|

市场调查报告书

商品编码

1248144

金属加工产品市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Fabricated Metal Products Market- Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

金属加工产品市场今年预计价值 231 亿美元,在预测期内以超过 4% 的复合年增长率增长。

主要亮点

- 金属加工业务的盈利能力取决于经济增长,因为需求是经济的一个函数。 自上次经济衰退后的经济復苏以来,金属加工已发展成为一个重要且充满活力的行业,并不断进行调整。 自动化加工已成为全球金属加工服务市场的主要市场驱动力。 由于自动化,加工服务的价格正在下降。 自动化使加工过程更加高效。 由于自动化,加工过程中的事故减少了。

- 对低污染内燃机车的需求不断增长等因素。 消费者在汽车安全和舒适功能方面的支出不断增加、汽车电气化趋势以及对高檔汽车的需求不断增长,将导致全球金属加工产品市场的增长。 全球从大流行中復苏也将是导致对这些金属加工产品的需求稳定增长的关键因素。

- 此外,由于亚太地区的建筑业是世界上最大的,因此建筑业不断增长的需求也是推动该市场发展的主要因素。 此外,根据中国国家发改委的数据,中国政府已于 2019 年批准了 26 个基础设施项目,预计投资约 1420 亿美元,将于 2023 年底完成。 基础设施投资的增加和復杂结构的建设预计将推动金属加工产品市场。

- 汽车、航空航天、建筑和能源行业都依赖金属加工行业,而金属加工行业本身俱有很强的周期性。 影响每个行业市场的市场和经济因素决定了每个行业的盈利能力。 投资者应考虑其特定的客户群以及可能不时影响他们的经济因素。 通过使客户群多样化并吸引不同行业的客户,可以更好地管理该行业的周期性。

金属加工产品的市场趋势

金属加工行业的自动化推动了金属加工市场

在金属製造行业,机器人和自动化设备的使用正在普及。 金属製造正在利用自动化来提高生产率并降低劳动力成本。 金属加工领域的自动化製造系统允许机器人执行焊接和切割等所有关键任务,从而有助于提高製造设施的安全性。

此外,激光锯等自动化工具有助于更快地生产精确切割的金属零件。 各种最终用途行业使用金属製造,包括汽车、石油和天然气、建筑、航空航天、农业、消费品、医疗设备以及军事和国防部门。 由于最终使用领域的多样化,金属加工业的周期性影响得到缓解。

此外,金属製造业还利用了各种 ERP 技术和应用程序。 这使得数据更容易访问,并加快了加工业的决策过程。 通过越来越多地使用计算机辅助製造技术,金属加工行业正在受益于运营效率和生产率的提高。

建筑业需求的增加推动了金属加工行业的需求

金属加工的类型包括焊接、机械加工、金属成型、金属剪切、金属切割、金属弯曲、金属轧製、金属冲压和金属冲压。 焊接是金属加工的重要组成部分。 它在所有工业过程中排名靠前,因为它是生产起重机、推土机、物料搬运、食品加工设备、办公设备、纺织、印刷和造纸机械等所必需的。

由于金属焊接是使用最广泛的工业过程,因此该市场预计将占整个金属加工市场的很大一部分。 由于中国、印度和日本等发展中国家的大规模建设和汽车基地,金属焊接的使用预计在预测期内将会增加。

中国仍然是一个充满希望的投资目的地,中国对亚洲的外国直接投资处于历史高位。 然而,鑑于与价值链复杂化和供应链多元化相关的成本上升,可以假设近期製造业生产从中国向越南和印度尼西亚转移的趋势将继续。 预计中国、印度和日本等发展中国家将拥有大量的建筑和汽车工业。

金属加工产品市场竞争者分析

就市场份额而言,目前由几家大公司主导市场。 然而,他们面临来自专注于提供金属製造产品的区域参与者和中小企业的激烈竞争。 Parker-Hannifin Corporation、Ametek、Nucor Corporation、ArcelorMittal 和 Ball Corporation 是全球金属加工产品市场的主要市场参与者。

必须满足的严格监管要求进一步加剧了服务提供商之间的竞争。 公司参与併购交易以开发产品线和扩大地域范围。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 市场定义和范围

- 调查先决条件

第二章研究方法论

第 3 章执行摘要

第 4 章市场动态和洞察

- 当前市场情况

- 市场动态

- 司机

- 约束因素

- 机会

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- 技术进步

- 政府法规和重大举措

- 关于 COVID-19 对市场的影响

第 5 章市场细分

- 最终用户行业

- 製造业

- 电力/公用事业

- 建筑

- 石油和天然气行业

- 其他最终用户行业

- 材料类型

- 钢铁

- 铝

- 其他

- 服务类型

- 选角

- 锻造

- 机加工

- 焊接/管材

- 其他服务

第六章竞争格局

- 市场集中度概述

- 公司简介

- Parker-Hannifin Corporation

- Ametek

- Nucor Corporation

- ArcelorMittal

- Ball Corporation

- Generac Holdings,

- Inner Mongolia Baotou Steel Union Co., Ltd

- China Steel Corporation

- Toyota Tsusho Corporation

- Howmet Aerospace

第7章全球金属加工产品市场的未来

第8章附录

The size of Fabricated Metal Products Market is USD 23.1 billion in the current year and is anticipated to register a CAGR of over 4% during the forecast period.

Key Highlights

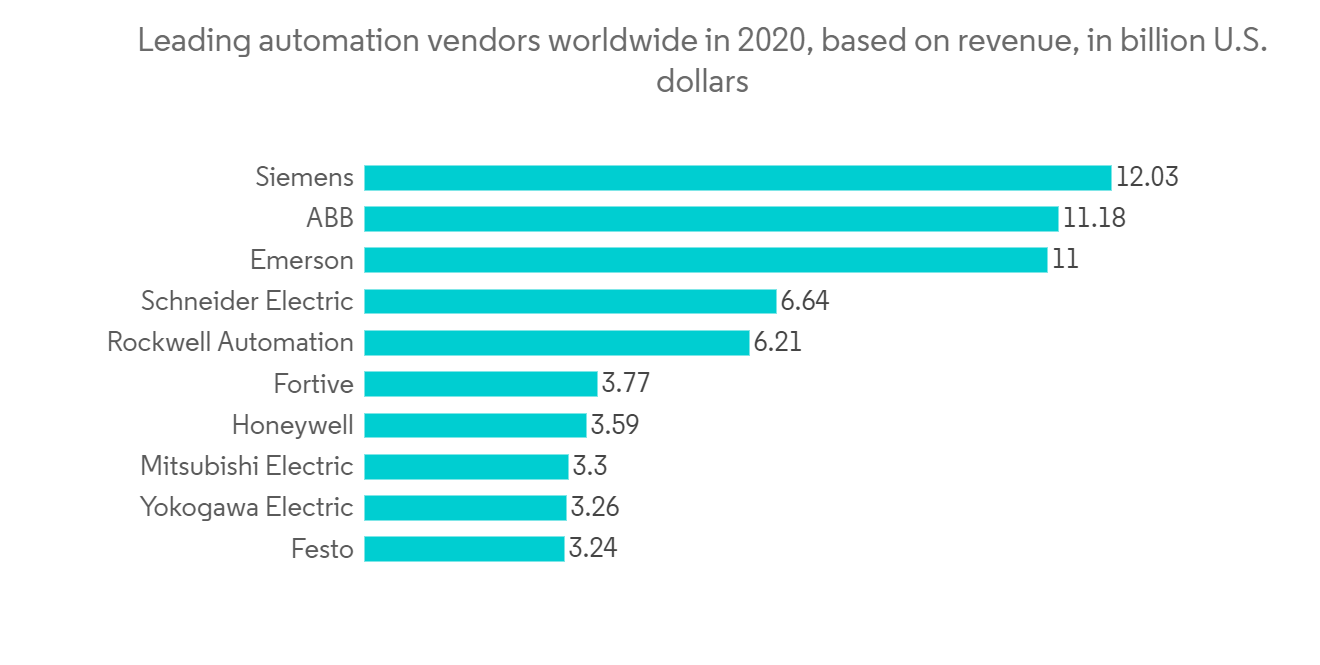

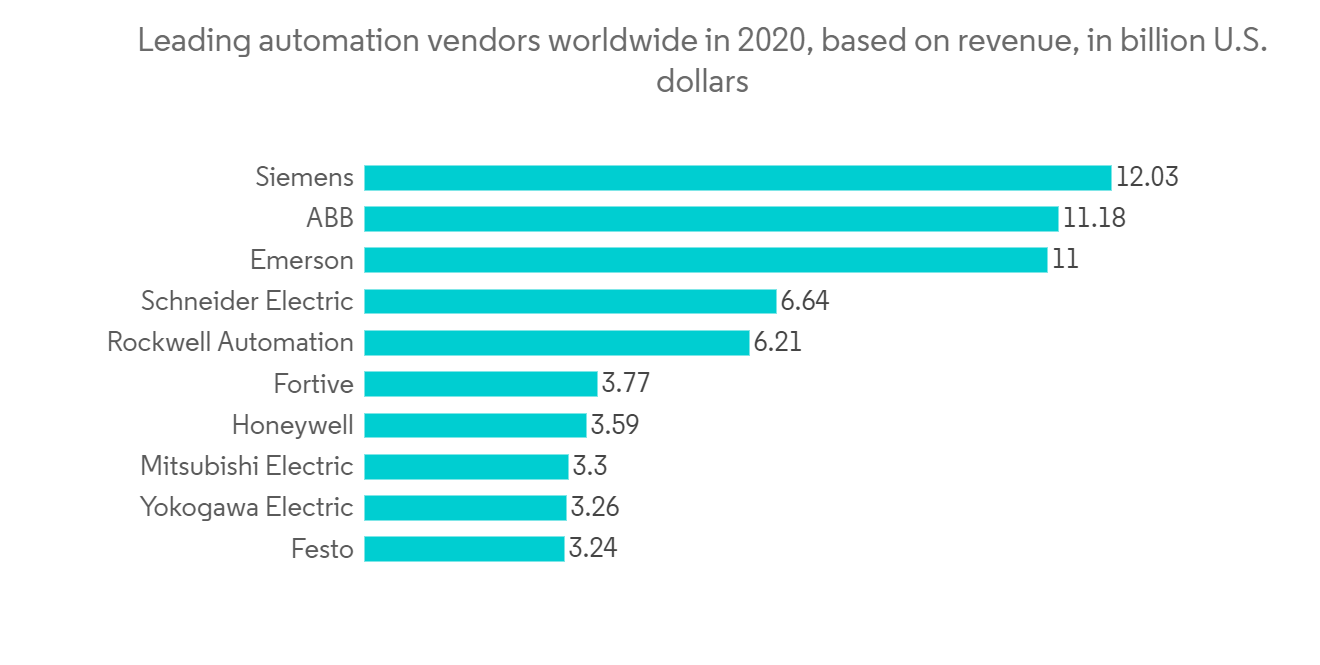

- The profitability of the metal fabrication business depends on economic growth because demand is a function of the economy. Metal fabrication has developed into a significant and vigorous industry that keeps recalibrating and thriving since the economic recovery following the previous recession. Automated fabrication is the main market driver for the global market for metal fabrication services. Prices for fabrication services have decreased as a result of automation. The fabrication process is now more effective thanks to automation. Fewer accidents happened throughout the fabrication process as a result of automation.

- Factors such as rising demand for low-emission ICE vehicles. Increasing consumer spending on safety and comfort features in automobiles and the growing trend of electrification of automobiles along with the growing demand for premium vehicles will lead to a growth in the global fabricated metal products market. The global recovery from the pandemic will also be a major factor leading to stable growth in demand for these fabricated metal products.

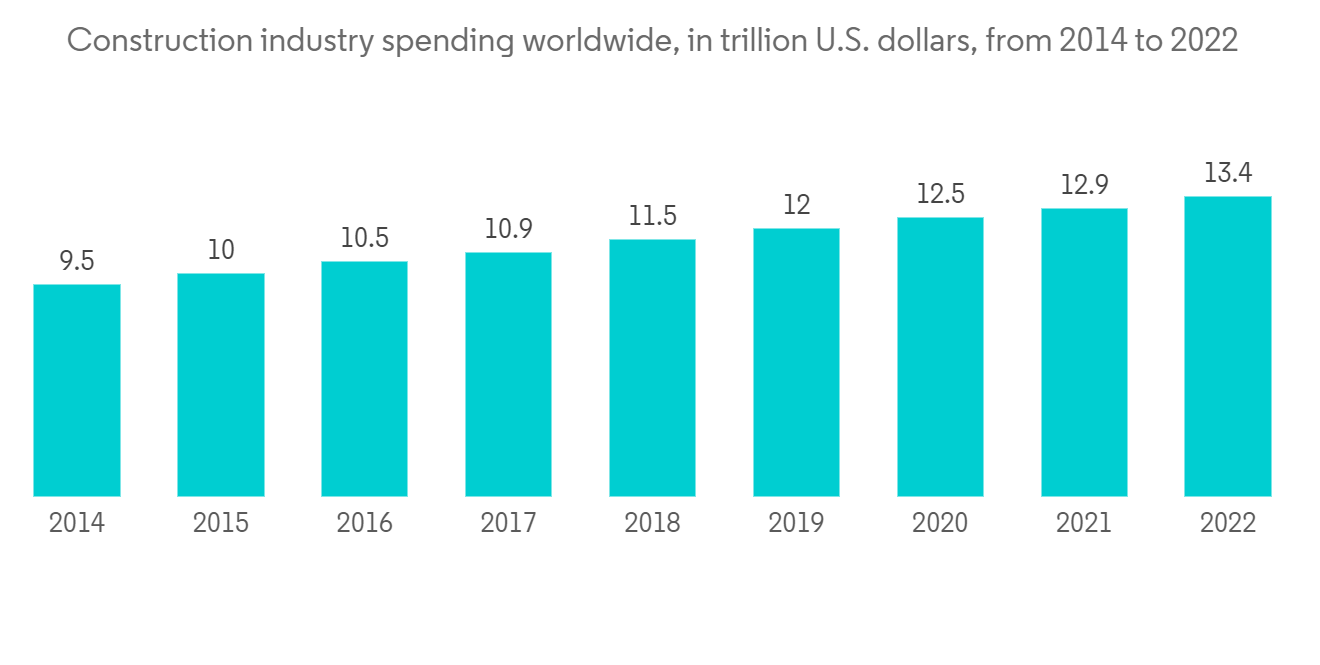

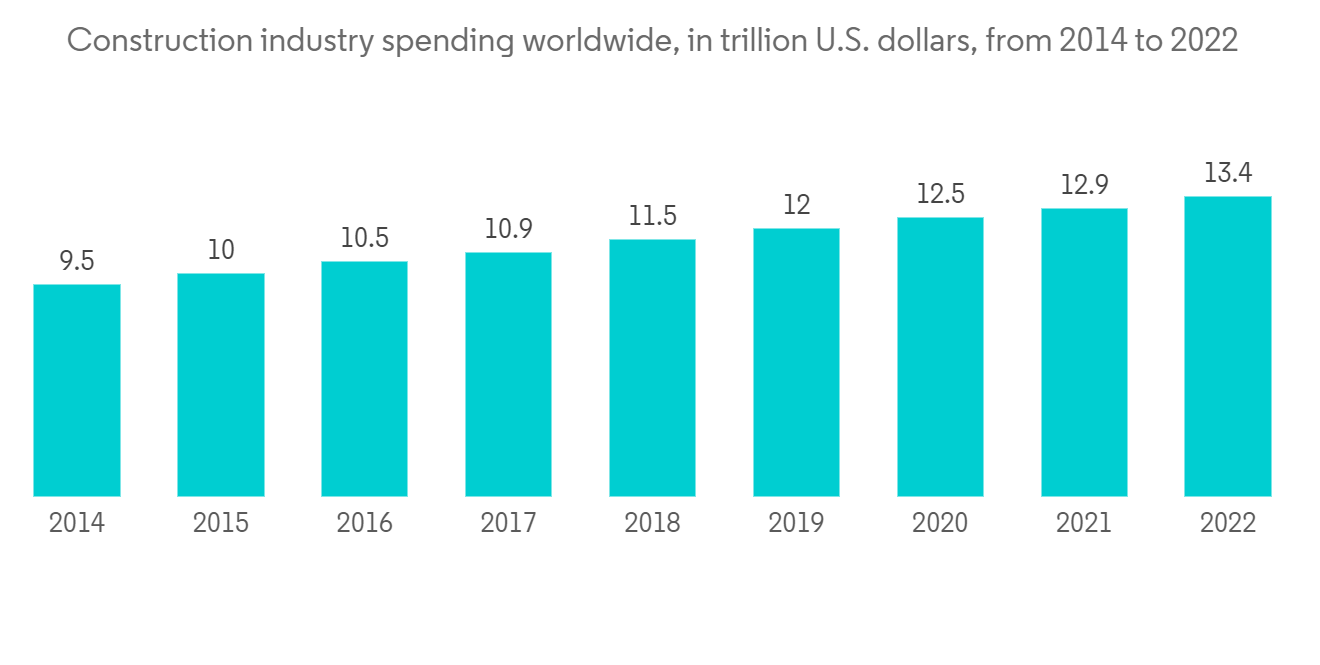

- One of the major factors propelling the market under study recently is an increase in demand from the building and construction industry, with the Asia-Pacific construction sector being the largest globally. Moreover, according to the National Development and Reform Commission of China, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion in 2019, which are expected to be completed by end of 2023. The growing infrastructure investment and building of complex structures are expected to drive the Fabricated Metal Products market.

- The automotive, aerospace, construction, and energy industries all depend on the metal fabrication sector, which is itself very cyclical. The market and economic elements influencing each sector's markets determine the earnings for each industry. Investors need to consider their specific clientele and the economic factors that may be having an impact on them at any given time. The cyclical nature of the industry can be better managed by diversifying the customer base and attracting clients from a variety of sectors.

Fabricated Metal Products Market Trends

Automation in Metal Fabrication Industry to Drive the Metal Fabrication Market

The usage of robotics and automation equipment is expanding in the metal manufacturing sector. In metal production, automation is utilized to boost productivity and cut labor costs. Automated manufacturing systems in the metal fabrication sector contribute to the safety of manufacturing facilities by having robots do all crucial tasks like welding and cutting.

In addition, automated tools like laser saws help fabricators produce precisely cut metal parts more quickly. Various end-use industries use fabricated metals, including the automotive, oil & gas, construction, aerospace, agricultural, consumer product, medical device, and military & defense sectors. The effects of the metal fabrication industry's cyclical nature are lessened as a result of the diversification of end-use sectors.

Additionally, the metal manufacturing business makes use of a variety of ERP technology and applications. This facilitates data accessibility and quickens the fabrication industry's decision-making process. The metal fabrication sector is benefiting from increased use of computer-aided manufacturing technologies by improving operational effectiveness and production

Rise in Demand from Construction Industry is Boosting Demand for Metal Fabrication Industry

Welding, machining, metal forming, metal shearing, metal cutting, metal folding, metal rolling, metal stamping, and metal punching are the different types of metal fabrication. One of the essential services included in the realm of metal manufacturing is welding. Due to the need for it in the production of cranes, bulldozers, material handling equipment, food processing equipment, office equipment, textiles, and printing and papermaking gear, it ranks highly among all industrial processes.

Given that metal welding is the most widely utilised industrial process, it is projected that this market category will hold a significant portion of the overall metal fabrication market. During the forecast period, there is expected to be an increase in the use of metal welding due to the sizeable construction and automotive bases in developing nations like China, India, and Japan.

China continues to be a desirable site for investments, foreign direct investment from China into Asia was at historic highs. However, given cost rises as the nation goes up the value chain and diversifies its supply chains, it should be assumed that the recent shift in manufacturing production from China to countries like Vietnam and Indonesia will continue. It is anticipated that developing nations like China, India, and Japan will have substantial building and automobile industries.

Fabricated Metal Products Market Competitor Analysis

In terms of market share, a few of the major players currently dominate the market studied. However, they face stiff competition from regional players and mid-size and smaller companies that are focused on providing fabricated metal products. Parker-Hannifin Corporation, Ametek, Nucor Corporation, ArcelorMittal, Ball Corporation are major market participants in global fabricated metal products market.

The competition amongst service providers is further heightened by the strict regulatory requirements that must be met. Businesses participate in M&A transactions to develop their product lines and expand regionally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Technological Advancements

- 4.6 Government Regulations and Key Initiatives

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Manufacturing

- 5.1.2 Power and Utilities

- 5.1.3 Construction

- 5.1.4 Oil and Gas

- 5.1.5 Other End-user Industries

- 5.2 Material Type

- 5.2.1 Steel

- 5.2.2 Aluminum

- 5.2.3 Others

- 5.3 Service Type

- 5.3.1 Casting

- 5.3.2 Forging

- 5.3.3 Machining

- 5.3.4 Welding & Tubing

- 5.3.5 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Parker-Hannifin Corporation

- 6.2.2 Ametek

- 6.2.3 Nucor Corporation

- 6.2.4 ArcelorMittal

- 6.2.5 Ball Corporation

- 6.2.6 Generac Holdings,

- 6.2.7 Inner Mongolia Baotou Steel Union Co., Ltd

- 6.2.8 China Steel Corporation

- 6.2.9 Toyota Tsusho Corporation

- 6.2.10 Howmet Aerospace*