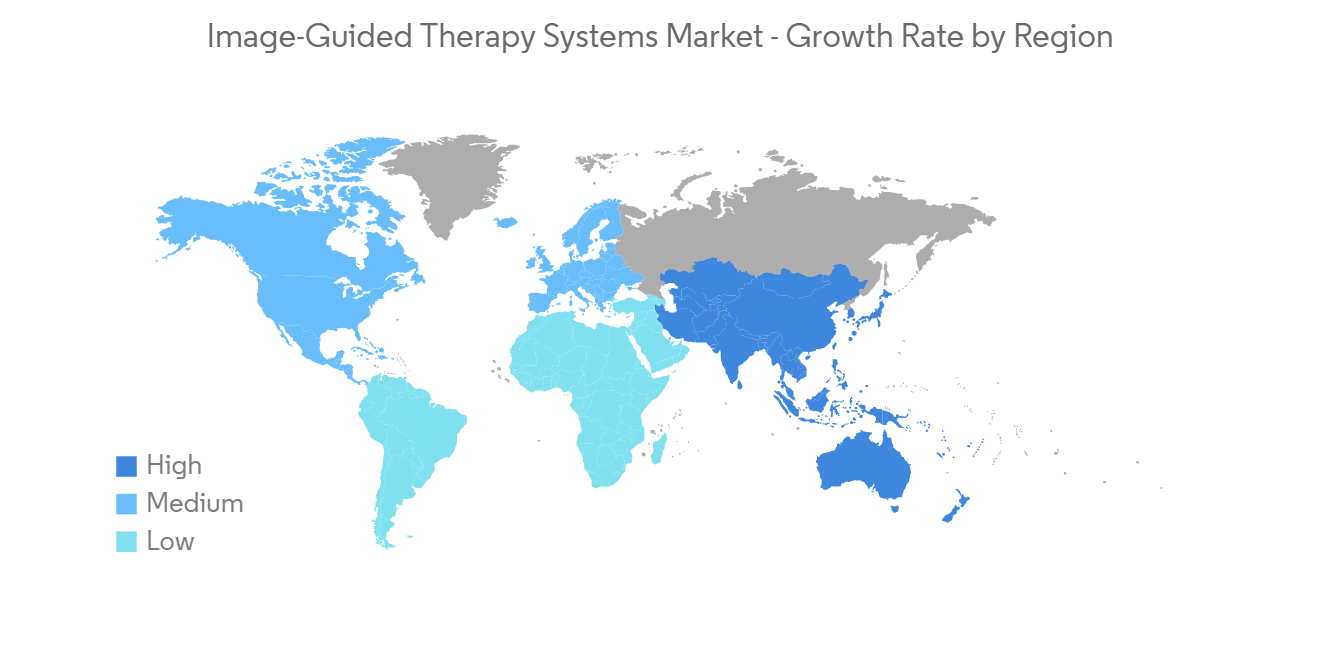

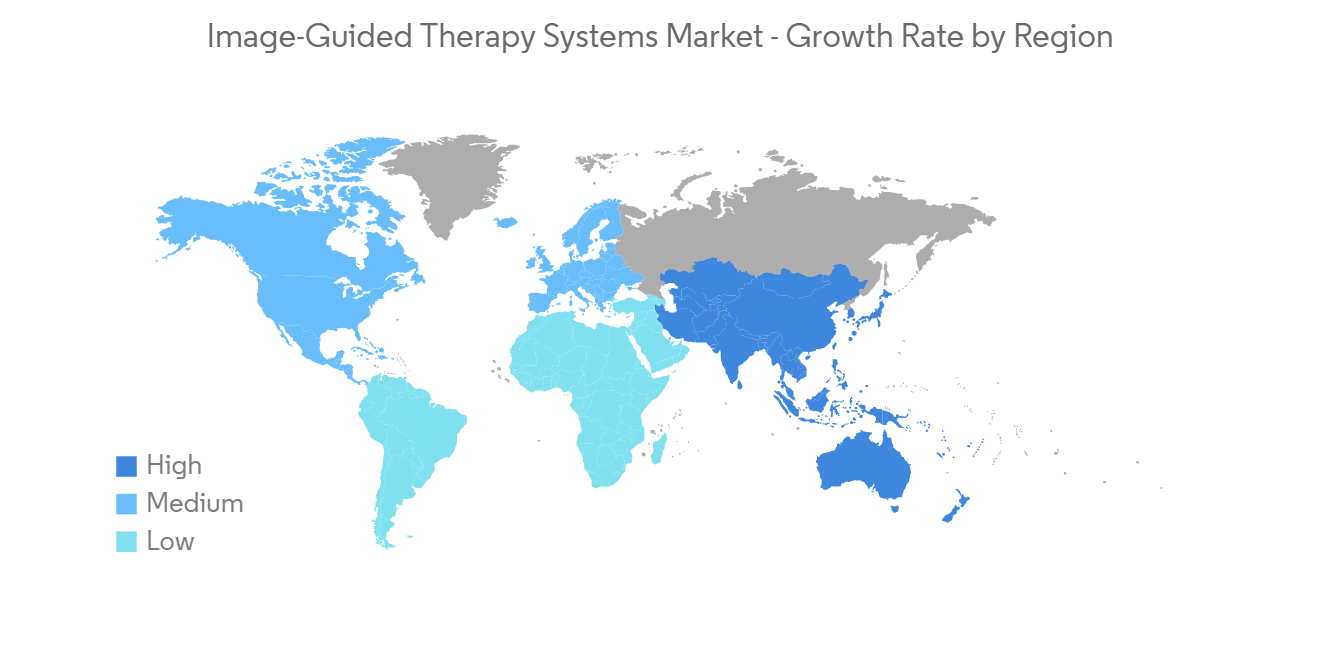

北美将占据很大的市场份额,预计在预测期内也会如此

由于其完善的医疗保健基础设施、不断增加的产品发布以及随着技术进步对先进放射疗法的快速采用,预计北美将在全球图像引导治疗系统市场中占据很大份额。

此外,随着人口老龄化,慢性病患者数量不断增加,报销以价值为基础,预计对微创治疗的需求会很高。被认为会促进增长 例如,根据加拿大统计局的 2022 年报告,到 2022 年,估计加拿大将有 233,900 人被诊断出患有癌症。

此外,图像引导治疗系统的产品发布、合作和伙伴关係有望促进市场增长。 例如,2022 年 6 月,GE Healthcare 宣布了用于微创图像引导手术的 Allia 平台。 通过与外科医生和介入医生的多年合作开发,这个新平台将改善消费者体验,提高工作流程效率,并在日常生活中增加对已开发图像指导的采用。 此外,2022 年 1 月,美敦力完成了对总部位于波士顿地区的私营医疗技术公司 Afella 的收购。 通过此次收购,美敦力将扩大其心臟消融产品和补充剂的供应范围,以满足不断增长的患者群体对医生的需求。

因此,由于慢性疾病的增加、图像引导治疗系统产品的推出增加以及微创手术的采用增加,预计北美地区的图像引导治疗系统市场在预测期内将出现增长。

图像引导治疗系统行业概览

图像引导治疗市场竞争适中,由几家大型企业组成。 就市场份额而言,目前少数大公司占据市场主导地位。 一些大公司正在收购其他公司以巩固其在全球市场的地位,其他公司则正在推出新产品。 目前主导市场的公司有 Siemens Healthneers、Koninklijke Philips N.V.、Altaris Capital Partners, LLC(Analogic Corporation)、Medtronic、KARL STORZ SE & Co.KG 和 Stryker Corporation。

他特典:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 研究假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 老年人口增加

- 慢性病负担将上升

- 癌症放疗倡议的数量增加

- 市场製约因素

- 图像引导治疗设备的定价

- 波特五力

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(按价值划分的市场规模 - 百万美元)

- 按产品类型

- 超声诊断设备

- 计算机断层扫描 (CT)

- 磁共振成像 (MRI)

- 内窥镜

- 正电子发射断层扫描 (PET)

- 其他

- 通过申请

- 神经外科

- 心臟外科

- 泌尿科

- 骨科

- 其他

- 最终用户

- 医院

- 门诊手术中心

- 诊所

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章 竞争情势

- 企业檔案

- Siemens Healthineers

- Koninklijke Philips N.V.

- General Electric Company(GE Healthcare)

- Altaris Capital Partners, LLC(Analogic Corporation)

- Brainlab

- Medtronic Plc

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Stryker Corporation

第7章 市场机会与今后动向

The image-guided therapy system market is expected to register a CAGR of 6.5% during the forecast period.

COVID-19 had a significant impact on the growth of the market during the forecast period owing to the rising adoption of image-guided therapy during COVID. For instance, the article published in July 2022 in the RSNA journal mentioned that adults who received image-guided corticosteroid injections for pain management performed during the pandemic recovery period had a lower incidence of symptomatic COVID-19 compared with the general population. An image-guided joint injection is a shot of anti-inflammatory steroid medicine that uses fluoroscopy or ultrasound to pinpoint where the needle needs to go and to show the needle's progress. Furthermore, the image-guided therapy system market is anticipated to witness growth in the coming years due to the rise in chronic diseases, the rise in the geriatric population, and the surge in cancer radiotherapy. For instance, as per the article published in February 2022, image-guided surgery can contribute to oncologic safety and decrease complications in gastric cancer surgery by helping surgeons optimize the surgical approach, and new developments show promise for the use of Intraoperative hyperspectral imaging (HSI) in intraoperative tissue diagnostics.

Several factors, such as a rise in the geriatric population, an increase in the burden of chronic diseases, and an increase in the number of initiatives for cancer radiotherapy, are propelling the growth of the image-guided therapy system. For instance, as per the American Cancer Society 2022 update, the estimated number of new cancer cases is 1.9 million in 2022 in the United States. Thus, the high prevalence of cancer cases leads to the rising demand for minimally invasive surgical procedures, thereby contributing to the growth of the image-guided therapy system market over the forecast period.

Moreover, collaborations, partnerships, and product launches in image-guided therapy are expected to drive market growth over the forecast period. For instance, in Aug 2021, Royal Philips signed an agreement with NICO.LAB, a MedTech stroke care company, to newly developed stroke abilities of Philips Image Guided Therapy System, Azurion. The new partnership particularly promotes Philips' dedication to enhancing results for people who suffer a stroke. Additionally, in February 2021, Philips launched an image-guided therapy solution called ClarifEye Augmented Reality Surgical Navigation for spine procedures; this solution has been designed to advance minimally-invasive spine procedures in the hybrid operating room, such as Philips hybrid suite.

Also, an increase in the geriatric population is likely to lead to many chronic conditions such as hypertension, high cholesterol, cancer, and many more, which further has a high chance of adopting an image-guided therapy system as the population is more inclined toward minimally invasive procedures. For instance, the data published by WPP in 2022, by 2050, the number of persons aged 65 years or over worldwide is projected to be more than twice the number of children under age five and about the same as the number of children under age 12. Moreover, minimally invasive image-guided therapies are preferred more as they reduce postoperative complications and control healthcare costs.

Thus, due to the rise in chronic diseases, the high prevalence of the geriatric population, and the increased adoption of minimally invasive procedures, the image-guided therapy system market is expected to drive growth over the forecast period.

Image Guided Therapy System Market Trends

Endoscopes Segment is Expected to Hold a Significant Market Share in the Image Guided Therapy System Market

The endoscopic system segment is anticipated to witness growth in the image-guided therapy system market owing to the factors such as the growing incidences of cancer and gastrointestinal diseases. According to the International Foundation for Gastrointestinal Disorders 2022 updates, it's estimated that 5-10% of the population has inflammatory bowel disease worldwide. Gastroenterologist visits in the United States were found to be 2.4 to 3.5 million yearly. Such factors are likely to boost the adoption of image-guided therapy systems, thereby contributing to the growth of the segment. The high volume of endoscope-guided surgeries with increased adoption of robot-assisted endoscopic-guided surgeries for diagnosis purposes is some more key driving factors for the market.

Moreover, technologically advanced endoscopies with many product developments and launches help to trigger the endoscopy segment. For example, in August 2022, Medtronic launched GI Genius, an artificial intelligence-driven endoscopy module for treating colorectal cancer. In addition, the magnetic resonance imaging-guided therapy segment is also showing significant market growth as these therapies are widely used in neurology, radiation oncology, and trauma care. Furthermore, in February 2022, Ambu received the 510(k) regulatory clearance from the FDA for the Ambu aScope Gastro and Ambu aBox 2 in the United States. aScope Gastro is Ambu's first sterile single-use gastroscope and includes new advanced imaging and design features in a combined solution with next-generation display and processor technology.

Thus, due to the rise in chronic diseases that require endoscopy, the rise in endoscopy product launches, and the increased adoption of minimally invasive procedures, the endoscopy segment is anticipated to witness a growth in the image-guided therapy system market over the forecast period.

North America is Expected to Hold a Significant Share in the Market and is Expected to do Same in the Forecast Period

North America is expected to hold a significant share in the global image-guided therapy system market attributed to the well-established healthcare infrastructure, rise in product launches, and quick adoption of advanced radiation therapies with technological advancements.

Moreover, the increasing aging population with rising cases of chronic diseases and value-based reimbursements in this region is likely to raise the high demand for minimally invasive procedures, thus promoting the growth of the image-guided therapy system market. For instance, as per the Statistics Canada 2022 report, an estimated 233,900 people in Canada is likely to be diagnosed with cancer in 2022.

Additionally, product launches, collaborations, and partnerships in image-guided therapy systems are anticipated to boost market growth. For instance, in Jun-2022 GE Healthcare launched the Allia platform for minimally invasive, image-guided surgery. The new platform is developed through a multi-year alliance with surgeons and interventionists to improve the consumer experience, enhance workflow efficiency, and grow the adoption of developed image guidance in daily routines. Furthermore, in January 2022, Medtronic completed the acquisition of Affera, a Boston area-based, personally held medical technology firm. This acquisition is likely to expand Medtronic's offering of developed cardiac ablation products and supplements to fulfill physician requirements within an increasing patient population.

Thus, due to the rise in chronic diseases, the rise in image-guided therapy system product launches, and the increased adoption of minimally invasive procedures, North America is anticipated to witness growth in the image-guided therapy system market over the forecast period.

Image Guided Therapy System Industry Overview

The image-guided therapy system market is moderately competitive and consists of several major players. In terms of market share, a few of the major players are currently dominating the market. Some prominent players are acquiring other companies to consolidate their market positions across the globe and while others are launching new products. Some of the companies which are currently dominating the market are Siemens Healthneers, Koninklijke Philips N.V., Altaris Capital Partners, LLC (Analogic Corporation), Medtronic, KARL STORZ SE & Co. KG, and Stryker Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Geriatric Population

- 4.2.2 Rising Burden of Chronic Diseases

- 4.2.3 Increase in the Number of Initiatives for Cancer Radiotherapy

- 4.3 Market Restraints

- 4.3.1 High Price of Image-Guided Therapy Systems

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Ultrasound Systems

- 5.1.2 Computed Tomography (CT) Scanners

- 5.1.3 Magnetic Resonance Imaging (MRI)

- 5.1.4 Endoscopes

- 5.1.5 Positron Emission Tomography (PET)

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Neurosurgery

- 5.2.2 Cardiac Surgery

- 5.2.3 Urology

- 5.2.4 Orthopedic Surgery

- 5.2.5 Others

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Clinics

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens Healthineers

- 6.1.2 Koninklijke Philips N.V.

- 6.1.3 General Electric Company (GE Healthcare)

- 6.1.4 Altaris Capital Partners, LLC (Analogic Corporation)

- 6.1.5 Brainlab

- 6.1.6 Medtronic Plc

- 6.1.7 Olympus Corporation

- 6.1.8 KARL STORZ SE & Co. KG

- 6.1.9 Stryker Corporation