|

市场调查报告书

商品编码

1272675

烷基胺市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Alkylamines Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,烷基胺市场预计将以超过 6% 的复合年增长率增长。

由于生产设施暂时关闭,COVID-19 对该行业的发展产生了重大影响。 然而,新兴国家纸浆和造纸行业的增长正在推动大流行后对烷基胺的需求。

主要亮点

- 油漆和涂料行业对烷基胺作为溶剂的需求不断增长,预计将在预测期内推动市场需求。

- 地区政府和机构对交通部门的排放施加限制可能会减缓市场增长。

- 未来,市场应该会受益于製药行业不断涌现的新想法。

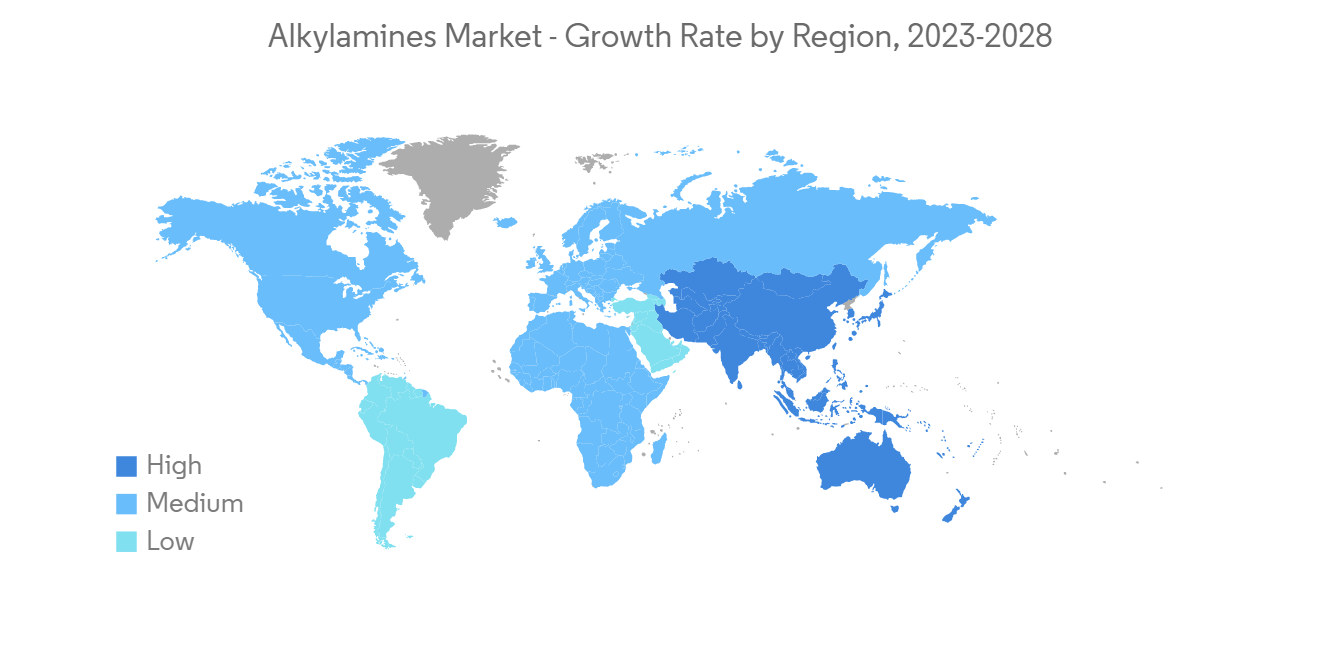

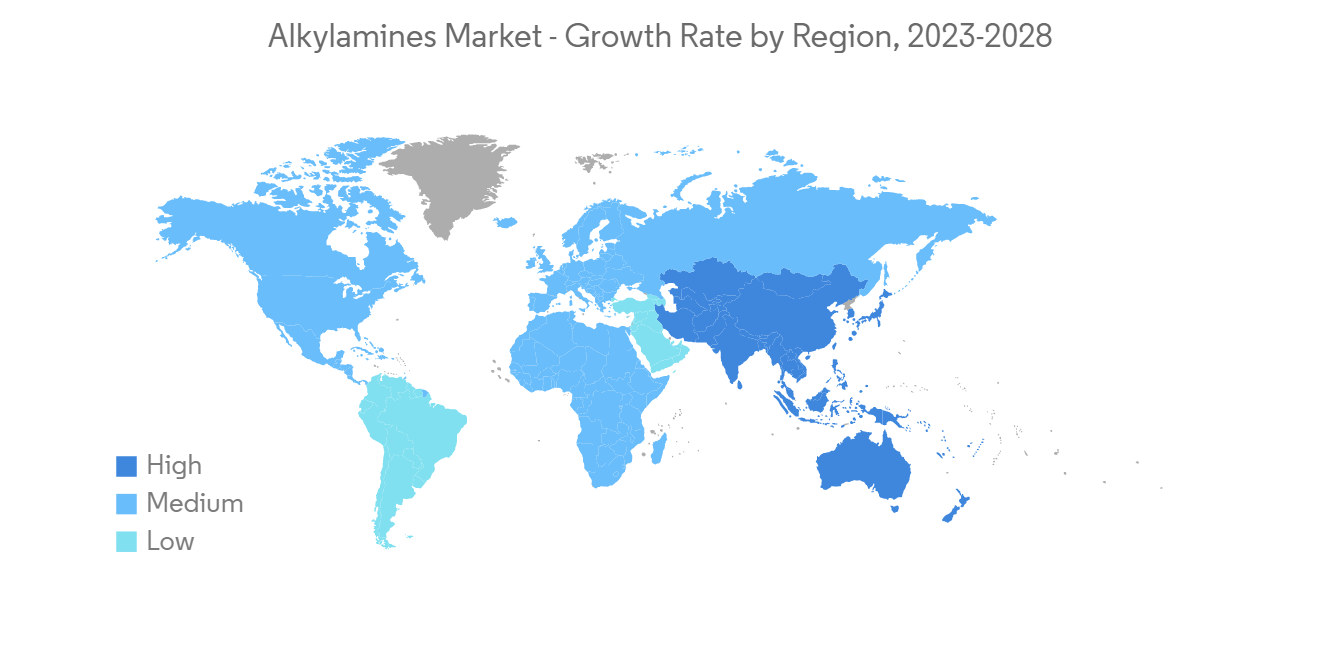

- 由于油漆和涂料行业的应用激增,亚太地区占据了全球烷基胺市场的主导地位。

烷基胺市场趋势

油漆和涂料行业对溶剂的需求不断扩大

- 烷基胺主要用作油漆和涂层剂配方中的溶剂。

- 汽车、机械和建筑等行业的发展正在推动对油漆和涂料的需求。

- 这主要是由于新兴市场对新建筑和其他工业应用的需求不断增长。

- 溶剂越来越多地用于油漆和涂料,因为油漆质量越来越好,市场竞争越来越激烈,客户偏好也在发生变化。

- 到 2021 年,全球油漆和涂料行业预计将增长到约 1600 亿美元。 预计到 2029 年将达到约 2350 亿美元。 市场主要受到建筑行业需求增长的推动,木材、一般工业、汽车、卷材、航空航天、栏桿和包装涂料市场也推动了需求增长。

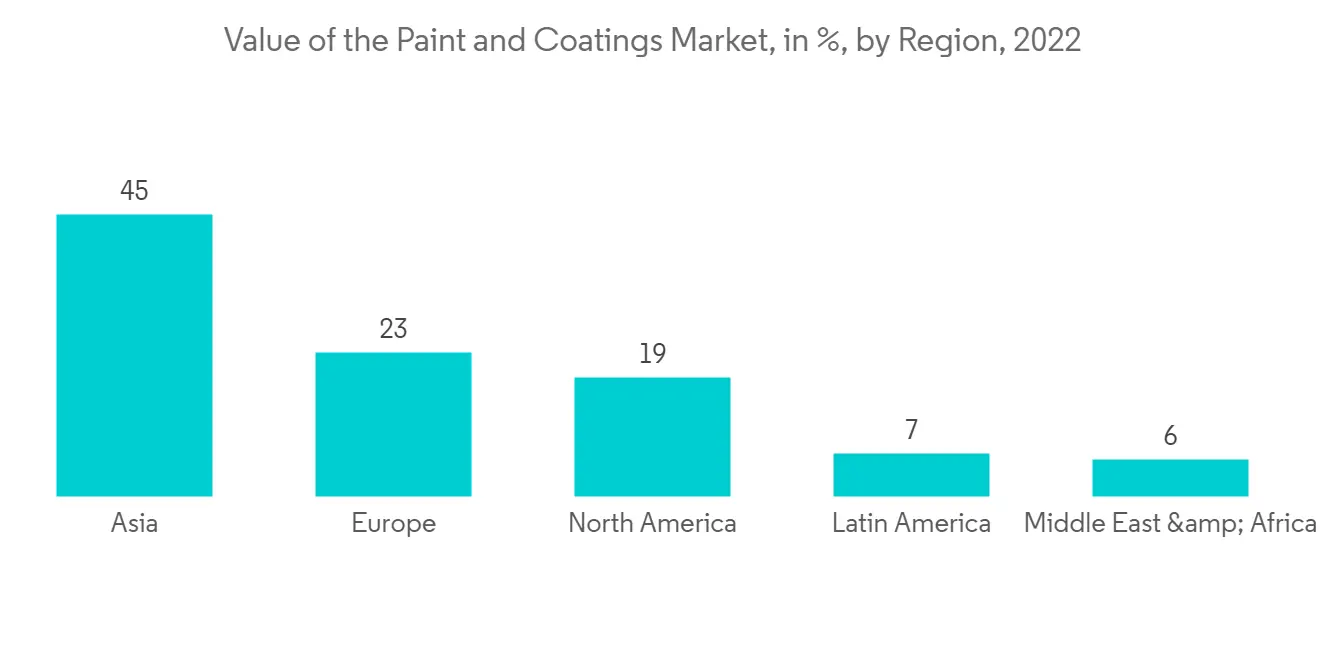

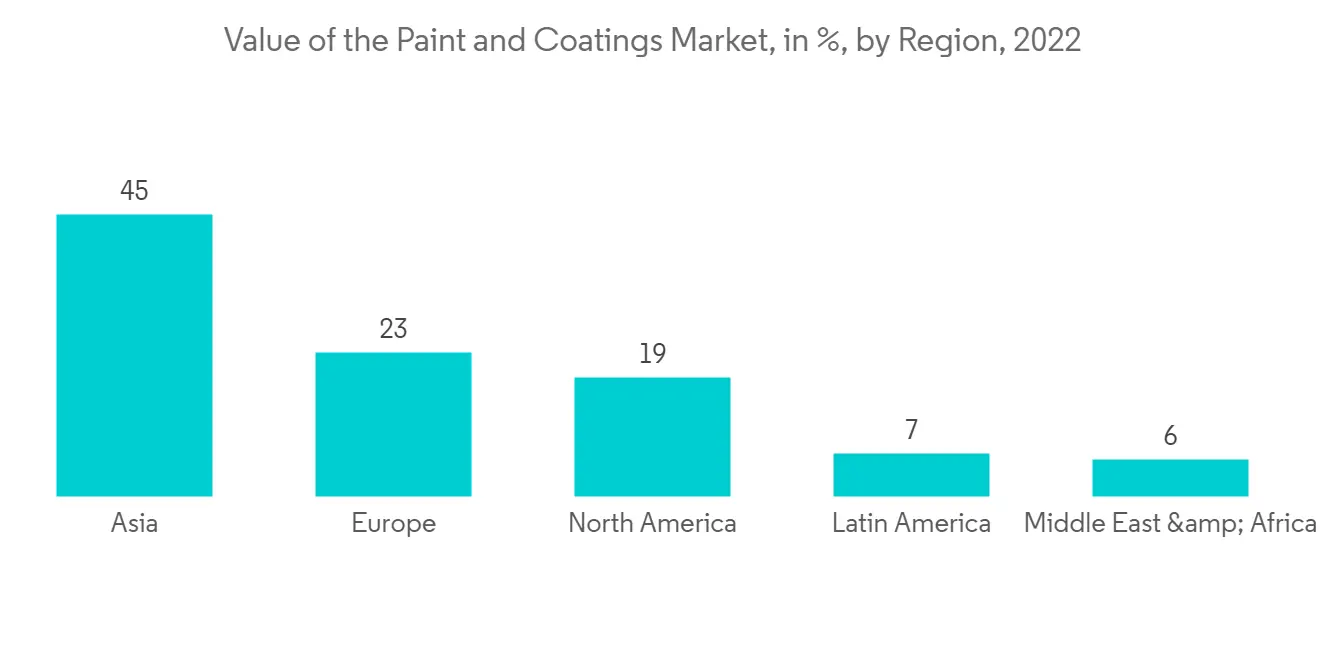

- 到 2022 年,亚洲将成为全球最大的油漆和涂料市场,市场份额约为 45%。 欧洲和北美紧随其后,分别占 23% 和 19% 的份额。

- 建筑行业是油漆和涂料的最大终端用户行业。 中国政府预计建筑业资本性支出同比增长7%以上。

- 根据立邦涂料集团的数据,2021 年中国整体油漆和涂料助剂市场规模将为 467 亿美元。 2021 年,中国建筑涂料製造商将生产 714 万吨建筑涂料,比 2020 年 COVID-19 爆发时增长 13% 以上。

- 印度涂料行业的价值超过 62,000 印度卢比(80 亿美元),是世界上增长最快的主要涂料经济体,在过去二十年中一直保持两位数的增长。

- 这些东西应该会让更多人想在未来几年使用油漆和涂层剂(溶剂)。 预计这将在预测期内推动对烷基胺的需求。

亚太地区主导市场

- 亚太地区主导着全球市场份额。 中国、印度、日本和韩国等国家对油漆和涂料的需求不断增长以及製药业的发展增加了该地区烷基胺的使用。

- 中国是最大的烷基胺生产国和消费国,占世界产能的绝大部分。

- 中国的医药市场位居世界第二。 预计到 2024 年将达到 1450 亿美元,预测期内復合年增长率为 3.4%。

- 在预测期内,印度橡胶工业预计将从目前的 111 万吨增长到 2023 年的 126 万吨,复合年增长率为 2.5%。 预计这将增加印度对烷基胺的需求。

- 此外,中国和印度不断发展的造纸和纸浆行业是烷基胺业务的主要推动力。 到 2022 年,中国纸和纸板製造市场将增长 5%,达到 2175 亿美元。

- 亚太地区的烷基胺消费量占全球总消费量的四分之三以上。 因此,预计亚太地区的新兴国家将成为整个预测期内烷基胺市场增长的主要驱动力。

烷基胺行业概况

烷基胺市场部分分散。 烷基胺市场的主要参与者包括 BASF SE、Alkyl Amines Chemicals Ltd、Dow、Eastman Chemical Company、Hutsman Internetional LLC 等(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 油漆和涂料行业对溶剂的需求不断扩大

- 新兴国家/地区造纸和纸浆行业的增长

- 约束因素

- 各国政府在交通运输领域的废气法规

- 工业价值链分析

- 波特的五力分析

- 新进入者的威胁

- 消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第 5 章市场细分(市场规模:基于金额)

- 产品类型

- 甲胺

- 乙胺

- 丙胺

- 丁胺

- 环己胺

- 用法

- 溶剂

- 橡胶

- 杀虫剂

- 造纸化学品

- 燃料添加剂

- 医药

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 阿拉伯联合酋长国

- 沙特阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- Akzo Nobel NV

- Alkyl Amines Chemicals Ltd.

- Arkema Group

- BASF SE

- Eastman Chemical Company

- Hutsman International LLC

- Kao Corporation

- Mitsubishi Chemical Corporation

- Procter & Gamble

- Solvay

- Dow

第七章市场机会与未来趋势

- 製药领域的创新技术

- 其他机会

During the time frame of the forecast, the market for alkylamines is expected to grow at a CAGR of over 6%.

COVID-19 highly impacted industry growth owing to the temporary halt on production facilities. However, the growing pulp and paper industry in developing countries has propelled the demand for alkylamines post-pandemic.

Key Highlights

- The growing demand for alkylamines as solvents in the paints and coatings industry globally is expected to drive demand for the market during the forecast period.

- Regional governments and organizations that put limits on emissions in the transportation sector are likely to slow the growth of the market.

- In the future, the market should benefit from the fact that there are more and more new ideas in the pharmaceutical industry.

- Asia Pacific dominated the global alkylamines market owing to their surging application in the paint and coatings industry.

Alkylamines Market Trends

Growing Demand of Solvent in the Paints and Coatings Industry

- Alkylamines are primarily employed in the formulation of paints and coatings as solvents.

- Due to the growth of industries like automotive, machinery, and construction, there is a growing need for paints and coatings right now.

- Big companies in the paint and coatings business are growing and putting most of their attention on developing economies around the world.This is mostly because the demand for new buildings and other industrial uses is growing in developing countries.

- Solvents are being used in more and more paints and coatings because paints are getting better, the market is getting more and more competitive, and customer tastes are changing.

- The global paint and coatings industry will be worth approximately USD 160 billion in 2021. It is forecast to reach around USD 235 billion by 2029. The market is mainly driven by increasing demand in the construction industry, with the wood, general industrial, automotive, coil, aerospace, railing, and packaging coatings markets also driving demand growth.

- In 2022, Asia was the world's largest paint and coatings market, with a market share of approximately 45 percent. Europe and North America came next, each with a 23 and 19 percent share of the market.

- The building and construction industry is the largest end-user industry for paints and coatings. The Chinese government has projected the capital expenditure in construction to be over 7% higher than the previous years.

- According to Nippon Paint Group, China's overall paints and coatings market was valued at USD 46.7 billion in 2021. In 2021, Chinese manufacturers of architectural coatings will have made 7.14 million metric tons of architectural coatings, which is more than 13% more than when COVID-19 hit in 2020.

- The Indian paint industry is worth over INR 62,000 crores (USD 8 billion) and is the fastest-growing major paint economy in the world, with consistent double-digit growth over the last two decades.

- All of these things should make more people want to use paints and coatings (solvents) in the coming years. This, in turn, is expected to drive demand for the alkylamines during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market share. With the growing demand for paints and coatings and the growing pharmaceutical industries in countries such as China, India, Japan, and South Korea, the usage of alkylamines is increasing in the region.

- China is the largest producer and consumer of alkylamines and accounts for a large chunk of the global capacity.

- China's pharmaceutical market is the second largest in the world. It is expected to reach USD 145 billion by 2024, which is a CAGR of 3.4% over the period of the forecast.

- During the period of the forecast, the Indian rubber industry is expected to grow at a CAGR of 2.5%, from 1.11 million metric tons of rubber now to 1.26 million metric tons in 2023. This will increase the demand for alkylamines in India.

- Also, the growing paper and pulp industries in China and India are a big driver of the alkylamines business.The market size of China's paper and paperboard manufacturing industry grew by five percent in 2022 to USD 217.5 billion.

- Asia-Pacific consumes more than three-fourths of the world's total alkylamine consumption. Hence, the developing countries of Asia-Pacific are expected to be the prime drivers of growth for the alkylamines market through the forecast period.

Alkylamines Industry Overview

The alkylamines market is partially fragmented. The key players in the allkylamines market include BASF SE, Alkyl Amines Chemicals Ltd, Dow, Eastman Chemical Company, and Hutsman Internetional LLC, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand as Solvent in the Paints and Coatings Industry

- 4.1.2 Growing Pulp and Paper Industry in Developing Countries

- 4.2 Restraints

- 4.2.1 Emission Restrictions in the Transportation Sector by Various Governments

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products/Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Methylamines

- 5.1.2 Ethylamines

- 5.1.3 Propylamines

- 5.1.4 Butylamines

- 5.1.5 Cyclohexylamines

- 5.2 Application

- 5.2.1 Solvent

- 5.2.2 Rubber

- 5.2.3 Agrochemical

- 5.2.4 Paper Chemicals

- 5.2.5 Fuel Additives

- 5.2.6 Pharmaceuticals

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Alkyl Amines Chemicals Ltd.

- 6.4.3 Arkema Group

- 6.4.4 BASF SE

- 6.4.5 Eastman Chemical Company

- 6.4.6 Hutsman International LLC

- 6.4.7 Kao Corporation

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Procter & Gamble

- 6.4.10 Solvay

- 6.4.11 Dow

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in the Pharmaceutical Sector

- 7.2 Other Opportunities