|

市场调查报告书

商品编码

1258767

数字伤口测量设备市场——增长、趋势、COVID-19 影响和预测 (2023-2028)Digital Wound Measurement Devices Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,数字伤口测量设备市场的复合年增长率为 4.5%。

COVID-19 大流行对所研究的市场产生了重大影响。 COVID-19 大流行引发了伤口护理远程医疗方法的重大转变,例如通过智能手机应用程序进行远程会诊,以及护士和伤口护理专业人员进行远程会诊。 Health.io Ltd 于 2022 年 6 月发布的数据证实,在大流行期间,人们更喜欢与伤口护理相关的虚拟就诊和咨询。 此外,2021 年 12 月,澳大利亚领先的远程医疗解决方案和 CSIRO 衍生公司 Coviu 将加入 CSIRO、悉尼大学、Australian Unity、Western NSW Primary Health Network 和悉尼科技大学,共同开发远程医疗伤口护理。我们有开发了一个全面的数字工具包 这增加了对远程缠绕服务的需求,并且研究市场已经增长,因为数字伤口测量是远程缠绕的关键方面之一。 因此,事实证明,COVID-19 大流行对研究市场产生了重大的积极影响。 同样,由于医疗保健的数字化程度不断提高,预计该市场在预测期内将实现健康增长。

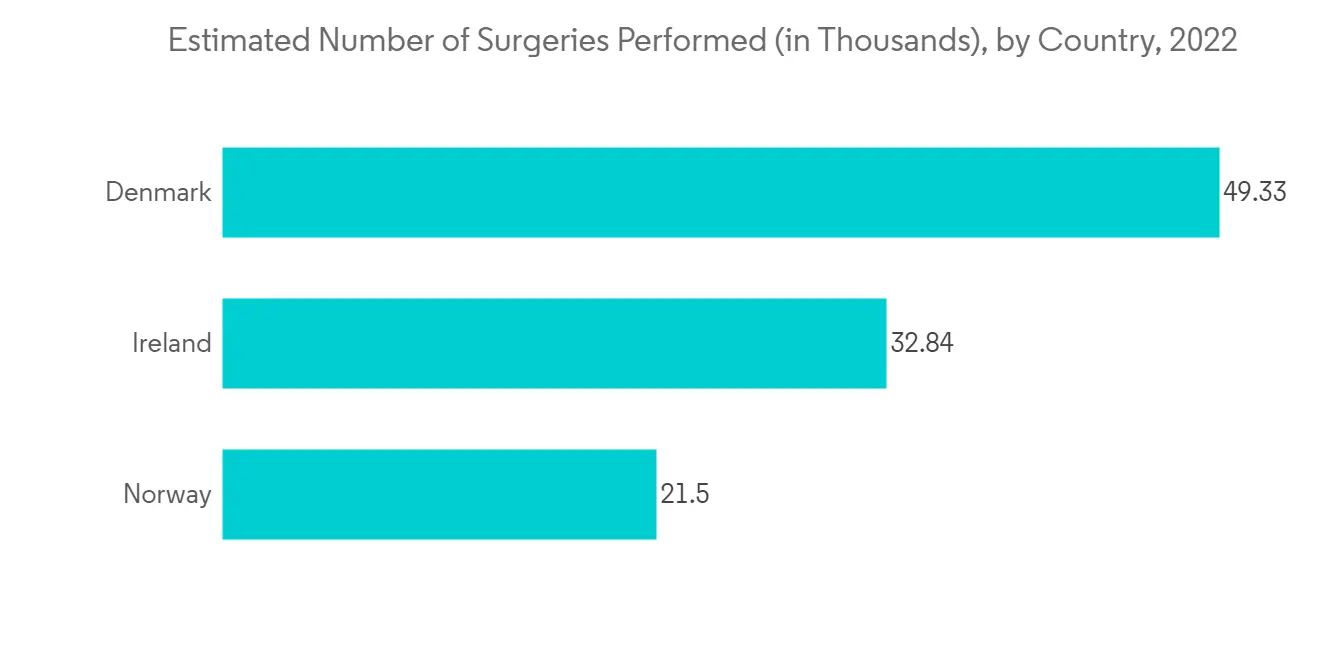

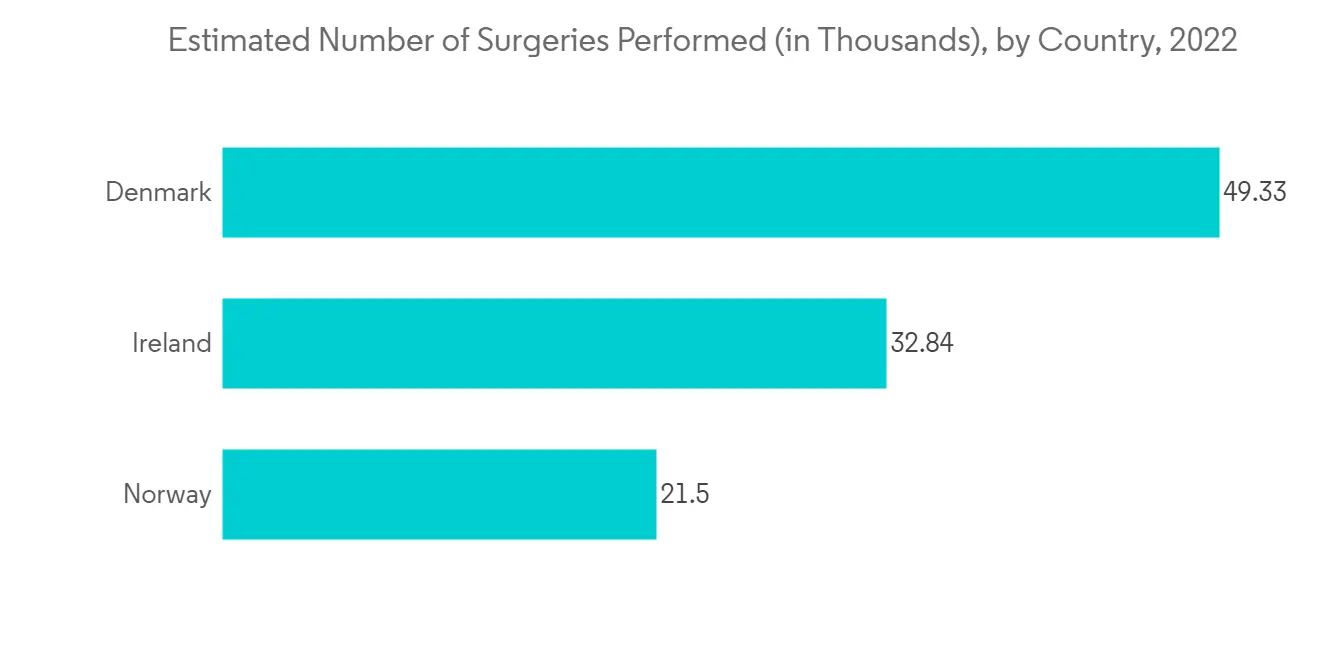

市场发展的主要驱动力是世界上伤口负担的增加、外科手术的增加、数字伤口测量设备的好处以及人口老龄化更容易患上糖尿病和其他疾病等疾病由伤口引起的慢性病。人口增加。

医疗保健中的伤口负担是该市场的主要驱动力之一。 多项研究表明,伤口是医疗保健设施不可或缺的一部分。 例如,2022 年 5 月发布的 PubMed 数据显示,大约 50% 的入院患者有伤口,而在发达国家,1% 至 2% 的普通人群患有慢性伤口。 由于受伤人数众多,整个医院对数字伤口测量设备的需求不断增长。 由于对伤口护理的需求不断增长,医疗保健信息技术公司开发了伤口测量设备,可以促进为患者提供的整体护理。 因此,医疗环境中不断增加的伤口负担已成为市场研究的主要驱动力。

另外,从美国国家生物技术信息中心2022年8月发表的一份报告来看,糖尿病足溃疡是糖尿病患者最常见的并发症之一,而血糖控制不佳,基础已被发现是由慢性神经病变引起的、外周血管疾病或足部护理不当。 大约 60% 的糖尿病患者会出现神经病变,最终导致足部溃疡。 全世界每年有 910 万至 2610 万人患糖尿病足溃疡。 据称约有 15% 至 25% 的糖尿病患者在其一生中会患上糖尿病足溃疡。 因此,随着新诊断糖尿病患者数量的增加,糖尿病足溃疡的发病率也有望增加,从而推动对数字伤口测量设备的需求。

市场正在考虑推出几款新品,这是市场增长的有利因素。 例如,2021 年 10 月,卫生保健公司 Essity 将推出一种名为“Cutimed Wound Navigator”的新型数字伤口评估工具。 为了为患者提供正确和最合适的护理,这款革命性的移动应用程序记录了关键的伤口特征,创建评估并协助医护人员选择合适的伤口解决方案。 然而,普通消费者缺乏对绕线规的认识以及相关的高成本限制了市场的增长。

数字伤口测量设备的市场趋势

预计在预测期内烧伤和外伤会显着增长

烧伤和外伤是最常见的需要紧急护理的伤口,因此请期待孩子健康成长。 随着世界范围内此类伤口的发生率增加,对治疗此类伤口的伤口测量设备的需求也在增加。 在烧伤期间使用伤口测量仪来确定烧伤对皮肤的影响有多深,从而使医生能够相应地制定治疗计划。

美国国立卫生研究院 (NIH) 于 2022 年 3 月发表的一项研究发现,印度每年记录了大约 100 万需要优质医疗护理的中度至重度烧伤。经证实,有 同样,根据 NIH 于 2021 年 8 月发布的另一项与沙特阿拉伯烧伤患病率相关的研究,沙特阿拉伯的一度烧伤患病率为 12.8%,二度烧伤患病率为 71.1%。三度烧伤为 16.1%,原因、部位和治疗类型分别为热水暴露 (36.1%)、上肢 (62.2%) 和皮肤清创术。 增加全球烧伤负担的其他因素包括森林火灾、战争和事故。 上述统计数据表明,各国烧伤的发生率很高,预计这将推动对伤口测量设备的需求,并有助于未来几年的细分市场增长。

此外,创伤也在增加,推动了对伤口测量设备的需求。 例如,约翰霍普金斯大学 2023 年 1 月更新的数据显示,美国有超过 3000 万儿童和青少年参加有组织的体育运动,其中超过 350 万患有外伤。 此外,根据 2022 年 12 月发表的 Journal of Orthopedic Research 的数据,从 2012 年到 2021 年的十年间,美国国家电子伤害监测系统记录了 4,666,491 起与自行车有关的伤害,据说是 上述统计数据表明,创伤正在上升,导致外科手术数量增加,预计将推动对伤口测量设备的需求。

此外,高精度的人工智能 (AI) 可以帮助医生评估烧伤表面、确定烧伤深度、确定是否需要手术或其他治疗、开出液体復苏处方、治疗并发症,并且可以支持预后预测。 因此,数字伤口测量的出现有望在预测期内推动细分市场的增长。

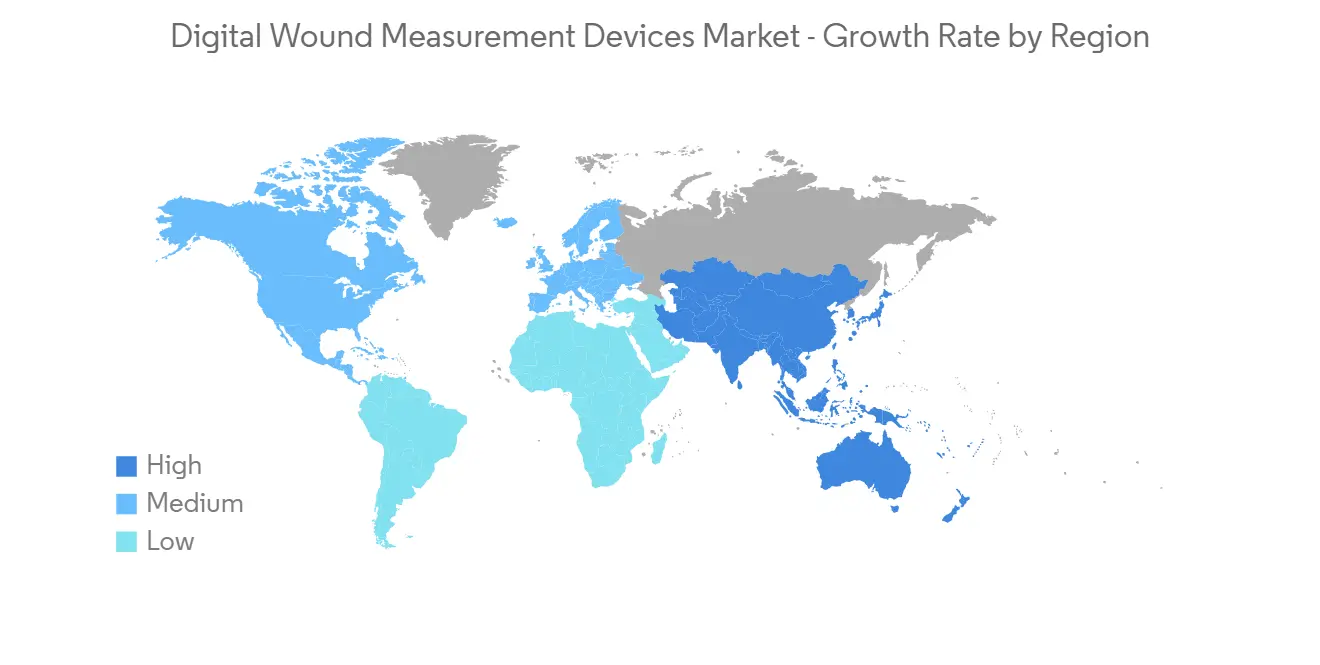

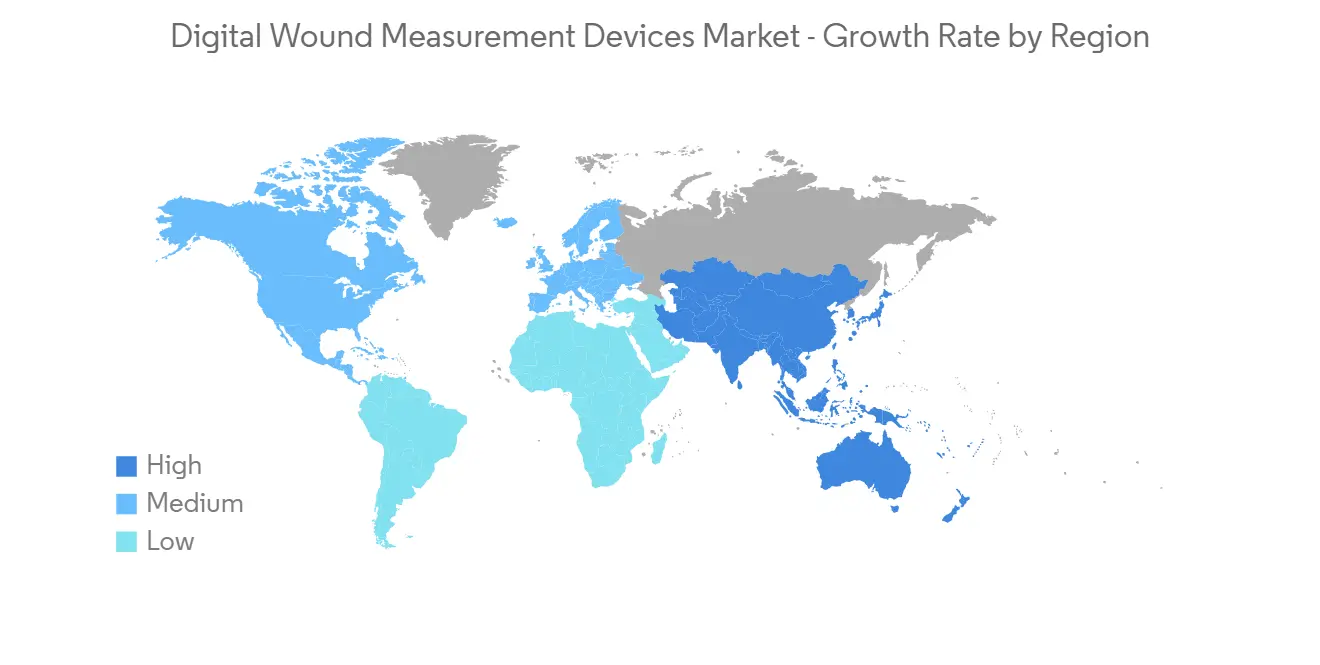

北美有望在预测期内主导市场

北美主要受慢性伤口负担增加以及美国和加拿大越来越多地采用数字医疗保健的推动。 预计美国将在该地区占据最大份额。 这是因为高度发达的医疗保健系统需要不断的技术发展。

预计糖尿病患病率上升和医疗保健支出增加将推动市场增长。 例如,根据国际糖尿病联合会第 10 版糖尿病地图集,2021 年美国约有 3220 万人患有糖尿病,预计到 2045 年这一数字将上升到 3630 万。 预计全国糖尿病患者人数的增加将增加糖尿病溃疡的病例数,从而促进美国市场的增长。

此外,根据 Mission Regional Medical Center 2022 Update,估计到 2022 年将有 670 万人患有慢性伤口,在未来十年内将增加 2% 以上。。 慢性伤口每年给美国医疗保健系统造成的损失超过 500 亿美元。 在美国,超过 2900 万人(占人口的 9.5%)患有糖尿病,其中每年有近 200 万人可能会患上糖尿病足溃疡和其他无法癒合的伤口。 因此,糖尿病和慢性伤口等致伤性疾病负担的增加预计将推动美国市场的增长。

数字式伤规行业概况

数字伤口测量设备市场竞争激烈。 随着新兴国家引入数字医疗,开发医疗 IT 业务的公司将重点放在提供伤口测量服务上。 市场参与者包括 MolecuLight Inc.、Wound Matrix Inc.、Kent Imaging Inc.、Woundvision 和 ARANZ Medical Limited。

额外福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 慢性伤口负担增加

- 手术次数增加

- 市场製约因素

- 设备认知度低,成本高

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分

- 按产品分类

- 接触式伤口测量装置

- 非接触式伤口测量装置

- 按伤口类型

- 慢性伤口

- 压疮

- 糖尿病足溃疡

- 其他

- 急性伤口

- 烧伤和外伤

- 手术伤口

- 慢性伤口

- 最终用户

- 医院

- 诊所

- 其他

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美

第6章竞争格局

- 公司简介

- MolecuLight Inc.

- Wound Matrix Inc,

- Kent Imaging Inc.

- Woundvision

- ARANZ Medical Limited

- TISSUE ANALYTICS

- WoundRight, LLC

- Parable Health

- Perceptive Solutions

- eKare Inc

第7章 市场机会与今后动向

Digital Wound Measurement Devices Market is expected to register a CAGR of 4.5% over the forecast period.

The COVID-19 pandemic had a significant impact on the market studied. The COVID-19 pandemic has triggered a significant movement toward telehealth approaches for wound care, whether a teleconsultation via a smartphone app or a remote consultation between a nurse and a wound care professional. According to the data from Health.io Ltd published in June 2022, it was observed that the preference for virtual visits and consultations related to wound care was on the rise during the pandemic. Additionally, in December 2021, Coviu, Australia's leading telehealth solution and CSIRO spin-out company, developed a comprehensive digital toolkit for telehealth wound care alongside CSIRO, The University of Sydney, Australian Unity, Western NSW Primary Health Network, and The University of Technology Sydney. This increased the demand for telewound services, which resulted in the growth of the market studied, as digital wound measurement is one of the key aspects of telewound. Therefore, it was found that the COVID-19 pandemic had a significant positive impact on the market studied. Similarly, with the current boost in healthcare digitalization, the market studied is believed to witness healthy growth over the forecast period.

Key factors propelling the market growth include the increasing burden of wounds globally, the growing number of surgical procedures, and the benefits provided by digital wound measurement devices coupled with the rising aging population prone to develop diseases such as diabetes or other chronic conditions resulting in wounds.

The burden of wounds on healthcare is one of the prominent drivers of the market studied. Several studies have indicated that wounds are integral to healthcare facilities. For instance, data from PubMed published in May 2022 indicated that about 50% of patients admitted to hospitals have wounds, while 1% to 2% of the general population in the developed world suffers from chronic wounds. With the many people with wounds, there is an increasing demand for digital wound measurement devices across hospitals. Due to the rising demand for wound care, healthcare information technology companies have developed wound measurement devices that can ease the overall care provided to the patient. Hence, the market studies are majorly driven by the increasing burden of wounds in healthcare settings.

In addition, from the National Center for Biotechnology Information report published in August 2022, it was found that diabetic foot ulcers are among the most prevalent complications of people with diabetes mellitus and can be brought on by inadequate glycemic control, underlying neuropathy, peripheral vascular disease, or improper foot care. About 60% of people with diabetes develop neuropathy, eventually leading to a foot ulcer. The annual incidence of diabetic foot ulcers worldwide is 9.1 to 26.1 million. Around 15 to 25% of patients with diabetes mellitus will develop a diabetic foot ulcer during their lifetime. Therefore, with the rising prevalence of newly diagnosed diabetes, the incidence of diabetic foot ulcers is also bound to increase, which is believed to propel the demand for digital wound measurement devices.

Several new launches in the market have been studied, which is a beneficial factor for market growth. For instance, in October 2021, a new digital wound assessment tool called Cutimed Wound Navigator was launched by the hygiene and wellness company Essity. To give patients the right and most suited care, the revolutionary mobile app records essential wound features, creates an assessment, and assists healthcare practitioners in selecting the appropriate wound solution. However, lack of awareness about wound measurement devices among the general population and the high cost associated with the same are some factors restraining the market growth.

Digital Wound Measurement Devices Market Trends

Burns and Trauma Wounds are Expected to Witness a Significant Growth Over the Forecast Period

Burns and trauma are poised to witness healthy growth as these are the most common wounds that require urgent care. With the growing incidence of these wounds across the globe, the demand for wound measurement devices to treat such wounds is on the rise. Wound measurement devices are used in burns to understand the burn's depth of impact on the skin, allowing doctors to plan the treatment accordingly.

According to a research study by the National Institute of Health (NIH) published in March 2022, it was observed that about 1 million cases of burn injury of moderate to a severe level that requires high-quality medical care are recorded every year in India. Similarly, according to another research study related to the burn prevalence in Saudi Arabia published by NIH in August 2021, it was found that the first-degree burn prevalence in Saudi Arabia was 12.8%, second-degree burn prevalence was 71.1%, and third-degree burn prevalence was 16.1%, and the most frequent causes, locations, and types of treatment were hot water injuries (36.1%), upper limbs (62.2%), and skin debridement, respectively. The other factors which may increase the global burden of burn injuries include forest fires, war, and accidents. The statistics mentioned above indicate that the occurrence of burns is high in various countries, which is expected to fuel the demand for wound measurement devices and contribute to segment growth in the coming years.

Furthermore, traumatic injuries are also rising, propelling the demand for wound measurement devices. For instance, John Hopkins University data updated in January 2023 indicated that over 30 million kids and teenagers play organized sports in the United States, among which more than 3.5 million have a traumatic injury. Additionally, the Journal of Orthopedic Research data published in December 2022 stated that during ten years from 2012 to 2021, there were 4,666,491 bicycle-related injuries logged in the National Electronic Injury Surveillance System in the United States. The statistics mentioned above indicate that traumatic injuries are on the rise, which will lead to an increasing number of surgical procedures expected to fuel the demand for wound measurement devices.

Additionally, with high accuracy, artificial intelligence (AI) can help doctors evaluate burn surfaces, identify burn depth, determine whether surgery or other treatments are necessary, direct fluid resuscitation, and forecast complications and prognosis. Therefore, the emergence of digital wound measurement is expected to fuel segment growth over the forecast period.

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to be the dominating region in the market studied, The high share is majorly attributed to the high adoption of digital healthcare in the United States and Canada along with the increasing burden of chronic wounds. In the region, the United States is expected to witness the largest share due to the highly developed healthcare system that continuously seeks development in terms of technology.

The growing prevalence of diabetes along with an increase in spending on healthcare management is anticipated to increase the market growth. For instance, according to the International Diabetes Federation Diabetes Atlas Tenth edition, in 2021, around 32.2 million people in the United States had diabetes, projected to grow to 36.3 million by 2045. The rising number of diabetic cases in the nation is expected to increase the number of diabetic ulcer cases and contribute to market growth in the United States.

Moreover, as per Mission Regional Medical Center's 2022 update, it was estimated that 6.7 million people were living with chronic wounds as of the year 2022, and that number is expected to grow by more than 2% for the next decade. Chronic wounds cost the US healthcare system more than USD 50 billion each year. In the United States, more than 29 million people (9.5% of the population) have diabetes, and nearly two million of those people are likely to develop a diabetic foot ulcer or another non-healing wound each year. Hence considering the increasing burden of wound-causing diseases such as diabetes and chronic wounds, the market is anticipated to witness growth in the United States.

Digital Wound Measurement Devices Industry Overview

The digital wound measurement devices market is moderately competitive. With the increasing adoption of digital healthcare in developing countries, companies operating in the healthcare IT business are focusing on the provision of wound measurement services. Some of the key companies in the market are MolecuLight Inc., Wound Matrix Inc, Kent Imaging Inc., Woundvision, and ARANZ Medical Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Chronic Wounds

- 4.2.2 Rising Number of Surgical Procedures

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness and High Cost Associated With the Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Contact Wound Measuring Devices

- 5.1.2 Non Contact Wound Measuring Devices

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Pressure Ulcers

- 5.2.1.2 Diabetic Foot Ulcers

- 5.2.1.3 Others

- 5.2.2 Acute Wounds

- 5.2.2.1 Burns and Trauma

- 5.2.2.2 Surgical Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Asutralia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 MolecuLight Inc.

- 6.1.2 Wound Matrix Inc,

- 6.1.3 Kent Imaging Inc.

- 6.1.4 Woundvision

- 6.1.5 ARANZ Medical Limited

- 6.1.6 TISSUE ANALYTICS

- 6.1.7 WoundRight, LLC

- 6.1.8 Parable Health

- 6.1.9 Perceptive Solutions

- 6.1.10 eKare Inc