|

市场调查报告书

商品编码

1258762

AC-DC 电源适配器市场-增长、趋势、COVID-19 影响和预测 (2023-2028)AC-DC Power Adapters Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

AC-DC 电源适配器市场预计在预测期内将以 8.18% 的复合年增长率增长。

AC-DC 电源适配器,有时称为 AC 适配器,是一种外部电源,由一个变压器和一个整流器/滤波设备组成,它们被封装在一个紧凑的密封单元中,以确保安全和美观。这是正常的。 这些适配器将便携式设备以及家用和商用电子产品中的交流电源转换为直流电源。

主要亮点

- 目前,大多数消费电子产品、计算机以及工业电气和电子设备都使用某种形式的 AC-DC 适配器。 这些适配器的重要应用包括无绳电话、手机、答录机、吹风机和其他便携式电子设备。

- 因此,越来越多地采用家庭自动化和楼宇自动化系统,推动了对 AC-DC 电源适配器的需求。 此外,便携式消费电子产品和计算设备的性能不断提高也是推动市场增长的主要因素之一。

- 在过去几年中,智能手机的普及率显着提高。 爱立信预测,到 2027 年,全球智能手机用户将达到 76.9 亿,高于 2018 年的 50.95 亿。 由于 AC-DC 电源适配器广泛应用于智能手机行业,这些趋势预计将影响市场增长。

- 但是,非标准适配器的普遍存在(尤其是在欠发达市场)正在影响市场增长。 对碳化硅 (SiC) 和氮化镓 (GaN) 器件不断增长的需求也抑制了市场增长。

- COVID-19 对市场产生了重大影响。 在早期阶段,严厉的封锁措施使原材料/零件的安全变得困难,扰乱了全球供应链。 然而,对计算设备和消费电子设备的需求增加支持了市场的增长。

AC-DC电源适配器市场趋势

消费电子产品需求增加推动市场增长

- 消费电子行业是 AC-DC 电源适配器的主要消费者之一,因为这些组件是消费电子设备充电基础设施不可或缺的一部分。 因此,这些适配器广泛用于智能手机、计算机和其他一些电子设备。

- 近年来,电子设备的普及取得了显着进步。 互联网的广泛使用、可支配收入的增加以及数字技术意识的提高是这一增长的关键因素。

- 根据美国消费技术协会 (CTA) 的数据,美国消费技术产品的零售额预计将在 2022 年首次达到 5050 亿美元。 智能手机和平板电脑等手持计算设备的日益普及也支持了市场的增长。

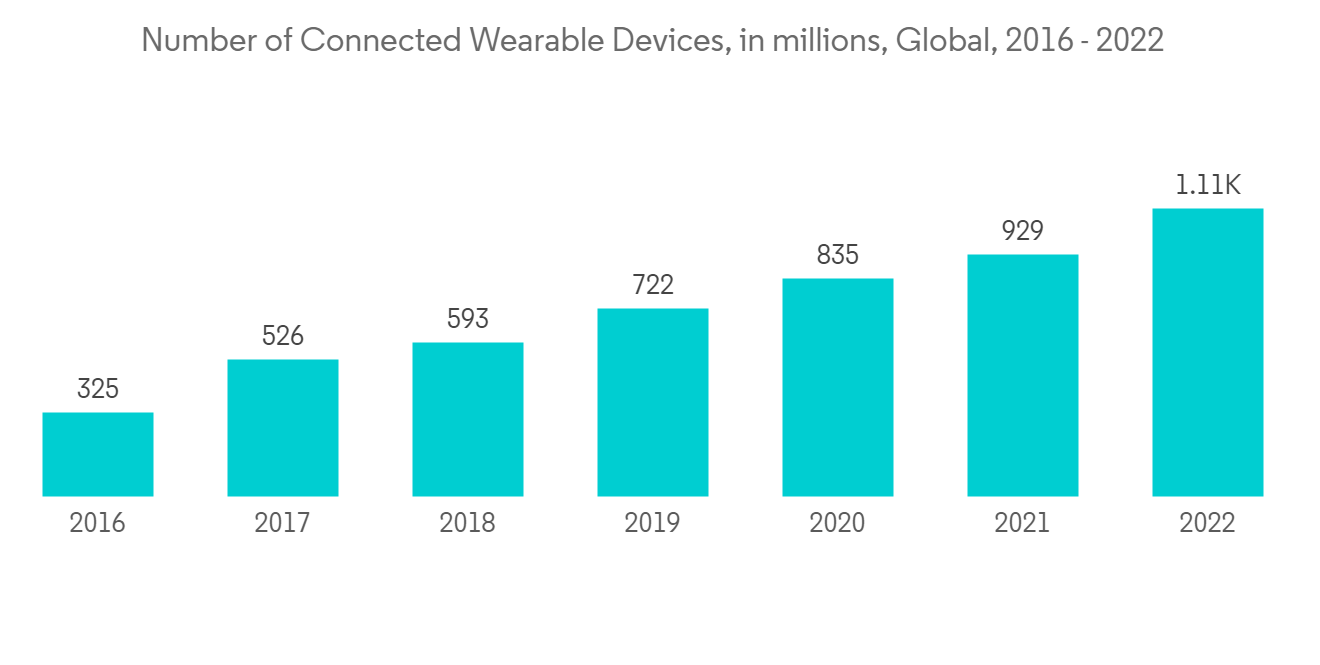

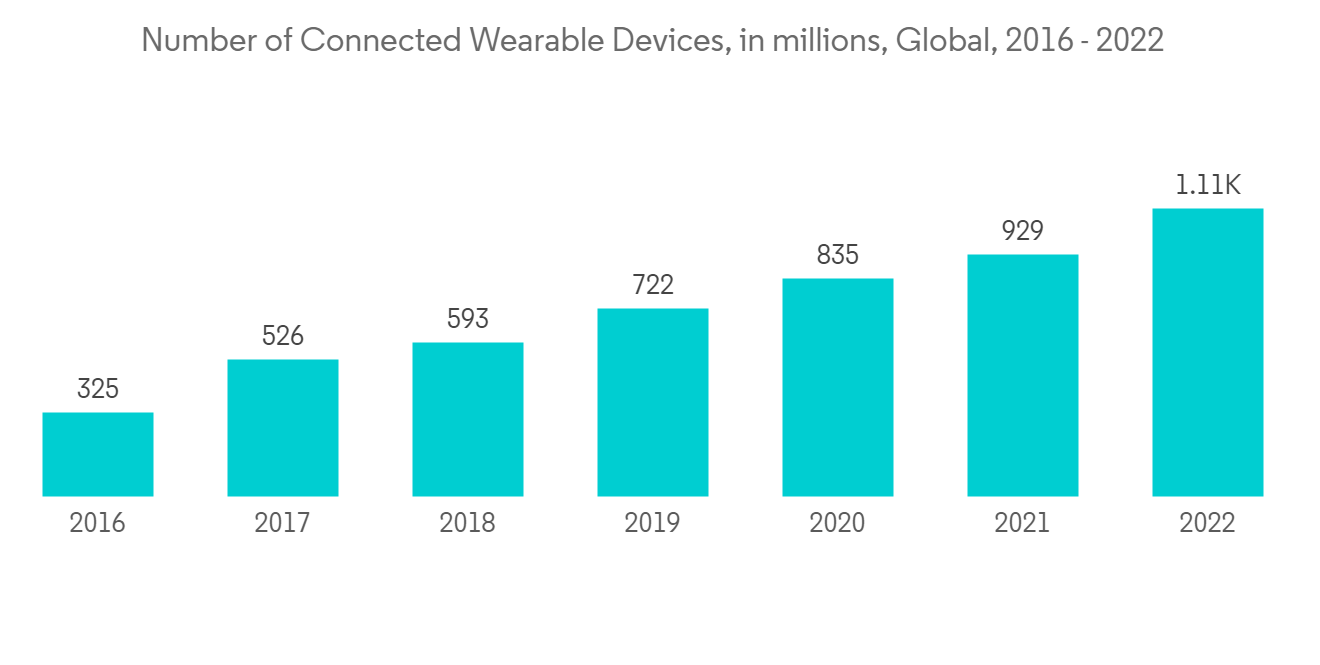

- 可穿戴消费电子产品是增长最快的细分市场之一,因为它易于携带并提供健身追踪器、集成呼叫和消息传递功能等功能。 因此,从年轻人到老年人的广泛人群的需求正在增加。 根据思科系统公司的预测,联网的可穿戴设备数量预计将从 2016 年的 3.25 亿增长到 2022 年的 11.05 亿。

- COVID-19 疫情显着推动了对智能手机、平板电脑和可穿戴设备等消费电子产品的需求,使消费者在各种日常活动中严重依赖数字技术和解决方案。 预计这一趋势将继续并推动市场的增长。

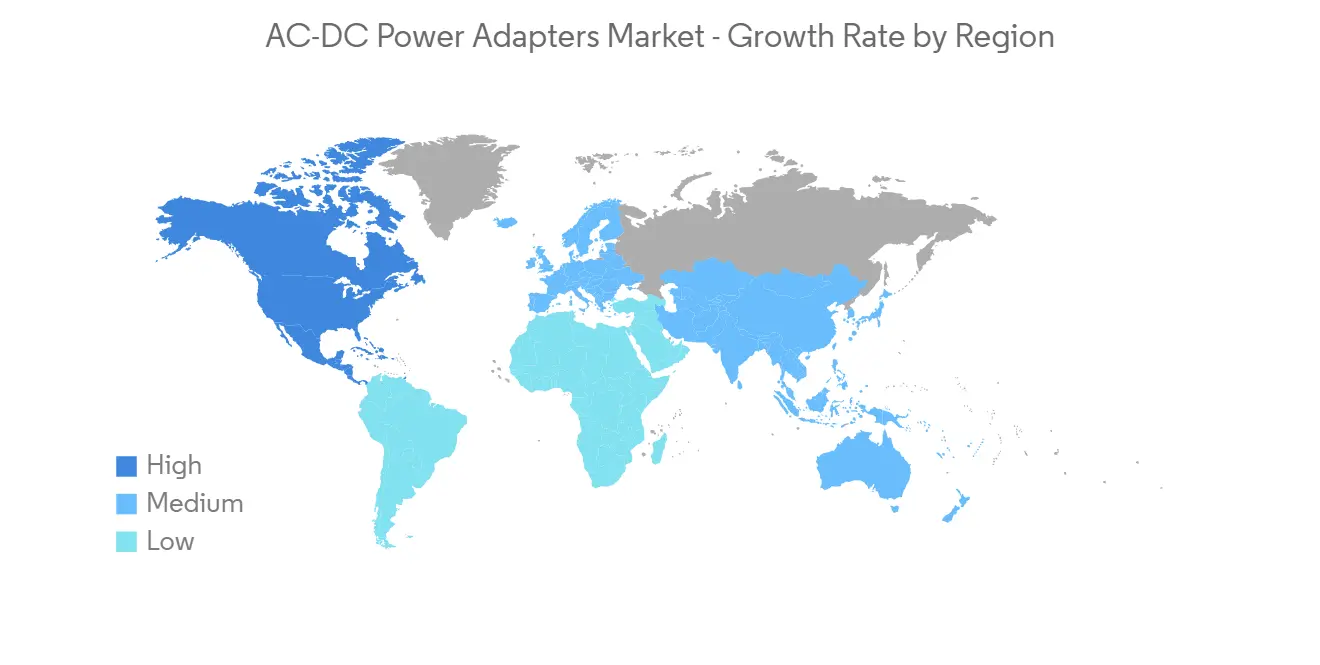

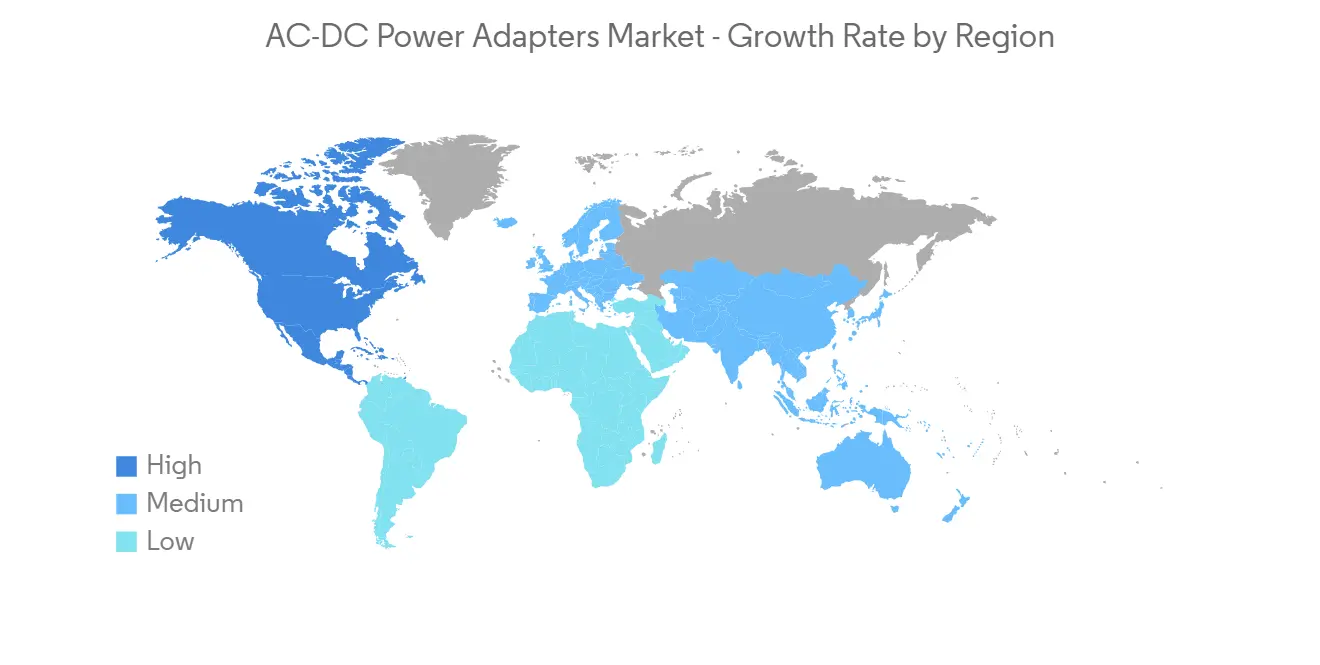

预计北美将录得最快的增长。

- 北美主要包括美国和加拿大。 在过去的几十年里,美国半导体行业的整体销售市场份额一直保持领先地位。 从电灯到门铃再到冰箱,过去几年北美智能家居设备的采用率显着增加。 智能家居和物联网设备中越来越多的应用也推动了该地区对 AC-DC 电源适配器的需求。

- 北美消费电子行业的繁荣是推动市场增长的主要因素之一。 根据美国消费技术协会 (CTA) 近期的预测,美国消费技术行业有望在 2022 年产生超过 5050 亿美元的零售销售收入。 继 2020 年令人印象深刻的 9.6% 增长之后,预计 2021 年收入将增长 2.8%。 据该集团称,对智能手机、汽车技术、健康设备和流媒体服务的强劲需求预计将占预测收入的很大一部分。

- 根据 CTA 的数据,美国智能家居市场预计到 2022 年将增长 3%,达到 238 亿美元。 由于能源成本不断上升,智能家居市场的需求预计将推动恆温器、照明和智能插座采用节能和节约成本的解决方案。 对此类智能家居设备和智能电源管理设备的需求不断增加,预计将推动该地区对模拟 IC 的需求。

- 据爱立信称,北美的智能手机用户数量预计将从 2021 年的 3.1 亿增长到 2028 年的 3.3 亿。 5G 的到来预计将推动智能手机在该地区的普及,为所研究的市场创造良好的前景,因为更多的客户将转向支持 5G 的设备。

- 据美国网络测量、测试和保障技术公司 Viavi Solutions 称,到 2022 年,美国 296 个城市将提供 5G 服务。 据爱立信称,北美的 5G 用户数量预计将从 2021 年的 7900 万增长到 2028 年的 4.2 亿。

- 过去两年,5G 部署在北美势头强劲,许多企业利用 5G 的速度和边缘计算的低延迟处理能力打造敏捷、高效和物联网驱动的未来。我是试图意识到 因此,预计此类发展将推动该地区的市场增长。

AC-DC电源适配器行业概览

AC-DC 适配器市场由已对其产品和製造工厂进行了大量投资的老牌公司组成。 新进入者需要适度的投入,但只有通过强有力的市场竞争策略才能保住自己的地位。 它还使新进入者受益,因为产品创新使他们能够瞄准新兴和未开发的应用并增加他们的市场占有率。 市场上的主要参与者是 AcBel Polytech Inc.、Belkin International 和 Delta Electronics Inc.。

- 2022 年 10 月,Belkin International 在 Amazon.com 上发布了“3-Outlet Power Cube”。 该产品在一个紧凑的解决方案中提供三个交流电源插座和三个 USB-A 端口,为亚马逊提供了一个广阔的市场来销售其产品。

2022 年 8 月,贝尔金推出了带 PPS 的 BOOSTCHARGE PRO 双 USB-C GaN 壁式充电器,它内置可编程电源 (PPS),可为多种设备提供理想的充电量。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 工业价值链分析

- 关于 COVID-19 对行业的影响

第 5 章市场动态

- 市场驱动力

- 对消费电子产品的需求增加

- 数字化正在兴起

- 市场製约因素

- 性能限制以及假冒和非标准产品的可用性

第 6 章技术快照

第 7 章市场细分

- 通过申请

- 计算机

- 移动设备

- 消费类电子产品

- 工业应用

- 其他用途

- 按地区

- 北美

- 欧洲

- 亚太地区

- 世界其他地区

第8章竞争格局

- 公司简介

- AcBel Polytech Inc.

- Belkin International(Foxconn)

- Delta Electronics Inc.

- Lite-on Technology Corporation

- Mean Well Enterprises Co. Ltd

- Momax

- Orico Technologies Co. Ltd

- Salcomp PLC

- Shenzhen Huntkey Electric Co. Ltd

第9章 市场将来性

The AC-DC power adapters market is expected to register a CAGR of 8.18% during the forecast period. AC-DC power adapters, sometimes called AC adapters, are external power supplies consisting of a transformer and rectifying and filtering units typically enclosed in a compact, sealed unit for safety and aesthetic reasons. These adapters convert AC power to DC for portable devices or household and commercial electronics.

Key Highlights

- Today, almost all consumer electronics, computing, and industrial electrical/electronic equipment use AC-DC adapters in some way or another. Some important applications of these adapters include cordless phones, cell phones, answering machines, hair dryers, and other portable electronic devices.

- Therefore, the increasing adoption of home and building automation systems is driving the demand for AC-DC power supply adapters. The growing performance of portable consumer electronics and computing devices are also among the significant factors driving the market's growth.

- The adoption of smartphones has increased significantly in the last few years. According to Ericsson's projections, global smartphone subscriptions will reach 7,690 million by 2027, from 5,095 million in 2018. As AC-DC power adapters are widely used in the smartphone industry, such trends are expected to impact the market's growth.

- However, the higher penetration of substandard adapters, especially in the lesser developed regions, is challenging the market's growth. The increasing demand for silicon carbide (SiC) and gallium nitride (GaN) devices is also restraining the market's growth.

- A notable impact of COVID-19 was observed in the market. During the initial phase, the manufacturers faced difficulties securing raw materials/components due to stringent lockdown measures, disrupting the supply chain globally. However, the increased demand for computing and consumer electronics devices supported the market's growth.

AC-DC Power Adapters Market Trends

Growing Demand for Consumer Electronic Products Drives the Market's Growth

- The consumer electronics industry is among the key consumer of AC-DC power adapters as these components are vital in the consumer electronic devices' charging infrastructure. Hence, these adapters are widely used with devices such as smartphones, computers, and several other electronic devices.

- In recent years, the adoption of electronic devices has increased significantly. The growing internet penetration, increasing disposable income driving affordability, and the growing awareness of digital technologies are crucial factors behind this growth.

- According to the Consumer Technology Association (CTA), retail sales revenue of consumer technology products in the United States was estimated to reach USD 505 billion for the first time in 2022. The increasing penetration of smartphones, tablets, and other handheld computing devices also supports the market's growth.

- Wearable consumer electronic devices are among the fastest-growing segment as they are easy to carry and offer features such as fitness trackers, integrated calling and messaging facilities, etc. Hence, their demand has been increasing equally among younger and older consumers. According to forecasts by Cisco Systems, the number of connected wearable devices was anticipated to grow from 325 million in 2016 to 1,105 million in 2022.

- The COVID-19 outbreak significantly boosted the demand for consumer electronic devices such as smartphones, tablets, and wearables, as consumers became heavily reliant on digital technologies and solutions for various day-to-day activities. This trend is expected to continue in the future and aid the market's growth.

North America is Expected to Register the Fastest Growth

- North America primarily includes the United States and Canada. Over the last several decades, the US semiconductor industry has maintained its leadership position in terms of the overall sales market share. From lighting to doorbells and refrigerators, the adoption of smart home devices in North America has risen significantly in the past few years. An increase in the applications of smart homes and IoT devices has also been driving the demand for AC-DC power adapters in the region.

- The proliferating consumer electronics industry in North America is one of the primary factors driving the market's growth. According to a recent forecast from the Consumer Technology Association (CTA), the consumer technology industry in the United States was anticipated to generate over USD 505 billion in retail sales revenue in 2022. The projection represents a 2.8% revenue increase from the impressive growth of 9.6% in 2021 over 2020. According to the organization, strong demand for smartphones, automotive tech, health devices, and streaming services is expected to contribute a significant portion of the projected revenue.

- According to the CTA, the smart home market in the United States was expected to grow by 3% in 2022 to reach USD 23.8 billion. The demand for smart home markets is expected to be driven by rising energy costs, which led to the adoption of energy-efficient and cost-saving solutions for thermostats, lighting, and smart outlets. Such an increase in the demand for smart home devices and smart power management devices is expected to fuel the demand for analog ICs in the region.

- According to Ericsson, smartphone subscription in North America is anticipated to grow from 310 million in 2021 to 330 million by 2028. The arrival of 5G is expected to boost the adoption of smartphones in the region as more and more customers will switch to 5G-enabled devices, creating a favorable outlook for the market studied.

- According to Viavi Solutions, an American network measurement, test, and assurance technology company, in 2022, 5G services were available in 296 cities in the United States. According to Ericsson, 5G subscriptions in North America are expected to grow from 79 million in 2021 to 420 million in 2028.

- With 5G rollouts already gaining momentum in the past two years in North America, many businesses are leveraging the speed of 5G with edge computing's low latency processing capabilities to realize an agile, efficient, and IoT-driven future. Hence, such trends are expected to drive the market's growth in the region.

AC-DC Power Adapters Industry Overview

The AC-DC Adapters market comprises long-standing established players that have invested significantly in the product and manufacturing plants. Although the new market players require moderate investments, they can sustain themselves only through powerful competitive strategies. Product innovations can also favor new players as they can target emerging and less explored application areas to expand their market presence. Some major players in the market are AcBel Polytech Inc., Belkin International, and Delta Electronics Inc.

- In October 2022, Belkin International introduced the 3-Outlet Power Cube on Amazon.com. The product offers three AC outlets and three USB-A ports in one compact solution, and Amazon provides the company with a large market to sell its product.

In August 2022, Belkin introduced its BOOSTCHARGE PRO Dual USB-C GaN Wall Charger with PPS, built with a Programmable Power Supply (PPS), delivering the ideal amount of power to multiple devices for an ideal charge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Consumer Electronic Products

- 5.1.2 Increasing Digitization

- 5.2 Market Restraints

- 5.2.1 Performance Limitations and Availability of Counterfeits or Substandard Products

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Computing

- 7.1.2 Mobile Devices

- 7.1.3 Consumer Electronics

- 7.1.4 Industrial Applications

- 7.1.5 Other Applications

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 AcBel Polytech Inc.

- 8.1.2 Belkin International (Foxconn)

- 8.1.3 Delta Electronics Inc.

- 8.1.4 Lite-on Technology Corporation

- 8.1.5 Mean Well Enterprises Co. Ltd

- 8.1.6 Momax

- 8.1.7 Orico Technologies Co. Ltd

- 8.1.8 Salcomp PLC

- 8.1.9 Shenzhen Huntkey Electric Co. Ltd