|

市场调查报告书

商品编码

1244372

全球电子听诊器市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Electronic Stethoscope Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球电子听诊器市场预计将以 5.1% 的复合年增长率增长。

COVID-19 疫情期间对市场增长产生了重大影响。 COVID-19 疫情增加了对电子听诊器的需求。 例如,电子听诊器 Thinklabs One 于 2020 年 5 月推出,以帮助在大流行期间保护医护人员的安全。 肺部听诊通常是用于确定肺部是否感染了 COVID-19 的第一个程序,因此听诊器通常在从医生到医院和家庭护理提供者的最终用户中使用。 这引发了听诊器市场的突然飙升,为市场参与者创造了很多前景。 此外,自 COVID-19 以来,全球限制有所放鬆,疾病筛查服务已恢復,因此在当前情况下,市场增长稳定。

电子听诊器的特性,例如声音的可变放大、较少的噪声干扰以及捕获信号以进行可视化和存储的能力,为电子听诊器市场的巨大增长提供了有利可图的机会。

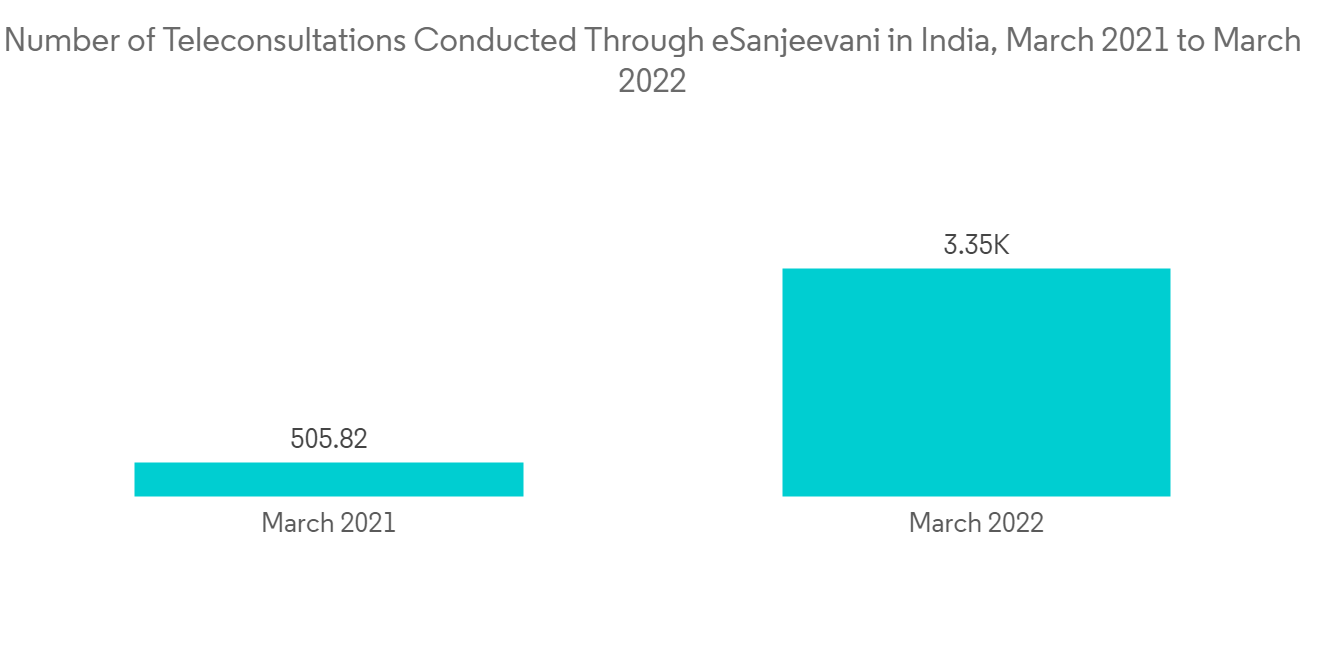

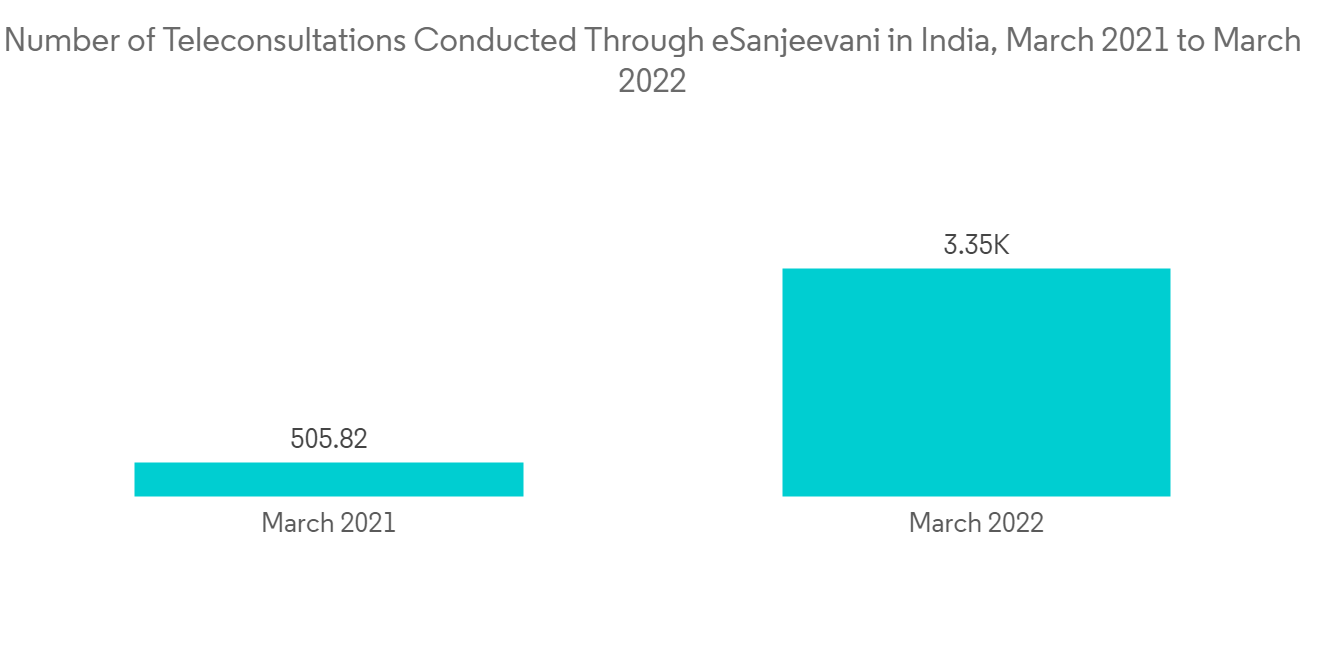

全球老年人口的增加、心血管和肺部疾病的高患病率、远程医疗需求的增长以及先进医疗设备的技术进步是推动全球电子听诊器市场增长的主要因素。它是一个因素。 根据联合国经济和社会事务部在其人口报告中公布的数据:根据2022年发布的《世界人口展望》,预计世界65岁及以上人口将从2022年的7.71亿增长到2050年的7.71亿增加到16亿。 不断增长的老年人口产生了对电子听诊器的需求。 老年人口是各种慢性病的高危人群,因此为这一人群配备电子听诊器成为必需品。

此外,根据 2022 年 2 月更新的 CDC 数据,到 2020 年,美国接受医生或其他医疗保健提供者就诊的成年人比例为 83.4%。 美国有 8.604 亿人次就诊,其中 51.2% 就诊于初级保健医生。 因此,患者平均看医生次数的增加也有望在预测期内推动市场。

此外,2021 年 11 月,全球医疗保健社区的技术合作伙伴 eMurmur 将在美国推出世界上第一个用于高级数字听诊(听诊器技术)的开放软件平台。它正在销售中。 此类发布也促进了市场的增长。

基于这些关键因素,电子听诊器市场有望在预测期内激增。 然而,与其他电子设备的干扰和设备的高成本预计将限制预测期内的市场增长。

电子听诊器市场趋势

预计在预测期内,电子听诊器市场将以无线传输方式为主

蓝牙技术的进步为无线听诊器的创新铺平了道路。 它允许医疗保健提供者在没有身体接触的情况下听到病人的声音。 无线听诊器可帮助医生以非接触方式评估患者,从而保护他们免受各种传染源的侵害。 近年来,随着对远程医疗的需求不断增长,无线电子听诊器正在帮助医疗保健提供商实时分析和共享世界各地的听诊结果。 由于这些原因,预计在预测期内,无线传输系统的电子听诊器市场将出现巨大增长。

在预测期内,产品发布的增加预计也将有助于所研究细分市场的增长。 例如,2021 年 6 月,3M Littmann 听诊器和 Eko 在英国和爱尔兰推出了 3M Littmann CORE 数字听诊器。 此类技术先进的产品在全球范围内的出现将有助于该细分市场的增长。

此外,2021 年 8 月,Caregility 和 Eko 宣布建立综合合作伙伴关係。 Caregility 的云平台与 Eko 的智能听诊器和软件无缝集成,使 Caregility 的 iConsult 应用程序的用户可以在虚拟体检期间对患者进行高质量的听诊(心、肺和其他身体声音)。

因此,在预测期内,所研究细分市场的增长预计将受到上述因素的推动。

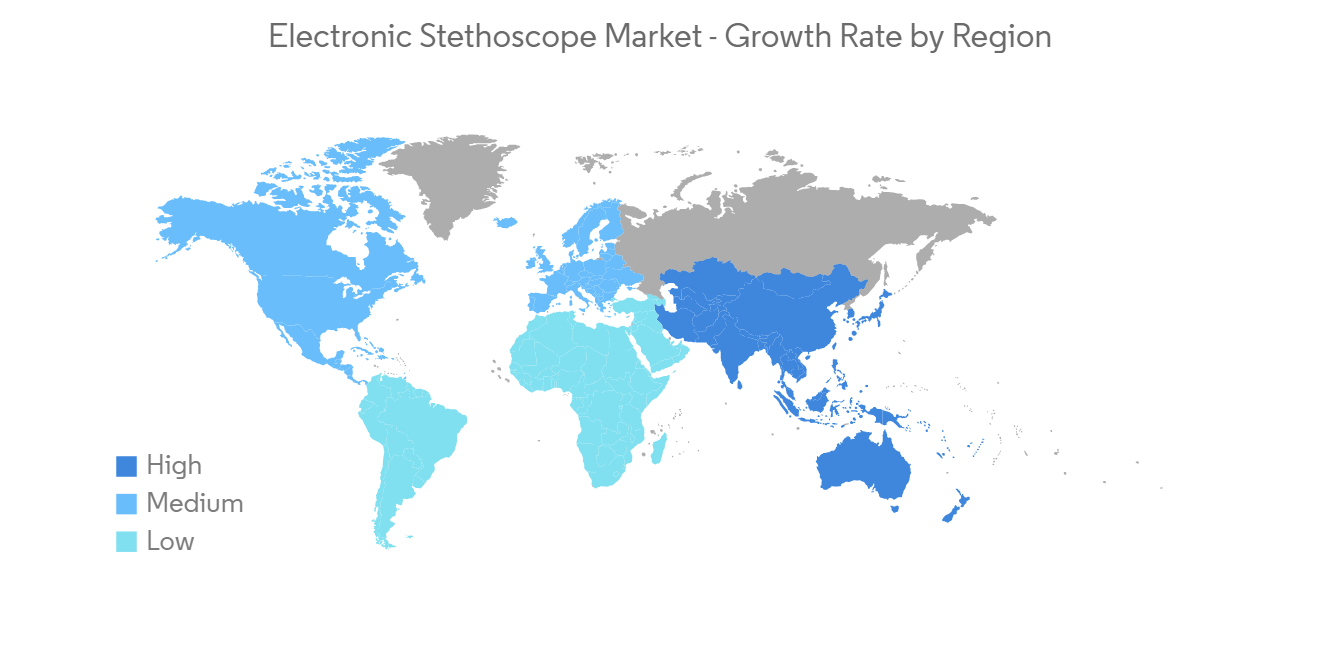

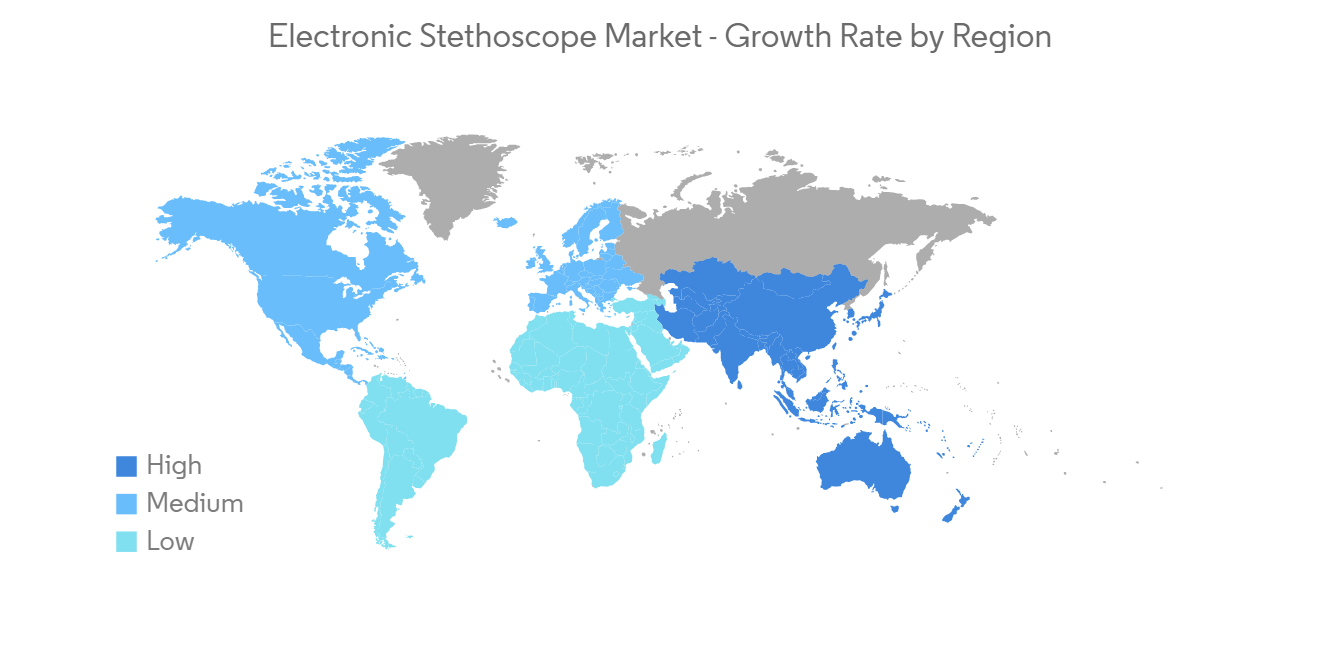

预测期内,北美电子听诊器市场有望实现健康增长

推动北美电子听诊器市场增长的主要因素是老年人口的增加、心肺病等慢性病的高患病率、大多数主要参与者的存在以及高水平的推进技术。招聘。

根据美国疾病预防控制中心 (CDC) 上次更新于 2022 年 7 月的数据,冠心病是最常见的心脏病类型。 到 2020 年,估计将影响美国约 2.01 亿 20 岁以上的成年人。 此外,根据 CDC 数据,每 40 秒就有一人心脏病发作,美国每年有近 805,000 人心脏病发作。 这表明对治疗慢性病的医学专业知识和医疗设备的需求不断增长。

此外,该地区不断增长的老年人口也推动了市场的增长。 例如,根据加拿大统计局 2021 年的人口普查,65 岁及以上的人口大约有 7,021,430 人,其中男性 3,224,680 人,女性 3,796,750 人。 由于老龄化社会容易感染各种疾病,因此健康检查必不可少,这推动了医疗机构对听诊器的需求。

此外,预计主要市场参与者的合作伙伴关係、併购等各种关键战略将提振该地区的市场。 例如,2022 年 4 月,Sanolla 向 FDA 推出了一款支持 AI 的低频听诊器 VoqX,供美国临床使用。 同样,2021 年 6 月,HD Medical 推出了 HD Steth。 HD Medical 最近将 Stethoscope.com 作为其在美国的主要在线分销合作伙伴。 此外,完善的医疗保健基础设施的存在也极大地推动了整个区域市场的增长。

换句话说,由于上述原因,未来几年市场可能会增长。

电子听诊器行业概况

电子听诊器市场适度整合,少数厂商主导市场。 大公司正在采取战略举措,例如收购和合作协议,以加强其市场地位。 3M 和美国诊断公司是市场上的两个主要参与者。 Cardionics、Contec Medical Systems、ThinkLabs Medical LLC、eKuore、Hill-Rom Services、Meditech Equipment。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 心血管和呼吸系统疾病患病率高

- 电子听诊器的新技术进展

- 对远程咨询的需求不断增长

- 市场製约因素

- 设备成本高

- 干扰其他电子设备

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(金额 - 百万美元)

- 按产品分类

- 带放大器的电子听诊器

- 数字电子听诊器

- 按技术

- 胸片集成系统

- 无线传输系统

- 带集成接收器的耳机系统

- 最终用户

- 医院和诊所

- 门诊手术中心

- 其他

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 世界其他地方

- 北美

第六章竞争格局

- 公司简介

- 3M

- American Diagnostic Corporation

- Cardionics

- AD Instruments

- Contec Medical Systems Co., Ltd.

- Thinklabs Medical LLC.

- eKuore

- HD Medical

- Meditech Equipment Co., Ltd.

- Eko

第7章 市场机会与今后动向

The electronic stethoscope market studied is expected to grow with an anticipated CAGR of 5.1% during the forecast period.

COVID-19 had a significant impact on the growth of the market during the pandemic period. The COVID-19 outbreak increased the demand for electronic stethoscopes. For instance, Thinklabs One, an electronic stethoscope, was launched in May 2020 to keep healthcare professionals safe during the pandemic. Because auscultation of the lungs was generally the first procedure used to determine whether the lungs were infected with COVID-19 or not, there has been an increase in demand for stethoscopes among end-users ranging from physicians to hospitals or home care providers.This triggered a sudden surge in the market for stethoscopes, creating numerous prospects for market players. In addition, the market growth is stabilizing in the current scenario after COVID-19 as the worldwide restrictions have eased and the disease screening services have been resumed.

The features of the electronic stethoscope, such as variable amplification of sound, minimal interference from noise, and the ability to capture signals for visualization and storage, have provided a lucrative opportunity for the tremendous growth of the electronic stethoscope market.

The increase in the global geriatric population, the high prevalence of cardiovascular and pulmonary diseases, rising demand for teleconsultation, and advancements in the technology for sophisticated medical devices are the major drivers of the growth of the global electronic stethoscope market. According to the data published by the United Nations Department of Economic and Social Affairs in its Population Report: World Population Prospects published in 2022, the global population aged 65 years or older is projected to rise from 771 million in 2022 to 1.6 billion in 2050. Such a rising geriatric population creates the need for an electronic stethoscope, as the geriatric population is at high risk of various chronic diseases that would require an electronic stethoscope for this population.

Moreover, according to CDC data updated in February 2022, the percentage of adults who had a visit with a doctor or other health care professional in the United States was 83.4% in 2020. The number of visits in the United States was 860.4 million, and the percentage of visits made to primary care physicians was 51.2%. Therefore, the increase in average patient visits to physicians is also expected to drive the market during the forecast period.

Furthermore, in November 2021, eMurmur, a technology partner to the global healthcare community, launched the world's first open software platform for advanced digital auscultation (stethoscope technology) available in the United States. Such launches also propel the growth of the market.

Given these key factors, the electronic stethoscope market is anticipated to surge over the forecast period. However, interference with other electronic devices and the high cost of devices are expected to restrain the growth of the market during the forecast period.

Electronic Stethoscope Market Trends

The Wireless Transmission System is Expected to Occupy a Significant Share in the Electronic Stethoscope Market Over the Forecast Period

The progression of Bluetooth technology has paved the way for the innovation of wireless stethoscopes. This helps healthcare providers listen to patients without any physical contact. The wireless electronic stethoscopes assist physicians in the contactless evaluation of patients, thereby protecting themselves from various infectious pathogens. With the increasing demand for teleconsultation services in recent years, wireless electronic stethoscopes help healthcare providers analyze and share auscultations across the globe in real-time. Given these factors, the wireless transmission system-based electronic stethoscope market is expected to grow tremendously over the forecast period.

Also, the increasing number of product launches is expected to contribute to the growth of the studied segment during the forecast period. For instance, in June 2021, 3M Littmann stethoscopes and Eko launched the 3M Littmann CORE digital stethoscope in the United Kingdom and Ireland. When these kinds of technologically advanced products come out all over the world, they help the market segment grow.

Moreover, in August 2021, Caregility and Eko announced an integration partnership. Caregility's cloud platform now seamlessly integrates with Eko's smart stethoscopes and software, enabling users of Caregility's iConsult application to perform high-quality auscultation (heart, lung, and other body sounds) on patients during a virtual physical exam.

Thus, the growth of the studied segment is likely to be driven by the above factors during the forecast period.

North America is Anticipated to Witness a Healthy Growth in Electronic Stethoscope Market Over the Forecast Period

The major factors driving the growth of the Electronic Stethoscope Market in North America are the increasing geriatric population, the high prevalence of chronic illnesses such as cardiac and pulmonary diseases, the existence of most of the major players, and the high adoption of advancing technology.

According to data from the CDC that was last updated in July 2022, coronary heart disease is the most common type of heart disease. In 2020, it will affect about 20,1 million 20-year-old and older adults in the United States. Additionally, as per the CDC data, every 40 seconds someone suffers from a heart attack, and nearly 805,000 people in the United States have a heart attack every year. This shows that there is a rising demand for medical expertise and devices to combat chronic diseases.

The growing geriatric population in the region is also propelling the growth of the market. For instance, as per the Statistics Canada 2021 census, there were around 7,021,430 people aged 65 years or above, out of which 3,224,680 were males and 3,796,750 were females. As the aging population is most vulnerable to various diseases, a health check-up has become mandatory, thereby driving the demand for stethoscopes across healthcare settings.

Furthermore, various key strategies by the key market players, such as partnerships, mergers, and acquisitions, are expected to boost the market in the region. For instance, in April 2022, Sanolla launched the AI-ready VoqX infrasound stethoscope with the FDA for clinical usage in the United States. Similarly, in June 2021, HD Medical launched HD Steth. HD Medical recently introduced Stethoscope.com as a key online distribution partner in the United States. Furthermore, the presence of well-established healthcare infrastructure is also fueling the growth of the overall regional market to a large extent.

So, because of the things listed above, the market is likely to grow over the next few years.

Electronic Stethoscope Industry Overview

The electronic stethoscope market is moderately consolidated, with a few players dominating the market. The key players are taking strategic initiatives, such as acquisitions and partnership agreements, to strengthen their position in the market. 3M and American Diagnostic Corporation are two of the market's major players. Cardionics, Contec Medical Systems Co., Ltd., ThinkLabs Medical LLC, eKuore, Hill-Rom Services, and Meditech Equipment Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Cardiovascular and Pulmonary Diseases

- 4.2.2 Advancements in New Technology of Electronic Stethoscope

- 4.2.3 Rising Demand for Teleconsultation

- 4.3 Market Restraints

- 4.3.1 High Cost of Device

- 4.3.2 Interference with Other Electronic Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Amplified Electronic Stethoscopes

- 5.1.2 Digital Electronic Stethoscopes

- 5.2 By Technology

- 5.2.1 Integrated Chest-Piece System

- 5.2.2 Wireless Transmission System

- 5.2.3 Integrated Receiver Head-Piece System

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 American Diagnostic Corporation

- 6.1.3 Cardionics

- 6.1.4 AD Instruments

- 6.1.5 Contec Medical Systems Co., Ltd.

- 6.1.6 Thinklabs Medical LLC.

- 6.1.7 eKuore

- 6.1.8 HD Medical

- 6.1.9 Meditech Equipment Co., Ltd.

- 6.1.10 Eko