|

市场调查报告书

商品编码

1258787

垂直软件市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Vertical Software Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

垂直软件市场预计在预测期内以 11.2% 的复合年增长率增长。

垂直市场软件具有许多明显的优势。 垂直市场软件可以更有效地响应行业特定的功能和流程。 与横向市场软件相比,它还允许更好地集成不同的功能和程序。 由于这些特点,垂直软件市场的市场规模预计将在预测期内呈现许多增长机会。

主要亮点

- 垂直软件市场领导者有能力在千层蛋糕上添加“集成服务”,例如支付处理。 大多数金融服务,如支付处理、工资单和贷款,都是商品。 通过提供通常更易于使用、更便宜且与该软件更好地集成的垂直专业产品,您将能够确立自己作为垂直受信任的软件供应商的地位。您有权击败第三方供应商。 这种方法的要点是公司不想让客户掏腰包购买更多的软件。 相反,您可以让交叉销售感觉“免费”,并通过更换客户已经支付的商品来减少销售中的摩擦。

- 例如,Shopify 筹集并承销业务资金。 具有现金流可见性的行业软件企业特别适合发起和承销贷款。 例如,当一家建筑公司获得新工作时,Procore 会提供贷款以资助购买建筑材料。 Truckstop 将在卡车司机完成业务后以其债务为抵押贷款。 Mindbody 为未来通过 Mindbody 平台支付的款项提供预付现金。

- 一些 B2B2C 垂直软件公司正试图通过消费者而不是商家获利。 FareHarbor 是一家为活动和旅游运营商市场提供软件的公司。 虽然它的许多竞争对手向运营商支付会员费,但 FareHarbor 通过提供免费软件和向最终用户收取交易费来赚钱。 这种突破性的定价让 FareHarbor 比价格更高的竞争对手更具优势。

- 在大流行期间,各个行业都成功地与软件公司合作,为其客户提供更好的体验。 例如,着名的 ERP 解决方案提供商 Rootstock Software 最近与 Vertical Aerospace 合作,以消除这种误解,并在全球 COVID-19 大流行期间实施 Rootstock 的云 ERP,仅用了三个半月就完成了。

- 有更多的规则和监管合规管理在各个公司中得到发展。 监管合规流程和战略指导公司努力实现其商业目标。 公司采用合规软件来确保所有产品组件和生产程序符合所有相关法律要求和工业质量基准。 在许多行业的供应链中,监管限制变得越来越严格。 与气候变化、全球化相关的环境问题以及随之而来的跟踪、满足和验证来自多个地点的法规遵从性的需求,以及大规模定制需要以更小的批次和更小的批次来满足不断增加的各种产品的要求,所有这些都增加了这些压力。

垂直软件市场趋势

BFSI有望带动市场

- 金融科技通过增加每个客户的收入和使产品更强大来影响垂直 SaaS 进入市场的渠道。 换句话说,金融科技在提高生命週期价值(LTV)的同时维持(如果没有降低)客户获取成本(CAC)。 例如,每个订户收入250美元/月的Mindbody,对软件包收取150美元/月的费用,平均1800美元/年,同时额外赚取100美元/月的支付收入。

- 此外,金融科技可以显着提高生命週期价值,因此垂直 SaaS 公司会在让金融科技成为主要收入来源之前提供更便宜(甚至免费)的 SaaS 产品。这也可以吸引对数字化犹豫不决的客户群。 Silo 是一个面向食品批发商的操作系统,目前不向客户收取软件费用,这使其能够在一个历来不愿采用软件的行业中有效地获得客户。我做到了。

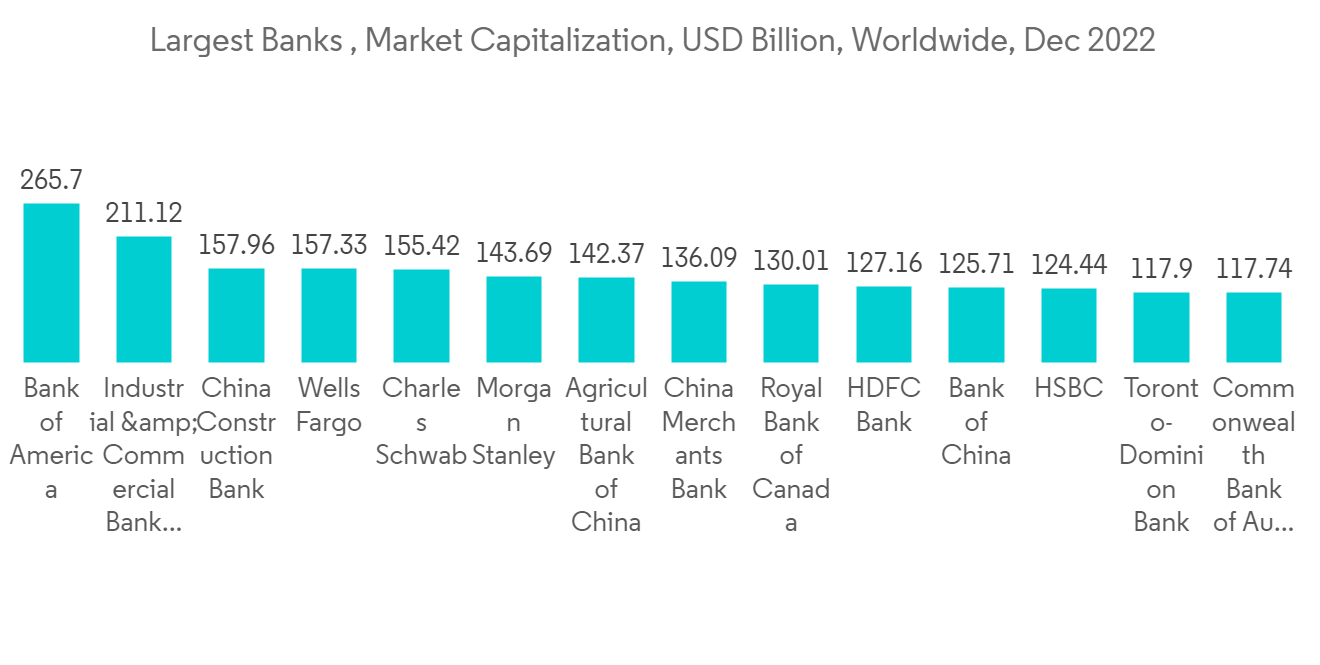

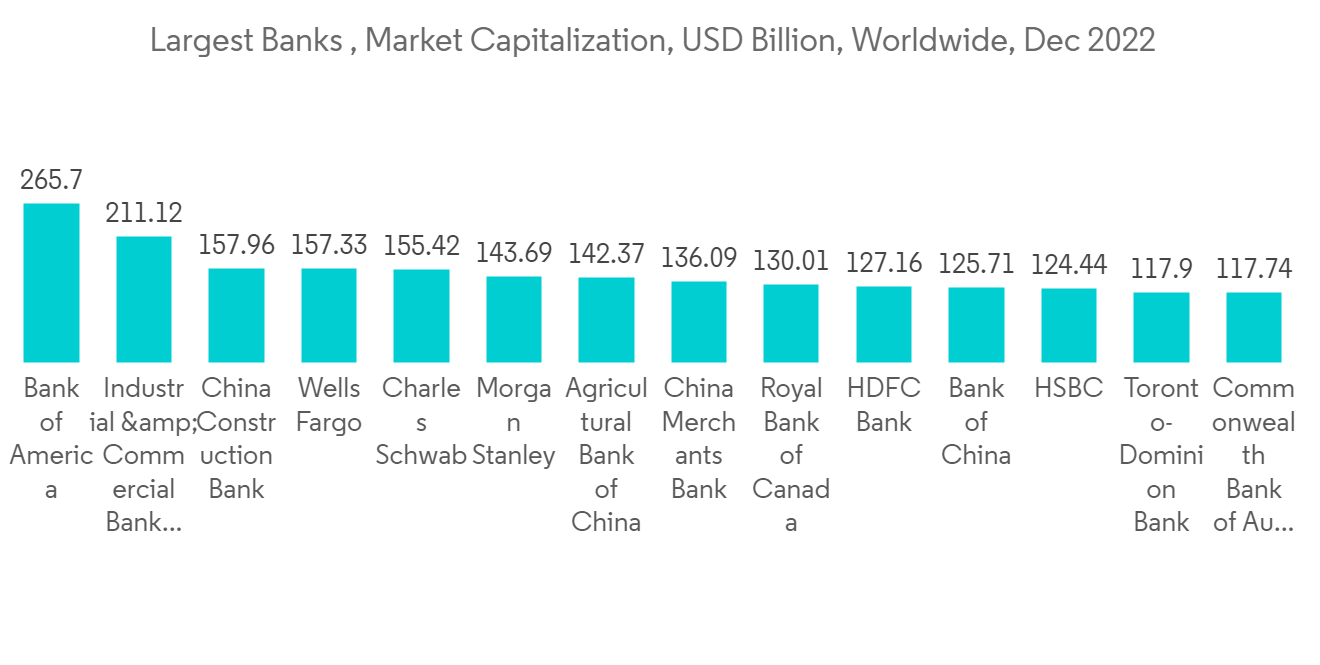

- 根据 CompaniesMarketCap 的数据,截至 2022 年 12 月 31 日,摩根大通是全球市值最大的银行。 摩根大通当时的市值约为 3930 亿美元,大大高于美国银行的市值(约 2657 亿美元)。 摩根大通是美国总资产最大的银行,但在全球仅排名第六。 如此巨大的银行市值为垂直软件公司将其解决方案部署到这些银行创造了机会。

- 随着金融行业对垂直软件的需求增加,公司提供了各种产品来占领市场份额。 例如,2022 年 7 月,金融服务软件解决方案提供商和平台 SAP Fioneer 推出了新的垂直产品战略,显着改变了其客户服务。 我们的三个平台采用垂直战略,提供适合个别市场和客户需求的 IT 解决方案,使我们能够应对日益复杂的金融世界。

- 同样,2022 年 2 月,新的 Databricks Lakehouse 金融服务版将面向银行、保险和资本市场客户。 行业特定的技术内容,包括解决方案加速器、欺诈检测和可持续性等金融服务用例的软件代码,以及与该领域常用数据集和第三方数据提供商的接口。加强您的平台。 据 Databricks 称,Lakehouse for Financial Services 为多云环境中的任何数据类型提供实时分析、商业智能和 AI 任务。

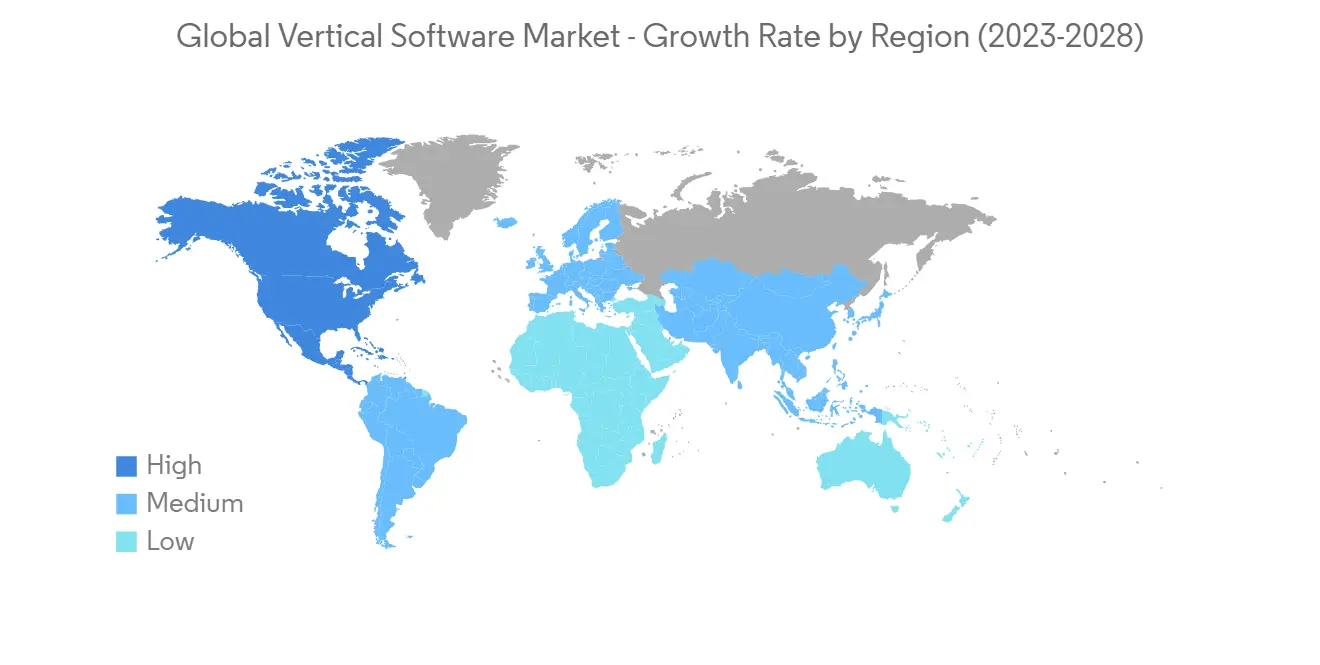

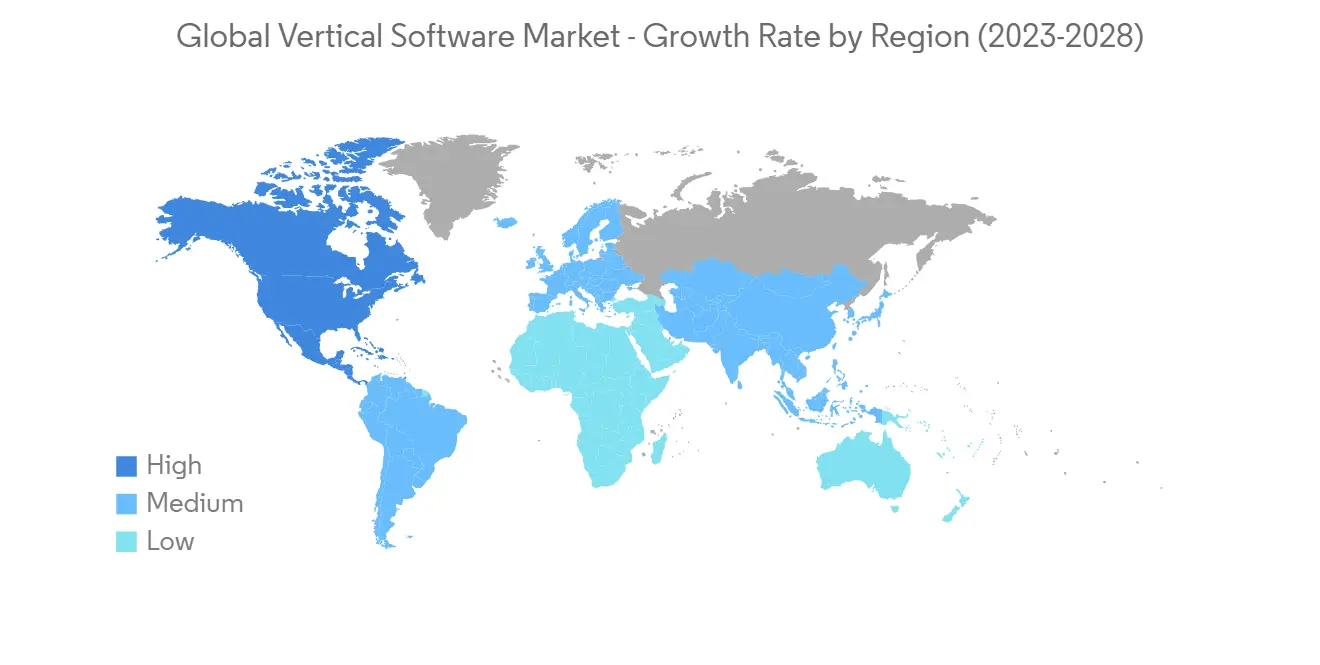

预计北美将占据主要份额

- 根据 Flexera Software 对北美地区 514 名 IT 高管的调查,49% 的受访者表示越来越多的公司将重点放在协作平台、服务、通信等方面的投资,并且该地区的 IT 投资正在增加。我们期望它会增加。 这为协作白板软件市场的供应商开闢了新的可能性。 Micro 总部位于旧金山,拥有 2000 万名财富 500 强协作白板用户,包括戴尔、思科、德勤、Okta 和 Pivotal。

- 与传统营销相比,由于转向数字全渠道营销,该地区的营销自动化软件采用率正在上升。 根据美国营销协会和杜克大学的 CMO 调查(n=356),2021 年 1 月,美国 B2B 产品营销人员在次年的传统广告支出将减少 0.61%,而数字营销支出预计将增加14.32%。

- 此外,2022 年 3 月,媒体和娱乐行业领先的版权和财务管理平台 Rightsline 收购了 REAL Software Systems,以扩展其核心知识产权管理服务。全面支持端到端的财务和忠诚度工作流程,同时将市场从媒体和娱乐扩展到游戏、出版、消费品、生命科学和高科技等全球行业。

- 2022 年 12 月,总部位于蒙特利尔的专注于为垂直市场获取和开发软件的公司 Valsoft Corporation Inc. 宣布收购北美企业资源规划 (ERP) 和仓库管理系统 (WMS) Apero Solutions软件供应商。我们很高兴地宣布收购 Inc.

- 同样,2023 年 1 月,i3 Verticals, Inc. 收购了为美国政府机构和非政府组织提供基金会计解决方案的 Accufund, Inc.。 Accufund 的会计软件解决方案将大大改善公共部门领域公司的上市战略。

垂直软件行业概览

由于多家公司的存在,垂直软件市场竞争相对激烈。 市场参与者正在采取产品创新、兼併和收购等战略来扩大产品组合、扩大地域范围,主要是为了保持市场竞争力。

2022 年 12 月,Constellation Software Inc. 及其子公司 Lumine Group Inc. 宣布与总部位于美国的媒体垂直市场软件供应商 WideOrbit Inc. (WideOrbit) 达成最终协议併计划合併。确实如此。 交易完成后,WideOrbit 将成为 Lumine Group 的全资子公司,并将作为 Lumine Group 企业组合中的一个独立业务部门运营。

2022 年 11 月,垂直智能软件和解决方案提供商 NowVertical Group Inc. 欣然宣布与墨西哥城的国际载旗航空公司 Grupo Aeromexico S.A.B. de C.V. 达成新协议。 通过该协议,NOW 将帮助推进墨西哥航空公司的数据治理计划,建立实现其成为数据驱动型航空公司的目标所需的愿景和路径。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 市场定义和范围

- 调查先决条件

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估 COVID-19 对市场的影响

第 5 章市场动态

- 市场驱动力

- 对企业特定解决方案和特定领域专业知识的需求不断增加

- 市场压制

- 实施复杂且缺乏敏捷性

第 6 章市场细分

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户行业

- BFSI

- 教育机构

- 法律/政府办公室

- 娱乐和款待

- 服装和服饰

- 医疗保健

- 农业

- 其他最终用户行业

- 按地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第7章竞争格局

- 公司简介

- Constellation Software

- Verisk Analytics

- Athena

- Bio-Logic Inc.

- vetBadger

- FastBound

- Mail Technologies Inc

- Granular

- FarmBite

- RenderForest

第8章 市场展望

The vertical software market is expected to register a CAGR of 11.2 % over the forecasted period. Vertical market software includes a number of distinct advantages. Vertical market software assists in more effectively addressing industry-specific features and processes. In comparison to software for the horizontal market, it also assists organizations in obtaining superior integration with various functionalities and procedures. As a result of these features, the vertical software market size is expected to witness numerous growth opportunities during the forecasted period.

Key Highlights

- Vertical software market leaders have the luxury of adding "integrated services" such as payment processing to their layer cake. Most financial services, such as payment processing, payroll, and lending, are commodities. You have the right to win against generic third-party suppliers as the trusted software vendor in your vertical by supplying a vertical-specific offering that is often more useable, inexpensive, and better integrated with this software. This method's significance is that businesses do not require customers to dip into their pockets and purchase more software. Firms instead replace something that customers already pay for, making the cross-sell feel "free" and lowering sales friction.

- For example, Shopify sources and underwrite business financing. Vertical software businesses with cash flow visibility are especially well-positioned to originate and underwrite loans. For example, Procore provides loans to assist construction companies in financing the acquisition of building materials when new work is awarded to them. Truckstop makes loans to trucking businesses after completing work that is secured by the amount they owe. Mindbody provides a cash advance against future payments made via the Mindbody platform.

- Some B2B2C vertical software companies are attempting to monetize the consumer rather than the merchant. FareHarbor is a software provider to the activity and tour operator markets. While most of its competitors paid operators a membership fee, FareHarbor provided free software and gained revenue by charging end-users a transaction fee. FareHarbor gained an advantage over more expensive competitors thanks to this revolutionary pricing approach.

- During the pandemic, various vertical industries collaborated with software firms to provide a better experience for customers. For instance, rootstock software, a prominent provider of ERP solutions, recently collaborated with Vertical Aerospace to debunk this misconception, completing the implementation of Rootstock's Cloud ERP in just three and a half months and amid the global COVID-19 outbreak.

- There have been more rules, and regulatory compliance management has grown in many different enterprises. Regulatory compliance processes and strategies guide organizations as they work to achieve their commercial objectives. Companies employ compliance software to ensure that all product components and production procedures meet all relevant legal requirements and benchmarks for industrial quality. Regulatory constraints are becoming more intense along many industry supply chains. Climate change-related environmental concerns, globalization and the resulting need to track, satisfy, and verify regulatory compliance from multiple locations, and mass customization, which necessitates regulatory compliance for an ever-increasing various of products in an ever-smaller variety of lots or batches, all contribute to these pressures.

Vertical Software Market Trends

BFSI is Expected to Drive the Market

- Fintech influences vertical SaaS go-to-market channels by increasing revenue per customer and making the product stickier. In other words, fintech maintains, if not decreases, the cost of customer acquisition (CAC) while improving lifetime value (LTV). Mindbody, for example, earned USD 250 per month per subscriber; while it charged USD 150 per month, or USD 1800 per year on average, for its software package, it made an additional USD 100 per month from payments income.

- Furthermore, because fintech can drastically enhance LTV, vertical SaaS companies might offer their SaaS product for cheaper (or even for free) to entice a client base that would otherwise be hesitant to digitize before piling on fintech goods as the primary revenue lever. Silo, an operating system for wholesale food wholesalers, does not now charge its customers for its software, which has allowed it to effectively land customers in an industry that has previously been resistive to software adoption.

- According to CompaniesMarketCap, As of December 31, 2022, JPMorgan Chase was the largest bank in the world by market capitalization. JPMorgan Chase's market capitalization was around USD 393 billion at the time, much higher than Bank of America's market capitalization, which was around USD 265.7 billion. JPMorgan Chase is also the largest bank in the United States in total assets but only the sixth largest globally. The such huge market capitalization of banks would create an opportunity for vertical software companies to deploy their solutions in those banks.

- With the rise in demand for vertical software in the financial sector, firms are providing various products to capture the market share. For instance, in July 2022, SAP Fioneer, a financial services software solutions provider and platform, launched a new vertical product strategy that drastically altered its client offering. Using a vertical strategy, three platforms will deliver IT solutions adapted to the individual market and client needs, allowing them to negotiate an increasingly complex financial world.

- Similarly, in February 2022, the new Databricks Lakehouse financial services edition aims at customers in the banking, insurance, and capital markets. It enhances the platform with industry-specific technical content such as solution accelerators, software code for financial service use cases such as fraud detection and sustainability, and interfaces to data sets and third-party data providers typically utilized by the sector. According to Databricks, the Lakehouse for Financial Services provides real-time analytics, business intelligence, and AI tasks on all data types in multi-cloud environments.

North America is Expected to Hold Major Share

- According to a Flexera Software poll of 514 IT executives in North America, 49% anticipate that IT spending in the region will increase as more firms focus on investing in collaboration platforms and services, communication, and other areas. This opens up new possibilities for suppliers in the collaborative whiteboard software market. Micro, a San Francisco-based firm, boasts 20 million users for its collaborative whiteboard, which includes Fortune 500 companies like Dell, Cisco, Deloitte, Okta, and Pivotal.

- The adoption of marketing automation software has been increasing in the region as there has been a shift to digital omnichannel marketing compared to traditional marketing. According to the CMO Survey by American Marketing Association and Duke University (n=356), in January 2021, B2B product marketers in the United States suggested that their spending on traditional advertising was expected to decline by 0.61% in the following year, while the digital marketing spending was projected to increase by 14.32%.

- Further, in March 2022, Rightsline, the leading rights and finance management platform for the media and entertainment industry, acquired REAL Software Systems to extend its core IP rights management services to fully support end-to-end financial and royalties' workflows while simultaneously expanding its market from media and entertainment into gaming, publishing, consumer products, life sciences, and high tech, among other global industries.

- In December 2022, Valsoft Corporation Inc., a Montreal-based business focusing on vertical market software acquisition and development, is happy to announce the acquisition of Apero Solutions Inc., a North American Enterprise Resource Planning (ERP) and Warehouse Management System (WMS) software supplier.

- Similarly, in January 2023, Accufund, Inc., a provider of fund accounting solutions for government bodies and NGOs in the United States, was acquired by i3 Verticals, Inc. Accufund's accounting software solutions will significantly improve enterprises' go-to-market strategy in the Public Sector area.

Vertical Software Industry Overview

The vertical software market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions to expand their product portfolio, expand their geographic reach, and primarily stay competitive in the market.

In December 2022, Constellation Software Inc. and its subsidiary Lumine Group Inc. announced a formal agreement and merger plan with WideOrbit Inc. ("WideOrbit"), a media vertical market software supplier based in the United States. WideOrbit will become a completely owned subsidiary of Lumine Group and will operate as an autonomous business unit within the Lumine Group's portfolio of companies after the deal is finalized.

In November 2022, NowVertical Group Inc., a vertical intelligence software and solutions firm, is thrilled to announce a new contract with Grupo Aeromexico S.A.B. de C.V., Mexico City's international flag carrier airline. Under the terms of the agreement, NOW will assist Aeromexico in advancing its data governance program, establishing the vision and path it will need to take to progress and achieve its aim of being a data-driven operator.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand of Enterprise-specific Solution and Domain-specific Expertise

- 5.2 Market Restrain

- 5.2.1 Implementation Complexities and Lack of Agility

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium Enterprise

- 6.1.2 Large Enterprise

- 6.2 By End-User Industry

- 6.2.1 BFSI

- 6.2.2 Educational Institution

- 6.2.3 Legal and Government

- 6.2.4 Entertainment and Hospitality

- 6.2.5 Clothing and Apparel

- 6.2.6 Healthcare

- 6.2.7 Farming and Agriculture

- 6.2.8 Rest of the End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Constellation Software

- 7.1.2 Verisk Analytics

- 7.1.3 Athena

- 7.1.4 Bio-Logic Inc.

- 7.1.5 vetBadger

- 7.1.6 FastBound

- 7.1.7 Mail Technologies Inc

- 7.1.8 Granular

- 7.1.9 FarmBite

- 7.1.10 RenderForest