|

市场调查报告书

商品编码

1272669

丙烯酸乳液市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Acrylic Emulsions Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,丙烯酸乳液市场的复合年增长率预计将超过 5%。

COVID-19 对市场产生了负面影响,因为所有行业都停止了製造过程。 封锁、社会疏远和贸易制裁对全球供应炼网络造成了巨大破坏。 由于活动暂停,建筑业出现下滑。 然而,预计 2021 年情况将有所改善,在预测期内使市场受益。

主要亮点

- 推动市场发展的主要因素是对水性涂料不断增长的需求。 这是由于溶剂型涂料的投入成本不断上升。

- 但是,聚氨酯在涂料应用中的日益偏爱预计会抑制市场增长。

- 建筑行业的发展壮大,以及人们对丙烯酸乳液技术优势的认识不断增强,为市场带来了增长机遇。

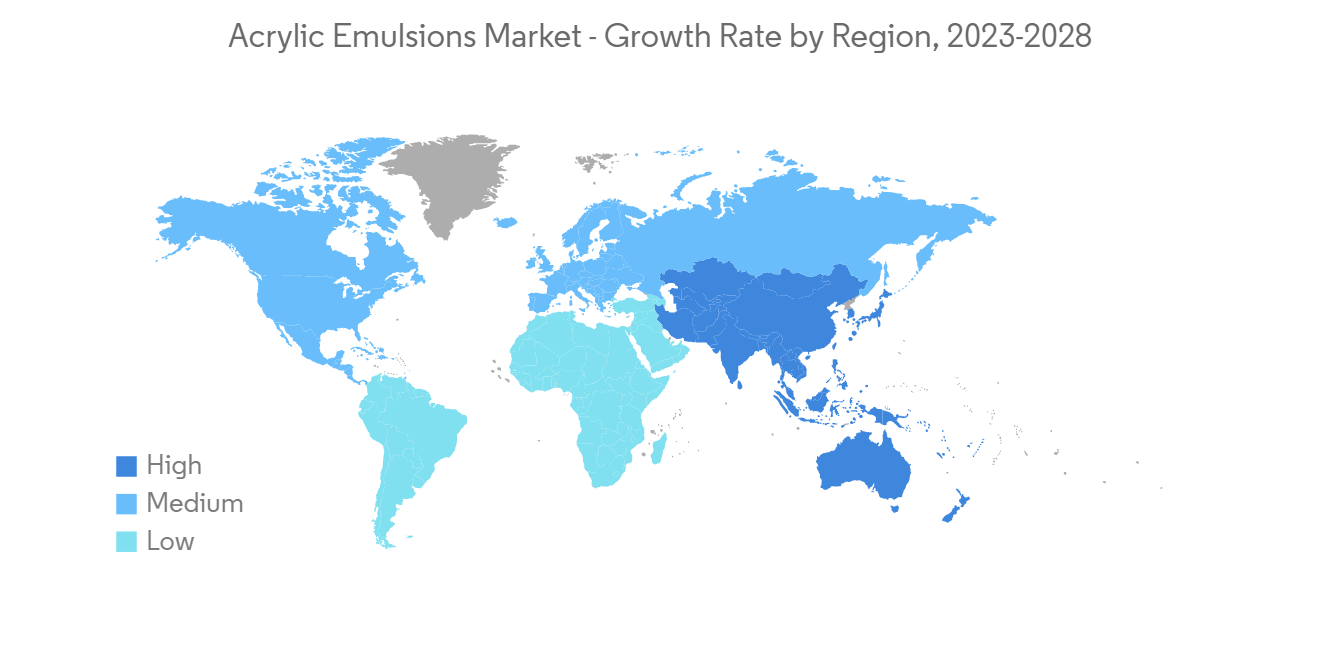

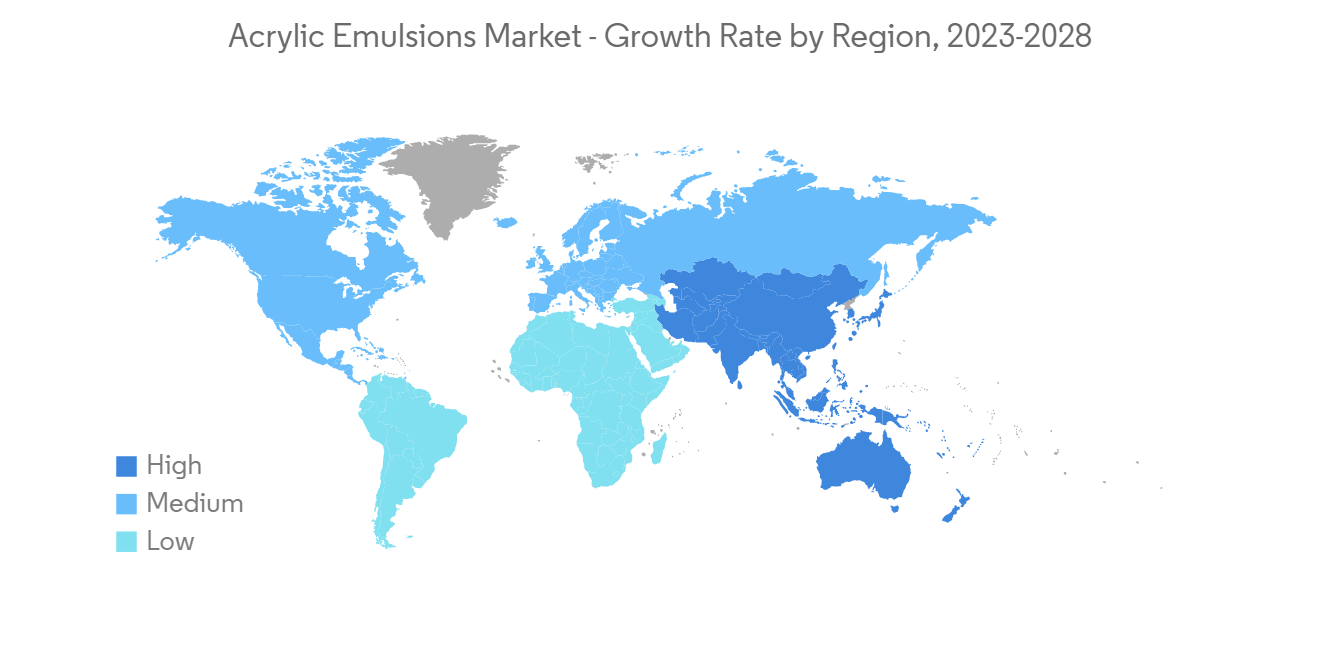

- 预计亚太地区将主导全球市场,因为快速的城市化和工业化将导致中国、日本和印度等国家/地区对丙烯酸乳液的大量需求。

丙烯酸乳液市场趋势

油漆和涂料应用主导市场

- 丙烯酸聚合物乳液具有多种优势,例如抗紫外线、伸长平衡、耐水性和良好的附着力。

- 丙烯酸乳液的一个重要应用是生产建筑和工业涂料,因为它具有低 VOC 排放、易于处理和水层高性能等因素。

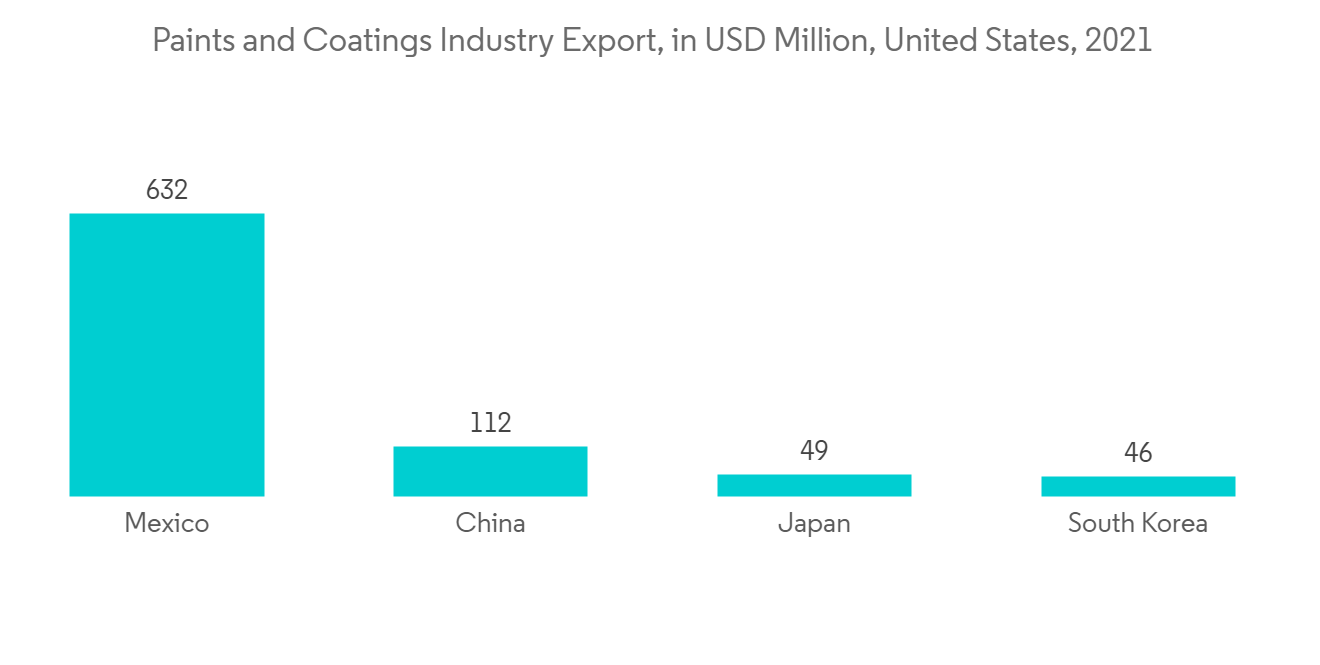

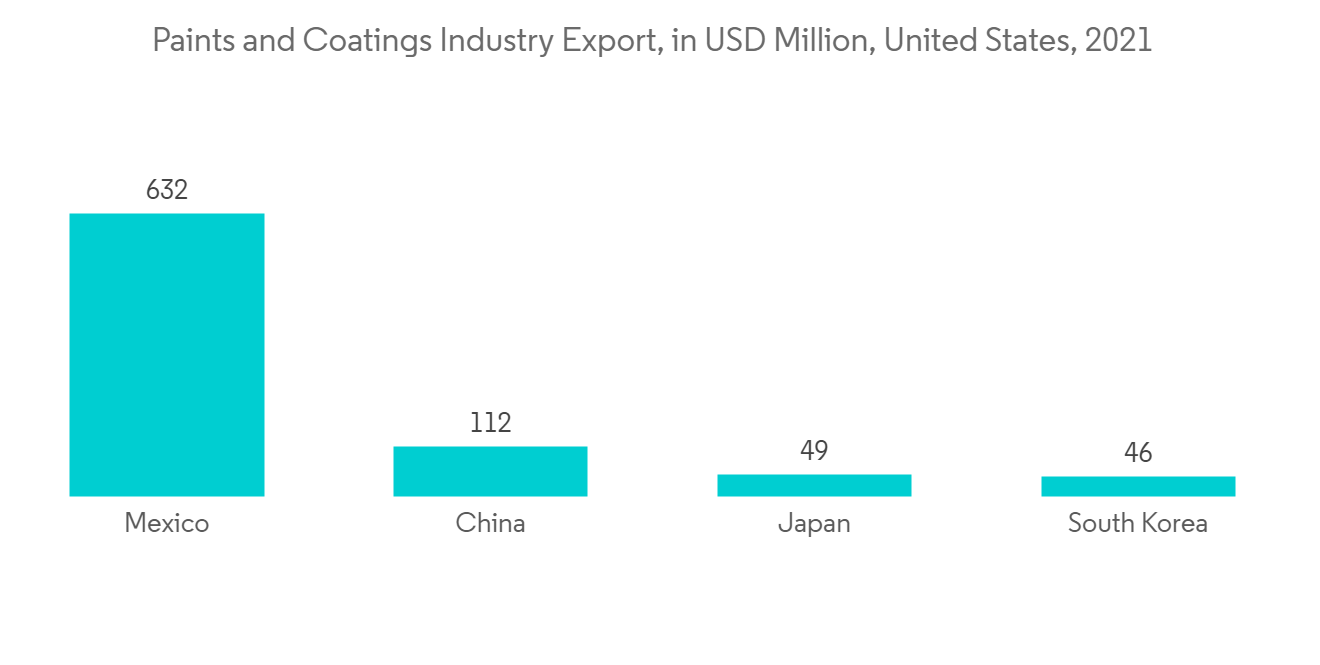

- 根据美国涂料协会的数据,油漆和涂料引领着全球对聚合物乳液的需求,到 2021 年将达到 150 亿美元。 此外,预计到 2027 年将达到 226 亿美元。 2021年,美国将出口25亿美元的油漆和涂料。

- 丙烯酸乳液因其出色的附着力和防水性能而广泛用于建筑行业。 根据美国人口普查局的数据,2021 年 12 月,该国的建筑支出经季节性调整后的年增长率估计为 1.6399 亿美元。 到 2022 年,美国将有 16,647,000 套已完工的许可私人住宅。

- 不断增长的世界人口将导致更高的住房消费和对用于油漆和涂料的聚合物乳液的更高需求。 据联合国经济和社会事务部预测,2022年11月世界人口将达到80亿,2030年将增加到85亿左右,2050年将增加到97亿左右,2100年将增加到104亿左右。

- 近年来,水性油漆和涂料的使用越来越多,因为它们具有高耐用性、低气味和低 VOC 排放量。 水性涂料约占住宅涂料领域销售颜色数量的80%。

- 因此,预计油漆和涂料应用在预测期内将继续主导市场。

亚太地区增长强劲

- 中国和印度不断增长的建筑需求使得亚太地区主导了全球丙烯酸乳液市场。

- 预计亚太地区将成为预测期内最具吸引力的市场,因为印度、日本、新加坡和马来西亚等国家/地区正在见证快速工业化和建筑活动的增加。。

- 例如,印度政府预计将在未来七年内投资约 1.3 万亿美元用于住房建设。 政府预计新建6000万套新房,提振丙烯酸乳液市场。

- 中国的建筑行业正在经历显着增长。 根据中国国家统计局的数据,2021 年中国建筑业产值约为 4.29 万亿美元。

- 全球建筑活动的增加影响了油漆和涂料中对丙烯酸乳液的需求。 中国计划到2025年在重大建设项目上投资1.43万亿美元。 根据国家发改委(NDRC)的数据,上海计划在未来三年内投资 387 亿美元,而广州已签署 16 个新的基础设施项目,投资 80.9 亿美元。。

- 2022 年,印度通过政府在基础设施和经济适用房方面的举措(例如全民住房和智慧城市计划)为建筑业贡献了约 6400 亿美元。 该国建筑活动的增加将推动对油漆和涂料的需求,这可能会在预测期内推动丙烯酸乳液市场。

- 在东盟国家,由于政府机构和私营公司的投资增加,商业和住宅建筑行业正在发展。

- 基于这些因素,预计亚太地区在预测期内将实现强劲增长。

丙烯酸乳液行业概况

丙烯酸乳液市场鬆散整合,少数公司占据大量市场份额。 主要参与者包括 BASF SE、Dow.、Arkema Group、Celanese Corporation 和 DIC CORPORATION。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对水性涂料的需求不断扩大

- 扩大对亚太地区建筑业的投资

- 约束因素

- 在涂料应用中越来越偏爱聚氨酯分散体

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 类型

- 纯丙烯酸乳液

- 苯丙乳液

- 乙烯基丙烯酸乳液

- 用法

- 油漆和涂层剂

- 建筑材料添加剂

- 纸张涂层剂

- 粘合剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳大利亚和新西兰

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 俄罗斯

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%) 分析**/排名分析

- 主要公司采用的策略

- 公司简介

- 3M

- Arkema Group

- BASF SE

- Celanese Corporation

- DIC Corporation

- Dow

- Gellner Industrial LLC

- Mallard Creek Polymers

- Pexi Chem Private Limited

- Royal DSM NV

- Synthomer plc

- The Cary Company

- The Lubrizol Corporation

第七章市场机会与未来趋势

- 丙烯酸乳液自交联技术进展

The market for acrylic emulsions is expected to register at a CAGR of over 5% during the forecast period.

COVID-19 negatively impacted the market as all the industries halted their manufacturing processes. Lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. The construction industry witnessed a decline due to the halt in activities. However, the condition recovered in 2021 is expected to benefit the market during the forecast period.

Key Highlights

- The major factors driving the market studied are the growing demand for water-based paints. It is due to the rising input costs for solvent-based paints.

- However, the growing preference for polyurethane in coating applications is expected to restrain the market growth.

- Growth and expansion of buildings and construction industry and increasing awareness about the benefits of acrylic emulsions technique act as opportunities for market growth.

- Asia-Pacific is expected to dominate the global market due to rapid urbanization and industrialization, leading to a massive demand for acrylic emulsions from countries such as China, Japan, and India.

Acrylic Emulsions Market Trends

Paints and Coatings Application to Dominate the Market

- Acrylic polymer emulsions are used for various benefits such as UV resistance, elongation balance, water resistance, good adhesion, and many others.

- One of the significant applications of acrylic emulsions is in making architectural and industrial coatings owing to factors like low VOC emissions, easy handling, and high performance in water-borne layers.

- According to the American Coatings Association, paints and coatings lead the worldwide demand for Polymer Emulsions, which accounted for USD 15 billion in 2021. It is further projected to reach USD 22.6 billion by 2027. In 2021, the United States exported USD 2.5 billion in paint and coatings products.

- Acrylic emulsion possesses excellent adhesive and waterproofing properties, so it is extensively used in the construction industry for various purposes. According to the US Census Bureau, in December 2021, construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,639.9 billion. In 2022, the completed authorized privately-owned housing units reached 16,647 thousand in the United States.

- The increasing global population increases the consumption of residential buildings, enhancing the demand for polymer emulsions to be used in paints and coatings. According to the United Nations Department of Economic and Social Affairs, the global population reached 8 billion in November 2022 and is estimated to grow to around 8.5 billion by 2030, 9.7 billion in 2050, and 10.4 billion in 2100.

- Water-based paints and coatings are recently adopted due to their high durability, less odor, and low VOC emissions. Water-based paints and coatings account for around 80% of total colors sold in the residential coatings sector.

- Hence, paints and coatings application is expected to continue dominating the market during the forecast period.

Asia-Pacific Region to Witness a Major Growth Rate

- Increasing demand for building and construction in China and India resulted in Asia-Pacific's domination over the global acrylic emulsions market.

- Due to fast industrialization and rising construction and building activities in nations including India, Japan, Singapore, & Malaysia, Asia-Pacific is expected to be the most appealing market over the projected timeframe.

- For instance, the Indian government will likely invest around USD 1.3 trillion in housing over the next seven years. The government will likely construct 60 million new homes, boosting the acrylic emulsions market.

- China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately USD 4.29 trillion.

- Increasing construction activities worldwide impact the demand for acrylic emulsions in paints and coatings. China planned to invest USD 1.43 trillion by 2025 in significant construction projects. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing to all, smart city plans, and others. The growing construction activities in the country are driving the demand for paint and coatings, which, in turn, may drive the acrylic emulsions market over the forecast period.

- The commercial and residential construction industries are witnessing growth in the ASEAN countries owing to the increasing investment by government and private organizations.

- Due to these factors, Asia-Pacific will likely witness a significant growth rate during the forecast period.

Acrylic Emulsions Industry Overview

The acrylic emulsions market is moderately consolidated, with a few players occupying a significant market share. Some key players include BASF SE, Dow., Arkema Group, Celanese Corporation, and DIC CORPORATION.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Water-Based Paints

- 4.1.2 Growing Investment in Asia-Pacific Construction Industry

- 4.2 Restraints

- 4.2.1 Growing Preference for Polyurethane Dispersions in Coating Applications

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pure Acrylic Emulsions

- 5.1.2 Styrene Acrylic Emulsions

- 5.1.3 Vinyl Acrylic Emulsions

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Construction Material Additives

- 5.2.3 Paper Coating

- 5.2.4 Adhesives

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia & New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 BASF SE

- 6.4.4 Celanese Corporation

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Gellner Industrial LLC

- 6.4.8 Mallard Creek Polymers

- 6.4.9 Pexi Chem Private Limited

- 6.4.10 Royal DSM NV

- 6.4.11 Synthomer plc

- 6.4.12 The Cary Company

- 6.4.13 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Self-crosslinking Technology of Acrylic Emulsion