|

市场调查报告书

商品编码

1272666

2-乙基己醇市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)2-Ethyl Hexanol Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,2-乙基己醇市场的复合年增长率预计将超过 5%。

主要亮点

- COVID-19 对 2020 年的市场产生了负面影响。 不过,预计市场将在2022年达到疫情前水平,并继续稳步增长。

- 油漆和涂料、粘合剂和建筑行业对丙烯酸 2-乙基己醇的需求不断增长,预计将在预测期内推动市场发展。 另一方面,北美和欧洲等地区对增塑剂的使用限制可能会阻碍市场扩张。

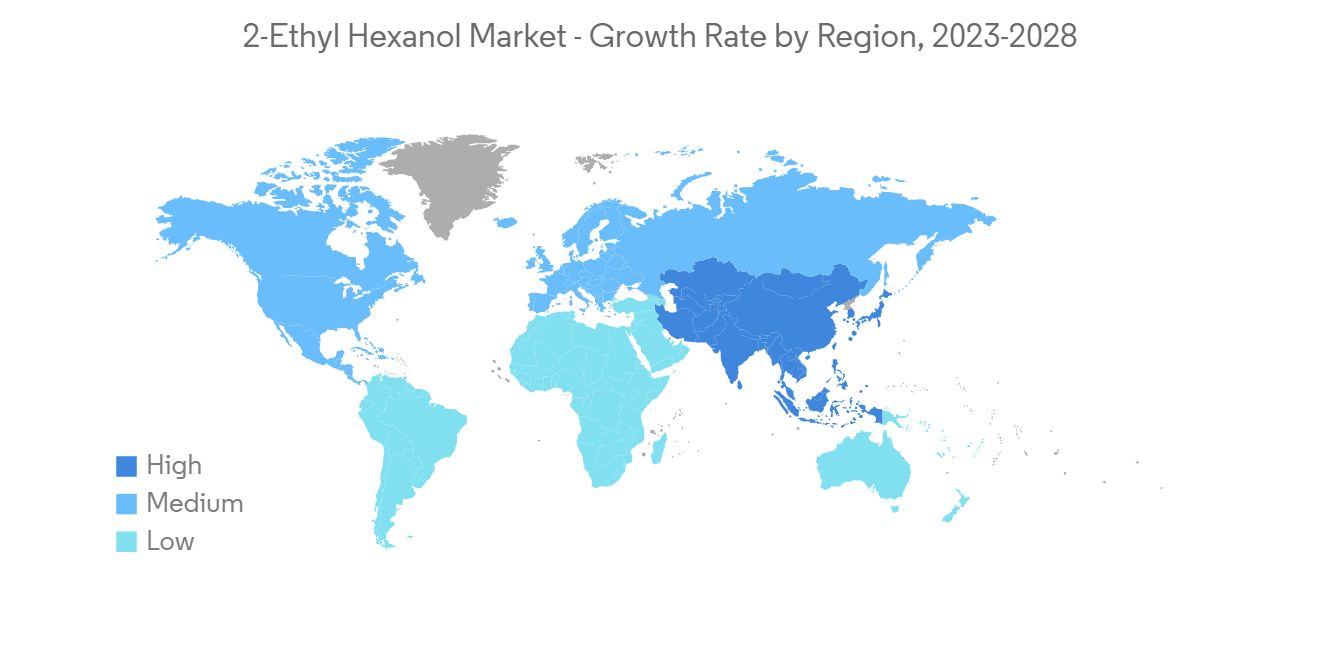

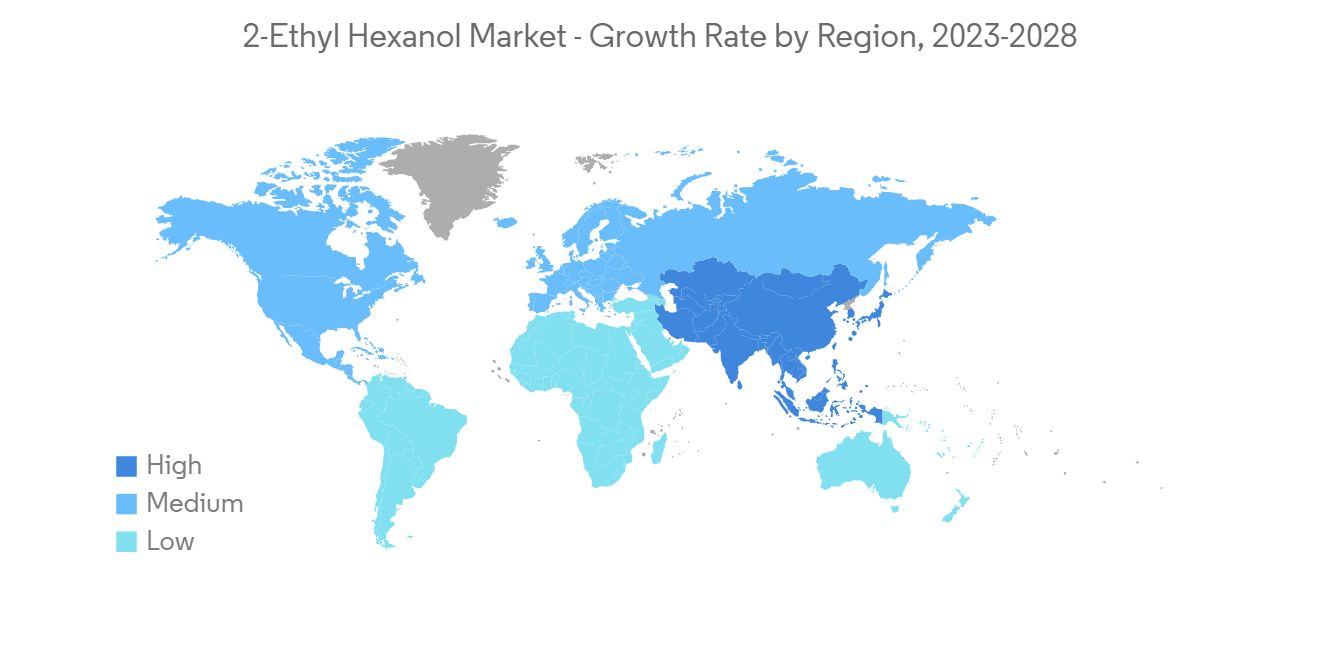

- 预计未来几年,各行业对化学品的需求不断增长,将为 2-乙基己醇市场带来机遇。 亚太地区在全球市场占据主导地位,中国、印度和日本等国家是最大的消费者。

2-乙基己醇市场走势

对丙烯酸 2-EH 的需求增长推动了市场

- 预计在预测期内,各最终用户行业对丙烯酸 2-乙基己酯的需求将增加市场产品需求。 2-乙基己基丙烯酸酯用于生产油漆和涂料、建筑材料和粘合剂。 此外,丙烯酸 2-乙基己酯在压敏粘合剂、乳胶、油漆、纺织品和皮革饰面以及纸张涂料的树脂中用作增塑共聚单体。

- 由于住宅和商业建筑活动的增加,全球油漆和涂料市场正在扩大,预计这将推动建筑工程对丙烯酸 2-乙基己酯的需求。 例如,中国的增长主要是由住宅和商业地产的快速扩张推动的。 中国鼓励并持续推进城镇化进程,预计到 2030 年城镇化比例将达到 70%。

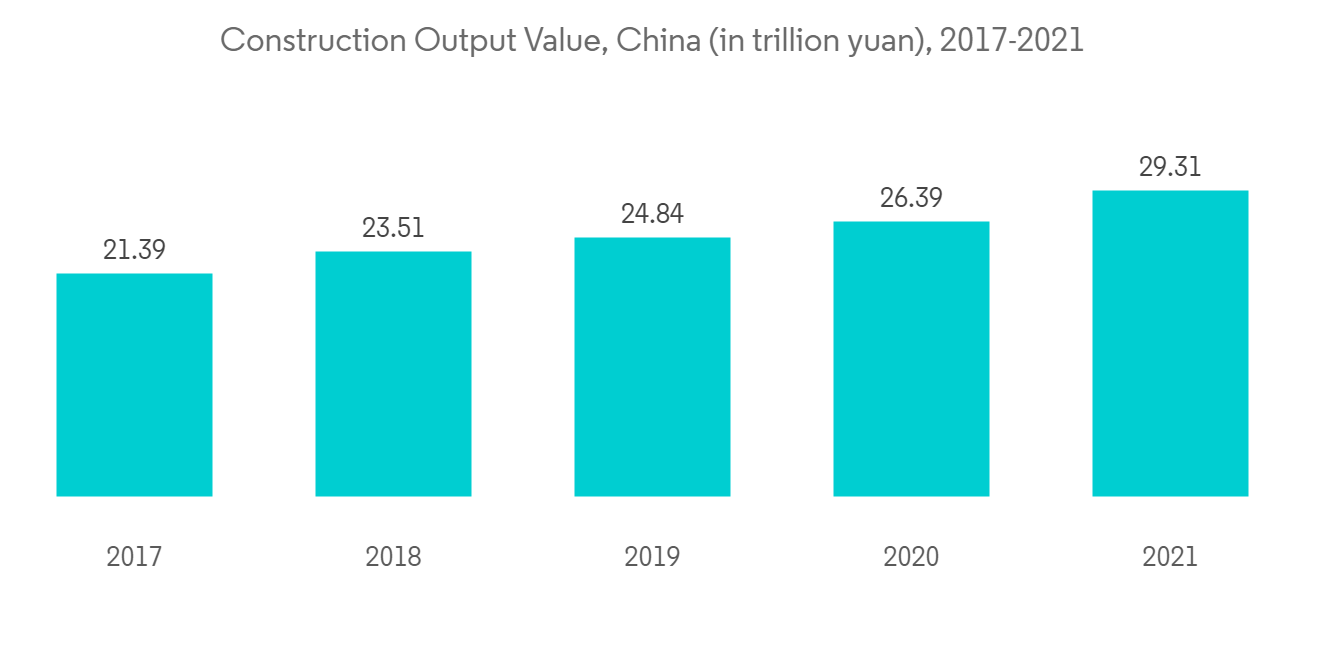

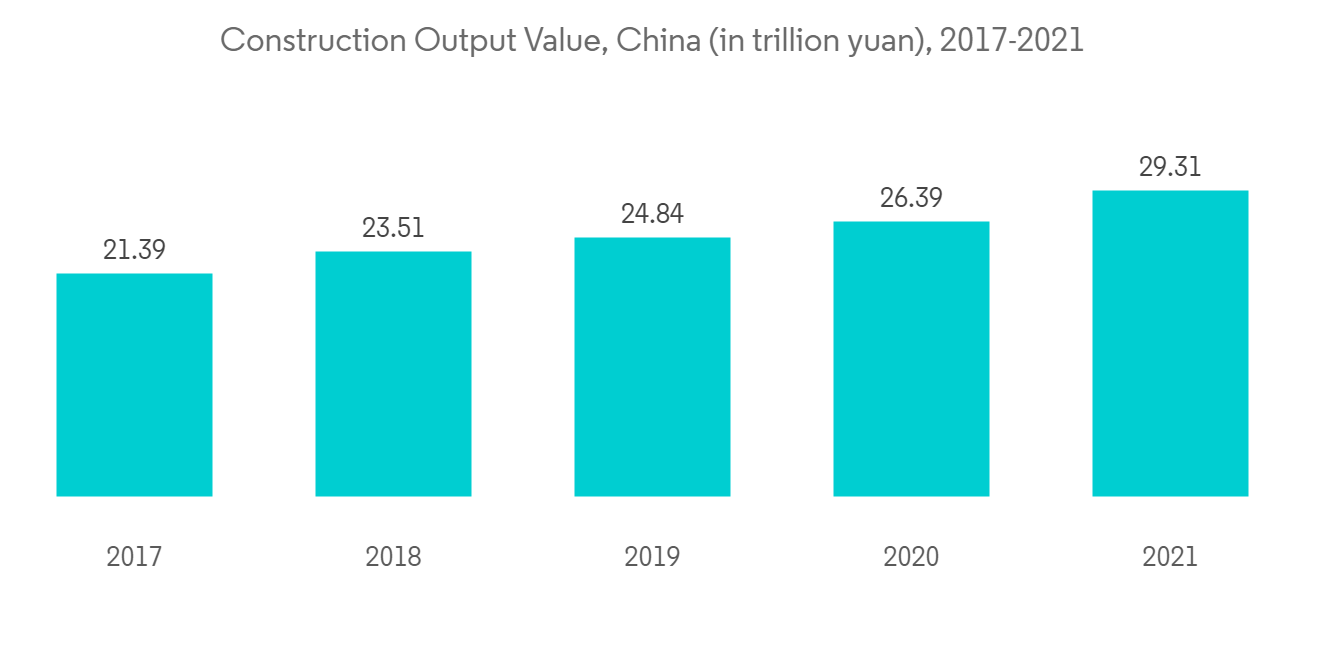

- 此外,中国的建筑产值将在 2021 年达到顶峰,达到约 4.21 万亿美元。 因此,这些因素往往会增加全球对丙烯酸 2-乙基己酯的需求。 预计所有上述因素将在预测期内推动全球 2-乙基己醇市场。

亚太地区需求旺盛

- 预计在预测期内,亚太地区将占据 2-乙基己醇市场的最大市场份额。 随着油漆、涂层剂和粘合剂等行业的扩张,预计该地区的市场将会增长。

- 中国的建筑活动显着增加,导致建筑应用对 2-乙基己醇的需求激增。 例如,中国是购物中心建设蓬勃发展的国家之一。 中国约有 4,000 家购物中心,预计到 2025 年还将新增 7,000 家。

- 此外,包装行业是粘合剂的最大消费者,包装行业的增长有望推动这一市场。 食品和饮料、化妆品、消费品和文具等终端用户对包装领域的需求强劲。

- 在印度,包装类别是最高的最终用户类别,约占粘合剂总用户的 67%,支持了预测期内的市场增长。 因此,预计在预测期内,各行业不断增长的需求将推动该地区的市场。

2-乙基己醇行业概况

2-乙基己醇市场因其性质而部分合併。 市场上的主要参与者包括 Ineos、三菱化学公司、SABIC、伊士曼化学公司和陶氏化学公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对 2-EH 丙烯酸酯的需求不断扩大

- 增塑剂消耗量增加

- 约束因素

- 北美和欧洲等地区限制使用增塑剂

- 其他限制

- 行业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 申请

- 增塑剂

- 2-EH 丙烯酸酯

- 2-EH硝酸盐

- 其他用途

- 最终用户

- 油漆和涂料

- 粘合剂

- 工业化学品

- 其他最终用户

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 西班牙

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 阿拉伯联合酋长国

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- Mitsubishi Chemical Corporation

- LG Chem

- INEOS

- NAN YA PLASTICS CORPORATION

- OQ Chemicals GmbH

- Elekeiroz

第七章市场机会与未来趋势

- 各个工业领域对化学品的需求不断增长

简介目录

Product Code: 69091

The market for 2-ethyl hexanol is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Increasing demand for 2-ethyl hexanol acrylate from the paint and coatings, adhesive, and construction industries is expected to drive the market during the forecast period. On the other hand, the market expansion is likely to be hampered by the restricted use of plasticizers in various regions, such as North America and Europe.

- The rising demand for chemicals across various industries is expected to provide opportunities for the 2-ethyl hexanol market in the coming years. The Asia-Pacific region dominates the market worldwide, with countries like China, India, and Japan being the biggest consumers.

2-Ethyl Hexanol Market Trends

Increasing Demand for 2-EH Acrylate to Propel the Market

- The demand for 2-ethylhexyl acrylate from various end-user industries is predicted to increase the product demand in the market during the forecast period. 2-ethylhexyl acrylate is used to manufacture paint and coatings, and construction and adhesives materials. Further, 2-ethylhexyl acrylate serves as a plasticizing co-monomer in resins for pressure-sensitive adhesives, latex, paints, textile and leather finishes, and coatings for paper.

- The global paints and coatings market is expanding owing to growing residential and commercial construction activities, which is expected to drive the demand for 2-ethylhexyl acrylate in construction work. For example, China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030.

- Also, China's construction output peaked in 2021 at a value of about USD 4.21 trillion. As a result, these factors tend to increase the demand for 2-ethylhexyl acrylate across the globe. All the aforementioned factors are expected to drive the global 2-ethyl hexanol market during the forecast period.

Asia-Pacific to Witness Strong Demand

- Asia-Pacific is expected to have the largest market share in the 2-ethyl hexanol market during the forecast period. With the expanding industries such as paints and coatings, adhesives, etc., the market is expected to bloom across the region.

- China experienced a significant increase in construction activities, resulting in a surge in demand for 2-ethyl hexanol in construction applications. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Furthermore, the packaging segment is the largest consumer of adhesives; thereby growing packaging industry is expected to drive the concerned market. Packaging is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, etc.

- In India, the packaging category is the highest end-user category, holding about 67% of total adhesive users, supporting the market growth during the forecast period. Thus, the rising demand from various industries is expected to drive the market in the region during the forecast period.

2-Ethyl Hexanol Industry Overview

The 2-ethyl hexanol market is partially consolidated in nature. Some of the major players in the market include Ineos, Mitsubishi Chemical Corporation, SABIC, Eastman Chemical Company, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for 2-EH Acrylate

- 4.1.2 Increasing Consumption of Plasticizers

- 4.2 Restraints

- 4.2.1 Restricted Use of Plasticizers in Various Regions, such as North America and Europe

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Applications

- 5.1.1 Plasticizers

- 5.1.2 2-EH Acrylate

- 5.1.3 2-EH Nitrate

- 5.1.4 Other Applications

- 5.2 End-User

- 5.2.1 Paint and Coatings

- 5.2.2 Adhesives

- 5.2.3 Industrial Chemicals

- 5.2.4 Other End-Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Aregentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow

- 6.4.2 BASF SE

- 6.4.3 Eastman Chemical Company

- 6.4.4 SABIC

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 LG Chem

- 6.4.7 INEOS

- 6.4.8 NAN YA PLASTICS CORPORATION

- 6.4.9 OQ Chemicals GmbH

- 6.4.10 Elekeiroz

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Rising Demand for Chemicals Across Various Industries

02-2729-4219

+886-2-2729-4219