|

市场调查报告书

商品编码

1272668

可吸收组织间隔器市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Absorbable Tissue Spacer Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,可吸收组织间隔器市场预计将以 4.9% 的复合年增长率增长。

COVID-19 大流行影响了世界各地的医疗保健系统,扰乱了许多医疗机构的正常护理,使易受伤害的癌症患者面临重大风险。 据报导,由于易感性和免疫抑制,癌症患者患 COVID-19 并发症和死亡的风险增加。 因此,政府努力克服这些并发症。 例如,根据 SAGE Publications 发表的一篇文章,在 2021 年 12 月 COVID-19 大流行期间,社区卫生委员会将创建无 COVID-19 区以确保癌症治疗的连续性安全。肿瘤中心。 欧洲肿瘤研究所 (IEO) IRCSS(意大利米兰)就是其中之一。 因此,虽然 COVID-19 流行病在早期阶段对市场增长产生了重大影响,但政府举措后癌症治疗的恢復对可吸收组织间隔器市场产生了重大影响。 此外,随着 COVID-19 病例转为下降,放疗需求恢復正常水平,市场预计在预测期内将出现显着增长。

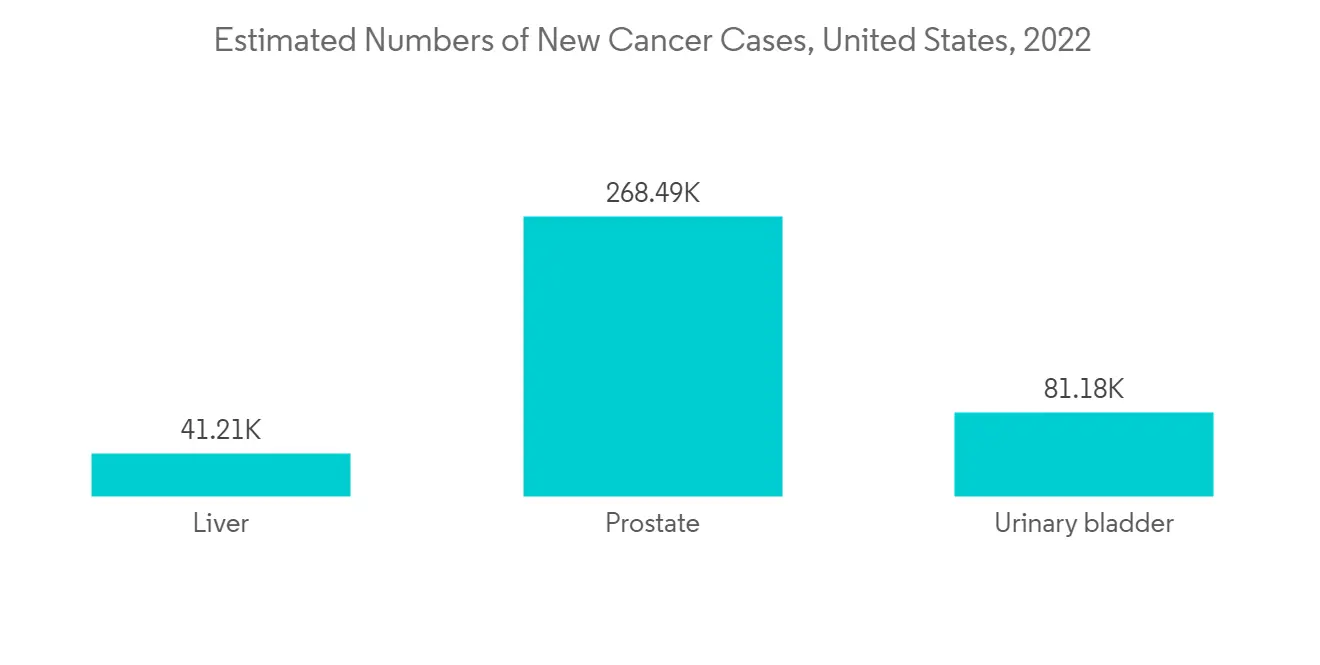

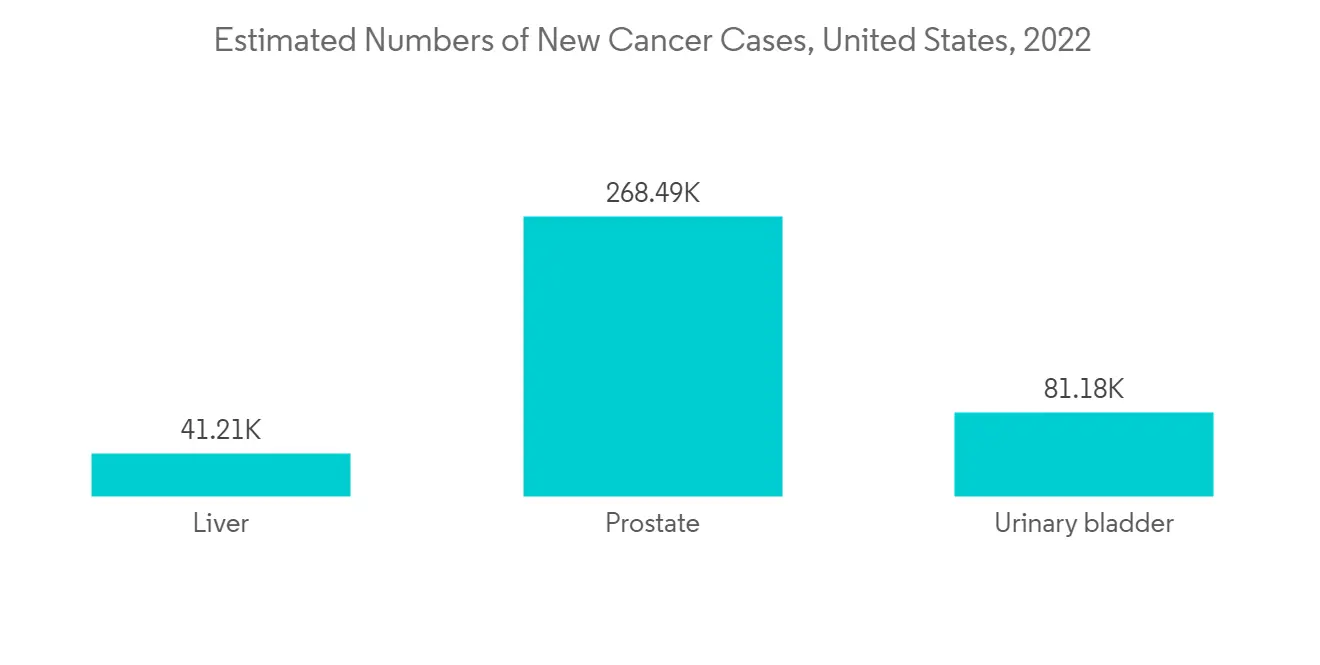

推动市场增长的某些因素包括癌症患病率的增加以及与组织间隔物相关的益处。 受各种癌症影响的人数增加是市场增长的主要驱动力。 例如,根据美国癌症协会2023年1月公布的数据,预计2023年美国将诊断出约1,958,310例新的癌症病例。 因此,预计癌症患病率的增加将对诊断和治疗产生大量需求。 此外,根据澳大利亚政府 2023 年 1 月的更新,估计 2022 年将诊断出 20,640 例新的乳腺癌病例。 因此,人口中癌症的高负担推动了对可吸收组织间隔器的需求,以提供足够的保护并在放射治疗期间形成强大的保护屏障,从而推动市场增长。

主要市场参与者采取的各种举措(例如产品发布、扩张和合作伙伴关係)预计将在预测期内推动市场增长。 例如,2022 年 2 月,Palette Life Sciences 将 Palette 的医疗产品组合商业化。 我们正在扩大我们在日本的产品范围,并积极寻求对 Barrigel 和 Solesta 品牌的监管批准。 预计此类新兴市场的发展将在预测期内推动市场增长。

然而,高成本和缺乏熟练的专业人员是预测期内阻碍市场增长的因素之一。

可吸收组织间隔器的市场趋势

在预测期内,可吸收组织间隔器的全球市场将由放射疗法主导。

由于癌症患病率上升以及在治疗各种癌症类型的放射治疗期间越来越多地采用间隔物等因素,预计放射治疗领域在预测期内将出现显着的市场增长。 例如,BioMed Central Ltd 在 2022 年 4 月发表的一篇文章估计,到 2030 年,德国的新癌症病例数将增加 20%。 此外,根据美国癌症研究协会(AACR)2022年癌症进展报告,过去三年生活在美国的癌症倖存者人数有所增加,截至2022年1月1日已超过1800万。到达

此外,在治疗各种类型癌症的放疗期间越来越多地采用间隔器也有助于这一领域的增长。 例如,根据 2022 年 7 月发表在《放射研究杂誌》上的一篇论文,间隔器在外照射放射治疗 (EBRT) 和近距离放射治疗中对前列腺放射治疗的管理产生了有利影响。 根据 2021 年 10 月发表在《泌尿外科》杂誌上的一篇论文,临床上越来越多地采用直肠间隔器来对抗辐射毒性。 间隔材料在患者的放射治疗期间(约 3 个月)保持完好,之后被身体吸收并随尿液排出。

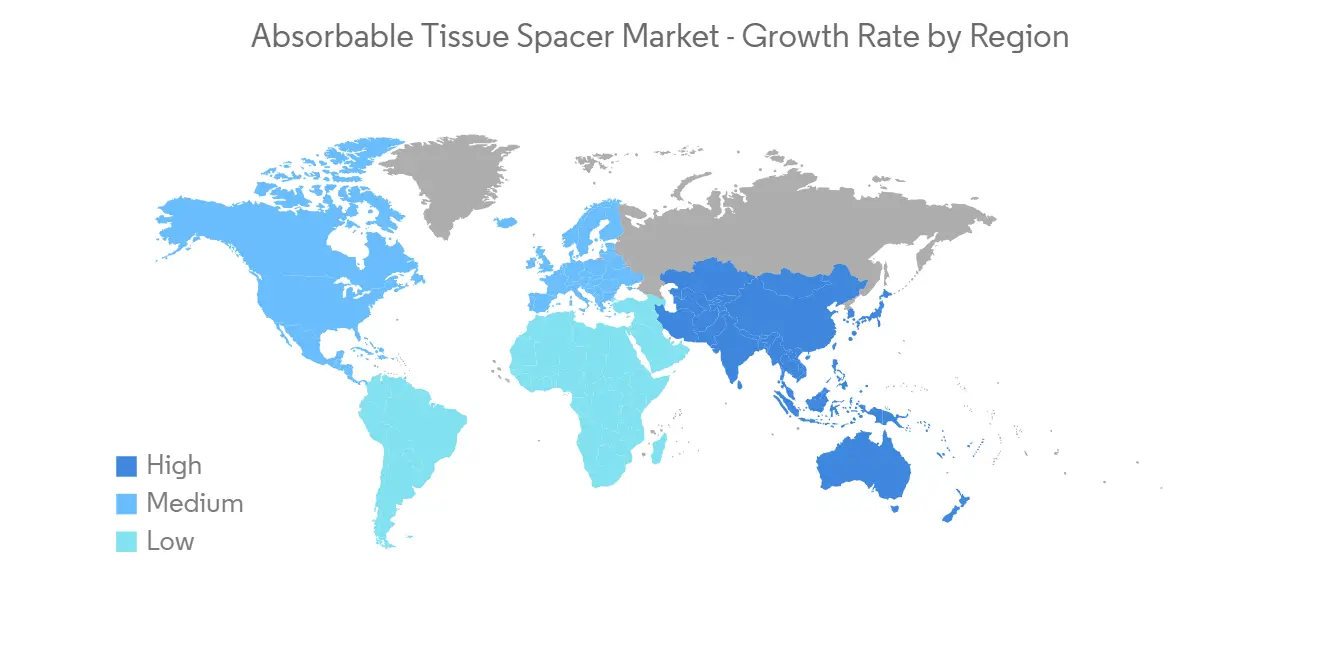

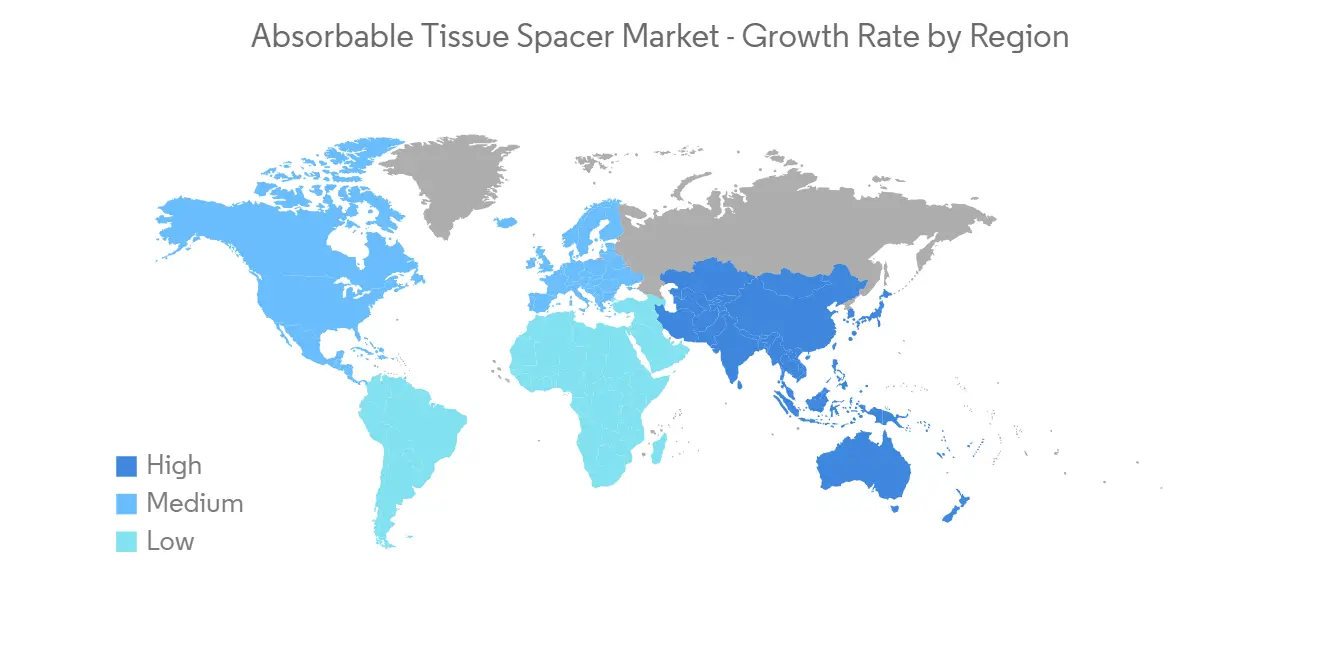

北美主导可吸收组织间隔器市场,预计在预测期内也会如此

由于癌症发病率和患病率的增加以及癌症治疗技术的进步等因素,预计北美的可吸收组织间隔器市场将出现显着增长。 例如,根据美国癌症协会的最新消息,2023 年 1 月,美国估计报告了 288,300 例前列腺癌新病例和 52,550 例结直肠癌新病例。

此外,使用可注射直肠间隔器将直肠前表面与前列腺分开是减少直肠意外辐射剂量的潜在策略。 例如,根据 MDPI 于 2022 年 10 月发表的一篇文章,在美国,水凝胶间隔物在前列腺癌治疗方案中越来越受欢迎。 在 SpaceOAR 获得 FDA 批准后,越来越多的专家收到了水凝胶放置的转介。 这种癌症治疗的进步预计将在预测期内推动市场增长。

可吸收组织间隔器行业概览

由于在全球和区域运营的公司数量不多,吸收性纸巾垫片市场具有整合性。 竞争格局包括具有市场份额的知名国际公司,例如 Biocomposites、Boston Scientific (Augmenix, Inc)、Bioprotect Ltd.、Palette Life Sciences, Inc、Becton、Dickinson, and Company (CR Bard),以及本地公司还对几家公司进行了分析。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 癌症患病率增加

- Tissue Spacer 的优势

- 市场製约因素

- 成本高且缺乏熟练的专业人员

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(市场规模(百万美元))

- 按产品类型

- 水凝胶基底垫片

- 可生物降解的气球垫片

- 通过使用

- 放射治疗

- 传染病控制

- 最终用户

- 医院

- 门诊手术中心

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Biocomposites

- Bioprotect Ltd.

- Boston Scientific

- Becton, Dickinson and Company(CR Bard)

- Palette Life Sciences

第七章市场机会与未来趋势

The absorbable tissue spacer market studied is anticipated to grow with a CAGR of 4.9%, during the forecast period.

The COVID-19 pandemic affected healthcare systems globally and resulted in the interruption of usual care in many healthcare facilities, exposing vulnerable patients with cancer to significant risks. Due to the fragility and immunosuppression, oncologic patients were reported to be at higher risk of COVID-19 complications and deaths. Hence, government initiatives were taken to overcome the complications. For instance, according to an article published by SAGE Publications, in December 2021, during the COVID-19 pandemic, the Regional Health Council converted selected hospitals for cancer care in oncologic hubs to create COVID-19-free zones and guarantee the continuation of cancer treatments safely. The European Institute of Oncology (IEO) IRCSS (Milan, Italy) was one of those. Therefore, even though the COVID-19 pandemic significantly impacted market growth in the initial phases, cancer treatments resumed following government initiatives, which significantly impacted the absorbable tissue spacer market. Additionally, as the COVID-19 cases started to decline, the market has returned to the normal levels of demand for radiotherapy and is anticipated to show significant growth over the forecast period.

Certain factors that are driving the market growth include the increasing prevalence of cancer and the advantages associated with tissue spacers. The growing number of people suffering from various cancers is the key driving factor for the growth of the market. For instance, as per the data published by the American Cancer Society in January 2023, around 1,958,310 people are expected to be diagnosed with new cancer cases in the United States in 2023. Thus, the increasing prevalence of cancer is likely to create a great demand for diagnosis and treatment. Additionally, according to a January 2023 update by the Australian Government, an estimated 20,640 new cases of breast cancer were diagnosed in 2022. Thus, the huge burden of cancers among the population is expected to increase the demand for absorbable tissue spacers to provide adequate protection and to produce a strong protective barrier during radiotherapy, thereby boosting the market growth.

Various initiatives taken by the key market players, such as product launches, expansion, and partnerships, are expected to boost the market's growth during the forecast period. For instance, in February 2022, Palette Life Sciences, commercialized Palette's portfolio of medical products. It expanded its Japanese offering, actively pursuing regulatory clearance for its Barrigel and Solesta brands. Such developments are expected to drive the growth of the market over the forecast period.

However, the high cost and lack of skilled professionals are some of the factors that are impeding the market growth over the forecast period.

Absorbable Tissue Spacer Market Trends

The Radiotherapy Segment to Hold Significant Share in the Global Absorbable Tissue Spacer Market Over the Forecast Period

The radiotherapy segment is expected to witness significant market growth over the forecast period owing to the factors such as the rising prevalence of cancer and the rising adoption of spacers during radiotherapy in treating various cancer types. For instance, according to an article published by BioMed Central Ltd in April 2022, the number of new cancer cases is estimated to increase by 20% by 2030 in Germany. Additionally, according to the American Association for Cancer Research (AACR) Cancer Progress Report 2022, in the past three years, there has been an increase in the number of cancer survivors living in the United States, reaching greater than 18 million as of January 1, 2022.

Additionally, the rising adoption of spacers during radiotherapy in treating various cancer types contributes to the segment's growth. For instance, according to an article published by the Journal of Radiation Research in July 2022, spacers had a favorable efficacy in the management of prostate radiotherapy in both external beam radiation therapy (EBRT) and brachytherapy. Also, according to an article published by Urology in October 2021, rectal spacers are being increasingly adopted into clinical practice to address radiation toxicity. The spacer material remains intact during the patient's radiation therapy (approximately 3 months), after which it is absorbed into the body and cleared in the urine.

North America Dominates the Absorbable Tissue Spacer Market and Expects to do the Same Over the Forecast Period

North America is expected to show significant growth in the absorbable tissue spacer market owing to factors such as the increasing incidence and prevalence of cancers and progressing technological advancements in cancer treatment. For instance, according to the American Cancer Society update, in January 2023, an estimated 288,300 new prostate cancer cases and 52,550 new colon and rectum cases were reported in the United States.

In addition, the use of injectable rectal spacers to distance the anterior rectum from the prostate is a potential strategy to reduce the dose of unintended radiation to the rectum. For instance, according to an article published by MDPI, in October 2022, hydrogel spacers are gaining increasing popularity in the treatment regimen for prostate cancer in the United States. After the FDA approval of SpaceOAR, specialists received more referrals for hydrogel placements. Such advancement in cancer treatment is expected to drive the growth of the market over the forecast period.

Absorbable Tissue Spacer Industry Overview

The absorbable tissue spacer market is consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well-known, including Biocomposites, Boston Scientific (Augmenix, Inc), Bioprotect Ltd., Palette Life Sciences, Inc., and Becton, Dickinson, and Company (CR Bard), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Cancer

- 4.2.2 Advantages associated with Tissue Spacer

- 4.3 Market Restraints

- 4.3.1 High Cost and Lack of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD million)

- 5.1 By Product Type

- 5.1.1 Hydrogel Based Spacers

- 5.1.2 Biodegradable Balloon Spacers

- 5.2 By Application

- 5.2.1 Radiotherapy

- 5.2.2 Infection Management

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Biocomposites

- 6.1.2 Bioprotect Ltd.

- 6.1.3 Boston Scientific

- 6.1.4 Becton, Dickinson and Company (CR Bard)

- 6.1.5 Palette Life Sciences