|

市场调查报告书

商品编码

1244375

全球医疗器械管理软件市场——增长、趋势和预测 (2023-2028)Medical Equipment Management Software Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球医疗设备管理软件市场预计将以 9.9% 的复合年增长率增长。

COVID-19 大流行最初在 2020 年影响了医疗设备管理软件市场,原因是医院和诊所的患者就诊次数减少,随后对医疗设备管理软件的需求减少。 例如,根据 BMJ Journals 于 2021 年 2 月发表的一篇文章,进行了一项系统研究,以确定 COVID-19 大流行期间医疗软件和服务使用变化的程度和性质。。 他们发现,在大流行期间,医疗保健软件和服务的使用率下降了约三分之一,因为许多不提供必要的 COVID-19 医疗服务的医院和诊所仍然关闭。确实如此。 因此,COVID-19 大流行对前一阶段的市场增长产生了负面影响。 然而,在大流行后的情况下,市场有望增长。

此外,医院和诊所数量的增加、基于网络和基于云的软件开发的技术进步、政府对高级软件开发的更多承诺等是推动医疗设备管理软件市场增长的主要驱动力. 就是这个原因。

随着全球医院和诊所数量的增加,医疗设备管理软件的使用预计也会增加。 例如,根据欧盟委员会(EU)2021年5月报告的数据,德国医院住院部规模较大,每千人拥有7.9张床位,为欧盟最高,欧洲平均水平(5.3张)为50%比......高 这表明越来越多地使用医疗设备管理软件来管理医院库存。 此外,根据澳大利亚卫生与公共服务研究所(AIHW)2022 年 7 月发布的数据,2020-21 年澳大利亚共有 697 家公立医院,较过去五年显着增加。 因此,随着医院和诊所的增加,医疗设备管理软件的使用也有望增加,这有望在预测期内推动医疗设备管理软件市场的增长。

此外,市场主要参与者的新产品发布和战略活动对医疗设备管理软件市场的增长产生了积极影响。 例如,2022年6月,GHX的子公司、国内领先的医疗库存管理和端到端供应链管理软件和服务提供商Syft将增强其供应链管理软件平台,发布Syft Synergy 4.5,具有重新设计的移动应用程序界面,简化了接收和分发过程 此外,2020 年 9 月,Lumiere32 开始为全国诊所提供新的人工智能库存管理软件平台。 因此,由于产品发布和合作伙伴关係,医疗设备管理软件市场预计在预测期内将出现显着增长。

但是,数据隐私问题和熟练专业人员的短缺可能会阻碍市场的发展。

医疗设备管理软件市场趋势

基于云的部分预计在预测期内增长

基于云的软件是託管在云端的应用软件。 它可以通过网络浏览器或与您的桌面或移动操作系统集成的专用桌面客户端访问。 此外,根据患者安全公司 2021 年 10 月发表的一篇文章,医疗保健中基于云的医疗设备管理软件为组织提供了安全性、数据共享能力和可扩展性的独特平衡。 它比现场数据中心更具成本效益,并且比将数据託管在个人计算机上更安全。 因此,基于云的医疗设备管理软件的优势可能会增加目标受众对这些产品的采用,最终推动医疗设备管理软件市场的增长。

基于云的软件还可以帮助组织有效地管理库存,因为所有数据都自动记录在云库存中,可以访问并用于轻鬆计算库存,并且可以更轻鬆地进行高效改进。 因此,技术先进的基于云的医疗设备管理软件正在为该细分市场创造未来的增长机会。

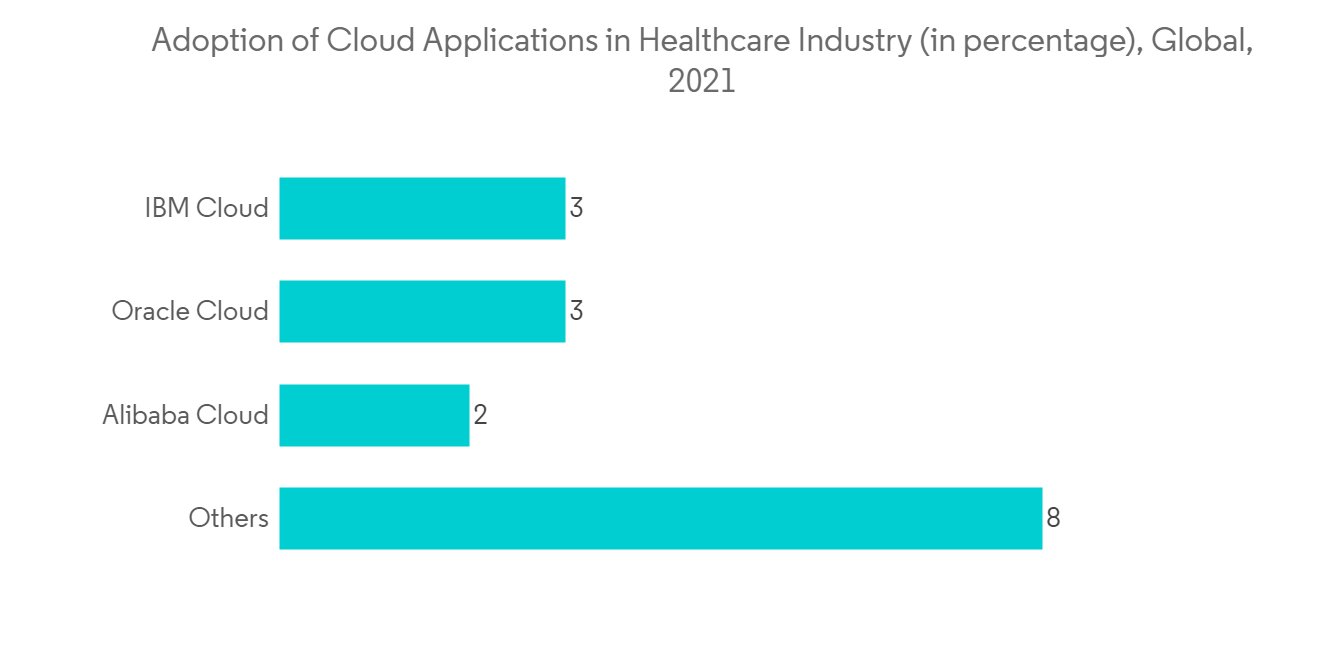

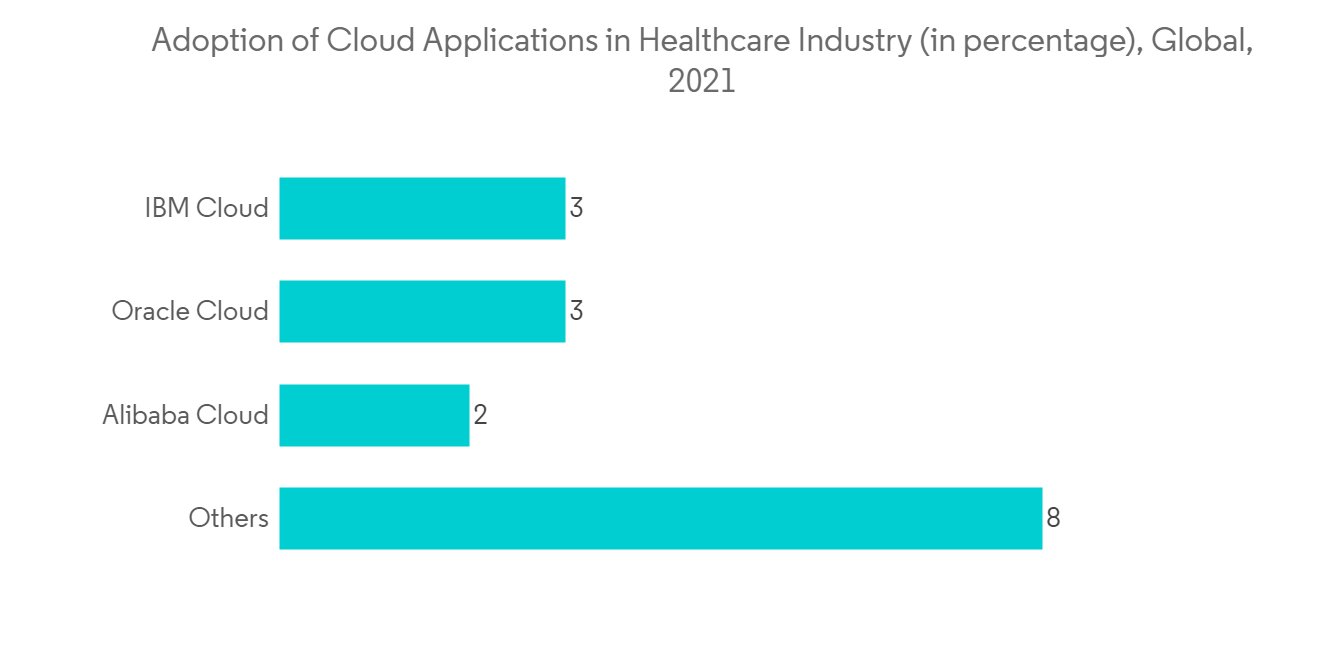

此外,市场领导者推出的产品对该细分市场的增长产生了积极影响。 例如,2022 年 3 月,微软宣布推出面向医疗机构的基于云的 Azure 健康数据服务平台。 此外,2021 年 6 月,iCoreConnect Inc.,一个基于云的软件即服务 (SaaS) 平台,用于医疗保健业务工作流,将推出面向医疗机构的 iCoreCloud,提供 SaaS 企业解决方案。宣布扩展。 此外,医疗保健行业越来越多地采用基于云的服务,也推动了医疗设备管理软件市场的增长。

因此,基于云的细分市场有望在预测期内实现显着增长。

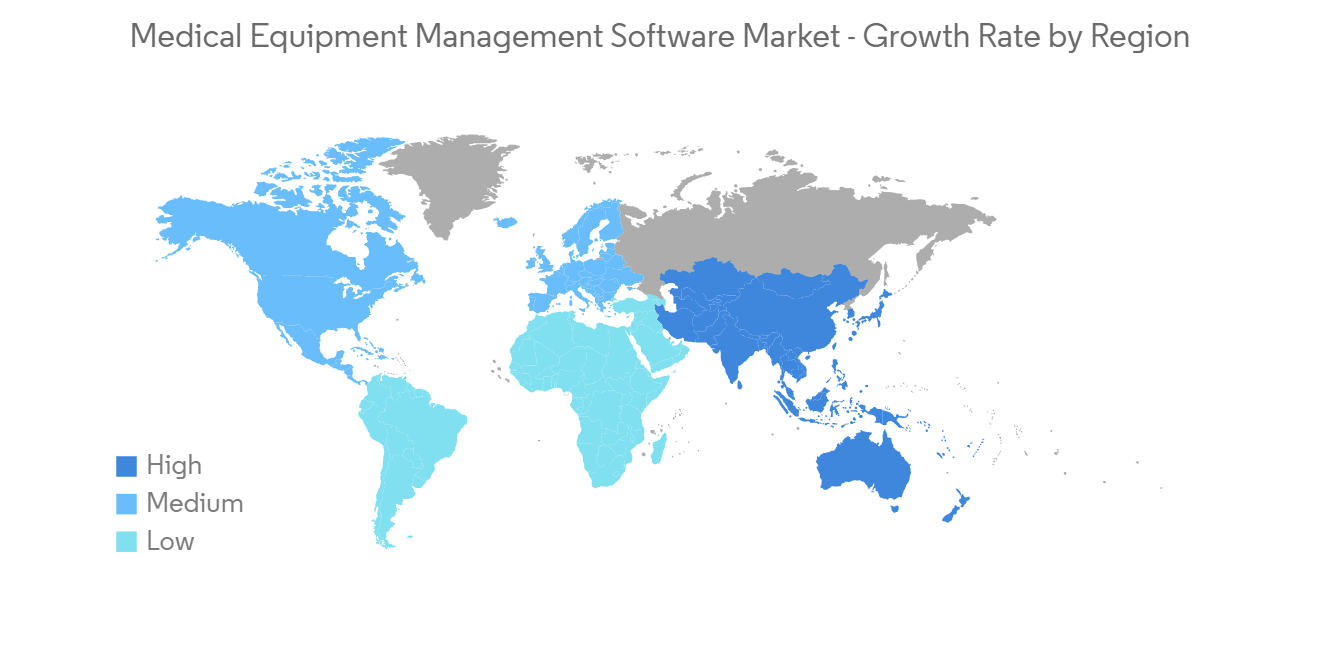

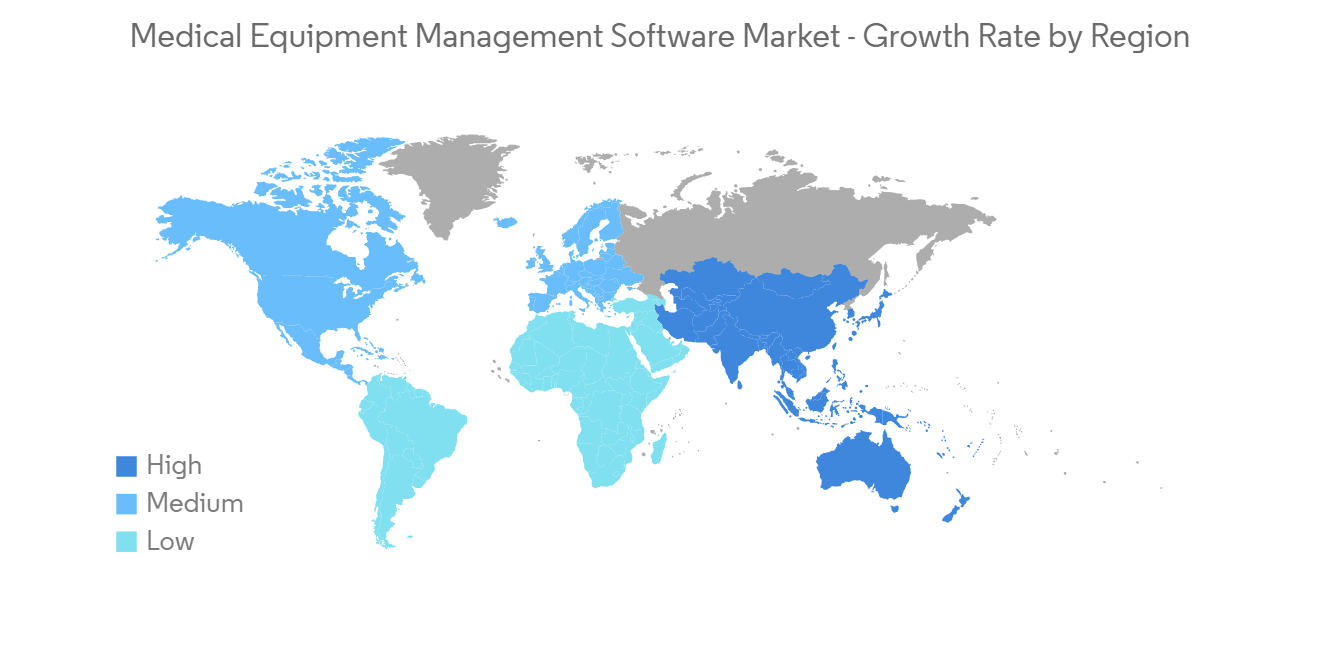

北美主导医疗设备管理软件市场

2021 年的市场由北美主导。 由于其发达的基础设施、医疗设备管理软件产品的高度采用以及主要市场参与者的存在,预计该地区将在预测期内保持其主导地位。。 此外,美国医院和诊所的数量正在增加,增加了对管理软件的需求。 这也是促成北美市场增长的重要因素之一。

例如,根据美国医院协会 (AHA) 的数据,2022 年 1 月美国医院数量为 6,093 家,高于 2021 年 1 月的 6,090 家。 随着医院和诊所数量的增加,医院的设备也趋于增加,导致采用更多的医疗设备管理软件。 因此,预计将推动该国的市场增长。

因此,由于上述因素,北美的医疗设备管理软件市场有望实现增长。

医疗器械管理软件行业概况

由于多家公司在全球和区域开展业务,医疗设备管理软件市场呈碎片化状态。 竞争格局包括对几家具有市场份额的知名国际和本地公司的分析。 市场参与者包括 Fortunesoft、Mymediset、CrelioHealth Inc.、eLabNext、EZOfficeInventory、Procurement Partners Company 的 Hybrent Inc.、eTurns Inc、Service Works Global、Innomaint 和 Crotall Healthcare。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 医院和诊所数量增加

- 基于网络和基于云的软件开发的技术进步

- 政府开发先进软件的努力变得活跃起来

- 市场製约因素

- 对数据隐私的担忧

- 缺乏熟练的专业人员

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(金额 - 百万美元)

- 按部署模式

- 基于云

- 基于网络

- 最终用户

- 医院

- 诊所

- 门诊手术中心

- 其他最终用户

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 世界其他地方

- 北美

第六章竞争格局

- 公司简介

- Fortunesoft

- Mymediset

- CrelioHealth Inc.

- eLabNext

- EZOfficeInventory

- Hybrent Inc. a Procurement Partners Company

- eTurns Inc.

- Service Works Global

- Innomaint

- Crothall Healthcare

第7章 市场机会与今后动向

The medical equipment management software market is expected to register a CAGR of 9.9% during the forecast period.

The COVID-19 pandemic initially impacted the medical equipment management software market in 2020, as there was a decrease in patient visits in hospitals and clinics, which subsequently decreased the demand for medical equipment management software. For instance, according to an article published by BMJ Journals in February 2021, a systemic study was performed to determine the extent and nature of changes in the utilization of healthcare software and services during the COVID-19 pandemic. It was found that healthcare software and services utilization decreased by about a third during the pandemic as many hospitals and clinics which were not providing essential COVID-19 care remained closed. Thus, the COVID-19 pandemic adversely affected the market's growth in its preliminary phase. However, the market is expected to grow in the post-pandemic scenario.

Further, the increasing number of hospitals and clinics, technological advancements in the development of web-based and cloud-based software, and rising government initiatives to develop advanced software are among the major factors driving the growth of the medical equipment management software market.

As the number of hospitals and clinics increases worldwide, the use of medical equipment management software is also expected to increase. For instance, according to the data by European Commission (EU) reported in May 2021, Germany has a large hospital inpatient sector, with 7.9 hospital beds per 1000 population which is the highest in the EU and 50% more than the Europe average (5.3 beds). This indicates that there will be more utilization of medical equipment management software to manage the hospital inventory. Furthermore, according to the data by the Australian Institute of Health and Welfare (AIHW) published in July 2022, in 2020-21, there were 697 public hospitals in Australia, which increased considerably in the last five years. Therefore, as the number of hospitals and clinics increases, the utilization of medical equipment management software is also expected to increase, thereby driving the growth of the medical equipment management software market during the forecast period.

Furthermore, new product launches and strategic activities by major players in the market are positively affecting the growth of the medical equipment management software market. For instance, in June 2022, Syft, a subsidiary of GHX and a leading national provider of healthcare inventory control and end-to-end supply chain management software and services, released Syft Synergy 4.5. with enhancements to the supply chain management software platform, including a redesigned mobile app interface that simplifies processes for receiving and distributing supplies. Additionally, in September 2020, Lumiere32 launched a new AI-driven inventory management software platform for clinics nationwide. Thus, due to product launches and partnerships, the medical equipment management software market is expected to have significant growth during the forecast period.

However, concerns over data privacy and a lack of skilled professionals are likely to impede market growth.

Medical Equipment Management Software Market Trends

Cloud-Based Segment is Expected to Witness Growth During the Forecast Period

Cloud-based software is application software that is hosted in the cloud. It can be accessed via a web browser or a dedicated desktop client that integrates with the desktop or mobile operating system. Moreover, according to an article published by The Patient Safety Company in October 2021, cloud-based medical equipment management software in healthcare provides organizations with a unique balance of security, data-sharing capabilities, and scalability. It is more cost-effective than on-site data centers and substantially more secure than hosting data on personal computers. Hence, owing to the advantages of cloud-based medical equipment management software, the adoption of these products is likely to increase among the target population, ultimately driving the growth of the medical equipment management software market.

In addition, cloud-based software can make it easier for organizations to improve their inventory management effectively and efficiently, as all the data will be recorded automatically with cloud stock which can be accessed and used to calculate inventory easily. Thus, technologically advanced cloud-based medical equipment management software is creating opportunities for future growth of the segment.

Furthermore, product launches by major players in the market are positively affecting the growth of the segment. For instance, in March 2022, Microsoft launched its cloud-based Azure Health Data Services platform for healthcare organizations. Additionally, in June 2021, iCoreConnect Inc., a cloud-based, Software-as-a-Service (SaaS) platform for healthcare business workflow, announced the expansion of its SaaS enterprise solutions with the launch of iCoreCloud for healthcare organizations. Moreover, the increasing adoption of cloud-based services in the healthcare industry is also boosting the growth of the medical equipment management software market segment.

Therefore, the cloud-based segment is expected to witness significant growth during the forecast period.

North America is Dominating the Medical Equipment Management Software Market

North America dominated the market in 2021. It is expected to maintain its dominance during the forecast period, owing to the well-established infrastructure, high adoption of medical equipment management software products, and presence of the major market players in the region. In addition, the rise in the number of hospitals and clinics established in the United States is generating the demand for management software. This is also one of the key factors contributing to the growth of the market in North America.

For instance, according to the data from American Hospital Association (AHA), in January 2022, there were 6,093 hospitals in the United States, an increase from 6,090 in January 2021. With the increase in the number of hospitals and clinics, equipment in hospitals is also poised to increase, leading to the adoption of more medical equipment management software. Hence, it is anticipated to drive the growth of the market in the country.

Therefore, owing to the factors mentioned above, the growth of the medical equipment management software market is anticipated in North America.

Medical Equipment Management Software Industry Overview

The medical equipment management software market is fragmented due to the presence of several companies operating globally and regionally. The competitive landscape includes an analysis of a few international and local companies which hold market shares and are well known. Some market players include Fortunesoft, Mymediset, CrelioHealth Inc., eLabNext, EZOfficeInventory, Hybrent Inc., a Procurement Partners Company, eTurns Inc., Service Works Global, Innomaint, and Crothall Healthcare among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Hospitals and Clinics

- 4.2.2 Technological Advancements in the Development of Web-Based and Cloud-Based Software

- 4.2.3 Rising Government Initiatives to Develop Advanced Software

- 4.3 Market Restraints

- 4.3.1 Concerns Over Data Privacy

- 4.3.2 Lack of Skilled Professionals

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Deployment Mode

- 5.1.1 Cloud-Based

- 5.1.2 Web-Based

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Clinics

- 5.2.3 Ambulatory Surgical Centers

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fortunesoft

- 6.1.2 Mymediset

- 6.1.3 CrelioHealth Inc.

- 6.1.4 eLabNext

- 6.1.5 EZOfficeInventory

- 6.1.6 Hybrent Inc. a Procurement Partners Company

- 6.1.7 eTurns Inc.

- 6.1.8 Service Works Global

- 6.1.9 Innomaint

- 6.1.10 Crothall Healthcare