|

市场调查报告书

商品编码

1258786

纺织废物管理市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Textile Waste Management Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,纺织废料管理市场的复合年增长率将超过 3%

主要亮点

- 由于人们的回收意识和对环境的关注度不断提高,预计纺织品回收市场将会增长。 此外,COVID-19 大流行对全球市场的增长产生了负面影响。 由于实施预回收流程的限制和障碍,纺织品回收行业面临挫折。

- 因此,服装和纺织品堆积在仓库中,减缓了市场发展。 在美国,各种举措和初创企业越来越受欢迎,并为提高纺织品回收率做出了重大贡献。 ATRS(American Textile Recycling Services)是一家捐赠箱运营商,提供服装、鞋类和家居用品的捐赠和收集服务。 ATRS 是一家提供服装、鞋类和家居用品捐赠和收集服务的捐赠箱运营商,它正在向美国各地的新地点扩张,以加速扩大回收范围。

- 此外,回收程序的进步和行业的新研究也有望帮助扩大市场。 例如,在 2022 年 2 月举行的国际纤维素纤维会议上,LIST Technology AG 宣布了一款全回收莱赛尔 T 恤,作为纺织品回收业务向前迈出的重要一步。 有限的可用性和足够的可回收材料的使用严重限制了市场扩张。 在大多数情况下,织物材料是组合在一起的,这使得分类过程和后续回收变得困难。 在新兴国家,非正规供应商也在收集和分类,这正在影响整体回收率和市场扩张。

纺织废料管理市场趋势

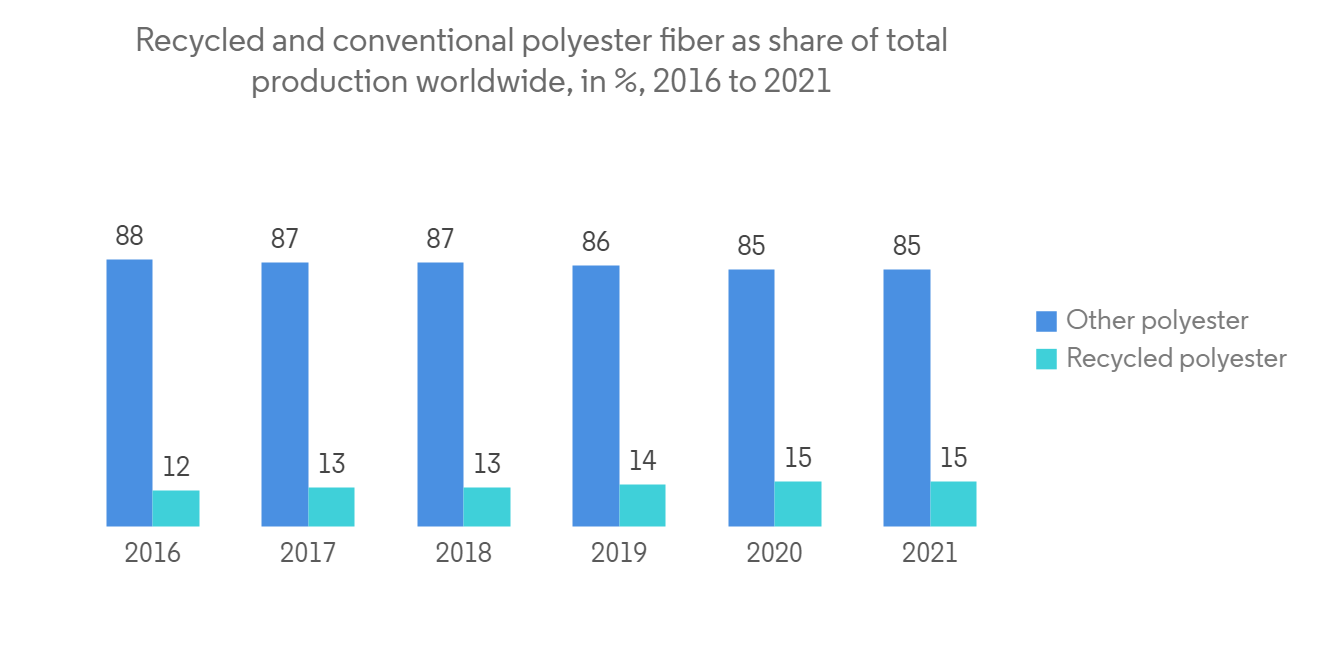

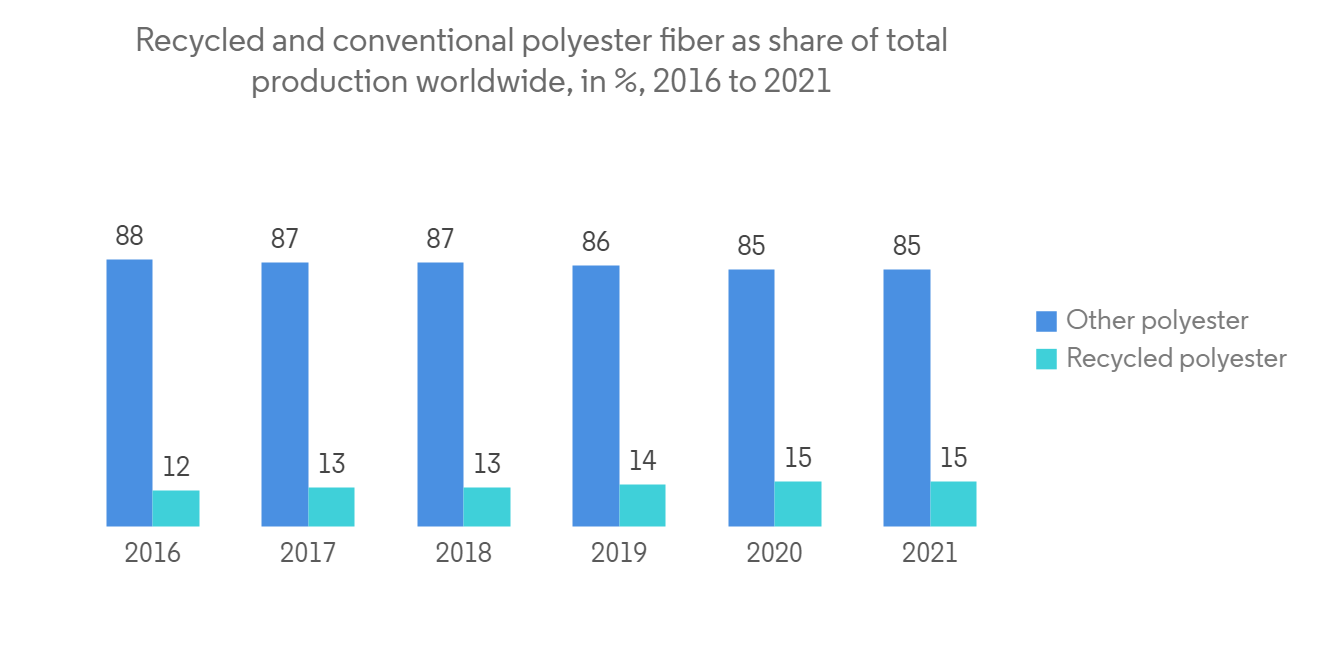

聚酯再生产业有望快速增长

由于时尚行业的需求增加,聚酯回收正在加快速度。 公司致力于在他们的服装中使用更多的再生聚酯来代替普通聚酯。 大多数聚□胺回收利用尼龙,并且大部分回收是通过化学回收方法完成的。 回收尼龙存在很多技术难点,目前回收尼龙的企业寥寥无几。 大多数用于回收的聚□胺来自消费后纺织品,但它们也可能来自已经使用过的渔网等物品。

2022 年 12 月,美国国家可再生能源实验室 (NREL) 的科学家发现了一种□,可以使回收废旧聚酯织物和瓶子比从石油中生产它们更便宜。. NREL 研究人员提出了多种□,可以分解各种聚对苯二甲酸乙二醇酯 (PET),甚至是持久的结晶形式。

一旦去除聚酯废料,回收的 PET 就可以製成涤纶纱线。 由于这种纱线具有与原生涤纶相同的特性,因此製造新纱线所需的能源更少。 回收聚酯废料不仅可以降低能源消耗,消除塑料废料在环境中的扩散,还可以降低后续製造成本,创造出高质量的产品。

亚太地区主导全球纺织废物管理行业

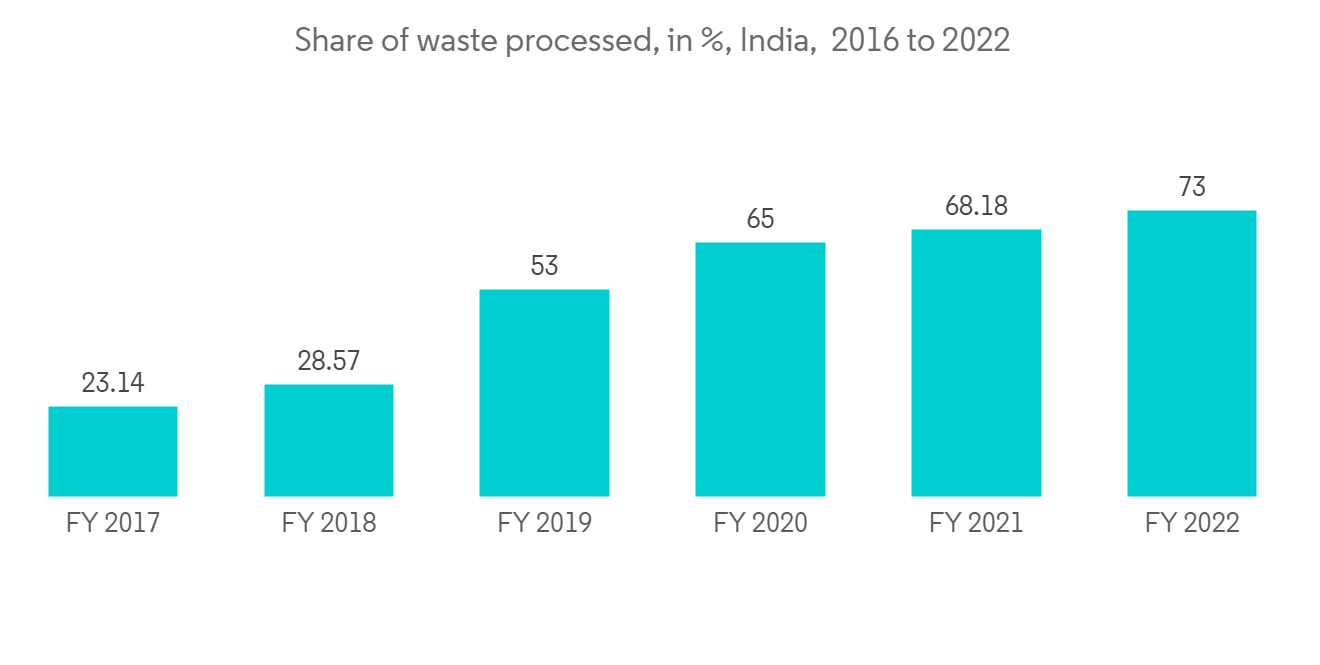

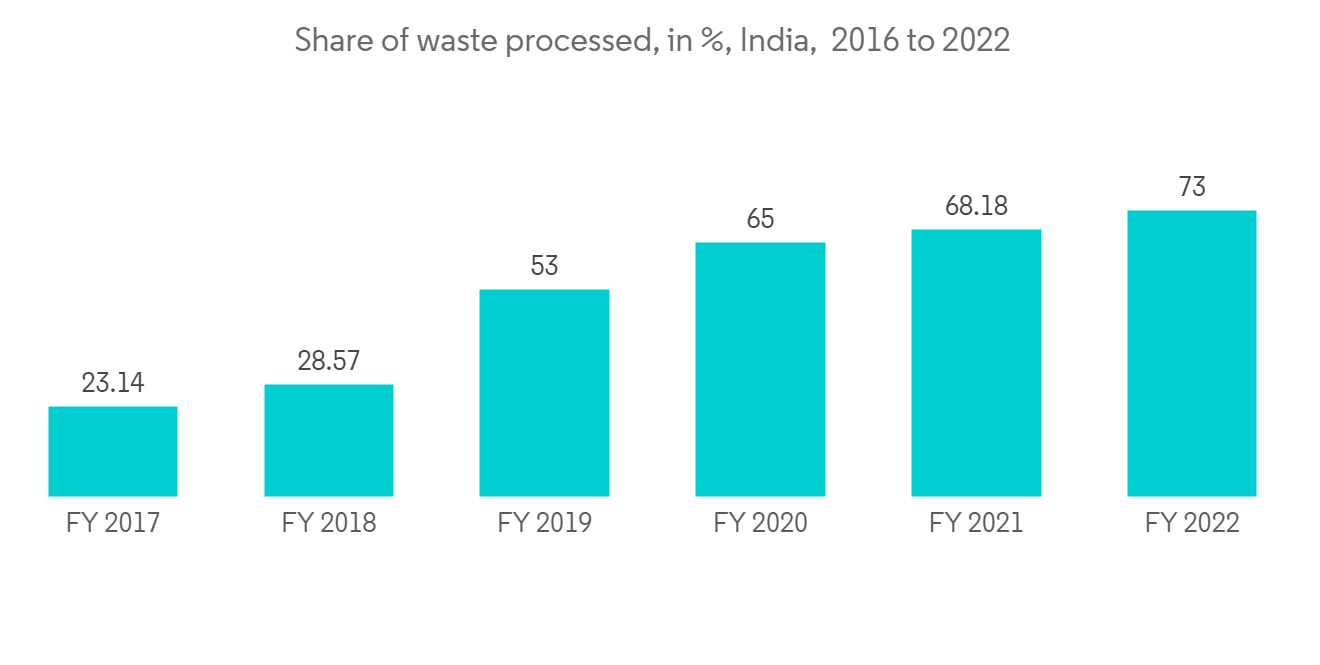

印度政府即将推出的新项目和建立综合纺织园区的计划推动了区域市场增长。 此外,越来越多的纺织品出口到美国、欧洲等国家,而中国、印度、孟加拉国和越南是重要的纺织国家,增加了市场拓展的潜力。 纺织废物管理也由废水处理厂主导,并将在未来四年内继续如此。 解决全球水资源短缺和清洁水供应中断的环境挑战的需要正在推动该行业的发展。

随着由回收织物和塑料等有机材料製成的生态服装的出现,亚太市场也在蓬勃发展。 其他增长因素包括上门收集衣物的流行以及在公共场所安装衣物收集箱。 此外,越来越多的人因为舒适等优点而选择家居材料,这也促进了市场的增长。 此外,亚太地区的纺织品回收市场预计在未来几年将增长,主要参与者将开髮用于自动分拣应用的新技术。

纺织废料管理行业概览

最终用户的需求在行业中创造了激烈的竞争,导致行业碎片化。 Infinite Fiber Company (IFC) 大力投资纺织品回收。 该公司近期在H&M Group、RGE Pte Ltd、Virala和新加坡Fortum等知名製造商的支持下,一直在开发回收技术。

全球纺织废料管理行业有望投资于创新技术。 此外,这些供应商的成功在很大程度上取决于他们是否愿意接受原料生产。 Worn Again Technologies、Re:NewCell 和 Pistoni S.r.l. 是该行业的主要参与者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察和动态

- 市场概览

- 市场驱动力

- 市场製约因素/挑战

- 市场机会

- 价值链/供应链分析

- 波特的五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 行业创新

- 政府为吸引行业投资所做的努力

- 关于 COVID-19 对行业的影响

第 5 章市场细分

- 通过浪费

- 危险

- 塑料

- 涤纶

- 其他废物

- 按服务

- 公开倾销

- 焚烧

- 垃圾填埋场

- 回收

- 最终用户

- 住宅

- 商业

- 工业

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 西班牙

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 孟加拉国

- 土耳其人

- 韩国

- 澳大利亚

- 印度尼西亚

- 其他亚太地区

- 中东和非洲

- 埃及

- 南非

- 沙特阿拉伯

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 市场集中度概述

- 公司简介

- Worn Again Technologies

- Veolia Environnement S.A.

- Boer Group

- Re:NewCell

- Pistoni S.r.l

- Lenzing AG

- Textile Recycling International

- RE TEXTIL Deutschland GmbH

- Hyosung Group

- Infinited Fiber Company

第7章市场机会与未来趋势

第8章附录

- 按活动划分的 GDP 分布

- 对资本流动的见解

The Textile Waste Management Market is expected to register a CAGR of over 3% during the forecast period.

Key Highlights

- The textile recycling market is expected to grow because people are becoming more aware of recycling and because they care more about the environment.Furthermore, the COVID-19 pandemic had a detrimental influence on worldwide market growth. The textile recycling industry is facing a setback due to constraints and impediments to executing the pre-recycling process.

- As a result, garments and textiles are stacked up in warehouses, slowing market development. Various initiatives and start-ups are gaining traction in the United States, contributing considerably to the rising rate of textile recycling. ATRS (American Textile Recycling Services) is the donation bin operator for clothes, footwear, and household items donation and collection services. ARTS is constantly extending to new locations around the country, accelerating the expansion of recycling.

- Furthermore, advancements in recycling procedures and new research in the industry are expected to aid market expansion. For example, at the International Conference on Cellulose Fibers in February 2022, LIST Technology AG presented an all-recycled lyocell t-shirt as a major step forward in the textile recycling business. The restricted availability and accessibility of sufficient recyclable material severely limits market expansion. Most of the time, the fabric material is combined, making the sorting procedure and subsequent recycling difficult. Additionally, informal vendors carry out the collecting and sorting process in less developed countries, which has an impact on the overall recycling rate and market expansion.

Textile Waste Management Market Trends

The Polyester Recycling Industry Is Predicted To Grow At A Rapid Pace

Polyester recycling is picking up speed because there is more demand for it in the fashion industry. Companies have promised to use more recycled polyester in clothes by replacing regular polyester.The majority of polyamide recycling is done using nylon, and the majority of the recycling is done using the chemical recycling method. The nylon recycling process is filled with technological difficulties, and there are now just a few businesses that recycle nylon. Polyamide used for recycling comes mostly from used fabric, but it can also come from things like fishing nets that have already been used.

And in December 2022, scientists at the National Renewable Energy Laboratory (NREL) in the United States found enzymes that might make recycling waste polyester fabrics and bottles cheaper than producing them from petroleum. Researchers at NREL came up with different enzymes that can break down all types of polyethylene terephthalate (PET), even the kind that lasts a long time and is crystalline.

When polyester waste is taken away, it is possible to make polyester yarn from recycled PET. This yarn has the same properties as first-process polyester, so it uses less energy to make new things. Polyester trash recycling not only reduces energy consumption and eliminates plastic waste dispersion in the environment, but it also saves money on subsequent manufacturing and high-quality goods.

Asia Pacific Region Dominated The Global Textile Waste Management Industry

Regional market growth is helped by upcoming new projects and plans by the Indian government to set up integrated textile parks. Also, more textiles are being sent to places like the U.S. and Europe, and the fact that China, India, Bangladesh, and Vietnam are important textile countries makes the market more likely to grow. Also, wastewater treatment plants dominated a part of the market for managing textile waste, and they are likely to continue to do so over the next four years. The need to address environmental concerns about water shortages and the loss of clean water supplies around the world is what is driving the growth of this industry.

The Asia-Pacific market is also getting a boost from the creation of eco-clothes made from recycled fabrics, plastics, and other organic raw materials. Aside from that, the popularity of door-to-door clothing pickup and the installation of clothing collection bins in public places are key growth drivers. And the market is growing because more people are choosing house materials because they are comfortable and have other benefits. Moreover, the Asia-Pacific textile recycling market is expected to grow over the next few years as leading companies create new technologies for automated sorting applications.

Textile Waste Management Industry Overview

The market is broken up because recycled textiles are being used in more and more consumer sectors to help make other products.End-user demand has created strong competition in the industry, resulting in industrial fragmentation. The Infinited Fiber Company (IFC) has invested much in textile recycling. The firm recently gained backing from well-known manufacturers to develop its recycling technology, including H&M Group, RGE Pte Ltd., Virala, and Singapore-based Fortum.

The global textile waste management industry is projected to invest in innovative technologies. Furthermore, the success of these suppliers is heavily reliant on their willingness to accept raw production. Worn Again Technologies, Re:NewCell, and Pistoni S.r.l. are a few of the industry's significant players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Market Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Innovations in the industry

- 4.8 Government Initiatives to Attract Investment in the Industry

- 4.9 Impact of COVID - 19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Waste

- 5.1.1 Hazardous

- 5.1.2 Plastic

- 5.1.3 Polyester

- 5.1.4 Other Wastes

- 5.2 By Service

- 5.2.1 Open dumping

- 5.2.2 Incineration

- 5.2.3 Landfil

- 5.2.4 Recycling

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Other End-Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Bangladesh

- 5.4.3.5 Turkey

- 5.4.3.6 South Korea

- 5.4.3.7 Australia

- 5.4.3.8 Indonesia

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 Egypt

- 5.4.4.2 South Africa

- 5.4.4.3 Saudi Arabia

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Worn Again Technologies

- 6.2.2 Veolia Environnement S.A.

- 6.2.3 Boer Group

- 6.2.4 Re:NewCell

- 6.2.5 Pistoni S.r.l

- 6.2.6 Lenzing AG

- 6.2.7 Textile Recycling International

- 6.2.8 RE TEXTIL Deutschland GmbH

- 6.2.9 Hyosung Group

- 6.2.10 Infinited Fiber Company*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity

- 8.2 Insights on Capital Flows