|

市场调查报告书

商品编码

1258759

冷却塔市场——增长、趋势和预测 (2023-2028)Cooling Tower Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,冷却塔市场的复合年增长率预计将超过 5%。

COVID-19 对 2020 年的市场产生了负面影响。 市场现在处于大流行前的水平。

主要亮点

- 从中期来看,HVAC 系统的技术进步和建筑活动的增加预计将推动冷却塔市场的需求增加。

- 另一方面,运营困难、高运营和维护成本预计会阻碍市场增长。

- 但是,随着人们对核能重新产生兴趣,冷却塔是发电厂不可或缺的一部分,预计冷却塔市场将提供重要的商机。

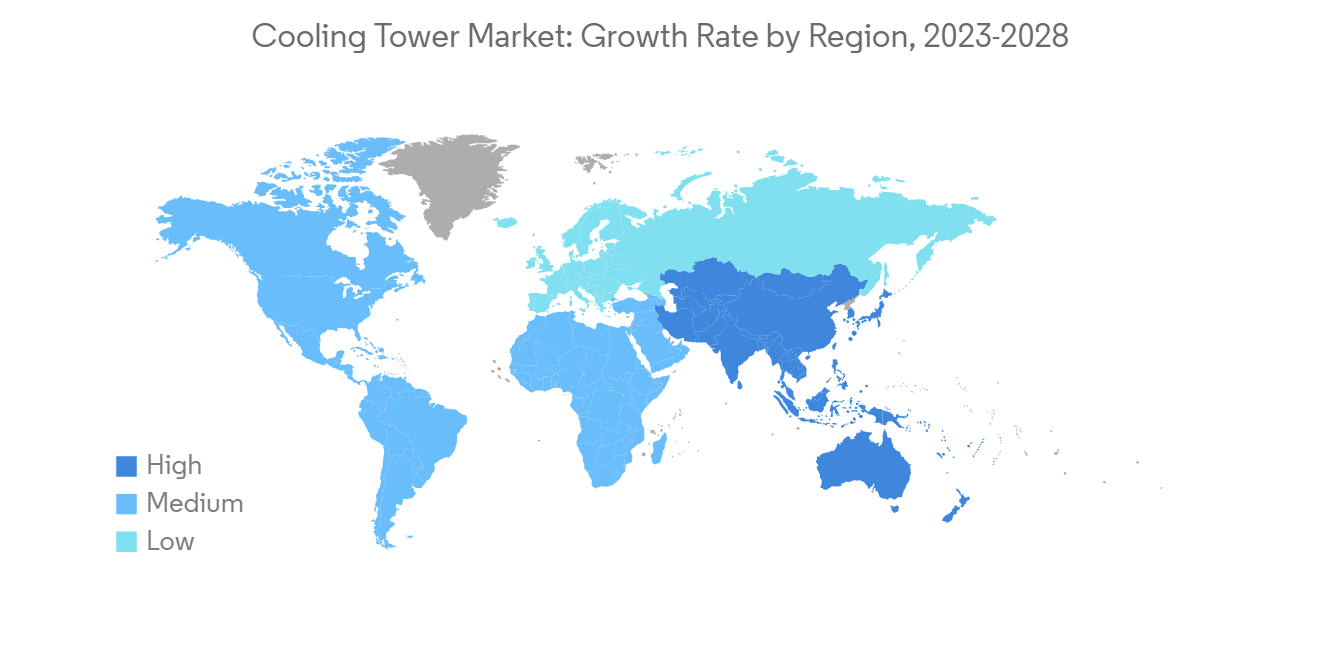

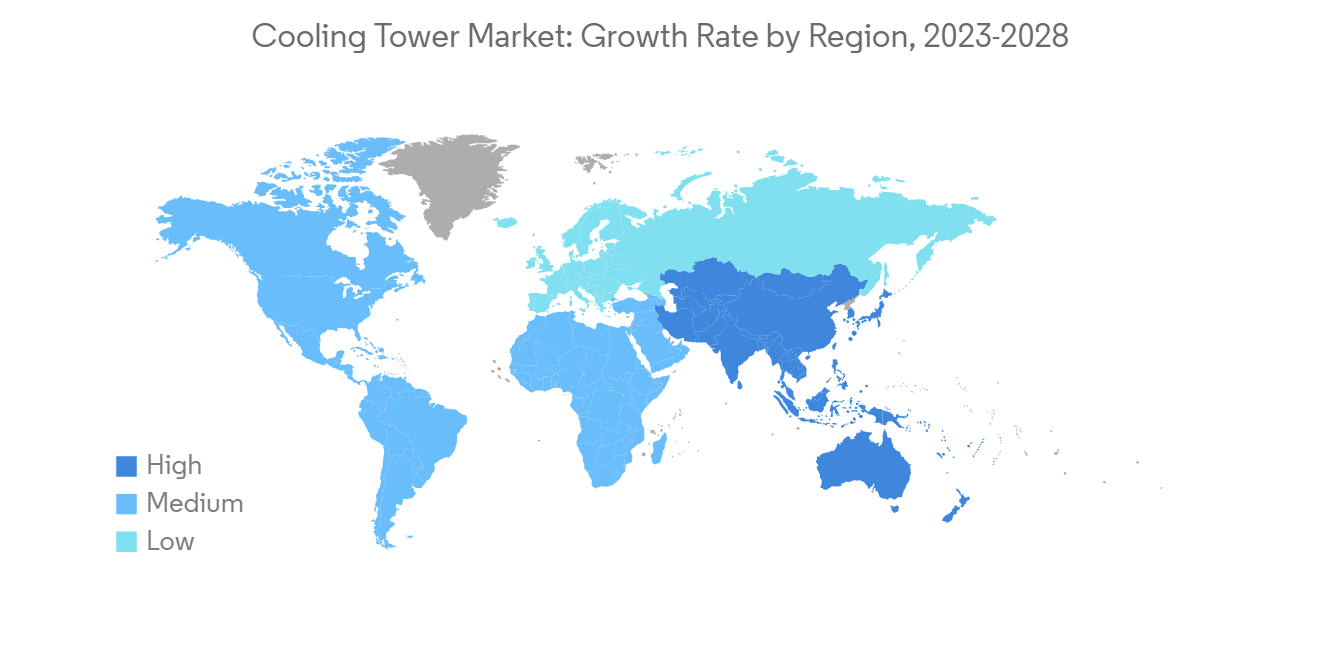

- 由于对基础设施开发和 HVAC 产品的需求不断增长,预计亚太地区在预测期内将主导市场,尤其是在印度和中国等国家/地区。

冷却塔市场趋势

预计发电量将增长

- 冷却塔是一种散发发电厂中各种活动和过程产生的热量的设备,通常使用水流。 冷却塔通过蒸发水来释放热量,利用逆流或逆流流体运动中的另一种冷却液,或完全依靠空气来降低其使用的流体的温度。

- 该塔在火力发电厂和核电站安装的发电设备中发挥着重要作用。 例如,在热电厂中,蒸汽经汽轮机膨胀后,用原水或冷却水在冷凝器中冷凝,水(蒸汽)在循环中重复使用。 冷却水通过从冷凝器中的蒸汽吸收热量而变暖。 这种冷却水必须先冷却,然后才能在冷凝器中重复使用。 然后,冷却水自然冷却或借助冷却塔中的风扇冷却。

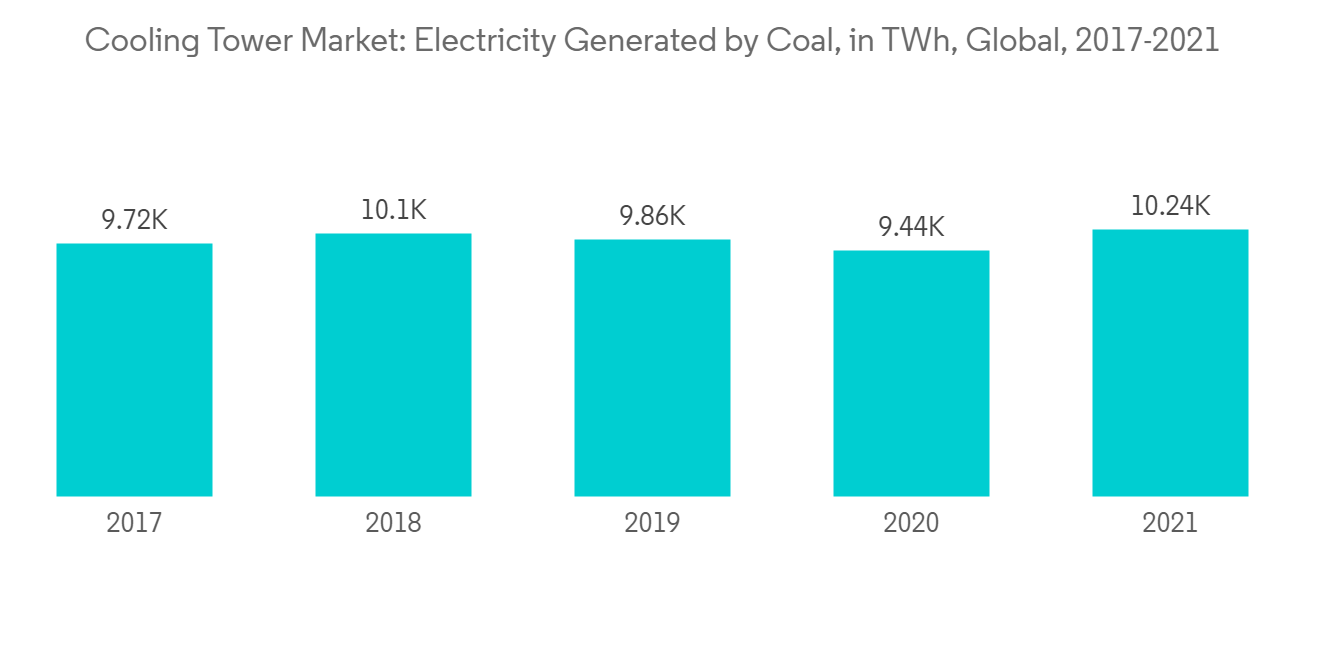

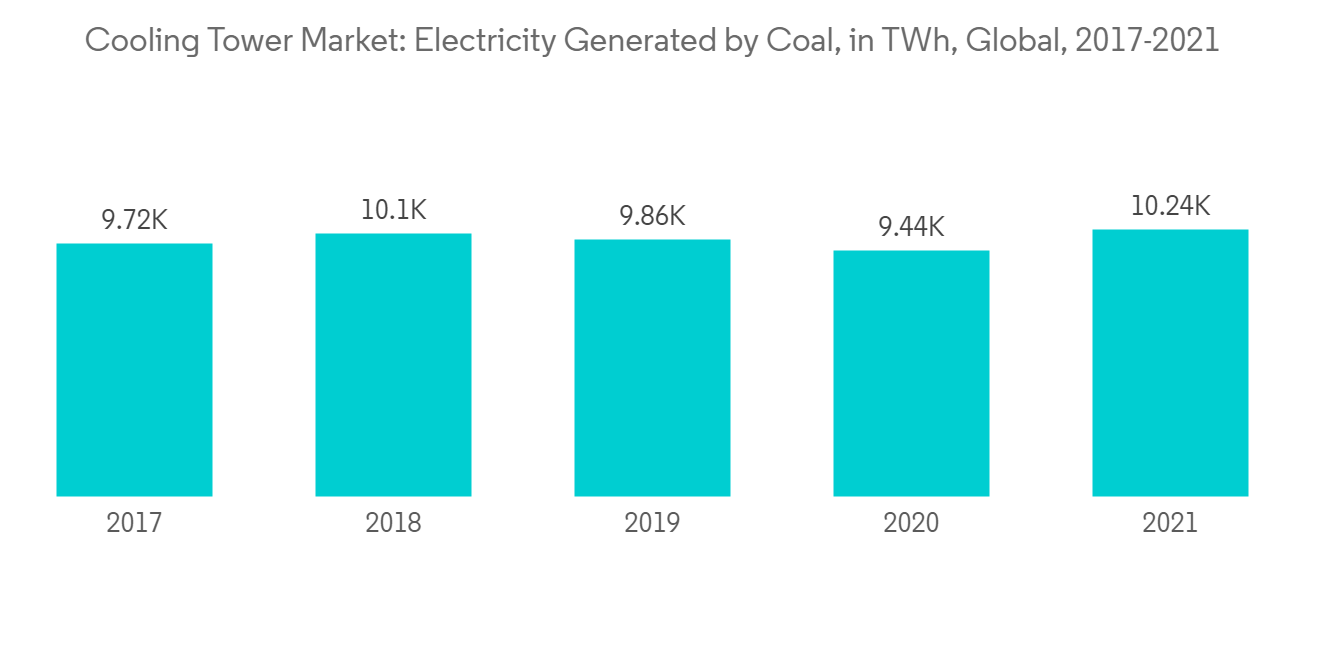

- 此外,近年来煤炭发电量显着增加。 与 2020 年相比,2021 年的燃煤发电量约为 8.8%。 2021 年,煤炭发电量为 10244 太瓦时,而煤炭发电量为 9439.3 太瓦时。 预计在预测期内,类似的趋势将在中期继续。

- 此外,2022 年 9 月,中国批准在中国上海建设一座新的 15GW 燃煤电厂。 据中国能源部称,中国各省政府已批准计划在 2022 年第一季度新增 8.63 吉瓦 (GW) 的燃煤电厂。

- 此外,俄乌战争使许多国家天然气供应短缺,对其发电设施产生了重大影响,因此日本和法国等国家转向核能以满足其日益增长的电力需求。重新引起了人们的兴趣。

- 因此,预计发电行业在预测期内将显着增长。

亚太地区主导市场

- 由于基础设施开发活动的增加、化石燃料发电量的增加、HVAC 产品在该地区的使用增加以及数据中心的增加,预计亚太地区在预测期内将实现显着增长。 预计这些行业将在该地区产生对冷却塔的巨大需求。

- 该地区基础设施的快速发展增加了对这些结构的需求。 新兴经济体的建筑活动预计将推动对供暖、通风、製冷和製冷设备的需求,从而推动市场。 因此,交通基础设施的扩张,如机场、桥樑和港口的扩建,预计将推动市场的增长。

- 此外,印度在该领域正经历着惊人的增长。 工业扩张的大量投资预计将推动该国区域工业中冷却塔的增长。 此外,食品和饮料行业对节能係统的需求不断增长,预计将在整个预测期内推动该国的市场增长并增加冷却塔的全球市场份额。

- 此外,该地区的电力需求不断增加,2021 年的发电量比 2020 年增长约 8.4%。 2021年总发电量13994.4太瓦时,2020年总发电量12949.3太瓦时。 该地区国家致力于可再生能源发电以满足当前的电力需求,而泰国、印度和中国等许多国家则致力于通过火力发电厂发电。

- 例如,据印度能源部称,印度准备到 2030 年增加多达 56GW 的燃煤发电容量,以满足日益增长的电力需求。 这表示增加了约 25%,在目前的 285 座燃煤电厂中,有 204 吉瓦的燃煤发电量。

- 由于上述原因,预计亚太地区将在预测期内主导该细分市场。

冷却塔行业概况

全球冷却塔市场较为分散。 该市场的主要参与者(排名不分先后)包括 Baltimore Aircoil Company Inc、Hamon、CIE、SPX Cooling Tech LLC、Johnson Control 和 Thermax Limited。

额外福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章研究方法论

第 4 章市场概述

- 介绍

- 到 2028 年的市场规模和需求预测

- 近期趋势和发展

- 政府政策和法规

- 市场动态

- 司机

- 约束因素

- 供应链分析

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分

- 申请

- 石油工业

- 暖通空调製冷

- 化学工业

- 发电

- 其他

- 流类型

- 横流

- 逆流

- 类型

- 蒸发冷却塔

- 干式冷却塔

- 混合冷却塔

- 地区(到 2028 年的市场规模和需求预测(仅按地区划分))

- 北美

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 澳大利亚

- 马来西亚

- 其他亚太地区

- 中东和非洲

- 沙特阿拉伯

- 阿拉伯联合酋长国

- 尼日利亚

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 北美

第6章竞争格局

- 併购、合资、合作、合同等。

- 主要参与者采用的策略

- 公司简介

- Baltimore Aircoil Company Inc

- Hamon and CIE

- SPX Cooling Tech LLC

- Johnson Control

- Evapco Inc

- Artech Cooling Towers Pvt. Ltd

- Babcock and Wilcox Enterprises Inc

- Brentwood Industries Inc

- Enexio Management Gmbh

- Thermax Limited

第7章 市场机会与今后动向

简介目录

Product Code: 93646

Cooling Tower Market is projected to register a CAGR of over 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing technological advancements in HVAC systems and construction activities are expected to increase the demand for a cooling tower market.

- On the other hand, the difficulty in operations, high operations, and maintenance costs are expected to hinder market growth.

- Nevertheless, the reignited interest in nuclear energy, where cooling towers are an essential part of the power plant, is expected to create huge opportunities for the cooling tower market.

- Asia-Pacific is expected to dominate the market during the forecasted period due to the region's increasing infrastructure development and HVAC product requirements, especially in countries like India and China.

Cooling Tower Market Trends

Power Generation Expected to Witness Growth

- A cooling tower is a device that dissipates the heat generated from various activities or processes in power plants, generally a stream of water. These towers either release heat by evaporating water using another coolant liquid in counter-flow or cross-flow fluid movement, or it relies entirely on air to bring the temperature down of the fluids utilized.

- These towers are critical in power generation facilities deployed in thermal and nuclear power plants. For instance, in thermal power plants, steam is condensed in the condenser using raw water or cooling water after expanding in the steam turbine to reuse that water (steam) in the cycle. The cooling water is heated by absorbing heat from the condenser's steam. This cooling water must cool before it can be reused in the condenser. As a result, this cooling water is cooled in the cooling tower either spontaneously or with the assistance of fans.

- Furthermore, the electricity generation from coal has increased significantly in recent years. In 2021 the electricity generated from coal was recorded at around 8.8% compared to 2020. In 2021 10244 TWh of electricity was generated from coal compared to 9439.3 TWh. A similar trend will be followed over the medium term during the forecasted period.

- Moreover, In September 2022, China approved 15 gigawatts of a new coal-fired thermal power plant in Shanghai, China. According to the Chinese department of energy, provincial governments across China approved plans to add 8.63 gigawatts (GW) of new coal power plants in the first quarter of 2022.

- Additionally, due to the Russia-Ukraine war, many countries suffered a gas supply shortage which significantly affected their power generation facilities and made countries like Japan and France reignite their interests in nuclear energy to meet the increasing electricity demands.

- Thus the power generation segment is expected to grow significantly during the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth during the forecasted period due to the increasing infrastructure development activities, increasing power generation through fossil fuels, increasing usage of HVAC products in the region, and increasing data centers. These increasing industries are expected to create significant demand for cooling towers in the region.

- The rapid pace of development of infrastructure around the region is increasing the demand for these structures. Construction activity in developing economies is driving demand for heating, ventilation, cooling, and refrigeration equipment, projected to drive the market. Thus, expanding transportation infrastructures such as airports, bridges, and port expansion is likely to drive market growth.

- Furthermore, India is experiencing tremendous growth in this area. Massive investments in industrial expansion would boost cooling tower growth in the country's area industry. Furthermore, the increased need for energy-efficient systems in the food and beverage industry will likely boost the market growth in the country and increase the worldwide cooling towers market share throughout the forecast period.

- Additionally, the electricity demand in the region is constantly increasing; the electricity generation increased by almost 8.4% in 2021 compared to 2020. In 2021 total electricity generated was 13994.4 TWh, and in 2020 total electricity generated was 12949.3 TWh. Although countries in the region are working on renewable energy sources to meet current electricity demands, many countries, such as Thailand, India, and China, are working on generating electricity through thermal power plants.

- For instance, According to the Ministry of Energy India, the country is preparing to add as much as 56 GW of coal-fired generation capacity by 2030 to meet the growing electricity demand. The increase in coal-fired capacity would represent about a 25% jump above the country's current 204 GW of coal-fueled generation from 285 coal thermal power plants.

- Thus due to the abovementioned points, the Asia-Pacific region is expected to dominate the market segment during the forecasted period.

Cooling Tower Industry Overview

The Global Cooling Tower Market is moderately fragmented. Some key players in this market (in no particular order) include Baltimore Aircoil Company Inc, Hamon, CIE, SPX Cooling Tech LLC, Johnson Control, and Thermax Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Oil Industry

- 5.1.2 HVACR

- 5.1.3 Chemical Industry

- 5.1.4 Power Generation

- 5.1.5 Others

- 5.2 Flow Type

- 5.2.1 Cross Flow

- 5.2.2 Counter Flow

- 5.3 Type

- 5.3.1 Evaporative Cooling Tower

- 5.3.2 Dry Cooling Tower

- 5.3.3 Hybrid Cooling Tower

- 5.4 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Australia

- 5.4.3.4 Malaysia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Nigeria

- 5.4.4.4 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Columbia

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baltimore Aircoil Company Inc

- 6.3.2 Hamon and CIE

- 6.3.3 SPX Cooling Tech LLC

- 6.3.4 Johnson Control

- 6.3.5 Evapco Inc

- 6.3.6 Artech Cooling Towers Pvt. Ltd

- 6.3.7 Babcock and Wilcox Enterprises Inc

- 6.3.8 Brentwood Industries Inc

- 6.3.9 Enexio Management Gmbh

- 6.3.10 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219